Global Waterproofing Chemicals Market – Analysis and Forecast (2025-2030)

Industry Insight by Material (bitumen, polyvinyl chloride (PVC), thermoplastic polyolefin (TPO), ethylene propylene diene terpolymer (EPDM), polytetrafluoroethylene (PTFE), and other materials), by Technology (integral systems, preformed membranes, liquid applied membrane systems, and other technology), by Application (roofing & wall, floor & basement, water & waste management, tunnel & landfills, bridge & highways, and other applications), by End-use Industry (commercial, residential, and industrial infrastructure development), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Dec, 2023 | Report Code : VRCH2108 | Industry : Chemicals & Materials | Available Format :

|

Page : 220 |

Global Waterproofing Chemicals Market – Analysis and Forecast (2025-2030)

Industry Insight by Material (bitumen, polyvinyl chloride (PVC), thermoplastic polyolefin (TPO), ethylene propylene diene terpolymer (EPDM), polytetrafluoroethylene (PTFE), and other materials), by Technology (integral systems, preformed membranes, liquid applied membrane systems, and other technology), by Application (roofing & wall, floor & basement, water & waste management, tunnel & landfills, bridge & highways, and other applications), by End-use Industry (commercial, residential, and industrial infrastructure development), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Waterproofing Chemicals Market Overview

Waterproofing chemicals are substances applied to surfaces to prevent water penetration and protect structures from moisture damage. These chemicals create a barrier that repels water, preventing it from seeping into buildings, foundations, or other surfaces. Commonly used in construction, waterproofing chemicals enhance the durability of structures by safeguarding against water-related issues such as dampness, mold, and corrosion. They come in various forms, including liquid coatings, membranes, and additives that can be mixed with construction materials. Waterproofing chemicals play a crucial role in maintaining the integrity of buildings, ensuring longevity, and minimizing the need for costly repairs caused by water damage.

Global waterproofing chemicals market was worth USD 34.10 billion in 2023 and is expected to reach USD 79 billion by 2030 with a CAGR of 12.52% during the forecast period, i.e., 2025-2030. The growing demand for waterproofing chemicals is driven by the increasing construction activities, climate change-induced weather extremes, a growing awareness of the importance of protecting structures from water damage, and a focus on sustainable building practices.

Geographically, the global waterproofing chemicals market is expanding rapidly in North America, Europe, and the Asia Pacific due to rising construction activities, climate variability, and a growing emphasis on infrastructure development. Increased awareness of the importance of waterproofing for sustainability and durability further propels the market's growth in these regions; however, the market confronts constraints such as stringent environmental regulations impacting chemical formulations, economic uncertainties affecting construction investments, and regional variations. Overall, the waterproofing chemicals market offers potential prospects for market participants to develop and fulfill the growing needs of a wide range of industries including packaging, food and beverages, healthcare/pharmaceutical, and other industries.

Market Segmentation

Insight by Material

Based on material, the global waterproofing chemicals market is segmented into bitumen, polyvinyl chloride (PVC), thermoplastic polyolefin (TPO), ethylene propylene diene terpolymer (EPDM), polytetrafluoroethylene (PTFE), and other materials. Thermoplastic polyolefin (TPO) dominated the global waterproofing chemicals market in 2022 due to its versatility, durability, and environmentally friendly characteristics. TPO membranes offer excellent resistance to UV radiation, chemicals, and punctures, making them ideal for roofing applications. They gained popularity in North America, Europe, and the Asia Pacific for commercial and residential roofing systems. For instance, Carlisle SynTec's Sure-Weld TPO and GAF's EverGuard TPO are widely used, reflecting the market's preference for TPO. Its reflective properties, ease of installation, and energy efficiency contribute to TPO's dominance in the waterproofing chemicals market, meeting the evolving demands of the construction industry for reliable and sustainable solutions.

Insight by Technology

Based on technology, the global waterproofing chemicals market is segmented into integral systems, preformed membranes, liquid applied membrane systems, and other technology. Preformed membranes dominated the global waterproofing chemicals market in 2022 owing to their efficiency and ease of installation. Products like Sika Sarnafil's G476 membrane and Carlisle SynTec's Sure-Seal EPDM membranes exemplify this trend, offering reliable waterproofing solutions for various applications. Preformed membranes, made from materials like EPDM or PVC, provide consistent coverage, durability, and resistance to environmental factors. While integral systems and liquid-applied membranes also play vital roles, preformed membranes, with examples like Firestone's UltraPly TPO, have gained prominence for their proven performance, versatility, and time-saving attributes, making them a preferred choice in the construction industry's waterproofing applications.

Insight by Application

Based on application, the global waterproofing chemicals market is segmented into roofing & wall, floor & basement, water & waste management, tunnel & landfills, bridge & highways, and other applications. Roofing & wall segment dominated the global waterproofing chemicals market in 2022 owing to the escalating demand for durable and weather-resistant building materials. Polyurethane liquid membranes, such as BASF's MasterSeal 550, gained traction for roofing applications, offering seamless protection against water ingress. Additionally, bitumen-based membranes, like Johns Manville's TorchFlex TP 180 FF, excelled in both roofing and wall applications. The imperative need for infrastructure development, coupled with a surge in construction activities globally, particularly in the Asia Pacific and North America, contributed to the ascendancy of roofing and wall applications in the waterproofing chemicals market, meeting the stringent requirements for effective and long-lasting protective solutions.

