GCC Home Decor Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Product Type (Furniture, Home textiles, Lighting, Decorative accessories), by Distribution Channel (Offline, Online), by Price Range (Economy, Mid-range, Premium), by End User (Residential, Commercial)

| Status : Published | Published On : Jan, 2026 | Report Code : VRCG7052 | Industry : Consumer Goods | Available Format :

|

Page : 125 |

GCC Home Decor Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Product Type (Furniture, Home textiles, Lighting, Decorative accessories), by Distribution Channel (Offline, Online), by Price Range (Economy, Mid-range, Premium), by End User (Residential, Commercial)

GCC Home Decor Market Overview

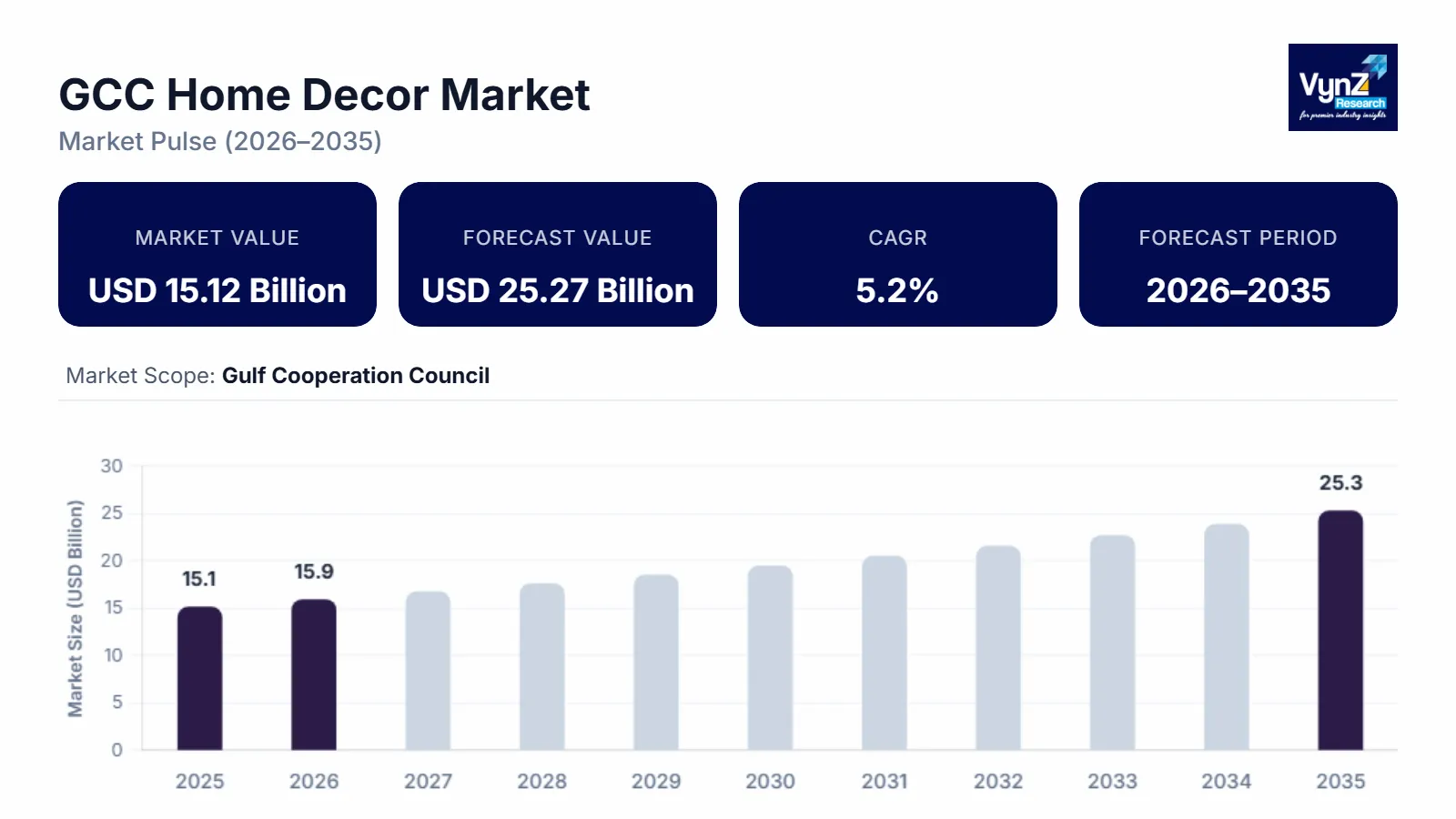

The GCC home decor market, which was valued at approximately USD 15.12 billion in 2025 and is estimated to rise further up to almost USD 15.91 billion by 2026, is projected to reach around USD 25.27 billion in 2035 expanding at a CAGR of about 5.2% during the forecast period from 2026 to 2035.

