Global Satellite and Spacecraft Subsystem Market – Analysis and Forecast (2026-2035)

Industry Insight by Satellite Subsystem (payload, electrical and power subsystem, command and data handling system, communication subsystem, thermal control subsystem, attitude determination and control subsystem, propulsion system, mechanism, actuator, and structure), by Launch Vehicle Subsystem (structure, avionics, propulsion system, control system, electrical system, stage separation, and thermal system), by Deep Space Probe Subsystem (stage separation, thermal system, and others), by End-use Industry (commercial, civil government, defense, research and academics, and other end-use industry), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Sep, 2025 | Report Code : VRAD12021 | Industry : Aerospace and Defense | Available Format :

|

Page : 220 |

Global Satellite and Spacecraft Subsystem Market – Analysis and Forecast (2026-2035)

Industry Insight by Satellite Subsystem (payload, electrical and power subsystem, command and data handling system, communication subsystem, thermal control subsystem, attitude determination and control subsystem, propulsion system, mechanism, actuator, and structure), by Launch Vehicle Subsystem (structure, avionics, propulsion system, control system, electrical system, stage separation, and thermal system), by Deep Space Probe Subsystem (stage separation, thermal system, and others), by End-use Industry (commercial, civil government, defense, research and academics, and other end-use industry), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Satellite and Spacecraft Subsystem Market Overview

Satellites and spacecraft consist of various subsystems that work harmoniously to ensure their functionality. The power subsystem manages energy through solar panels or batteries, providing electricity for operations. Communication subsystems enable data transmission to and from Earth, often utilising antennas and transponders. Thermal control systems regulate temperature, preventing equipment overheating or freezing. Guidance, navigation, and control subsystems ensure precise positioning and orientation. Payload subsystems carry instruments or equipment for specific missions, such as cameras or scientific instruments. Additionally, propulsion subsystems allow orbital maneuvers or trajectory adjustments. These interdependent subsystems collectively enable satellites and spacecraft to perform diverse tasks, from Earth observation to deep space exploration.

Global Satellite and Spacecraft Subsystem Market was worth USD 30.40 billion in 2025 and is expected reach USD 45.00 billion by 2035 with a CAGR of 5.47% during the forecast period, i.e., 2026-2035. The growing demand for satellite and spacecraft subsystem is driven by increasing demand for satellite-based services, growth in space exploration initiatives, rising commercial space activities, and advancements in satellite technology. Additionally, the expanding satellite communication and Earth observation sectors contribute to the market's sustained growth.

Geographically, the global satellite and spacecraft subsystem market is expanding rapidly in North America, Europe, and the Asia Pacific, as a result of increased investments in space exploration, rising demand for satellite-based services, technological advancements, and supportive government policies fostering space industry growth in these regions; however, the market confronts constraints such as the increasing threat of space debris, regulatory complexities, limited spectrum availability, and the high costs associated with research, development, and deployment. Overall, the satellite and spacecraft subsystem market offer potential prospects for market participants to develop and fulfill the growing needs of wide range of industries including commercial, civil government, defence and other industries.

Satellite and Spacecraft Subsystem Market Segmentation

Insight by Satellite Subsystem

Based on the satellite subsystem type, the global satellite and spacecraft subsystem market is segmented into payload, electrical and power subsystem, command and data handling system, communication subsystem, thermal control subsystem, attitude determination and control subsystem, propulsion system, mechanism, actuator, and structure. Payload segment dominated the global satellite and spacecraft subsystem market, as it encompasses mission-specific instruments critical for satellite objectives. For instance, SpaceX launched the Falcon 9 rocket carrying the Landsat 9 satellite, equipped with advanced imaging payload for Earth observation. Similarly, the James Webb Space Telescope, set for launch in December 2021, features a sophisticated scientific payload for deep space exploration. Payloads determine a satellite's purpose, from communication instruments to scientific sensors, making them pivotal. The market's growth is driven by increasing demand for specialized payloads across diverse applications, including telecommunications, remote sensing, and scientific research.

