Ceramic Tiles Market Size & Share - Growth Forecast Report (2036-2035)

Industry Insight by end user, the residential realm held the dominant profit share of nearly 64% in 2025, supported by affordable programs and rising private investments. Expanding middle income populations and bettered access to finance are contributing to stable long-term consumption across civic and semi civic regions. (Atlas Concorde S.p.A., Florim Ceramiche S.p.A., Grupo Lamosa, Kajaria Ceramics Limited, Mohawk Industries, Inc., Pamesa Ceramica, PORCELANOSA Grupo A.I.E., RAK Ceramics PJSC, SCG Ceramics PCL, Siam Cement Group), by Product Type (Floor Tiles, Wall Tiles, Others), by Construction Type (New Construction, Renovation & Replacement), by Distribution Channel (Offline, Online), by End User (Residential Consumers, Commercial Establishments, Institutional)

| Status : Published | Published On : Feb, 2026 | Report Code : VRCH2121 | Industry : Chemicals & Materials | Available Format :

|

Page : 186 |

Ceramic Tiles Market Size & Share - Growth Forecast Report (2036-2035)

Industry Insight by end user, the residential realm held the dominant profit share of nearly 64% in 2025, supported by affordable programs and rising private investments. Expanding middle income populations and bettered access to finance are contributing to stable long-term consumption across civic and semi civic regions. (Atlas Concorde S.p.A., Florim Ceramiche S.p.A., Grupo Lamosa, Kajaria Ceramics Limited, Mohawk Industries, Inc., Pamesa Ceramica, PORCELANOSA Grupo A.I.E., RAK Ceramics PJSC, SCG Ceramics PCL, Siam Cement Group), by Product Type (Floor Tiles, Wall Tiles, Others), by Construction Type (New Construction, Renovation & Replacement), by Distribution Channel (Offline, Online), by End User (Residential Consumers, Commercial Establishments, Institutional)

Ceramic Tiles Market Overview

The global ceramic tiles market, which was valued at roughly USD 204 billion in 2025 and is estimated to rise further over to nearly USD 212.36 billion in 2026, is projected to reach around USD 304.88 billion by 2035, expanding at a CAGR of about 4.1% during the forecast period from 2026 to 2035.

Market growth is driven by rapid-fire urbanization, expanding domestic and marketable construction. Rising demand for durable and low-consumption flooring accessories and ongoing investments in smart megacity and planning programs are further supporting expansion across major regions including China, India, and the United States.

Government-backed data from the World Bank highlights sustained global structure spending and civic population growth, both of which directly stimulate construction material consumption. The United Nations Human Settlements Program reports nonstop expansion of civic structure conditions, particularly across Asia Pacific. In addition, structure operations led by the Ministry of Housing and Urban Affairs and construction outlook assessments from the U.S. Census Bureau indicate steady increases in domestic permits and public workshop investments. These policy driven developments are strengthening long term demand for ceramic surfacing tiles across structured and rising construction markets.

Ceramic Tiles Market Dynamics

Market Trends

The market is witnessing structural shifts in design preferences, sustainability norms, and procurement strategies across domestic and marketable construction. A crucial trend is the growing preference for environmentally responsible and energy effective structures, reflecting alignment with sustainable construction promoted by the United Nations Environment Program and green structure guidelines supported by the International Energy Agency. These materials emphasize low carbon manufacturing, effective kiln technologies, and resource optimization, encouraging manufacturers to borrow recycled inputs and digital product systems.

Another rising trend is the rapid-fire waiver of large format and digitally published products, driven by technological modernization and evolving architectural norms. Construction outlook assessments issued by the U.S. Census Bureau and civic data from the National Bureau of Statistics of China indicate sustained growth in ultramodern domestic and mixed-use structure, supporting demand for aesthetic, high continuity surfacing results. These developments are encouraging companies to concentrate on advanced glazing technologies, bettered water resistance, and enhanced lifecycle performance, thereby reshaping competitive positioning within the sector.