Insight by End-use Industry

Based on end-use industry, the global waterproofing chemicals market is segmented into commercial, residential, and industrial infrastructure development. Residential industry dominated the global waterproofing chemicals market in 2022 due to increased construction and renovation activities. Homeowners and builders prioritized waterproofing solutions to protect structures from water damage. Liquid applied membranes like Henry Company's Tropi-Cool Roof Coating were favored for residential roofs, offering energy-efficient and durable protection. Additionally, integral waterproofing systems, such as Xypex Admix C-Series, gained popularity in residential basements. The growing awareness of the importance of waterproofing in maintaining property value and minimizing maintenance costs fueled the residential sector's dominance in the waterproofing chemicals market, with a focus on delivering reliable and long-lasting solutions for homes worldwide.

Waterproofing Chemicals Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2018 – 2023 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025 - 2030 |

|

Market Size in 2023 |

$34.19 Billion |

|

Revenue Forecast in 2030 |

$79 Billion |

|

Growth Rate |

CAGR 12.52% |

|

Segments Covered in the Report |

By Material, By Technology, By Application, By End-Use Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and South America |

Industry Dynamics

Growth Drivers

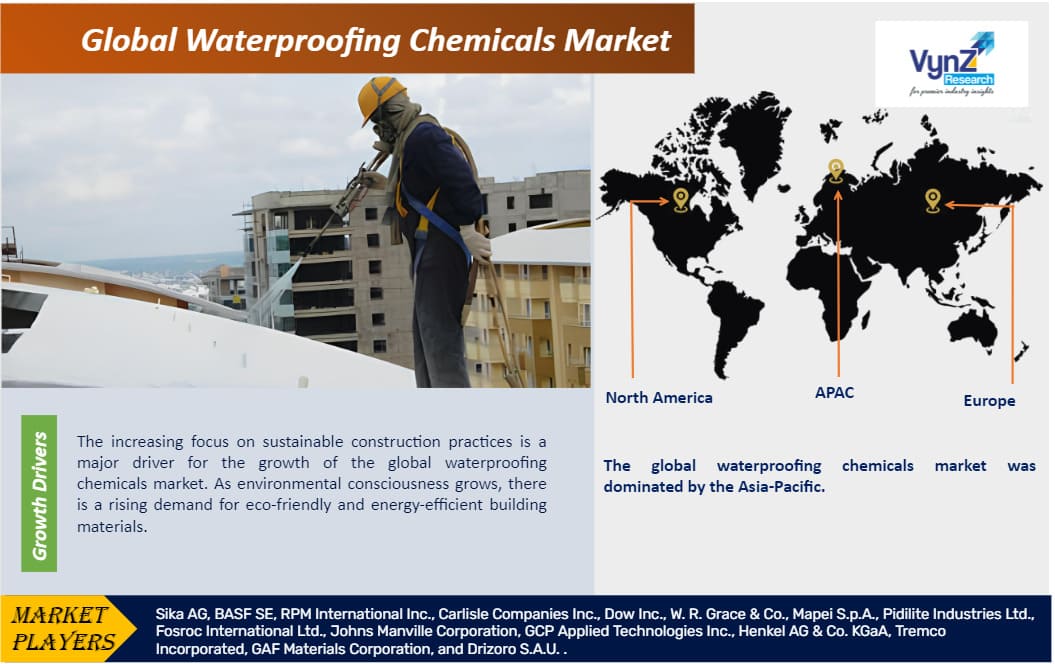

Increasing focus on sustainable construction practices

The increasing focus on sustainable construction practices is a major driver for the growth of the global waterproofing chemicals market. As environmental consciousness grows, there is a rising demand for eco-friendly and energy-efficient building materials. Waterproofing chemicals play a crucial role in enhancing the sustainability of structures by preventing water damage and extending the lifespan of buildings. For instance, eco-friendly liquid applied membranes like KEMPEROL 2K-PUR by Kemper System are solvent-free and contribute to green building initiatives.

Furthermore, the adoption of reflective roofing materials, a subset of waterproofing solutions, is on the rise to improve energy efficiency. Cool roofing systems, exemplified by products like GAF's EverGuard TPO and Duro-Last Cool Zone roofing membrane, reflect sunlight and reduce heat absorption, leading to lower energy consumption for cooling. This aligns with global efforts to create environmentally responsible and energy-efficient buildings, propelling the growth of the waterproofing chemicals market.

Increasing urbanization and construction activities

Urbanization and the subsequent surge in construction activities are significant drivers for the global waterproofing chemicals market. As populations grow, there is a heightened demand for infrastructure development, leading to increased construction of residential, commercial, and industrial buildings. Waterproofing chemicals become essential in protecting these structures from water ingress, ensuring longevity and minimizing maintenance costs. For instance, integral waterproofing admixtures like PENETRON Admix are used in concrete to enhance its impermeability, making it a vital solution for construction projects in urban environments.

