Dental Implants Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Component / Product (Fixtures, Abutments, Related Components), by Material (Titanium, Zirconium, Ceramic), by Design (Tapered, Parallel-Walled, Others), by Procedure Type (Conventional Two-Stage, Immediate-Load, Mini Implants), by Surface Treatment / Technology (SLA / SLActive, Anodized, Nano-Textured, Others), by End User (Dental Hospitals / Clinics, Dental Laboratories / Academic & Research Institutes, Specialty Clinics)

| Status : Published | Published On : Feb, 2026 | Report Code : VRHC1328 | Industry : Healthcare | Available Format :

|

Page : 183 |

Dental Implants Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Component / Product (Fixtures, Abutments, Related Components), by Material (Titanium, Zirconium, Ceramic), by Design (Tapered, Parallel-Walled, Others), by Procedure Type (Conventional Two-Stage, Immediate-Load, Mini Implants), by Surface Treatment / Technology (SLA / SLActive, Anodized, Nano-Textured, Others), by End User (Dental Hospitals / Clinics, Dental Laboratories / Academic & Research Institutes, Specialty Clinics)

Dental Implants Market Overview

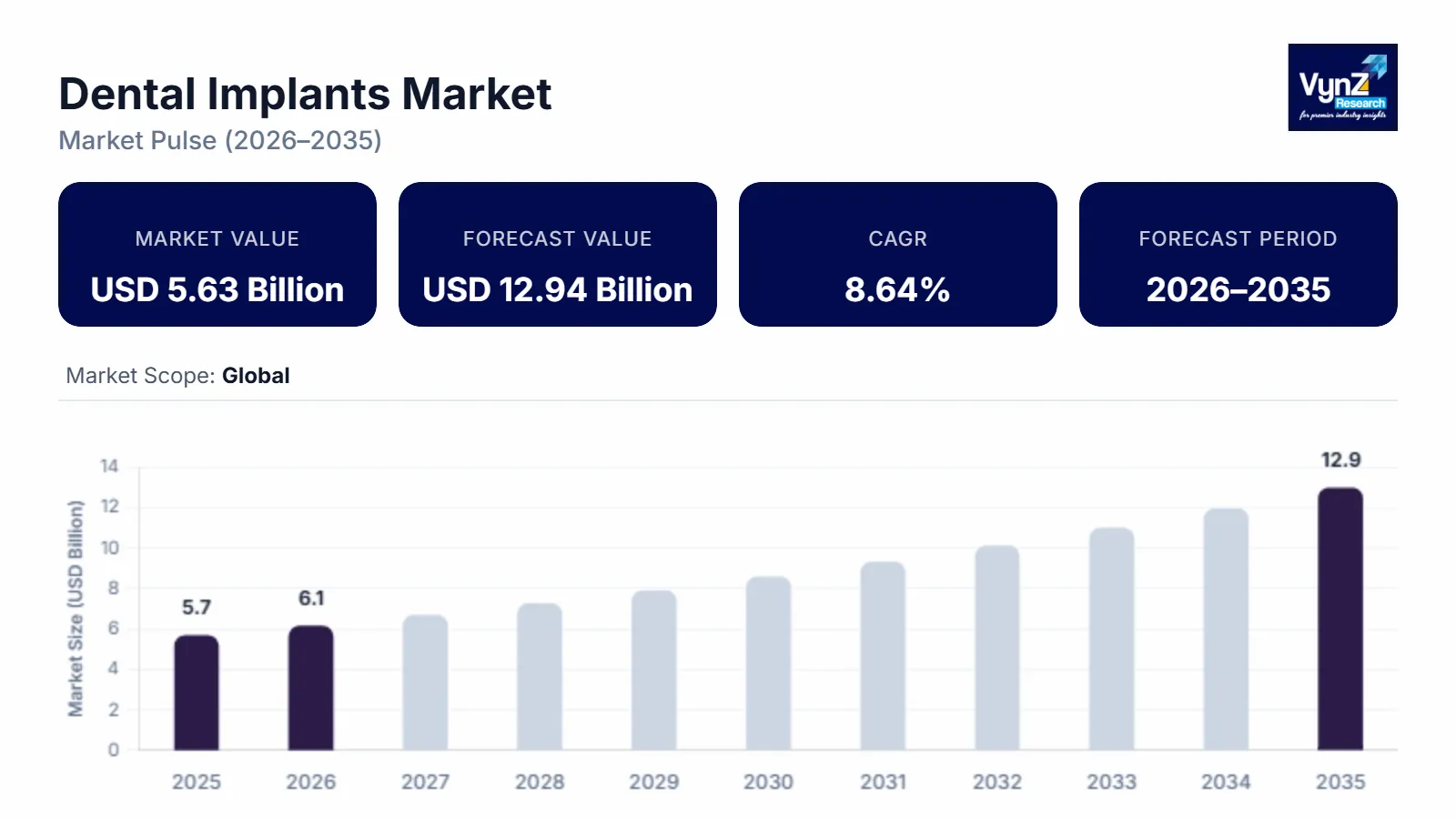

The global dental implants market, valued at approximately USD 5.65 billion in 2025 and estimated to reach around USD 6.13 billion in 2026, is projected to reach approximately USD 12.94 billion by 2035, expanding at a CAGR of about 8.64% from 2026 to 2035.

Market expansion is primarily supported by the increasing prevalence of oral diseases such as tooth loss and periodontal disease. The World Health Organization (WHO) oral health reports indicate a sustained global disease burden that elevates demand for permanent restorative solutions. Ongoing innovations in implant technology enhancing osseointegration and procedural success, further support growth.

Government initiatives aimed at improving access to dental care and public oral health are strengthening adoption across major markets. For example, national public health programs integrating preventive dental services and coverage enhancements for prosthetic rehabilitation are enabling broader clinical uptake. Insurance frameworks that include partial coverage for implant procedures and oral health awareness campaigns further bolster market dynamics. These supportive policy measures, sustained by public investment in healthcare infrastructure and rising acceptance of digital dentistry, are fostering demand across North America, Europe, Asia Pacific, where structured oral health promotion and reimbursement reforms continue to advance clinical adoption.

Dental Implants Market Dynamics

Market Trends

