Aviation Fuel Market Overview

Global Aviation Fuel Market is anticipated to grow at a CAGR of 12.9% from USD 249.3 billion in 2023 to USD 695.8 billion in 2030 during the forecast period from 2025 to 2030.

The aircraft is powered by the aviation fuel which is a by-product of crude oil. The growing trend of the expanding aviation sector in various developing nations and air travel is the major growth driver of the aviation fuel market. Factors such as fluctuating crude oil prices and stringent environmental regulations can hamper growth of this market. The low-cost carriers and the development of aviation biofuels are expected to create good opportunities during the forecast period. The growing tourism industry, growing disposable income and increase in investment in aviation sector are the factors which supports the aviation fuel market.

Market Segmentation

Insight by Fuel Type

On the basis of fuel type, the Aviation Fuel Market is bifurcated into conventional fuel and sustainable fuel. Conventional fuel segment is anticipated to develop significantly during the forecast period as there is increase in air passenger traffic.

Insight by End-user

Based on end-user, the Aviation Fuel Market is segregated into commercial aircraft, military aircraft, Private aircraft. Commercial aircraft segment shall dominate the market during the forecast period due to increase in the international air traffic.

Global Aviation Fuel Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 249.3 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 695.8 Billion

|

|

Growth Rate

|

12.9%

|

|

Segments Covered in the Report

|

By Fuel Type, By End-User

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, South America, Middle East And Africa

