Global IoT Sensors Market – Analysis and Forecast (2025-2030)

Industry Insights by Sensor Type (Temperature Sensors, Magnetometers, Proximity Sensors, Accelerometers, Pressure Sensors, Image Sensors, Acoustic Sensors, Humidity Sensors, Touch Sensors, Co2 Sensors, Motion Sensors, Inertial Sensors, Flow Sensors, Gyroscopes, Occupancy Sensors and Others), by Network Technology (Wired and Wireless), and by Vertical (Consumer, Industrial and Commercial) and by Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9012 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 210 |

Global IoT Sensors Market – Analysis and Forecast (2025-2030)

Industry Insights by Sensor Type (Temperature Sensors, Magnetometers, Proximity Sensors, Accelerometers, Pressure Sensors, Image Sensors, Acoustic Sensors, Humidity Sensors, Touch Sensors, Co2 Sensors, Motion Sensors, Inertial Sensors, Flow Sensors, Gyroscopes, Occupancy Sensors and Others), by Network Technology (Wired and Wireless), and by Vertical (Consumer, Industrial and Commercial) and by Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

IoT Sensors Market Overview

The global IoT sensors market currently is expected to grow from USD 7.84 billion in 2023 to reach USD 32.46 billion by 2030, at a CAGR of 22.6% during the forecast period 2025-2030.

The Internet of Things (IoT) refers to the innovative technology that different devices build with a sensor to the internet. This creates an accessible network in the process with trillions of data points.

The IoT sensors market offers effective and crucial solutions for creating IoT technologies that help detect external information and translate it into signals comprehensible by both humans and machines. These sensors play a crucial role in operations across several industry verticals, such as healthcare, medical, nursing, logistics, transportation, agriculture, disaster prevention, tourism, and more.

There has been significant growth in the adoption and use of IoT devices across a wide range of applications, which has fueled the growth of the global IoT sensors market. The need for using these sensors across several devices and applications is also attributed to the increase in the internet penetration rate. There are different types of IoT sensors used, out of which the pressure sensors are used more extensively, thereby creating a higher demand for them in the global IoT sensors market. This is mainly attributed to the growing concerns over safety and comfort levels, along with the growing need to reduce auto emissions.

IoT Sensors Market Segmentation

Insight by Sensor Type

The global IoT sensors market is divided into motion sensors, pressure sensors, flow sensors, inertial sensors, occupancy sensors, gyroscopes, and temperature sensors based on their diverse types. In addition, there are also other types of sensors, such as proximity sensors, magnetometers, accelerometers, image sensors, acoustic sensors, touch sensors, humidity sensors, and CO2 sensors. Out of all these segments, the market share of the pressure sensor segment is supposed to grow during the projected period at a faster rate due to the higher demand to meet increased safety and comfort concerns and also to reduce auto emissions.

As for the rate of growth, the gyroscopes segment is expected to grow much faster than others during the forecast period. This is due to the higher demand for such sensors in equipment that need enhanced sensors such as those used for satellite positioning and navigation. Also, there is a rise in automation needs in both businesses and homes as well as a growing need for guidance of remotely operated vehicle guidance, which is expected to propel the growth of this specific segment of the global IoT sensors market.

Insight by Network Technology

The two specific categories that the global IoT sensors market is divided into based on the network technology use are wired and wireless categories. Out of these two segments, the latter is expected to continue contributing a larger share to the global IoT sensors market than the former segment due to the proliferation of mobile devices and the rapid adoption of the "Bring Your Own Device" or BYOD policy.

Furthermore, during the forecast period, it is also expected that the 5G cellular wireless technology will provide greater internet coverage and connectivity, which will once again have a positive impact in terms of growth on this specific segment.

Insight by Vertical

Considering the industry verticals, the global IoT sensors market is divided into industrial, consumer, and commercial segments. Out of these three segments, the consumer vertical is expected to grow at a much higher rate than others during the forecast period. This is mainly due to the growing use of smart devices in smart cities, home automation, and wearables. It is also attributed to the extensive participation of the major players in the IoT infrastructural development, both in the domestic and international arena. However, the larger share of the global IoT sensors market will belong to the industrial sector.

Insight by Communication Interface

The different communication interfaces divide the global IoT sensors market into embedded sensors, USB, and wireless and Bluetooth modules. Out of these segments, the wireless and Bluetooth modules are expected to grow at a higher rate during the forecast period due to convenience and reasonably high efficacy.

Global IoT Sensors Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 7.84 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 32.46 Billion |

|

Growth Rate |

22.6% |

|

Segments Covered in the Report |

By Sensor Type, By Network Technology, By Vertical and Insight by Communication Interface |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and the Rest of the World |

Industry Dynamics

IoT Sensors Industry Trends

The automotive sector all over the world is now transitioning steadily toward an autonomous age due to higher joint ventures and business collaborations with major players in the automotive industry apart from chip manufacturers, cybersecurity providers, and system integrators. The advent of highly (Level 4) and fully (Level 5) autonomous vehicles has facilitated proper communication and vehicle connectivity. This helps in decision-making due to proper integration and understanding of visual, audio, geographical, and other data.

The emergence of smart cities and Car2Car connectivity are also noticed, pushing the demand for IoT sensors.

The major car manufacturers are investing more in developing smart cars with better features to ensure safer, comfortable, and convenient driving experiences, which is expected to increase the adoption of IoT sensors during the forecast period. IoT has also facilitated preventative maintenance in the transportation and logistics industries. This ensures connected mobility and real-time data access resulting in higher adoption of IoT sensors in these industry verticals.

