Global Satellite Flat Panel Antenna Market - Analysis and Forecast (2026-2035)

Industry Insight By Type (Electronically Steered Antenna, Mechanically Steered Antenna, and Hybrid), By Frequency (L and S Band, C and X Band, and Ku, K, and Ka Band), By End User (Automotive, Aviation, Defense and Government, Enterprise, Maritime, Oil and Gas, and Space), and By Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

| Status : Published | Published On : Jun, 2025 | Report Code : VRAD12012 | Industry : Aerospace and Defense | Available Format :

|

Page : 200 |

Global Satellite Flat Panel Antenna Market - Analysis and Forecast (2026-2035)

Industry Insight By Type (Electronically Steered Antenna, Mechanically Steered Antenna, and Hybrid), By Frequency (L and S Band, C and X Band, and Ku, K, and Ka Band), By End User (Automotive, Aviation, Defense and Government, Enterprise, Maritime, Oil and Gas, and Space), and By Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

Satellite Flat Panel Antenna Market Overview

The Global Satellite Flat Panel Antenna Market was valued at USD 3.4 billion in 2025 and is anticipated to grow to USD 18.6 billion by 2035, registering a CAGR of 16.3% during the forecast period 2026-2035. A flat panel antenna is a type of directional antenna that only emits and receives radio signals from one direction. It has a wider beam, allowing the signal to cover more ground. Flat-panel antennas are now being developed for maritime satellite communications applications, as well as military, naval, and commercial aviation radar. It utilizes phased array technology and keeps track of multiple satellites. Flat-panel phased array technology could become increasingly relevant as numerous new Low Earth Orbit (LEO) constellations are being developed, each with hundreds of cross-linked satellites orbiting the earth. Also, a flat-panel antenna can utilize meta-materials or optical-beam forming.

Flat-panel antennas based on electromagnetic metamaterials technologies are being developed by industry. To electronically acquire, guide, and lock a beam to any satellite, these ultra-thin antennas use a holographic technique. Flat-panel directional antennas provide a high gain while being extremely small and low profile. They're tough and weatherproof, so they'll last a long time even in the roughest conditions. Airborne and distant ground surveillance, video transmission, border patrol, and tactical assistance are all provided by unmanned systems, and continuous communication with the control centre is essential. As the demand for unmanned systems grows, so does the demand for antennas with longer ranges for payloads and C4I2SR missions.

Satellite Flat Panel Antenna Market Segmentation

Insight by Type

The electronically steered antenna contributes to a significant share of the market. An electronically steered antenna assists in steering the beam in the desired direction with no moving parts, thus extending the operational range. These compact, lightweight, and low-profile antennas can provide good coverage while being less power efficient and costlier than standard technology due to design complexity. Electronic antenna steering is more flexible and requires less maintenance than mechanical antenna steering.

Insight by Frequency

The frequencies covered by the Kurz-under (Ku), Kurz, and Kurz-above (Ka) designations are 13 to 18 GHz, 18 to 27 GHz, and 27 to 40 GHz, respectively. The Ku, K, and Ka frequency categories hold the highest share during the projected period owing to the benefits offered by the category which include high bandwidth and support applications that need high transmission power.

Insight by End-User

The defence & government sector contributes to the largest share in the global satellite flat panel antenna market during the projected period owing to the rising prominence of satellite internet across several applications. Some governments throughout the world are negotiating contracts and forming strategic collaborations with flat panel antenna companies to deliver internet access to rural and difficult-to-reach areas.

Global Satellite Flat Panel Antenna Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 3.4 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 18.6 Billion |

|

Growth Rate |

16.3% |

|

Segments Covered in the Report |

By Type, By Frequency, and By End-User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Industry Trends

The rising trends toward the development of high-speed 5G/6G devices and the need to reduce the cost of launching a satellite will proliferate the growth of the satellite flat panel antenna market.

