Saudi Arabia Interior Design Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Project Type (New Build Projects, Renovation and Remodeling Projects), by Price Tier (Economy, Mid-range, Luxury, Ultra-luxury), by Material Type (Wood and Timber, Glass and Ceramics, Metals, Textiles and Fabrics, Sustainable and Recycled Materials), by End User (Residential, Commercial Office, Hospitality and Leisure, Retail and F&B, Healthcare, Others (Education and Industrial Facilities))

| Status : Published | Published On : Feb, 2026 | Report Code : VRCG7053 | Industry : Consumer Goods | Available Format :

|

Page : 139 |

Saudi Arabia Interior Design Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Project Type (New Build Projects, Renovation and Remodeling Projects), by Price Tier (Economy, Mid-range, Luxury, Ultra-luxury), by Material Type (Wood and Timber, Glass and Ceramics, Metals, Textiles and Fabrics, Sustainable and Recycled Materials), by End User (Residential, Commercial Office, Hospitality and Leisure, Retail and F&B, Healthcare, Others (Education and Industrial Facilities))

Saudi Arabia Interior Design Market Overview

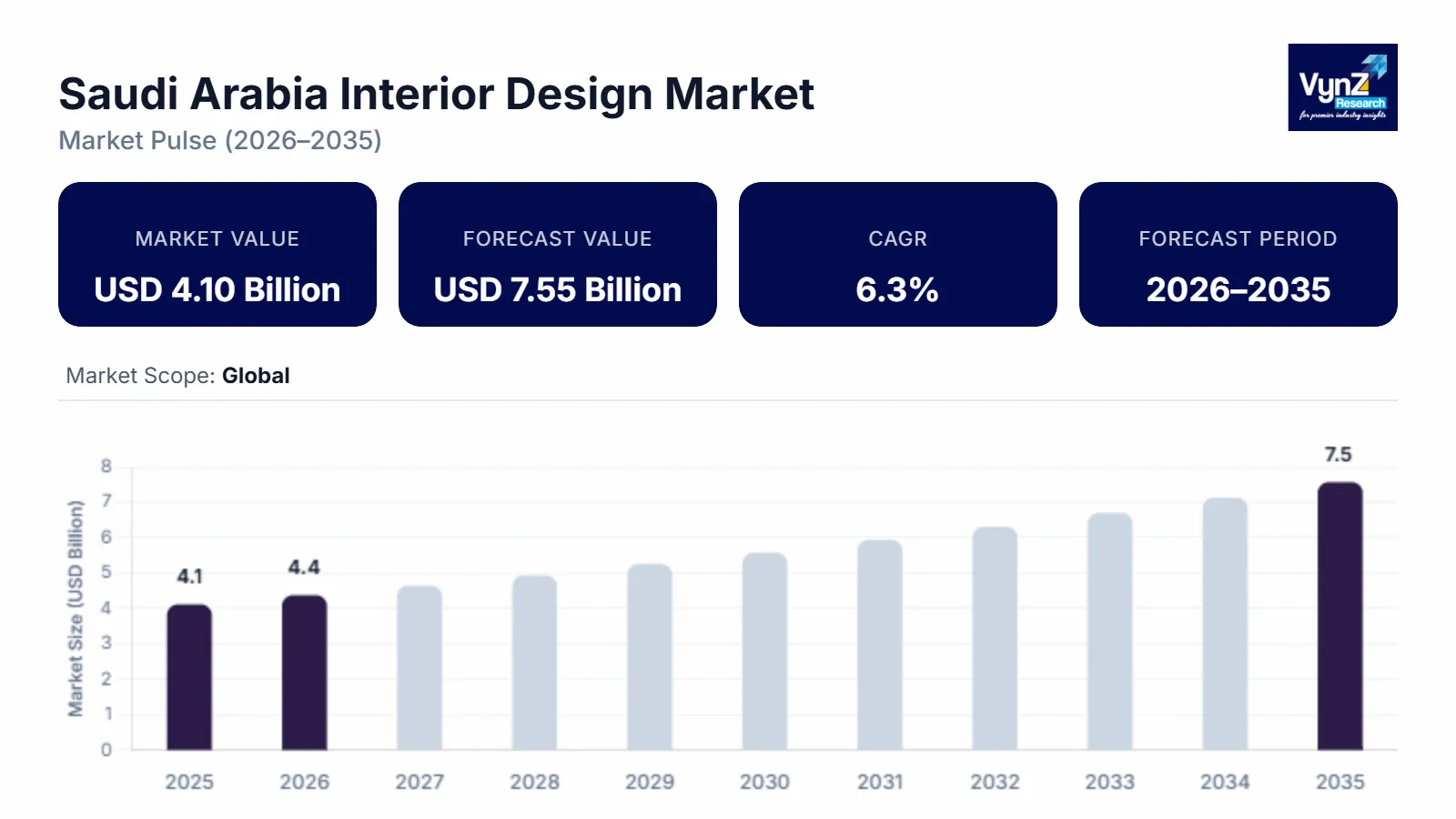

The Saudi Arabia interior design market size is estimated at USD 4.1 billion in 2025 and estimated to rise USD 5.25 billion in 2026, projected to reach USD 10.4 billion by 2035, growing at a CAGR of 6.3% during the forecast period (2026–2035).

Market growth ties back to massive property ventures launched through Vision 2030, and, at the same time, hotels and tourist facilities keep spreading fast. Residential builds continue rising, holding a steady trend and turnkey interior setups gain more ground now instead of later. Also, high-end homes need finer details inside, luxury brands shape hotel vibes, city workspaces lean into sleeker layouts and government keeps funding huge undertakings, reshaping cities, stitching together live-work hubs. These efforts feed momentum from Riyadh down to Jeddah, stretch west toward Makkah and Madinah, reach new spots built around travel-driven economies.

Saudi Arabia Interior Design Market Dynamics

Market Trends

The Saudi interior scene rests on full-package solutions, where delivery speed, budget, and one-name responsibility matter most. Instead of juggling multiple vendors, clients now look for unified workflows, fueled by housing megaprojects, offices, hotels tied to Vision 2030 goals. Roughly half the market rides on these bundled setups, blending design with execution under a single roof.

A shift is unfolding driven by eco-conscious materials, adaptive spatial planning, with designs rooted in cultural context. Function meets practical living, pairs with lower energy demand while resonating with regional character, pulling focus from generic solutions. Projects centered on lasting impact outpace broader industry growth, as companies lean into layered services instead of standalone deliverables.

