Global Next-Generation Surgical Robots Market – Analysis and Forecast (2025-2030)

Industry Insights by Product and Service (Robotic Systems, Instruments & Accessories, Services), Application (Gynaecological Surgery, Urological Surgery, Neurosurgery, Orthopaedic Surgery, General Surgery, Other Applications), End User (Hospitals, Ambulatory Surgery Centres), and by Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Dec, 2023 | Report Code : VRHC1240 | Industry : Healthcare | Available Format :

|

Page : 185 |

Global Next-Generation Surgical Robots Market – Analysis and Forecast (2025-2030)

Industry Insights by Product and Service (Robotic Systems, Instruments & Accessories, Services), Application (Gynaecological Surgery, Urological Surgery, Neurosurgery, Orthopaedic Surgery, General Surgery, Other Applications), End User (Hospitals, Ambulatory Surgery Centres), and by Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Next-Generation Surgical Robots Market Overview

The Global Next-Generation Surgical Robotics Market size was valued at $0.32 billion in 2023 and is expected to grow at a CAGR of 27.6% during the forecast period 2025-2030 anticipated to reach $6.5 billion in 2030. The next-generation surgical robotics market refers to the growing field of advanced robotic systems used in surgical procedures. These systems combine robotic technology, artificial intelligence, and other cutting-edge innovations to enhance the precision, efficiency, and safety of surgical interventions.

Some of the key driver factoring to this growth in the Global Next-Generation Surgical Robotics Market are technological breakthroughs, advantages of robotic-assisted surgery, highly increasing adoption of surgical robots by ambulatory surgery centres and the hospitals & raising fundings for the medical robot research. However, the growth of the market is constrained by high costs for the construction of robotic devices and a lack of qualified professionals.

On an unparalleled scale, the COVID-19 epidemic has upended many lives and businesses. The pandemic would have a detrimental effect on the demand for next-generation surgical robots. The pandemic has culminated in a temporary ban on elective surgeries across the world, resulting in cancellations of elective surgeries worldwide. The latest outbreak of the pandemic of coronavirus disease (COVID-19) has posed an unprecedented threat to the world's healthcare systems.

It has become important to recognize the future role of robotic-assisted surgery in the current pandemic as elective operations are halted and concerns are raised about how the remaining procedures on COVID-19 positive patients can be safely conducted. A number of robotic-assisted surgery societies have also recently provided their recommendations on this subject.

Market Sementation

Surgical robotic systems mainly include surgical systems, instruments & accessories, and facilities (capital equipment) (maintenance and up-gradation). The definition of these advanced technologies has developed over the past decade, including the use of these devices for different surgical procedures, ranging from general surgery to orthopaedic surgery.

Based on Product and Service

Among all segments of the Next-Generation Surgical Robotics Market, the instruments & accessories segment is estimated to be fastest-growing for the forecasted period.

As per the Product & Service type, the market for Next-Generation Surgical Robotics is segmented into the following:

a. Robotic systems

b. Instruments & Accessories

c. Services

The international market is segmented into robotic systems, instruments, and accessories & services on the basis of product and service. The largest market share was commanded by the instruments & accessories segment in 2019. As compared to robotic systems, which are a one-time investment, the large share and fast growth rate of this segment are driven primarily by the recurring purchase of instruments & accessories.

Based on Application

The fastest-growing segment from the irrigation automation market for the forecast period is estimated to be the general surgery segment.

As per the Application, the market for Next-Generation Surgical Robotics is segmented into the following:

a. Gynaecological Surgery

b. Urological Surgery

c. Neurosurgery

d. Orthopaedic Surgery

e. General Surgery

f. Other Applications

The market is segmented into general surgery, urological surgery, gynaecological surgery, orthopaedic surgery, neurosurgery, and other applications, depending on the application. During the forecast period, the general surgery segment is anticipated to rise at the highest rate.

Based on End User

The fastest-growing segment from the irrigation automation market for the forecast period is estimated to be the hospital's segment.

As per the End User, the market for Next-Generation Surgical Robotics is segmented into the following:

a. Hospitals

b. Ambulatory Surgery Centres

The market is segmented into hospitals and ambulatory surgery centres, based on end-users. The market for surgical robots in hospitals is mainly motivated by the growing emphasis on improved accuracy in performing surgeries and ensuring greater comfort for surgeons.

Global Next-Generation Surgical Robots Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 0.32 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 6.5 Billion |

|

Growth Rate |

27.6% |

|

Segments Covered in the Report |

By Product and Service, By Application and By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, South America and Rest of the World |

Industry Dynamics

Market Trends

Miniaturization: Miniaturization is one of the key trends in the next-generation surgical robotics market. Smaller robots are easier to use and can be used in more minimally invasive procedures.

Autonomy: Autonomous surgical robots are robots that can perform surgery without the need for human intervention. This technology is still in its early stages, but it has the potential to revolutionize the field of surgery.

Telesurgery: Telesurgery is a type of surgery where the surgeon is not physically present in the operating room. The surgeon controls the surgical robot remotely from another location. This technology is becoming increasingly popular, as it allows surgeons to provide care to patients in remote areas.

Market Drivers

The next-generation surgical robotics market is a highly competitive market. The leading players in the market are investing heavily in research and development to develop new technologies and improve the performance of their surgical robots.

The next-generation surgical robotics market is a promising market with a lot of potential. The market is expected to grow significantly in the coming years, and the leading players in the market are well-positioned to benefit from this growth.