Satellite Flat Panel Antenna Market Growth Drivers

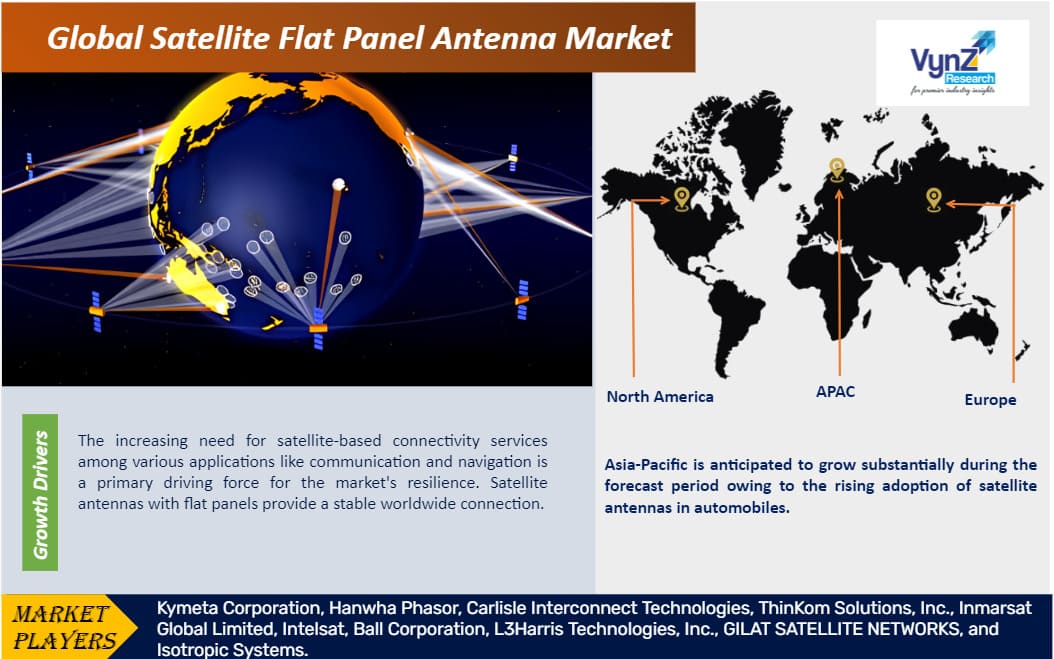

The increasing need for satellite-based connectivity services among various applications like communication and navigation is a primary driving force for the market's resilience. Satellite antennas with flat panels provide a stable worldwide connection. They are resistant to adverse weather conditions due to their rugged design. Moreover, flat panel antennas (FPA) are also in high demand as the demand for Communication on the Move grows (COTM). Due to technological advancements in the satellite sector, flat-panel satellite antennas (FPGAs) are getting prominence for use in aeronautical, terrestrial, and maritime applications. The increased adoption of small satellites, rising use of satellite-based warfare systems, and massive investment in space exploration projects will drive the growth of the satellite flat panel antenna market. Furthermore, they are extensively used in maritime applications to customize satellite products that provide signal transmission and receiving for military, commercial, and recreational uses.

Satellite Flat Panel Antenna Market Challenges

The massive initial investment, strict government regulations, and variable performance may pose challenges in the growth of flat-panel antennas.

Satellite Flat Panel Antenna Market Opportunities

The advent of Neo-Geostationary Orbit Satellite constellations from industry players such as Telesat, Space X, SES, etc. will create opportunities for growth in the satellite flat panel antenna market. Also, the rising demand for internet connectivity globally will accelerate opportunities in the market.

Satellite Flat Panel Antenna Market Geographic Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Vietnam

- Thailand

- Malaysia

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

North America contributes the largest share in the satellite flat antenna market owing to the rising number of investments and continuous research and development activities in the region. Furthermore, the existence of sophisticated infrastructure, several space programs, and increased adoption of commercial satellite imaging will proliferate the growth of the satellite flat panel antennas market in the region.

Asia-Pacific is anticipated to grow substantially during the forecast period owing to the rising adoption of satellite antennas in automobiles. Furthermore, Space exploration activities by Asian space agencies such as India's Space Research Organization (ISRO) and China's National Space Administration (CNSA) are expected to drive the Asia Pacific's flat-panel satellite antenna market.

Satellite Flat Panel Antenna Market Competitive Insight

- Kymeta Corporation

- Hanwha Phasor

- Carlisle Interconnect Technologies

- ThinKom Solutions, Inc.

- Inmarsat Global Limited

- Intelsat

- Ball Corporation

- L3Harris Technologies, Inc.

- GILAT SATELLITE NETWORKS

- Isotropic Systems

There is a revolution in the global communication space industry and the advent of space technology has led to a pivot role in the development of antennas, resulting in R&D initiatives by businesses and massive investment to develop novel innovative technologies, resulting in the growth of the global satellite flat panel antenna market. The players are collaborating with other businesses to strengthen their foothold in the market.

Recent Developments By the Key Players

Açaí Motion, a Brazilian brand of natural energy drinks, has teamed up with Ball Corporation, the world's top supplier of sustainable aluminum packaging for beverages, personal care, and home goods, to introduce a new can that has been approved by the Aluminium Stewardship Initiative (ASI). With this certification, the companies' partnership promotes sustainability and innovation in the beverage industry while guaranteeing traceability, excellent quality, and a resolute dedication to the circular economy.

Mitsui OSK Lines (MOL) and Inmarsat Maritime have reached an agreement to help MOL's fleet switch from Fleet Xpress (FX) to Inmarsat's NexusWave service. By offering a fully managed bonded connectivity service across all of its vessels, this improvement seeks to further the Japanese maritime company's digitalization initiatives. Local Inmarsat partner JSAT MOBILE Communications will be in charge of managing the transition's implementation and support. They will be in charge of a varied fleet that includes automobile carriers, oil tankers, and liquefied natural gas (LNG) carriers.

The Satellite Flat Panel Antenna Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Satellite Flat Panel Antenna Market