Global Naphthenic Base Oil Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (35-60 SUS, 80-130 SUS, 200-300 SUS, 400-800 SUS, Above 1200 SUS), by Application (Process Oil, Electrical Oil, Metal Working, Industrial Lubes and Grease, Rubber Oil and Others), and by Geography (North America, Europe, Asia Pacific and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRCH2089 | Industry : Chemicals & Materials | Available Format :

|

Page : 175 |

Global Naphthenic Base Oil Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (35-60 SUS, 80-130 SUS, 200-300 SUS, 400-800 SUS, Above 1200 SUS), by Application (Process Oil, Electrical Oil, Metal Working, Industrial Lubes and Grease, Rubber Oil and Others), and by Geography (North America, Europe, Asia Pacific and Rest of the World)

Naphthenic Base Oil Market Overview

The Global Naphthenic Base Oil Market size is anticipated to grow from USD 2.5 billion in 2023 to USD 3.25 billion by 2030. It will witness a 3.85% CAGR during the forecast period 2025 - 2030.

Naphthenic base oil is produced by hydrotreating crude oil. This helps in producing hydrocarbons. The process helps in reducing the content of paraffin in the oil and also reduces its smell significantly.

Used across a wide range of industries, this oil is characterized by its superior solubility and lower viscosity. This makes it an ideal material to produce different types of oils such as gear oil, electrical oil, metalworking oil, grease, and industrial lubrication, all having varied applicability. It is also used extensively as automatic transmission and hydraulic fluids, all of which create wide opportunities for this market to expand significantly in the forecast period.

Industry Trends

A few years back, the market of Naphthenic base oil was slumped due to the notable economic crisis. However, in the past couple of years, the market has recovered to some extent. This is due to the strategic methods and practices followed by the manufacturers and the major players in the market. They helped the global market recovery from the setbacks with their innovative approaches.

Market Segmentation

Insight by Type

Based on its different types like 35-60 SUS, 80-130 SUS, 200-300 SUS, 400-800 SUS, and more than 1200 SUS, the naphthenic base Oil market can be divided into as many heads. Out of all these, the demand for 35-60 SUS is comparatively high due to its lower temperature and pour point. This makes it ideal for the production of transformer oil and process oil enabling it to capture a larger share of this market. However, the demand for types 80-130 SUS, 400-800 SUS, and above 1200 SUS of naphthenic base oil is also increasing continuously due to its higher solvency which makes it ideal for producing automotive and metal-working lubricants.

Insight by Application

Based on the varied applicability of naphthenic base oil, its market can be divided into process oil, electrical oil, metal-working oil, rubber oil, grease, industrial lubricant, and others. Out of these, the demand for process oil is high due to its low consumption of fuel, low carbon emission, and smaller rolling resistance. The oil also helps in increasing tire grip resulting in higher safety of vehicles.

Global Naphthenic Base Oil Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 2.5 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 3.25 Billion |

|

Growth Rate |

3.85% |

|

Segments Covered in the Report |

By Type, By Application |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific and Rest of the World |