The market is undergoing a structural shift toward digital, precision-guided restorative solutions, aligned with technological integration programs promoted by public health authorities and professional dental associations. Frameworks supported by the World Health Organization (WHO) oral health reports and national dental wellness programs emphasize minimally invasive procedures, standardization of treatment protocols, and evidence-based clinical outcomes to improve patient satisfaction and procedural efficiency. This has accelerated the adoption of CAD/CAM-enabled designs, 3D-printed surgical guides, and robotic-assisted implant placement, supporting precision, reduced healing times, and higher success rates. Clinics and hospitals are increasingly deploying digital imaging, guided surgery, and computer-aided treatment planning to improve clinical accuracy and patient outcomes, consistent with national oral health roadmaps in regions such as the United States, Europe, and Asia Pacific. Government-backed oral health initiatives and reimbursement policies issued by authorities such as the U.S. Department of Health & Human Services and the National Health Service (UK) are reinforcing demand for implants capable of providing predictable, long-term restorative solutions while maintaining clinical efficiency.

Growth Drivers

Globally, growth in the market is driven by demographic changes, including an aging population with increasing prevalence of tooth loss and periodontal disease. The adoption of advanced implant materials, surface technologies, and guided surgical techniques enables improved osseointegration, higher functional success, and enhanced aesthetic outcomes, making digital and precision implants a foundational element of modern restorative dentistry. Rising patient awareness of oral health benefits, combined with government-backed preventive and restorative dental care programs, is encouraging higher adoption rates across private and public clinics. These initiatives, supported by national oral health frameworks in countries such as the United States, Germany, and Japan, facilitate standardized procedures, coverage enhancements, and improved accessibility, contributing to sustained market expansion.

Market Restraints / Challenges

The shift toward high-precision and digital dental implant solutions requires significant capital investment in surgical equipment, digital imaging systems, CAD/CAM software, and training programs. Government reports, including the U.S. Department of Health & Human Services Oral Health Report 2023 and the European Commission Oral Health Policy Framework, highlight that clinics in developing and emerging economies face budget constraints and limited skilled personnel, which can slow adoption. Dental implants also require regulatory approvals from agencies such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA), adding compliance complexity and lifecycle costs. Dependence on imported implant materials and high procedural costs can lead to limited accessibility in price-sensitive markets, affecting overall market performance during periods of economic uncertainty.

