TIC Market for Sports & Entertainment Industry Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Service Type (Testing, Inspection, Certification), by Sourcing Type (In house, Outsourced), by Application Type (Permanent venues, Temporary event infrastructure), by End User (Sports venues and stadium operators, Entertainment organizers, Broadcasters and media production entities)

| Status : Published | Published On : Feb, 2026 | Report Code : VRSME9186 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 180 |

TIC Market for Sports & Entertainment Industry Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Service Type (Testing, Inspection, Certification), by Sourcing Type (In house, Outsourced), by Application Type (Permanent venues, Temporary event infrastructure), by End User (Sports venues and stadium operators, Entertainment organizers, Broadcasters and media production entities)

TIC Market for Sports & Entertainment Industry Overview

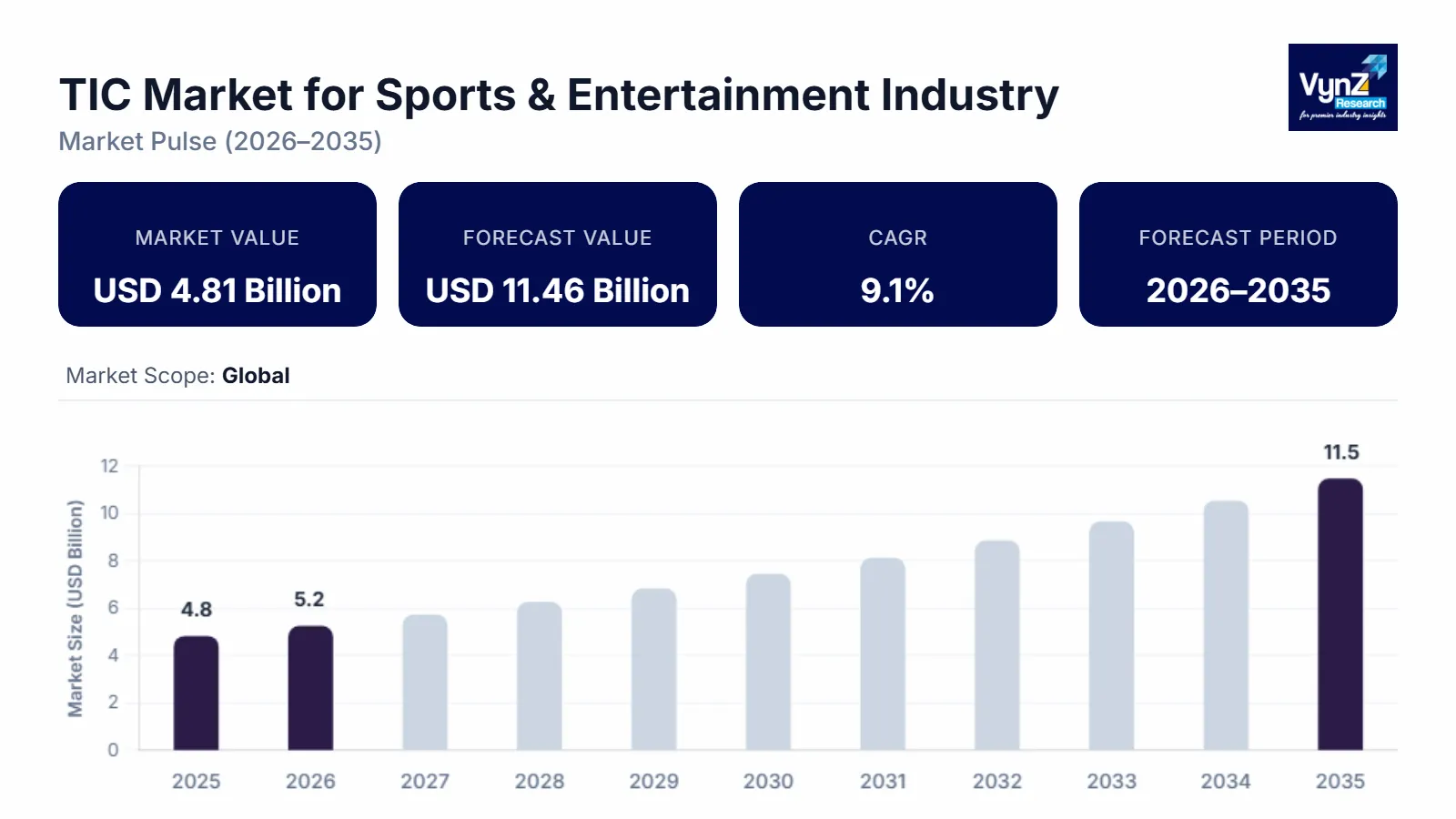

The TIC market for the sports & entertainment industry, which was valued at approximately USD 4.81 billion in 2025 and is estimated to reach around USD 5.24 billion in 2026, is projected to reach nearly USD 11.46 billion by 2035, expanding at a CAGR of about 9.1% during the forecast period from 2026 to 2035.

The industry continues to expand steadily as event organizers broadcasters and venue operators prioritize regulatory compliance safety assurance and service quality across large scale live environments.

Market growth is supported by rising regulatory enforcement for public safety electrical integrity and equipment reliability across stadium arenas, theme parks and large entertainment venues along with increasing outsourcing of testing inspection and certification services. Growing adoption of advanced audiovisual systems, smart lighting, and temporary power infrastructure and crowd management technologies further accelerates demand across the TIC sector. Government backed safety frameworks and inspection protocols issued by public health authorities, labor safety agencies and national standards bodies continue to reinforce structured compliance requirements. Public investments in sports infrastructure urban recreation facilities and international event hosting across Asia Pacific, Middle East and parts of Europe further sustain long term industry expansion.

TIC Market for Sports & Entertainment Industry Dynamics

Market Trends

