Land Mobile Radio Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by end user, public safety accounted for the largest share of the market in 2025, representing approximately 41% of total revenue. Sustained government investment in emergency response systems, disaster preparedness, and secure communication infrastructure underpins this segment’s leadership. Mandatory interoperability standards and long-term procurement programs further reinforce consistent demand. (Anritsu, Airbus DS Communications, BK Technologies, Codan Limited, Hytera Communications Corporation Limited, Icom Inc., JVCKENWOOD Corporation, Kenwood Corporation, L3Harris Technologies, Inc., Leonardo S.p.A.), by Technology (Digital Land Mobile Radio, Analog Land Mobile Radio), by Frequency (VHF, UHF), by System Type (Portable Radios, Mobile Radios, Fixed Infrastructure Systems), by Distribution Channel (Direct Sales, System Integrators, Distributors and Dealers), by Price Range (Economy, Mid-Range, Premium), by End User (Public Safety, Transportation, Utilities, Industrial and Commercial)

| Status : Published | Published On : Feb, 2026 | Report Code : VRSME9196 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 185 |

Land Mobile Radio Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by end user, public safety accounted for the largest share of the market in 2025, representing approximately 41% of total revenue. Sustained government investment in emergency response systems, disaster preparedness, and secure communication infrastructure underpins this segment’s leadership. Mandatory interoperability standards and long-term procurement programs further reinforce consistent demand. (Anritsu, Airbus DS Communications, BK Technologies, Codan Limited, Hytera Communications Corporation Limited, Icom Inc., JVCKENWOOD Corporation, Kenwood Corporation, L3Harris Technologies, Inc., Leonardo S.p.A.), by Technology (Digital Land Mobile Radio, Analog Land Mobile Radio), by Frequency (VHF, UHF), by System Type (Portable Radios, Mobile Radios, Fixed Infrastructure Systems), by Distribution Channel (Direct Sales, System Integrators, Distributors and Dealers), by Price Range (Economy, Mid-Range, Premium), by End User (Public Safety, Transportation, Utilities, Industrial and Commercial)