Market Opportunities

The market presents opportunities in expanding access to cost-effective and digitally enabled implant solutions, particularly in emerging economies where dental tourism and affordable high-quality care are gaining traction. Government-supported oral health programs and public investment in preventive dental care, such as those implemented by the U.S. Department of Health & Human Services and India’s National Oral Health Program, are enabling wider adoption and infrastructure expansion. The integration of artificial intelligence-assisted treatment planning, automated design systems, and digital workflow solutions is expected to enhance precision, reduce chair time, and improve patient engagement. Companies offering high-performance, customizable, and digital-enabled implants are well-positioned to capture incremental demand and long-term client relationships, driving sustainable market growth.

Global Dental Implants Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 5.65 Billion |

|

Revenue Forecast in 2035 |

USD 12.94 Billion |

|

Growth Rate |

8.64% |

|

Segments Covered in the Report |

By Component / Product, By Material, By Design, By Procedure Type, By Surface Treatment / Technology, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Rest of the World |

|

Key Companies |

AlphaBio Tec., BEGO GmbH & Co. KG, Bicon LLC, BioHorizons IPH Inc., Bioconcept Dental Implants, Blue Sky Bio LLC, Cortex Dental Implants Industries Ltd., Dentis India, Dentium Co., Ltd., DIO, Double Medical Technology Inc., Envista Holdings (Nobel Biocare), GC Corporation, Institut Straumann AG, Kyocera Medical Corporation |

|

Customization |

Available upon request |

Dental Implants Market Segmentation

By Component / Product

Fixtures accounted for the largest share of the dental implants market in 2025, representing approximately 52% of total revenue. Their dominance reflects widespread clinical adoption across dental hospitals and clinics, long replacement cycles, and consistent procedural outcomes. Regulatory approvals and compliance with safety standards established by authorities such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) further reinforce the preference for fixtures in restorative dentistry. Increasing investments in oral healthcare infrastructure and government-backed initiatives for advanced dental procedures continue to sustain demand across both developed and emerging markets.

Abutments and related components are expected to register the fastest growth, with an estimated CAGR of 7.3% during the forecast period from 2026 to 2035. This growth is driven by innovations in modular connectivity, precision engineering, and increasing adoption of digital dentistry tools that enhance surgical accuracy and patient outcomes. Public health programs emphasizing minimally invasive procedures and long-term restorative efficiency are further supporting segment-level expansion.

By Material

Titanium implants accounted for the largest share in 2025, contributing roughly 55% of total segment revenue. Their continued dominance is attributed to biocompatibility, proven osseointegration, and long-term clinical reliability. Adoption is reinforced by standards and guidance issued by dental regulatory authorities in North America, Europe, and Asia, as well as government-backed programs promoting advanced oral healthcare and quality restorative solutions. These factors encourage widespread deployment of titanium implants across hospitals, clinics, and academic centers.

Zirconium and ceramic implants are projected to grow at the fastest pace during 2026 to 2035, with an estimated CAGR of 7.1%. Growth is driven by rising aesthetic demand, metal-free alternatives, and regulatory approvals for innovative materials. The expansion of specialized clinics offering premium and patient-centric restorative solutions is also contributing to increased adoption in urban and high-income regions.

By Design

Tapered implant designs held the largest market share in 2025, accounting for approximately 50% of segment revenue. Their prominence is supported by procedural familiarity, predictable clinical outcomes, and compatibility with immediate-load protocols. Adoption is further reinforced by government-supported oral health programs and professional guidelines advocating standardized implant procedures to ensure safety and long-term success.

Parallel-walled implant designs are anticipated to witness the fastest growth, registering a CAGR of 7.4% from 2026 to 2035. The growth is driven by technological advancements in guided surgical tools, CAD/CAM planning systems, and increasing clinical preference for enhanced stability and osseointegration. Public health initiatives promoting modernized dental treatment standards are further encouraging adoption in both private and institutional dental settings.

