Multilayer Ceramic Capacitor Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Type (Standard MLCC, Specialty MLCC), by Dielectric Type (Class 1, Class 2), by Mounting Type (Surface Mount, Through-Hole), by Rated Voltage (Low Voltage, Medium Voltage, High Voltage), by Case Size (Small, Medium, Large), by End Use Industry (Consumer Electronics, Automotive Electronics, Industrial & Telecommunications)

| Status : Published | Published On : Jan, 2026 | Report Code : VRSME9176 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 190 |

Multilayer Ceramic Capacitor Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Type (Standard MLCC, Specialty MLCC), by Dielectric Type (Class 1, Class 2), by Mounting Type (Surface Mount, Through-Hole), by Rated Voltage (Low Voltage, Medium Voltage, High Voltage), by Case Size (Small, Medium, Large), by End Use Industry (Consumer Electronics, Automotive Electronics, Industrial & Telecommunications)

Multilayer Ceramic Capacitor Market Overview

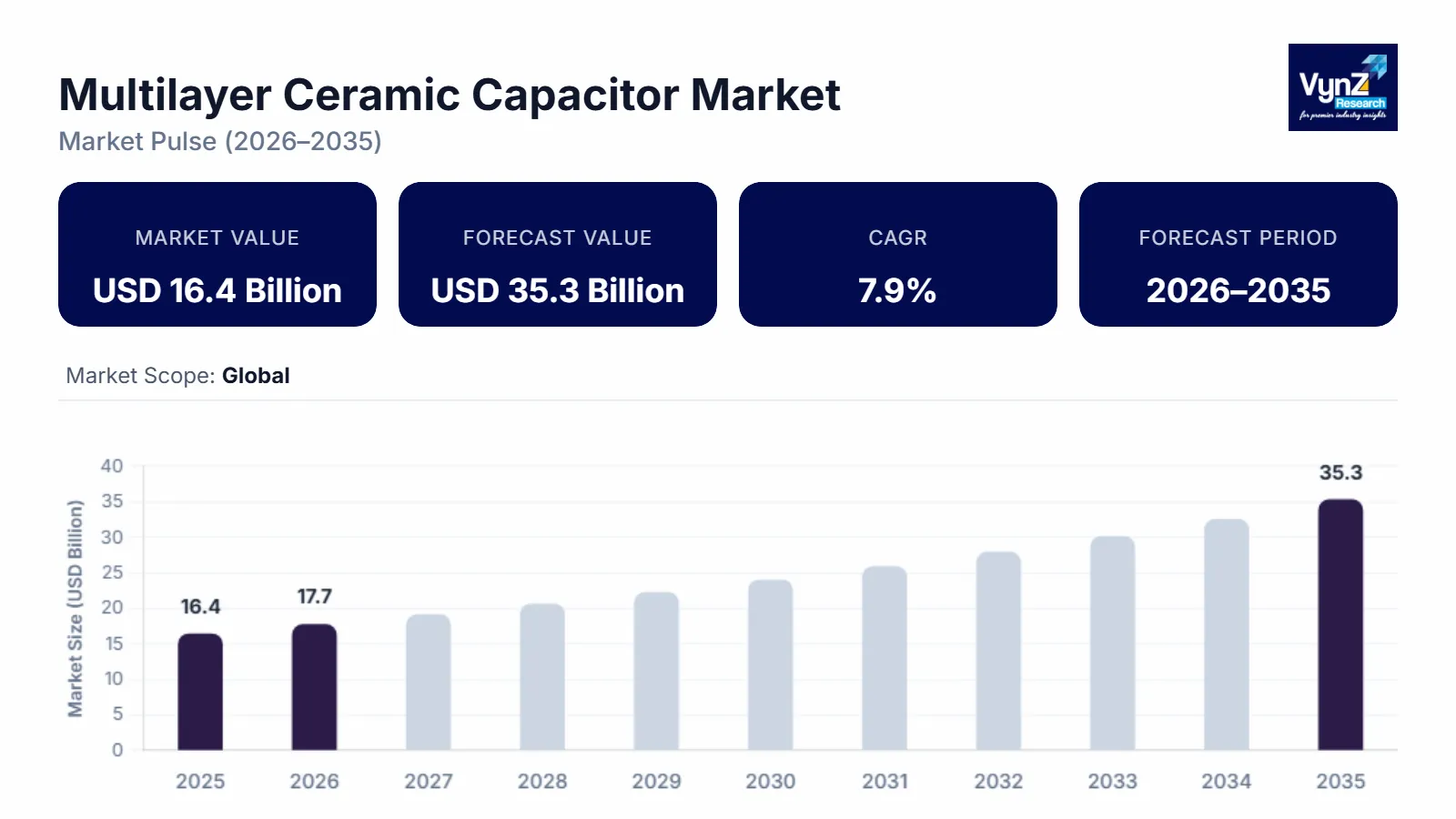

The global multilayer ceramic capacitor market which was valued at approximately USD 16.4 billion in 2025 and is estimated to rise further up to around USD 17.7 billion by 2026, is projected to reach around USD 35.3 billion in 2035, expanding at a CAGR of about 7.9% during the forecast period from 2026 to 2035.

Market growth is driven by rising adoption of compact, highcapacitance components in consumer electronics, rapid penetration of 5G infrastructure requiring highfrequency capacitors, and accelerating electrification in automotive applications which increase MLCC content per vehicle. Increasing deployment of electric and hybrid vehicles and ongoing public investments in semiconductor supplychain enhancement under initiatives such as the U.S. CHIPS Act and regional electronics manufacturing policies are further supporting market expansion across major regions including Asia Pacific, North America, and Europe.

Multilayer Ceramic Capacitor Market Dynamics

Market Trends

The global multilayer ceramic capacitor industry is witnessing notable shifts in component miniaturization, performance optimization, and compliance with environmental and manufacturing policies. One of the key trends shaping the market is accelerated demand for ultra‑compact MLCCs, reflecting changing preferences toward efficiency, space‑saving designs, and high frequency performance in advanced electronics, automotive systems, and 5G infrastructure. Smaller package formats such as 0402 and sub‑0603 are increasingly adopted to support higher capacitance in compact circuit boards, enabling improved signal integrity and power delivery in next‑generation devices.