Land Mobile Radio Market Overview

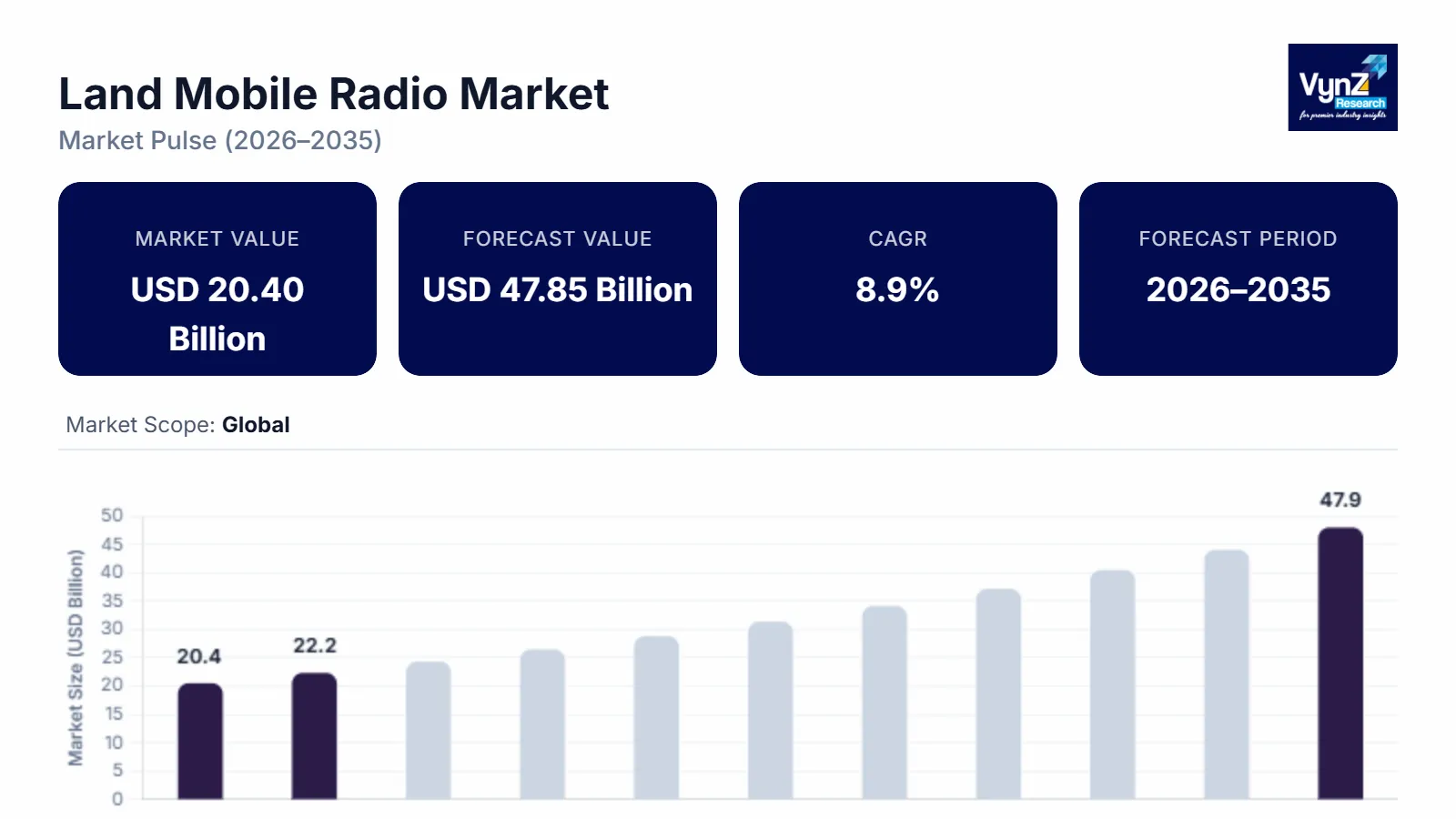

The global land mobile radio market, valued at approximately USD 20.40 billion in 2025 and estimated to rise to almost USD 22.22 billion by 2026, is projected to reach around USD 47.85 billion by 2035, expanding at a CAGR of about 8.9% from 2026 to 2035.

Market growth is supported by sustained investments in mission critical communication systems, public safety modernization programs and large-scale infrastructure protection initiatives. Increasing adoption of digital and interoperable radio platforms across emergency response, transportation and utility operations continues to support demand.

Government backed spectrum harmonization policies, public safety communication frameworks and disaster preparedness programs promoted by national telecom regulators and international public safety agencies are reinforcing deployment across North America, Europe and Asia Pacific, while supporting long term network reliability and operational resilience.

Land Mobile Radio Market Dynamics

Market Trends

The market is witnessing a clear transition toward digital and interoperable communication platforms, aligned with modernization programs defined by national telecommunications and public safety authorities. Regulatory frameworks and spectrum efficiency initiatives issued by the U.S. Federal Communications Commission and the European Conference of Postal and Telecommunications Administrations are accelerating migration from analog to digital LMR technologies to improve spectral efficiency and communication reliability across public safety and utility networks. These initiatives reflect a broader policy focus on optimized spectrum utilization and standardized communication architectures.

Another emerging trend is the convergence of LMR systems with broadband and data enabled applications, driven by public sector digital transformation agendas. Government programs promoted by the U.S. Department of Homeland Security and the European Commission emphasize enhanced situational awareness, real time data exchange and coordinated emergency response. These developments are encouraging suppliers to prioritize software driven capabilities, interoperable platforms and integrated communication solutions, thereby reshaping competitive positioning within the market.

Growth Drivers

The growth of the market is largely supported by sustained public investment in mission critical communication infrastructure for emergency services, defense and transportation. National public safety communication strategies supported by the U.S. Department of Justice and the Federal Emergency Management Agency continue to generate consistent demand for reliable and resilient LMR networks across law enforcement, fire services and emergency medical operations. Similar government led initiatives across Europe and Asia Pacific are reinforcing long term replacement and upgrade cycles.

Additionally, increasing emphasis on regulatory compliance and network reliability is playing a crucial role in driving adoption. Guidelines and resilience frameworks issued by the International Telecommunication Union and national telecom regulators require secure, interference resistant and highly available communication systems for critical operations. As public agencies and infrastructure operators prioritize compliance with these mandates, demand for advanced LMR platforms is expected to remain strong throughout the forecast period.

