U.S. Microgrid as a Service Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Grid Type (Grid-Connected, Off Grid / Islanded), by Service Type (Software as a Service, Monitoring & Control Service, Operation & Maintenance Service), by Application (Utility, Commercial & Industrial, Residential, Military & Government), by Deployment Model (On Site Microgrids, Remote / Distributed Microgrids), by Technology Component (Energy Storage Systems, Distributed Energy Resources (DER), Control & Automation Systems)

| Status : Published | Published On : Feb, 2026 | Report Code : VREP3062 | Industry : Energy & Power | Available Format :

|

Page : 135 |

U.S. Microgrid as a Service Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Grid Type (Grid-Connected, Off Grid / Islanded), by Service Type (Software as a Service, Monitoring & Control Service, Operation & Maintenance Service), by Application (Utility, Commercial & Industrial, Residential, Military & Government), by Deployment Model (On Site Microgrids, Remote / Distributed Microgrids), by Technology Component (Energy Storage Systems, Distributed Energy Resources (DER), Control & Automation Systems)

U.S. Microgrid as a Service Market Overview

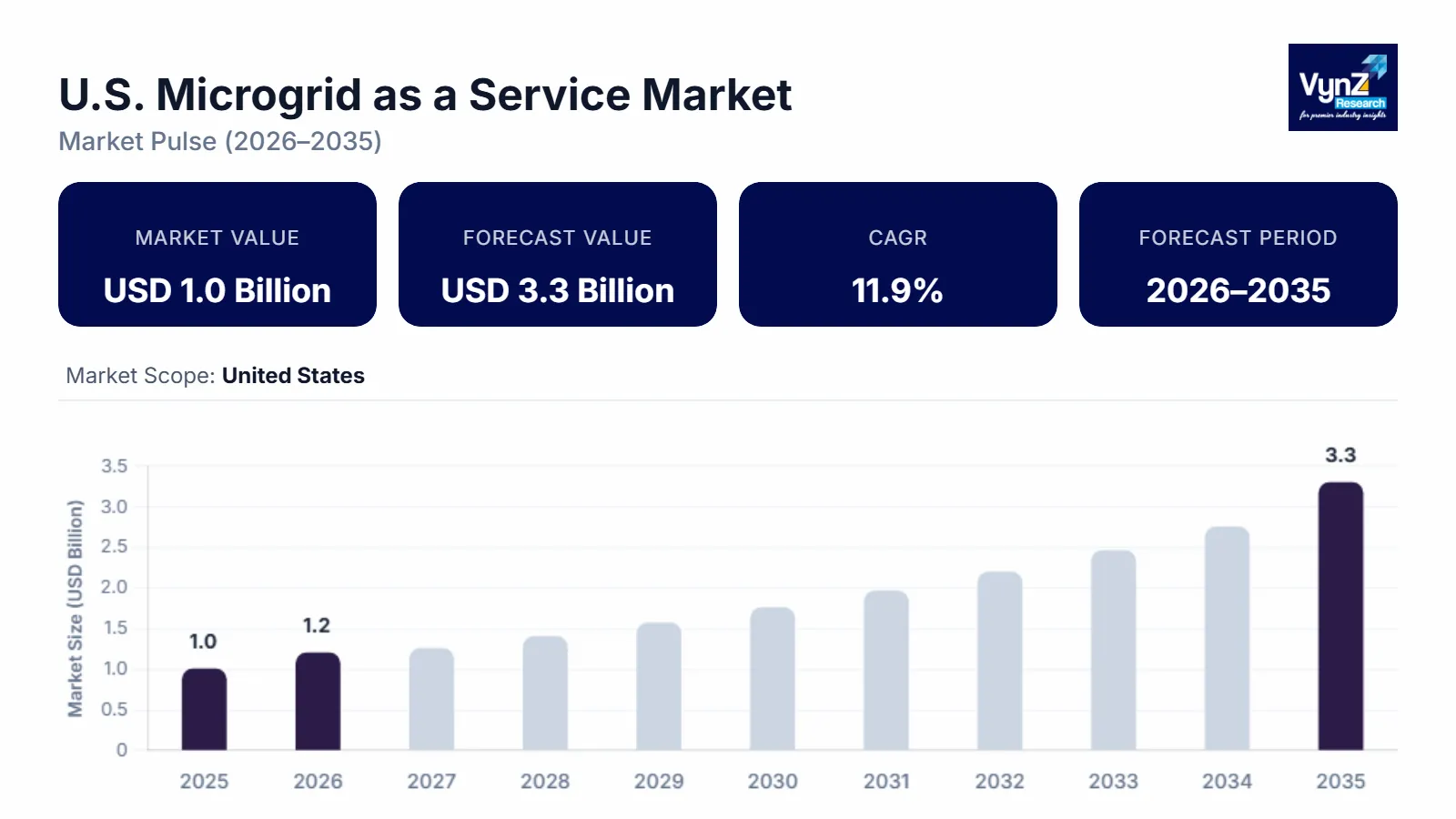

The U.S. microgrid as a service market, which was valued at approximately USD 1.0 billion in 2025 and is estimated to reach around USD 1.2 billion in 2026, is projected to reach close to USD 3.3 billion by 2035, expanding at a CAGR of about 11.9% during the forecast period from 2026 to 2035.

The U.S. market is expanding because organisations across the country are emphasising a growing focus on decentralised power solutions for energy resiliency, reliability, and in response to the need for ageing grid infrastructure upgrades, severe weather, and changing critical loads. Utilities, commercial campuses, industrial facilities, and other mission-critical facilities, such as hospitals and data centres, are demanding microgrid services to provide localised generation, local storage, and automated controls to meet their demand. The increasing desire to integrate renewable energy into the electric grid, combined with favourable public policy and increased investment in grid modernisation, will enable new service-based deployment models that simplify upfront complexity for users and improve operational continuity and energy security among various applications, as According to the U.S. Energy Information Administration, utility-scale battery storage capacity in the United States increased by 66% in 2024, reflecting accelerating adoption of flexible distributed energy infrastructure.

