Global Atrazine Market – Analysis and Forecast (2025-2030)

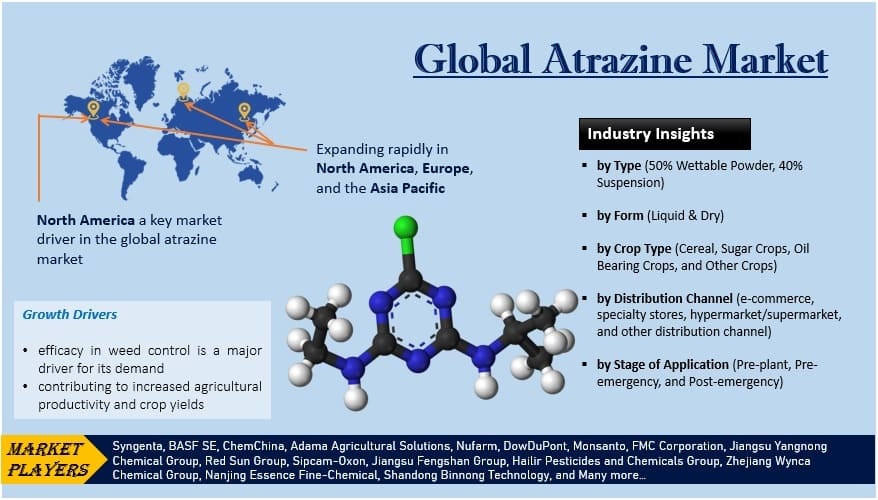

Industry Insight by Type (50% wettable powder, 40% suspension), by Form (Liquid, Dry), by (Cereal, Sugar crops, Oil bearing crops, and Other crops), by (E-commerce, Specialty stores, Hypermarket/supermarket, Other distribution channel), and by Stage of Application (Pre-plant, Pre-emergency, and Post-emergency)

| Status : Published | Published On : Jan, 2024 | Report Code : VRCH2109 | Industry : Chemicals & Materials | Available Format :

|

Page : 203 |

Global Atrazine Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (50% wettable powder, 40% suspension), by Form (Liquid, Dry), by (Cereal, Sugar crops, Oil bearing crops, and Other crops), by (E-commerce, Specialty stores, Hypermarket/supermarket, Other distribution channel), and by Stage of Application (Pre-plant, Pre-emergency, and Post-emergency)

Industry Overview

Atrazine is a widely used herbicide in agriculture, primarily employed to control broadleaf and grassy weeds in crops like corn and sugarcane. Classified as a chlorotriazine, it inhibits photosynthesis in plants by disrupting the electron transport chain. Atrazine's efficacy and persistence make it popular, but concerns have been raised due to its environmental impact. Controversies include potential water contamination, affecting aquatic ecosystems and posing risks to human health. Regulatory bodies monitor its use, considering both agricultural benefits and environmental implications, aiming to strike a balance between effective weed control and minimizing adverse effects on ecosystems and water quality.

Global Atrazine Market was worth USD 1.65 billion in 2023 and is expected to reach USD 2.74 billion by 2030 with a CAGR of 7.25% during the forecast period, i.e., 2025-2030. The demand for atrazine is propelled by its effectiveness as a herbicide in agriculture, particularly for controlling weeds in crops like corn and sugarcane. Its broad-spectrum activity, cost-effectiveness, and persistent weed control contribute to its popularity among farmers. However, environmental concerns, regulatory scrutiny, and health considerations also impact its demand, prompting a nuanced evaluation of its usage in modern agriculture.

Geographically, the global atrazine market is expanding rapidly in North America, Europe, and the Asia Pacific due to its effective weed control in agriculture, increased demand for high-yield crops, and the ongoing search for efficient and cost-effective herbicide solutions in these regions; however, the market confronts constraints such as increasing regulatory scrutiny over environmental and health concerns, potential water contamination issues, and a shift towards sustainable and eco-friendly agricultural practices. Overall, the atrazine market offers potential prospects for market participants to develop and fulfill the growing needs of wide range of industries including agriculture, food and beverages, and other industries.

Market Segmentation

Insight by Type

Based on the type, the global atrazine market is segmented into 50% wettable powder and 40% suspension. 50% wettable powder segment dominated the global atrazine market in 2023 due to its versatility and ease of application. This formulation dissolves readily in water, facilitating uniform distribution across crops. Farmers find it convenient for spray applications, ensuring effective weed control. For instance, Atrazine 50 WP is widely used, offering a concentrated formulation that enhances efficacy. While 40% suspension concentrates are also employed, the wettable powder's practical advantages, such as better coverage and reduced environmental impact, make it the preferred choice, contributing to its dominance in the evolving landscape of the global atrazine market.