Market Restraints / Challenges

Despite favorable growth prospects, the landscape faces challenges related to regulatory complexity and spectrum availability. Reports from the U.S. Government Accountability Office and national telecom authorities indicate that spectrum congestion, licensing constraints and fragmented allocation policies can increase deployment costs and delay network expansion, particularly in densely populated regions. These regulatory hurdles may restrict rapid modernization efforts for smaller agencies and emerging markets.

Furthermore, dependence on specialized radio hardware and skilled technical personnel poses operational challenges for system deployment and maintenance. Government procurement reviews and public infrastructure audit reports highlight that reliance on imported components can expose projects to supply chain risks and cost volatility. Budgetary constraints and extended public procurement cycles may further affect implementation timelines during periods of fiscal pressure.

Market Opportunities

The market presents significant opportunities through government led public safety modernization and critical infrastructure protection programs. National resilience and disaster preparedness initiatives promoted by agencies such as the U.S. Department of Homeland Security and civil protection authorities in Europe are driving demand for interoperable, scalable and future ready communication systems. Vendors offering modular architectures and upgradeable platforms are well positioned to benefit from long-term public-sector contracts.

Another key opportunity lies in the integration of LMR with digital command and control platforms under smart city and e governance initiatives. Programs supported by national urban development ministries and public safety departments are encouraging investments in data driven communication ecosystems. Advancements in software defined radio technologies and network management tools are expected to support higher operational efficiency, stronger user engagement and sustained market growth.

Global Land Mobile Radio Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 20.40 Billion |

|

Revenue Forecast in 2035 |

USD 47.85 Billion |

|

Growth Rate |

8.9% |

|

Segments Covered in the Report |

By Technology, By Frequency, By System Type, By Distribution Channel, By Price Range, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia Pacific, Europe, Other Regions |

|

Key Companies |

Anritsu, Airbus DS Communications, BK Technologies, Codan Limited, Hytera Communications Corporation Limited, Icom Inc., JVCKENWOOD Corporation, Kenwood Corporation, L3Harris Technologies, Inc., Leonardo S.p.A., Motorola Solutions Inc., Simoco Wireless Solutions Limited, Thales Group |