U.S. Microgrid as a Service Market Dynamics

Market Trends

The industry is increasingly moving toward service-driven, decentralised energy deployment models that emphasise resilience, flexibility, and operational continuity in the face of grid disruptions. As a result of this trend, organizations in multiple sectors, including commercial, industrial, utility, and critical infrastructure, are establishing "as a service" offerings, which include a combination of local generation capabilities (e.g., solar, wind), local energy storage capabilities, and local automated control systems that enable end-users to manage their own energy requirements on a local basis without having to invest significant amounts of capital. Additionally, the use of enhanced monitoring, predictive analytics, artificial intelligence (AI), and Internet of Things (IoT) is providing more responsive and optimised service frameworks. Overall, the trend represents a further step in the ongoing decentralisation of the energy system, and microgrids are evolving from being viewed as unique experiments to becoming strategic and mainstream energy assets in support of both reliability and sustainability, as According to the International Renewable Energy Agency, the power sector added 452 GW of solar photovoltaic capacity in 2024, accounting for over 77% of new renewable installations and reinforcing the expansion of localized generation systems.

Growth Drivers

A primary factor in the growth of the microgrid-as-a-service (MaaS) market is the growing emphasis on reliability and resiliency of energy supply systems to address vulnerabilities in the utility grid due to severe weather, ageing infrastructure, and fluctuating customer demand. As utilities, businesses, and other institutional facilities seek out reliable local sources of energy to mitigate the negative impacts of these events on their operations, they have been actively pursuing service models that provide consistent, localised energy capabilities. The regulatory and policy environment supporting grid modernisation and the development of distributed energy resources (DERs) continues to drive interest in MaaS products, which offer reduced operational risk and contribute to energy security objectives. The emphasis on developing resilient, dependable energy infrastructure has been a frequently stated motivation for deploying MaaS solutions by customers and vendors alike, as According to the International Energy Agency, global investment in electricity grids reached USD 400 billion in 2024 as infrastructure modernization accelerated to support distributed energy resources.

