Global Cyber-security Insurance Market - Analysis and Forecast (2025-2030)

Industry Insights By Component (Solutions and Services), By Type (Standalone and Packaged), By Coverage (Data Breach and Cyber Liability), By Enterprise Size (Large and Small & Medium Enterprises), By End-User (BFSI, IT & Telecom, Retail, Healthcare, Manufacturing and Others) and By Geography (North America, Europe, Asia-Pacific, South America and Middle East and Africa)

| Status : Published | Published On : Mar, 2024 | Report Code : VRICT5176 | Industry : ICT & Media | Available Format :

|

Page : 196 |

Global Cyber-security Insurance Market - Analysis and Forecast (2025-2030)

Industry Insights By Component (Solutions and Services), By Type (Standalone and Packaged), By Coverage (Data Breach and Cyber Liability), By Enterprise Size (Large and Small & Medium Enterprises), By End-User (BFSI, IT & Telecom, Retail, Healthcare, Manufacturing and Others) and By Geography (North America, Europe, Asia-Pacific, South America and Middle East and Africa)

Cyber-security Insurance Market Overview

Global Cyber-security Insurance Market is anticipated to grow at a CAGR of 10.9% from USD 9.8 billion in 2023 to USD 19.4 billion in 2030 during the forecast period from 2025 to 2030.

Cyber security is the cyber insurance which provides cover against first- and third-party financial losses which do arise from damage to, or loss of data from, IT systems. After pandemic, cyber risks are growing for SMEs of all sizes hence there is a probability that many SMEs will purchase cyber insurance. As economies shall return to growth, cyber security shall receive growing demand in the coming years. Increased remote working of SMEs specify the purchase of cyber security.

Cyber-security Insurance Market Trends

The trends that are shaping the cyber insurance market are technology, regulatory and macroeconomic trends. Cyber security providers and insurers are collaborating to better understand the risks and provide the useful tools in the process. Mandatory cyber insurance, General Data Protection Regulations (GDPR), ransomware regulations, California Consumer Privacy Act (CCPA), and other national cybersecurity and data protection regulations are the major trends impacting the market growth of cyber insurance. The Russia-Ukraine conflict, Geopolitics, inflation, nation-state cyberattacks and a poor macroeconomic outlook are the major macroeconomic trends impacting the market growth.

Market Segmentation

Insight by Component

On the basis of component, the Cyber-security Insurance Market is classified into Solutions and Services. Solutions segment is anticipated to develop considerably during the forecast period as these services focus on the time lines, goals, pain areas considering the competence of human and technology.

Insight by Type

Based on Type, the Cyber-security Insurance Market is segregated into Standalone and packaged. Standalone segment shall dominate the market during the forecast period due to its widespread cover policy.

Insight by Coverage

Based on coverage, the Cyber-security Insurance Market is bifurcated into data breach and cyber liability. Among these, cyber liability segment shall dominate the market during the forecast period as the organization’s financial costs associated with cyber attacks and viruses are been recovered.

Insight by Enterprise Size

The Cyber-security Insurance Market is segregated into Large and Small & Medium enterprises based on the enterprise size. Among these large enterprise is projected to account for highest revenue during the forecast period.

Insight by End-user

The Cyber-security Insurance Market is segregated into BFSI, IT & Telecom, retail, healthcare, manufacturing and others. BFSI division shall hold the major share in this market during the forecast period, due to the security of vast data in BFSI sector.

Cyber-security Insurance Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 9.8 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 19.4 Billion |

|

Growth Rate |

10.9% |

|

Segments Covered in the Report |

By Component, By Type, By Coverage, By Enterprise Size, By End-User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, South America and Middle East and Africa |