Growth Drivers

Expansion in the market stems from massive construction pushes tied to Vision 2030, with residential zones, office spaces, and hotels keeping interior design services busy. Public housing initiatives feed into this flow, alongside multi-functional city hubs where living, working, and shopping blend. Medical centers emerge steadily, shaping a major 60% of demand for interior work. Schools and universities add their weight too, forming a steady pull-on design service. Together, these sectors make up well over half of what drives the country's interior landscape forward.

A fresh wave of hotel builds and leisure spots pushes higher appetite for top-tier interiors. Meanwhile, more spending power at home fuels consistent uptick in living space makeovers across the coming years. Growth in travel-focused infrastructure quietly lifts commercial design needs alongside personal projects.

Market Restraints / Challenges

Even with strong potential ahead, the interior design scene in Saudi Arabia runs into hurdles that slow its momentum. Rising expenses from high-end materials weigh heavily on budgets, especially when tailored solutions enter the mix and approval procedures add layers of complexity, stretching timelines beyond comfort. Mid-tier home and office builds feel this pinch most sharply and especially when cash flow tightens, clients hesitate, personal tastes shift and plans stall, making homeowners to think and builders wait.

Focusing on foreign talent and shipping in materials can complicate how design studios run because relying heavily on outside know-how along with distant vendors tends to inflate expenses while inviting late arrivals both mess with timelines and growth potential. Such pressures hit harder when workloads spike, since the need for capable designers, coordinators, or niche builders quickly exceeds what's available nearby.

Market Opportunities

The market opens doors through massive infrastructure pushes and city reshaping efforts, fueled by steady public funding alongside broader economic ambitions. Firms that blend adaptability with cohesion in their interior offerings find themselves aligned with builders focused on hotels, combined residential-commercial spaces, and organizations needing uniform results at scale. Rather than one-size-fits-all, it's about fluid responses, shifting layouts, evolving materials, and designs that adjust without losing identity. Government-backed plans keep momentum alive, while private players respond with systems built for repetition without rigidity. Growth isn't sudden but it unfolds quietly through repeated contracts and trust is built project after project.