Another emerging trend is the integration of MLCCs in high‑voltage applications driven by advances in electric vehicle architectures, renewable energy systems, and industrial automation. Electrification of vehicles and stringent regulatory standards for automotive electronics demand capacitors with enhanced dielectric strength, temperature stability, and reliability, prompting manufacturers to focus on high‑voltage MLCC variants and differentiated product portfolios. Policy support for electronics component manufacturing, including production incentives under the India Electronics Component Manufacturing Scheme aimed at passive components such as capacitors, bolsters investments and supply‑chain localization.

Growth Drivers

The growth of the market is largely supported by the escalating proliferation of consumer electronics, which continues to generate consistent demand across smartphones, laptops, tablets, wearables, and IoT devices that require compact high‑performance passive components. These devices increasingly incorporate high‑capacitance MLCCs to enable miniaturization, superior signal integrity, and efficient power delivery in dense circuit designs, reflecting fundamental shifts in electronic design and user expectations.

Rising deployment of 5G networks, supported by extensive global infrastructure investments, amplifies demand for MLCCs in base stations, small cells, and associated RF modules that require high‑frequency decoupling and noise suppression capabilities at scale. Ongoing electrification trends in the automotive sector also play a crucial role in boosting adoption as electric and hybrid vehicles integrate tens of thousands of MLCCs per unit for battery management systems, inverters, and advanced driver‑assistance systems, reinforcing long‑term market expansion. Government‑backed initiatives such as India’s Production Linked Incentive scheme for electronics manufacturing and China’s “Made in China 2025” policy, which emphasize domestic electronics production capability and passive component self‑sufficiency, are further supporting industry growth through capacity expansion and localized investment.