Growth Drivers

Growth of the market is largely supported by sustained expansion in domestic and public structure development, which continues to induce harmonious demand across civic and semi civic regions. Structure investment data published by the World Bank highlights adding capital allocation toward transport networks, public installations, and affordable casing systems, all of which need durable flooring and wall covering accessories. Rising investments in smart megacity programs and civic redevelopment enterprise are further accelerating material consumption across developing economies.

Also, rising marketable real estate modernization are playing a pivotal part in boosting the market. Construction permit statistics released by the Ministry of Housing and Urban Affairs and construction pointers from the Eurostat demonstrate steady refurbishment exertion in hospitality, healthcare, and retail structure. As inventors prioritize continuity, humidity resistance, and long lifecycle performance, demand for advanced ceramic tiles is anticipated to remain stable throughout the forecast period.

Market Challenges

Despite favorable expansion prospects, the landscape faces challenges related to energy-intensive manufacturing and raw material cost volatility. Energy consumption reports from the International Energy Agency indicate that kiln blasting processes contribute significantly to greater energy demand, exposing manufacturers to fluctuations in energy and electricity pricing. Similar cost pressures affect operating perimeters, particularly for companies operating in price sensitive markets.

Also, environmental compliance conditions pose functional complications for manufacturers and suppliers. Regulatory laws covered by the European Environment Agency emphasize emigration reductions and waste operation norms for construction sector, adding capital expenditure on pollution control technologies. Dependence on imported raw materials and glazing composites can also lead to forced supply chain disruptions and delivery detainments and trade insecurity, impacting overall sector performance.

Market Opportunities

The market presents significant openings in sustainable construction and green structure instruments, particularly driven by climate adaptability programs and civic sustainability requirements. The United Nations Human Settlements Program encourage abdication of low conservation accessories and adopt affordable and flexible structure systems. Companies offering energy effective product processes and recyclable products are well deposited to capture incremental demand from institutional and public sector developments.

Another crucial opening lies in decoration architectural operations and digitally enabled manufacturing systems, where rising investments in automated product and smart quality control are creating avenues for functional effectiveness and periphery enhancement. Artificial modernization strategies outlined by the Organization for Economic Co-operation and Development punctuate robotization and digital metamorphosis in enhancing manufacturing productivity. Advancements in robotic glazing, data driven design customization, and perfection cutting technologies are anticipated to upgrade product isolation and long-term customer engagement across global construction markets.

Global Ceramic Tiles Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 204 Billion |

|

Revenue Forecast in 2035 |

USD 304.88 Billion |

|

Growth Rate |

4.1% |

|

Segments Covered in the Report |

Product Type, Construction Type, Application, Distribution Channel, End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Asia Pacific, Europe, North America, Rest of the World |

|

Key Companies |

Atlas Concorde S.p.A., Florim Ceramiche S.p.A., Grupo Lamosa, Kajaria Ceramics Limited, Mohawk Industries, Inc., Pamesa Ceramica, PORCELANOSA Grupo A.I.E., RAK Ceramics PJSC, SCG Ceramics PCL, Siam Cement Group |

|

Customization |

Available upon request |

Ceramic Tiles Market Segmentation

By Product Type

By product type, the market demonstrates strong attention in floor tiles, which reckoned for nearly 54% of total profit in 2025, supported by high continuity conditions and wide demand across residential and public flooring operations. Large scale developments and structure modernization programs continue to support structural demand, particularly in civic sector with sustained construction initiation.

Wall tile segment is projected to expand at about 6.8% during the forecast period, driven by rising demand for ornamental interior and humidity resistant walls. Growth is further supported by hospitality and healthcare construction sectors, where hygiene norms and conservation effectiveness remain critical considerations. Other technical formats are anticipated to grow at nearly 5.4%, reflecting stable indigenous operation patterns and climate-driven construction preferences.

