Global Electronic Warfare Market – Analysis and Forecast (2025-2030)

Industry Insights By Capability (Electronic Support, Electronic Attack and Electronic Proportion), By Platform (Airborne, Naval, Ground and Space), By Product (EW Equipment and EW Operational Support), By Technology (Antennas, Anti-jam Electronic Protection Systems, Directed Energy Weapons, IR Missile Warning Systems, Optical Attack Solutions and Others) and By Geography (North America, Europe, Asia-Pacific and Rest of the World)

| Status : Published | Published On : Aug, 2024 | Report Code : VRAD12035 | Industry : Aerospace and Defense | Available Format :

|

Page : 204 |

Global Electronic Warfare Market – Analysis and Forecast (2025-2030)

Industry Insights By Capability (Electronic Support, Electronic Attack and Electronic Proportion), By Platform (Airborne, Naval, Ground and Space), By Product (EW Equipment and EW Operational Support), By Technology (Antennas, Anti-jam Electronic Protection Systems, Directed Energy Weapons, IR Missile Warning Systems, Optical Attack Solutions and Others) and By Geography (North America, Europe, Asia-Pacific and Rest of the World)

Electronic Warfare Market Overview

The Global Electronic Warfare Market is projected to grow from USD 10.6 billion in 2023 to USD 23.5 billion in 2030 at a CAGR of 13.4% during the forecast period from 2025 to 2030.

Electronic Warfare (EW) refers to the use of electromagnetic spectrum, such as signals and radio frequency. Activities such as jamming, deciphering and intercepting signals are involved to provide situational awareness to a country and help them take defensive measures, prepare for offensive situations and get diplomatic insights at every level before conflicts arise. Advanced warfare techniques can decode opposition, identify and intercept data. Also, they can project directed energy to disrupt enemy operations. The rise in regional conflicts and geopolitical tensions demand the adoption of advanced warfare methods. The rise in the use of technology in warfare has positively driven the electronic warfare market growth.

Due to increasing tactical combat operations, Russia-Ukraine War has a positive impact on the market. The Russian government invested in EW systems, that were used to jam GPS signals, detect smart bombs supplied by Western nations and allowing Russian forces to launch an aerial attack. The war has showcased the evolving role of EW in modern conflicts and highlighted the strategies and technologies employed by both sides. Moreover, the Russia-Ukraine war was closely linked with cyber operations. The conflict has driven both countries to invest in the modernization of their EW capabilities. Such developments catalyze the applications of EW in modern-day conflicts.

Market Segmentation

Insight by Capability

- Electronic Support

- Electronic attack

- Electronic proportion

On the basis of capability, the Global Electronic Warfare Market is segregated into electronic support, electronic attack and electronic proportion. The electronic support segment dominated the electronic warfare market during the forecast period 2025 to 2030. The advancements in threat recognition algorithms, signal processing and spectrum management technologies influence the growth of electronic support segment in the Electronic Warfare Market.

Insight by Platform

- Airborne

- Naval

- Ground

- Space

According to the platform, The Global Electronic Warfare Market is segregated into airborne, naval, ground and space. The airborne segment dominated the market as it is driven by rising demand for self protection, signal intelligence and sophisticated surveillance in recent aircraft. Also machine learning and AI is integrated for real time threat analysis and decision making that shall enhance operational effectiveness and efficiency.

Insight by Product

- EW Equipment

- EW Operational Support

The Global Electronic Warfare Market based on product is divided into EW equipment and EW operational support. Among these, electronic warfare equipment segment shall dominate the market during the forecast period as there is a great development in the integrated systems that offer better capabilities across infrared, radio frequency and cyber domains.

Insight by Technology

- Antennas

- Anti-jam Electronic Protection Systems

- Directed Energy Weapons

- IR Missile Warning Systems

- Optical Attack Solutions

- Others

On the basis of technology, The Global Electronic Warfare Market is segmented into antennas, anti-jam electronic protection systems, directed energy weapons, IR missile warning systems, optical attack solutions, and others. IR missile warning systems dominated during the forecast period it supports various operations for Electronic Support Measures (ESM). Furthermore, the rise in government funding for threat detection and improved border security leads to the segment growth.

