Global Next Generation Anode Materials Market – Analysis and Forecast (2025-2030)

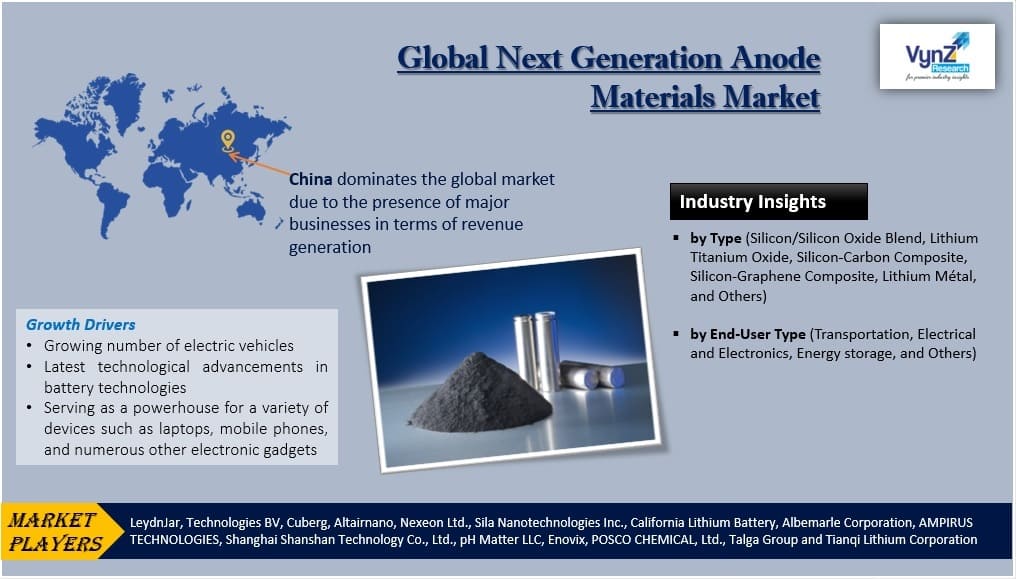

Industry Insight by Type (Silicon/Silicon Oxide Blend, Lithium Titanium Oxide, Silicon-Carbon Composite, Silicon-Graphene Composite, Lithium Metal, and Others),and End-user type (Transportation, Electrical and Electronics, Energy storage, and Others)

| Status : Published | Published On : Jan, 2024 | Report Code : VRCH2101 | Industry : Chemicals & Materials | Available Format :

|

Page : 203 |

Global Next Generation Anode Materials Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (Silicon/Silicon Oxide Blend, Lithium Titanium Oxide, Silicon-Carbon Composite, Silicon-Graphene Composite, Lithium Metal, and Others),and End-user type (Transportation, Electrical and Electronics, Energy storage, and Others)

Next Generation Anode Materials Market Overview

The Global Next-Generation Anode Materials Market was valued at $2.55 billion in 2023, and it is expected to grow at a CAGR of 15.91% and reach $10.67 billion by 2030. The increasing demand for next-generation anode materials with faster charging properties and enhanced power density is mainly responsible to drive the growth of this market. Consumer electronics and transportation sectors are still constrained by the inefficient power sources employed in product manufacturing even if these sectors have had substantial growth over the few years. In most laptops and phones, batteries occupy almost half of the space. Lithium-ion batteries remain the dominant energy storage paradigm today, there has not been much progress in battery technology. Additionally, it is anticipated that within the next few years, lithium-ion battery technology is expected to grow.

Impact of the Market

Increasing frequency of R&D projects to enhance battery competition, the increasing need for high-density and fast charging batteries, and growing concerns for the environment and carbon neutrality targets are rising the demand for the adoption of the Global Next-Generation Anode Materials in the market. Furthermore, the growth is also due to benefits such as enhanced capacity and stability, improved life cycle, and high energy density. The effectiveness and endurance is increased dueto the increased density of energy within next-generation anode materials that are assisting in making batteries more lightweight, which is crucial for electric vehicles. Next-Generation Anode Materials offer long-term solutions that comply with environmental standard guidelines and help in protecting the environment for upcoming generations. Furthermore, the companies are establishing a large international customer base while increasing R&D investments by providing customers with cutting-edge and sustainable products. Market growth is held back either due to the increased volume and degradation of silicon anodes or lack of large-scale production of high-quality graphene. Over the projected period, it is anticipated that this market environment will become more sympathetic and assist in promoting market expansion.

Market Segmentation

Insight by Type

Based on type, the Global Next-Generation Anode Materials Market is classified into Silicon/Silicon Oxide Blend, Lithium Titanium Oxide, Silicon-Carbon Composite, Silicon-Graphene Composite, Lithium Metal and Others. Silicon/Silicon Oxide Blend Segment shall lead the Global Next-Generation Anode Materials Market as in the coming years, there could be an increase in the consumption of silicon/silicon oxide blend anode material.

Insight by End-user Type

On the basis of end-user type, the Global Next-Generation Anode Materials Market is segmented into transportation, electrical and electronics, energy storage and others. Transportation segment is further classified into Passenger Electric Vehicles, Commercial Electric Vehicles and others.

Transportation segment is likely to dominate the Global Next-Generation Anode Materials Market due to rising sales of electric vehicles globally. The producers and suppliers of next-generation anode materials for the transportation sector are anticipated to benefit from this during the forecast period.

