North America TIC Market – Analysis and Forecast (2025-2030)

Industry Insights by Sourcing Type (In-House and Outsourced), by Service Type (Testing, Inspection, and Certification), by Industry Vertical (Agriculture & Food, Construction, Life Science, Consumer Goods & Retail, Transportation, Energy, Oil, Gas & Chemical, Mining, Environmental, and Others) and by Geography (U.S., Canada, and Rest of North America)

| Status : Published | Published On : Feb, 2024 | Report Code : VRSME9137 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 118 |

North America TIC Market – Analysis and Forecast (2025-2030)

Industry Insights by Sourcing Type (In-House and Outsourced), by Service Type (Testing, Inspection, and Certification), by Industry Vertical (Agriculture & Food, Construction, Life Science, Consumer Goods & Retail, Transportation, Energy, Oil, Gas & Chemical, Mining, Environmental, and Others) and by Geography (U.S., Canada, and Rest of North America)

North America TIC Market Overview

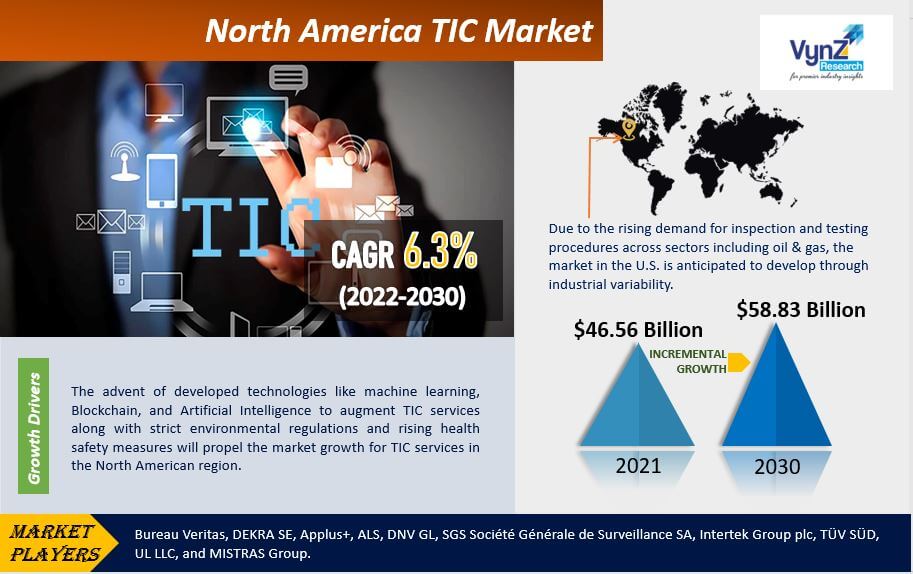

The North American Testing, Inspection, and Certification (TIC) market size is expected to grow from USD 46.56 billion in 2023 to USD 58.83 billion by 2030, witnessing a CAGR of 6.3% during the forecast period 2025 - 2030.

Testing refers to the industrial process where individual components, goods, manufacturers, and multi-component systems are verified. It is very important for every manufacturing company. This helps in determining several different aspects, such as the quality of the product, productivity, and cost factors, as well as other elements of market share, delivery, and more.

Testing, Inspection, and Certification (TIC) ensures that the safety aspects and quality standards are not compromised in terms of the products, services, or even the infrastructure. It is a very common process followed in North America and is performed in most industries at regular intervals irrespective of seasonality.

This market will grow significantly in the forecast periods as people today want to use safer and more efficient products. These certifications will signify the reliability, safety, and efficiency of the products. Manufacturers will benefit in terms of sales since their products will be TIC-certified.

Market Segmentation

Insight by Sourcing Type

According to the sourcing type, the North American Testing, Inspection, and Certification (TIC) market is divided into in-house and outsourced types, with the latter having a higher CAGR than the former. This is mainly due to the growing need for medical equipment and to reduce costs.

Insight by Service Type

As per the service type, the market can be divided into testing, inspection, and certification, which gives it its name. out of these, testing is the largest contributor. This is because consumers today are more concerned quality of products.

