Avionics Market Overview

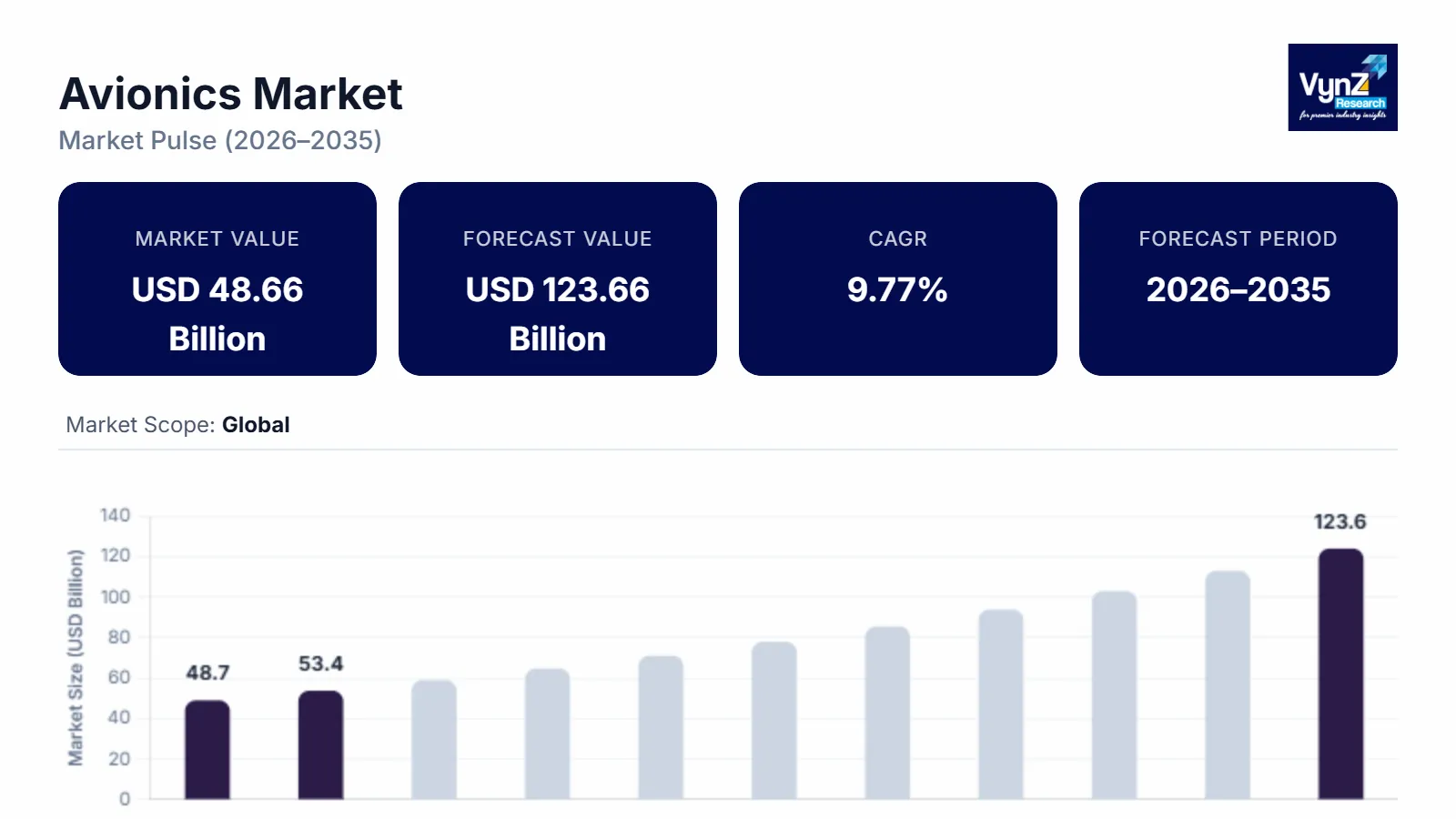

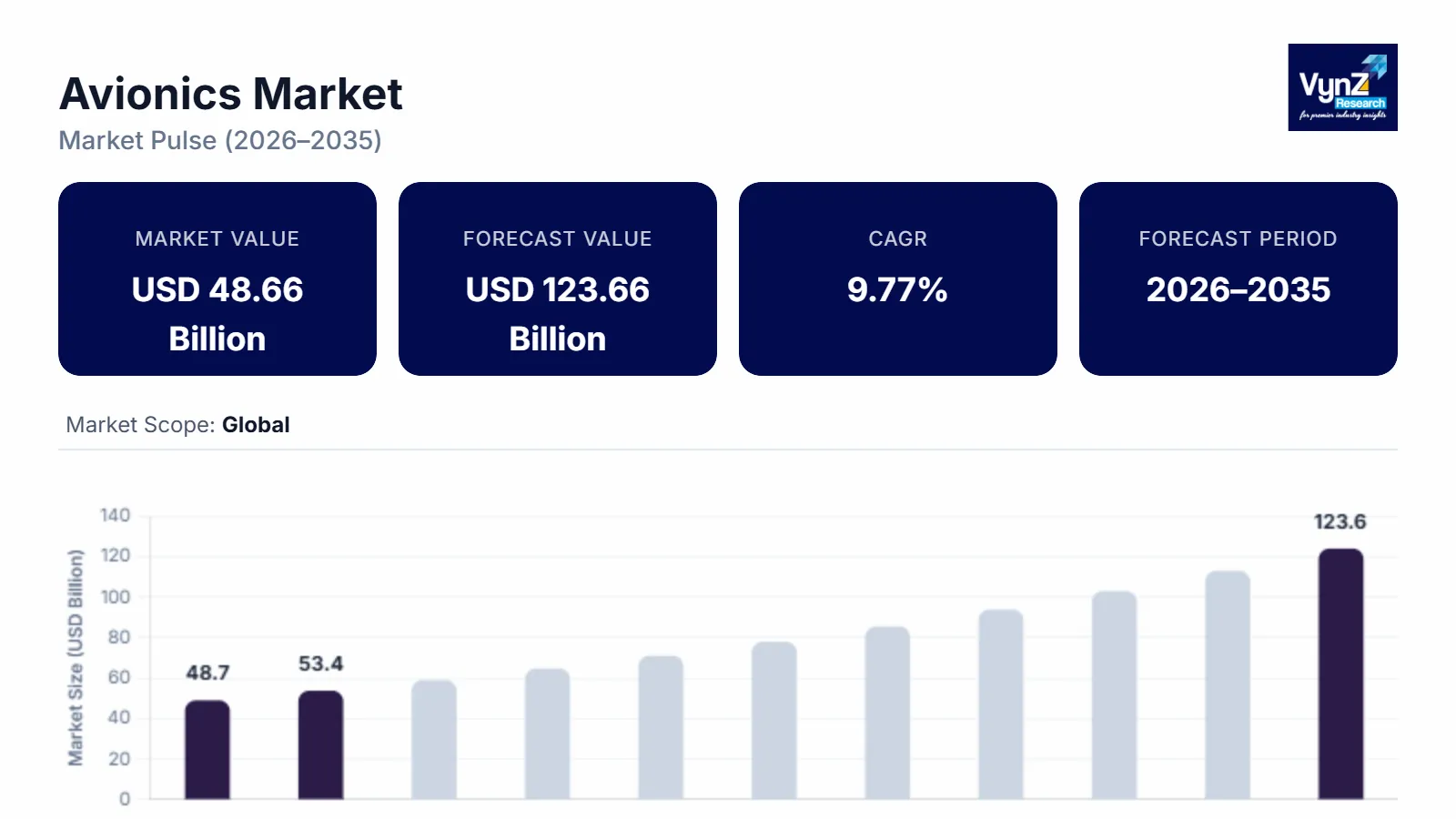

The Global Avionics Market size was valued at USD 48.66 billion in 2025 and is estimated to reach around USD 53.42 billion in 2026. It is projected to reach around USD 123.66 billion by 2035, expanding at a CAGR of about 9.77 % during the forecast period from 2026 to 2035.

Rapid increase in avionics requirement in defense sector is pushing the market forward. Increase in global defense budget and strategic upgrades have fueled the demand for advanced avionics systems. High technological requirements in combat aircraft and UAVs are also stimulating the growth of market.

Avionics are the electronic systems used in aircraft and spacecraft. It includes navigation, communication, radar and autopilot systems. This technology is based on modern software and satellite-based connectivity.

Avionics makes flying safe and efficient. This technology provides automated control systems to assist the pilot. It is used in military and commercial aircraft, helicopters and drones. It plays a major role in takeoff, landing and in-flight operations. Advances in avionics have also improved air traffic control and flight management.

Global Avionics Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 48.66 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 123.66 Billion

|

|

Growth Rate

|

9.77%

|

|

Segments Covered in the Report

|

By System, By Platform, By Fit and By End User

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia Pacific, Rest of the World

|

Global Avionics Industry Dynamics

Global Avionics Market Trends/Growth Drivers:

Rapid expansion of automation and digital aviation technology

The demand for smart and automated systems is rapidly growing in the aviation industry. The importance of auto pilot, digital flight control, and real-time data analytics is increasing every day. Safety and efficiency of flight are prime concerns which can be enhanced with the integration of AI and machine learning in the existing avionics systems. With the rise in adoption of electric aircraft and e-aviation, there is a growing need for more effective and lightweight electronic avionics systems. Also, the growing significance of sophisticated communication systems and navigation control systems stems is noticed in both civil and defense segments. Need to reduce operational and maintenance expenses promotes digitalization which is attracting investments in the global avionics market.