By Construction Type

By construction type, new construction reckoned for roughly 61% of the total request share in 2025, supported by expanding domestic and public construction. Civic population growth and smart megacity development continue to stimulate large scale design prosecution, sustaining primary demand for durable surfacing accessories.

Renovation and replacement segments are anticipated to register growth of around 6.5%, driven by growing construction and modernization trends in developed markets. Adding expenditure on renovation and aesthetic upgrades, particularly in metropolitan regions, is strengthening the market further.

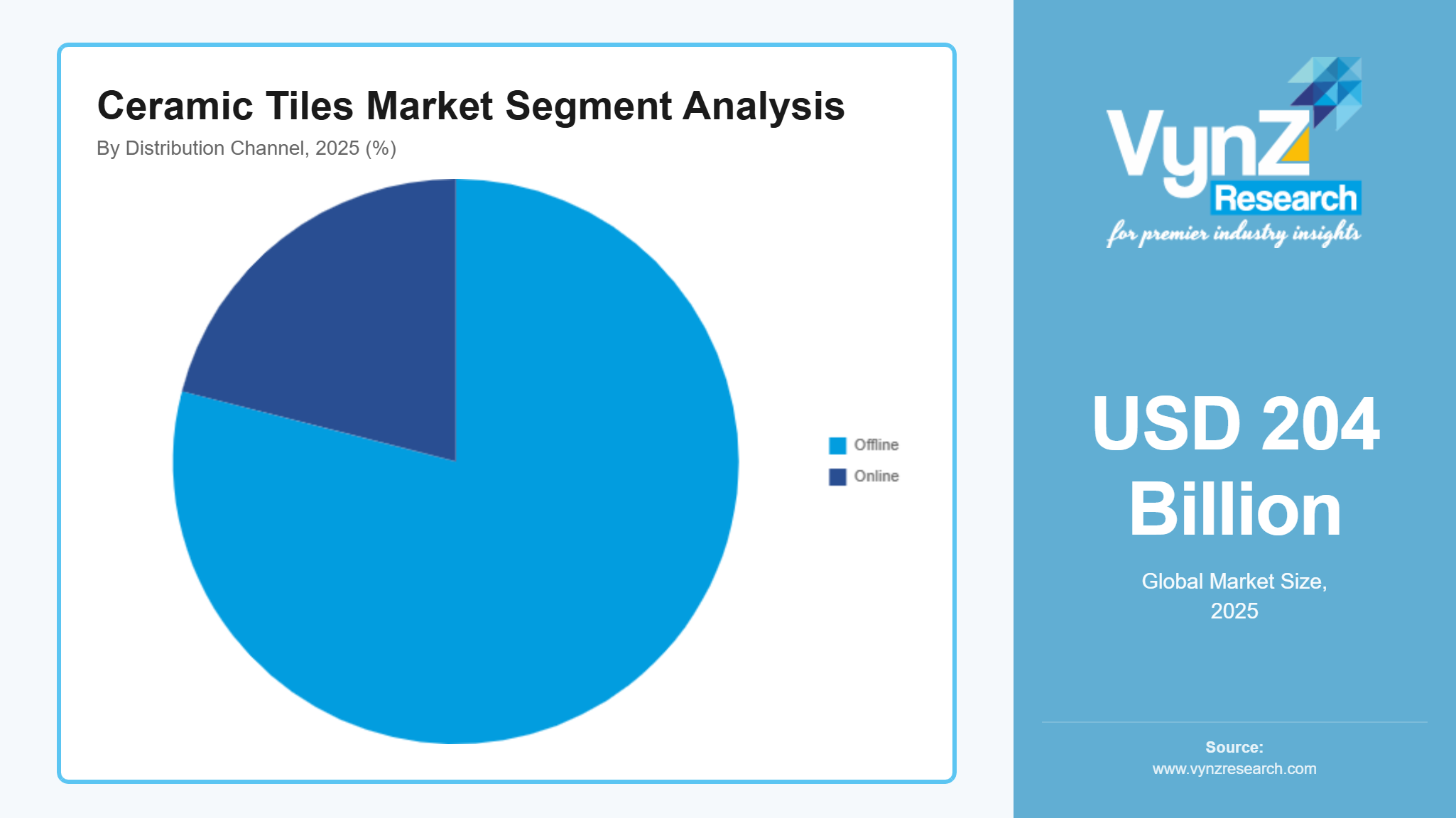

By Distribution Channel

By distribution channel, offline networks estimated for nearly 79% of total profit in 2025, as contractors and inventors continue to prioritize physical verification, bulk procurement arrangements, and established distributor connections. Traditional dealer networks remain critical in large design force chains and indigenous distribution systems.

Online channels are anticipated to grow at around 7.4%, supported by digital procurement integration and bettered logistics. Increased transparency in pricing and expanded access to product registers are attracting small contractors and individual buyers, contributing to growth in purchasing models.

By End User

By end user, the residential realm held the dominant profit share of nearly 64% in 2025, supported by affordable programs and rising private investments. Expanding middle income populations and bettered access to finance are contributing to stable long-term consumption across civic and semi civic regions.

The commercial segment is projected to expand at about 6.9%, driven by institutional development, retail structure upgrades, and hospitality expansion. Growth in public structure installations and mixed-use commercial structures is enhancing procurement volumes, strengthening overall market expansion.

Institutional application is anticipated to expand at about 6.3%, supported by public investment in healthcare, education, and transportation installations, reinforcing stable long-term demand across public construction systems.

Regional Insights

Asia Pacific

Asia Pacific registered nearly 38% of the market share in 2025, driven by large-scale residential construction, public structure and urbanization drives in China, India, Japan, South Korea, and Southeast Asia. Construction data published by the National Bureau of Statistics of China and development updates from the Ministry of Housing and Urban Affairs indicate sustained growth in civic constructions and smart megacity programs. Major civic centers including Shanghai, Mumbai, Tokyo, and Jakarta continue to induce strong procurement volumes.