Insight by Launch Vehicle Subsystem

Based on launch vehicle subsystem, the global satellite and spacecraft subsystem market is segmented into structure, avionics, propulsion system, control system, electrical system, stage separation, and thermal system. Structure launch vehicle subsystem dominated the market due to the continuous demand for efficient launch solutions. Arianespace successfully launched the OneWeb 16 mission using the Ariane 5 rocket, showcasing the significance of robust launch vehicle structures. Additionally, the increasing trend of small satellite deployments, like the Rocket Lab Electron launch in carrying multiple small satellites, emphasizes the importance of adaptable and cost-effective launch vehicle subsystems. The demand for reliable and versatile structures for various payload sizes and mission profiles contributes to the prominence of this segment in the evolving space industry.

Insight by Deep Space Probe Subsystem

Based on deep space probe subsystem, the global satellite and spacecraft subsystem market is segmented into stage separation, thermal system, and others. Thermal system dominated the market, due to the critical role it plays in regulating temperatures during prolonged space missions. NASA's Europa Clipper, planned for launch, emphasizes the significance of thermal systems in deep space exploration. The spacecraft will employ advanced thermal control technologies to withstand extreme temperature variations near Jupiter's moon Europa. The success of deep space missions relies on maintaining optimal operating conditions for instruments and subsystems, making thermal systems indispensable. As space agencies and private entities pursue ambitious deep space exploration, the demand for effective thermal management solutions continues to drive this segment's dominance in the market.

Insight by End-use Industry

Based on end-use industry, the global satellite and spacecraft subsystem market is segmented into commercial, civil government, defense, research and academics, and other end-use industry. Commercial industry dominated the global satellite and spacecraft subsystem market due to a surge in private space ventures. SpaceX's Falcon 9 launched the Transporter-5 mission, deploying numerous commercial payloads. Furthermore, companies like Blue Origin, with its New Shepard suborbital rocket, exemplify the increasing private investment in spacecraft subsystems for research and tourism. The burgeoning satellite internet sector is also pivotal, highlighted by OneWeb's constellation expansion, initiated with a Soyuz rocket launch. This shift towards commercial endeavors underscores the market's transformation, driven by innovation, cost efficiency, and increased accessibility to space, creating opportunities for satellite and spacecraft subsystem providers.

Global Satellite and Spacecraft Subsystem Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 30.40 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 45 Billion |

|

Growth Rate |

5.47% |

|

Segments Covered in the Report |

By Satellite Subsystem, By Launch Vehicle Subsystem, By Deep Space Probe Subsystem and By End-Use |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and South America |