A shift toward high-end living fuels interest in tech-smart interiors of luxury homes, name-brand hotels, and shops that sell an atmosphere now reliant on integrated systems for comfort and control. Digital modeling gives clients a clearer picture early on, shaping choices before work begins and some studios adopt real-time rendering so adjustments happen faster, keeping feedback loops tight. Smarter layouts emerge from data-informed plans, not guesswork, fitting lifestyles more naturally which helps trust grow when people see ideas take form smoothly, without surprises down the line.

Saudi Arabia Interior Design Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 4.1 Billion |

|

Revenue Forecast in 2035 |

USD 7.55 Billion |

|

Growth Rate |

6.3% |

|

Segments Covered in the Report |

Project Type, Price Tier, Material Type, End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Riyadh Metropolitan, Makkah Province, Eastern Province |

|

Key Companies |

Dar Al Riyadh, Dewan Architects & Engineers, Hirsch Bedner Associates, Wilson Associates, Perkins & Will, Gensler, AtkinsRéalis, Omrania, Godwin Austen Johnson, Kristina Zanic Consultants |

|

Customization |

Available upon request |

Saudi Arabia Interior Design Market Segmentation

By Project Type

Based on project type, the market is segmented into new build projects and renovation and remodeling projects. New builds take the biggest share, roughly two-thirds by 2025, driven by wide-stretching residential tracts, towering offices, health hubs, combined with city-scale developments linked to government-led building pushes. The leftover portion comes from reworking existing spaces, guided more by changing functional demands than fresh footprints.

Renovation activity keeps gaining momentum, expected to grow roughly 7.2% each year moving forward. Older hotels are getting facelifts as owners reconsider layouts, trading cluttered spaces for simpler movement through rooms and inside offices, changes go beyond appearance where spaces adapt to how people actually work now. Stores tweak their entrances, striving for warmth while keeping things understated and homes get reworked just like anything else, where updates mix function with looks in subtle ways.