The efficiency of the IoT devices in collecting and handling large data sets has also increased their usage in telematics and traffic congestion control systems within motor vehicles as well as in booking and reservation systems used by transport operators in addition to remote vehicle monitoring and security and surveillance systems.

IoT Sensors Market Growth Drivers

The most crucial factor that has a positive impact on the growth of the global IoT sensors market is the higher use of IoT devices and other applications. These devices need sensors to operate. Also, the introduction of IPv6 and the growing internet penetration rate pushes the global IoT sensors market upward.

Some other growth factors of the global IoT sensors market are the launch of 13, 14, and 3 GPP specifications, the growing demand for and use of wearable and connected devices, and the growing awareness of the significance and adoption of real-time computing for IoT applications.

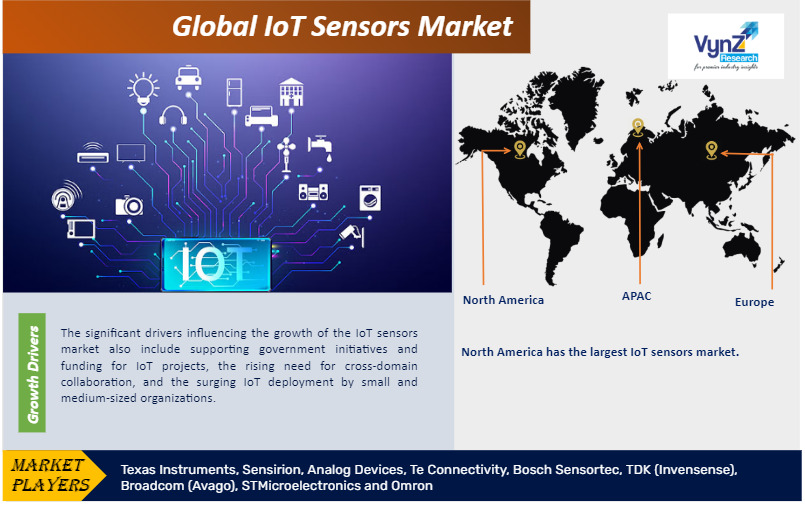

Another major growth driver of the global IoT sensors market is the favorable government initiatives to promote IoT projects and funding. There is also a notable rise in the demand for cross-domain collaboration and IoT deployment by small and medium-sized businesses, which have also influenced the growth of the global IoT sensors market.

IoT Sensors Market Challenges

One of the biggest hurdles to the growth of the global IoT sensors market is the growing concern over data security and privacy. The inconsistent communication standards and protocols along with the lack of skilled technicians also affect the growth negatively. The operational inefficiencies due to high power consumption by connected devices, constrained bandwidth, and high expectancy also pose significant challenges to the growth of this market.

IoT Sensors Market Opportunities

The growth opportunities of the global IoT sensors market are however enhanced by the major players in the sector with their new product launches. These established companies can take advantage of the global market expansion possibilities due to lower competition because the substantial capital requirement prevents new entrants into the market.

The key players in the IoT sensors market are either working with or acquiring small businesses to meet the growing demand for IoT sensors. Also, they are making higher investments in the global portfolio of technically advanced goods, which is creating newer opportunities for the global IoT sensors market to grow.

IoT Sensors Market Geographic Overview

North America has the largest share of the global IoT sensors market mainly due to the widespread use of wireless sensors. In addition, there is also a significant increase in internet usage in this region along with IoT sensor devices in several sectors, such as healthcare, oil & gas, automotive, transportation, retail, and consumer electronics.

On the other hand, the APAC market is expected to grow at a high CAGR during the forecast period as a result of the growing disposable income among people in this region. Moreover, the increased use of the Internet in public and private areas and the development of the IT infrastructure will also promote the growth of the global IoT sensors market in this region.

IoT Sensors Market Competitive Insight

Key players in the IoT sensors market are meeting the demand by working with small businesses, acquiring them, and investing in a global portfolio of technologically advanced goods. For instance, the ultra-lower gas sensor SGPC3 was introduced by Sensirion. It manages indoor air quality detection for mobile and battery-powered applications. The major suppliers of IoT sensors are Texas Instruments, Te Connectivity, Sensirion, Analog Devices, STMicroelectronics, Bosch Sensortec, Broadcom (Avago), TDK (Invensense), and Omron.

Recent Development by Key Players

TDK Corporation has launched the TDK i3 Micro Module (the world’s first module with built-in edge AI and wireless mesh connectivity capability) collaborating with Texas Instruments (TI) for real-time monitoring. The new module also integrates TDK’s IIM-42352 high-performance SmartIndustrialTM MEMS accelerometer and digital output temperature sensor, edge AI, and mesh network functionality into a single unit, facilitating data aggregation, integration, and processing.

Te-Connectivity has launched its first start-up accelerator program in India. This program is designed to accelerate and promote start ups in the energy and electrification, smart cities and IoT domiains by providing them with mentorship support, global network and access to resources.

The IoT Sensors Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Sensor Type

- Motion Sensors

- Pressure Sensors

- Flow Sensors

- Inertial Sensors

- Occupancy Sensors

- Gyroscopes Sensors

- Temperature Sensors

- By Network Technology

- Wireless Network Technologies

- Wired

- By Vertical

- Industrial

- Consumer

- Commercial

- Vertical

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

IoT Sensors Market