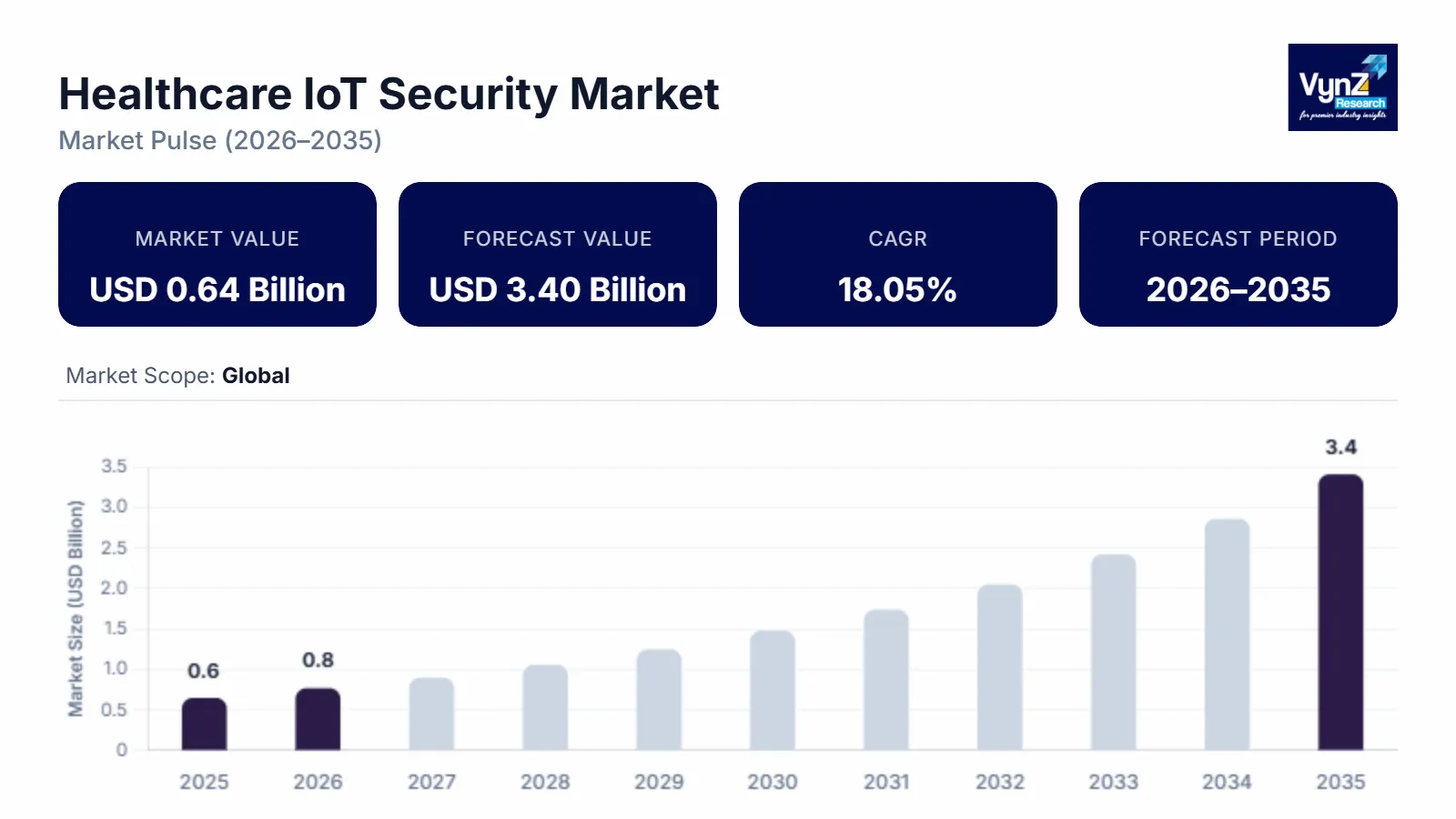

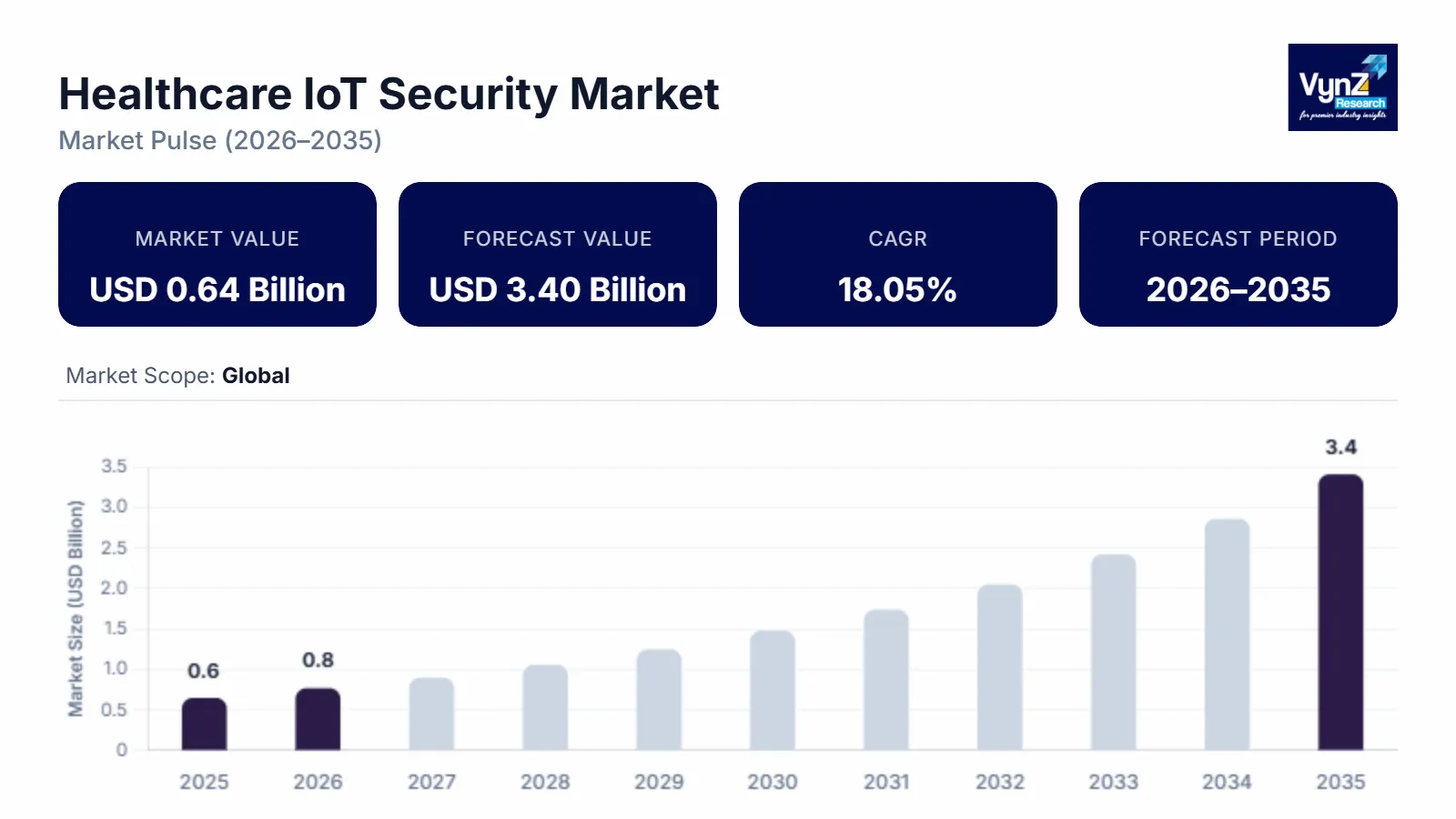

Healthcare IoT Security Market Overview

The global Healthcare IoT Security Market size was valued at USD 0.64 billion in 2025 and is estimated to reach aroundB. It is projected to reach around USD 3.40 billion by 2035, expanding at a CAGR of about 18.05% during the forecast period from 2026 to 2035.

