India Electric Bike (E-bike) Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Component (Solutions, Services), by Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), by Battery Type (Lithium-Ion Battery, Lead-Acid Battery, Swappable Battery Systems), by End User/Application (Personal Commuting, Last-Mile Delivery & Logistics, Ride-Sharing & Rental Fleets, Institutional Use), by Distribution Channel (Online Sales Platforms, Company-Owned Brand Stores, Multi-Brand Retailers & Dealerships, Corporate / Fleet Sales)

| Status : Published | Published On : Feb, 2026 | Report Code : VRAT9664 | Industry : Automotive & Transportation | Available Format :

|

Page : 130 |

India Electric Bike (E-bike) Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Component (Solutions, Services), by Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), by Battery Type (Lithium-Ion Battery, Lead-Acid Battery, Swappable Battery Systems), by End User/Application (Personal Commuting, Last-Mile Delivery & Logistics, Ride-Sharing & Rental Fleets, Institutional Use), by Distribution Channel (Online Sales Platforms, Company-Owned Brand Stores, Multi-Brand Retailers & Dealerships, Corporate / Fleet Sales)

India E-Bike Market Overview

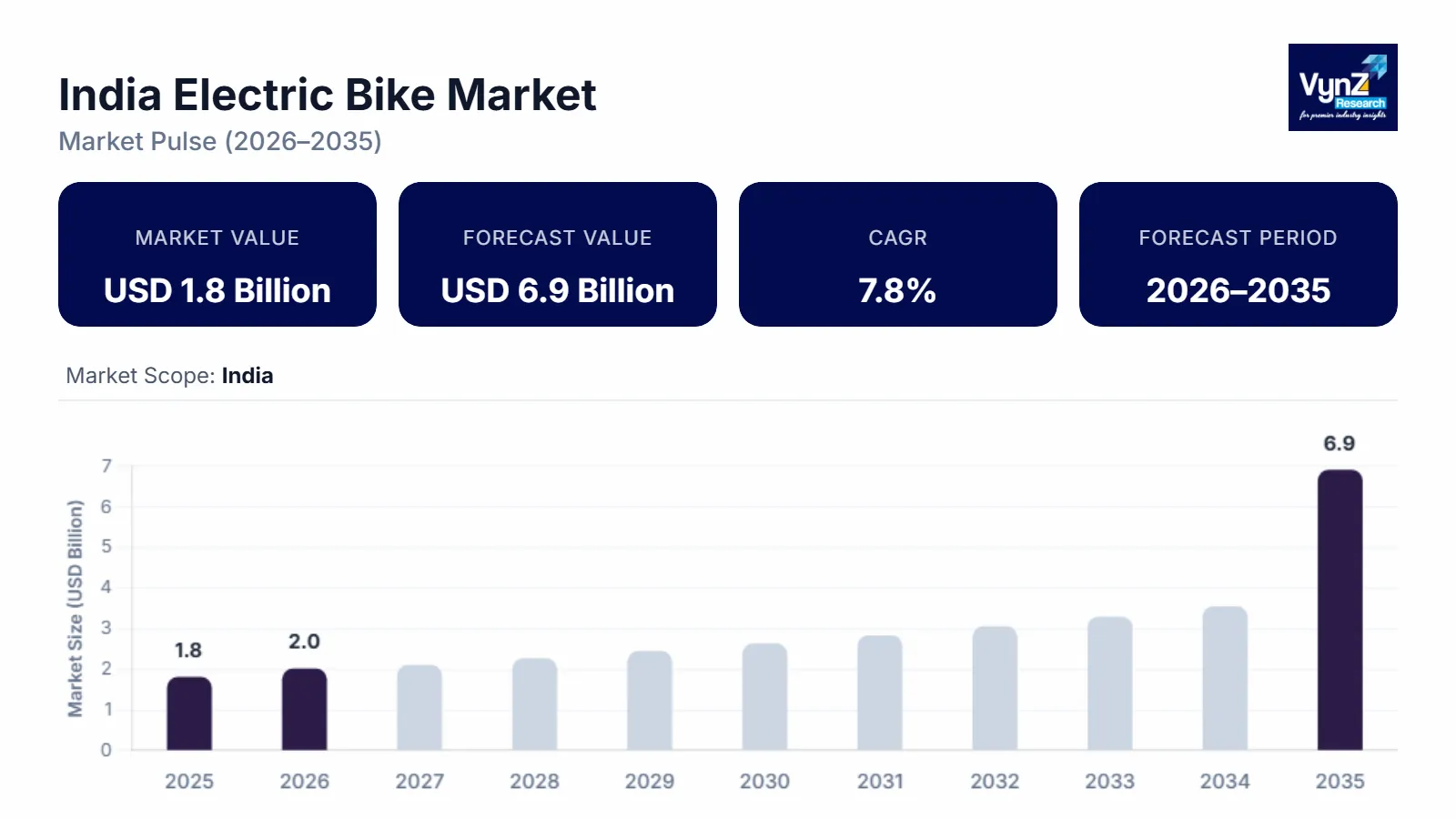

The India E-bike market which was valued at approximately USD 1.8 billion in 2025 and is estimated to reach around USD 2.0 billion in 2026, is projected to reach close to USD 6.9 billion by 2035, expanding at a CAGR of about 7.8% during the forecast period from 2026 to 2035.

The Indian e-bike market continues to expand as urban mobility comes under increasing pressure from traffic congestion, escalating fuel costs, and tightening air quality regulations. Daily commuters are actively seeking convenient and efficient solutions for short-distance travel that reduce dependence on petrol-powered vehicles. E-bikes are well positioned to address this demand, supported by the convenience of home and neighborhood charging and ongoing improvements in battery performance and reliability.

At the same time, adoption among delivery personnel and gig-economy riders is accelerating, as lightweight electric vehicles help lower operating effort and overall running costs. Urban authorities are reinforcing this shift by developing dedicated lanes, implementing parking frameworks, and introducing policy measures that support two-wheeled electric mobility. According to the Ministry of Road Transport and Highways (Vahan Dashboard), electric two-wheeler registrations in India reached a record 1.28 million units in 2025, reflecting an 11% year-on-year increase, driven by the growing uptake of high-speed electric scooters across both personal and commercial applications.

India E-bike Market Dynamics

Market Trends

