Asia Pacific Hospital Bed Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Type (General hospital beds, Bariatric beds, Pediatric beds, Pressure relief beds, Birthing beds, Others), by Area of Use (Acute care beds, Critical care beds, Long-term care beds), by Power Type (Manual beds, Semi electric beds, Electric beds), by End User (Hospitals, Elderly care facilities, Home care settings)

| Status : Published | Published On : Feb, 2026 | Report Code : VRHC1323 | Industry : Healthcare | Available Format :

|

Page : 145 |

Asia Pacific Hospital Bed Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Type (General hospital beds, Bariatric beds, Pediatric beds, Pressure relief beds, Birthing beds, Others), by Area of Use (Acute care beds, Critical care beds, Long-term care beds), by Power Type (Manual beds, Semi electric beds, Electric beds), by End User (Hospitals, Elderly care facilities, Home care settings)

Asia Pacific Hospital Bed Market Overview

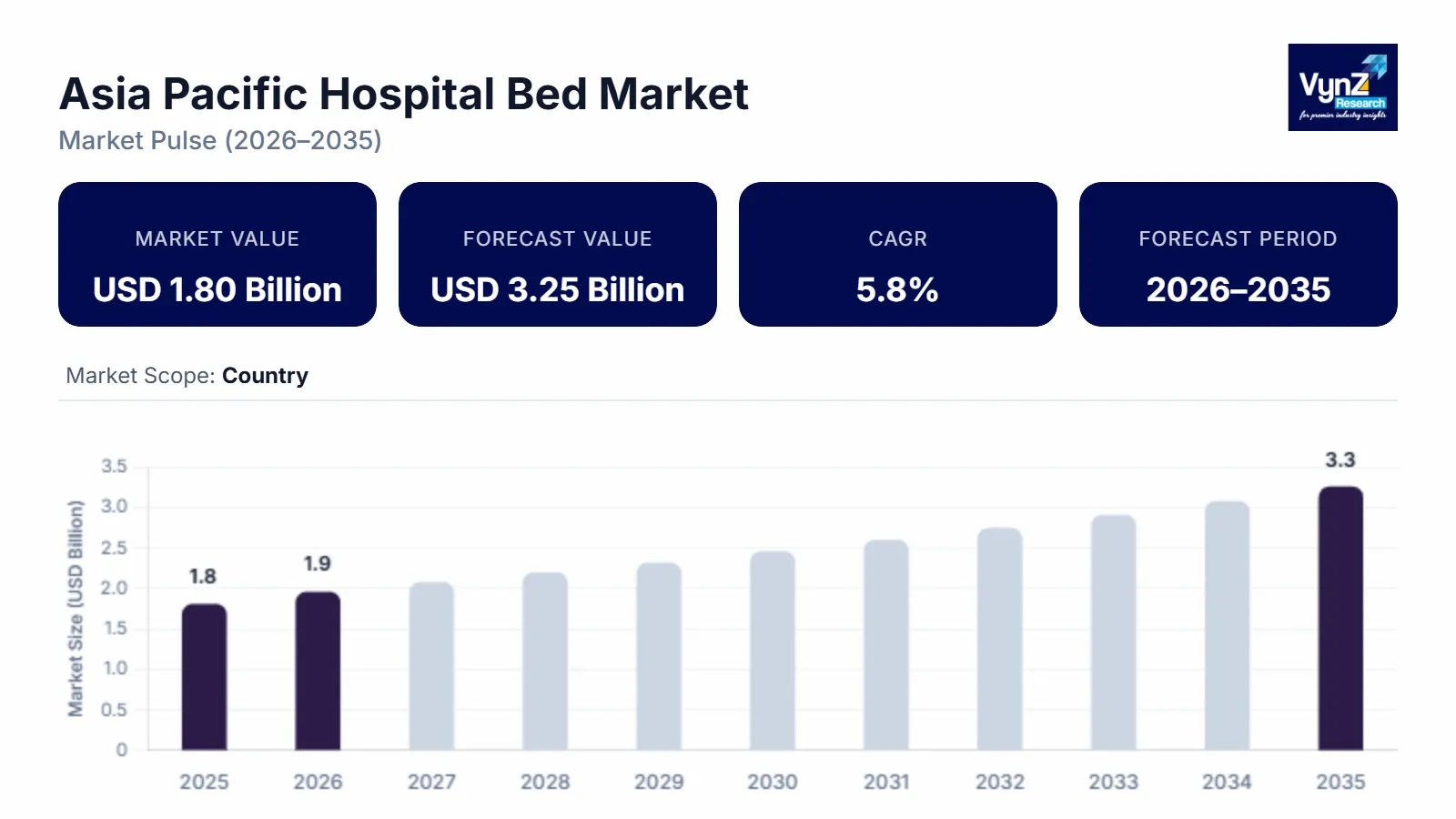

The Asia Pacific hospital beds market which was valued at approximately USD 1.85 billion in 2025 and is estimated to reach around USD 1.96 billion in 2026, is projected to reach approximately USD 3.25 billion by 2035, expanding at a CAGR of about 5.8% during the forecast period from 2026 to 2035.

Market expansion is primarily supported by rising inpatient admissions linked to demographic ageing and the increasing burden of chronic diseases requiring prolonged hospitalization. World Health Organization healthcare capacity assessments highlight persistent gaps in hospital bed density across several Asia Pacific economies which continue to drive structured capacity expansion. Ongoing adoption of electric and semi electric beds improving patient safety clinical monitoring and caregiver efficiency further supports growth.

Government initiatives aimed at strengthening healthcare infrastructure and inpatient readiness are reinforcing adoption across major countries. National health planning frameworks and public investment programs emphasize hospital capacity enhancement critical care preparedness and emergency response resilience particularly following pandemic related system stress. Reports published by ministries of health and government backed planning bodies indicate sustained capital allocation toward public hospitals medical colleges and district level facilities. These policy driven investments combined with expanding insurance coverage for inpatient services are fostering demand across China, India and Southeast Asia where healthcare access indicators and hospital utilization rates continue to show consistent improvement.

Asia Pacific Hospital Bed Market Dynamics

Market Trends

The industry is witnessing notable shifts in technology usage and procurement patterns as healthcare systems prioritize patient safety clinical efficiency and capacity optimization. One of the key trends shaping the market is the growing preference for electric and semi electric beds which reflects changing requirements toward operational efficiency infection control and caregiver ergonomics. Another emerging trend is the integration of smart monitoring features driven by digital health adoption and regulatory alignment around patient safety standards. Health system strengthening frameworks supported by the World Health Organization emphasize improvements in inpatient care quality bed utilization efficiency and clinical monitoring. These developments are influencing product offerings and encouraging manufacturers to focus on value added features modular designs and integrated solutions thereby redefining competitive dynamics within the market.

