Global Wireless Audio Device Market – Analysis and Forecast (2025-2030)

Industry Insight by Product (Headphones, Earphones, Speaker Systems, Headsets, Microphones, Soundbars, True Wireless Hearables/ Earbuds, and Others), by Technology (Smart Devices and Non-Smart Devices), by Functionality (AirPlay, Bluetooth, Wi-Fi, Bluetooth + Wi-Fi, Radio Frequency, and Others), by Application (Commercial, Consumer, Home Audio, Automotive, and Others), and Geography (North America, Europe, Asia Pacific and Rest of the World)

| Status : Published | Published On : Feb, 2024 | Report Code : VRSME9114 | Industry : Semiconductor & Electronics | Available Format :

|

Page : 220 |

Global Wireless Audio Device Market – Analysis and Forecast (2025-2030)

Industry Insight by Product (Headphones, Earphones, Speaker Systems, Headsets, Microphones, Soundbars, True Wireless Hearables/ Earbuds, and Others), by Technology (Smart Devices and Non-Smart Devices), by Functionality (AirPlay, Bluetooth, Wi-Fi, Bluetooth + Wi-Fi, Radio Frequency, and Others), by Application (Commercial, Consumer, Home Audio, Automotive, and Others), and Geography (North America, Europe, Asia Pacific and Rest of the World)

Wireless Audio Device Market Overview

The Global Wireless Audio Device Market reached USD 71.3 billion by 2023 and is projected to achieve USD 154.3 billion by 2030, with a strong compound annual growth rate (CAGR) of approximately 17.3% throughout the forecast period from 2025 to 2030.

Ideally, all wireless audio devices improve the functionality of audio accessories for PCs, laptops, smartphones, and gaming consoles. The wireless operation relies on different technologies, such as Bluetooth, RF, airplay, IR, Wi-Fi, and more. These technologies promote media streaming in real-time from the primary source to the output with seamless connectivity and offering convenience and flexibility.

As a result, these devices are used extensively for a wide range of applications in the consumer, commercial, defense, and automotive sectors, which accounts for the significant and continual growth of this market.

COVID-19 has also contributed to the growth of this specific market since the demand for home entertainment and video streaming platforms increased significantly as people stayed in their homes. Also, remote learning, remote workouts, and remote working have spurred the expansion of this market.

Market Segmentation

Insight by Product

The global wireless audio devices market can be divided into earphones, headphones, headsets, speaker systems, sound bars, microphones, earbuds or hearables, and more, based on the product. Out of these, the headphones segment is expected to grow significantly within the forecast period due to its extensive use and acceptance of the benefits offered, such as seamless data transmission wirelessly from the source, like smartphones, to output units, such as speakers with built-in control functions.

Insight by Technology

Based on the technologies, the market can be divided into smart and non-smart gadgets. Reports show that the former will grow significantly and at a much faster rate than the latter due to extensive technological advancements.

Insight by Functionality

The market can also be divided based on the functionality into Bluetooth, Wi-Fi, Airplay, Radio Frequency, Bluetooth and Wi-Fi combo, and more.

Out of these all, the Bluetooth + Wi-Fi combo segment holds the larger share of the market and is expected to grow significantly due to the increase in demand for wireless devices for their portability, seamless connectivity, and cost-effectiveness.

Insight by Application

Based on diverse applications, this market can also be divided into commercial, home audio, consumer, automotive, and more. Out of these, the consumer segment is expected to grow more than the other segments within the forecast period due to wider acceptance and use of headsets, headphones, and speakers with computers, smartphones, and gaming consoles.

Global Wireless Audio Device Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 71.3 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 154.3 Billion |

|

Growth Rate |

17.3% |

|

Segments Covered in the Report |

By Product, By Technology, By Application, |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific and Rest of the World |

Industry Dynamics

Industry Trends

One of the most notable trends witnessed in this industry is the rise in the use of connected devices. In addition, technological improvements, innovative products, and increased spending on semiconductors are also worth mentioning in this regard.

Moreover, the growth dynamics of this market are subject to the increased use of wireless audio systems in the defense sector for secure, seamless, long-distance communication.