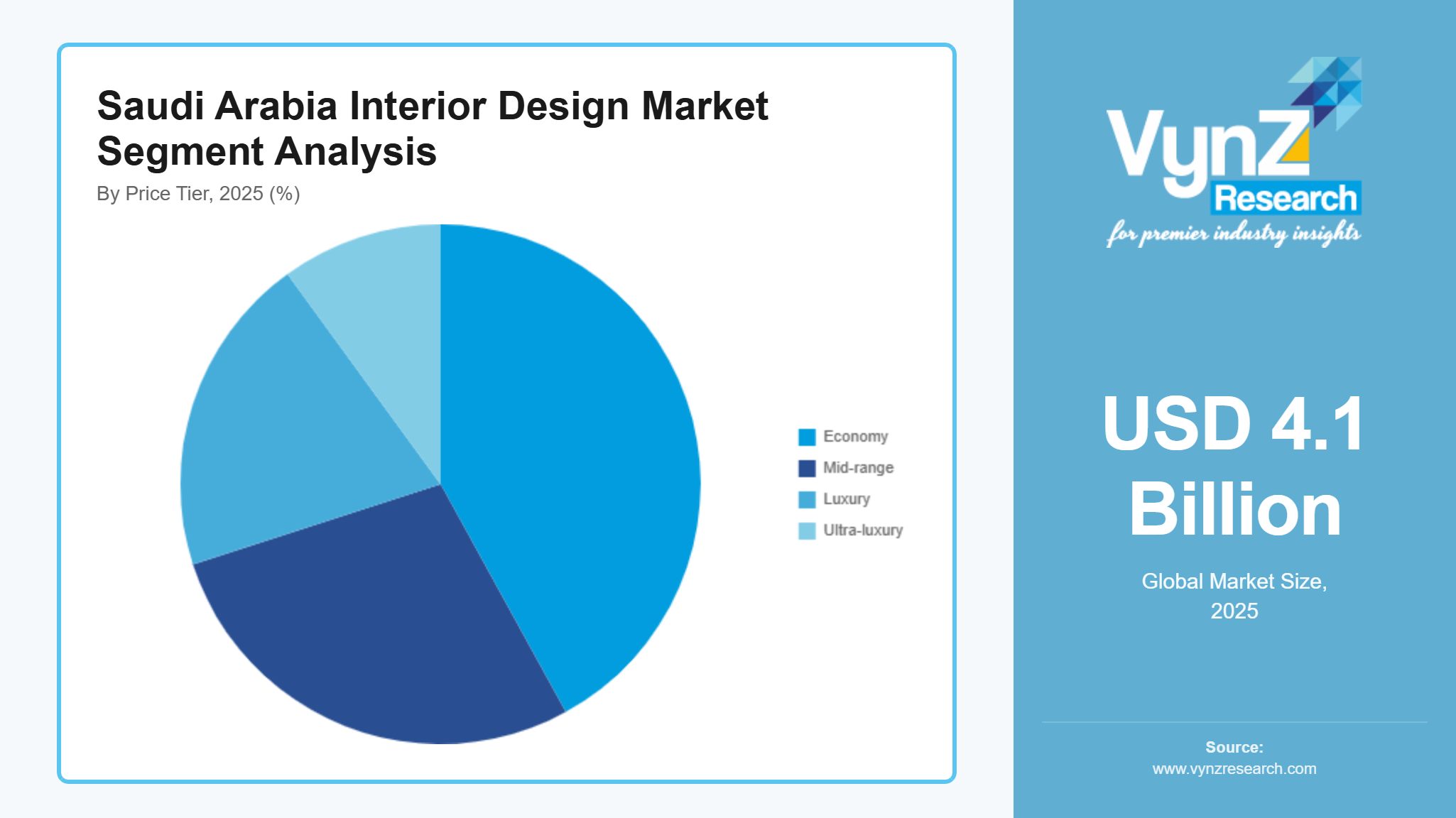

By Price Tier

Based on price tier, the Saudi Arabia interior design market is segmented into economy, mid-range, luxury, and ultra-luxury categories. Sitting at roughly 42% by 2025, the mid-level bracket takes the lead, fuelled mostly by everyday housing needs, workplace setups, alongside builders who watch costs but still want solid aesthetics minus the steep tags.

Luxury plus ultra-luxury spaces show stronger momentum and is expected to expand by roughly 8.3% annually from 2025 through 2035. Rising demand comes not just from elite buyers but also corporate investors drawn to private villas, name-backed homes, top-tier resorts. Crafted interiors matter more now with custom layouts, foreign-sourced materials, tailored aesthetics gaining ground as priorities shift toward personal signature over status display.

By Material Type

Based on material type, the market is segmented into wood and timber, glass and ceramics, metals, textiles and fabrics, and sustainable or recycled materials.

Wood and timber take up most of the marketspace, making about a third of the market by 2025, simply because they’re used everywhere for furniture, walls, cabinets, and little details in homes and offices alike. Glass, ceramics, metals come next, each holding their own in different corners with textiles drape through spaces softly, adding texture where needed. Then there's the growing bunch of reused stuff, eco-minded picks gaining ground slow but steady. However, while wood still leads, others keep finding ways to fit in.

Sustainable materials plus recycled ones make up the quickest expanding category, projected to grow at roughly 8% each year through the outlook window. This momentum comes from eco-conscious construction trends, stronger rules pushing environmental responsibility, alongside growing attention from builders and residents drawn to low-impact supplies, spaces that save power, also savings over time.

By End User

Based on end user, the Saudi Arabia interior design market is segmented into residential, commercial office, hospitality and leisure, retail and F&B, healthcare, and others including education and industrial facilities.

The residential segment made up close to two-fifths of income last year, lifted by steady home building, widespread villa ownership, along with rising budgets for indoor improvements within mid-to-upper-income families, especially around Riyadh and Jeddah.

Hospitality and leisure segment is the fastest-growing end-user segment, expected to expand at a CAGR of around 7.5% during 2026 to 2035. Growth is driven by new hotel developments, resort projects, and entertainment destinations under Vision 2030, alongside refurbishment of existing hotels to meet international brand and experience standards, which continues to generate high-value interior design and fit-out demand.

Regional Insights

Riyadh Metropolitan

The Riyadh Metropolitan region made up around 40% of Saudi Arabia’s interior design sector in 2025, fueled by its status as the nation’s main hub for business, governance, and trade. Demand remains high from big housing complexes, office spaces, public institutions, medical centers alongside blended real estate ventures keeping momentum steady, while interior investments rise alongside city growth and people moving in.

State efforts tied to Vision 2030 like shifting regional hubs and reshaping city landscapes are nudging firms to spend more on polished interior solutions and full-build workplace setups. A growing appetite for sleek, consistent workspaces that still feel upscale, alongside luxury home designs, quietly cements Riyadh’s role as the market's biggest earner, steady amid shifts elsewhere.