Also, the high standards and strict regulations imposed by the government force businesses to test their products to ensure they abide by the regulatory standards. Newer changes made in the certification standards are also affecting its growth.

For example, the US Fish and Wildlife Service has made changes in its policies and has informed the Canadian Food Inspection Agency about it. Changes are made in the export of live finfish as well as salmonid class, stocking, germplasm, and genetic material for culture, enhancement, or research on dead exenterated salmonids. This resulted in the market growth.

Insight by Industry Vertical

The market can be divided into life science, agriculture &food, construction, transportation, consumer goods, retail, oil and gas, energy, mining, chemical, power, environment, and more, based on the industry verticals.

The consumer goods and retail market will grow in the forecast period with a higher CAGR than others. This is mainly due to higher safety requirements, quality concerns, growing awareness, consumer expenditure, product marketability, and strict regulations of the governments.

The healthcare sector will also grow significantly due to higher chronic illnesses among the population all over the world due to sedentary lifestyles. They now need more medicines and regular monitoring of their health through a wide range of care and services.

North America TIC Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 46.56 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 58.83 Billion |

|

Growth Rate |

6.3% |

|

Segments Covered in the Report |

By Sourcing Type, By Service Type, By Industry Vertical |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

U.S., Canada, and Rest of North America |

Industry Dynamics

Growth Drivers

A notable development in technologies and the use of AI, machine learning, and blockchain and strict government regulations to ensure every product is of the highest standards and does not cause harm to the environment, both contribute to the growth of this market.

There has been an increase in developing health safety measures to ensure optimal consumer health and awareness among consumers regarding product standards and their customizability has also propelled its growth. Consumers today look for safer equipment that conforms with the set rules and regulations of the government.

There has been a notable change in the business activities of late, which results in the expansion of the market as well. These changes are a result of integrated supply chains, increased trade flows, and rising outsourcing.

Restraints

New companies find it very hard to participate in the market due to strict regulatory requirements. There are significant issues and loopholes in standardization, especially concerning cross-border businesses. However, efforts are made to do away with these hindrances to the growth of the North American TIC market.

Opportunities

A lot of opportunities are created for the TIC market to grow, thanks to the newer research and development events happening in the fields of gas, oil, chemical, and other industries. Newer opportunities are also created by the stringent safety requirements for food.

Overall, there will be a notable increase in industrial applications of all the latest developments, for which quality and compatibility are to be ensured. This will help in future development and appraisal.

Geographic Overview

The North American market will continue to dominate the TIC market during the forecast period due to increased demand across several industry sectors, improvements in development projects, and certification standards. Most importantly, a lot of mining operations are carried out in this region, leading to the growth of the TIC market.

Key Players Covered in the Report

Some of the major players operating in the North American TIC industry include Bureau Veritas, DEKRA SE, Applus+, ALS, DNV GL, SGS Société Générale de Surveillance SA, Intertek Group plc, TÜV SÜD, UL LLC, and MISTRAS Group.

Recent Developments by Key Players

ALS, a testing service provider has acquired US east coast-based York Analytical Laboratories and Germany’s Wessling Holding GmbH & Co to expand its environmental services operations through two separate acquisitions worth USD 225 million that shall boost its annual revenue by about USD 195 million.

TÜV SÜD has opened its new state-of-the-art environmental laboratory in Auburn Hills, MI. which shall provide sustainability, cutting-edge testing, safety and reliability. TÜV SÜD America Inc. is commited to advancing the highest quality and performance standards in EV battery and system solutions. It ensures that EV batteries meet the highest standards of reliability, sustainability and safety, through rigorous product development and validation processes.

The North America TIC market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Sourcing Type

- In-House

- Outsourced

- By Service Type

- Testing

- Inspection

- Certification

- By Industry Vertical

- Agriculture & Food

- Construction

- Life Science

- Consumer Goods & Retail

- Transportation

- Energy

- Oil

- Gas & Chemical

- Mining

- Environmental

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Rest of North America

PRIMARY RESEARCH INTERVIEWS – BREAKDOWN

.png)

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

North America TIC Market