Market Restraints / Challenges

Despite favorable growth prospects, the landscape faces certain challenges that may limit its expansion. Raw material price volatility, such as fluctuations in the cost of nickel, palladium, and ceramic powders used in dielectric and electrode materials, continues to affect profitability and market penetration, particularly among price‑sensitive manufacturers and emerging suppliers. Disruptions in global supply chains due to geopolitical tensions and trade restrictions have led to shortages and extended lead times, constraining production capacity and increasing inventory costs for high‑performance MLCCs used in automotive and 5G applications.

Dependence on imported raw materials and advanced manufacturing technologies can lead to cost pressures and delivery delays, impacting overall market performance during periods of economic uncertainty, as highlighted by industry supply‑chain risk analyses and capacity reports. Furthermore, stringent environmental regulations, such as China RoHS controls on hazardous substances in electronic components and National Policy on Electronics frameworks promoting sustainable production, add compliance complexity and elevate manufacturing costs for global MLCC producers.

Market Opportunities

The market presents significant opportunities in electric vehicle electrification and advanced driver‑assistance systems. Rapid technological advancements in automotive electronic architectures and growing demand for high-performance components that operate reliably under extreme conditions are key drivers. Companies offering high-performance, automotive-grade MLCC solutions are well-positioned to capture incremental demand from automotive OEMs and tier‑1 suppliers, particularly those prioritizing efficiency, safety, and compliance with regulations such as the U.S. Federal Motor Vehicle Safety Standards and EU automotive directives.

Another key opportunity lies in industrial automation and renewable energy systems. Rising investments in smart manufacturing, robotics, and grid modernization are creating demand for specialized, ruggedized MLCC offerings with extended lifetime performance. These solutions enable higher margins and long-term client relationships, supporting industry growth.

Advancements in digital fabrication methods, automated quality inspection tools, and smart supply-chain integration are expected to enhance production consistency, improve yield, and strengthen customer engagement across industrial and energy applications. Government-backed initiatives, including the U.S. Department of Energy’s Advanced Manufacturing Office funding for electronics innovation and the European Union’s Green Deal industrial modernization programs, further support adoption of advanced passive components and capacity expansion.

Global Multilayer Ceramic Capacitor Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 16.4 Billion |

|

Revenue Forecast in 2035 |

USD 35.3 Billion |

|

Growth Rate |

7.9% |

|

Segments Covered in the Report |

Type, Dielectric Type, Mounting Type, Rated Voltage, Case Size, End Use Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Asia Pacific, North America, Europe, Middle East & Africa, Others |

|

Key Companies |

Murata Manufacturing Co. Ltd., TDK Corporation, Samsung Electro-Mechanics, Taiyo Yuden Co. Ltd., Kyocera Corporation, Yageo Corporation, AVX Corporation (Kyocera AVX), Vishay Intertechnology Inc., Walsin Technology Corporation, Darfon Electronics Corp |

|

Customization |

Available upon request |

Multilayer Ceramic Capacitor Market Segmentation

By Type

Multilayer ceramic capacitors based on standard general-purpose designs are projected to account for approximately 61% of total market revenue in 2025. These MLCCs are widely deployed across consumer electronics, computing devices, and general industrial applications where cost efficiency, volume scalability, and stable electrical performance are required. High-volume production for smartphones, laptops, and household electronics continues to support dominance of this segment across Asia Pacific manufacturing clusters.

Specialty MLCCs are estimated to represent around 39% of the market in 2025. Growth in this segment is supported by applications requiring higher reliability, enhanced temperature stability, and performance under harsh operating conditions. Automotive electronics, medical devices, telecommunications infrastructure, and aerospace systems increasingly rely on specialty MLCC variants, supporting steady value-driven expansion.