Public construction and modernization programs are encouraging domestic building expansion. Regional profitable assessments released by the Asian Development Bank highlight ongoing capital allocation toward transport corridors, commercial complexes, and public installations, strengthening structural demand across domestic and institutional sectors.

Europe

Europe contributed roughly 25% of the market in 2025, supported by higher demand and strict construction quality norms across Germany, Italy, Spain, France, and the United Kingdom. Reports issued by Eurostat reflect steady spending and energy effectiveness upgrades in domestic and commercial structures.

Environmental regulations covered by the European Environment Agency are encouraging sustainable manufacturing practices and recyclable construction. Public investments in healthcare and transport structure modernization further support steady consumption situations across Western and Southern European countries.

North America

North America accounted for nearly 17% of the market in 2025, driven by domestic renovation drives and commercial construction across the United States, Canada, and Mexico. Construction statistics released by the U.S. Census Bureau indicate stable growth in institutional structure systems in metropolitan regions similar as New York, Los Angeles, Toronto, and Mexico City.

Energy effectiveness norms and green structure instruments promoted by public nonsupervisory agencies are farther encouraging use of durable and sustainable tiling products across public and private sector developments.

Rest of the World

The rest of the world registered 20% share of the market in 2025, which included Brazil and Argentina in Latin America, Saudi Arabia, Egypt and the United Arab Emirates in the Middle East, and South Africa along with other African regions. Growth in these regions is supported by civic expansion, tourism related structure, and public construction investments. Reports issued by the World Bank highlight ongoing capital expenditure in transport, housing, and public installations across developing regions.

Government backed diversification strategies and civic development programs are strengthening construction material demand, although penetration remains below that of Asia Pacific and Europe.

Competitive Landscape / Company Insights

The market is moderately to largely competitive, with global and indigenous manufacturers focusing on product invention, capacity expansion, and geographic diversification. Companies are investing in energy effective kiln technologies, digital printing systems, and sustainable manufacturing processes to strengthen functional effectiveness. Growing demand is supported by construction and structure programs covered by the World Bank and development overseen by the Ministry of Housing and Urban Affairs, encouraging companies to expand distribution networks and support long term market positioning.