Market Restraints / Challenges

Although there is considerable momentum building behind the microgrid industry, it still faces a number of challenges that impede widespread deployment and adoption. Technical and procedural complexities associated with connecting microgrids to existing utility systems and regulatory frameworks are creating barriers to both interconnection and coordinated operations. Discontinuity in policy and incentives across jurisdictions may create uncertainty in investment decision-making. The high upfront cost associated with microgrid development (planning and engineering), as well as the lack of standardisation around performance evaluation and contracting, also dissuades many from adopting this technology. Finally, the skills gap among current workforce members to design, operate, and maintain distributed energy systems continues to impede scalability. As such, these long-standing structural and regulatory impediments continue to be the primary constraint on expanding the microgrid market.

Market Opportunities

There are many opportunities in this market based on a combination of the growing use of renewable energy to meet electricity needs, expanding options for energy storage, and the need to create reliable energy systems for all types of consumers across all industries. As corporations and institutions increasingly commit to being sustainable, they are rapidly adopting service-based microgrids to provide themselves with carbon-reduced energy without having to spend large amounts of money upfront. There are also federal and state incentives available to support the expansion of electric vehicles, modernisation of the grid, and development of distributed energy resources (DERs), which provide a platform for developing new business models and partnerships. Additionally, as more advanced analytical tools become available, such as AI-assisted optimisation and predictive maintenance services, service providers can create additional revenue streams through their enhanced operational value proposition, creating opportunities for long-term customer relationships.

U.S. Microgrid as a Service Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 1.0 Billion |

|

Revenue Forecast in 2035 |

USD 3.3 Billion |

|

Growth Rate |

11.9% |

|

Segments Covered in the Report |

Grid Type, Service Type, Application, Deployment Model, Technology Component |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

West, South |

|

Key Companies |

General Electric (GE), Eaton Corporation, ABB Ltd., Schneider Electric SE, Siemens AG, Spirae, Inc., Ameresco, Inc., PowerSecure, Inc., ENGIE, NRG Energy, Inc., Younicos / Aggreko, Northern Power Systems, Honeywell International Inc., Green Energy Corp., AlphaStruxure |

|

Customization |

Available upon request |

U.S. Microgrid as a Service Market Segmentation

By Grid Type

Grid-connected microgrids is the largest category with a market share of around 70% in 2025, because most organizations view an interface with the existing utility network as a source of both reliability and cost savings. Large commercial entities and utilities generally prefer microgrid solutions which can support their reliance on the utility grid while minimizing disruptions and enabling seamless connectivity to the grid; in addition, these types of microgrids can utilize the existing infrastructure to manage peak loads, integrate distributed energy resources and provide the ability for demand response participation; this reduces the likelihood of operational disruptions and provides a level of financial predictability to the consumer. Additionally, the level of technological maturation combined with the presence of well-established regulatory frameworks for grid-connected microgrid deployments has driven widespread adoption across the US, with the highest levels of adoption occurring among urban and industrial energy consumer, as According to the U.S. Energy Information Administration, utility-scale battery storage capacity in the United States increased by 66% in 2024, supporting wider deployment of grid-integrated resilience solutions.

Islanded or off-grid microgrids is the fastest category with a CAGR of 12.2% in the coming years. This is due to increasing demand for energy independence and resilience, particularly in remote, critical, or disaster-prone areas. This has resulted in organizations using islanded microgrids to provide continuous energy supply and to reduce their dependency upon the main electrical distribution grid; many of these islanded microgrids are providing additional benefits through the inclusion of renewable energy sources and energy storage to provide completely independent energy supplies. Hospitals, government buildings and industrial parks have been implementing microgrids to provide continued operation during periods of grid outage; declining cost of equipment and advances in energy storage technologies are also facilitating increased adoption of microgrid systems. Regulatory incentives and innovation in distributed energy management systems are expected to continue to grow this category of the microgrid market and therefore will be the fastest growing category in the market, as According to the World Bank, global mini-grid installations increased more than 13-fold since 2014, highlighting rising demand for independent power systems in remote applications.