By Procedure Type

Conventional two-stage procedures accounted for the largest share of the market in 2025, representing approximately 53% of revenue. Their dominance reflects high practitioner familiarity, established clinical protocols, and long-term restorative reliability. Government-backed dental education and training programs reinforce procedural standardization, ensuring adoption across hospital and clinic networks.

Immediate-load procedures are projected to register the fastest growth, with an estimated CAGR of 7.6% during 2026 to 2035. Growth is driven by rising patient preference for reduced treatment times, enhanced surgical precision through digital guidance systems, and regulatory approvals for advanced surgical protocols. Public oral health initiatives promoting minimally invasive and efficient restorative procedures continue to support market expansion in urban and emerging regions.

By Surface Treatment / Technology

SLA and SLActive surface-treated implants accounted for the largest share in 2025, contributing roughly 54% of segment revenue. Their prominence is due to superior osseointegration, procedural reliability, and regulatory compliance with standards from dental authorities in North America and Europe. Government programs supporting innovation in oral healthcare and advanced restorative solutions further reinforce adoption in hospitals and specialty clinics.

Anodized and nano-textured surface implants are expected to register the fastest growth, with a CAGR of approximately 7.5% during 2026 to 2035. Growth is driven by material innovations, enhanced biocompatibility, and rising preference for long-term stability in restorative outcomes. Adoption is further accelerated by government-backed recommendations and professional dental association guidelines promoting advanced surface technologies.

