Global LEO Satellite Market Size & Share | Growth Forecast Report 2035

Industry Insights By Type (Small Satellites, Medium Satellites and Large Satellites), By Frequency Band (L Band, S Band, C Band, X Band, Ku Band and Ka Band), By Application (Communication, Earth Observation, Navigation, Scientific Research and Surveillance), By End User (Government & Defense, Commercial and Academic & Research Institutions) and By Geography (North America, Europe, Asia Pacific, Rest of the World)

| Status : Published | Published On : Sep, 2025 | Report Code : VRICT5198 | Industry : Aerospace and Defense | Available Format :

|

Page : 137 |

Global LEO Satellite Market Size & Share | Growth Forecast Report 2035

Industry Insights By Type (Small Satellites, Medium Satellites and Large Satellites), By Frequency Band (L Band, S Band, C Band, X Band, Ku Band and Ka Band), By Application (Communication, Earth Observation, Navigation, Scientific Research and Surveillance), By End User (Government & Defense, Commercial and Academic & Research Institutions) and By Geography (North America, Europe, Asia Pacific, Rest of the World)

LEO Satellite Market Overview

The Global LEO Satellite Market size was valued at USD 12.3 billion in 2025. It is likely to grow up to USD 21.9 billion by 2035 at a CAGR of 11.5 % during the forecast period ranging between 2026 and 2035.

Increasing use in military and defense communications promotes market growth. Military agencies are now preferring LEO satellites for real-time, secure and low-latency data transfer as they are faster and more adaptable than traditional GEO satellites.

Increasing use in military and defense communications promotes market growth. Military agencies are now preferring LEO satellites for real-time, secure and low-latency data transfer as they are faster and more adaptable than traditional GEO satellites.

LEO satellites orbit at an altitude of 500 to 2,000 kilometers above the Earth's surface. These satellites provide high-speed data transfer due to their short distance. They use laser link, Ku-band and advanced tracking technologies. Their response time is very fast, which provides low latency service and they are helpful in improving internet connectivity in remote areas. These satellites are typically used in weather forecasting, earth monitoring, military communication and tracking.

Global LEO Satellite Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 12.3 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 21.9 Billion |

|

Growth Rate |

11.5% |

|

Segments Covered in the Report |

By Type, By Frequency Band, By Application and By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Rest of the World |

Global LEO Satellite Industry Dynamics

Global LEO Satellite Market Trends/Growth Drivers:

Demand for global internet connectivity

The biggest trend in the global LEO satellite market is to provide high-speed internet to remote and under-served regions. As digitalization reaches rural areas and developing countries, the demand for broadband connectivity is also growing rapidly. Traditional fiber infrastructure is expensive and time-consuming to reach these areas, while LEO satellites provide low-cost and low-latency solutions. This digital inclusion drive has revolutionized the telecom, education and health sectors.

Other key growth drivers and trends include significant decline in space launch costs and development of reusable rockets, accuracy and clarity of LEO satellites for Earth observation services, increasing use in smart agriculture, climate tracking and maritime surveillance, need for low orbit coverage to support 5G and IoT networks, growing partnerships between private space companies and government space agencies and advances in small sat technology making both manufacturing and launch easier.

Global LEO Satellite Market Challenges

Orbital congestion and space debris

With the increasing number of LEO satellites, traffic in orbital space and the risk of collision have increased manifold, making the problem of space debris severe. Thousands of small and large satellites can cause problems in accurate navigation, telemetry and future launches. Moreover, continuous tracking and collision avoidance technologies are limited and expensive so far. Regulation and licensing processes by governments are complex and lack legal clarity in many countries. Also, launch costs, spectrum conflicts and long-term maintenance challenges are also slowing down the global LEO satellite market.

Global LEO Satellite Market Opportunities

Need for digital inclusion in developing countries

Billions of people in developing countries around the world are still deprived of fast internet, and LEO satellites can be the solution to providing them affordable and reliable connectivity. Remote education, telemedicine, online banking and digital services require fast networks in rural and backward areas, which LEO satellites can fulfill even without fiber or towers. Apart from this, the participation of private companies is increasing in government missions. These satellites can also make a big contribution in smart agriculture, disaster management and climate monitoring, creating new growth opportunities for the global LEO satellite market.