By Dielectric Type

Class 2 MLCCs are expected to hold approximately 65% of total market revenue in 2025. Their higher capacitance density and cost advantages make them suitable for power management, decoupling, and bulk capacitance applications across consumer electronics and automotive systems. Continuous demand from compact and multifunctional electronic devices remains a key growth contributor.

Class 1 MLCCs account for nearly 35% of the market, supported by applications requiring precise capacitance stability, low dielectric loss, and high-frequency performance. Telecommunications equipment, medical electronics, and precision instrumentation continue to drive adoption of this segment.

By Mounting Type

Surface mount MLCCs are projected to account for approximately 72% of total market revenue in 2025. The widespread adoption of surface mount technology across consumer electronics, automotive control units, and industrial automation systems supports this segment’s dominance. High compatibility with automated assembly processes and compact circuit design requirements continues to drive sustained demand.

Through-hole MLCCs contribute around 28% of market revenue in 2025. Demand is primarily supported by industrial equipment, power electronics, and applications requiring stronger mechanical stability or higher voltage endurance, where through-hole mounting remains preferred.

By Rated Voltage

Low voltage MLCCs are estimated to hold approximately 57% of total market revenue in 2025. Their extensive use in smartphones, laptops, wearables, and compact consumer devices supports consistent volume growth, reinforced by ongoing device miniaturization trends.

Medium voltage MLCCs represent around 28% of the market. Growth is driven by automotive electronics, industrial automation systems, and power conversion equipment, where balanced voltage tolerance and reliability are critical.

High voltage MLCCs account for close to 15% of total revenue, supported by renewable energy systems, industrial power supplies, and electric vehicle power electronics requiring enhanced voltage endurance.

By Case Size

Small case size MLCCs are projected to contribute approximately 45% of total market revenue in 2025. Rising demand for thinner, lighter, and more compact electronic products continues to support this segment.

Medium case size MLCCs account for around 35% of the market, supported by applications requiring a balance between capacitance performance and mechanical durability across automotive and industrial electronics.

Large case size MLCCs represent nearly 20% of total revenue, driven by industrial machinery, power infrastructure, and specialized electronic systems requiring higher capacitance and thermal stability.