The electric two-wheeler market is rapidly evolving beyond entry-level e-bikes toward versatile models tailored for daily commuting, urban errands, and real-world usage. Manufacturers and brands are increasingly prioritizing robust frame designs, enhanced load-bearing capabilities, and durable components engineered to withstand uneven city roads and frequent use. Contemporary models now integrate a suite of smart features, including seamless app connectivity, real-time GPS tracking, and remote locking systems, elevating both convenience and security for riders.

In parallel, commercial delivery fleets are accelerating the adoption of swappable battery technology to drastically reduce downtime otherwise spent on charging, improving operational efficiency and route flexibility. To mitigate global supply chain disruptions, many OEMs are also expanding local assembly operations, enabling faster product roll-outs, reduced dependency on imports, and greater adaptability to market demand.Shifts in distribution strategies are reshaping how consumers access electric two-wheelers, with a growing blend of online and offline sales channels improving availability and customer experience. According to the Ministry of Road Transport and Highways (Vahan Dashboard), electric two-wheeler registrations in India surged to approximately 1.15 million units in 2024, representing nearly 59% of all electric vehicle registrations in the country for the year—underscoring a definitive transition toward practical, everyday electric mobility solutions.

Growth Drivers

Market expansion is being strongly propelled by the growing preference for cost-efficient, convenient, and reliable last-mile mobility solutions. Rapid urbanization has intensified challenges such as chronic traffic congestion, limited parking infrastructure, and rising fuel prices, prompting consumers to seek practical alternatives for short-distance, daily travel.

E-bikes are increasingly positioned as a viable mobility solution for office commuting, routine shopping, and last-mile delivery operations, particularly within densely populated urban centers. Beyond functional convenience, buyers are also demonstrating heightened awareness of environmental sustainability, favoring vehicles that offer lower emissions, reduced noise levels, and minimal urban air pollution.

From an economic perspective, electric two-wheelers present a compelling value proposition. Home-based charging infrastructure significantly enhances user convenience, while eliminating recurring dependency on fuel stations. According to NITI Aayog, the total cost of ownership (TCO) for electric two-wheelers was approximately 30%–50% lower than internal combustion engine (ICE) models in 2024, reinforcing the long-term financial attractiveness of battery-powered mobility. This cost advantage is particularly resonant among daily commuters, gig-economy participants, and last-mile delivery operators, accelerating adoption across key end-user segments.