Additionally, the trend toward green roofs and sustainable urban planning has driven the demand for waterproofing solutions in landscaping and urban agriculture. Products like CETCO's COREFLEX provide effective waterproofing for below-grade structures in green roof applications, contributing to the growth of the waterproofing chemicals market amid the evolving needs of modern urban development.

Challenge

Complex And Stringent Regulatory Requirements

One major challenge for the growth of the global waterproofing chemicals market is the stringent regulatory environment. Evolving environmental regulations, particularly concerning chemical formulations and emissions, pose challenges for manufacturers in the industry. Compliance with diverse and stringent standards across regions requires continuous innovation and adaptation, impacting the development and use of certain waterproofing chemicals. Meeting these regulatory requirements while maintaining product effectiveness and cost efficiency presents a hurdle for companies operating in the waterproofing chemicals market, influencing their strategies for sustainable and compliant solutions.

Geographic Overview

-

North America

-

Europe

-

Asia Pacific (APAC)

-

Middle East and Africa (MEA)

-

South America

The global waterproofing chemicals market is segmented into North America, Europe, the Asia-Pacific, South America, and the Middle East and Africa region. The global waterproofing chemicals market was dominated by the Asia-Pacific in 2022 due to robust construction activities and rapid urbanization in countries like China and India. The region's dynamic infrastructure development and increased awareness of waterproofing solutions contributed to market dominance. Products such as Fosroc's Proofex Engage and Sika's BituSeal exemplify the region's preference for effective waterproofing. The susceptibility to heavy rainfall and the need for long-lasting protection against water damage further fueled the demand. Additionally, government initiatives promoting sustainable construction practices and the rising middle-class population with increased home ownership amplified the use of waterproofing chemicals, consolidating Asia-Pacific's position as a key market player.

Competitive Insight

Sika AG is a global leader in the waterproofing chemicals market, securing a prominent position with a comprehensive product portfolio and a strong focus on innovation. The company's SikaProof A-08 membrane is widely recognized for its efficacy in below-ground waterproofing. Sika's strategic acquisitions, like that of Parex in 2019, have expanded its market reach. The company emphasizes sustainability, with products like SikaRoof MTC contributing to green building practices. Sika's global presence, extensive R&D, and commitment to quality have solidified its market position, catering to diverse construction needs.

BASF SE stands as a key player in the global waterproofing chemicals market, leveraging its vast chemical expertise. The MasterSeal range, including products like MasterSeal HLM 5000, showcases BASF's commitment to providing effective waterproofing solutions. The company's focus on research and development, exemplified by collaborations like the one with HPF The Mineral Engineers, ensures innovative and high-performance products. BASF's global distribution network and emphasis on sustainable solutions, as seen in their eco-friendly MasterSeal Traffic 2500 system, position them as a major influencer in the evolving landscape of waterproofing chemicals.

Recent Development by Key Players

In June 2023, Swedish firm OrganoClick introduced a new PFAS-free, bio-based, and biodegradable waterproof coating for textiles under its OrganoTex brand. The product, free from fossil-based plastics and synthetic waxes, utilizes the natural fatty acids of plants and the surface structure of leaves. Employing Nobel Prize-winning organocatalysis chemistry, it mimics the water repellency of lotus leaves, offering an eco-friendly alternative for textile waterproofing.

In December 2022, Nippon Paint (India) announced its entry into India's construction chemicals market, focusing on dry mix, repair, maintenance, and waterproofing solutions in response to rising demand in residential and commercial construction driven by urbanization. The company aims to increase dealer touch points by 50%, manufacturing liquid-based products in Chennai and sourcing aerosol-based products through acquisitions and strategic partnerships. With optimism for growth and innovation, Nippon Paint eyes opportunities in the Rs 12,500 crore construction chemicals market in India.

Key Players Covered in the Report

Sika AG, BASF SE, RPM International Inc., Carlisle Companies Inc., Dow Inc., W. R. Grace & Co., Mapei S.p.A., Pidilite Industries Ltd., Fosroc International Ltd., Johns Manville Corporation, GCP Applied Technologies Inc., Henkel AG & Co. KGaA, Tremco Incorporated, GAF Materials Corporation, and Drizoro S.A.U. .

The waterproofing chemicals market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

By Material

-

Bitumen

-

Polyvinyl chloride (PVC)

-

Thermoplastic polyolefin (TPO)

-

Ethylene propylene diene terpolymer (EPDM)

-

Polytetrafluoroethylene (PTFE)

-

Other products

-

By Technology

-

Integral systems

-

Preformed membranes

-

Liquid applied membrane systems

-

Other technology

-

By Application

-

Roofing & wall

-

Floor & basement

-

Water & waste management

-

Tunnel & landfills

-

Bridge & highways

-

Other applications

-

By End-Use Industry

-

Commercial

-

Residential

-

Industrial infrastructure development

Region Covered in the Report

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

Primary Research Interviews Breakdown

%20System%20Market.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Waterproofing Chemicals Market