Global Electronic Warfare Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 10.6 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 23.5 Billion |

|

Growth Rate |

13.4% |

|

Segments Covered in the Report |

By Capability, By Platform, By Product and By Technology |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific and Rest of the World |

Industry Dynamics

Growth Drivers

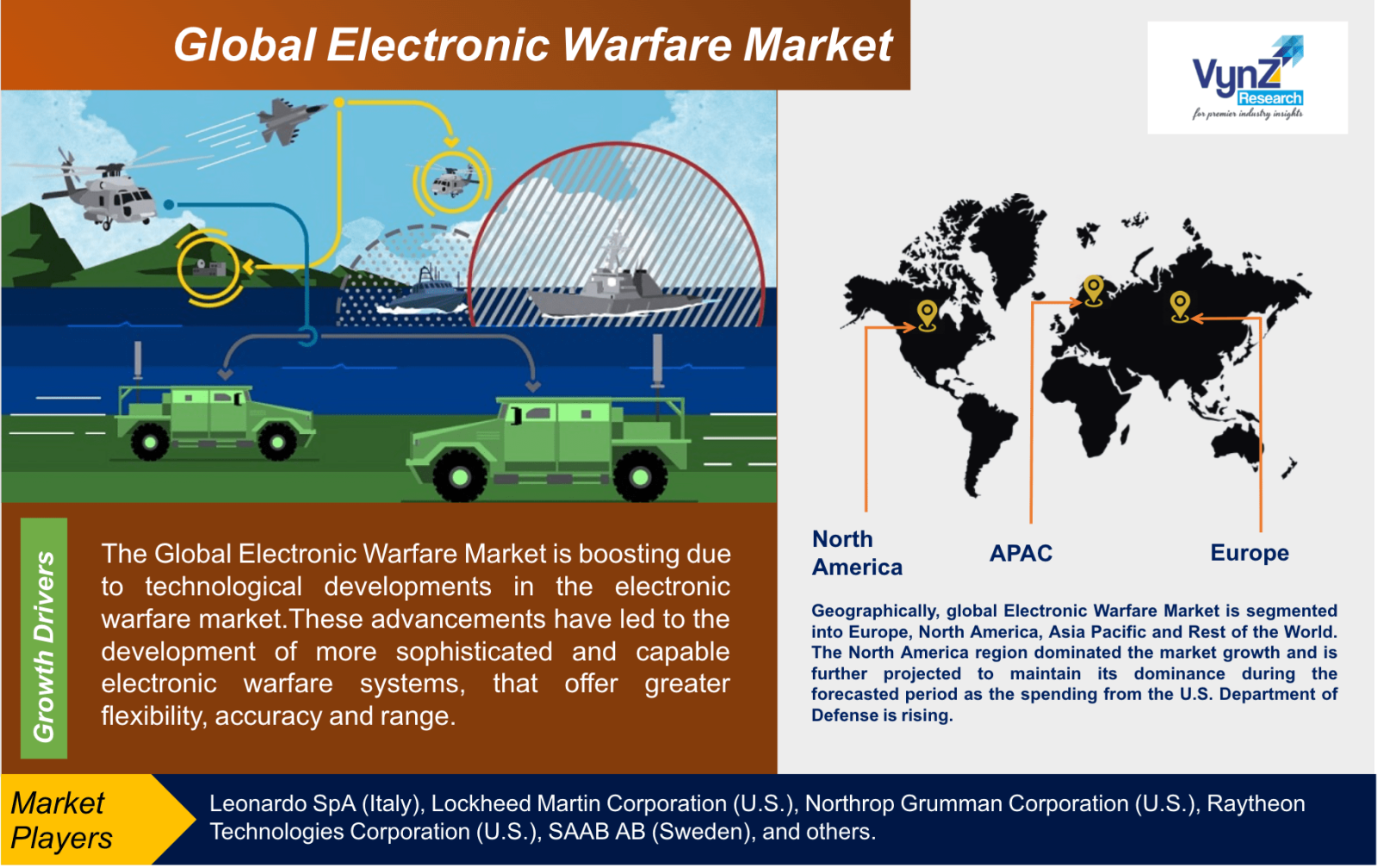

The Global Electronic Warfare Market is boosting due to technological developments in the electronic warfare market. These advancements have led to the development of more sophisticated and capable electronic warfare systems, that offer greater flexibility, accuracy and range. Also high-sensitivity sensors are being incorporated into Electronic Countermeasure Systems (ECS) that are capable of classifying and identifying a wide range of electrical signals like radar emissions and communication transmission. The sensors are becoming compact, more energy efficient that are able to operate across several frequency ranges. To increase agility, efficiency and effectiveness, the use of a variety of cutting-edge technologies in various areas of operation is referred to as 'digital transformation. Modern electronic warfare systems are becoming more digitized and integrated with broader capabilities of the Network Centric Warfare (NCW). This enables enhanced situational awareness & coordination in the face of threats. In addition, EW has improved as a result of advances in digital signal processing and machine learning algorithms. Accurate analysis of complicated signals are enabled by these technologies with rapid identification of threats from various sources. Increasing use of warfare equipment due to deployment of cyber operations to propel market growth. Cyberspace plays a vital role in national security across domains, such as air, land, sea and space.

Restraints

The main restraint of the Global Electronic Warfare Market is the complex electronic countermeasure systems which require seamless integration with various sensors, platforms and communication networks. Modern military operations often involve multiple domains such as land, air, sea, cyberspace and others. EW systems must be incorporated across these domains for comprehensive situational awareness and effective response. To achieve flawless integration is a challenge that may hinder the market growth. Furthermore, designing an EW system that can adapt to diverse platforms imposes a major challenge as different military platforms posses different power operational requirements and limitations.

Geographic Overview