Market Restraints / Challenges

The e-bike industry is encountering challenges that hinder the spread of the use of these products. It has been noticed that many riders are concerned about the limited battery range and the fact that it takes time to recharge the battery after each trip, especially in locations where charging stations are not common. Additionally, the availability of spare parts and repair services outside major cities is not stable, which leads buyers to be doubtful about the level of support they will receive in the future. Price sensitivity remains a factor that limits product demand, as a majority of households continue to compare electric models with cheaper petrol alternatives. According to the Ministry of Heavy Industries, only 29,151 public charging stations were operational across India in 2025, highlighting a nationwide infrastructure gap that continues to limit long-distance usage and increase range anxiety among potential buyers.

Market Opportunities

The market presents substantial opportunities for expansion, particularly as a large number of Indian cities continue to lack accessible charging infrastructure and dependable service networks. Companies that deploy basic charging solutions near residential areas, retail outlets, and office clusters can directly address one of the most critical barriers to purchase and adoption. In addition, there is considerable scope for businesses offering battery-swapping services along high-traffic commuting corridors and at last-mile delivery hubs. Demand from villages and smaller towns remains largely underserved, creating strong potential for affordable e-bike models engineered to perform on uneven and rough road conditions.

Financing remains another key opportunity area. Flexible payment options and easy monthly instalment plans can attract first-time buyers who are unwilling or unable to make large upfront payments. Furthermore, local assembly and domestic sourcing of components create openings for new suppliers and ecosystem participants. According to NITI Aayog, the electric vehicle financing market in India is projected to reach an annual value of INR 3.7 lakh crore by 2030, underscoring the long-term growth potential for credit, leasing, and financing solutions tailored to electric two-wheelers.

India E-Bike Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 1.8 Billion |

|

Revenue Forecast in 2035 |

USD 6.9 Billion |

|

Growth Rate |

7.8% |

|

Segments Covered in the Report |

Component Type, Organization Size, Battery Type, Distribution Channel, End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North, East, West, South |

|

Key Companies |

Hero Lectro E-Cycles, EMotorad (Inkodop Technologies Pvt. Ltd.), Elecson (EV Elecson Electric Bicycles), Lekeamp, Ninety One Cycles, SK Ebicycle LLP, Stryder Cycle Pvt. Ltd., Toutche Electric, Virtus Motors Pvt. Ltd., Voltebyk, Voltrix Mobility Pvt. Ltd., Ampere Electric, Revolt Motors, Avon Cycles, Kabira Mobility |

|

Customization |

Available upon request |

India E-bike Market Segmentation

By Component Type

Solutions represented the largest segment of the market, accounting for approximately 70% share in 2025. This dominance is primarily driven by strong demand from Indian consumers for ready-to-use e-bikes that can be purchased and deployed immediately. Buyers increasingly prefer complete vehicle solutions with integrated batteries, motors, and essential software, eliminating the complexity of sourcing components from multiple vendors.

From a distribution perspective, retailers favor offering fully assembled e-bikes, as complete solutions are easier to demonstrate, explain, and convert into sales. According to the Ministry of Road Transport and Highways (Vahan Dashboard), electric two-wheelers accounted for the majority of consumer spending within India’s electric mobility segment in 2025, reinforcing sustained demand for turnkey electric mobility solutions.

There solutions further classified into followings

- Pedal-Assist E-bikes

- Throttle-Based E-bikes

- Cargo / Utility E-bikes

- Folding E-bikes

- High-Speed / Performance E-bikes

The Services segment is projected to be the fastest-growing, registering a CAGR of 8.2% over the forecast period. Growth in this segment is driven by increasing demand for post-purchase support, as a significant number of riders experience battery discharge issues, charging-related concerns, and component wear from frequent usage. As e-bikes gain traction for work-related and commercial applications, service offerings are becoming essential rather than optional.

Fleet operators, in particular, are opting for structured service agreements to minimize downtime and ensure operational continuity. The rising need for maintenance, diagnostics, and technical support is enabling services to expand at a faster pace than product sales. To meet this demand, certified service networks are expected to expand to nearly 10,000 partners across India by 2025, directly addressing the growing requirement for accessible after-sales support and faster maintenance solutions.