Growth Drivers

The growth of the market is largely supported by rising inpatient admissions associated with population ageing and the increasing prevalence of chronic and lifestyle related diseases requiring extended hospital stays. Increasing investments in public healthcare infrastructure and hospital capacity expansion are further accelerating market growth across both urban and secondary care settings. Additionally, government led universal health coverage initiatives and emergency preparedness programs are playing a crucial role in boosting adoption. As healthcare providers prioritize patient safety compliance and operational efficiency demand for advanced inpatient bed solutions is expected to remain strong throughout the forecast period. These trends are reinforced by national health system development plans and capacity expansion targets issued by ministries of health across major Asia Pacific economies.

Market Restraints / Challenges

Despite favorable growth prospects the market faces certain challenges that may limit expansion. High capital expenditure requirements associated with advanced electric beds and smart hospital infrastructure continue to affect affordability particularly among resource constrained public hospitals and smaller private facilities. Government health financing assessments indicate that budget limitations and uneven healthcare funding distribution remain persistent issues in several emerging economies. Furthermore, dependence on imported components and specialized manufacturing inputs poses operational challenges for suppliers. Supply chain disruptions regulatory compliance requirements and currency volatility can lead to cost pressures and delivery delays impacting procurement cycles and overall market performance during periods of economic and fiscal uncertainty.

Market Opportunities

The market presents significant opportunities in the expansion of secondary and district level healthcare facilities particularly driven by demographic shifts and unmet inpatient care demand. Companies offering cost effective modular and durable bed solutions are well positioned to capture incremental demand from public hospitals and medical colleges. Another key opportunity lies in the adoption of digitally enabled and critical care beds where rising investments in intensive care capacity and emergency preparedness are creating avenues for higher value procurement. Government backed healthcare modernization programs and digital health strategies emphasize improved patient monitoring and hospital efficiency. Advancements in smart bed technologies and integrated monitoring systems are expected to enhance clinical outcomes and strengthen long term supplier relationships.