Industry Dynamics

Satellite and Spacecraft Subsystem Market Growth Drivers

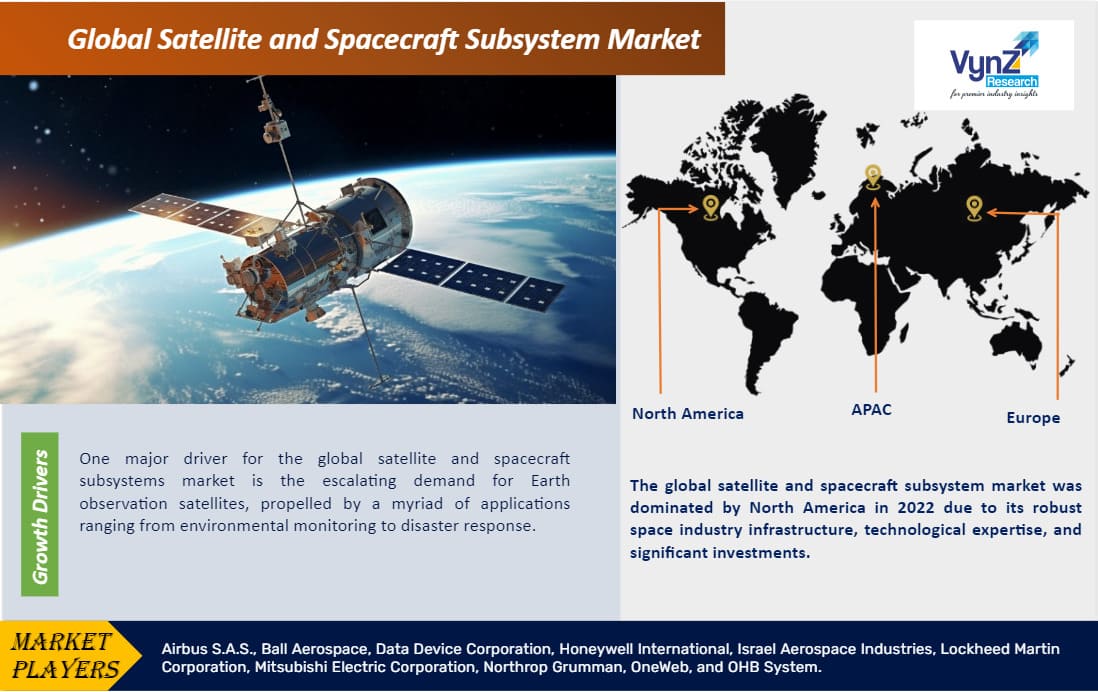

Escalating demand for Earth observation satellites

One major driver for the global satellite and spacecraft subsystems market is the escalating demand for Earth observation satellites, propelled by a myriad of applications ranging from environmental monitoring to disaster response. In October 2022, the European Space Agency (ESA) launched the Sentinel-6 Michael Freilich satellite to enhance global sea-level monitoring, showcasing the critical role of satellite subsystems in collecting vital Earth data. This demand surge extends to the commercial sector, exemplified by Planet Labs launching multiple Earth imaging satellites in March 2023 to bolster their satellite constellation for daily Earth observation. The imperative for timely, accurate, and frequent Earth data, driven by environmental concerns and commercial opportunities, underscores the pivotal role of satellite and spacecraft subsystems in fulfilling these diverse observational needs, fostering continued market growth.

Increasing Environmental Consciousness

Rapid expansion of satellite-based communication networks is another major growth drivers for the global satellite and spacecraft subsystems market. The increased demand for global connectivity and high-speed internet fuels the deployment of communication satellites, driving the demand for advanced communication subsystems. In July 2022, SpaceX launched the Transporter-10 mission, deploying multiple communication satellites using the Falcon 9 rocket. Companies like SpaceX's Starlink, OneWeb, and Amazon's Project Kuiper are actively working on creating extensive satellite constellations to provide broadband services worldwide, emphasizing the critical role of communication subsystems in achieving this goal. The growing need for reliable and widespread internet coverage, especially in remote and underserved regions, propels continuous innovation and investment in satellite communication subsystems, contributing to the market's sustained growth.

Satellite and Spacecraft Subsystem Market Challenge

Rising threat of space debris

A significant challenge for the growth of the global satellite and spacecraft subsystems market is the increasing threat of space debris. The proliferation of defunct satellites and fragments poses risks to operational spacecraft, leading to potential collisions and damage. As of now, over 3,000 tons of space debris orbit the Earth. Addressing this challenge involves developing effective debris mitigation strategies and technologies to ensure the long-term sustainability of space activities. This necessitates international cooperation and innovative solutions to minimize space debris and safeguard the functionality and safety of satellite and spacecraft subsystems.

