Commercial Space Payload Market Overview

The Global Commercial Space Payload Market was valued at $ 25.55 billion in 2025 and is estimated to reach around $ 27.61billion in 2026. .It is projected to reach around $55.55 billion by 2035, expanding at a CAGR of about 8.08 % during the forecast period from 2026 to 2035 .

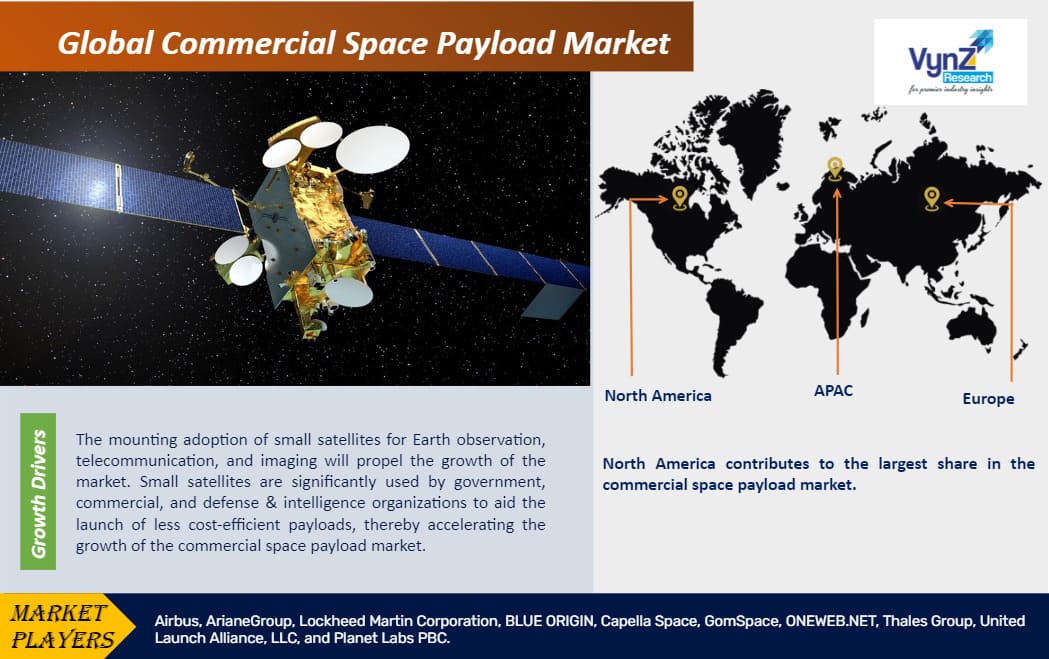

Commercial space payloads are revenue-generating satellites or cargo that are launched into Earth's orbit by a space launch vehicle. Satellites are sophisticated radio-based instruments and communication systems that can be used for a variety of purposes, including Earth observation and remote sensing, communication, and satellite internet. The payload contains antennas, receivers, and transmitters for data transmission and storage, both in space and on the ground, to enable the delivery of satellite communication services.

The commercial space payload industry makes money by launching satellites into Earth's orbit, primarily in Low Earth Orbit (LEO) and Geosynchronous Earth Orbit (GEO). Many governments and commercial organizations, including SpaceX, Ariane Space, the European Space Agency (ESA), the National Aeronautics and Space Administration (NASA), and the Japan Aerospace Exploration Agency (JAXA), began demonstrating the new propulsion system for various satellites in Low Earth Orbit between 1957 and 2021. (LEO). Since then, technology has progressed at a rapid speed, transforming the entire space industry through the development of novel goods and systems.

The pandemic has disrupted supply chains, causing satellite launches to be postponed. The market has also been harmed by a shortage of components as a result of laws governing the import and export of commodities.

Commercial Space Payload Market Segmentation

Insight by Product

- Nano and Microsatellite

- Small Satellite

- Medium Satellite

- Large Satellite

The small satellite is anticipated to grow at a faster pace during the projected period owing to increased demand for small satellites in several industries like television & entertainment, aviation, military, and space research & development.

Insight by Orbit

- GEO

- MEO

- LEO

- Communication

- Earth Observation and Remote Sensing

- Space Exploration

- Surveillance and Reconnaissance

The GEO segment is anticipated to be the fastest-growing segment during the projected period owing to increased demand for direct-to-home (D2h) broadcasting, internet, and regional mobile telecommunication services.

Insight by Application

Communication application is anticipated to have significant growth during the projected period owing to increased demand for remote sensing, Earth observation, and navigation, surveillance, and satellite internet. Moreover, the increased demand for navigation among consumers will drive the industry players to focus on the communication segment in the commercial space payload market.

Global Commercial Space Payload Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 25.55 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 55.55 Billion

|

|

Growth Rate

|

8.08%

|

|

Segments Covered in the Report

|

By Product, By Orbit, and By Application

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Industry Trends

The increased demand for Earth observation to deliver high-resolution imagery which is used in civil engineering & construction, transportation, agriculture & forestry industries, and increased investment by the defense sector to have high-speed communication services and navigation are the trends in the commercial space payload market.

