Global Industrial Pump Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (Centrifugal Pump, Positive Displacement Pump, and Others), by End-Use (Textile, Metal & Mining, Water & Wastewater Treatment, Chemical, Oil & Gas, Power Generation, Agriculture, and Others), and Geography (North America, Europe, Asia Pacific and Rest of the World)

| Status : Published | Published On : Feb, 2024 | Report Code : VRCH2090 | Industry : Chemicals & Materials | Available Format :

|

Page : 200 |

Global Industrial Pump Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (Centrifugal Pump, Positive Displacement Pump, and Others), by End-Use (Textile, Metal & Mining, Water & Wastewater Treatment, Chemical, Oil & Gas, Power Generation, Agriculture, and Others), and Geography (North America, Europe, Asia Pacific and Rest of the World)

Industrial Pump Market Overview

The Global Industrial Pumps Market size is anticipated to grow at a CAGR of 5.2% during the forecast period. It will grow from USD 57.56 billion in 2023 to USD 94.56 billion in 2030. Industrial pumps are used to transport different types of fluids from one place to another. These mechanical devices can transport oil, chemicals, wastewater, slurry, and more. Depending on the type of liquid to carry, these machines can come in different shapes, sizes, and specifications. Different materials or metal alloys are used to make these pumps, such as stainless steel, cast iron, carbon steel, and others.

Different factors can fuel the growth of this market in the forecast period, such as project requirements, higher industrialization, electricity demand, and investment in the renewable energy sector, especially in the power sector of developing countries. In developed countries like the US, higher investments in production and exploration in the oil and gas sector fuel the market growth. Currently, there is a notable increase in the demand for these pumps in the food and pharmaceutical industries.

Market Segmentation

Insight by Type

Based on the type of these machines, the global industrial pump market can be divided into centrifugal pump, positive displacement pump, vane pump, lobe pump, jet pump, and electromagnetic pump segments. The centrifugal pumps can be further divided into propellor pumps, axial flow pumps, mixed flow pumps, and radial flow pumps. The positive displacement pumps can be further categorized into rotary and reciprocating pumps, while the latter can be even divided into plunger pumps, piston pumps, and diaphragm pumps. The rotary pumps have two other types such as gear pumps and screw pumps.

Out of all these, the centrifugal pumps are the largest contributor to the market and will continue to be so in the forecast period. It is mainly due to its varied applications in water supply, fire, food & beverage, chemical, and sewage disposal sectors. These pumps can transfer fluids in larger volumes irrespective of fluid pressure, solid concentrations, and low viscosity.

Moreover, the market demand for these pumps will grow due to extensive residential and commercial constructions, higher infrastructure investments, and expansion of the manufacturing sector.

Insight by End-Use

Based on end-use, the market can be divided into metal, textile, chemicals, oil and gas, power, water and wastewater, agriculture, and mining segments. Out of these, the water and wastewater segment is the largest contributor due to the rising demand to meet with scarcity of water worldwide.

The power segment will also grow due to extensive demand for these pumps across a wide range of industries, such as boiler feed, flue gas desulfurization, circulation or cooling water, condensate water, and more. Steam generation sectors also need these pumps in the form of booster pumps, boiler feed pumps, circulation pumps, and condensate pumps.