Makkah Province (including Jeddah and Mecca)

Makkah Province accounted for around 26% of the interior design market in 2025, supported by continuous hospitality, retail, and mixed-use development linked to religious tourism and coastal urban growth. Cities such as Jeddah and Mecca generate strong demand for hotel interiors, serviced apartments, retail complexes, and public infrastructure that require frequent upgrades and capacity-driven interior planning.

Ongoing government investment in tourism infrastructure, alongside expansion and refurbishment of hotels to accommodate rising visitor volumes, is sustaining demand for high-value interior design and fit-out services. In addition, increasing focus on culturally aligned design and durable interior materials in public-facing spaces continues to support steady project flow across the province.

Eastern Province

The Eastern Province made up around 15% percent of the market by 2025, fueled mainly through housing projects alongside business hubs tied to oil operations rather than unrelated sectors. Design needs here lean heavily toward workplaces built out from raw spaces, gated homes, clinics, and schools spaces where getting things done matters more than looking flashy.

While project sizes here don't match those in Riyadh or Jeddah, reliable industrial demand keeps things moving - infrastructure updates add momentum along the way. Older homes and offices are being refreshed more often now, adapting to current layouts and functions through small-scale rebuilds and tweaks.

Competitive Landscape / Company Insights

The Saudi Arabian interior design scene holds steady, shaped by homegrown studios alongside global names chasing work in homes, offices, and hotels. Rivalry hinges on sharp design sense, solid build-out skills, tight cost control, while also managing full-scope developments from start to finish. Firms now pour energy into identity presence, adopt smart software for layouts, grow on-the-ground teams locally, aiming to bond better with clients and move faster on site.

Mini Profiles

Dar Al Riyadh provides integrated interior design, architectural, and engineering services, with a strong presence in government, commercial, and mixed-use projects. The firm benefits from long-standing relationships with public-sector clients and deep experience in managing large, complex developments across Saudi Arabia.

Dewan Architects & Engineers operates strongly in hospitality, residential, and commercial interiors, emphasizing design quality and alignment with international standards. The company leverages regional expertise and global design capabilities to support high-end hotels, residential towers, and mixed-use developments.

Hirsch Bedner Associates focuses on premium hospitality and luxury interior design projects, particularly for international hotel brands. Its strength lies in high-end concept development, brand-led interior experiences, and execution across large resort and urban hotel developments.

Wilson Associates specializes in upscale hospitality interiors, with a strong track record in hotels, resorts, and branded residences. The firm emphasizes bespoke design, material quality, and guest experience, supporting premium projects across key Saudi cities.

Perkins & Will operates across commercial, institutional, and mixed-use interior projects, leveraging sustainable design principles and integrated digital workflows. The firm’s focus on functionality, compliance, and cultural adaptation supports its growing presence in public-sector and corporate developments.

Key Players

- Dar Al Riyadh

- Dewan Architects & Engineers

- Hirsch Bedner Associates

- Wilson Associates

- Perkins & Will

- Gensler

- AtkinsRéalis

- Omrania

- Godwin Austen Johnson

- Kristina Zanic Consultants

Recent Developments

In March 2025, Gensler expanded its Middle East interior design practice in Saudi Arabia, aimed at supporting large-scale commercial and mixed-use developments linked to Vision 2030 and rising demand for workplace and urban interior solutions.

In January 2025, AtkinsRéalis announced an expansion of its design and engineering integration services in Saudi Arabia to strengthen its position in large public-sector, healthcare, and infrastructure-led interior projects.

In February 2025, Omrania launched an enhanced interior design and fit-out coordination offering, aimed at improving delivery efficiency for government buildings, corporate offices, and mixed-use developments across Riyadh and Jeddah.

In April 2025, Godwin Austen Johnson expanded its hospitality interior design portfolio in Saudi Arabia to strengthen its presence in luxury hotel, resort, and branded residential segments tied to tourism growth.

In May 2025, Kristina Zanic Consultants announced new hospitality-focused interior design contracts in Saudi Arabia, aimed at reinforcing its position in high-end hotel and lifestyle-led interior projects across key urban and tourism markets.