Market expansion is primarily supported by sustained residential construction activity, lifestyle-driven refurbishment demand and rising expenditure on premium and customized interior products across the region. Increasing adoption of contemporary furnishings smart decor solutions and sustainable materials is reshaping the regional home decor landscape.

Growth is further reinforced by government led housing, urban development and quality of life initiatives across GCC countries. Programs under Saudi vision 2030 the UAE national housing strategy and Qatar’s national vision 2030 emphasize modern living standards efficient housing design and urban regeneration supported by ministries of housing and municipal authorities. These initiatives encourage higher spending on interior aesthetics furniture lighting and decorative accessories. Strong demand from urban households’ high-income consumers and expatriate communities across cities such as Riyadh Dubai and Doha continues to support market expansion across the GCC region.

GCC Home Decor Market Dynamics

Market Trends

The market is undergoing a gradual shift toward premium, design-led, and sustainability-aligned interior solutions, influenced by evolving consumer lifestyles and government-backed housing and urban development programs. One of the key trends shaping the market is the growing preference for modern, minimalist, and culturally blended design aesthetics, reflecting higher disposable incomes and exposure to global design standards. Government housing initiatives such as Saudi Arabia’s Vision 2030 Housing Program and the UAE’s National Housing Strategy emphasize quality of living, space optimization, and contemporary residential standards, indirectly driving demand for modular furniture, coordinated decor themes, and customized interior products supported by official housing and urban planning authorities.

Another notable trend is the increasing adoption of sustainable and locally compliant materials, driven by regulatory alignment and green building frameworks promoted by government-backed entities. Programs such as the UAE’s Estidama Pearl Rating System and Saudi Arabia’s National Building Code encourage energy efficiency, responsible material sourcing, and environmentally conscious construction practices. These frameworks are influencing home decor manufacturers and suppliers to focus on eco-friendly materials, long-lasting finishes, and value-added design features, reshaping product portfolios and competitive positioning across the GCC region.

Growth Drivers

The growth of the GCC home decor market is largely supported by sustained residential construction activity and population growth in urban centers, driven by long-term government investments in housing and infrastructure. National development plans, including Saudi Vision 2030, Qatar National Vision 2030, and Kuwait Vision 2035, prioritize large-scale residential projects, urban regeneration, and mixed-use developments overseen by ministries of housing, municipalities, and public works authorities. These initiatives continue to generate consistent demand for furniture, lighting, home textiles, and decorative accessories across both affordable and premium housing segments.

Additionally, rising consumer expenditure on home improvement and interior upgrades is playing a crucial role in boosting adoption. As households across the GCC increasingly prioritize aesthetics, comfort, and personalization, demand for premium furnishings, smart decor elements, and coordinated interior solutions remains strong. Government-backed economic diversification efforts and employment growth in non-oil sectors have supported higher disposable incomes, reinforcing long-term demand for home decor products across key markets such as Saudi Arabia, the UAE, and Qatar.

Market Restraints / Challenges

Despite favorable growth prospects, the market faces challenges related to supply chain dependency and cost volatility. Heavy reliance on imported raw materials, finished furniture, and decorative products exposes manufacturers and distributors to fluctuations in global shipping costs, currency movements, and trade-related disruptions. Government trade and logistics assessments published by GCC statistical authorities and customs agencies highlight the region’s continued dependence on imports for wood, textiles, and finished decor products, which can affect pricing stability and profit margins, particularly in price-sensitive consumer segments.

