Global Lithium Ion Battery Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (Lithium Nickel Manganese Cobalt, Lithium Titanate Oxide, Lithium Manganese Oxide, Lithium Cobalt Oxide, Lithium Iron Phosphate, and Lithium Nickel Cobalt Aluminum Oxide), by Power Capacity (0 to 3,000 mAh, 3,000 mAh to 10,000 mAh, 10,000 mAh to 60,000 mAh and More than 60,000 mAh ), by End User (Consumer Electronics, Automotive, Industrial, Power, Medical, Aerospace And Defense, And Marine), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9014 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 200 |

Global Lithium Ion Battery Market – Analysis and Forecast (2025-2030)

Industry Insight by Type (Lithium Nickel Manganese Cobalt, Lithium Titanate Oxide, Lithium Manganese Oxide, Lithium Cobalt Oxide, Lithium Iron Phosphate, and Lithium Nickel Cobalt Aluminum Oxide), by Power Capacity (0 to 3,000 mAh, 3,000 mAh to 10,000 mAh, 10,000 mAh to 60,000 mAh and More than 60,000 mAh ), by End User (Consumer Electronics, Automotive, Industrial, Power, Medical, Aerospace And Defense, And Marine), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Lithium Ion Battery Market Overview

The global lithium-ion battery market size was assessed at USD 54.4 billion in 2023 and is projected to grow at a CAGR of 12.8% during the forecast period, resulting in a market size of USD 127.7 billion by 2030.

Rechargeable lithium-ion batteries signify an advanced technology. The main component of these batteries is lithium ions and its electrochemistry provides excellent voltage and charge storage per unit mass and volume. These parameters are much higher than other regular batteries.

The lithium-ion battery market involves research and development, raw material sourcing, component production, assembly, distribution, and sales. It comprises a wide range of stakeholders such as manufacturers, suppliers of raw materials and components, battery management system providers, battery pack assemblers, and end-users.

These batteries have wider applicability and are used widely in various applications, including electric vehicles (EVs), portable electronics, renewable energy integration, and energy storage systems.

The expansion of the global lithium-ion battery market is expected to be significant due to a variety of factors such as greater lifespan, higher density, lower prices, and extensive usage in the consumer electronics sector. The growth is also attributed to increased research and development activities of several battery manufacturers and organizations.

Lithium Ion Battery Market Segmentation

Insight by Type

- Lithium Nickel Manganese Cobalt (Li-NMC)

- Lithium Titanate Oxide (LTO)

- Lithium Manganese Oxide (LMO),

- Lithium Cobalt Oxide (LCO)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

There are different types of lithium-ion batteries, such as Lithium Nickel Manganese Cobalt (Li-NMC), Lithium Titanate Oxide (LTO), Lithium Manganese Oxide (LMO), Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), and Lithium Nickel Cobalt Aluminum Oxide (NCA). The global lithium-ion battery market is divided into each of these segments according to their types.

Out of all these segments, the Lithium Iron Phosphate (LFP) segment contributes the largest share in the global lithium-ion battery market. This is attributed to the growing demand for these batteries known for their durability, portability, and efficacy. Furthermore, LFP batteries are very safe to use and offer a much longer shelf life, which will also drive its growth during the forecast period.

However, the Lithium Cobalt Oxide segment will grow at a faster rate due to higher research and development activities and its ability to offer much-improved cathode and electrolyte solutions. This will augment its usage across a wide variety of industry verticals.

On the other hand, the Lithium Nickel Manganese Cobalt (NMC) segment is also expected to grow at a high CAGR during the forecast period due to lower prices, longer life, and extensive adoption and use in several equipment such as electric power trains and bikes.

Insight by Power Capacity

- 0 to 3,000 mAh

- 3,000 mAh to 10,000 mAh

- 10,000 mAh to 60,000 mAh

- More than 60,000 mAh

Considering the power capacity of these batteries, the global lithium-ion battery market is divided into 0 to 3,000 mAh, 3,000 mAh to 10,000 mAh, 10,000 mAh to 60,000 mAh, and more than 60,000 mAh.