There services further classified into followings

- Battery Leasing & Replacement Services

- Maintenance & Repair Services

- Subscription & Rental Services

- Fleet Management Services

- Financing & Insurance Services

By Organization Size

Large enterprises accounted for the largest share of the market, representing approximately 65% in 2025, driven by bulk procurement of electric bikes for delivery services, rental operations, and internal transportation needs. These organizations are increasingly replacing fuel-powered two-wheelers to improve route efficiency, streamline daily operations, and reduce operating costs. Centralized charging and servicing infrastructure further strengthens fleet utilization, while consolidated procurement enables structured and efficient fleet management.

Large enterprises continue to scale electric mobility adoption across logistics and last-mile delivery operations, supported by the deployment of more than 10,000 electric delivery vehicles in India during 2024. This reflects an aggressive shift toward fleet electrification among corporate users.

Small and medium-sized enterprises (SMEs) represent the fastest-growing buyer category, as smaller businesses increasingly transition to electric bikes for routine operations. Local retailers, courier firms, and service providers are adopting e-bikes to ease operational pressure and lower running costs, particularly for short and repetitive travel routes where electric two-wheelers are highly effective. Flexible financing and easy payment plans further support adoption among cost-sensitive businesses.

Gradual, step-by-step fleet transitions are enabling SMEs to emerge as the fastest-expanding customer group. According to the Ministry of Road Transport and Highways (Vahan Dashboard), the electric cart segment—primarily used by small businesses—recorded year-on-year growth of 59.5% in 2025, underscoring the rapid uptake of affordable electric mobility solutions among SMEs and local delivery operators.

By Battery Type

Lithium-ion batteries represented the largest battery segment, accounting for approximately 75% of the market in 2025. This dominance reflects the fact that the majority of e-bikes sold today are equipped with lithium-ion batteries as the standard configuration. The technology offers a favorable balance of lightweight design, home-charging convenience, and suitability for daily commuting needs. As a result, manufacturers have largely standardized product development around this battery format, reinforcing its widespread adoption across brands and models.

According to the Ministry of Finance, concessional customs duties on lithium-ion cell imports were extended in 2026, supporting continued cost competitiveness and supply stability of the dominant battery technology used in electric two-wheelers.

Swappable battery systems are the fastest-growing battery category, registering a CAGR of 7.9%, driven by demand for instant energy access and reduced charging downtime. Delivery personnel and gig-economy riders are among the most active users of battery swapping, particularly during high-intensity operating hours. High-traffic work zones and commercial clusters are increasingly being equipped with dedicated swap stations, while fleet operators view battery swapping as an efficient solution for managing energy needs across distributed teams.

The everyday operational practicality of swap-based models is accelerating adoption across commercial use cases. According to the Ministry of Heavy Industries, the PM E-Drive scheme launched in 2024 allocated ₹10,900 crore to accelerate the deployment of public charging and battery swapping infrastructure for commercial two- and three-wheelers, further supporting long-term growth of this segment.

By End User

Personal commuting represents the largest application segment, accounting for approximately 55% of the market in 2025, as most e-bikes are purchased for routine, everyday mobility. Consumers primarily use e-bikes for commuting to work, visiting local retail outlets, and traveling to nearby destinations within urban areas. The convenience and efficiency of e-bikes for short city trips continue to drive adoption, with many households also purchasing e-bikes for shared family use. According to the Ministry of Road Transport and Highways (Vahan Dashboard), electric two-wheelers accounted for approximately 57% of total electric vehicle sales in India in 2025, underscoring the dominance of personal mobility demand within the electric vehicle market.

Last-mile delivery and logistics is the fastest-growing application segment, registering a CAGR of 8.4%, driven by the rapid expansion of home delivery services from major metropolitan areas into smaller cities and towns. E-bikes are particularly well suited for short delivery routes that involve frequent stops, offering efficiency and cost advantages for logistics operators. According to the International Energy Agency, global sales of electric two- and three-wheelers reached 10 million units in 2024, highlighting the accelerating adoption of these vehicle types for urban mobility and short-distance connectivity.

By Distribution Channel

Online sales platforms represent the largest distribution channel, accounting for approximately 40% of total market share in 2025. This dominance is driven by consumer preference for comparing multiple models, specifications, and price points within a single digital interface. In addition to third-party platforms, manufacturers are increasingly leveraging their own direct-to-consumer websites to expand reach and improve customer engagement. The broad accessibility of online channels across both metropolitan areas and smaller towns continues to reinforce their leadership in overall sales. According to the Ministry of Road Transport and Highways (Vahan Dashboard), direct-to-consumer online channels captured a market share of 29.7% within India’s electric two-wheeler segment in FY2025, reflecting a sustained shift in consumer purchasing behavior toward digital platforms.