|

Industry Dynamics

Growth Drivers

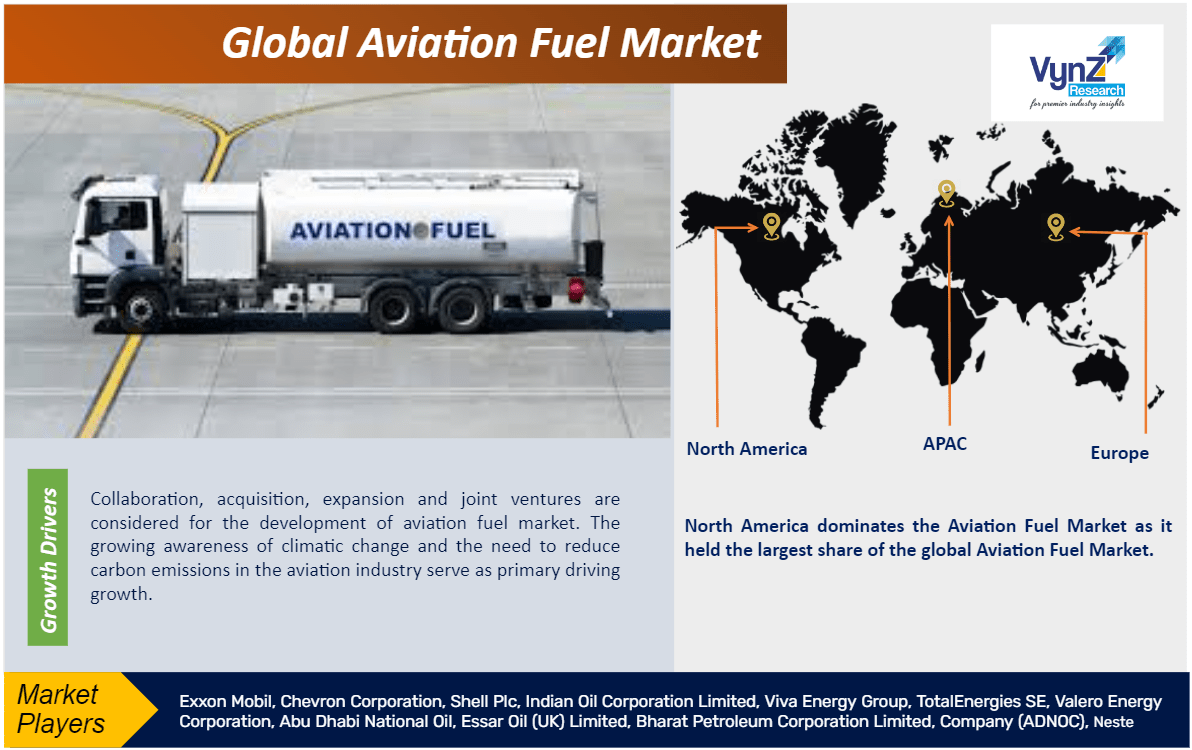

Collaboration, acquisition, expansion and joint ventures are considered for the development of aviation fuel market. The growing awareness of climatic change and the need to reduce carbon emissions in the aviation industry serve as primary driving growth. Constantly evolving aviation engine technology has made existing technology obsolete. This can further result into the industry rivalry amongst the major market players. The use of aircraft is highly growing throughout the logistics applications. The threat of new entrant is moderate in the aviation fuel market as less suppliers of aviation fuel as compared to its buyers. The demand for international safe and efficient air service is anticipated to rise enormously in the near future.

Restraints

To achieve self-imposed greenhouse gas emission reduction as flight and engine improvements are insufficient, airlines need sustainable jet fuel. Sustainable jet fuel requires expensive technical processes, even though it is made from waste feed stocks. The cost of fuel is the major constraint of this market. Due to the installation of additional manufacturing capacity, sustainable jet fuel is more expensive than regular fuel. In the current business situation, each organization is vulnerable to changes in the price of raw materials for lubricants and crude oil. Manufacturers rely mainly on oil commodities in their manufacturing processes, so they are susceptible about price fluctuations in the oil products. Unstable global markets have extensive effects on manufacturing companies. As unexpected challenges are disrupting supply chains and making it difficult for manufacturers to stay profitable, in rising energy costs and the fluctuations in the cost of manufacturing crude oil. To build new biodiesel facilities, manufacturers require time and money, which drives up the cost of their goods that limits their ability to reach the crucial point of profitability.

Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa

North America dominates the Aviation Fuel Market as it held the largest share of the global Aviation Fuel Market. The North American region is expected to grow as it consists of countries with favorable economic policies, early adoption of the latest aviation fuel and high gross domestic product.

Competitive Insights

Shell Plc has developed safer and more efficient refuelling systems, by ensuring the security of supply and managing risk. Company provides expert technical advice to help overcome the industry’s challenges and are focused on helping the aviation sector tackle the challenges to date - carbon emissions. Shell Aviation is fully committed to working with customers to help power the global recovery while enabling them to move towards a low carbon future.

IndianOil Aviation Service is a leading aviation fuel solution provider in India and the most-preferred supplier of jet fuel to major international and domestic airlines. IndianOil Aviation Service refuels over 2,200 flights from the bustling metros to the remote airports linking the vast Indian landscape, from the icy heights of Leh (the highest airport in the world at 10,682 ft) to the distant islands of Andaman & Nicobar.

Key Players Covered in the Report

Some of the prominent players in this market include Exxon Mobil, Chevron Corporation, Shell Plc, Indian Oil Corporation Limited, Viva Energy Group, TotalEnergies SE, Valero Energy Corporation, Abu Dhabi National Oil, Essar Oil (UK) Limited, Bharat Petroleum Corporation Limited, Company (ADNOC), Neste

Recent developments by Key Players

ExxonMobil (XOM) has Commenced the work of Fawley Oil Refinery in UK and shall complete a $1-billion expansion project for diesel production. The Fawley oil refinery is the oldest and largest among the other operational refinery sites in the UK. 270,000 barrels of crude per day is processed by this facility. The refinery is expected to achieve full production in 2025, by increasing low-sulfur diesel production by 40%.

Recently As part of Chevron's renewable fuel conversion project at its El Segundo Refinery in Southern California- US, Chevron Lummus Global LLC (CLG) has announced the completion and startup of an ISOTERRA unit to achieve excellent diesel yields. This unit leverages both the refinery's existing assets and CLG’s proprietary catalyst and reactor internals technology that shall satisfy the growing demand for alternative fuels.

The global Aviation Fuel Market report offers a comprehensive market segmentation analysis along with the estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Fuel Type

- Conventional Fuel

- Sustainable Fuel

- By End-user

- Commercial Aircraft

- Military Aircraft

- Private Aircraft

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- Turkey

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

.png)

To explore more about this report - Request a free sample copy

.png)