Out of all these segments, the 10,000 - 60,000 MAh segment accounts for the largest market share in the global lithium-ion battery market during the forecast period.

Batteries of such high capacity are usually used extensively for high-capacity applications such as e-motorcycles, electric vehicles, plug-in hybrid electric vehicles, material handling equipment, robots, marine, industrial, telecommunication systems, electronic cash registers, standby power supplies, golf cart vehicles, hybrid trucks, buses, smart grid, aviation industry, automated guided vehicle, yachts, solar backup power, energy storage system (ESS) platforms, military applications, low earth orbit (LEO), medium earth orbit (MEO), and geostationary or geosynchronous orbit (GEO) satellites, and launch vehicles. With such extensive applicability, the market for this segment will grow significantly during the forecast period.

Insight by End User

- Consumer Electronics

- Smartphones

- Laptops

- UPS

- Others

- Automotive

- Battery Electric Vehicles

- Plug-In Hybrid Electric Vehicles

- Industrial

- Construction Equipment

- Mining Equipment

- Power

- Medical

- Aerospace and Defense

- Marine

The global lithium-ion battery market is divided into consumer electronics, smartphones, laptops, UPS, automotive, battery electric vehicles, plug-in hybrid electric vehicles, industrial, construction equipment, mining equipment, power, medical, aerospace, defense, and marine segments.

Out of all these categories, the automotive industry is expected to have the largest share in the global lithium-ion battery market during the forecast period due to lower dependency on fossil fuels by the automotive sector. It is also attributed to the increase in sales of electric vehicles.

There are several reasons for such an increase in sales. First, compared to nickel-based batteries, the self-discharge of these batteries is less than half. Also, they need little priming when new and less maintenance. They can endure hundreds of charge/discharge cycles.

The features are also quite enticing and useful such as high energy efficiency, long life cycle, high energy density, and high power density. All these facets make lithium-ion batteries most ideal energy storage device for powering electric vehicles (EVs). Furthermore, higher energy densities than lead-acid or nickel-metal hydride batteries, these batteries are smaller but offer the same storage capacity. Add to that, increased government expenditure to expedite the adoption of electric vehicles, EPA rules on lead contamination, environmental concerns, and laws on lead-acid battery storage, disposal, and recycling, have increased the demand for these batteries in the automobile industry and is expected to grow more, pushing the global lithium-ion battery market further forward.

Insight by Materials

The materials used in the making of these batteries are also used as a parameter to divide the global lithium-ion battery market into electrolyte material, cathode material, anode material, separator material, and other segments.

Out of all these segments, the cathode material segment is expected to grow at a much higher CAGR during the forecast period. This is mainly attributed to the fact that cobalt is extensively used in making the batteries that are to be used in portable devices such as laptops, smartphones, digital cameras, and others.

These specific batteries are the most popular options for new and innovative technologies because they offer higher specific energy and have a much longer runtime offering a steady supply of current throughout the charging or discharging process.

Global Lithium Ion Battery Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 54.4 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 127.7 Billion |

|

Growth Rate |

12.8% |

|

Segments Covered in the Report |

By Type, By Power Capacity, and By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Lithium Ion Battery Industry Trends

Higher internet penetration and usage have promoted the demand for smartphones, tablets, laptops, and other mobile devices. The change in lifestyle and higher disposable income among consumers is also noticed which will eventually drive the demand for these batteries. The war between Russia and Ukraine, both having large and unexplored lithium reserves, has impacted the supply but has not halted it. Therefore, the production of lithium-ion batteries will not stop or drop drastically.

Over the past couple of years, the manufacturers have been emphasizing mission-critical projects to help the industries and economies keep functioning. Moreover, stakeholders are concerned about the environmental impacts due to the growing disposable waste of lithium-ion batteries. So, they are investing more in material recycling research to alleviate such impacts.

