Introduction

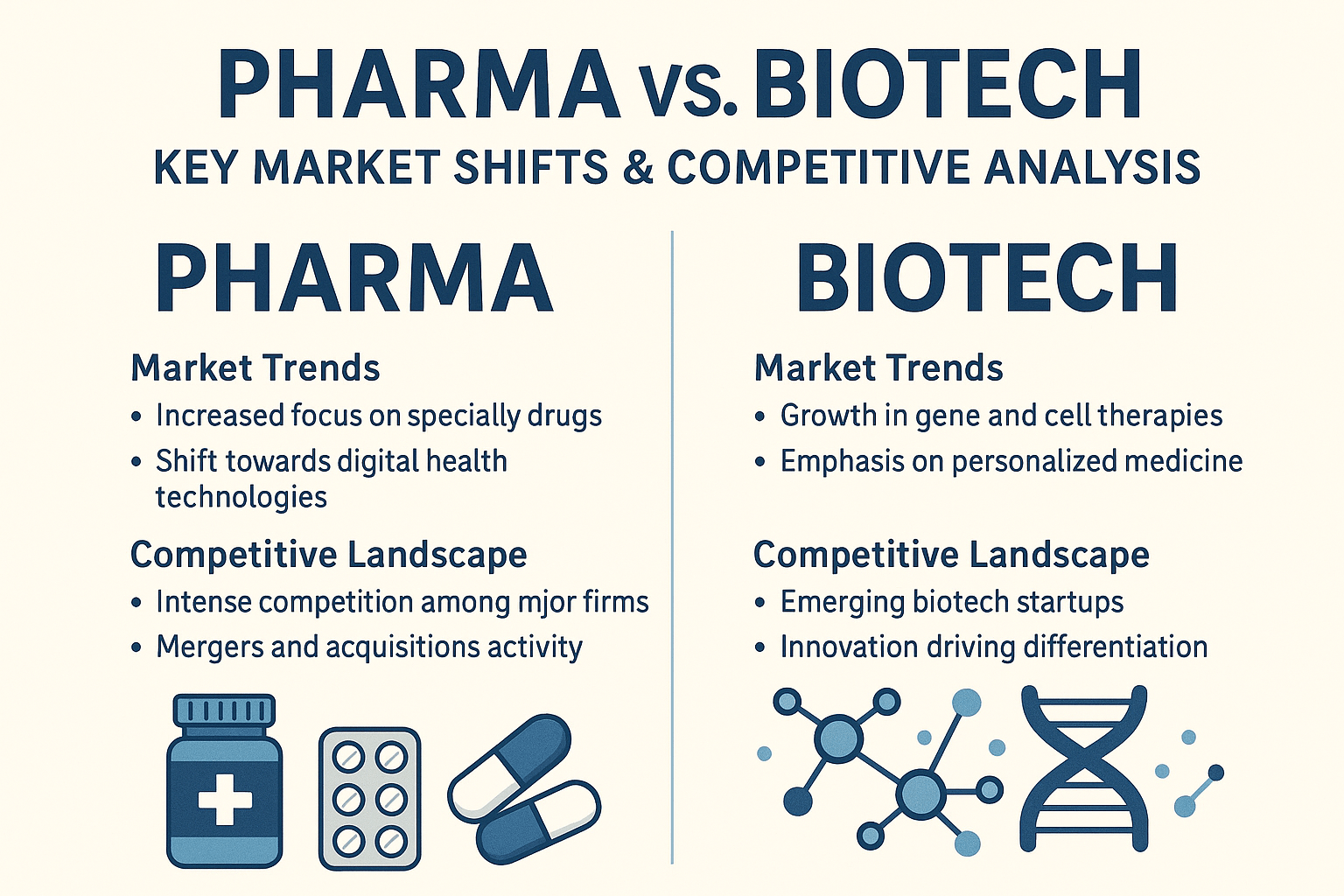

Pharma and biotech are literally two giants that are at a crossroads today. However, they were considered as parallel paths before. Their intersection now, which is more of a rivalry, is not just scientific but is also strategic, financial, and deeply competitive. For CEOs, businesses and marketers, the boundary between the two is both an opportunity and a risk. As pipelines evolve and platforms scale, knowing where the shifts are happening is critical for them to make informed decisions. Ideally, where pharma brings power and legacy to business, biotech, in comparison, brings speed and bold innovation. However, despite this major difference, both are equally potential and grow to become the driving force of the economy in the future.

Therefore, businesses need to understand the key differences and converging trends of biotech and pharma to predict who will lead the next era of healthcare.

Ideally, where pharma brings power and legacy to business, biotech, in comparison, brings speed and bold innovation. However, despite this major difference, both are equally potential and grow to become the driving force of the economy in the future.

Therefore, businesses need to understand the key differences and converging trends of biotech and pharma to predict who will lead the next era of healthcare.