|

Customization |

Available upon request |

Land Mobile Radio Market Segmentation

By Technology

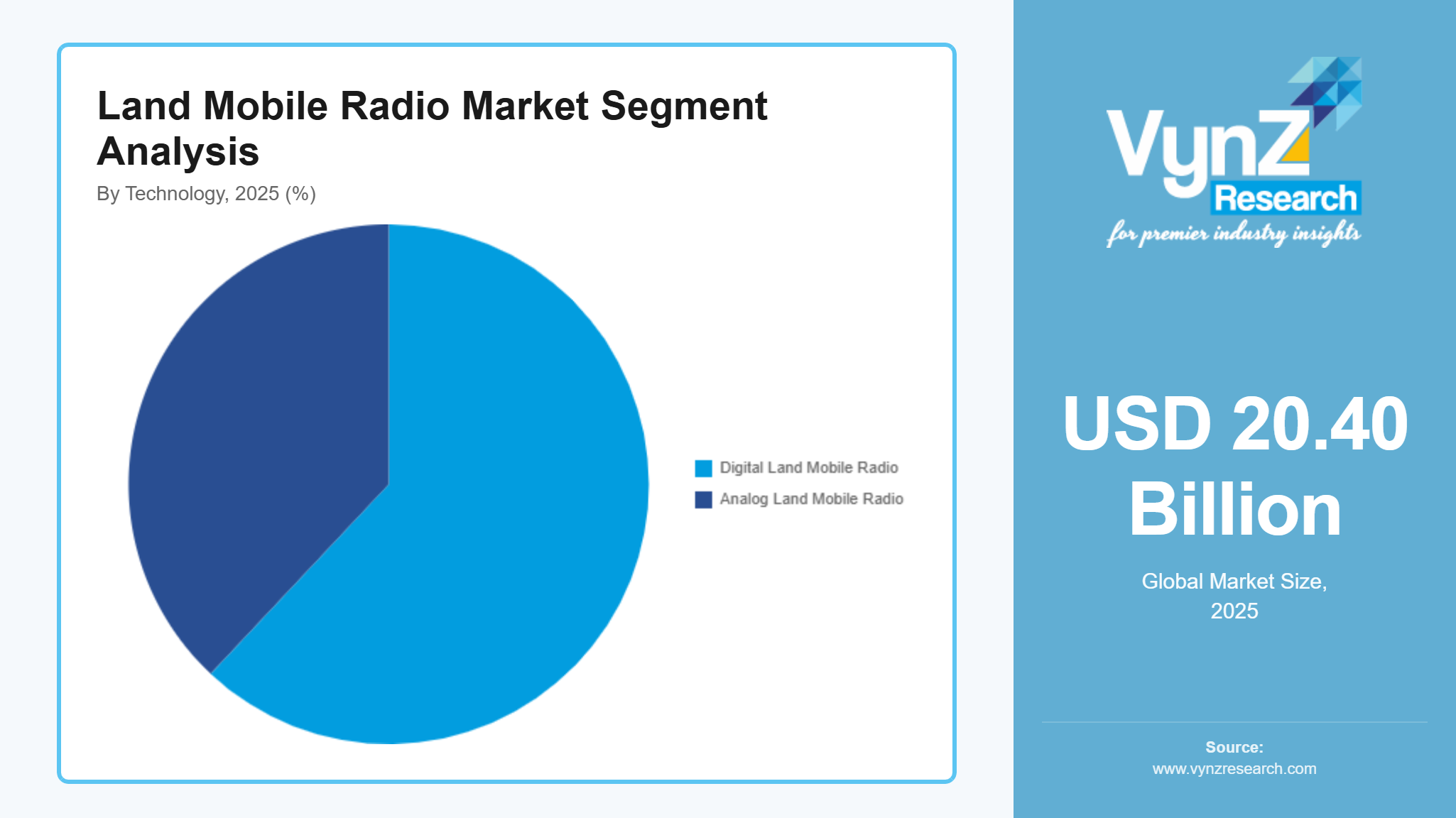

Based on technology, digital land mobile radio accounted for the largest share of the market in 2025, contributing approximately 62% of total revenue. The dominance of digital systems is supported by superior spectrum efficiency, encrypted communication, interoperability compliance, and the ability to support both voice and limited data services. Public safety agencies, transportation authorities, and utility operators increasingly prefer digital platforms to meet regulatory mandates for secure and interference-resistant communication, reinforcing strong replacement and upgrade cycles across developed and emerging regions.

Analog land mobile radio continues to maintain relevance in cost-sensitive deployments and low-density coverage areas where migration timelines remain extended. However, this segment is expanding at a comparatively slower pace, with an estimated CAGR of around 4.8%, as long-term spectrum strategies and public-sector modernization frameworks continue to favor digital standards over analog systems.

By Frequency

By frequency, UHF systems represented the leading subsegment in 2025, accounting for approximately 58% of market revenue. UHF radios are widely adopted due to better signal penetration in dense urban environments, indoor facilities, and complex infrastructure settings. Their suitability for metropolitan public safety operations, transportation hubs, airports, and utilities supports sustained deployment across high-density regions.

VHF systems remain critical for wide-area and rural communication requirements, particularly in forestry, mining, oil and gas, and remote utility operations. This segment is expected to grow at a moderate CAGR of about 5.3%, supported by longer transmission range, lower infrastructure density requirements, and continued government allocation of VHF spectrum for regional and industrial use cases.

By System Type

By system type, portable radios dominated the market in 2025, contributing nearly 46% of total revenue. High unit deployment volumes, frequent replacement cycles, and extensive use by frontline personnel across public safety, transportation, and industrial operations underpin this dominance. Ongoing improvements in battery life, ruggedization, and ergonomic design further sustain demand for portable devices.

Mobile radios and fixed infrastructure systems continue to experience steady expansion as agencies invest in fleet-wide communication coverage and network reliability. Infrastructure-related systems are projected to grow at an estimated CAGR of around 7.9%, driven by investments in base stations, repeaters, and network upgrades aimed at improving coverage resilience, redundancy, and operational continuity.

By Distribution Channel

Based on distribution channel, direct sales accounted for the largest market share in 2025, representing approximately 49% of total revenue. Government agencies and large enterprises typically prefer direct procurement models to ensure compliance, customization, long-term service contracts, and secure deployment of mission-critical communication systems.

System integrators are witnessing faster growth, with an estimated CAGR of about 8.4%, driven by increasing demand for turnkey solutions that integrate radios, network infrastructure, software platforms, and lifecycle services. Distributors and dealers continue to serve smaller agencies and commercial users, supporting localized deployment and after-sales service, particularly in emerging markets.