Next Generation Anode Materials Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2026 |

U.S.D. 2.55 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 10.67 Billion |

|

Growth Rate |

15.91% |

|

Segments Covered in the Report |

By Type, and By End-User Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Growth Drivers

Growing number of electric vehicles and latest technological advancements in battery technologies are boosting the implementation of next-generation anode materials market all over the world. By serving as a powerhouse for a variety of devices such as laptops, mobile phones, and numerous other electronic gadgets, the lithium-ion batteries plays a lead role in a digital electronic revolution. Established and emerging next-generation anode materials providers in the next-generation anode materials industry are into competition due to which the global next-generation market if expected to grow. Furthermore, energy from renewable sources has seen an expansion in investments worldwide its minimal carbon footprint and competitive manufacturing expenditures.

One of its primary benefits is, next-generation anode materials' is capable to outshine more traditional battery technologies in terms of effectiveness. Transportation, electrical, energy storage and electronics sectors have a great demand for next-generation anode materials during the forecast period. The growing demand for EVs has a direct impact on the lithium-ion battery and next-generation anode materials markets. Major obstruction to the growth of EVs and consumer appliances are charging difficulties, as recharging EV batteries takes much longer than fueling conventional petroleum vehicles. Graphite, a commonly used anode material, has a considerably low discharge potential. This inhibits the lithium-ion battery's ability to charge quickly. Various combinations of battery anode elements such as silicon, tin, and germanium are used to enable the batteries' quick charging capability without compromising their durability. The growing demand for higher-density and fast-charging batteries is driving the growth of the global next-generation anode materials market.

Restraints

Manufacturing costs have been a major obstacle to widespread electric vehicle adoption and ongoing research aims to develop more cost-effective battery chemistries and production processes.

Also the widespread of the electrochemical performance of numerous end-use applications has improved as a result of the evolution of nanostructured graphene. According to scientists, batteries with graphene coatings have a five-fold increase in charging capacity as it is a potential additive for self-healing materials. Graphene's electronic properties have the potential to conduct a revolutionary development in energy storage applications. Despite its advantageous properties, the difficulty in scaling up mass graphene production, limits the wide adaptability of grapheme. Large-scale production has a significant impact on graphene's characteristics, including its thermal conductivity, mechanical flexibility, transparency, and electrical conductivity. As a result, maintaining the quality of graphene becomes challenging.

Geographic Overview

- North America: U.S., Canada, and Mexico

- Europe:

- U.K.

- Asia-Pacific and Japan

- Rest-of-the-World: Middle East and Africa and South America

The global next-generation anode materials market is segmented into North America, Europe, U.K, China, Asia Pacific& Japan and Rest of the World. The next-generation anode materials market is expected to witness significant growth in the coming years. China dominates the global market for next-generation anode materials due to the presence of major businesses in terms of revenue generation. The early adoption of lithium-ion battery technology, as well as the presence of a substantial EV fleet, is another factor driving market growth. Furthermore, China's rapidly rising economy and the presence of key industry players along the supply chain of next-generation anode material components are having a significant impact on the market's growth.

Key Players Covered in the Report

Key players of The Global Next-Generation Anode Materials are LeydnJar, Technologies BV, Cuberg, Altairnano, Nexeon Ltd., Sila Nanotechnologies Inc., California Lithium Battery, Albemarle Corporation, AMPIRUS TECHNOLOGIES, Shanghai Shanshan Technology Co., Ltd., pH Matter LLC, Enovix, POSCO CHEMICAL, Jiangxi Ganfeng Lithium Co., Ltd., Talga Group and Tianqi Lithium Corporation.

In recent times, LeydenJar plans to begin mass production in 2026 in a "Plant One" factory in the Brainport Eindhoven region. LeydenJar focuses on the anode to use off-the-shelf materials to build the end product in any form, ranging from cylindrical to pouch or prismatic. This is been done to change the traditional graphite anode into a pure silicon anode, because silicon can host ten times more anodes per gram, for batteries which have a much higher density.

Nexeon, has entered into a partnership with Panasonic Energy Co. Ltd., Nexeon has developed an advanced silicon-based anode material that has the potential to project the energy density of lithium-ion cells by up to 50%. The agreement will see Nexeon supplying materials to Panasonic that will result in the production of cells which will address key consumer concerns related to EVs. The next generation ‘drop-in’ material, allows Panasonic to use a much higher percentage of silicon in lithium-ion cell anodes when compared with first generation materials such as Silicon-oxide, without requiring critical changes to the cell manufacturing process or significant capital investment. In addition to improved performance, the technology will enable automotive manufacturers to realize impactful cost savings on their EV battery pack systems.

The Global Next-Generation Anode Materials Market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Partnerships, agreements, and collaborations are the strategies preferred by companies to maintain and strengthen their market position.

The Global Next-Generation Anode Materials Market report offers a comprehensive market segmentation analysis along with estimation for the forecast period 2025–2030.

Segments Covered in the Report

By type

- Silicon/Silicon Oxide Blend

- Lithium Titanium Oxide

- Silicon-Carbon Composite

- Silicon-Graphene Composite

- Lithium Metal

- Others

By End-user type

- Transportation

- Electrical and Electronics

- Energy storage

- Others

Regions Covered in the Report

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- Spain

- Poland

- Hungary

- Rest-of-Europe

U.K

Asia-Pacific and Japan

- China

- Japan

- India

- South Korea

- Rest-of-Asia-Pacific

Rest-of-the-World:

- Middle East and Africa

- South America

.png) Source: VynZ Research

Source: VynZ Research

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverabvle

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Next Generation Anode Materials Market