Furthermore, regulatory compliance and localization requirements pose operational challenges for market participants. Standards related to product safety, fire resistance, and material compliance enforced by authorities such as the Saudi Standards, Metrology and Quality Organization (SASO) and the UAE’s Ministry of Industry and Advanced Technology can increase certification costs and extend time-to-market. Smaller suppliers and new entrants may face scalability constraints due to these compliance and operational requirements during periods of economic uncertainty.

Market Opportunities

The market presents significant opportunities in affordable and modular interior solutions, driven by expanding middle-income populations and government-supported housing supply programs. Public housing initiatives and mortgage support schemes across Saudi Arabia and the UAE are increasing home ownership rates, creating incremental demand for cost-effective, space-efficient, and customizable decor solutions. Companies offering modular furniture, multi-functional decor, and locally adaptable designs are well-positioned to capture demand from young families and first-time homeowners.

Another key opportunity lies in the premium and smart home decor segment, supported by rising investments in luxury residential developments and smart city initiatives. Government-led projects such as NEOM in Saudi Arabia and smart urban developments in the UAE and Qatar are encouraging adoption of high-end furnishings, designer lighting, and digitally enabled decor solutions. Advancements in digital visualization tools, online customization platforms, and virtual showrooms are also enhancing customer engagement, improving conversion rates, and enabling suppliers to build long-term client relationships across the GCC region.

GCC Home Decor Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 15.12 Billion |

|

Revenue Forecast in 2035 |

USD 25.27 Billion |

|

Growth Rate |

5.2% |

|

Segments Covered in the Report |

By Product Type, By Distribution Channel, By Price Range, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Saudi Arabia, United Arab Emirates, Qatar, Other GCC Countries |

|

Key Companies |

Home Centre (Landmark Group), Dewan Architects + Engineers, Pan Emirates Home Furnishings, Royal Furniture, Danube Home, Al Huzaifa Furniture, Midas Furniture, United Furniture, Bukannan Furniture, Western Furniture LLC, Gautier Furniture |

|

Customization |

Available upon request |

GCC Home Decor Market Segmentation

By Product Type

Furniture accounted for the largest market share of approximately 40% in 2025, supported by its high-ticket size, longer replacement cycles, and strong linkage with new residential construction and large-scale housing projects across Saudi Arabia and the UAE. Continuous government-backed housing supply under Vision 2030 aligned programs sustains consistent demand for living room, bedroom, and dining furniture across mid-range and premium categories.

Home textiles, including curtains, carpets, rugs, and upholstery fabrics, represent around 29% of market revenue, benefiting from higher replacement frequency and seasonal refresh cycles. This segment is also witnessing steady growth of nearly 6.8% CAGR, driven by consumer preference for aesthetic upgrades at lower cost points.

Lighting and decorative accessories together account for roughly 31%, with decorative accessories emerging as the fastest-growing subsegment at an estimated 7.50% CAGR, supported by impulse buying behavior, gifting culture, and increasing penetration of online channels.

By Distribution Channel

Offline channels held a dominant share of approximately 74% in 2025, as consumers continue to prioritize physical inspection, material validation, customization, and after-sales support for furniture and premium decor products. Large-format furniture stores, branded showrooms, and specialty home decor retailers remain critical to purchasing decisions, particularly for high-value items.

Online channels account for around 26% of market revenue and are witnessing the fastest growth, registering an estimated 9.0% CAGR during the forecast period. Growth is driven by rising digital adoption, improved last-mile logistics, and pricing transparency across GCC markets. Integration of e-commerce platforms with physical retail models, including click-and-collect and virtual design consultations, is further expanding customer reach and improving conversion rates, especially among younger and urban consumers.

By Price Range

The mid-range segment dominates in terms of volume and value, accounting for approximately 48% of total market revenue in 2025, supported by strong mass-market demand and value-for-money offerings aligned with middle-income households. This segment benefits from government-supported home ownership programs and rising urban population density.

The economy segment contributes around 32%, driven by demand from rental housing and price-sensitive consumers, particularly in high-density urban areas.

However, the premium segment, currently accounting for 20%, is expected to grow at a faster pace with a projected 8.2% CAGR. Rising disposable incomes, luxury residential developments, and demand for branded and customized interiors are driving higher margins and making the premium segment strategically important for key players.