There is a growing need for supporting renewable energy integration, load balancing, and grid stabilization, which needs large-scale energy storage systems. The lithium-ion batteries are the most suitable choice due to their quick response times, high energy density, and longer life cycle. Also, most industries today are focused on improving energy efficiency. This has resulted in higher adoption of efficient energy storage solutions. This will not only reduce energy consumption but will also optimize power usage.

In addition, there are also notable advancements made in the smart grid technologies and battery management systems to enhance the reliability as well as the efficiency of the energy storage solutions. This results in a faster and smoother transition from traditional to more sustainable and cleaner energy sources, where these lithium-ion batteries are the crucial component.

Lithium Ion Battery Market Growth Drivers

Surge in Demand from Consumer Electronics Propelling the Market Demand for Lithium ion Batteries

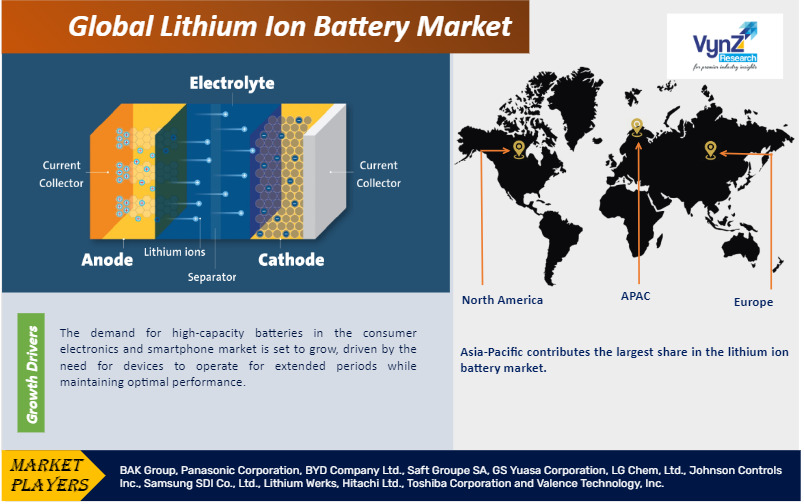

There is a notable increase in the demand from the consumer electronics sector, which is driving the growth of the global lithium-ion battery market. Also, the rise in demand for high-capacity batteries for mobile devices to function for longer periods offering optimal performance will drive this market. The useful features such as flexible design, higher rechargeability, and the ability to customize sizes make them the preferred choice for consumer electronics which offers several lucrative business opportunities. This further facilitates the growth of the global lithium-ion battery market.

Also, the increased demand for continuous power supply in critical infrastructure and battery-operated material handling equipment due to automation propels the market growth.

Governments all over the world are modifying their policies and regulations to promote the adoption of electric vehicles, energy storage systems, and renewable energy and taking several initiatives as well in the form of providing incentives, subsidies, and tax benefits. This will increase the demand and thereby push the growth of the global lithium-ion battery market.

Continual research and development efforts by the players in the industry to improve the safety and functionality of lithium-ion batteries are also contributing to the growth.

The integration of these efficient batteries into renewable energy systems is also driving the growth of the global lithium-ion battery market. This is because the global shift towards solar and wind energy sources has increased the need for an efficient storage system that will help in energy management and storage to ensure grid stability. These batteries offer the best solution because their construction allows for storing excess energy when produced and releasing it when needed. These useful features are driving larger investments in large-scale energy storage projects intended for both commercial and residential use.

Lithium Ion Battery Market Challenges

Safety is a primary concern for using lithium-ion batteries due to flammable electrolytes. Then there are concerns for storage and transportation that may stymie the growth of the global lithium-ion battery market to some extent. The higher prices of these batteries compared to lead-acid, sodium-sulfur, and nickel-metal-hydride batteries also limit their usage resulting in poor acceptance rate and hampering the market growth.

Lithium Ion Battery Market Opportunities

During the projected period, it is expected that the major players in the industry will emphasize boosting manufacturing capacity. This will create more opportunities for the global lithium-ion battery market to grow during the forecast period.

Also, the growing demand for using these batteries in digital cameras will open up new business opportunities.