Industry Dynamics

Growth Drivers

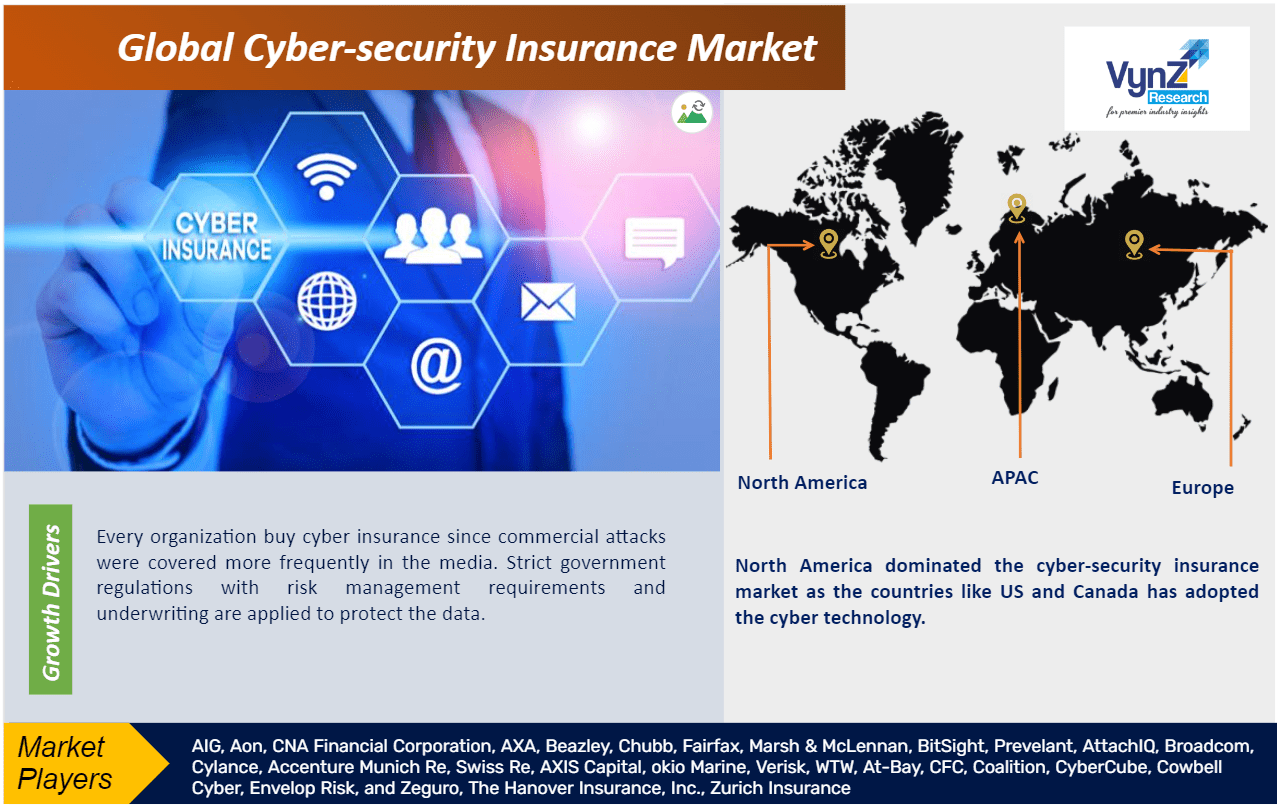

Now-a-days, cyber security insurance is more common in small, medium, and large-scale enterprises prior to the advanced technology. Every organization buy cyber insurance since commercial attacks were covered more frequently in the media. Strict government regulations with risk management requirements and underwriting are applied to protect the data. Adaptive cyber policies are been implemented in various organizations to gather and report specific market data which is simple to use and uniform across the board. The widespread usage of the internet is driving the demand for cyber insurance plans to protect against cyber-attacks. To support growing demand for cyber insurance, new capacity needs to be generated along with the access to risk capacity from capital markets for the worst accumulation scenarios.

Restraints

The challenges mainly limiting the growth of the Cyber Security Market are the costs of cybercrime which include damage and theft of data, intellectual property, lost productivity, costs for forensic investigation, disruption and reputational damage and restoration of hacked assets. The main problem affecting the market was the supply of hardware. Post pandemic, work-from-home provisions increased in popularity, which has endangered the employers with complicated cyber-attacks. Markets have shifted to digitization due to the prevalence of BYOD devices. Therefore, there is a need for more investment in cyber data standardization and development of robust modeling approaches. To address the cyber talent gap, it is important for the industry to invest in the development of cyber expertise.

Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa

Geographically, North America dominated the cyber-security insurance market as the countries like US and Canada has adopted the cyber technology. The frequency of cyber attacks is increased it has a financial impact on organizations of all sizes. Due to strict regulations of US, significant opportunities are provided for cyber security solution providers.

Key Players Covered in the Report

The key players of cyber-security insurance market are AIG, Aon, CNA Financial Corporation, AXA, Beazley, Chubb, Fairfax, Marsh & McLennan, BitSight, Prevelant, AttachIQ, Broadcom, Cylance, Accenture Munich Re, Swiss Re, AXIS Capital, okio Marine, Verisk, WTW, At-Bay, CFC, Coalition, CyberCube, Cowbell Cyber, Envelop Risk, and Zeguro, The Hanover Insurance, Inc., Zurich Insurance

Recent developments by Key Players

BOXX Insurance (Global InsurTech firm) recently collaborated with AXA (a leader in insurance and asset management) to address the issue of cyber attacks. This partnership shall focus on uncover cyber risk mitigation solution for the needs of small enterprises. This initiative shall recognize the critical importance of robust cyber protection for the growth of small businesses.

Carbon Black and Symantec businesses are being merged into a new unit that shall combine data telemetry with Endpoint Detection and Response (EDR) technologies and network which is been announced by Broadcom. A new Enterprise Security Group business unit is created to manage its cybersecurity.

The global Cyber-security Insurance Market report offers a comprehensive market segmentation analysis along with the estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Component

- Solutions

- Services

- By Type

- Standalone

- Packaged

- By Coverage

- Data Breach

- Cyber Liability

- By Enterprise Size

- Large enterprise

- Small and Medium enterprise

- By End-User

- BFSI

- IT & Telecom

- Retail

- Healthcare

- Manufacturing

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Asia-Pacific (APAC)

- China

- Japan

- South Korea

- India

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- Turkey

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Cyber-security Insurance Market