Global Micro Server IC Market – Analysis and Forecast (2025-2030)

Industry Insight by Component (Hardware and Software), by Application (Web Hosting & Enterprise Applications, Analytics & Cloud Computing, and Edge Computing), by Processor Type (X86 and ARM), by End-User (Enterprises and Data Centers), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : May, 2023 | Report Code : VRSME9081 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 189 |

Global Micro Server IC Market – Analysis and Forecast (2025-2030)

Industry Insight by Component (Hardware and Software), by Application (Web Hosting & Enterprise Applications, Analytics & Cloud Computing, and Edge Computing), by Processor Type (X86 and ARM), by End-User (Enterprises and Data Centers), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Micro Server IC Market Overview

The projected market size for Micro Server IC is USD 1.8 billion in 2023, expected to grow at a CAGR of 12.5% to reach USD 3.6 billion by 2030.

Micro servers are economical and miniature servers whose parts are narrowed and scaled back, aiding them to be packed in clusters. They are typically based on a small form factor, a system-on-chip (SoC) board that can pack the CPU, memory, and system I / O into a single integrated circuit. Due to the small size of the board, a dense cluster of microservers can be built and save data center space. Factors propelling the growth of micro server IC market include less power consumption, less space utilization of micro servers, increasing trend of cloud computing and web hosting, and the advent of hyper-scale data center architectures. A microprocessor server IC integrates a large number of semiconductors, including resistors, transistors, or capacitors. Thus, the increasing trend for virtualization and demand for miniaturization will bolster the growth of the micro server IC market.

The microserver IC market has seen an adverse impact due to the COVID19 outbreak as there was a slow down in manufacturing utilization, travel bans, and closure of facilities. Nevertheless, the pandemic has increased the trend in remote work, e-commerce, and automation which provide promising opportunities in micro server IC market.

Micro Server IC Market Segmentation

Insight by Component

Based on the component, the micro server IC market is bifurcated into hardware and software. The hardware segment dominates the market in terms of revenue in 2020 and is anticipated to grow significantly during the forecast period as hardware is the core part of an SoC. Organizations like Intel and ARM have increased their ICs capability to make architecture dense and efficient. Furthermore, the evolving edge computing ecosystem i.e. provision of developed computation, storage, and network capability near data sources to accomplish low-latency event processing and high-throughput analytical processing will propel the growth of the micro server hardware market during the forecast period.

Insight by Application

On the basis of application, the micro server IC market is categorized into web hosting & enterprise applications, analytics & cloud computing, and edge computing. Edge computing is anticipated to witness high CAGR during the forecast period 2025-2030 as it is one of the emerging applications. The COVID-19 pandemic has led to the rise in investment in hyperscale cloud applications and IoT that will provide a competitive edge and lead to growth in the micro server IC market.

Insight by Processor Type

Based on processor type, the micro server IC market is divided into X86 and ARM. The Intel processor dominates the market as it provides smooth software support to the customers, resulting in an increase in the adoption of ICs. Moreover, the increased adoption of 14nm process technology to produce an extensive range of chips will bolster the growth of this segment.

Insight by End User

Based on end-user, the global micro server IC market is divided into enterprises and data centers. Enterprises are sub-divided into small, mid-scale, and large. The enterprise is anticipated to witness the highest market share during the forecast period 2023-2030 owing to the rising adoption of smartphones, social platforms, big data, and IoT, and the increasing quantity and diversity of data have become massive. Small and medium enterprises need server platforms to address current needs, handle future workloads, and involve fewer costs. Micro servers employ low power per node, decrease costs, and surge in operational efficiency resulting in a perfect choice for medium-sized enterprises.

Global Micro Server IC Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 1.8 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 3.6 Billion |

|

Growth Rate |

12.5% |

|

Segments Covered in the Report |

By Component, By Application, By Processor, and By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Micro Server IC Industry Trends

The emergence of hyper-scale data center architecture, the surge in industry 4.0 revolution, digitalization of business are the key trends in the micro server IC market.