Global LEO Satellite Market Segmentation

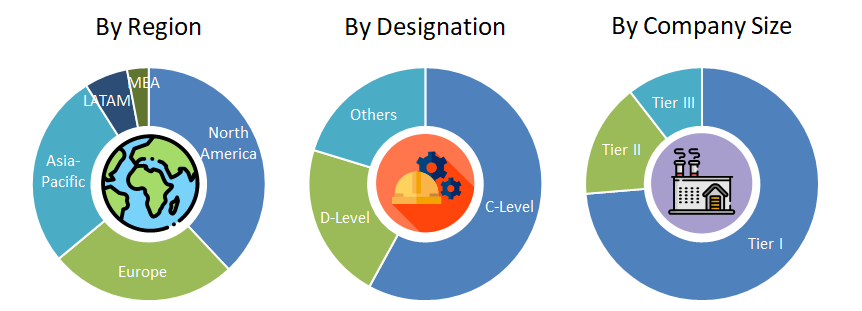

VynZ Research provides an analysis of the key trends in each segment of the Global LEO Satellite Market report, along with forecasts at the regional and country levels from 2026-2035. Our report has categorized the market based on type, frequency band, application and end user.

Insight by Type

- Small Satellites

- Medium Satellites

- Large Satellites

Small satellites rule being cheaper

The global LEO satellite market is divided by type into Small Satellites (≤500kg), Medium Satellites (500–1,000kg), and Large Satellites (>1,000kg). Small Satellites are growing the fastest as they are cheaper to manufacture, lighter to launch, and flexible to operate.

Insight by Frequency Band

- L Band

- S Band

- C Band

- X Band

- Ku Band

- Ka Band

Ka-band communication due to support for high-speed broadband communication

The global LEO satellite market is divided by frequency band into L-Band, S-Band, C-Band, X-Band, Ku-Band, and Ka-Band. Among these, Ka-Band is becoming the most important segment as it supports high-speed broadband communication. This band is excellent in cloud-penetration and data throughput, due to which internet service providers are giving it priority in both rural and urban areas.

Insight by Application

- Communication

- Earth Observation

- Navigation

- Scientific Research

- Surveillance

Communication services due to higher demand

The global LEO satellite market is divided by application into Communication, Earth Observation, Navigation, Scientific Research, and Surveillance. Among these, Communication is the largest and sustainable demand segment as telecom companies and governments are relying on LEO satellites to deliver internet to remote areas. These satellites are ideal for mobile connectivity, data backhaul, and broadband expansion.

Insight by End User

- Government & Defense

- Commercial

- Academic & Research Institutions

Government and defense agencies rule due to higher usage

The global LEO satellite market is divided by end user into Government & Defense, Commercial, and Academic & Research Institutions. Of these, Government & Defense is the most dominant consumer segment as secure and real-time data transfer is essential to their missions. The fast response and low orbit coverage of LEO satellites is extremely useful for military operations, border tracking, and disaster management.

Global LEO Satellite Market: Geographic Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Vietnam

- Thailand

- Malaysia

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

North America is the most dominant region in this market, where SpaceX, Amazon Kuiper and government agencies such as NASA and DoD are investing heavily.

Asia-Pacific is the most promising region where India, China and Japan are expanding their constellations and launch capabilities.

In Europe, organizations such as ESA, OneWeb and Airbus are extensively using LEO satellites for data communication and earth monitoring.

Global LEO Satellite Market: Major Players

- SpaceX

- OneWeb

- Amazon (Project Kuiper)

- Airbus Defence and Space

- Thales Alenia Space

- Northrop Grumman

- L3Harris Technologies

- Lockheed Martin

- Sierra Space

- Rocket Lab

- LeoSat Enterprises

- Planet Labs

- Spire Global

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

LEO Satellite Market