Geographically, global Electronic Warfare Market is segmented into Europe, North America, Asia Pacific and Rest of the World. The North America region dominated the market growth and is further projected to maintain its dominance during the forecasted period as the spending from the U.S. Department of Defense is rising. Europe held a significant EW market share due to an increase in investment in the latest warfare technologies. The Asia Pacific market is also projected to grow with the highest CAGR over the forecast period. The increasing expenditure in the defense sector from India, Japan, China and Australia is responsible for the growth in this region.

Competitive Insights

The major players are actively investing in new product launches, research and development, partnerships, expansions and acquisitions.

Leonardo S.p.A., is an Italian multinational company that specializes in aerospace, defense and security. The company is headquartered in Rome, Italy with 180 sites worldwide. The company provides latest advances in radio frequency technology to military customers in the UK and further afield.

The Lockheed Martin Corporation is an American aerospace and defense manufacturer. The company delivers proven technologies and functional capabilities that provide real-time situational awareness which enables the U.S. Navy to intercept signals that identify both imminent and potential threats.

Key Players Covered in the Reports

Some of the key players in this market are Leonardo SpA (Italy), Lockheed Martin Corporation (U.S.), Northrop Grumman Corporation (U.S.), Raytheon Technologies Corporation (U.S.), SAAB AB (Sweden), and others.

Recent developments by Key Players

To meet the latest NATO self-protection standard STANAG 4781 with additional features including compatibility with new smart dispenser systems, Leonardo has upgraded its BriteCloud 55 T variant electronic warfare decoy. New features include BriteCloud being able to switch data with its aircraft’s on-board self-protection system that maximize the performance.

Lockheed Martin partnered with peer General Dynamics to build solid rocket motors, which propel missiles, along with surging demand driven by conflicts in the Middle East and Ukraine.

The global Electronic Warfare Market report offers a comprehensive market segmentation analysis along with estimation for the forecast period 2025–2030.

Segments Covered in the Report

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Rest of the World

- Brazil

- Saudi Arabia

- South Africa

- U.A.E

- Other Countries

.png)

Source: VynZ Research

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Electronic Warfare Market