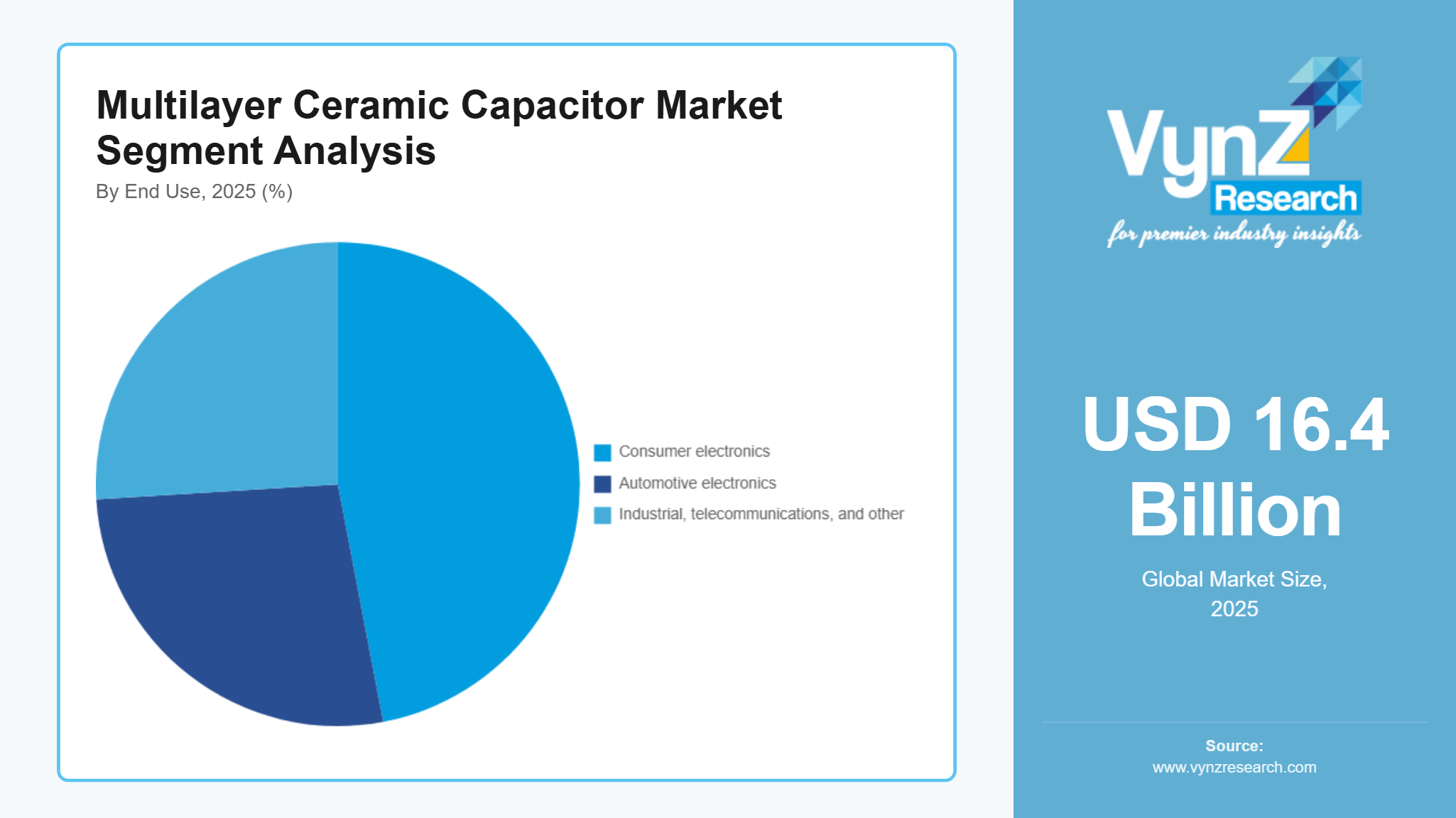

By End Use Industry

Consumer electronics are estimated to account for approximately 47% of total market revenue in 2025. High production volumes of smartphones, tablets, televisions, and computing devices continue to drive sustained MLCC demand globally.

Automotive electronics contribute around 27% of the market, supported by increasing electronic content per vehicle, electrification trends, and advanced safety and infotainment system deployment.

Industrial, telecommunications, and other end-use sectors collectively represent roughly 26% of total revenue. Growth is supported by automation investments, expansion of 5G infrastructure, and increasing demand for reliable electronic components across critical systems.

Regional Insights

Asia Pacific

Asia Pacific accounted for approximately 57% of the global multilayer ceramic capacitor market in 2024, driven by its role as the world’s largest electronics manufacturing and assembly hub. Regional demand is anchored by China’s dominance in smartphone and consumer electronics production Japan’s advanced MLCC materials innovation and South Korea’s semiconductor and display industries. Government initiatives such as China’s Electronics Information Industry Development Fund and industrial policies boosting semiconductor selfsufficiency promote localized manufacturing capacity expansion that strengthens the supply chain and reduces dependency on imports. Proximity to final assembly hubs for consumer devices and rapidly growing electric vehicle production in the region further encourage broad content adoption of MLCCs across multiple enduse verticals.

North America

North America contributed approximately 20% of the global multilayer ceramic capacitor market in 2024, supported by strong automotive electronics growth, industrial automation, and data center infrastructure expansion in the United States. The region benefits from policy support under the U.S. CHIPS and Science Act that funds semiconductor and advanced passive component lines, promoting nearshoring of production and design capabilities. Increased electrification, 5G network buildouts, and substantial corporate investments in AI and edge computing drive MLCC consumption, especially as automotive OEMs and industrial OEMs adopt more robust, highvoltage and highfrequency capacitive solutions.