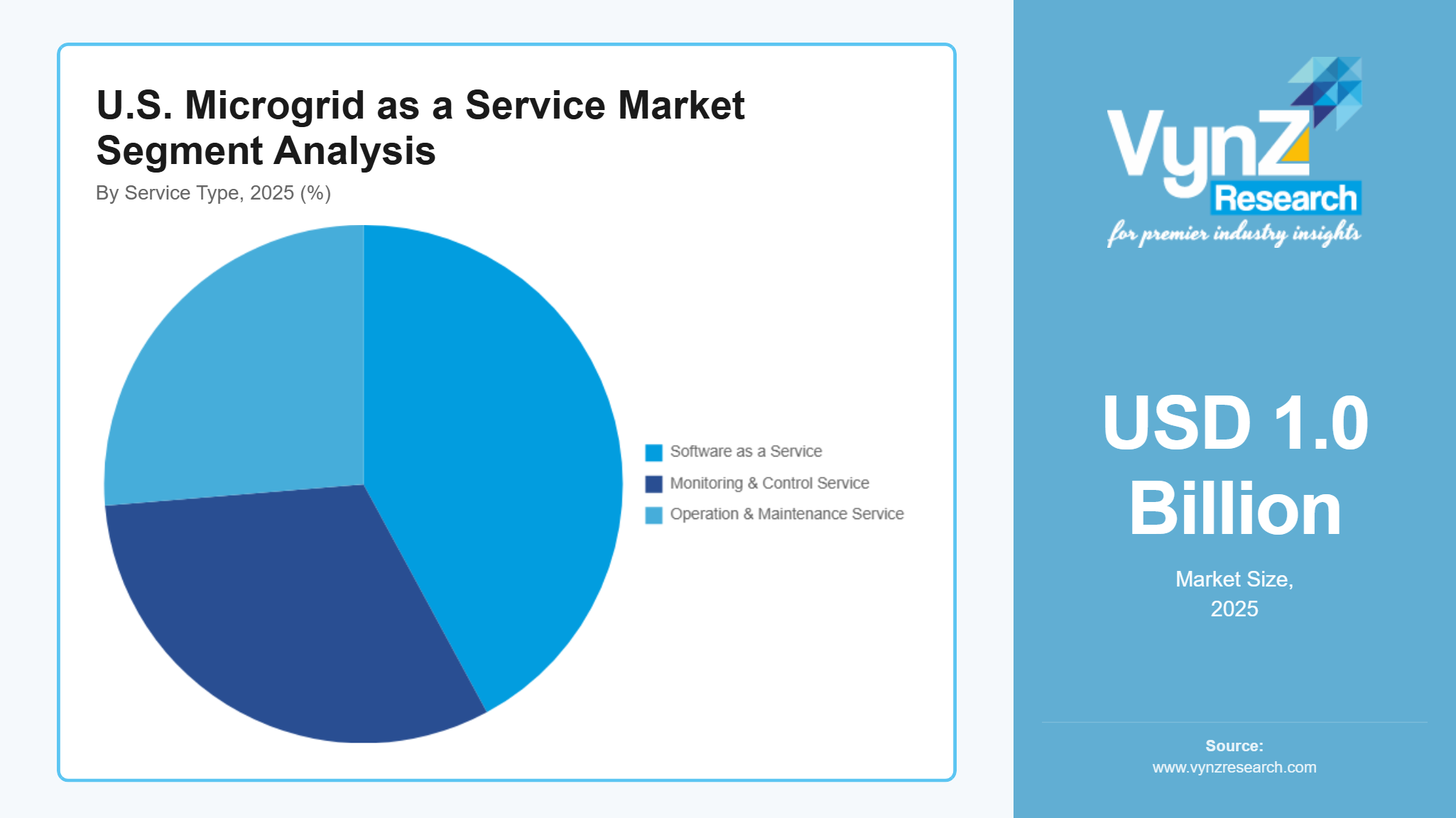

By Service Type

Monitoring and control services is the largest category with a share of approx. 40% in 2025, because all reliable and safe microgrids must have MCS as a fundamental operational requirement. Users of microgrids are primarily utilities, commercial, and industrial; they need MCS to monitor their systems, manage the flow of energy through them, and respond to changes in the utility grid. As a result of the existence of established standards and well-proven technologies that enable integration, compliance and reporting, MCS has the greatest deployment base among all the service offerings. Because organizations must prioritize reliability and regulatory compliance, there will be consistent demand for MCS. The critical nature of MCS to ensure uptime for large deployments of microgrids ensures that MCS is the dominant service category in the microgrid market.

SaaS models are the fastest category due to the fact it can be monitored remotely using advanced software, provides predictive analytics and allows for the automation of microgrid control through a low-cost, no or little upfront cost, scalable solution that optimizes the use of customer energy, integrates distributed resources, ensures reliable operation at a lower cost of ownership and requires minimal internal technical expertise. This growing demand is driven by the increasing use of IoT (Internet of Things) and AI (Artificial Intelligence) based energy management systems in the cloud that allow providers to offer flexible, subscription-based services to customers across their various locations. As organizations are looking to adopt service-oriented models that reduce their internal burden on maintenance, increase the visibility of operations, and speed up deployment timelines, there will continue to be a high-growth environment for SaaS offerings in the US Microgrid Market, as the International Energy Agency reported 1,650 GW of renewable energy projects awaiting grid connection in 2024, creating demand for scalable software-based management platforms.

By Application

Utilities is the largest category with an estimated market share of about 40% in 2025, as it requires a significant amount of grid integrated microgrids to provide reliability, manage Distributed Energy Resources (DERs), and engage in Demand Response Programs. In order to meet the needs of their urban and industrial customer base efficiently, utilities have invested in Centralized Management Systems (CMS) to balance the grid, and integrate renewable energy into their systems. Regulatory support, long-term planning horizon, and access to capital enable utilities