The industry is undergoing a structural transition toward standardized compliance driven service delivery as venue operators and event organizers increase reliance on third party testing inspection and certification frameworks. Regulatory alignment with public safety electrical integrity and crowd management standards issued by national labor safety authorities and public health agencies is accelerating demand for pre-event and in service inspection protocols. This shift reflects growing emphasis on risk mitigation operational continuity and liability reduction across large scale stadiums arenas and temporary event infrastructure in regions such as Asia Pacific, Middle East and Europe.

Another notable trend is the increasing integration of digital inspection tools remote auditing platforms and real time monitoring solutions within tic workflows. Government backed initiatives promoting digital compliance traceability and infrastructure safety modernization are encouraging service providers to adopt sensor-based testing mobile inspection systems and centralized reporting platforms. These developments are influencing service portfolios and driving providers to focus on integrated solutions lifecycle compliance management and value-added advisory capabilities thereby reshaping competitive positioning across the market landscape.

Growth Drivers

The growth of the industry is primarily supported by stricter enforcement of safety and operational regulations governing public gatherings electrical installations and temporary structures. National occupational safety agencies building authorities and fire safety departments continue to mandate periodic inspection and certification of event infrastructure generating consistent demand across stadiums convention centers amusement parks and live event venues. Rising investments in sports infrastructure urban entertainment districts and international event hosting programs are further accelerating service adoption across key Regions.

Additionally, increased focus on compliance driven procurement among venue owners, broadcasters and event management firms is strengthening demand for accredited TIC services. As enterprises prioritize regulatory adherence operational reliability and brand reputation demand for inspection certification and conformity assessment services remains strong. Government funded sports development initiatives and public private partnerships supporting large scale recreational infrastructure continue to reinforce long term market expansion across emerging and developed economies.

Market Restraints / Challenges

Despite favorable growth prospects the industry faces challenges related to regulatory complexity and cost sensitivity. Variation in safety codes, certification requirements and inspection protocols across jurisdictions increases compliance costs and operational complexity particularly for multinational event organizers and service providers. Price pressure among smaller venues and regional event operators can also limit service penetration affecting profitability and market scalability in cost sensitive segments.