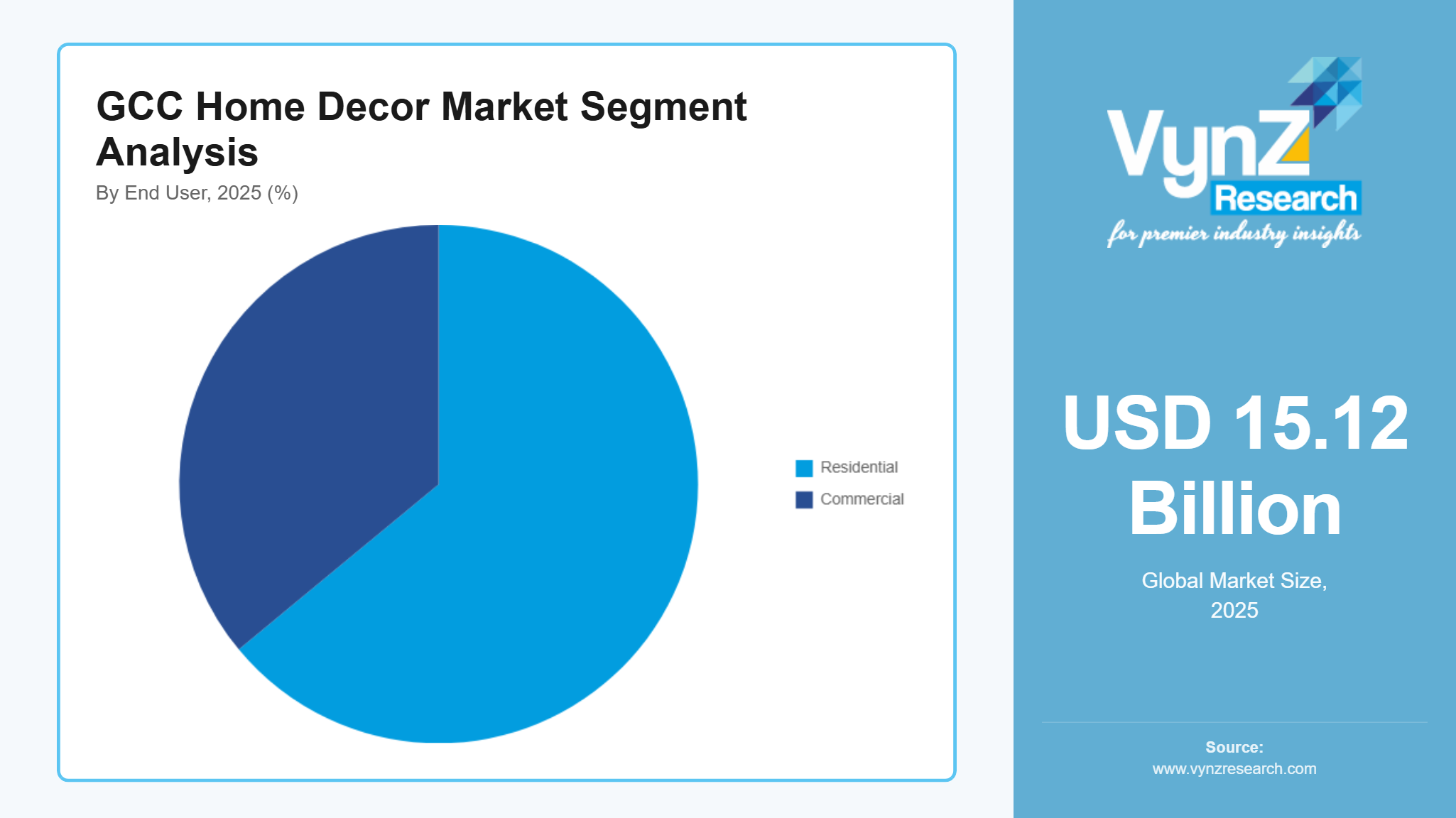

By End Use

The residential segment accounted for the highest revenue share of approximately 64% in 2025, supported by sustained housing construction, population growth, and government-backed residential development programs across Saudi Arabia, the UAE, and Qatar. Rising consumer focus on interior aesthetics, comfort, and personalization continues to drive consistent demand.