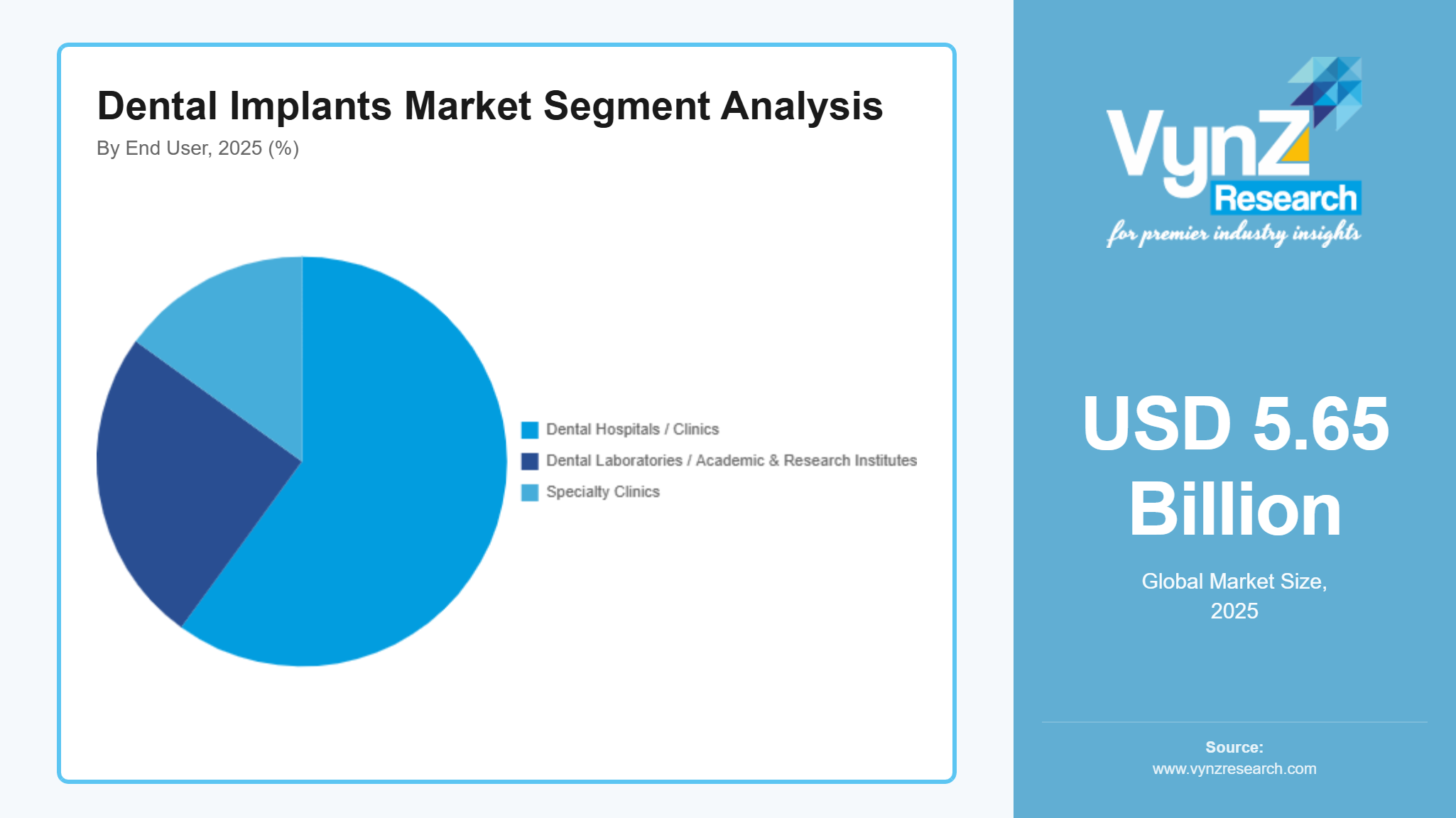

By End User

Dental hospitals and clinics accounted for the largest segment in 2025, representing approximately 60% of total market revenue. Their share is supported by urbanization, rising oral health awareness, and government oral healthcare programs, including initiatives by the U.S. Department of Health & Human Services and European national dental wellness frameworks. Expansion of infrastructure, professional training, and technology adoption continues to reinforce dominance in this segment.

Dental laboratories and academic/research institutes are expected to grow at a CAGR of 6.8% during 2026 to 2035. Growth is supported by the integration of digital planning technologies, expansion of research programs, and rising demand for customized restorative solutions. Specialty clinics and high-volume procedural centers are also contributing to sustained revenue growth, enhancing overall market penetration across developed and emerging regions.

Regional Insights

North America

North America is estimated to account for approximately 31% of the market in 2025. Growth in the region is driven by high healthcare expenditure, advanced dental infrastructure, and stringent regulatory standards enforced by the U.S. Food and Drug Administration (FDA) and the Centers for Medicare & Medicaid Services (CMS). Major urban centers including New York, Los Angeles, and Chicago continue to witness strong adoption of dental implants across hospitals and specialty clinics.

Government-backed initiatives promoting oral health awareness, professional training programs, and reimbursement schemes for restorative procedures are further encouraging investments in advanced dental implant solutions. Integration of digital dentistry platforms and minimally invasive procedural technologies is enhancing clinical efficiency and patient outcomes.

Europe

Europe contributes approximately 24% of the market in 2025. The region’s growth is supported by well-established healthcare systems, regulatory compliance under the European Medicines Agency (EMA), and increasing prevalence of dental disorders among adults. Countries such as Germany, the UK, France, and Italy are witnessing high adoption of titanium and ceramic implants across hospitals, private clinics, and dental laboratories.

Public health campaigns, insurance coverage, and reimbursement programs for dental procedures continue to drive demand. Adoption of digital planning tools, guided implant surgery, and CAD/CAM integration improves procedural accuracy, reinforces clinical outcomes, and strengthens market expansion across both mature and emerging European economies.

Asia Pacific

Asia Pacific is projected to represent roughly 21% of the market in 2025. Growth is fueled by rising disposable incomes, increasing oral health awareness, and expanding dental infrastructure in countries such as China, India, and Japan. Key cities like Beijing, Mumbai, and Tokyo serve as major hubs for dental implant procedures and specialty clinics.

Government-supported oral healthcare initiatives, training programs for dental professionals, and promotion of minimally invasive procedures encourage adoption of modern implant technologies. Expansion of private dental chains, urbanization-driven demand, and integration of digital dentistry platforms further contribute to regional market performance.

Rest of the World

The Rest of the World, including Latin America, Africa, and the Middle East, accounts for approximately 24% of the market in 2025. Growth in these regions is supported by increasing urbanization, investments in healthcare infrastructure, and rising awareness of oral health. Major cities and emerging economies are beginning to adopt modern implant solutions, although penetration remains lower than in North America, Europe, and Asia Pacific.