Mini Profiles

Atlas Concorde S.p.A. focuses on ultra expensive ceramic tiles, supported by strong global distribution networks, advanced design capabilities, and brand recognition that reinforces its leadership in architectural and high-end domestic sectors.

Florim Ceramiche S.p.A. focuses in aesthetics and innovative design, sustainability, and high- performance ceramic tiles, supported by international outlets and a strong presence in luxury construction markets.

Grupo Lamosa leverages indigenous manufacturing strength and strategic agreements to expand market presence, offering cost-effective ceramic tiles supported by expansive distribution networks across Latin America and growing international operations.

Kajaria Ceramics Limited focuses on large-scale manufacturing, supported by brand leadership in India, effective product capacity, and wide dealer networks that strengthen its dominance in domestic and commercial construction sectors.

Mohawk Industries Inc. operates in large-scale decoration flooring tiles, emphasizing diversified product portfolios and global supply chain, supported by strong retail connections and multinational manufacturing capabilities that enhance competitive positioning.

Key Players

- Atlas Concorde S.p.A.

- Florim Ceramiche S.p.A.

- Grupo Lamosa

- Kajaria Ceramics Limited

- Mohawk Industries, Inc.

- Pamesa Ceramica

- PORCELANOSA Grupo A.I.E.

- RAK Ceramics PJSC

- SCG Ceramics PCL

- Siam Cement Group

Recent Developments

In November 2025, To boost operations and stop a decline in earnings, Siam Cement Pcl is investing an additional $500 million at its largest petrochemical facility in Vietnam. Vietnam has a very bright future in terms of economic growth and urbanization, thus the corporation wants to take advantage of its reduced expenses and expanding economy to offset Thailand's poor performance. With 50% of its output going to markets in China, Europe, and Australia and the remaining 50% going to Vietnam, the Long Son Petrochemicals Complex is predicted to make $1.5 billion in 2026 and have positive cash flow in 2028.

In May 2025, Atlas Concorde USA unveiled two new porcelain tile collections at Coverings 2025. Drawing from the beauty of natural materials, this year’s collections - Legacy Marblestone and Legacy Limestone—blend the finest details of different stones and expand their color range beyond what is found in nature to meet the world of interior design, according to the company.

Global Ceramic Tiles Market Coverage

Global Ceramic Tiles Market by Region

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Table of Contents for Ceramic Tiles Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

6. North America Market Estimate and Forecast

6.0..

U.S. Market Estimate and Forecast

6.0.1.

Canada Market Estimate and Forecast

6.0.2.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.0.3.

Germany Market Estimate and Forecast

7.0.4.

France Market Estimate and Forecast

7.0.5.

U.K. Market Estimate and Forecast

7.0.6.

Italy Market Estimate and Forecast

7.0.7.

Spain Market Estimate and Forecast

7.0.8.

Russia Market Estimate and Forecast

7.0.9.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.0.10.

China Market Estimate and Forecast

8.0.11.

Japan Market Estimate and Forecast

8.0.12.

India Market Estimate and Forecast

8.0.13.

South Korea Market Estimate and Forecast

8.0.14.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.0.15.

Brazil Market Estimate and Forecast

9.0.16.

Saudi Arabia Market Estimate and Forecast

9.0.17.

South Africa Market Estimate and Forecast

9.0.18.

U.A.E. Market Estimate and Forecast

9.0.19.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Atlas Concorde S.p.A.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Florim Ceramiche S.p.A.

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Grupo Lamosa

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Kajaria Ceramics Limited

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Mohawk Industries, Inc.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Pamesa Ceramica

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. PORCELANOSA Grupo A.I.E.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. RAK Ceramics PJSC

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. SCG Ceramics PCL

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Siam Cement Group

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Ceramic Tiles Market