to deploy Microgrid-As-A-Service (MaaS) solutions on a large scale. The fact that utilities play a critical role in providing regional energy service, and have control over infrastructure development, has also resulted in utilities being the dominant participant in the U.S. MaaS Market, as According to the U.S. Department of Energy, approximately USD 2 billion was invested in transmission and grid upgrades in 2024 to improve reliability and renewable integration capacity.

Commercial and industrial is growing rapidly at a CAGR of 12.5 in the coming years. This is due to the growing number of operational risks due to power outages, increasing pressure to control energy costs, and a desire to meet sustainability goals. Many of these facilities have created on-site microgrids that allow them to better manage their energy resources while allowing them to use on-site renewable energy and to better utilize their energy resources, and many are also using cloud-based (SaaS) or hosted microgrid services to better take advantage of economies-of-scale. Decreasing costs of the technologies used to create microgrid systems, advancements in energy storage options, and the fact that microgrids can continue to operate when there are disruptions to the local electric grid, all contribute to the expected rapid growth in demand for microgrid systems within this end-use market, as According to the International Energy Agency, distributed solar PV applications accounted for nearly 40% of global solar expansion in 2024 as businesses adopted on-site energy generation.

By Deployment Model

On-site microgrids is the largest category with a market share of 70% in 2025, because all large companies want some level of control over their own power, some level of reliability to operate without interruption and some way to integrate their microgrid into their local operation; they want to be able to respond rapidly to changing loads or grid outages and use distributed generation, storage and automation to do so. Because it's an on-premise solution, there is no need to build new infrastructure, and using existing design standards, which have already been vetted by regulatory agencies, provides a clear pathway forward for these companies to deploy and scale. Large campus owners/operators, industrial facility operators and municipal utilities are among those that will continue to prefer on-site solutions, making them the largest deployment option in the U.S. microgrid market, as According to the International Energy Agency, decentralised solar PV installations added 118 GW of capacity in 2024, growing 23% as organizations expanded self-consumption energy assets.