Geographic Overview

-

North America

-

Europe

-

Asia Pacific (APAC)

-

Middle East and Africa (MEA)

-

South America

The global satellite and spacecraft subsystem market is segmented into North America, Europe, the Asia-Pacific, South America, and the Middle East and Africa region. The global satellite and spacecraft subsystem market was dominated by North America in 2022 due to its robust space industry infrastructure, technological expertise, and significant investments. In June 2022, Northrop Grumman launched the MEASAT-3d satellite, showcasing the region's advanced capabilities in satellite manufacturing and deployment. Companies like SpaceX, based in the United States, play a pivotal role; in August 2022, SpaceX launched the Starlink 2-10 mission, underlining the region's leadership in deploying large-scale satellite constellations for global communication services. The concentration of major aerospace corporations, research institutions, and government initiatives in North America contributes to its dominance in the rapidly evolving satellite and spacecraft subsystems market.

Satellite and Spacecraft Subsystem Market Competitive Insight

Lockheed Martin Corporation holds a leading position in the global satellite and spacecraft subsystems market, offering a comprehensive range of space technologies. Their notable presence is evident in projects like the GPS III satellite constellation. In September 2022, Lockheed Martin successfully launched the GPS III-5 satellite, further expanding the U.S. Space Force's GPS network. This exemplifies Lockheed Martin's expertise in providing critical subsystems for navigation and communication satellites. The company's commitment to innovation is demonstrated through advancements in thermal management and propulsion subsystems, contributing to its strong market standing.

Airbus S.A.S. is a key player in the global satellite and spacecraft subsystems market, renowned for its diverse portfolio and international collaborations. A notable example is the successful launch of the European Space Agency's (ESA) Solar Orbiter mission in February 2020. Airbus designed and manufactured the spacecraft, showcasing their prowess in payload subsystems for scientific exploration. Additionally, Airbus plays a crucial role in Earth observation with projects like the Copernicus program. Their focus on sustainability is evident in initiatives like developing efficient satellite propulsion systems, reinforcing Airbus's influential position in the evolving satellite subsystems market.

Recent Development by Key Players

IAI (Israel Aerospace Industries) and DCX Systems Limited have fformed a new joint venture (JV) to support the Indian Government’s 'Make in India' vision. The new JV named ELTX, shall deliver transfer of knowledge and technology of high-end defense systems' capabilities such as airborne radars and ground systems for the Indian defense sector.

Mitsubishi Electric Corporation and Nozomi Networks collaborated where Mitsubishi Electric will acquire Nozomi Networks, a global vendor in OT (operational technology), IoT, and CPS security. Nozomi will operate as a wholly owned subsidiary upon completion, maintaining its independent structure. The acquisition is designed to accelerate Nozomi’s cybersecurity innovation while preserving its heterogeneous approach to customer and partner support. Thispartnership shall harness data and AI to advance cyber defense, enhance operational efficiency, and strengthen resilience across industrial environments.

Key Players Covered in the Report

Airbus S.A.S., Ball Aerospace, Data Device Corporation, Honeywell International, Israel Aerospace Industries, Lockheed Martin Corporation, Mitsubishi Electric Corporation, Northrop Grumman, OneWeb, and OHB System.

The satellite and spacecraft subsystem market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2025–2030.

Segments Covered in the Report

-

By Satellite Subsystem

-

Payload

-

Electrical and Power Subsystem

-

Command and Data Handling System

-

Communication Subsystem

-

Thermal Control Subsystem

-

Attitude Determination and Control Subsystem

-

Propulsion System

-

Mechanism

-

Actuator

-

Structure

-

By Launch Vehicle Subsystem

-

Structure

-

Avionics

-

Propulsion System

-

Control System

-

Electrical System

-

Stage Separation

-

Thermal System

-

By Deep Space Probe Subsystem

-

Stage Separation

-

Thermal System

-

Others

-

By End-Use Industry

-

Commercial

-

Civil Government

-

Defense

-

Research and Academics

-

Other end-use industry

Region Covered in the Report

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Rest of Europe

-

Asia-Pacific (APAC)

-

China

-

Japan

-

India

-

South Korea

-

Rest of Asia-Pacific

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

U.A.E

-

South Africa

-

Rest of MEA

-

South America

-

Argentina

-

Brazil

-

Chile

-

Rest of South America

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Satellite and Spacecraft Subsystem Market