Furthermore, dependence on skilled inspectors, specialized testing equipment and accredited laboratories poses operational constraints. Shortages of certified professionals and reliance on imported testing instruments can lead to cost pressures and service delays during peak event seasons. Economic uncertainty and fluctuating public funding cycles may further impact project timelines and inspection volumes affecting overall market performance.

Market Opportunities

The market presents significant opportunities in advanced compliance management services supporting large scale multi venue and international events. Growing demand for centralized certification management digital documentation and continuous compliance monitoring is creating scope for service providers offering integrated and scalable solutions. Organizations delivering customizable audit frameworks and rapid deployment inspection models are well positioned to capture incremental demand from global sports leagues entertainment groups and government backed event authorities.

Another key opportunity lies in premium digital enabled TIC offerings including remote inspections, predictive risk assessments and data driven compliance analytics. Rising public investment in smart venue development and safety digitization programs is supporting adoption of technology enhanced services. Advancements in automation digital reporting and sensor-based testing are expected to improve service efficiency client engagement and long-term contract retention across the industry.

Global TIC Market for Sports & Entertainment Industry Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 4.81 Billion |

|

Revenue Forecast in 2035 |

USD 11.46 Billion |

|

Growth Rate |

9.1% |

|

Segments Covered in the Report |

By Service Type, By Sourcing Type, By Application Type, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Asia Pacific, Europe, North America, Other Regions |

|

Key Companies |

Applus+, Bureau Veritas, Intertek Group, SGS, Turk Loydu, UL, TUV Nord, TUV Rheinland, TUV SUD, Kiwa NV, ALS Limited |

|

Customization |

Available upon request |

TIC Market for Sports & Entertainment Industry Segmentation

By Service Type

Inspection services accounted for the largest revenue share of approximately 46% in 2025. This dominance is supported by mandatory on site safety audits structural assessments and electrical inspections required before and during live events.

Certification services contribute nearly 32%, driven by compliance with fire safety crowd control and equipment performance standards mandated by national authorities.

Testing services represent close to 22%, supported by demand for load testing material verification and performance validation of temporary installations.

Inspection services are projected to grow at about 8.8% due to increasing event frequency, while certification services are expected to expand at nearly 9.4% supported by tightening regulatory oversight and standardized compliance frameworks.

By Sourcing Type

In house TIC services held an estimated 58% market share in 2025, as large stadium operators and entertainment groups maintain internal compliance teams to manage recurring inspections and documentation. This approach supports operational control faster turnaround and alignment with venue specific safety protocols.

Outsourced TIC services accounted for approximately 42%, reflecting growing reliance on accredited third-party providers for specialized audits and international event compliance. Outsourced services are expected to register the fastest growth at around 9.7%, driven by rising cross border events complex regulatory environments and the need for globally recognized certification. Increasing collaboration between venue owners and external TIC specialists is strengthening service depth and geographic scalability.

By Application Type

Permanent venues including stadiums arenas and theme parks represented nearly 61% of market revenue in 2025, supported by continuous inspection cycles asset intensive infrastructure and year-round operational requirements.

Temporary event infrastructure accounted for approximately 39%, driven by concerts exhibitions and international sporting events requiring short term compliance validation.

Permanent venues are expanding at about 8.6% due to sustained public investment in sports infrastructure, while temporary installations are growing faster at nearly 9.9%, supported by rising frequency of large-scale live events and stricter temporary structure regulations issued by public safety authorities. Increased focus on risk mitigation and liability management continues to reinforce application-level demand.