Industry Dynamics

Growth Drivers

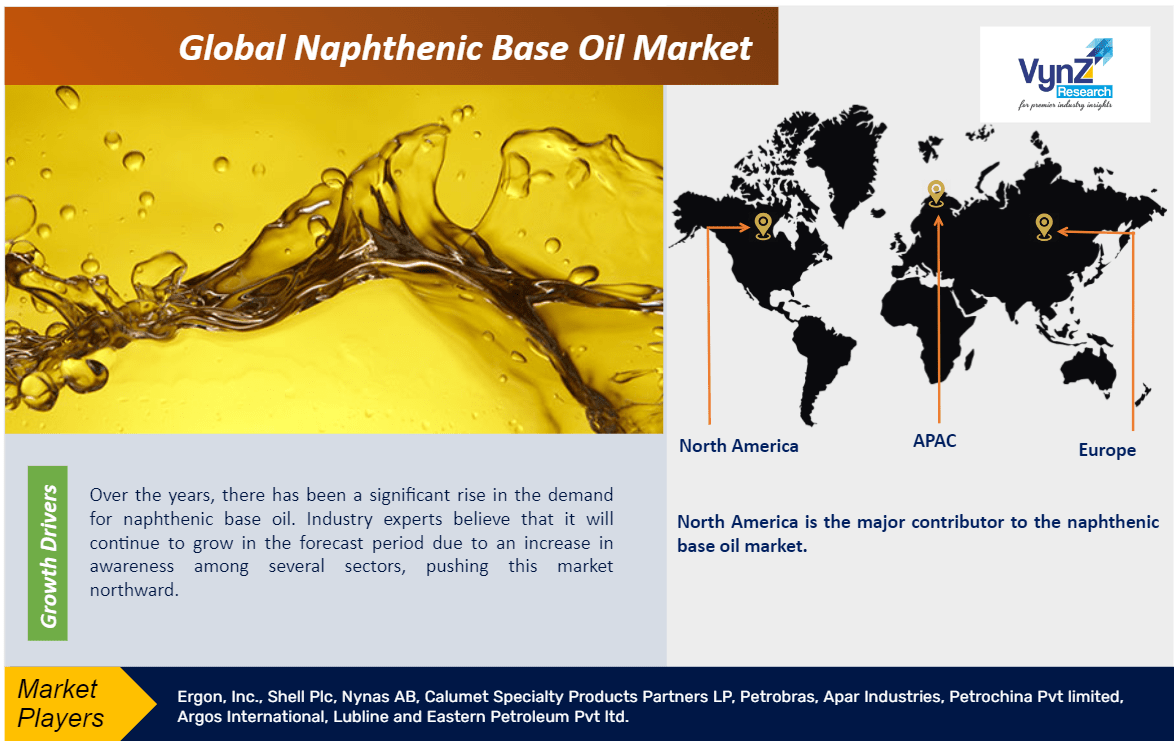

Over the years, there has been a significant rise in the demand for naphthenic base oil. Industry experts believe that it will continue to grow in the forecast period due to an increase in awareness among several sectors, pushing this market northward. Also, the increased production of hybrid and electric vehicles of late has spiked its demand and contributed to the significant growth of the naphthenic base oil market.

There has been a higher demand for and adoption of metal-working fluids in different industries such as lubrication and cooling, which has also resulted in the growth of this market. Naphthenic base oil has unique properties that allow using it for a wide array of applications such as general machining, bearing, automotive, aeronautics, and others. It has lower temperature fluidity, lower aromatic and paraffin content, better solubility, and form-stable emulsion.

Most manufacturing industries of late have moved from paraffin oil to naphthenic base oil to find a suitable lubricating and cooling fluid. This fueled the market growth as well.

Restraints

The cost involved creates a significant hindrance in the growth of the naphthenic base oil market. It is more expensive compared to other alternatives available in the market. This is mainly due to the higher cost of production of this oil.There are also a few significant environmental concerns over the production of naphthenic base oil. The cost of raw materials is pretty unstable, especially the cost of crude oil due to several economic and political factors, which seriously affect the growth of the market.

However, this will not affect the market for long because a lot of initiatives are taken by the government and major players in the industry to reduce costs and practice sustainable and environmentally friendly techniques.

Opportunities

Still, the naphthenic base oil market is experiencing a notable increase in size, thanks to the innovative amenities used for its manufacturing. The increase in demand and its ability to perform at a high level, even at high temperatures, also contributes to its growth.

The oil also provides a better revenue opportunity for businesses due to its increased adoption in automotive lubricants, process oil, insulating oils, adhesives, sealants, insoluble sulfur, printing inks, greases, tire, and battery separators, and other industries that need better-performing gear oils and hydraulic fluids for their fluctuating formulations.

Geographic Overview

North America is the major contributor to the naphthenic base oil market. It is mainly because people now do not want to use vehicles that use lubricants other than this. Moreover, the automotive, power, and energy sectors of this region have a higher demand for high-solvency formulations that need such oil. Add to that, there are lots of major players in the region who invest a large amount of money in the market.

On the other hand, several Asia-Pacific countries such as India and China have developed their automotive sector, which has increased the production of industrial lubes. Industry experts believe that these markets have the highest CAGR and will even move northwards within the forecast period mainly due to higher application and use of hybrid vehicles to deal with environmental concerns.

Key Players Covered in the Report

Some of the major key players in the market of Naphthalene Base Oil market are Ergon, Inc., Shell Plc, Nynas AB, Calumet Specialty Products Partners LP, Petrobras, Apar Industries, Petrochina Pvt limited, Argos International, Lubline and Eastern Petroleum Pvt ltd.

Recent Developments by Key Players

Nordmann (Chemicals distributor) and Ergon International Inc. collaborated to consolidate distribution of activities across the Baltic States, the DACH region, Spain , France, the Nordic countries, Benelux, Serbia, and the UK. Ergon is a major supplier of naphthenic process and base oils for industrial and technical applications. These processes have advantages in terms of colour and UV stability. With this partnership it will be easy to offer solutions for many different types of applications with their naphthenic process and base oils.

The Naphthenic Base Oil Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Type

- 35-60 SUS

- 80-130 SUS

- 200-300 SUS

- 400-800 SUS

- Above 1200 SUS

- By Application

- Process Oil

- Electrical Oil

- Metal Working

- Industrial Lubes and Grease

- Rubber Oil

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Naphthenic Base Oil Market