The commercial segment represents around 36% of market revenue and is the fastest-growing end-use segment, expanding at an estimated 7.8% CAGR. Growth is driven by investments in hospitality, retail spaces, offices, and mixed-use developments, particularly aligned with tourism, entertainment, and mega infrastructure projects. Renovation cycles and brand-driven interior upgrades in hotels and retail outlets further contribute to sustained commercial demand across the GCC.

Regional Insights

Saudi Arabia

Saudi Arabia accounted for approximately 34% of the market in 2025, supported by large-scale residential construction, population growth, and sustained government investment in housing and urban development. Programs under Vision 2030, including initiatives led by the Ministry of Municipal Rural Affairs and Housing and the National Housing Strategy, continue to expand home ownership and residential supply across Riyadh, Jeddah, and Dammam. Rising demand for interior furnishings and decorative products is further reinforced by new mixed-use developments and lifestyle-focused communities. Expansion of organized retail and branded home decor outlets, combined with growing e-commerce penetration supported by the Saudi Digital Government Authority, is strengthening overall market performance.

United Arab Emirates

The UAE market is witnessing steady growth and accounted for approximately 27% of GCC revenue in 2025, driven by high urbanization levels, premium residential developments, and strong demand from hospitality and tourism-linked projects. Government-backed real estate and urban planning initiatives led by authorities such as the Dubai Land Department and Abu Dhabi Department of Municipalities and Transport continue to support new housing and refurbishment activity. Increasing consumer preference for premium and customized interior solutions, particularly in Dubai and Abu Dhabi, is sustaining demand. The rapid expansion of digital retail platforms, aligned with the UAE Digital Economy Strategy, is further enhancing access to home decor products across residential and commercial end users.

Qatar and Other GCC Countries

Qatar, along with Kuwait, Oman, and Bahrain, collectively contributes approximately 17% of the GCC home decor market, supported by infrastructure modernization, residential expansion, and rising consumer spending on home aesthetics. In Qatar, government-led urban development programs and post-infrastructure investments overseen by the Ministry of Municipality continue to drive housing demand. Across other GCC countries, gradual expansion of organized retail and increased availability of imported decor products are supporting market growth. The remaining 22% of the market is covered by other smaller regional contributions, reflecting steady but comparatively lower demand growth outside the primary GCC economies.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with regional and international players emphasizing product differentiation, brand positioning, and retail network expansion. Companies are investing in design innovation, digital marketing, and omnichannel distribution to strengthen visibility and pricing power. Market activity is supported by government-backed housing and urban development programs under Saudi Vision 2030, UAE National Housing Strategy, and related initiatives by ministries of housing and urban planning, which continue to stimulate residential demand and long-term sector growth across the GCC.

Mini Profiles

Home Centre (Landmark Group) focuses on mass-market furniture and home décor offerings, supported by strong brand recognition, a wide GCC store network, and a diversified private-label portfolio catering to everyday household needs.

IKEA GCC operates primarily in the mass-market segment, emphasizing functional design, affordability, and operational efficiency, with integrated logistics and large-format stores ensuring consistent availability and high customer throughput.

Pan Emirates Home Furnishings serves mid-range to premium customer segments, leveraging frequent design updates and coordinated décor collections to appeal to both value-conscious and style-driven buyers.

West Elm Middle East operates in the premium segment, emphasizing contemporary design, sustainability-focused materials, and curated collections targeted at urban professionals and high-income households.

Royal Furniture UAE leverages local manufacturing capabilities and customization expertise to serve residential and commercial clients, offering tailored furniture solutions and full interior fit-out services across key GCC markets.

Key Players

- Home Centre (Landmark Group)

- Dewan Architects + Engineers

- Pan Emirates Home Furnishings

- Royal Furniture

- Danube Home

- Al Huzaifa Furniture

- Midas Furniture

- United Furniture

- Bukannan Furniture

- Western Furniture LLC

- Gautier Furniture

Recent Developments

December 2025 - In ways that are relevant and useful at home, the campaign aims to link IKEA's affordability, sustainability, and Scandinavian design. This project lays the groundwork for a year-long conversation that connects consumers with truly significant experiences.

August 2025 - Through a strategic alliance with MoEngage, Danube Home, a leading player in home furnishings and remodeling throughout the Middle East and Indian Subcontinent, is poised to transform its customer interaction approach. In order to fuel its next phase of substantial expansion, the company has formally integrated MoEngage's AI-powered Customer Data and Engagement Platform (CDEP). Through this partnership, Danube Home will be able to provide genuinely customized shopping experiences, seamlessly integrating each customer's online and in-store experiences, and guaranteeing a smooth, cohesive brand experience as Danube Home grows its market share.