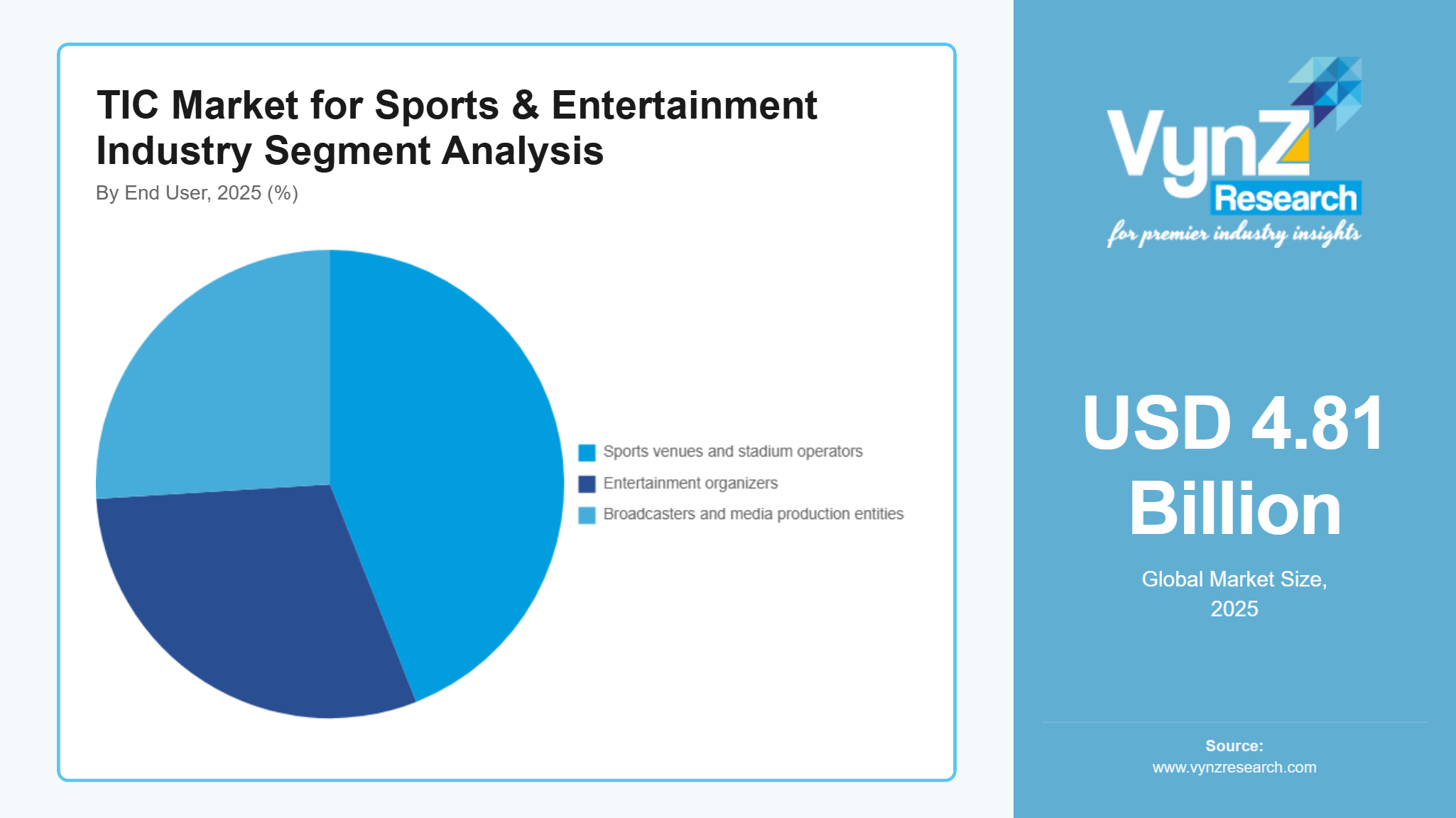

By End User

Sports venues and stadium operators accounted for the largest share of approximately 44% in 2025, supported by high inspection frequency regulatory exposure and long asset lifecycles.

Entertainment organizers including concert promoters and exhibition managers represented close to 33%, reflecting demand for event specific inspection and certification services.

Broadcasters and media production entities contributed around 23%, driven by compliance requirements for temporary power systems lighting rigs and broadcast equipment.

Entertainment organizers are projected to grow at about 9.6%, outpacing other segments due to rising international tours and mobile event formats. Sports venues continue to expand steadily at nearly 8.7%, supported by refurbishment cycles and compliance driven operational upgrades.