Other key growth drivers and trends include advanced satellite and in-flight communication, growing need for connectivity, expansion of passenger safety and entertainment systems in civil aviation, trend towards eco-friendly and fuel-efficient electronic systems, adoption of avionics by low-cost carriers for technological upgrades, growing air travel opportunities in emerging countries driving demand, and modularity and upgradability of avionics systems.

Global Avionics Market Challenges

High cost and technological complexity

The design, development of new technologies and integration of avionics systems is very costly. Research and developments for innovation needs huge investments. Also, complexity of installing new systems into old ones increases expenses significantly. In addition, stringent regulatory measures, high safety standards, long process, absence of skilled personnel hinders the growth of the global avionics market.

Global Avionics Market Opportunities

Digital transformation in defense and commercial aviation

There is a huge growing demand for smart avionics systems in military and commercial aviation. The development of autonomous aircraft and UAVs (drones) is opening up new possibilities in the global avionics market. The need for advanced communication, navigation and display technologies is growing rapidly. The proliferation of satellite-based navigation systems is bringing opportunities globally and new avionics are needed to enhance airline safety and improve fuel efficiency. Increasing levels of air traffic in developing countries and the demand for digital avionics is increasing in the MRO (Maintenance, Repair, Overhaul) sector are creating new investment opportunities.

Recent Developments by the Key Players

In the three crucial areas of air and air defense, naval, and space, Thales and Terma have committed to local industrial collaboration and a possible strategic alliance by signing a Memorandum of Understanding. For the benefit of the domestic and global defense industries, this collaboration and strategic alliance will contribute to the development of the European industrial and technological basis.

Honeywell have signed a strategic agreement with Bombardier, to provide advanced technology for current and future Bombardier aircraft in avionics, propulsion and satellite communications technologies.

Global Avionics Market Segmentation

VynZ Research provides an analysis of the key trends in each segment of the Global Avionics Market report, along with forecasts at the regional and country levels from 2026-2035. Our report has categorized the market based on system, platform, fit and end user.

Insight by System

- light Control Systems

- Communication Systems

- Navigation Systems

- Monitoring Systems

- Weather Systems

Flight control systems rule as they are essential for automated flight, stability, and safety

The global avionics market is segmented on the basis of systems into Flight Control Systems, Communication Systems, Navigation Systems, Monitoring Systems, and Weather Systems. Among these, Flight Control Systems is the fastest growing segment as they have become essential for automated flight, stability, and safety.

Insight by Platform

- Commercial Aviation

- Military Aviation

- Business Jets

- General Aviation

- Helicopters

Commercial aviation rules being the largest platform

The global avionics market is segmented on the basis of platform into Commercial Aviation, Military Aviation, Business Jets, General Aviation, and Helicopters. Among all these the Commercial Aviation is the largest and fastest growing platform as the global demand for air travel continues to grow.

Insight by Fit

Retrofit will grow more due to higher need and potential

The global avionics market is divided into two parts on the basis of fit namely, Line Fit and Retrofit. The Retrofit segment has more potential as it has become necessary to update old aircraft with modern avionics. Upgrades have become necessary as per aviation regulations in different countries. Airlines are upgrading existing aircraft to save costs rather than buying new aircraft.

Insight by End User

Defense sector rules due to higher investment

Based on end user, the global avionics market is divided into Defense and Civil sectors. The Defense sector is rapidly investing as advanced avionics have become mandatory in modern warfare systems. The role of avionics is becoming very important in intelligence, surveillance, and drone-based missions. Many governments are emphasizing on making their defense aircraft smart and autonomous.

Global Avionics Market: Geographic Overview

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Vietnam

- Thailand

- Malaysia

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

North America is the most prominent region as it is home to major aircraft manufacturers and high investments in defense innovation. FAA regulations in the US encourage technological advancement.

Europe is leading in avionics innovation as global players like Airbus are present. EU's stringent security policies make technological upgrades imperative.

Asia-Pacific is the fastest growing region as air travel and defense budgets in China and India are constantly growing. The development of smart aviation infrastructure is rapid.

Global Avionics Market: Major Players

- Honeywell International Inc.

- Collins Aerospace (Rockwell Collins)

- Thales Group

- Raytheon Technologies Corporation

- Garmin Ltd.

- BAE Systems plc

- Safran S.A.

- RTX Corporation General Electric Company

- Cobham plc

- Elbit Systems Ltd.

- Universal Avionics Systems Corporation