By Price Range

By price range, the mid-range segment dominates in terms of volume, accounting for approximately 44% of total shipments in 2025. This segment benefits from a balance between performance, durability, and cost efficiency, making it suitable for public utilities, transportation operators, and mid-sized enterprises.

The premium segment is expected to grow at a faster pace, registering an estimated CAGR of around 9.1%, supported by demand for advanced encryption, ruggedized designs, extended battery performance, and integrated software capabilities. Economy models continue to find adoption in budget-constrained deployments, particularly in rural and emerging regions, contributing steady but slower growth.

By End User

By end user, public safety accounted for the largest share of the market in 2025, representing approximately 41% of total revenue. Sustained government investment in emergency response systems, disaster preparedness, and secure communication infrastructure underpins this segment’s leadership. Mandatory interoperability standards and long-term procurement programs further reinforce consistent demand.

Transportation and utilities are expected to witness the fastest growth, with an estimated CAGR of around 8.6%, driven by rail network expansion, grid modernization initiatives, and increasing emphasis on operational safety and real-time coordination. Industrial and commercial users continue to adopt LMR systems to enhance workforce safety and on-site communication reliability, contributing steady incremental demand across manufacturing, logistics, and large facility operations.

Regional Insights

North America

North America accounted for approximately 32% of the global market in 2025, supported by sustained investments in public safety communication systems, defense modernization, and critical infrastructure protection. High adoption across the United States and Canada is driven by federal, state, and municipal agencies that rely on LMR networks for mission-critical voice communication during emergencies, disaster response, and daily operations. Major metropolitan regions continue to prioritize interoperable and resilient radio networks to support law enforcement, fire services, emergency medical services, and transportation authorities.

Government-backed programs play a central role in market stability. In the United States, public safety spectrum allocation policies, nationwide interoperability frameworks, and funding support for emergency communications modernization have accelerated replacement of legacy analog systems with digital LMR platforms. Federal emergency preparedness initiatives and homeland security programs further support demand for secure, encrypted, and highly reliable communication infrastructure. Canada follows similar modernization efforts through nationwide public safety communication upgrades, particularly across provincial emergency services and transportation networks.

Asia Pacific

Asia Pacific is projected to represent approximately 34% of the global market in 2025, driven by rapid urbanization, expanding public infrastructure, and rising investments in disaster management and internal security systems. Countries such as China, India, Japan, South Korea, and Australia are strengthening nationwide emergency communication frameworks to address natural disasters, urban congestion, and large-scale public events. Dense population centers and expanding industrial corridors continue to generate sustained demand for professional radio communication systems.

Government-led initiatives are a primary growth driver across the region. National disaster response agencies, rail authorities, airport operators, and law enforcement bodies are upgrading LMR networks to improve coverage, reliability, and interoperability. In India, emergency response modernization, smart city programs, and transportation safety initiatives have increased deployment of digital radio systems across police, fire, railways, and municipal services. In China, public safety and transportation authorities continue to invest in secure communication infrastructure aligned with national emergency preparedness objectives.

Europe

Europe accounted for approximately 19% of the market in 2025, supported by public safety modernization, cross-border interoperability requirements, and stringent security standards. Countries including Germany, the United Kingdom, France, Italy, Spain, and the Nordic region maintain strong demand for LMR systems across law enforcement, emergency medical services, railways, airports, and utility operators. Modernization of aging communication infrastructure remains a priority across Western and Northern Europe.

Growth is reinforced by government-backed public safety frameworks and regional interoperability mandates that emphasize secure, resilient, and coordinated communication during emergencies. Emergency response agencies are upgrading digital radio networks to meet operational continuity, encryption, and resilience requirements. Transportation authorities across Europe are also expanding LMR adoption to support rail safety, airport ground operations, and tunnel communications, particularly in high-traffic and cross-border transit corridors.

Other Regions

Other regions, including Latin America, the Middle East, and Africa, collectively contribute approximately 15% of the global market, with the remaining share distributed across smaller regional markets. Growth in these regions is supported by gradual modernization of public safety infrastructure, expansion of urban transportation systems, and increasing government focus on disaster preparedness and critical infrastructure protection.