Remote and distributed microgrids is the fastest category because they are being adopted by underserved communities and/or by those in a geographically-isolated area that have unreliable grid access. The autonomous nature of these systems, through use of renewables, energy storage, etc., will reduce their dependency on central infrastructure; and organizations like hospitals, military bases, and university/research campuses, will continue to adopt distributed microgrids to maintain their resiliency, business continuity, and ability to operate independently. In addition, as the cost of this technology continues to decline, along with increased incentives to support adoption, will continue to increase the speed at which these systems are deployed, making remote and distributed microgrids the fastest growing deployment model in the market today, as According to the World Bank and SEforALL, mini-grid installations grew six-fold since 2018 with committed funding surpassing USD 2.5 billion in 2023, accelerating decentralized electrification.

By Technology Component

Energy storage is the fastest category as battery technologies, advanced inverters, and hybrid storage solutions become integral to reliable microgrid operations. This type of storage provides load shifting, renewable integration, and resiliency and supports the growing need for independent energy management and use. The cost reduction of energy storage products, the increased efficiency of those products and the increasing regulatory incentives to encourage the use of energy storage are all factors that are driving the high rate of adoption of energy storage. As a result, commercial, industrial and utility customers are beginning to see the value of energy storage as a way to optimize energy flow, reduce outage time, and participate in demand response programs; therefore, it is expected that this product category will be the fastest growing category in the U.S. MaaS market, as According to the International Energy Agency, global battery demand exceeded 1 TWh for the first time in 2024, improving the economics of stationary storage deployment.

Distributed energy resources (DER) are the largest category with a market share of 45% in 2025, as the microgrid depends heavily on locally generated power such as solar, wind, and CHP. The use of DER to support the grid, to promote energy independence and energy resilience can be seen across the majority of utilities or large facilities that utilize DER because of the proven ability to integrate these resources into the grid as well as the knowledge of regulatory requirements that are needed to deploy these resources. The broad use of DER by utilities, large industrial sites, and large campuses provides a significant degree of reliability and scalability in the deployment of DER as a resource in the use of microgrids. Because DER is foundational in allowing microgrids to operate and mature from the development and operational perspectives, DER is the market's largest technology category.

Regional Insights

U.S. Microgrid as a Service Market

The microgrid-as-a-service (MaaS) market within the United States is indicative of the different priorities of regional energy resiliency and differing infrastructure approaches based on the various risks associated with climate, pressures on the electric grid, and the potential of renewable energy resources. Utilities, commercial and industrial facilities, and critical infrastructure throughout the nation are increasingly deploying microgrids for localised generation, storage, and automated energy management to address vulnerability in the electric grid and extreme weather-related disruptions. Federal and state programs focused on grid modernization and community resiliency have been driving MaaS adoption across multiple regional environments. Both coastal and inland states are utilising service-based microgrids to provide reliable, decentralised energy support for populations, businesses, and mission-critical facilities.

Western

The Western U.S. is the largest of the regional markets, largely because of wildfires that pose a threat to the grid, grid modernisation initiatives that are proactive, and renewable energy potential that supports the use of microgrids for utility support, community resilience, and critical load continuity, as According to the California Public Utilities Commission, a USD 200 million Microgrid Incentive Program was launched in 2024 to fund community resilience projects in high-risk areas.

South

The South U.S. market is growing steadily, driven by frequent hurricanes, severe storms, and flooding that strain grid reliability across the region. Utilities, municipalities, and commercial facilities are increasingly adopting MaaS to ensure uninterrupted power for critical infrastructure such as hospitals, data centers, and emergency services without high upfront capital costs. Strong solar potential and the rising deployment of battery energy storage systems further support microgrid adoption in the South.

Competitive Landscape / Company Insights

The U.S. microgrid-as-a-service market has a competitive and highly fragmented market environment in which no one company has dominant control over the entire market, and a large number of established and new entrants are actively contributing to total market output. A variety of global energy systems companies, technology companies, and service companies, as well as specialised microgrid developers, are active participants in the development and delivery of services related to the deployment of microgrids to clients. Companies develop their respective shares of the services delivered by winning contracts for specific microgrid projects and delivering those services at a client level rather than through the acquisition of a unified share of the services.

