Global Energy Efficient Motor Market – Analysis and Forecast (2025-2030)

Industry Insight by Efficiency Level (IE1, IE2, IE3, and IE4), by Type (DC Motor (Brushed DC Motors and Brushless DC Motors) and AC Motor (Induction Motors and Synchronous Motors)), by Application (Fans, Air Compressor, Pumps, Material Handling, Material Processing, and HVAC), by End User Vertical (Commercial Building, Automotive, Residential, Aerospace and Defense, Industrial, and Agriculture), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Feb, 2024 | Report Code : VRSME9128 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 200 |

Global Energy Efficient Motor Market – Analysis and Forecast (2025-2030)

Industry Insight by Efficiency Level (IE1, IE2, IE3, and IE4), by Type (DC Motor (Brushed DC Motors and Brushless DC Motors) and AC Motor (Induction Motors and Synchronous Motors)), by Application (Fans, Air Compressor, Pumps, Material Handling, Material Processing, and HVAC), by End User Vertical (Commercial Building, Automotive, Residential, Aerospace and Defense, Industrial, and Agriculture), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Energy Efficient Motor Market Overview

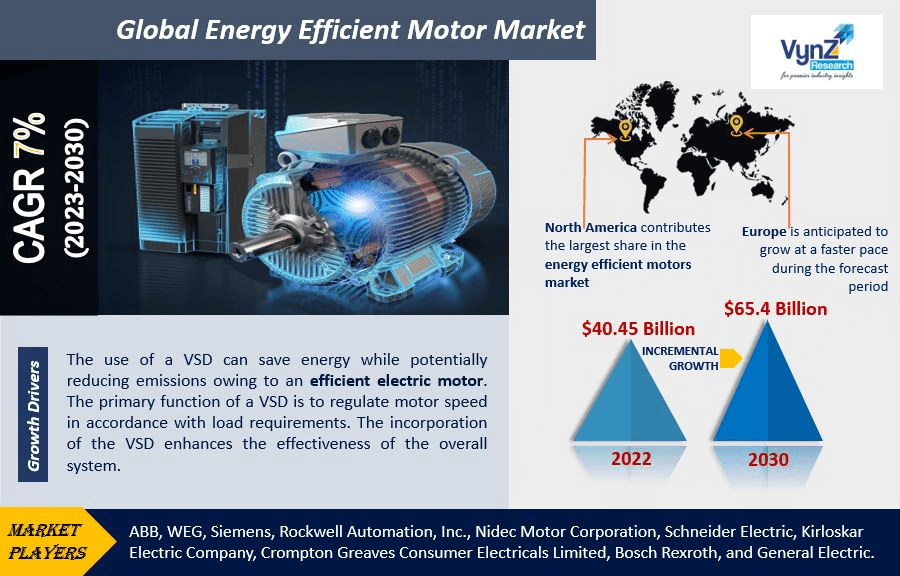

The Global Energy-Efficient Motor Market is poised for remarkable growth, with the global market size estimated to achieve USD 65.4 billion by 2030, representing a substantial increase from USD 40.45 billion in 2023. This upward trajectory indicates a steady Compound Annual Growth Rate (CAGR) of 7% during the forecast period.

The ability of the energy-efficient motors to expedite the production process due to the sophisticated materials used in their making makes them stand out. These outstanding features offer significant benefits in terms of service, reducing heat production, lower vibration, extended life, and minimum maintenance requirements. Overall, it reduces losses due to over-consumption of energy by about 3 to 6%.

Overall, the future of this market looks very promising and bright with continual growth expected due to rapid improvement in technology, manufacturing process, and efficiency. Its use will be widespread across a wide range of industries such as commercial, residential, industrial, automotive, and others. It will reduce operational costs and help industries achieve their goal for a more sustainable and greener future.

Industry Trends

There is a continual rise in the demand for these energy-efficient motors across the industries. It is mainly due to the energy crisis the entire world is facing currently. Some other factors to push the demand include rise in the prices of oil and natural gas, disruptions in supply chains, and more.

There is also a growing need for innovative and more effective solutions for the production and supply of energy due to the growing demand for energy across the globe and the unstable financial market.

Market Segmentation

Insight by Efficiency Level

Based on the energy level, the global energy-efficient motor market can be divided into Standard (IE1), High (IE2), Premium (IE3), and Super Premium (IE4)segments. Out of these, the IE2 segment is currently the largest contributor to the market and will be so in the future due to its higher efficiency level, lower residual heat generation, and the fact that these can be used in inverters. Also, the market will expand due to the mandatory requirement according to the Minimum Energy Performance Standards (MEPS).

Insight by Type

According to the type of these motors, the market can be divided into AC motors, brushed and brushless DC motors, induction motors, and synchronous motors. Out of these, the AC motors segment dominates the market due to higher efficiency, lower carbon emission, and power consumption.