Europe

Europe represented approximately 15% of total global demand in 2024, underpinned by premium automotive production, industrial automation adoption, and renewable energy projects requiring stable, high reliability MLCCs. Germany, France, and Italy lead regional MLCC consumption with strong automotive electronics integration and factory automation installations. European Union policies such as the European Battery Alliance and strategic electronics initiatives support local component adoption and regulatory alignment on safety and environmental standards, which sustain longterm market growth.

Middle East & Africa and Others

Middle East & Africa and others held roughly 8% of the global multilayer ceramic capacitor market in 2024, driven by expanding telecommunications infrastructure, renewable energy systems, and automation projects in the UAE and Saudi Arabia. National strategies to diversify economies and build smart urban environments encourage regional adoption of advanced passive components, although overall share remains smaller than core manufacturing regions. South Africa and Egypt also exhibit growing industrial demand for MLCCs in energy and transportation control systems. In total, the regions detailed above represent about 80% of the global market, with the remaining share attributable to Latin America and other emerging markets not individually covered here.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, characterized by the presence of large multinational manufacturers and specialized regional suppliers. Market participants focus on continuous product innovation, capacity expansion, and cost optimization to address rising demand from automotive, consumer electronics, and industrial applications. Government-backed initiatives such as the U.S. CHIPS and Science Act, Japan’s semiconductor and electronic component support programs, and industrial policies in South Korea and China encourage domestic production and supply chain resilience, indirectly strengthening competitive intensity and long-term industry investments.

Mini Profiles

Murata Manufacturing Co., Ltd. focuses on high-volume and high-reliability multilayer ceramic capacitors for consumer, automotive, and industrial electronics. Its strong materials expertise and global manufacturing footprint support cost efficiency and stable supply.

Samsung Electro-Mechanics operates in mass and premium MLCC segments, emphasizing miniaturization and high-capacitance products. Demand is supported by smartphones, automotive electronics, and advanced computing applications.

TDK Corporation delivers performance-focused MLCCs for automotive and industrial uses, prioritizing durability and compliance. Continuous R&D and global production enable consistent quality and reliability.

Taiyo Yuden Co., Ltd. specializes in compact MLCCs for mobile devices and communication equipment. Precision manufacturing and strong OEM relationships support its market position.

Yageo Corporation focuses on cost-competitive MLCCs across consumer, industrial, and automotive applications. A wide distribution network and brand portfolio strengthen its global reach.

Key Players

- Murata Manufacturing Co. Ltd.

- TDK Corporation

- Samsung Electro-Mechanics

- Taiyo Yuden Co. Ltd.

- Kyocera Corporation

- Yageo Corporation

- AVX Corporation (Kyocera AVX)

- Vishay Intertechnology Inc.

- Walsin

- Technology Corporation

- Darfon

- Electronics Corp

Recent Developments

In March 2025, Murata Manufacturing announced the expansion of its multilayer ceramic capacitor production capacity for automotive and industrial applications, focusing on high-capacitance and high-reliability MLCCs to support growing demand from electric vehicles and advanced driver-assistance systems.

In April 2025, Samsung Electro-Mechanics introduced a new range of ultra-small, high-capacitance MLCCs designed for AI servers and high-performance computing platforms, targeting improved power stability and space efficiency in data center and accelerator board designs.

In May 2025, TDK Corporation disclosed investments to optimize its MLCC manufacturing lines for automotive-grade components, aligning with rising requirements for temperature resistance, long operational life, and compliance with global automotive electronics standards.

In June 2025, Taiyo Yuden announced process enhancements at its MLCC production facilities to improve yield and supply consistency for compact capacitors used in smartphones, wearables, and communication devices, addressing continued miniaturization trends.

In July 2025, Yageo Corporation reported capacity balancing initiatives across its MLCC manufacturing network to support stable supply for consumer and industrial electronics, reflecting sustained global demand and longer-term contracts with OEM customers.