Modernization and technological development have encouraged hospitals to use digital platforms to track the health data of patients. Many pharmaceutical industries and medical centers have collaborated with healthcare IoT security companies to provide customers’ data. This demands ensuring the privacy and security of patient data as well as crucial healthcare infrastructure. Healthcare IoT security implies the process that offers end-to-end data security. The process uses a cloud-based platform to protect patient data, healthcare infrastructure, and interconnected medical devices. The market players include technology providers, cybersecurity firms, and consulting agencies that specialize in providing healthcare IoT security services and solutions.

The growth of the global healthcare IoT security market is the consequence of the rising implementation of IoT devices in healthcare and the growing concern over cybersecurity in the healthcare industry. Apart from that, the need for data protection and privacy along with the need to maintain integrity of the critical healthcare infrastructure propels the market demand and growth.

The market growth is, however, hampered by inadequate awareness about technological threats. Growth opportunities are, however, presented by emerging economies with their developing infrastructure.

Healthcare IoT Security Market Segmentation

Insight by Component

- Solutions (Analytics

- Encryption

- Data Loss Protection

- Identity and Access Management

- Unified Threat Management

- Others

The global healthcare IoT security market is divided by component into solutions and services where the former is further divided into analytics, encryption, data loss protection, identity and access management, unified threat management, and other segments, and the latter is subdivided into consulting services, risk assessment services, design & integration services, managed security services, and others. Out of these segments, the service segment will dominate the market due to growing concerns among consumers regarding data security and privacy. The solutions segment will, however, grow at a higher CAGR due to the rise in demand for strong security solutions to prevent loss or misuse of patient and healthcare data.

Insight by Services

- Consulting Services

- Risk Assessment Services

- Design & Integration Services

- Managed Security Services

- Others

Insight by Security

- Network Security

- Endpoint Security

- Content Security

- Application Security

- Cloud Security

- Others

The global healthcare IoT security market is divided by security into network security, endpoint security, content security, application security, cloud security, and another segment, where the cloud security segment is expected to grow higher than the others due to greater usage in the healthcare sector to improve operational flexibility, efficiency, performance, and decrease infrastructural cost.

Insight by Application

- Clinical Operations & Workflow Management

- Telemedicine (Remote Patient Monitoring

- Store & Forward Telemedicine

- and Interactive Telemedicine)

- Connected Imaging

- Medication Management

- Inpatient Management

- Others

The global healthcare IoT security market is also divided by application into clinical operations & workflow management, telemedicine, connected imaging, medication management, inpatient management, and other segments. Out of these segments, the telemedicine sector with grow at a rapid pace during the forecast period due to higher adoption to manage and track patient data. The inpatient management segment is also expected to grow significantly due to the provision of continuous measurement of the physiological functions of a patient to help make the right therapeutic interventions and management decisions.

Insight by Connectivity Technology

- Near Field Communication (NFC)

- Cellular

- Satellite

- Wi-Fi

- Bluetooth Low Energy (BLE)

- ZigBee

According to the connectivity technology, the global healthcare IoT security market is split into Near Field Communication (NFC), Cellular, Satellite, Wi-Fi, Bluetooth Low Energy (BLE), and ZigBee segments. Among all these segments, the cellular technology segment will grow more due to greater portability, versatility, and usability for connected medical devices to help in remote patient monitoring.

Insight by End-User

- Hospitals

- Surgical Centers

- and Clinics

- Clinical Research Organizations

- Government and Defense Institutions

- Research and Diagnostic Laboratories

The global healthcare IoT security market is divided by end users into hospitals, surgical centers, clinics, clinical research organizations, government and defense institutions, and research and diagnostic laboratories. Out of these, the hospital segment is expected to grow more and contribute larger revenue to the market due to extensive use in inpatient and outpatient monitoring automation of HVAC systems to avoid spreading infections. Asset tracking to update inventory management for medical workers.

