Global TIC Market for Food & Beverage Industry – Analysis and Forecast (2025-2030)

Industry Insight by Sourcing Type (In-House and Outsourced), by Service Type (Testing, Inspection, and Certification), by Application (Convenience Food Solutions, Dairy Solutions, Animal Feed & Pet Food Solutions, Fruits and Vegetable Solutions, Honey Solutions, Meat & Seafood Solutions, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Jan, 2024 | Report Code : VRSME9053 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 155 |

Global TIC Market for Food & Beverage Industry – Analysis and Forecast (2025-2030)

Industry Insight by Sourcing Type (In-House and Outsourced), by Service Type (Testing, Inspection, and Certification), by Application (Convenience Food Solutions, Dairy Solutions, Animal Feed & Pet Food Solutions, Fruits and Vegetable Solutions, Honey Solutions, Meat & Seafood Solutions, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

TIC Market for Food & Beverage Industry Overview

The Food And Beverage Industry's Testing, Inspection, And Certification Market reached a valuation of USD 16.3 billion in 2023, with a projected compound annual growth rate (CAGR) of 9% throughout the forecast period from 2025 to 2030.

Testing in TIC means an industry activity that assures manufactured products, individual components, and multi-component systems are suitable for the predetermined purpose. Inspection and testing are the operating parts of quality control, which is the most critical factor for the survival of any manufacturing company. Quality control directly supports other factors such as cost, productivity, on-time delivery, and market share. The testing, inspection, and certification market report is composed of conformity assessment agencies, which provide services from audit and inspection to testing, verification, quality assurance, and certification.

Globalization has led to product standardization norms and has penetrated developed technologies across various industries such as food and beverage, electronics and automotive industries, etc., resulting in the growth of the TIC market during the forecast period 2023-2030. Moreover, the growing middle-class population, rapid urbanization, mandatory safety regulations, upsurge in the illicit trade of counterfeit and pirated products, advancement in networking and communication technology, the inclination of outsourcing testing, inspection, and certification services has propelled the growth of the TIC market in food and beverage industry. Nevertheless, TIC provides various advantages related to its credibility and image, compliance with legal and regulatory requirements, less turnover of employees, high level of cost control improvement, and fast improvement of different processes. The volume of imports and exports has increased in the food products internationally, resulting in providing more scope of TIC services in the food and beverage industry. TIC companies are catering to different industrial sectors such as agriculture, automotive, raw materials, IT and electronics, environmental protection, food testing, and oil and gas, maritime, medicine, education, tourism, logistics, consumer products, etc. and provide various standards and legislation

The COVID-19 pandemic resulted in a short-term decline in demand and revenue in the first quarter of 2020. Moreover, TIC is playing a crucial role by offering assurance that the products and services offered to the customers will provide safety and health standards. However, due to the COVID19 pandemic, food businesses around the world have been affected owing to negative publicity on social media regarding the health risks associated with eating animal products, information technology has already affected the meat product market. These factors are expected to propel the demand for plant-based products, which is expected to promote the growth of the plant-based food certification market.

Business organizations in the TIC market are intensifying IT infrastructures and developing business continuity plans, implying that the testing, inspection, and certification market are holding the substantial potential to bounce back from the COVID-19 outbreak. This is due to the fact that TIC services will enhance and protect brand reputation, verify products’ safety, and enables trade.

TIC Market for Food & Beverage Industry Segmentation

Insight by Sourcing Type

Based on sourcing type, the TIC market for the food & beverage industry is bifurcated into in-house and outsourced. Among the two segments, the in-house segment dominates the market and is anticipated to hold the largest share during the forecast period 2023-2030. Deploying in-house testing and inspection will offer companies to have complete control over the entire process in terms of technology, skilled personnel, and testing and measurement equipment. Thus, enabling organizations to handle TIC activities like on-site availability, ability to employ talent, and establish custom practices as per the needs and desires of the organizations.

Insight by Service Type

Based on service type, the TIC market for the food & beverage industry is segmented into testing, inspection, and certification. Among these segments, the testing segment holds the largest share in the testing, inspection, and certification market in 2022 owing to the diverse product standards, mandatory regulation for food products, increasing need for improved safety, growing industrialization, and a need to protect the brand. Moreover, the certification market is anticipated to have a high CAGR during the forecast period owing to the consumer awareness about the certified products, companies growing need to improve the product value, the surge in demand for quality and safe products, and mandatory regulatory requirements.