Industry Dynamics

Growth Drivers

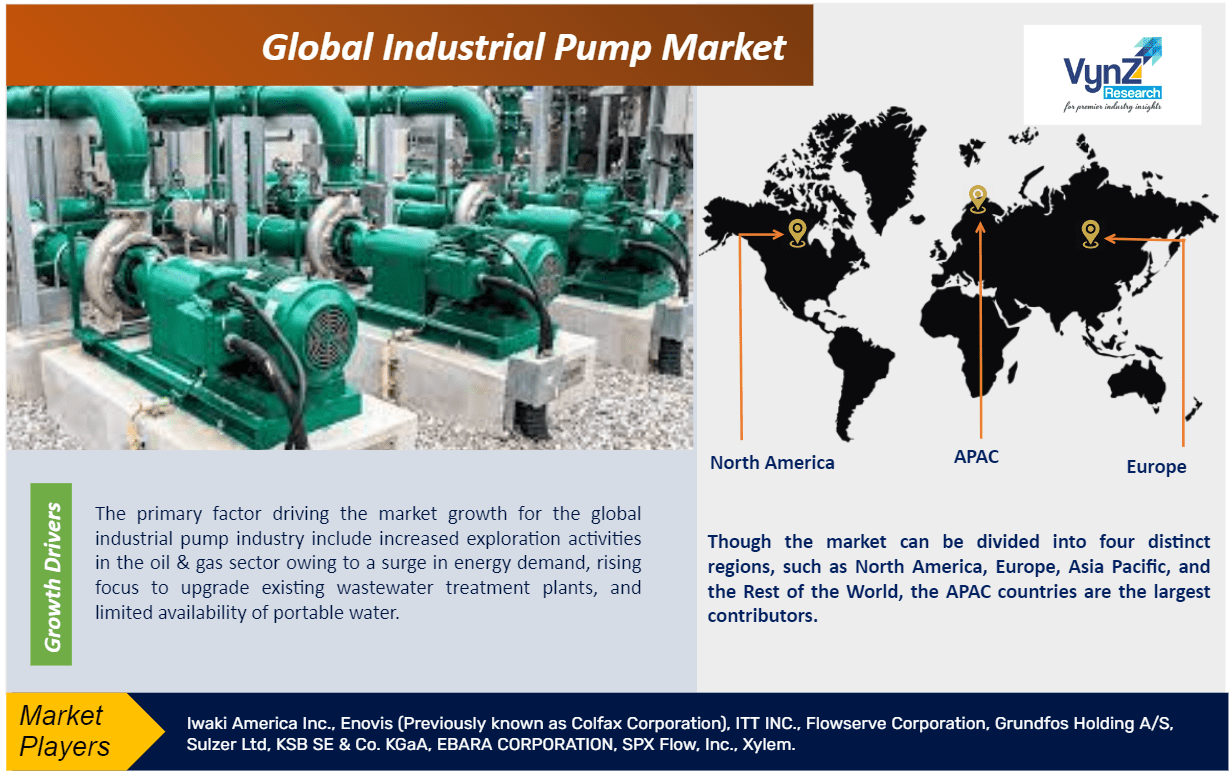

The primary factor driving the market growth for the global industrial pump industry include increased exploration activities in the oil & gas sector owing to a surge in energy demand, rising focus to upgrade existing wastewater treatment plants, and limited availability of portable water. Moreover, rising concerns about the environment, urbanization, increased awareness regarding the harmful effects of drinking contaminated water, and mounting infrastructure development will bolster the market growth for the global industrial pumps industry. In the power industry, industrial pumps of various sizes and forms are used for circulation, boiler feed, and sludge handling. To diversify their product offerings and gain an advantage over rivals, the main players are focusing on mergers and acquisitions (M&A) with small and medium-sized enterprises (SMEs).

Restraints

The factors limiting market expansion are fluctuating component prices and stringent environmental laws imposed by regional governments. Also, due to constant exposure to water and other fluid substances, industrial pumps can corrode and hinder machine operation. This is a key impediment to the widespread use of industrial pumps.

Opportunities

Over the projection period, oil production is expected to increase due to technological advancements that have made deepwater and ultra-deepwater exploration viable and cost-effective. During the forecast period, it may give an opportunity for market expansion.

Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Though the market can be divided into four distinct regions, such as North America, Europe, Asia Pacific, and the Rest of the World, the APAC countries are the largest contributors. This is because there is rapid industrialization in these countries, a rise in refining capacities, and the growing need of the rising population.

The regulatory framework in the refining sector and the abundance of oil and gas in these regions are also good reasons for its dominance and rapid market expansion.

Competitive Insight

Because of the anticipated growth in demand for water treatment over the next few years, the market is characterized by the presence of both international and regional manufacturers. Businesses promote their products using a range of channels via websites, e-commerce sites, retailers, wholesalers, and end consumers. Manufacturers compete on several aspects like product cost, performance, design, technology, reputation, and availability. Companies are using a variety of strategies such as new product launches, distribution network expansion, R&D expenditure, and M&A, to increase their market share and reach.

Key Players Covered in the Report

Some of the major players operating in the global industrial pumps industry include Iwaki America Inc., Enovis (Previously known as Colfax Corporation), ITT INC., Flowserve Corporation, Grundfos Holding A/S, Sulzer Ltd, KSB SE & Co. KGaA, EBARA CORPORATION, SPX Flow, Inc., Xylem.

Recent Developments by Key Players

EBARA Pumps Europe S.p.A. and SKF Lubrication Systems Germany GmbH (SKF) signed an agreement, regarding the transfer of SKF's coolant pump (Spandau Pumpen) business. Through this partnership EBARA shall enter the global market for machine tools and furtherer expand its business by providing new products and services.

ITT took over Svanehoj to boost the growth of its industrial process segment. Svanehøj is Based in Svenstrup, Denmark, which offers pumps and aftermarket services, that specializes in cryogenic applications. The company provides a comprehensive line of deep well gas cargo pumpall s, tank control systems and fuel and energy pumps. ITT shall integrate Svanehøj into its industrial process segment which manufactures engineered fluid-process equipment for diverse industries like mining, power generation, oil & gas and chemical.

The Industrial Pump Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Type

- Centrifugal Pump

- Axial Flow Pump or Propeller Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating Pump

- Piston Pump

- Diaphragm Pump

- Rotary Pump

- Screw Pump

- Gear Pump

- Reciprocating Pump

- Others

- Centrifugal Pump

- By End-Use

- Textile

- Metal & Mining

- Water & Wastewater Treatment

- Chemical

- Oil & Gas

- Power Generation

- Agriculture

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

To explore more about this report - Request a free sample copy

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Industrial Pump Market