Insight by Form

Based on form, the global atrazine market is segmented into liquid and dry. Dry formulation segment dominated the global atrazine market in 2023 owing to its logistical advantages and cost-effectiveness. Atrazine in granular or powder form, such as Aatrex 4L, is favored for ease of storage, transportation, and application. Dry formulations offer better shelf life, reduce packaging waste, and simplify handling for farmers. While liquid formulations like Atrazine 4L exist, the dry segment prevails due to practical benefits, aligning with agricultural efficiency and sustainability goals. The preference for dry atrazine formulations underscores their pivotal role in shaping the market landscape and meeting the demands of modern agriculture.

Insight by Crop Type

Based on crop type, the global atrazine market is segmented into cereal, sugar crops, oil bearing crops, and other crops. Cereal crop, mainly corn, dominated the global atrazine market in 2023 due to its extensive usage in weed control. Corn cultivation extensively relies on atrazine for effective and economical weed management. Atrazine's efficacy in preventing broadleaf and grassy weed growth aligns with the needs of cereal crops, contributing to its dominance.

Insight by Distribution Channel

Based on distribution channel, the global atrazine market is segmented into e-commerce, specialty stores, hypermarket/supermarket, and other distribution channel. Hypermarket/supermarket segment dominated the global atrazine market in 2023 due to its widespread accessibility and convenience for agricultural input procurement. Farmers often obtain atrazine from these outlets, streamlining the purchase process. For instance, major agrochemical brands distribute atrazine through established hypermarkets, ensuring broad market reach. While e-commerce is gaining traction, the bulk and specialized nature of agrochemical purchases still favor physical stores. The hypermarket/supermarket segment's established infrastructure and familiarity make it a pivotal distribution channel, facilitating the widespread availability and adoption of atrazine in the global agricultural sector.

Insight by Stage of Application

Based on stage of application, the global atrazine market is segmented into pre-plant, pre-emergency, and post-emergency. Pre-emergency segment dominated the global atrazine market in 2023 as it prevents weed growth before crops emerge, ensuring effective weed control and higher crop yields. Atrazine applied pre-emergence provides a barrier against weed competition, optimizing its effectiveness.

Atrazine Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 1.65 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 2.74 Billion |

|

Growth Rate |

7.25% |

|

Segments Covered in the Report |

By Type, By Form, By Crop Type, By Distribution Channel, and By Stage of Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and South America |

Industry Dynamics

Growth Drivers

Application in weed control

Atrazine’s efficacy in weed control is a major driver for its demand and it is contributing to increased agricultural productivity and crop yields. Atrazine, a widely used herbicide, effectively targets broadleaf and grassy weeds, making it particularly valuable in crops like corn, sorghum, and sugarcane. For instance, the Aatrex product series, containing atrazine as a key ingredient, exemplifies its significance. Farmers globally rely on atrazine to suppress weed growth, reducing competition for nutrients, water, and sunlight, thereby optimizing crop performance.

Moreover, the adoption of genetically modified (GM) crops, such as herbicide-tolerant varieties, further accentuates atrazine's importance. GM crops engineered to withstand atrazine enable farmers to apply the herbicide for weed control without harming the crop. This enhances the herbicide's utility and reinforces its position as a vital tool in modern agriculture. As the demand for high-yield and sustainable farming practices continues, the effectiveness of atrazine in weed management remains a crucial driver shaping the growth of the atrazine market.

Cost effectiveness compared to other weed controlling methods

Another significant driver for the atrazine market is its cost-effectiveness compared to alternative weed control methods. Atrazine offers an economical solution for farmers, as it is relatively affordable and requires lower application rates to achieve effective weed suppression. This cost advantage is crucial for farmers seeking efficient weed management without significantly impacting their operational expenses. For example, the Atrazine 90 DF (dry flowable) formulation is known for its cost-effective application and broad-spectrum weed control.

In comparison to some organic or non-synthetic herbicides, atrazine often proves more economical, providing farmers with an accessible and efficient option. While certain alternative herbicides may offer environmentally friendly profiles, the cost-effectiveness of atrazine remains a compelling factor for many agricultural operations, especially in large-scale farming scenarios. This economic viability cements atrazine's position as a preferred choice among farmers globally, contributing to its sustained demand and market growth.