Insight by Industry Vertical

Based on industry vertical, the TIC market for the food & beverage industry is divided into convenience food solutions, dairy solutions, animal feed & pet food solutions, fruits and vegetable solutions, honey solutions, meat & seafood solutions, and others. There is a rising demand for convenient and high-quality food in today’s busy life, resulting in putting pressure on manufacturers to provide safe, speedy, and new products in this changing world. The quality of food given to animals and livestock is important and should comply with global regulations. Consumers anticipate the meat and dairy products to be safe and without chemicals and will not cause any harm to them. Moreover, pets are part of the family so pet food is anticipated to be safe, good quality, and should have nutrition value. Thus, companies are providing end-to-end solutions which include responsible sourcing, retail-level food safety audits, and inspection in restaurants, hotels, casinos, convenience stores, online alcohol seller-server training, rapid swab testing, complying with regulation and standards such as Food Safety Modernization Act (FSMA), Safe Quality Foods (SQF) certification and training, HACCP planning, U.S. FDA compliance testing.

Global TIC Market for Food & Beverage Industry Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 16.3 Billion |

|

Revenue Forecast in 2035 |

U.S.D. xx.x Billion |

|

Growth Rate |

9% |

|

Segments Covered in the Report |

By Sourcing Type, By Service Type, By Industry Vertical. |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

TIC Market for Food & Beverage Industry Trends

The TIC food and beverage industry is characterized by various industry trends such as growing investment in AR and VR, mounting adoption of connected devices and cloud-based technology, increasing mergers and acquisitions by the industry players, and sustained consolidation of suppliers leading to globalization.

