Hot Melt Adhesives Market Overview

The global hot melt adhesives market is projected to grow from USD 8.9 billion in 2025 to USD 14.9 billion by 2035, registering a CAGR of 6.1% during the forecast period ranging from 2026 to 2035.

Hot melt adhesives typically refer to a specific type of thermoplastic adhesive. It is normally applied with the help of a hot glue gun. This is why these tapes are called hot glue tapes as well. Both synthetic and natural adhesive variants are available in this category of huge array of polymers.

The growth of the hot melt adhesives market is attributed to the rising spending power of the consumers in developing countries as well as the significant expansion of the packaging industry and the growing adoption of this tape in this specific sector.

The continual fluctuation in the prices of raw materials used to make hot melt adhesives is the major factor that is hindering the growth of its global market because it makes it difficult for the manufacturers to balance production and selling cost precisely to make profits. However, there are leveraging market growth by using innovative assembly methods, especially in the automotive industry and upgrading technology to develop new products to gain a competitive edge. This is offering new growth opportunities.

Hot Melt Adhesives Market Segmentation

Insight by Type

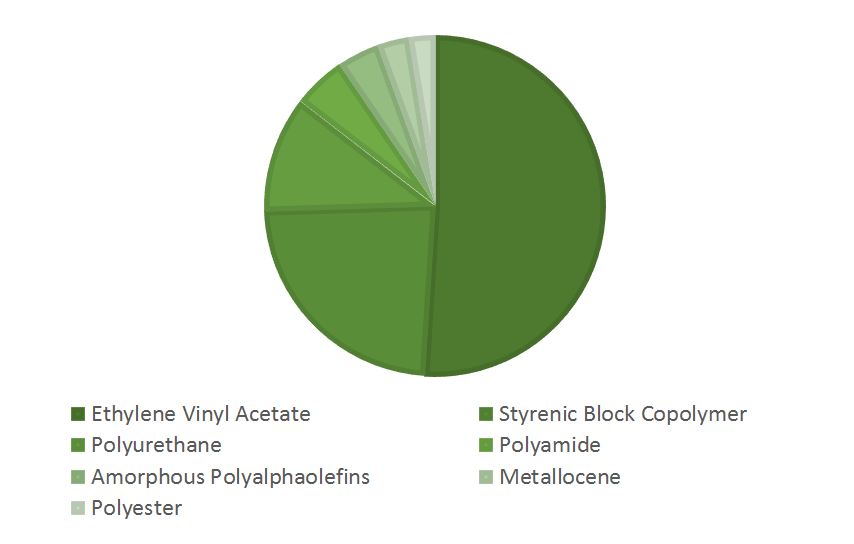

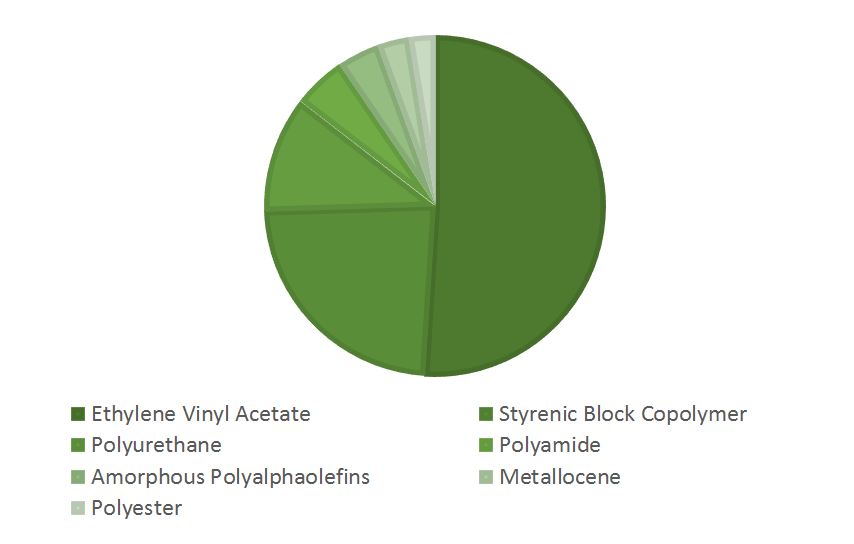

The global hot melt adhesives market is divided on the basis of its type into styrene block copolymers (SBC), polyamide (PA), polyurethane (PU), ethylene-vinyl acetate (EVA), amorphous poly-alpha olefin (APAO), polyester, and metallocene polyolefin (MPO) categories. Among all these categories, the EVA segment is expected to generate the largest revenue throughout the forecast period due to its various benefits such as durability, quicker time setting, suitability in a huge variety of temperatures, and the rapid expansion and higher demand in the automobile and construction sectors.

GLOBAL HOT MELT ADHESIVES MARKET SHARE, BY TYPE

Insight by Application

The global hot melt adhesives market is divided on the basis of application into furniture, hygiene, bookbinding, packaging solutions, automobile, textile, electronics, footwear, and other segments. Of these, the automobile application segment is expected to witness higher growth during the forecast period due to extensive use in the components of commercial and personal vehicles and high adoption in developing economies. Furthermore, it also used extensively for packaging solutions which will also bolster the growth of the marker further.