Regional Insights

Asia Pacific

Asia Pacific accounted for approximately 32% of the market in 2025, driven by rapid expansion of sports infrastructure, increasing frequency of international tournaments, and large-scale entertainment events across China, India, Japan, and Australia. Strong demand from metropolitan hubs such as Beijing, Shanghai, Mumbai, Tokyo, and Sydney continues to support market growth. Government backed sports development programs, public stadium modernization initiatives, and national safety regulations issued by building and labor authorities are reinforcing the need for structured inspection and certification services across permanent and temporary venues.

In addition, rising public investment in smart cities, recreational infrastructure, and crowd safety management systems is strengthening regional adoption of TIC services. Regulatory frameworks issued by public health agencies and occupational safety departments are encouraging compliance driven procurement, while increased digitalization of inspection workflows is improving service efficiency. These factors collectively support sustained regional expansion through the forecast period.

Europe

Europe represented an estimated 26% of the market in 2025, supported by mature regulatory environments and strict enforcement of venue safety, fire protection, and electrical compliance standards. Countries such as Germany, the United Kingdom, France, Spain, and Italy continue to generate steady demand due to refurbishment of aging stadiums, expansion of multipurpose arenas, and recurring international sporting and cultural events. Compliance requirements aligned with national building authorities and public safety regulators underpin consistent inspection and certification activity.

Growth is further supported by government funded urban regeneration programs and sustainability focused venue upgrades. Public sector guidelines on crowd safety, structural integrity, and event risk assessment are driving continuous inspection cycles. Increasing adoption of digital compliance documentation and harmonized safety standards across the region is also contributing to stable long-term demand for TIC services.

North America

North America accounted for approximately 20% of the market in 2025, driven by high event density, strong liability management practices, and rigorous enforcement of safety and certification standards. The United States and Canada remain key contributors, supported by major sports leagues, large scale entertainment tours, and technologically advanced venues. Federal and state level safety regulations issued by labor, fire, and public health authorities mandate periodic inspections, reinforcing recurring demand for TIC services.

Ongoing investments in stadium upgrades, broadcast infrastructure, and temporary event installations continue to support market growth. Government supported initiatives focused on public safety, emergency preparedness, and infrastructure resilience are encouraging venue operators to adopt comprehensive testing and inspection protocols.

Other Regions

The remaining approximately 22% of the market is collectively covered by regions not detailed above, including the Middle East, Latin America, and parts of Africa, where growth is supported by emerging sports infrastructure and increasing adoption of international safety standards.

Competitive Landscape / Company Insights

The industry is moderately to highly competitive, with global and regional providers emphasizing service standardization, pricing efficiency, and geographic expansion. Companies are increasingly investing in digital inspection platforms, compliance management systems, and accredited testing capabilities to strengthen market positioning. Adoption is supported by government backed safety regulations and inspection frameworks issued by public health authorities, labor safety agencies, and national building regulators. These compliance driven mandates encourage long term contracts and recurring service demand across major sports and entertainment venues globally.

Mini Profiles

Applus+ delivers testing, inspection, and certification services for large venues and event infrastructure, supported by strong technical expertise, international accreditations, and efficient project execution across sports and entertainment facilities.

Bureau Veritas operates across premium and mass TIC segments, emphasizing regulatory compliance, safety assurance, and risk management, backed by global brand recognition, extensive laboratory networks, and strong relationships with public authorities.

DEKRA focuses on inspection and certification services, leveraging deep safety expertise, standardized audit frameworks, and strong presence in regulated markets to support compliance requirements for sports venues and entertainment events.

Eurofins Scientific provides specialized testing and analytical services, supported by advanced laboratories, technical depth, and strong quality systems, enabling reliable validation of equipment materials and safety standards.

Intertek Group delivers integrated TIC solutions, emphasizing performance testing, compliance certification, and digital inspection platforms, supported by global reach, strong customer relationships, and comprehensive assurance capabilities.