Growth Drivers

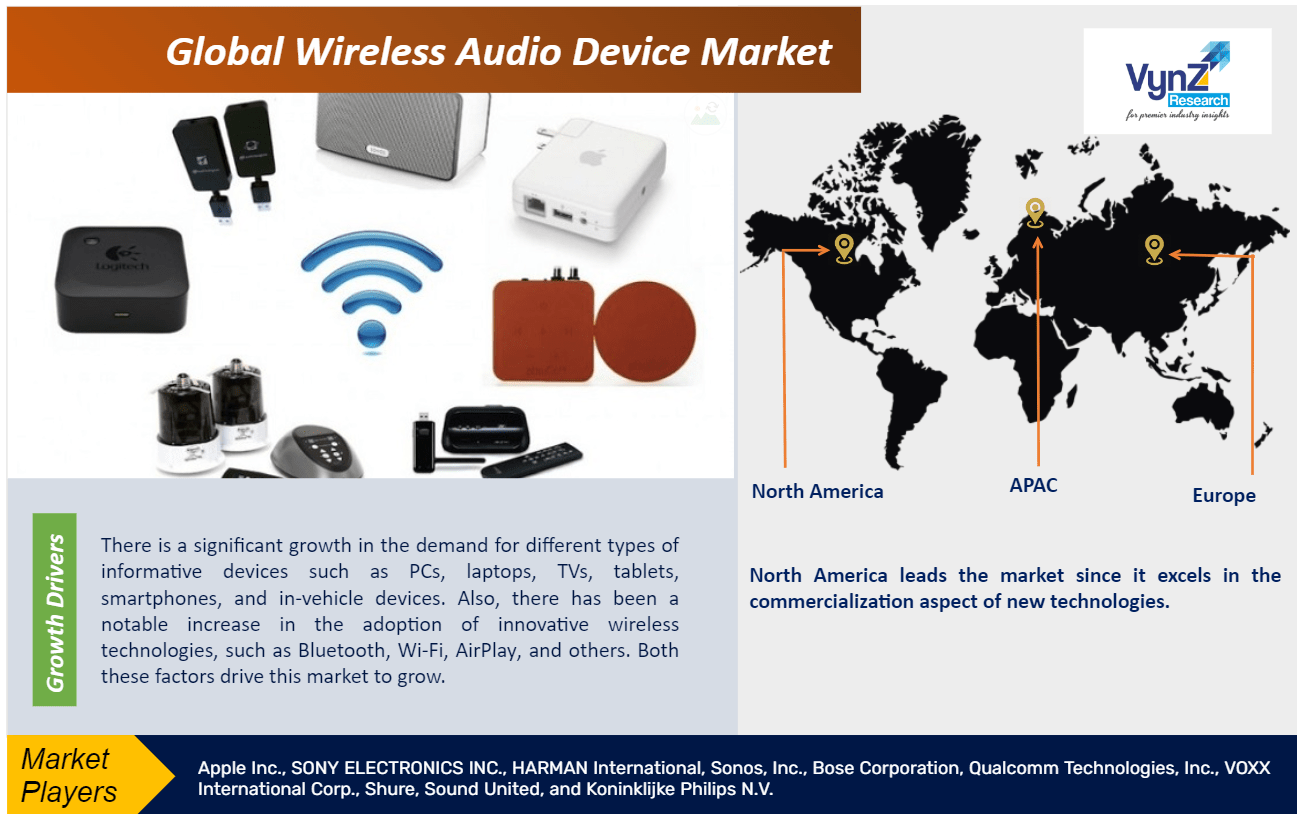

There is a significant growth in the demand for different types of informative devices such as PCs, laptops, TVs, tablets, smartphones, and in-vehicle devices. Also, there has been a notable increase in the adoption of innovative wireless technologies, such as Bluetooth, Wi-Fi, AirPlay, and others. Both these factors drive this market to grow.

The benefits offered by these systems also account for the growth of the market. These benefits include improved technology that promises seamless connectivity and better reception and transmission of signals, convenience in use since there are no wires required to connect devices,durability, and longevity.

Consumers today have a higher demand for mobile solutions such as cloud services, and others and the Original Equipment Manufacturers are investing more in research and development for better products to cater to the needs of the people.The devices today offer better features such as remote accessibility, portability, and ease of installation and maintenance, better and faster audio transmission, which has resulted in growing popularity.These devices, therefore, can be used for various applications in different sectors, such as media, entertainment, education, sports, conferences, meetings, news broadcasting, auctions, and more.And, as said earlier, the impact on society and lifestyle has also spurred the growth of the global wireless audio device market.

Restraints

There are severe restrictions imposed by the government on the volume of audio devices since exposure to high sound levels of more than 85 decibels for more than 8 hours can cause hearing impairment. Also, strict government regulations, privacy, quality, and power concerns impede market growth. Efforts are however made to liberalize things including mitigating health hazards so that the growth of this market is not hampered.

Opportunities

The growth of global wireless audio devices is not going to be affected significantly despite the obstacles due to continual and rapid technological improvements. These gadgets offer better performance and convenience to the users along with other influencing factors for its expansion.

Geographic Overview

North America leads the market since it excels in the commercialization aspect of new technologies. Moreover, the rising popularity and adoption among users of electronic devices and the importance of innovative wireless technologies will also foster its growth in this specific region.

On the other hand, the Asia-Pacific countries are also expected to grow significantly during the forecast period due to a high CAGR, continual economic growth, growing adoption of such devices in the consumer electronics segment, and faster industrialization.

Key Players Covered in the Report

Some of the major players in the wireless audio device industry include Apple Inc., SONY ELECTRONICS INC., HARMAN International, Sonos, Inc., Bose Corporation, Qualcomm Technologies, Inc., VOXX International Corp., Shure, Sound United, and Koninklijke Philips N.V.

Recent Developments by Key Players

Sony has launched three wireless microphones with exceptional sound quality, unparalleled portability and lightweight. ECM-S1 enables clear sound pickup with high-quality streaming microphone sound for in-camera audio recording and ECM-W3 and ECM-W3S allow for a wide range of shooting.

Harman International (Samsung’s wholly owned audio electronics) has acquired Roon Labs (the US-based high-end music streaming platform) for its streaming platform and hi-fi sound. Roon offers a music player platform with a rich interface for browsing and discovering music. It is supported by various operating systems which is compatible with any audio device.

The Wireless Audio Device Market report includes a comprehensive market segmentation analysis as well as projections for the analysis period 2025-2030.

Segments Covered in the Report

- By Product

- Headphones

- Earphones

- Speaker Systems

- Headsets

- Microphones

- Sound Bars

- True Wireless Hearables/ Earbuds

- Others

- By Technology

- Smart Devices

- Non-Smart Devices

- By Functionality

- Airplay

- Bluetooth

- Wi-Fi

- Bluetooth + Wi-Fi

- Radio Frequency

- others

- By Application

- Commercial

- Consumer

- Home Audio

- Automotive

- Others

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

.png)

To explore more about this report - Request a free sample copy

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Wireless Audio Device Market