Asia Pacific Hospital Bed Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 1.85 Billion |

|

Revenue Forecast in 2035 |

USD 3.25 Billion |

|

Growth Rate |

5.8% |

|

Segments Covered in the Report |

By Type, By Area of Use, By Power Type, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

China, India, Japan, South Korea, Singapore, Rest of Asia Pacific |

|

Key Companies |

Carevel Medical Systems Private Limited, Getinge AB, Hill-Rom Holdings, Inc., Invacare Corporation, Jiangsu Aegean Technology Co. Ltd., Medline Industries, Inc., Merivaara Corp., Midmark Corporation, Paramount Bed Holdings Co., Ltd., Stryker Corporation |

|

Customization |

Available upon request |

Asia-Pacific Hospital Bed Market Segmentation

By Type

General hospital beds accounted for the largest share of the market in 2025, contributing approximately 46% of total segment revenue. Their dominance is supported by widespread deployment across public and private hospitals high utilization rates and routine replacement cycles driven by infection control and patient safety requirements. Government health infrastructure assessments issued by ministries of health across Asia Pacific emphasize the need to improve general inpatient capacity particularly in district and secondary care facilities. These policy driven capacity expansion programs continue to sustain consistent procurement of standard hospital beds across the region.

Specialized beds including critical care and pressure management variants are expected to register the fastest growth during the forecast period with an estimated CAGR of 4.8% from 2026 to 2035. Growth is driven by rising intensive care admissions increasing surgical volumes and structured expansion of critical care units. Government backed emergency preparedness frameworks and intensive care capacity guidelines issued by public health authorities reinforce demand for specialized inpatient solutions across tertiary hospitals.

By Area of Use

Acute care settings held the largest share of the market in 2025 accounting for approximately 49% of total revenue. This leadership is supported by high patient turnover surgical admissions and sustained demand for short term hospitalization across urban healthcare facilities. Public health system performance reports highlight rising admission rates for non-communicable diseases and trauma care which continue to place pressure on acute care bed availability. Investments in public hospital expansion and clinical capacity upgrades further reinforce dominance in this segment.

Critical and long-term care applications are projected to grow at a faster pace with a combined CAGR of around 4.6% during the forecast period. Growth is supported by ageing populations increasing chronic disease prevalence and extended recovery durations. Government supported long term care policies and elderly health programs across Asia Pacific are encouraging structural expansion of rehabilitation and chronic care facilities thereby supporting sustained segment level growth.

By Power Type

Manual hospital beds represented the largest share of the market in 2025 contributing approximately 44% of total segment revenue. Their continued dominance reflects cost efficiency ease of maintenance and suitability for high volume public hospitals particularly in price sensitive healthcare systems. Government procurement frameworks and standardized hospital equipment guidelines continue to prioritize affordability and durability reinforcing adoption of manual beds in secondary and rural healthcare facilities.

Electric and semi electric beds are expected to witness the fastest growth registering a CAGR of about 5.1% from 2026 to 2035. Growth is driven by increasing emphasis on patient safety caregiver ergonomics and clinical efficiency. National healthcare quality improvement programs and hospital accreditation standards supported by public health authorities encourage adoption of advanced bed technologies particularly in tertiary care and private hospitals.

By End User

Hospitals accounted for the largest end user segment in 2025 representing approximately 68% of total market revenue. This dominance is supported by expanding public hospital infrastructure rising inpatient admissions and continuous bed replacement cycles. Government backed healthcare infrastructure development plans and national hospital expansion initiatives continue to drive procurement across general and specialty hospitals particularly in urban and semi urban regions.

Elderly care facilities and home care settings are expected to grow at a CAGR of around 4.5% during the forecast period. Growth is supported by demographic ageing policy driven expansion of long-term care infrastructure and rising preference for post-acute and home-based care. Public health ageing strategies and long-term care frameworks issued by regional governments are reinforcing adoption across non hospital care environments.