Insight by Specialty Applications

The global hot melt adhesives market is divided on the basis of specialty application into labels, disposable products, and medical dressings segments. Out of these the labels section is likely to grow more during the forecast period due to increased e-commerce activities and demand for diverse and efficient packaging solutions.

Insight by Functional Properties

The global hot melt adhesives market is divided on the basis of functional properties into high temperature resistance, moisture resistance, UV stability, and biodegradability category. Out of these the high temperature resistance is likely to grow more due to higher demand in automotive and aerospace applications, while marine applications influence moisture resistant tapes, and outdoor signage pushes the demand for UV-resistant adhesives.

Global Hot Melt Adhesives Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 8.9 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 14.9 Billion

|

|

Growth Rate

|

6.1%

|

|

Segments Covered in the Report

|

By Type, and By Application

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Industry Trends

There is a notable shift among the automobile manufacturers from traditional methods to newly accomplished assembly techniques. Also, the evolving trends of the consumers in developing countries and in the APAC region is encouraging development of varied, complex, and environment-friendly offerings. This specific trend is making these adhesives more accessible and popular among the consumers of this region.

Hot Melt Adhesives Market Growth Drivers

The higher disposable income of consumers in developing countries such as China, India, and Indonesia is one of the major factors driving the growth of the global hot melt adhesives market. As a result, there is an increasing demand of these tapes for various products such as electronics, clothes, and footwear at a rapid pace across the globe. In addition, the rapid growth of the packaging industry and industrialization are other factors driving the market growth. There are also a few other factors that are contributing significantly to the growth of the market, which include technological advancements and innovations in adhesive formulations, increased construction activities worldwide, growth of the automotive industry and rising vehicle production and demand, expansion of eCommerce and healthcare sector for packaging requirements, growing awareness and demand from consumers for sustainable and non-toxic solutions, and strict government regulations and standards of emissions and environmental impact.

Hot Melt Adhesives Market Challenges

The strict regulations on volatile organic compounds (VOCs) and other environmental concerns hinders the use and production, which affects the market growth. Inadequate supply of raw materials, technological barriers needing constant innovation and adaptation to new technologies, stiff competition from alternative bonding technologies, and shifting consumer preferences towards more sustainable and eco-friendly products are other challenges to the market growth.

Hot Melt Adhesives Market Opportunities

The market is however prospective for growth during the forecast period due to the rapid industrialization and urbanization in emerging markets and development of advanced bio-based and eco-friendly formulations that help meet the strict regulatory standards. In addition, innovative product applications across several industries, customized adhesive solutions offerings, and growth in eCommerce and packaging are presenting novel growth opportunities to the market.

Hot Melt Adhesives Market Geographic Overview

The North American market is expected to grow at a higher rate and generate higher revenue during the forecast period due to continual technological advancements and innovation in adhesive technologies, increasing production and demand in the automotive industry, rising construction and infrastructure projects, rising awareness for sustainable products and growing shift towards it, and higher regulatory pressures.

The Asia Pacific market is expected to witness the fastest rate of growth during the forecast period due to the rapid development in the infrastructure in developing countries such as India and China. Also, ongoing industrialization and urbanization, growth in consumer and electronics manufacturing, and rise in disposable incomes among consumers all raises the demand for this product and pushes the market growth as a result.

Hot Melt Adhesives Market Competitive Insight

Sika AG is a Swiss multinational specialty chemical company that supplies to the building sector and motor vehicle industry. SikaMelt adhesives are part of range of hotmelt products, with a chemical structure based on polyurethane, polyolefin. SikaMelt is ideal for bonding plastics and composites along with wood, paper, metals, textiles and foams, for both interior and exterior automotive applications.

Westlake Corporation is an international manufacturer and supplier of polymers, fabricated building products and petrochemicals, which are fundamental to various consumer and industrial markets. It is a leading supplier to the Hot Melt Adhesive industry for over 60 years.

Some of the major players operating in the global hot melt adhesives market are Sika AG, Beardow & Adams (Adhesives) Limited., 3M Company, Westlake Chemical Corporation, Bostik Inc., Jowat SE, H.B. Fuller Company, Avery Dennison Corporation, Arkema Group, DowDuPont Inc., and Henkel & Co. KGaA.

Recent Developments By Key Players

Westlake Chemical Corporation has collaborated with Hexion Inc. to acquire Hexion's global epoxy business.

The Hot Melt Adhesives Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

Segments Covered in the Report

- Type

- Styrenic Block Copolymers (SBC)

- Polyamide (PA)

- Polyurethane (PU)

- Ethylene-vinyl Acetate (EVA)

- Amorphous Poly-Alphaolefin (APAO)

- Polyester

- Metallocene Polyolefin (MPO)

- Application

- Furniture

- Hygiene

- Bookbinding

- Packaging Solutions

- Automobile

- Textile

- Electronics

- Footwear

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Middle East and Africa (MEA)

- South America

Source: VynZ Research