Insight by Application

According to their applicability, the market can be categorized into pumps, air compressors, HVAC, and material processing and handling. Among these, the pumps section is the largest contributor to the market in terms of revenue due to higher adoption across several industries such as commercial, wastewater, oil and natural gas, agriculture, and more.

Insight by End-User Vertical

The market can be divided into different heads based on the end-user verticals as well, such as automotive, residential and commercial building, agriculture, industrial, aerospace, and defense. The industrial vertical is the largest contributor to the market since there are so many industries these machines are used in, such as oil and gas, marine, power and energy, waste, and wastewater. The most significant benefits offered by these machines include lower energy consumption and operational costs.

Industry Dynamics

Global Energy Efficient Motor Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 40.45 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 65.4 Billion |

|

Growth Rate |

7%% |

|

Segments Covered in the Report |

By Efficiency Level, By Type, By Application, and By End User Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Growth Drivers

A lot of energy is saved when VSDs are used in electric motors. It also increases their efficiency and reduces carbon emissions. They can regulate the speed of the motor based on the load. The manufacturers are now using them extensively to enhance efficiency and production and reduce environmental impacts, processing time, and errors.

There is a rise in factory automation practices of late which promotes load tolerance and reduces failures. These energy-efficient motors are more cost-effective than traditional motors, both in the short and long run. Customers prefer using these motors over others due to the advantages provided, low fan losses, better insulation and lamination, and their enhanced abilities.

In addition, there are also other factors than the above that drive the growth of energy-efficient motors. These are fast urbanization, technological development, and increased awareness.

Challenges

The high initial cost of the motors due to better and high-end materials, especially the super-efficient IE4 motors, in comparison to regular motors,and the dependence of the market on high initial investment may impede the growth of this market. Also, a lot of people are not aware of the utility of these motors.

However, growing awareness and reduced costs will help the market overcome the challenges in the forecast period.

Opportunities

There will be a lot of innovations and technological developments to make these machines far more efficient and cost-effective due to lower energy consumption. This will encourage users to invest in these seemingly expensive motors.

Additionally, the revenue of this market is also expected to grow due to their higher demand in specific industries, such as machine tools, HVAC, power tools, home appliances, robotics, and more.

Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

North America is the leading contributor to the global energy-efficient motor market due to the rising prices of electricity and more and more businesses consequently looking for more energy-efficient motors. The agricultural and automotive sectors are highly dependent on these types of machines to perform a diverse set of activities.

The European market, on the other hand, is also expected to grow noticeably due to the increase in demand for energy-efficient home appliances by the residential sector and the escalating GDP per capita income.

Competitive Insight

The key players in the energy-efficient motor industry aim to expand their production capacity while also enhancing cost efficiency and streamlining their operations, aided by new digitalization opportunities. In addition, significant expansion efforts by MNCs and well-established organizations, as well as new product launches, collaborations, and M&As, are predicted to raise the market share of energy-efficient motors.

Key Players Covered in the Report

Some of the prominent players in the global energy efficient motor industry include ABB, WEG, Siemens, Rockwell Automation, Inc., Nidec Motor Corporation, Schneider Electric, Kirloskar Electric Company, Crompton Greaves Consumer Electricals Limited, Bosch Rexroth, and General Electric.

Recent Development by Key Players

04/07/2023 - ABB has developed the new generation AMI 5800 NEMA modular induction motor to offer exceptional energy efficiency and reliability in demanding applications such like fans, extruders, conveyors, pumps, compressors and crushers. The AMI 5800 offers the capability for a high degree of modularity and customisation to suit both new-build and upgrade projects in a wide range of industries including conventional power generation, mining and cement, chemical oil and gas and metals. This innovative feature improves performance at high speeds and enables the motor to be used as a simple drop-in replacement to upgrade existing equipment.

MARCH 27, 2024 - Siemens AG has signed an agreement to acquire the industrial drive technology (IDT) business of ebm-papst. The business includes intelligent, integrated mechatronic systems in the protective extra-low voltage range and innovative motion control systems. These systems are used in free-range driverless transport systems. This shall strengthen Siemens’ position as a leading solutions provider for flexible production automation.

The Energy Efficient Motor Market research report includes a comprehensive market segmentation analysis as well as projections for the analysis period 2025-2030.

Segments Covered in the Report

- By Efficiency Level

- Standard (IE1)

- High (IE2)

- Premium (IE3)

- Super Premium (IE4)

- By Type

- DC Motor

- Brushed DC Motors

- Brushless DC Motors

- AC Motor

- Induction Motors

- Synchronous Motors

- By Application

- Fans

- Air Compressor

- Pumps

- Material Handling

- Material Processing

- HVAC

- By End User Vertical

- Commercial Building

- Automotive

- Residential

- Aerospace and Defense

- Industrial

- Agriculture

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

To explore more about this report - Request a free sample copy

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Energy Efficient Motor Market