Global Healthcare IoT Security Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 0.64 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 3.40 Billion

|

|

Growth Rate

|

18.05%

|

|

Segments Covered in the Report

|

By Component, By Security, By Application, By Connectivity Technology and By End-User

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, South America and Rest of the World

|

Industry Dynamics

Industry Trends

There is a notable increase in the digitalization of healthcare, which has encouraged the adoption of IoT. Other significant trends in the market include significant development in connections and higher dependency on connected devices. Another notable trend of the industry is the higher prominence of smart wearable devices with IoT sensors.

Healthcare IoT Security Market Growth Drivers

The global healthcare IoT security market growth drivers include higher adoption of cloud computing, growing demand for real-time processing of patient data and medical records, rising vulnerabilities in connected devices, and awareness among consumers facilitating services like online booking for an appointment with a doctor. In addition, growing government concerns over security, the possibility of data breaches, and higher adoption of smart devices for hospital management have propelled the market growth.

Healthcare IoT Security Market Challenges

The strict regulations for data privacy and security breaches also hinder market growth. In addition, significant problems such as interoperability issues and inconsistent interconnectivity also prevent higher usage and market growth. Apart from that, poor authentication methods, weak passwords, and loss of data during transfer due to poor networks hinder market growth.

Healthcare IoT Security Market Opportunities

Growth opportunities are, however, presented by the significant tech advancements that have developed the systems without any glaring issues, which has promoted their acceptance. Furthermore, supportive government initiatives and subsidiaries also encourage higher adoption and promotion of the use of IoT technology in healthcare.

Healthcare IoT Security Market Geographic Overview

North America leads the market mainly due to the presence of a large number of industry players and the higher adoption of IoT technology in the healthcare sector for patient data security and privacy. Moreover, there is a higher penetration of IoT-enabled and smart devices, the growing popularity of wearable devices, increasing healthcare expenditure, the growing geriatric population, and increasing cybercrimes in healthcare, all of which fuel the market growth in this region.

The Asia-Pacific market will also grow significantly during the forecast period due to rising digital health adoption, cyber threats, healthcare infrastructure, and awareness of data privacy. It is also attributed to the strict regulatory standards and developments in medical technology,

Healthcare IoT Security Market Competitive Insight

The industry players are striving to get traction in the competitive market by adopting strategies such as product penetration, product differentiation, mergers & acquisitions, collaborations, and partnerships to sustain in the market.

Cisco Systems, Inc. is an American multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment and other high-technology services and products.

Dell Inc. is an American technology company that develops, sells, repairs, and supports computers and related products and services. Dell is owned by its parent company, Dell Technologies.

Some of the key players operating in the healthcare IoT security market: are Cisco Systems, Inc., Inside Secure SA, Dell Inc., Intel Corporation, Deutsche Telekom AG, IBM, Oracle, Fortinet, Inc., Agile Cybersecurity Solutions, LLC, and Check Point Software Technologies Ltd.

Recent Developments by Key Players

Cisco acquired Splunk to bring market-leading security and observability to empower organizations with a real-time unified view of their digital enterprises.

Intel Corporation and Apollo entered into a partnership where Apollo shall managed funds and affiliates will lead an investment of USD 11 billion to acquire from Intel a 49% equity interest in a joint venture entity related to Intel’s Fab 34.

The Healthcare IoT Security Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

Segments Covered in the Report

- By Component Type

- Solutions

- Analytics

- Encryption

- Data Loss Protection

- Identity and Access Management

- Unified Threat Management

- Others

- Services

- Consulting Services

- Risk Assessment Services

- Design & Integration Services

- Managed Security Services

- Others

- By Security

- Network Security

- Endpoint Security

- Content Security

- Application Security

- Cloud Security

- Others

- By Application

- Clinical Operations & Workflow Management

- Telemedicine

- Remote Patient Monitoring

- Store & Forward Telemedicine

- Interactive Telemedicine

- Connected Imaging

- Medication Management

- Inpatient Management

- Others

- By Connectivity Technology

- Near Field Communication (NFC)

- Cellular, Satellite

- Wi-Fi

- Bluetooth Low Energy (BLE)

- ZigBee

- By End-User

- Hospitals, Surgical Centers, and Clinics

- Clinical Research Organizations

- Government and Defense Institutions

- Research and Diagnostic Laboratories

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

.png)