Fleet and corporate sales constitute the fastest-growing distribution segment, supported by rising adoption of electric vehicles by organized enterprises. Delivery companies and rental operators are increasingly placing bulk orders to electrify their fleets, typically prioritizing standardized vehicle models bundled with comprehensive service and maintenance support. As a result, fleet and corporate sales are expanding at a faster pace than individual retail purchases. Corporate fleet electrification is gaining momentum globally, with more than 700,000 electric vehicles deployed across organized operations by 2025, underscoring the rapid transition toward large-scale, professionally managed electric fleets.

Regional Insights

North India

North India accounted for approximately 40% of the total market share in 2025, emerging as the largest regional contributor to the Indian e-bike market. The region’s leadership is driven by high population density, significant urban concentration, and early adoption of electric mobility solutions. Major urban centers such as Delhi NCR, Jaipur, and Chandigarh demonstrate higher awareness of sustainable transportation and benefit from stronger access to e-bike brands, dealership networks, and after-sales service infrastructure. Supportive state-level EV policies, rising fuel prices, and persistent traffic congestion are accelerating the shift toward e-bikes for short-distance commuting across the region. In addition, relatively higher disposable income levels compared to eastern states are improving affordability, supporting adoption among daily commuters, students, and last-mile delivery users. According to the Ministry of Road Transport and Highways (Vahan Dashboard), Uttar Pradesh accounted for approximately 19% of national electric two-wheeler registrations in FY2025, reinforcing North India’s position as the largest regional driver of market demand.

West India

West India is the fastest-growing regional market, projected to register a CAGR of 8.3% over the forecast period. Growth is being driven by rapid urban expansion, strong industrial activity, and proactive electric vehicle policies across key states. Maharashtra and Gujarat remain the primary growth engines, supported by state-level incentives, the presence of EV manufacturing hubs, and steadily improving charging infrastructure. Rising fuel prices and longer commuting distances in major urban centers such as Mumbai, Pune, and Ahmedabad are accelerating demand for cost-efficient electric bicycles. In addition, the region benefits from a strong startup ecosystem, expanding logistics activity, and increasing adoption of electric fleets by corporate and last-mile delivery operators. Heightened environmental awareness, coupled with rising public and private investment in EV ecosystems, is enabling West India to outpace other regions in terms of growth rate and adoption momentum.

Competitive Landscape / Company Insights

The Indian e-bike market is characterized by a highly fragmented competitive landscape, with a large number of participants rather than dominance by a small group of major players. Alongside established national and international manufacturers, the market includes a wide range of local brands, startups, and regional distributors actively offering e-bike products across the country. Product strategies are increasingly tailored to diverse rider requirements, including cargo transport, urban commuting, and foldable mobility solutions, rather than a one-size-fits-all approach. In parallel, both dealership networks and online platforms provide a broad and varied product mix, ensuring strong consumer choice and limiting dependency on any single manufacturer. This competitive diversity continues to drive innovation, pricing flexibility, and rapid product differentiation across the market.

Mini Profiles

Hero Lectro E-Cycles continues to be one of the mainstays in the Indian e-bike market with its pedal, assist and city-focused electric bicycles, along with the wider Hero brand ecosystem.

EMotorad (Inkodop Technologies Pvt. Ltd.) is committed to designing utility-oriented and commuter e-bikes for Indian road conditions and daily work usage.

Elecson (EV Elecson Electric Bicycles) mainly operates in the mass market segment, providing basic electric bicycles that are suitable for short trips and household use.

Ninety One Cycles is a combination of traditional bicycle manufacturing knowledge and electric assistance to cater to the needs of urban commuters and lifestyle riders.

Toutche Electric is a brand in the premium urban e-bike segment, and its products are characterised by features such as lightweight design, lithium-ion batteries, and smart connectivity solutions.

Recent Developments

February 2026 - Yamaha Motor India began commercial availability of the EC-06 electric scooter in India, with the model distributed through Yamaha’s dealership network across select cities.

January 2026 - Suzuki Motorcycle India started market availability of its e-ACCESS electric scooter in India, with units listed for customer delivery at authorised dealerships.

October 2025 - Ultraviolette Automotive initiated customer deliveries of its X47 Crossover electric motorcycle in India following its market launch the previous month.