In this context, there exists a high degree of fragmentation due to the diversity of the needs of customers, who include utilities, commercial and industrial entities, and infrastructure providers. These types of customers prefer customized microgrid solutions and direct, localized services, in addition to the fact that there are varying degrees of complexity associated with the integration process, a wide variety of regulatory environments at the regional level, and constantly changing technology configurations that further emphasize a decentralized competitive structure in which the best-in-class position will be determined by the success of project-specific specialties and strategic partnerships rather than the size and concentration of market share.

Mini Profiles

General Electric (GE) continues to expand its global presence by providing advanced microgrid systems, distributed energy resources, and grid management solutions that support utilities, commercial, and industrial customers across the U.S. and international markets.

Eaton Corporation delivers cutting-edge power management solutions, including microgrid integration, energy storage, and control systems, helping commercial, industrial, and utility clients achieve resilient, efficient, and reliable energy operations.

ABB Ltd. focuses on innovation in automation and energy management, offering microgrid control and distributed energy resource solutions that serve utilities, commercial facilities, and industrial sectors with scalable, technology-driven platforms.

Schneider Electric SE develops microgrid-as-a-service offerings, energy storage, and automation systems that enhance operational efficiency and energy resilience for commercial, industrial, and institutional customers worldwide.

Siemens AG continues to lead in industrial and energy technology by supplying microgrid integration, energy management software, and renewable resource solutions to utilities, commercial enterprises, and industrial facilities on a global scale.

Key Players

- General Electric (GE)

- Eaton Corporation

- ABB Ltd.

- Schneider Electric SE

- Siemens AG

- Spirae, Inc.

- Ameresco, Inc.

- PowerSecure, Inc.

- ENGIE

- NRG Energy, Inc.

- Younicos / Aggreko

- Northern Power Systems

- Honeywell International Inc.

- Green Energy Corp.

- AlphaStruxure

Recent Developments

October 2025 - Oracle, in partnership with OpenAI and Vantage Data Centres, began powering its second “Stargate” data centre in Texas using an off-grid natural gas microgrid designed to bypass traditional utility connection delays.

July 2025 - HNO International scheduled deployment of its first two HyGrid™ intelligent hydrogen microgrid systems near Houston, marking the company’s first real-world installations of compact, continuous clean-power microgrids.

June 2025 - ProPetro secured a distributed microgrid contract with a Coterra Energy subsidiary to deliver turnkey microgrid power installations in the Permian Basin, with deployment planned for early 2026.

February 2025 - Ameresco completed the White Sands Missile Range water resiliency microgrid project, delivering integrated solar, battery, and generator systems to ensure the uninterrupted operation of water wells at the U.S. Army installation.

U.S. Microgrid as a Service Market Coverage

Grid Type Insight and Forecast 2026 - 2035

- Grid-Connected

- Off Grid / Islanded

Service Type Insight and Forecast 2026 - 2035

- Software as a Service

- Monitoring & Control Service

- Operation & Maintenance Service

Application Insight and Forecast 2026 - 2035

- Utility

- Commercial & Industrial

- Residential

- Military & Government

Deployment Model Insight and Forecast 2026 - 2035

- On Site Microgrids

- Remote / Distributed Microgrids

Technology Component Insight and Forecast 2026 - 2035

- Energy Storage Systems

- Distributed Energy Resources (DER)

- Control & Automation Systems

U.S. Microgrid as a Service Market by Region

- West

- By Grid Type

- By Service Type

- By Application

- By Deployment Model

- By Technology Component

- South

- By Grid Type

- By Service Type

- By Application

- By Deployment Model

- By Technology Component

Table of Contents for U.S. Microgrid as a Service Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Grid Type

1.2.2. By

Service Type

1.2.3. By

Application

1.2.4. By

Deployment Model

1.2.5. By

Technology Component

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. U.S. Market Estimate and Forecast