Regional Insights

China

China accounted for approximately 34% of the market in 2025 driven by large scale public healthcare infrastructure expansion, rising inpatient admissions and sustained government investment in hospital capacity enhancement. Major metropolitan areas including Beijing, Shanghai and Guangzhou continue to represent high demand centers due to dense populations and advanced tertiary care networks. National health development plans issued by government authorities emphasize improvements in hospital bed density emergency preparedness and critical care readiness. These initiatives combined with increasing adoption of electric and semi electric beds to improve patient safety and workflow efficiency are strengthening market performance across both urban and provincial healthcare systems.

India

India represented an estimated 22% share of the market in 2025 supported by rapid expansion of public hospitals rising private healthcare investment and increasing utilization of inpatient services. High demand from urban centers such as Delhi, Mumbai and Bengaluru continues to drive procurement across government and private facilities. Government backed programs focused on universal health coverage, medical college expansion and district hospital modernization are accelerating hospital bed additions. Policy driven funding for secondary and tertiary care infrastructure combined with growing private hospital chains is supporting steady market growth and replacement demand across multiple care levels.

Japan

Japan contributed approximately 14% of the market in 2025 reflecting its ageing population, high hospitalization rates and well-established inpatient care system. Demand is supported by continuous replacement cycles and emphasis on advanced care quality standards particularly in acute and long-term care facilities. Government health system sustainability strategies prioritize elderly care capacity, rehabilitation services and patient centric hospital environments. Adoption of technologically advanced beds supporting mobility assistance and patient monitoring remains strong across hospitals and long-term care institutions reinforcing regional market stability.

Rest of Asia Pacific

Other Asia Pacific countries including South Korea, Australia, Indonesia, Thailand and Vietnam collectively accounted for around 8% of the market in 2025. Growth in these countries is supported by healthcare infrastructure modernization, rising insurance coverage and increased public and private investment in hospital expansion. Government backed health system strengthening initiatives and emergency preparedness programs are improving inpatient capacity and equipment standards.

Together China, India, Japan and the rest of Asia Pacific account for the major share of the market in 2025. The remaining share of the market not individually analyzed above include emerging economies and other smaller regional markets with ongoing hospital development and long-term growth potential.

Competitive Landscape / Company Insights

The market is moderately to highly competitive with the presence of multinational manufacturers and strong regional suppliers focusing on product innovation pricing optimization and geographic expansion. Companies are increasingly investing in research and development smart bed technologies and ergonomic designs to improve clinical efficiency and patient safety. Adoption is supported by government backed healthcare modernization programs hospital accreditation standards and capacity expansion initiatives guided by ministries of health and the World Health Organization. These frameworks encourage technology upgrades localization of manufacturing and long-term supplier partnerships across public and private healthcare systems.

Mini Profiles

Carevel Medical Systems Private Limited focuses on hospital and critical care beds, supported by regional manufacturing capabilities, competitive pricing, and strong penetration across public healthcare facilities and private hospitals in Asia Pacific.

Getinge AB operates in premium hospital bed and critical care solutions, emphasizing advanced design, patient safety technologies, and integrated care environments supported by global brand recognition and strong institutional relationships.

Baxter International is a major global healthcare technology company producing infusion systems, renal care products, sterile IV solutions, and other hospital supplies.

Invacare Corporation operates in mass and value hospital bed segments, emphasizing cost efficiency, functional durability, and wide accessibility supported by established supply chains and broad healthcare provider reach.

Medline Industries, Inc. leverages large-scale manufacturing and integrated distribution to expand hospital bed offerings, supported by operational efficiency, strong logistics infrastructure, and long-term partnerships with healthcare institutions.

Key Players

- Carevel Medical Systems Private Limited

- Getinge AB

- Baxter International

- Invacare Corporation

- Jiangsu Aegean Technology Co. Ltd.

- Medline Industries, Inc.

- Merivaara Corp.

- Midmark Corporation

- Paramount Bed Holdings Co., Ltd.

- Stryker Corporation

Recent Developments

In January 2025, Invacare Europe and Asia Pacific operations have been combined with Direct Healthcare Group (DHG) to form a new entity called DHCare, aimed at better serving individuals with reduced movement needs across those regions. This reflects a restructuring under new ownership by private equity firm Rhône Capital.