Government-backed oral health programs and regional healthcare initiatives in countries such as Brazil, South Africa, and Mexico are promoting access to dental implants and specialty restorative procedures. The remaining market demand not specifically covered by North America, Europe, and Asia Pacific is included within this segment, representing a mix of emerging and underserved regions with long-term growth potential.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on product innovation, pricing strategies, and geographic expansion. Key vendors are investing in advanced implant materials, digital dentistry platforms, and guided surgical systems to enhance clinical outcomes. Adoption is supported by government initiatives such as U.S. Centers for Medicare & Medicaid Services (CMS) reimbursement programs, national oral health campaigns in Europe, and public healthcare modernization projects across Asia Pacific. These frameworks encourage companies to strengthen market position and expand clinical reach.

Mini Profiles

AlphaBio Tec focuses on innovative implant systems, supported by regional market penetration, strong clinical training programs, and cost‑effective product offerings that strengthen presence in value‑oriented dental care segments.

BioHorizons IPH Inc. operates in premium and mass dental implant segments, emphasizing advanced surface technologies and regenerative solutions that enhance osseointegration, supported by clinician education and comprehensive support services.

Cortex Dental Implants Industries Ltd. leverages local manufacturing and strategic partnerships to expand market presence, offering tailored implant solutions with streamlined supply chains and regional distribution networks that support clinical adoption.

Dentis focuses on innovative implant technologies and digital dentistry integration, supported by design performance, extensive clinical support networks, and expanding partnerships that enhance procedural efficiency and strengthen market footprint.

Envista Holdings (Nobel Biocare) operates in premium implant solutions, emphasizing esthetic design and digital workflow integration, supported by a robust R&D pipeline and international clinician education programs.

Key Players

- AlphaBio Tec.

- BEGO GmbH & Co. KG

- Bicon LLC

- BioHorizons IPH Inc.

- Bioconcept Dental Implants

- Blue Sky Bio LLC

- Cortex Dental Implants Industries Ltd.

- Dentis India

- Dentium Co., Ltd.

- DIO

- Double Medical Technology Inc.

- Envista Holdings (Nobel Biocare)

- GC Corporation

- Institut Straumann AG

- Kyocera Medical Corporation

Recent Developments

In November 2025, Dental medical device specialist Dentium Co., Ltd. declared that it is now the first company in South Korea to receive certification under the EU's enhanced Medical Device Regulation (MDR). 'bright CT' dental imaging equipment and 'bright Alone' hydraulic treatment chair are two of Dentium's products covered by this certification. It is significant because it demonstrates that domestic medical device technology has complied with the world's most stringent safety and quality standards. The European Union has been implementing a new medical device certification system called the MDR (European Medical Device Regulation) Since 2021, which has far more stringent requirements than earlier rules for clinical data, product safety, and manufacturing and quality management.

In July 2025, Envista Holdings Corp, a dental corporation established in the United States, has began its new production base project in China by signing an investment agreement with the Suzhou New District government in Suzhou, Jiangsu province, for a total investment of USD 139.6 million. Two decades after entering the second-largest economy in the world, Envista has made investments and set up industrial facilities there, producing invisible aligners for both local and foreign markets.

In March 2025, BEGO Implant Systems announced its strategic partnership with NovaBone on March 2, 2025. Under this agreement, BEGO will take over the distribution of NovaBone’s bone graft substitute products in Europe, combining BEGO’s implantology expertise with NovaBone’s regenerative materials to enhance clinical solutions for dental professionals.