Key Players

- Applus+

- Bureau Veritas

- Intertek Group

- SGS

- Turk Loydu

- UL

- TUV Nord

- TUV Rheinland

- TUV SUD

- Kiwa NV

- ALS Limited

Recent Developments

In February 2026, DNV, the independent energy expert and assurance supplier, has released DNV-RP-A102, a recommended practice for fire detector mapping in high‑hazard industrial buildings. By guaranteeing effective fire detection and prompt response, this aids operators in determining the ideal quantity, location, and orientation of flame detectors that improve process safety. The RP helps safety engineers and facility designers enhance risk management, operational dependability, and adherence to industrial safety regulations by using a 3D mapping technique.

In January 2025, SAI Global expanded its certification and assurance services for sports and entertainment venues, strengthening regulatory compliance and safety management capabilities across large event infrastructure. This expansion aligns SAI Global with growing demand for structured safety and compliance assurance in high-traffic, high-risk public venues, complementing its global portfolio of testing, inspection, certification, and assurance services.

In June 2025, UL Solutions Inc., a global leader in safety science and third‑party conformity assessment, introduced a new testing and certification service for immersion cooling fluids used in data centers. The program is designed to enhance the safety, performance and reliability of immersion cooling fluids specialized liquids that dissipate heat from high‑power information technology equipment.

Global TIC Market for Sports & Entertainment Industry Coverage

Service Type Insight and Forecast 2026 - 2035

- Testing

- Inspection

- Certification

Sourcing Type Insight and Forecast 2026 - 2035

- In house

- Outsourced

Application Type Insight and Forecast 2026 - 2035

- Permanent venues

- Temporary event infrastructure

End User Insight and Forecast 2026 - 2035

- Sports venues and stadium operators

- Entertainment organizers

- Broadcasters and media production entities

Global TIC Market for Sports & Entertainment Industry by Region

- North America

- By Service Type

- By Sourcing Type

- By Application Type

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Service Type

- By Sourcing Type

- By Application Type

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Service Type

- By Sourcing Type

- By Application Type

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Service Type

- By Sourcing Type

- By Application Type

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for TIC Market for Sports & Entertainment Industry Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Service Type

1.2.2. By

Sourcing Type

1.2.3. By

Application Type

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Service Type

5.1.1. Testing

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Inspection

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Certification

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Sourcing Type

5.2.1. In house

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Outsourced

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Application Type

5.3.1. Permanent venues

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Temporary event infrastructure

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Sports venues and stadium operators

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Entertainment organizers

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Broadcasters and media production entities

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Service Type

6.2. By

Sourcing Type

6.3. By

Application Type

6.4. By

End User

6.4.1.

U.S. Market Estimate and Forecast

6.4.2.

Canada Market Estimate and Forecast

6.4.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Service Type

7.2. By

Sourcing Type

7.3. By

Application Type

7.4. By

End User

7.4.1.

Germany Market Estimate and Forecast

7.4.2.

U.K. Market Estimate and Forecast

7.4.3.

France Market Estimate and Forecast

7.4.4.

Italy Market Estimate and Forecast

7.4.5.

Spain Market Estimate and Forecast

7.4.6.

Russia Market Estimate and Forecast

7.4.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Service Type

8.2. By

Sourcing Type

8.3. By

Application Type

8.4. By

End User

8.4.1.

China Market Estimate and Forecast

8.4.2.

Japan Market Estimate and Forecast

8.4.3.

India Market Estimate and Forecast

8.4.4.

South Korea Market Estimate and Forecast

8.4.5.

Vietnam Market Estimate and Forecast

8.4.6.

Thailand Market Estimate and Forecast

8.4.7.

Malaysia Market Estimate and Forecast

8.4.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Service Type

9.2. By

Sourcing Type

9.3. By

Application Type

9.4. By

End User

9.4.1.

Brazil Market Estimate and Forecast

9.4.2.

Saudi Arabia Market Estimate and Forecast

9.4.3.

South Africa Market Estimate and Forecast

9.4.4.

U.A.E. Market Estimate and Forecast

9.4.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Applus+

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Bureau Veritas

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Intertek Group

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. SGS

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Turk Loydu

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. UL

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. TUV Nord

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. TUV Rheinland

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. TUV SUD

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Kiwa NV

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. ALS Limited

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

TIC Market for Sports & Entertainment Industry