TIC Market for Food & Beverage Industry Growth Drivers

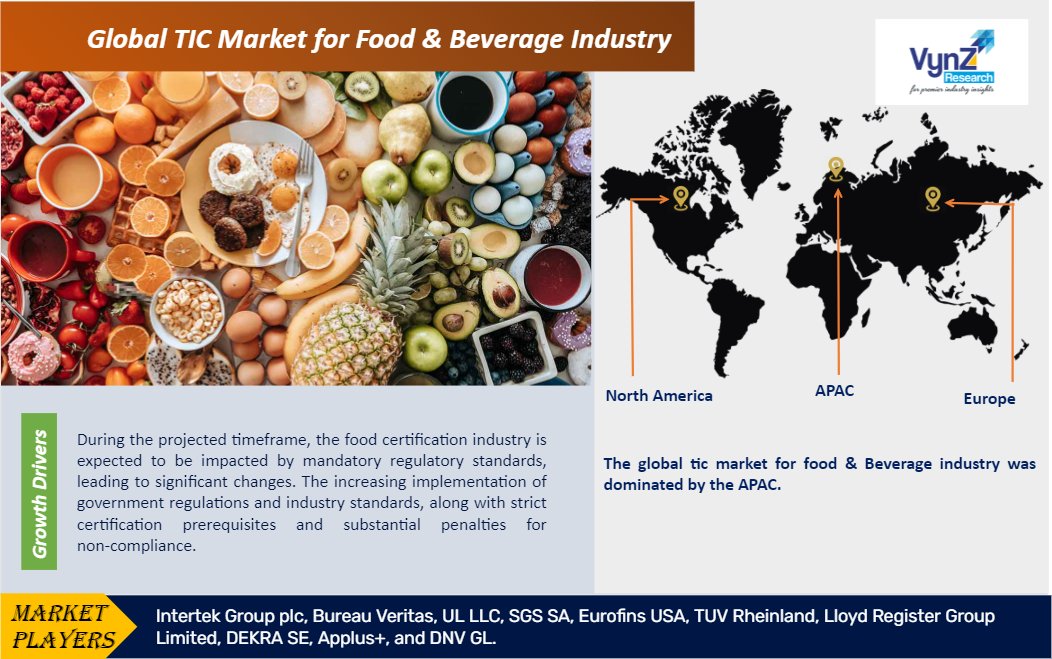

During the projected timeframe, the food certification industry is expected to be impacted by mandatory regulatory standards, leading to significant changes. The increasing implementation of government regulations and industry standards, along with strict certification prerequisites and substantial penalties for non-compliance, will be key drivers for the demand of Testing, Inspection, and Certification (TIC) services in the food and beverage sector. Additionally, manufacturers' growing focus on providing high-quality products to ensure customer satisfaction will result in increased customer retention. This, in turn, will drive the demand for interoperability testing of connected devices and Internet of Things (IoT) technologies. Furthermore, the globalization of trade and the emergence of digital technologies will further fuel the growth of the TIC market within the food and beverage industry.

TIC Market for Food & Beverage Industry Challenges

The testing, inspection, and certification market face certain challenges like trade wars and growth fluctuations, huge investment for automation and installation of industrial safety systems, high cost of TIC owing to diverse standards and regulations globally. The concern regarding adulterated food and food ingredients and lack of harmonization in food safety standards are acting as a restraint in the TIC market. Moreover, a lack of testing facilities and skilled personnel may hamper the growth of the TIC market.

TIC Market for Food & Beverage Industry Opportunities

Testing, inspection, and certification is a massive market that provides lucrative opportunities in technologies such as AI, robotics, drones, big data analytics, next-generation automation, and cloud and cybersecurity. Moreover, there is a growing demand for halal, organic, and free-from food certifications, and growing consumer awareness about food safety will provide promising opportunities in the TIC market for the food and beverage industry.

TIC Market for Food & Beverage Industry Geographic Overview

Geographically, APAC is anticipated to have a high CAGR during the forecast period owing to the rising investment in R&D, rapid urbanization, huge manufacturing capabilities and exports, improved lifestyles, and increasing consumer awareness about the importance of certification. Moreover, the developed countries have their manufacturing units in the region, especially in China and India. Nevertheless, the growing middle-class population has led to the growth in private consumption and mounting demand for safety and product quality, resulting in providing opportunities in food and consumer goods testing, For instance, the acquisition of TUV Rheinland’s food analysis laboratories in China, by Tentamus Group.

TIC Market for Food & Beverage Industry Competitive Insight

Key players are adopting technological changes to improve their product portfolio and generate new revenues, optimize the operational cost, and enhance service efficiencies via process upgrades. The industry players are taking the COVID-19 crisis as an opportunity to restructure and revisit their existing strategies, focus on new services and delivery models to access the demand for rising automation, remotely-performed services, and enhanced digitization.

Intertek is a leading provider of testing and analysis services to the global food industry. Intertek helps in executing comprehensive food safety and quality strategies and complying with local, national, and international regulations.

UL has advanced food testing laboratories that use standard test methods to find the presence of pathogens accurately in food & beverages. Microbiological batch testing identifies aerobic plate counts, yeast, and mold. Thus, ULs’ food forensics service can check the presence and causes of alleged problems.

Some of the key players operating in the TIC market in food & beverage industry: Intertek Group plc, Bureau Veritas, UL LLC, SGS SA, Eurofins USA, TUV Rheinland, Lloyd Register Group Limited, DEKRA SE, Applus+, and DNV GL.

Recent Developments by Key Players

Transport General Authority (TGA) of Saudi Arabia and Bureau Veritas Marine & Offshore both have signed a memorandum of understanding (MoU) for enhancingsocial, environmental and governance (ESG) aspects of marine sustainability.

Intertek is a leading Total Quality Assurance provider to industries worldwide has launched iCare in Bangladesh. Following its successful introduction in Türkiyeand India, this digital platform is set to support the local textile industry by offering a seamless and pioneering solution for managing testing processes from start to finish.

The global TIC Market For Food & Beverage Industry report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

- By Sourcing Type

- In-House

- Outsourced

- By Service Type

- Testing

- Inspection

- Certification

- By Industry Vertical

- Convenience Food Solutions

- Dairy Solutions

- Animal Feed & Pet Food Solutions

- Fruits and Vegetable Solution

- Honey Solutions

- Meat & Seafood Solutions

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

TIC Market for Food & Beverage Industry