December 2025 - Gensler, a global architecture and design firm has collaborated with Mitrex which is the biggest manufacturer of Building-Integrated Photovoltaics (BIPV) in North America, to develop its latest innovation, eFacade PRO+ with Honeycomb Backing. This partnership has set a new standard for solar facades that combine high performance, sustainability, and architectural freedom. Mitrex's desire to increase the capabilities of building envelopes lies at the heart of the collaboration. eFacade PRO+ with Honeycomb Backing was created with Gensler as a product design consultant to support landmark architecture when performance, artistic expression, and stringent safety regulations are required.

GCC Home Decor Market Coverage

Product Type Insight and Forecast 2026 - 2035

- Furniture

- Home textiles

- Lighting

- Decorative accessories

Distribution Channel Insight and Forecast 2026 - 2035

- Offline

- Online

Price Range Insight and Forecast 2026 - 2035

- Economy

- Mid-range

- Premium

End User Insight and Forecast 2026 - 2035

- Residential

- Commercial

GCC Home Decor Market by Region

- Saudi Arabia

- By Product Type

- By Distribution Channel

- By Price Range

- By End User

- United Arab Emirates

- By Product Type

- By Distribution Channel

- By Price Range

- By End User

- Qatar

- By Product Type

- By Distribution Channel

- By Price Range

- By End User

- Other GCC Countries

- By Product Type

- By Distribution Channel

- By Price Range

- By End User

Table of Contents for GCC Home Decor Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Product Type

1.2.2. By

Distribution Channel

1.2.3. By

Price Range

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. GCC Market Estimate and Forecast

4.1. GCC Market Overview

4.2. GCC Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Product Type

5.1.1. Furniture

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Home textiles

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Lighting

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.1.4. Decorative accessories

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2035

5.2. By Distribution Channel

5.2.1. Offline

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Online

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Price Range

5.3.1. Economy

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Mid-range

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Premium

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Residential

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Commercial

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

6. Saudi Arabia Market Estimate and Forecast

6.1. By

Product Type

6.2. By

Distribution Channel

6.3. By

Price Range

6.4. By

End User

6.4.1.

Saudi Arabia Market Estimate and Forecast

6.4.2.

United Arab Emirates Market Estimate and Forecast

6.4.3.

Qatar Market Estimate and Forecast

6.4.4.

Other GCC Countries Market Estimate and Forecast

7. United Arab Emirates Market Estimate and Forecast

7.1. By

Product Type

7.2. By

Distribution Channel

7.3. By

Price Range

7.4. By

End User

7.4.1.

Saudi Arabia Market Estimate and Forecast

7.4.2.

United Arab Emirates Market Estimate and Forecast

7.4.3.

Qatar Market Estimate and Forecast

7.4.4.

Other GCC Countries Market Estimate and Forecast

8. Qatar Market Estimate and Forecast

8.1. By

Product Type

8.2. By

Distribution Channel

8.3. By

Price Range

8.4. By

End User

8.4.1.

Saudi Arabia Market Estimate and Forecast

8.4.2.

United Arab Emirates Market Estimate and Forecast

8.4.3.

Qatar Market Estimate and Forecast

8.4.4.

Other GCC Countries Market Estimate and Forecast

9. Other GCC Countries Market Estimate and Forecast

9.1. By

Product Type

9.2. By

Distribution Channel

9.3. By

Price Range

9.4. By

End User

9.4.1.

Saudi Arabia Market Estimate and Forecast

9.4.2.

United Arab Emirates Market Estimate and Forecast

9.4.3.

Qatar Market Estimate and Forecast

9.4.4.

Other GCC Countries Market Estimate and Forecast

10. Company Profiles

10.1. Home Centre (Landmark Group)

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Dewan Architects + Engineers

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Pan Emirates Home Furnishings

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Royal Furniture

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Danube Home

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Al Huzaifa Furniture

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Midas Furniture

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. United Furniture

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Bukannan Furniture

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Western Furniture LLC

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Gautier Furniture

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

GCC Home Decor Market