Government-backed emergency response programs, national security initiatives, and investments in transportation safety are encouraging adoption, particularly across metropolitan areas and industrial zones. While overall penetration remains lower compared with North America, Asia Pacific, and Europe, these regions represent long-term opportunities as governments continue to strengthen public safety communication frameworks.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on technology upgrades, network reliability, and geographic expansion. Vendors are investing in digital LMR platforms, encryption, interoperability, and lifecycle support to meet public safety and critical infrastructure requirements. Market adoption is reinforced by government-backed emergency communication modernization programs, public safety spectrum policies, and national disaster preparedness frameworks, which promote deployment of secure, resilient, and interoperable radio networks across North America, Europe, and Asia Pacific.

Mini Profiles

Anritsu provides radio test, measurement, and network assurance solutions supporting land mobile radio deployment, optimization, and compliance, leveraging strong engineering expertise and global service capabilities for mission-critical communication networks.

BK Technologies operates primarily in the public safety segment, focusing on rugged LMR devices designed for reliability and interoperability, supported by long-standing relationships with emergency services and cost-efficient product positioning.

Hytera Communications Corporation Limited delivers digital and analog land mobile radio systems, emphasizing interoperability, encryption, and scalable platforms, supported by broad product portfolios and strong presence across public safety and commercial users.

Icom Inc. specializes in professional and industrial radio communications, emphasizing performance, durability, and audio quality, supported by strong brand recognition and extensive global distribution across commercial and government customers.

JVCKENWOOD Corporation focuses on professional radio and communication solutions, combining advanced digital technology with manufacturing expertise and global partnerships to support public safety, transportation, and critical infrastructure communication needs.

Key Players

- Anritsu

- Airbus DS Communications

- BK Technologies

- Codan Limited

- Hytera Communications Corporation Limited

- Icom Inc.

- JVCKENWOOD Corporation

- Kenwood Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Motorola Solutions, Inc.

- Simoco Wireless Solutions Limited

- Thales Group

Recent Developments

February 2026 - To increase its digital and advanced technology presence in Singapore, Thales Group inked three Memorandums of Understanding (MoUs) with the Singapore Economic Development Board (EDB), emphasizing talent, manufacturing, and innovation. Singapore will become one of three worldwide research hubs for this cloud-native platform as Thales expands its Inflight Entertainment (FlytEDGE) cloud R&D capabilities there. A cybersecure, AI-powered regulatory technology solution aimed at fintech and other regulated industries will be developed by Thales and EDB. Using platforms like AWS, Azure, and Google Cloud, this solution assists businesses in maintaining cloud security and compliance.

November 2025 - Agnet Direct, a multi-mode solution introduced by Airbus Public Safety and Security (PSS), enables mission-critical applications (MCX) users, including emergency services and public safety forces, to maintain communication with team members even in the absence of broadband (4G/5G) networks. The first safe, robust nationwide broadband communication network in Europe for emergency rescue and domestic security forces was created by Airbus and has been field-tested.

August 2025 - Motorola Solutions has closed the deal to acquire Silvus Technologies Holdings Inc., a company based in Los Angeles that specializes in high-speed software-defined mobile ad-hoc network (MANET) systems. The acquisition adds leadership in mobile ad-hoc networking to Motorola’s safety and security ecosystem and positions the company in a rapidly growing multi-billion-dollar market for unmanned systems and tactical connectivity.

Global Land Mobile Radio Market Coverage

Global Land Mobile Radio Market by Region

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Table of Contents for Land Mobile Radio Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

6. North America Market Estimate and Forecast

6.0..

U.S. Market Estimate and Forecast

6.0.1.

Canada Market Estimate and Forecast

6.0.2.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.0.3.

Germany Market Estimate and Forecast

7.0.4.

France Market Estimate and Forecast

7.0.5.

U.K. Market Estimate and Forecast

7.0.6.

Italy Market Estimate and Forecast

7.0.7.

Spain Market Estimate and Forecast

7.0.8.

Russia Market Estimate and Forecast

7.0.9.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.0.10.

China Market Estimate and Forecast

8.0.11.

Japan Market Estimate and Forecast

8.0.12.

India Market Estimate and Forecast

8.0.13.

South Korea Market Estimate and Forecast

8.0.14.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.0.15.

Brazil Market Estimate and Forecast

9.0.16.

Saudi Arabia Market Estimate and Forecast

9.0.17.

South Africa Market Estimate and Forecast

9.0.18.

U.A.E. Market Estimate and Forecast

9.0.19.

Other Countries Market Estimate and Forecast

10. Company Profiles

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Land Mobile Radio Market