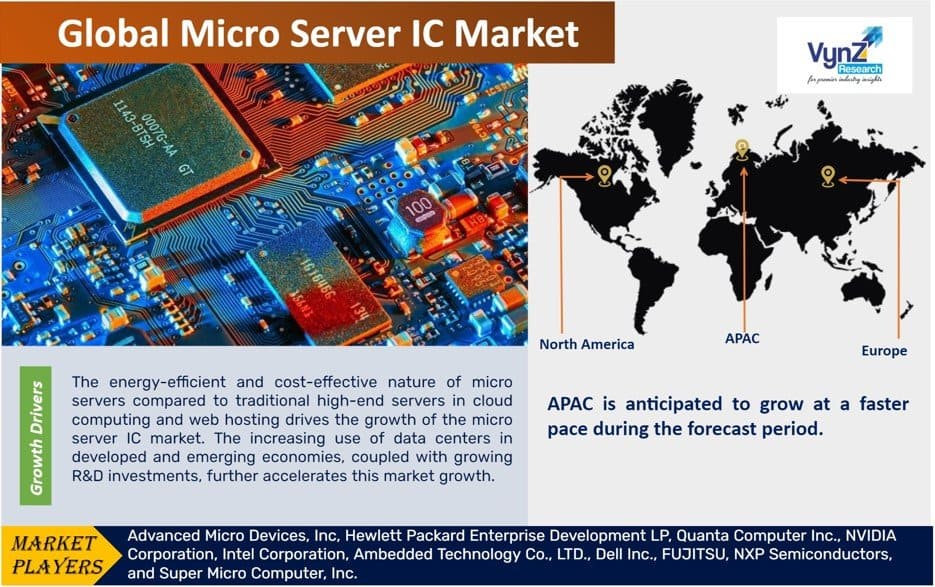

Micro Server IC Market Growth Drivers

The energy-efficient and cost-effective nature of micro servers compared to traditional high-end servers in cloud computing and web hosting drives the growth of the micro server IC market. The increasing use of data centers in developed and emerging economies, coupled with growing R&D investments, further accelerates this market growth. Technological advancements leading to the production of energy-efficient micro server ICs at a lower cost will also contribute to the market's expansion.

Micro Server IC Market Challenges

Micro server has limited applications, limited storage capacity, not able to handle large volumes of data in large enterprises owing to small data storage capacities are the challenges faced by the micro server IC market. Moreover, large enterprises choose traditional enterprise-class servers instead of micro server ICs which act as a restraint for micro server IC market.

Micro Server IC Market Opportunities

Micro server ICs are gaining prominence in data center applications as they are economical, consume less power, and save physical space. The rising demand for data centers in different industry verticals like IT & telecom, banking, healthcare, agricultural, and the government will create opportunities for growth in micro server IC market.

Micro Server IC Market Geographic Overview

APAC is anticipated to grow at a faster pace during the forecast period in 2023-2030 in the global micro server IC market owing to the increasing usage of microservers across small and medium enterprises. Moreover, the growing penetration of internet services, adoption of smart devices have led to the growth of micro server IC market in the region. For instance, China has planned to invest about USD 1.4 trillion by 2025 in partnership with government and private technology giants such as Alibaba and Huawei to create opportunities for connected devices, AI, and autonomous driving applications, which will propel edge computing applications in the region.

Micro Server IC Market Competitive Insight

The companies are relying on organic and inorganic strategies to stay competitive in the market and includes product launch and development, partnerships and collaborations, M&A. These strategies will provide a competitive edge and strengthen their position in the microserver IC market.

Intel Corporation is an American multinational corporation and technology company headquartered in Santa Clara, California, and incorporated in Delaware. Intel Corp. is the world's largest manufacturer of central processing units and semiconductors. The company is best known for CPUs based on its x86 architecture, which has been continuously modified, revised and modernized.

Hewlett Packard Enterprise Co (HPE) provides intelligent solutions and cloud-based services. The company's product portfolio comprises servers, converged systems, software, storage devices, networking products, customized financial solutions and cloud service-based products.

Some of the key players operating in the micro server IC market: Advanced Micro Devices, Inc, Hewlett Packard Enterprise Development LP, Quanta Computer Inc., NVIDIA Corporation, Intel Corporation, Ambedded Technology Co., LTD., Dell Inc., FUJITSU, NXP Semiconductors, and Super Micro Computer, Inc.

Recent Developments by Key Players

Fujitsu Limited announced the development of a new millimeter-wave chip for 5G that supports multibeam multiplexing that enabled to four beams to be multiplexed by a single millimeter-wave chip for the radio units (RU) of 5G base stations.

Intel Corporation is bringing its Software Guard Extension confidential computing technology to the company’s Xeon Scalable lineup for the first time with the upcoming Ice Lake server processors, which will come with expanded capabilities and new security features.

NVIDIA and SoftBank Group Corp. (SBG) announced a definitive agreement under which NVIDIA will acquire ARM Limited from SoftBank in a transaction valued at USD 40.0 billion. The combination will bring together NVIDIA’s leading AI computing platform with ARM’s vast ecosystem to create a premier computing company for the age of AI, accelerating innovation while expanding into large, high-growth markets.

The Micro Server IC Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Component

- Hardware

- Software

- By Application

- Web Hosting & Enterprise Applications

- Analytics & Cloud Computing

- Edge Computing

- By Processor Type

- X86

- ARM)

- By End-User

- Enterprises

- Data Centers

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Micro Server IC Market