Commercial Space Payload Market Growth Drivers

The mounting adoption of small satellites for Earth observation, telecommunication, and imaging will propel the growth of the market. Small satellites are significantly used by government, commercial, and defense & intelligence organizations to aid the launch of less cost-efficient payloads, thereby accelerating the growth of the commercial space payload market. Furthermore, technological development such as miniaturization of components, microelectronics, materials, and software, rising number of commercial satellite launches, growing deep space exploration missions, increased usage of software-defined satellites, and increasing trend of the hosted payload will accelerate the growth of the market.

Commercial Space Payload Market Challenges

The rising concerns about space debris as a result of more satellite payload launches, technical issues related to low-cost space technologies, as well as strict government rules associated with a satellite launch, are projected to impede market expansion.

Commercial Space Payload Market Opportunities

The growing investments by governments and research institutions globally, as well as increasing usage of satellite constellations for high-speed communication services, are likely to provide growth prospects during the projection period.

Commercial Space Payload Market Geographic Overview

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Vietnam

- Thailand

- Malaysia

- Rest of Asia-Pacific

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

North America contributes to the largest share in the commercial space payload market owing to the rising investment in R&D that emphasizes military & defense and space exploration applications and the presence of established players like Raytheon Technologies, Lockheed Martin Corporation, and Honeywell International Inc. in the region. Also, the industry players are emphasizing adopting satellite connectivity technologies to enhance operations in the region.

Commercial Space Payload Market Competitive Insight

Some of the key players are :

- Airbus

- ArianeGroup

- Lockheed Martin Corporation

- BLUE ORIGIN

- Capella Space

- GomSpace

- ONEWEB NET

- Thales Group

- United Launch Alliance, LLC

- Planet Labs PBC

There is increased commercialization of space and private funding from several organizations. With increased global competition and new entrants, the international arena is changing. Due to flexible techniques, quick development, and lower prices, large, medium-sized, and startup firms are investing in space technologies. Innovative applications, new operators, and new finance sources are all on the rise in the industry. Many startups are putting money into nanosatellite constellations in order to provide high-speed communication, navigation, and imaging services. This new ecosystem will offer highly efficient and cost-effective satellite control and monitoring software, specialized subsystems, solar panels, batteries, and rockets.

ArianeGroup designs and manufactures high-performance propulsion and equipment for satellites and other spacecraft, as well as payload equipment and instruments for commercial, institutional, and science satellites. ArianeGroup provides propulsion systems, equipment, and services for satellites of all sizes, from the largest geostationary platforms to the tiniest microsatellites, as well as other spacecraft, kick stages, service modules, landing modules. In addition to multi-payload dispensers for the launch of smallsats and constellations, their equipment includes composite structures, mechanics, star trackers, and more. They also provide a comprehensive range of launch support services, such as consultancy, testing, and propellant management.

For government and commercial customers, Lockheed Martin Corporation builds satellites and spacecraft that perform incredible feats in space. Satellites produced by Lockheed Martin provide early warning of severe weather, connect troops on the battlefield, and provide GPS directions to a billion people across the world. They'll also be driving technologies in the future to enable customers to achieve even more in space. That's why they're developing smarter satellites that work like smartphones in the sky, with software that can be updated in orbit and react to changing mission requirements on the ground.

Airbus has been contracted to provide more than fifteen satellite platforms derived from the Airbus Arrow platform and supply them to space start-up Loft Orbital. Arrow is the OneWeb constellation's primary satellite platform. There are 394 Airbus Arrow platforms in orbit for the OneWeb constellation, with another 254 on the way to complete the constellation's 648 spacecraft requirement. Loft Orbital confirms its intention to make the Airbus Arrow platform a true workhorse, enabling its service business model, with this acquisition.

ESA has chosen payloads that best fit the profile of the first mission of its new-generation Ariane 6 launch vehicle from Europe's Spaceport in French Guiana, in conjunction with ArianeGroup and Arianespace.

Orbital Reef, a commercially developed, owned, and operated space station to be built in low Earth orbit, was unveiled today by Blue Origin and Sierra Space. By supporting the emergence of a healthy ecosystem and economic model for the future, the station will usher in the next chapter of human space exploration and development.

Recent Developments by Key Players

Blue Origin has launched its 35th New Shepard suborbital mission. The Blue Origin capsule carried more than 40 scientific payloads on its suborbital flight, including 24 payloads from the NASA TechRise Student Challenge, which empowers teams of 6th-12th graders to design, build and launch experiments on NASA supported test flights.

GomSpace has signed a contract with Unseenlabs to deliver two additional cube satellites to extend the service capacity of the current generation in orbit.

The Commercial Space Payload Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

.png)

.png)