Global Dental Implants Market Coverage

Component / Product Insight and Forecast 2026 - 2035

- Fixtures

- Abutments

- Related Components

Material Insight and Forecast 2026 - 2035

- Titanium

- Zirconium

- Ceramic

Design Insight and Forecast 2026 - 2035

- Tapered

- Parallel-Walled

- Others

Procedure Type Insight and Forecast 2026 - 2035

- Conventional Two-Stage

- Immediate-Load

- Mini Implants

Surface Treatment / Technology Insight and Forecast 2026 - 2035

- SLA / SLActive

- Anodized

- Nano-Textured

- Others

End User Insight and Forecast 2026 - 2035

- Dental Hospitals / Clinics

- Dental Laboratories / Academic & Research Institutes

- Specialty Clinics

Global Dental Implants Market by Region

- North America

- By Component / Product

- By Material

- By Design

- By Procedure Type

- By Surface Treatment / Technology

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Component / Product

- By Material

- By Design

- By Procedure Type

- By Surface Treatment / Technology

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Component / Product

- By Material

- By Design

- By Procedure Type

- By Surface Treatment / Technology

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Component / Product

- By Material

- By Design

- By Procedure Type

- By Surface Treatment / Technology

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Dental Implants Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Component / Product

1.2.2. By

Material

1.2.3. By

Design

1.2.4. By

Procedure Type

1.2.5. By

Surface Treatment / Technology

1.2.6. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Component / Product

5.1.1. Fixtures

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Abutments

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Related Components

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Material

5.2.1. Titanium

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Zirconium

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Ceramic

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Design

5.3.1. Tapered

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Parallel-Walled

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Others

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By Procedure Type

5.4.1. Conventional Two-Stage

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Immediate-Load

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Mini Implants

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.5. By Surface Treatment / Technology

5.5.1. SLA / SLActive

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Anodized

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Nano-Textured

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.5.4. Others

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2035

5.6. By End User

5.6.1. Dental Hospitals / Clinics

5.6.1.1. Market Definition

5.6.1.2. Market Estimation and Forecast to 2035

5.6.2. Dental Laboratories / Academic & Research Institutes

5.6.2.1. Market Definition

5.6.2.2. Market Estimation and Forecast to 2035

5.6.3. Specialty Clinics

5.6.3.1. Market Definition

5.6.3.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Component / Product

6.2. By

Material

6.3. By

Design

6.4. By

Procedure Type

6.5. By

Surface Treatment / Technology

6.6. By

End User

6.6.1.

U.S. Market Estimate and Forecast

6.6.2.

Canada Market Estimate and Forecast

6.6.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Component / Product

7.2. By

Material

7.3. By

Design

7.4. By

Procedure Type

7.5. By

Surface Treatment / Technology

7.6. By

End User

7.6.1.

Germany Market Estimate and Forecast

7.6.2.

U.K. Market Estimate and Forecast

7.6.3.

France Market Estimate and Forecast

7.6.4.

Italy Market Estimate and Forecast

7.6.5.

Spain Market Estimate and Forecast

7.6.6.

Russia Market Estimate and Forecast

7.6.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Component / Product

8.2. By

Material

8.3. By

Design

8.4. By

Procedure Type

8.5. By

Surface Treatment / Technology

8.6. By

End User

8.6.1.

China Market Estimate and Forecast

8.6.2.

Japan Market Estimate and Forecast

8.6.3.

India Market Estimate and Forecast

8.6.4.

South Korea Market Estimate and Forecast

8.6.5.

Vietnam Market Estimate and Forecast

8.6.6.

Thailand Market Estimate and Forecast

8.6.7.

Malaysia Market Estimate and Forecast

8.6.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Component / Product

9.2. By

Material

9.3. By

Design

9.4. By

Procedure Type

9.5. By

Surface Treatment / Technology

9.6. By

End User

9.6.1.

Brazil Market Estimate and Forecast

9.6.2.

Saudi Arabia Market Estimate and Forecast

9.6.3.

South Africa Market Estimate and Forecast

9.6.4.

U.A.E. Market Estimate and Forecast

9.6.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. AlphaBio Tec.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. BEGO GmbH & Co. KG

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Bicon LLC

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. BioHorizons IPH Inc.

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Bioconcept Dental Implants

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Blue Sky Bio LLC

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Cortex Dental Implants Industries Ltd.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Dentis India

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Dentium Co., Ltd.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. DIO

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Double Medical Technology Inc.

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Envista Holdings (Nobel Biocare)

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. GC Corporation

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

10.14. Institut Straumann AG

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5. Recent

Developments

10.15. Kyocera Medical Corporation

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Dental Implants Market