Report Coverage

By Type

Standard MLCC

Specialty MLCC

By Dielectric Type

Class 1

Class 2

By Mounting Type

Surface Mount

Through-Hole

By Rated Voltage

Low Voltage

Medium Voltage

High Voltage

By Case Size

Small

Medium

Large

By End Use Industry

Consumer Electronics

Automotive Electronics

Industrial & Telecommunications

Global Multilayer Ceramic Capacitor Market Coverage

Type Insight and Forecast 2026 - 2035

- Standard MLCC

- Specialty MLCC

Dielectric Type Insight and Forecast 2026 - 2035

- Class 1

- Class 2

Mounting Type Insight and Forecast 2026 - 2035

- Surface Mount

- Through-Hole

Rated Voltage Insight and Forecast 2026 - 2035

- Low Voltage

- Medium Voltage

- High Voltage

Case Size Insight and Forecast 2026 - 2035

- Small

- Medium

- Large

End Use Industry Insight and Forecast 2026 - 2035

- Consumer Electronics

- Automotive Electronics

- Industrial & Telecommunications

Global Multilayer Ceramic Capacitor Market by Region

- North America

- By Type

- By Dielectric Type

- By Mounting Type

- By Rated Voltage

- By Case Size

- By End Use Industry

- By Country - U.S., Canada, Mexico

- Europe

- By Type

- By Dielectric Type

- By Mounting Type

- By Rated Voltage

- By Case Size

- By End Use Industry

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Type

- By Dielectric Type

- By Mounting Type

- By Rated Voltage

- By Case Size

- By End Use Industry

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Type

- By Dielectric Type

- By Mounting Type

- By Rated Voltage

- By Case Size

- By End Use Industry

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Multilayer Ceramic Capacitor Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Type

1.2.2. By

Dielectric Type

1.2.3. By

Mounting Type

1.2.4. By

Rated Voltage

1.2.5. By

Case Size

1.2.6. By

End Use Industry

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Type

5.1.1. Standard MLCC

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Specialty MLCC

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Dielectric Type

5.2.1. Class 1

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Class 2

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Mounting Type

5.3.1. Surface Mount

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Through-Hole

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By Rated Voltage

5.4.1. Low Voltage

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Medium Voltage

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. High Voltage

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.5. By Case Size

5.5.1. Small

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Medium

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Large

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.6. By End Use Industry

5.6.1. Consumer Electronics

5.6.1.1. Market Definition

5.6.1.2. Market Estimation and Forecast to 2035

5.6.2. Automotive Electronics

5.6.2.1. Market Definition

5.6.2.2. Market Estimation and Forecast to 2035

5.6.3. Industrial & Telecommunications

5.6.3.1. Market Definition

5.6.3.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Type

6.2. By

Dielectric Type

6.3. By

Mounting Type

6.4. By

Rated Voltage

6.5. By

Case Size

6.6. By

End Use Industry

7. Europe Market Estimate and Forecast

7.1. By

Type

7.2. By

Dielectric Type

7.3. By

Mounting Type

7.4. By

Rated Voltage

7.5. By

Case Size

7.6. By

End Use Industry

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Type

8.2. By

Dielectric Type

8.3. By

Mounting Type

8.4. By

Rated Voltage

8.5. By

Case Size

8.6. By

End Use Industry

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Type

9.2. By

Dielectric Type

9.3. By

Mounting Type

9.4. By

Rated Voltage

9.5. By

Case Size

9.6. By

End Use Industry

10. Company Profiles

10.1. Murata Manufacturing Co. Ltd.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. TDK Corporation

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Samsung Electro-Mechanics

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Taiyo Yuden Co. Ltd.

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Kyocera Corporation

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Yageo Corporation

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. AVX Corporation (Kyocera AVX)

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Vishay Intertechnology Inc.

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Walsin Technology Corporation

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Darfon Electronics Corp

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Multilayer Ceramic Capacitor Market