Lithium Ion Battery Market Geographic Overview

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Asia-Pacific contributes the largest share in the lithium ion battery market owing to rising demand for smartphones and tablets along with electric vehicles in developing countries like China, Japan, and India, an upsurge in funding from the government, increased disposable income and rising consumer awareness about environment-friendly technologies will proliferate the market growth of the lithium ion batteries in the region.

North America contributes significant share in the lithium ion battery market owing to surge in sale of electric vehicles, supportive federal policies, presence of prominent industry players, thereby propelling the market demand for lithium ion batteries in the region.

Lithium Ion Battery Market Competitive Insight

The worldwide lithium-ion battery industry is extremely fragmented owing to the presence of domestic players. For the advancement of the lithium-ion battery industry, most of the leading market players are partnering with government authorities.

The key industry participants are focusing on strategic collaborations to achieve a competitive advantage. To establish their brand in the lithium-ion battery market, prominent industry players are using methods such as mergers, acquisitions, partnerships, and joint ventures. In order to gain a dominant position in the lithium-ion battery market, these techniques are also assisting in improving production efficiency and lowering overall battery prices. The government is also assisting on a major scale in this regard.

Panasonic Corporation is a world pioneer in the development of breakthrough technology and services for consumer electronics, housing, automotive, and business-to-business applications (B2B).

Panasonic's specialised technologies have made batteries thinner and lighter for use in devices such as notebook computers and mobile phones. They are also used in electric vehicles (EV), backup base stations for mobile telephones, solar-powered electricity storage systems, and a variety of other industrial applications. Panasonic continues to improve battery materials and manufacturing processes, while also working to improve battery control technology, thus allowing Panasonic batteries to be used safely, particularly when layering up from cell to pack, module, and system. These activities contribute to Panasonic's batteries' high reliability.

Cylindrical, prismatic, and polymer batteries, as well as battery packaging and solutions, are among BAK Power's goods and services, which are largely employed in new energy vehicles, consumer products, and backup energy storage. They offer a complete line of BAK Lithium Ion Battery batteries ranging in size from 2200mah to 5000mAh.

Recent Development by Key Players

BAK Battery shall build big cylindrical battery production factory in Changzhou city. Shenzhen BAK Power Battery Co. (a Chinese power battery maker, signed an agreement on Jan. 28 to form a strategic cooperation with the municipal government of Changzhou city, Jiangsu province, as part of efforts to expand its battery production capacity.

Panasonic collaborated with IOCL to manufacture cylindrical lithium-ion batteries. This initiative is for the expansion of the demand for batteries for two- and three-wheel vehicles and energy storage systems in the Indian market.

Key Players Covered in the Report

BAK Group, Panasonic Corporation, BYD Company Ltd., Saft Groupe SA, GS Yuasa Corporation, LG Chem, Ltd., Johnson Controls Inc., Samsung SDI Co., Ltd., Lithium Werks, Hitachi Ltd., Toshiba Corporation and Valence Technology, Inc. are the major players providing lithium ion battery.

The Lithium Ion Battery Market research includes a comprehensive market segmentation analysis as well as projections for the analysis period 2025-2030.

Segments Covered in the Report

- By Type

- Lithium Nickel Manganese Cobalt (Li-NMC)

- Lithium Titanate Oxide (LTO)

- Lithium Manganese Oxide (LMO),

- Lithium Cobalt Oxide (LCO)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- By Power Capacity

- 0 to 3,000 mAh

- 3,000 mAh to 10,000 mAh

- 10,000 mAh to 60,000 mAh

- More than 60,000 mAh

- By End User

- Consumer Electronics

- Smartphones

- Laptops

- UPS

- Others

- Automotive

- Battery Electric Vehicles

- Plug-In Hybrid Electric Vehicles

- Industrial

- Construction Equipment

- Mining Equipment

- Power

- Medical

- Aerospace and Defense

- Marine

- Consumer Electronics

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

To explore more about this report - Request a free sample copy

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Lithium Ion Battery Market