September 2025 - Ultraviolette Automotive opened market availability of the X47 Crossover electric motorcycle in India, with orders accepted through dealerships and online channels.

June 2025 - Suzuki commenced market sales of the e-ACCESS electric scooter in India after completing its domestic launch earlier that month, marking the company’s entry into the electric two-wheeler segment.

India E-Bike Market Coverage

Component Insight and Forecast 2026 - 2035

- Solutions

- Services

Organization Size Insight and Forecast 2026 - 2035

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Battery Type Insight and Forecast 2026 - 2035

- Lithium-Ion Battery

- Lead-Acid Battery

- Swappable Battery Systems

End User/Application Insight and Forecast 2026 - 2035

- Personal Commuting

- Last-Mile Delivery & Logistics

- Ride-Sharing & Rental Fleets

- Institutional Use

Distribution Channel Insight and Forecast 2026 - 2035

- Online Sales Platforms

India E-Bike Market by Region

- North

- By Component

- By Organization Size

- By Battery Type

- By End User/Application

- By Distribution Channel

- East

- By Component

- By Organization Size

- By Battery Type

- By End User/Application

- By Distribution Channel

- West

- By Component

- By Organization Size

- By Battery Type

- By End User/Application

- By Distribution Channel

- South

- By Component

- By Organization Size

- By Battery Type

- By End User/Application

- By Distribution Channel

Table of Contents for India E-Bike Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Component

1.2.2. By

Organization Size

1.2.3. By

Battery Type

1.2.4. By

End User/Application

1.2.5. By

Distribution Channel

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. India Market Estimate and Forecast

4.1. India Market Overview

4.2. India Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Component

5.1.1. Solutions

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Services

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Organization Size

5.2.1. Large Enterprises

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Small & Medium Enterprises (SMEs)

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Battery Type

5.3.1. Lithium-Ion Battery

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Lead-Acid Battery

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Swappable Battery Systems

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By End User/Application

5.4.1. Personal Commuting

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Last-Mile Delivery & Logistics

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Ride-Sharing & Rental Fleets

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Institutional Use

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.5. By Distribution Channel

5.5.1. Online Sales Platforms

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

6. North Market Estimate and Forecast

6.1. By

Component

6.2. By

Organization Size

6.3. By

Battery Type

6.4. By

End User/Application

6.5. By

Distribution Channel

6.5.1.

North Market Estimate and Forecast

6.5.2.

East Market Estimate and Forecast

6.5.3.

West Market Estimate and Forecast

6.5.4.

South Market Estimate and Forecast

7. East Market Estimate and Forecast

7.1. By

Component

7.2. By

Organization Size

7.3. By

Battery Type

7.4. By

End User/Application

7.5. By

Distribution Channel

7.5.1.

North Market Estimate and Forecast

7.5.2.

East Market Estimate and Forecast

7.5.3.

West Market Estimate and Forecast

7.5.4.

South Market Estimate and Forecast

8. West Market Estimate and Forecast

8.1. By

Component

8.2. By

Organization Size

8.3. By

Battery Type

8.4. By

End User/Application

8.5. By

Distribution Channel

8.5.1.

North Market Estimate and Forecast

8.5.2.

East Market Estimate and Forecast

8.5.3.

West Market Estimate and Forecast

8.5.4.

South Market Estimate and Forecast

9. South Market Estimate and Forecast

9.1. By

Component

9.2. By

Organization Size

9.3. By

Battery Type

9.4. By

End User/Application

9.5. By

Distribution Channel

9.5.1.

North Market Estimate and Forecast

9.5.2.

East Market Estimate and Forecast

9.5.3.

West Market Estimate and Forecast

9.5.4.

South Market Estimate and Forecast

10. Company Profiles

10.1. Hero Lectro E-Cycles

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. EMotorad (Inkodop Technologies Pvt. Ltd.)

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Elecson (EV Elecson Electric Bicycles)

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Lekeamp

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Ninety One Cycles

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. SK Ebicycle LLP

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Stryder Cycle Pvt. Ltd.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Toutche Electric

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Virtus Motors Pvt. Ltd.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Voltebyk

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Voltrix Mobility Pvt. Ltd.

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Ampere Electric

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. Revolt Motors

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

10.14. Avon Cycles

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5. Recent

Developments

10.15. Kabira Mobility

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

India E-Bike Market