4.1. U.S. Market Overview

4.2. U.S. Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Grid Type

5.1.1. Grid-Connected

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Off Grid / Islanded

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Service Type

5.2.1. Software as a Service

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Monitoring & Control Service

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Operation & Maintenance Service

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Application

5.3.1. Utility

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Commercial & Industrial

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Residential

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Military & Government

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.4. By Deployment Model

5.4.1. On Site Microgrids

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Remote / Distributed Microgrids

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.5. By Technology Component

5.5.1. Energy Storage Systems

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Distributed Energy Resources (DER)

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Control & Automation Systems

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

6. West Market Estimate and Forecast

6.1. By

Grid Type

6.2. By

Service Type

6.3. By

Application

6.4. By

Deployment Model

6.5. By

Technology Component

7. South Market Estimate and Forecast

7.1. By

Grid Type

7.2. By

Service Type

7.3. By

Application

7.4. By

Deployment Model

7.5. By

Technology Component

8. Company Profiles

8.1.

General Electric (GE)

8.1.1.

Snapshot

8.1.2.

Overview

8.1.3.

Offerings

8.1.4.

Financial

Insight

8.1.5.

Recent

Developments

8.2.

Eaton Corporation

8.2.1.

Snapshot

8.2.2.

Overview

8.2.3.

Offerings

8.2.4.

Financial

Insight

8.2.5.

Recent

Developments

8.3.

ABB Ltd.

8.3.1.

Snapshot

8.3.2.

Overview

8.3.3.

Offerings

8.3.4.

Financial

Insight

8.3.5.

Recent

Developments

8.4.

Schneider Electric SE

8.4.1.

Snapshot

8.4.2.

Overview

8.4.3.

Offerings

8.4.4.

Financial

Insight

8.4.5.

Recent

Developments

8.5.

Siemens AG

8.5.1.

Snapshot

8.5.2.

Overview

8.5.3.

Offerings

8.5.4.

Financial

Insight

8.5.5.

Recent

Developments

8.6.

Spirae, Inc.

8.6.1.

Snapshot

8.6.2.

Overview

8.6.3.

Offerings

8.6.4.

Financial

Insight

8.6.5.

Recent

Developments

8.7.

Ameresco, Inc.

8.7.1.

Snapshot

8.7.2.

Overview

8.7.3.

Offerings

8.7.4.

Financial

Insight

8.7.5.

Recent

Developments

8.8.

PowerSecure, Inc.

8.8.1.

Snapshot

8.8.2.

Overview

8.8.3.

Offerings

8.8.4.

Financial

Insight

8.8.5.

Recent

Developments

8.9.

ENGIE

8.9.1.

Snapshot

8.9.2.

Overview

8.9.3.

Offerings

8.9.4.

Financial

Insight

8.9.5.

Recent

Developments

8.10.

NRG Energy, Inc.

8.10.1.

Snapshot

8.10.2.

Overview

8.10.3.

Offerings

8.10.4.

Financial

Insight

8.10.5.

Recent

Developments

8.11.

Younicos / Aggreko

8.11.1.

Snapshot

8.11.2.

Overview

8.11.3.

Offerings

8.11.4.

Financial

Insight

8.11.5.

Recent

Developments

8.12.

Northern Power Systems

8.12.1.

Snapshot

8.12.2.

Overview

8.12.3.

Offerings

8.12.4.

Financial

Insight

8.12.5.

Recent

Developments

8.13.

Honeywell International Inc.

8.13.1.

Snapshot

8.13.2.

Overview

8.13.3.

Offerings

8.13.4.

Financial

Insight

8.13.5.

Recent

Developments

8.14.

Green Energy Corp.

8.14.1.

Snapshot

8.14.2.

Overview

8.14.3.

Offerings

8.14.4.

Financial

Insight

8.14.5.

Recent

Developments

8.15.

AlphaStruxure

8.15.1.

Snapshot

8.15.2.

Overview

8.15.3.

Offerings

8.15.4.

Financial

Insight

8.15.5.

Recent

Developments

9. Appendix

9.1. Exchange Rates

9.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

U.S. Microgrid as a Service Market