In December 2025, Stryker Corporation has invested around $ 615.6% of its total worth in Utah by expanding its Salt Lake City operations. The Governor's Office of Economic Opportunity oversees the administration of Utah's Economic Development Tax Increment Financing (EDTIF) program. Stryker and Utah officials highlighted how the investment might lead to improved patient-focused medical device manufacturing, technical advancement, and more jobs in the area.

In November 2025, A strategic partnership was established between Getinge and SteriPro International with the goal of revolutionizing sterile processing services for medical facilities throughout North America. Through off-site processing centers rather than conventional in-hospital processes, the partnership capitalizes on the complementary strengths of both businesses to provide a more comprehensive, effective, and scalable approach for sterile instrument reprocessing.

Asia Pacific Hospital Bed Market Coverage

Type Insight and Forecast 2026 - 2035

- General hospital beds

- Bariatric beds

- Pediatric beds

- Pressure relief beds

- Birthing beds

- Others

Area of Use Insight and Forecast 2026 - 2035

- Acute care beds

- Critical care beds

- Long-term care beds

Power Type Insight and Forecast 2026 - 2035

- Manual beds

- Semi electric beds

- Electric beds

End User Insight and Forecast 2026 - 2035

- Hospitals

- Elderly care facilities

- Home care settings

Asia Pacific Hospital Bed Market by Region

- China

- By Type

- By Area of Use

- By Power Type

- By End User

- Japan

- By Type

- By Area of Use

- By Power Type

- By End User

- India

- By Type

- By Area of Use

- By Power Type

- By End User

- South Korea

- By Type

- By Area of Use

- By Power Type

- By End User

- Vietnam

- By Type

- By Area of Use

- By Power Type

- By End User

- Thailand

- By Type

- By Area of Use

- By Power Type

- By End User

- Malaysia

- By Type

- By Area of Use

- By Power Type

- By End User

- Rest of Asia-Pacific

- By Type

- By Area of Use

- By Power Type

- By End User

Table of Contents for Asia Pacific Hospital Bed Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Type

1.2.2. By

Area of Use

1.2.3. By

Power Type

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Asia Market Estimate and Forecast

4.1. Asia Market Overview

4.2. Asia Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Type

5.1.1. General hospital beds

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Bariatric beds

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Pediatric beds

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.1.4. Pressure relief beds

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2035

5.1.5. Birthing beds

5.1.5.1. Market Definition

5.1.5.2. Market Estimation and Forecast to 2035

5.1.6. Others

5.1.6.1. Market Definition

5.1.6.2. Market Estimation and Forecast to 2035

5.2. By Area of Use

5.2.1. Acute care beds

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Critical care beds

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Long-term care beds

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Power Type

5.3.1. Manual beds

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Semi electric beds

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Electric beds

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Hospitals

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Elderly care facilities

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Home care settings

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

6. China Market Estimate and Forecast

6.1. By

Type

6.2. By

Area of Use

6.3. By

Power Type

6.4. By

End User

7. Japan Market Estimate and Forecast

7.1. By

Type

7.2. By

Area of Use

7.3. By

Power Type

7.4. By

End User

8. India Market Estimate and Forecast

8.1. By

Type

8.2. By

Area of Use

8.3. By

Power Type

8.4. By

End User

9. South Korea Market Estimate and Forecast

9.1. By

Type

9.2. By

Area of Use

9.3. By

Power Type

9.4. By

End User

10. Vietnam Market Estimate and Forecast

10.1. By

Type

10.2. By

Area of Use

10.3. By

Power Type

10.4. By

End User

11. Thailand Market Estimate and Forecast

11.1. By

Type

11.2. By

Area of Use

11.3. By

Power Type

11.4. By

End User

12. Malaysia Market Estimate and Forecast

12.1. By

Type

12.2. By

Area of Use

12.3. By

Power Type

12.4. By

End User

13. Rest of Asia-Pacific Market Estimate and Forecast

13.1. By

Type

13.2. By

Area of Use

13.3. By

Power Type

13.4. By

End User

10. Company Profiles

10.1. Carevel Medical Systems Private Limited

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Getinge AB

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Baxter International

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Invacare Corporation

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Jiangsu Aegean Technology Co. Ltd.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Medline Industries, Inc.

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Merivaara Corp.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Midmark Corporation

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Paramount Bed Holdings Co., Ltd.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Stryker Corporation

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Asia Pacific Hospital Bed Market