Challenge

Increasing regulatory scrutiny and environmental concerns

Increasing regulatory scrutiny and environmental concerns are the major challenges for the global atrazine market. Atrazine has faced restrictions and bans in some regions due to its potential impact on water quality and aquatic ecosystems, raising questions about its long-term sustainability. Regulatory measures to address these environmental issues pose challenges for atrazine manufacturers and users. As agriculture shifts towards more sustainable practices, the herbicide market must navigate stringent regulations and develop eco-friendly alternatives to mitigate the challenges associated with atrazine use in modern farming.

Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- South America

The global atrazine market is segmented into North America, Europe, the Asia-Pacific, South America, and the Middle East and Africa region. The global atrazine market was dominated by North America in 2023 due to extensive use in major crops like corn. The region's large-scale corn cultivation relies heavily on atrazine for effective weed control. For instance, in the United States, atrazine is a staple herbicide in corn farming, ensuring high yields. Favorable climatic conditions and advanced agricultural practices further contribute to North America's dominance. The prevalence of atrazine-resistant weeds and the need for consistent, reliable herbicides in corn production solidify the herbicide's central role, making North America a key market driver in the global atrazine market.

Competitive Insight

Syngenta is the largest player in the global atrazine market, being a key player in agrochemicals. The company's flagship product, AAtrex, is a well-known atrazine-based herbicide extensively used for weed control, particularly in crops like corn and sorghum. Syngenta's strategic investments and innovations in agrochemical solutions reinforce its leadership. In recent years, the company has focused on sustainable practices, exemplified by its commitment to advancing agricultural sustainability through initiatives like The Good Growth Plan. This holistic approach aligns with evolving industry trends and positions Syngenta as a major influencer and contributor to the global atrazine market's growth and development.

BASF plays a significant role in the global atrazine market, known for its robust agrochemical portfolio. The herbicide product, Aresenal® PowerLine™, demonstrates the company's commitment to innovative atrazine-based solutions for effective weed control. With extensive global production facilities, including a major presence in North America and Europe, BASF ensures a reliable supply chain. The acquisition of significant portions of Bayer's seed and non-selective herbicide businesses in 2018 further solidified BASF's position in the market. This strategic move broadened the company's agricultural offerings, emphasizing its role as a key contributor and competitor in the dynamic landscape of the global atrazine market.

Recent Development by Key Players

Recently, Brazilian labor prosecutors seek a court order to ban atrazine, present in 5% of pesticides sold in the country. ANVISA, the Brazilian health regulator, might cancel pesticide registrations with atrazine if the order passes. Atrazine, used on crops like sugarcane and corn, faces scrutiny due to potential groundwater contamination. Banned in the EU in 2003 and Switzerland in 2012, it's produced by Syngenta, headquartered in Switzerland. Syngenta defends atrazine's safety on its website, citing permitted use on U.S. farms. The legal action reflects growing global concerns about the herbicide's environmental and health impacts.

Recently, The EPA proposed label changes for atrazine products, aiming to curb herbicide runoff. The proposal suggests prohibiting application during saturated soil conditions, rain, or impending storm events. Aerial applications were asked to be banned, and annual application rates restricted to 2 pounds per acre for sorghum, field corn, and sweet corn. Atrazine, widely used in agriculture, faces environmental concerns, and this move was aimed to address the issues related to water quality, responding to calls for increased restrictions from environmental groups.

Key Players Covered in the Report

Syngenta, BASF SE, ChemChina, Adama Agricultural Solutions, Nufarm, DowDuPont, Monsanto, FMC Corporation, Jiangsu Yangnong Chemical Group, Sipcam-Oxon, Jiangsu Fengshan Group, Hailir Pesticides and Chemicals Group, Zhejiang Wynca Chemical Group, Red Sun Group, Nanjing Essence Fine-Chemical, Shandong Binnong Technology, Shandong Qiaochang Chemical, Hubei Sanonda, Shandong Dacheng Pesticide, and Zhejiang Heben Pesticide & Chemicals.

The atrazine market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2024–2030.

Segments Covered in the Report

By Type

- 50% wettable powder

- 40% suspension

By Form

- Liquid

- Dry

By Crop Type

- Cereal

- Sugar crops

- Oil bearing crops

- Other crops

By Distribution Channel

- E-commerce

- Specialty stores

- Hypermarket/supermarket

- Other distribution channel

By Stage of Application

- Pre-plant

- Pre-emergency

- Post-emergency

Region Covered in the Report

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

Middle East and Africa (MEA)

- Saudi Arabia

- U.A.E

- South Africa

- Rest of MEA

South America

- Argentina

- Brazil

- Chile

- Rest of South America

.png)

Source: VynZ Research

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Atrazine Market