Saudi Arabia Interior Design Market Coverage

Project Type Insight and Forecast 2026 - 2035

- New Build Projects

- Renovation and Remodeling Projects

Price Tier Insight and Forecast 2026 - 2035

- Economy

- Mid-range

- Luxury

- Ultra-luxury

Material Type Insight and Forecast 2026 - 2035

- Wood and Timber

- Glass and Ceramics

- Metals

- Textiles and Fabrics

- Sustainable and Recycled Materials

End User Insight and Forecast 2026 - 2035

- Residential

- Commercial Office

- Hospitality and Leisure

- Retail and F&B

- Healthcare

- Others (Education and Industrial Facilities)

Saudi Arabia Interior Design Market by Region

- Riyadh Metropolitan

- By Project Type

- By Price Tier

- By Material Type

- By End User

- Makkah Province

- By Project Type

- By Price Tier

- By Material Type

- By End User

- Eastern Province

- By Project Type

- By Price Tier

- By Material Type

- By End User

Table of Contents for Saudi Arabia Interior Design Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Project Type

1.2.2. By

Price Tier

1.2.3. By

Material Type

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Saudi Market Estimate and Forecast

4.1. Saudi Market Overview

4.2. Saudi Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Project Type

5.1.1. New Build Projects

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Renovation and Remodeling Projects

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Price Tier

5.2.1. Economy

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Mid-range

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Luxury

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Ultra-luxury

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.3. By Material Type

5.3.1. Wood and Timber

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Glass and Ceramics

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Metals

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Textiles and Fabrics

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.3.5. Sustainable and Recycled Materials

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Residential

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Commercial Office

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Hospitality and Leisure

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Retail and F&B

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.4.5. Healthcare

5.4.5.1. Market Definition

5.4.5.2. Market Estimation and Forecast to 2035

5.4.6. Others (Education and Industrial Facilities)

5.4.6.1. Market Definition

5.4.6.2. Market Estimation and Forecast to 2035

6. Riyadh Metropolitan Market Estimate and Forecast

6.1. By

Project Type

6.2. By

Price Tier

6.3. By

Material Type

6.4. By

End User

7. Makkah Province Market Estimate and Forecast

7.1. By

Project Type

7.2. By

Price Tier

7.3. By

Material Type

7.4. By

End User

8. Eastern Province Market Estimate and Forecast

8.1. By

Project Type

8.2. By

Price Tier

8.3. By

Material Type

8.4. By

End User

9. Company Profiles

9.1.

Dar Al Riyadh

9.1.1.

Snapshot

9.1.2.

Overview

9.1.3.

Offerings

9.1.4.

Financial

Insight

9.1.5.

Recent

Developments

9.2.

Dewan Architects & Engineers

9.2.1.

Snapshot

9.2.2.

Overview

9.2.3.

Offerings

9.2.4.

Financial

Insight

9.2.5.

Recent

Developments

9.3.

Hirsch Bedner Associates

9.3.1.

Snapshot

9.3.2.

Overview

9.3.3.

Offerings

9.3.4.

Financial

Insight

9.3.5.

Recent

Developments

9.4.

Wilson Associates

9.4.1.

Snapshot

9.4.2.

Overview

9.4.3.

Offerings

9.4.4.

Financial

Insight

9.4.5.

Recent

Developments

9.5.

Perkins & Will

9.5.1.

Snapshot

9.5.2.

Overview

9.5.3.

Offerings

9.5.4.

Financial

Insight

9.5.5.

Recent

Developments

9.6.

Gensler

9.6.1.

Snapshot

9.6.2.

Overview

9.6.3.

Offerings

9.6.4.

Financial

Insight

9.6.5.

Recent

Developments

9.7.

AtkinsRéalis

9.7.1.

Snapshot

9.7.2.

Overview

9.7.3.

Offerings

9.7.4.

Financial

Insight

9.7.5.

Recent

Developments

9.8.

Omrania

9.8.1.

Snapshot

9.8.2.

Overview

9.8.3.

Offerings

9.8.4.

Financial

Insight

9.8.5.

Recent

Developments

9.9.

Godwin Austen Johnson

9.9.1.

Snapshot

9.9.2.

Overview

9.9.3.

Offerings

9.9.4.

Financial

Insight

9.9.5.

Recent

Developments

9.10.

Kristina Zanic Consultants

9.10.1.

Snapshot

9.10.2.

Overview

9.10.3.

Offerings

9.10.4.

Financial

Insight

9.10.5.

Recent

Developments

10. Appendix

10.1. Exchange Rates

10.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Saudi Arabia Interior Design Market