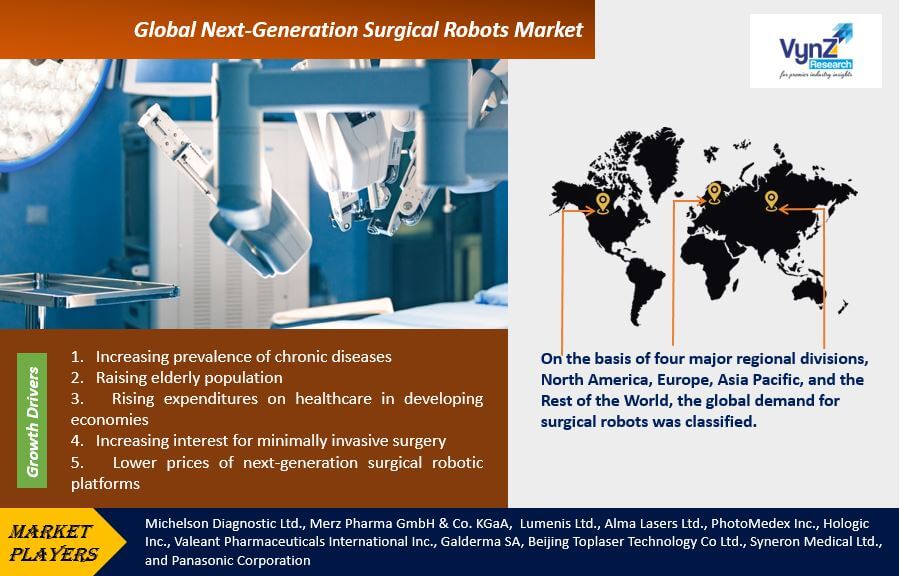

1. Increasing prevalence of chronic diseases

2. Raising elderly population

3. Rising expenditures on healthcare in developing economies

4. Increasing interest for minimally invasive surgery

5. Lower prices of next-generation surgical robotic platforms

6. Robotics-based surgery in the field of surgery is at the cutting edge of precision, experiencing a dramatic transition due to the recent phenomenal developments in devices. In various applications such as urology, gynaecology, orthopaedic and general surgery, robot-assisted procedures are now commonly conducted by tiny incisions and are widely performed.

7. The key factors driving the market growth are the growing prevalence of chronic diseases, the rapid increase in the geriatric population, the sophistication of surgical procedures and the increasing preference for minimally invasive surgery (MIS) with greater precision and versatility.

8. With the introduction of technological advancements and developments in minimally invasive surgical procedures, the continuing trend of increasing demand for surgical robotic systems is expected to continue in the future.

Opportunities

1. Production of next-generation surgical systems with low costs

2. Production of Surgical Training Simulators

Challenges

1. High-entry level cost - High funding, particularly in the current economic climate, is unattainable for entry-level researchers.

2. Lack of professionals with expertise.

3. Restrictive system for reimbursement in many countries.

4. The effect on healthcare economics - It strains the already financially unsustainable health services, at the expense of the substantial capital cost of a robot as well as the ongoing cost of the maintenance and tools.

5. It is complex to implement.

6. Regulatory challenges - Robotic surgery affects and disrupts the healthcare system with more and more patients. The proximity of surgical robotics to humans invoked severe regulatory interference from the beginning of the industry, unlike industrial robotics, which could be seen as an insular research-and-development sector limited to product manufacturing.

Geographical Analysis

Based on Geography, the Irrigation Automation market is segmented into-

a. North America – US, Canada

b. Europe – Germany, UK, France, Italy, Spain, Rest of Europe

c. Asia Pacific (APAC) – India, Japan, China, Rest of APAC

d. Rest of the World – Middle East & Africa.

Significant growth is to be witnessed by the North America segment from the year 2022 to 2030.

On the basis of four major regional divisions, North America, Europe, Asia Pacific, and the Rest of the World, the global demand for surgical robots was classified. In 2019, the largest share of the global market was North America. The availability of funding for R&D in surgical robots in this area and the growing adoption of surgical robots for paediatric surgeries in Canada and general surgery procedures in the US can be due to the large percentage of the North American industry.

Competitive Insights

Key players in the global next-generation surgical robots market include:

Intuitive Surgical (U.S.A) develops surgical robots used for surgical procedures. For the surgical robotics industry, the company develops, produces and markets robotic-assisted systems and other associated instruments and accessories. A variety of procedures, including prostatectomy, hysterectomy, hernia repair, cholecystectomy, partial nephrectomy, Sacro-colpopexy, mitral valve repair, lobectomy, and colon and rectal procedures, are designed for the da Vinci system.

Stryker (U.S.A) – The company acquired MAKO Surgical (US), a company producing surgical robots, in December 2013. This acquisition allowed Stryker to enter the market for surgical robots. Within its Orthopaedics market division, Stryker provides surgical robots. In the US, Canada, Europe, Japan, and other countries in the Pacific and Latin American areas, the organization has a large geographical presence.

Other players are:

1. Smith & Nephew (UK)

2. Hansen Medical (US)

3. Medrobotics (US)

4. TransEnterix (US)

5. Medtech (France)

6. Renishaw (UK)

7. THINK Surgical (US)

Recent Developments by Key Players

Montérégie Integrated Cancer Center in Quebec, Canada, part of Charles-LeMoyne Hospital, is the first center in the country to treat cancer patients using Accuray's Radixact radiation therapy delivery system.

Smith+Nephew (medical technology company) has launched its RENASYS EDGE Negative Pressure Wound Therapy (NPWT) System in the US which is designed to improve home-based care for patients with chronic wounds, including ulcers. It is designed to be compact, lightweight and discreet, the system can be easily carried.

Industry Dynamics

The Next-Generation Surgical Robots Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Product and Service

- Robotic Systems

- Instruments & Accessories

- Services

- By Application

- Gynaecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopaedic Surgery

- General Surgery

- Other Applications

- By End-User

- Hospitals

- Ambulatory Surgery Centres

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Next-Generation Surgical Robots Market