GCC Green Buildings Market Size & Share | Growth Forecast Report 2036

Industry Insight by Building Type (Residential, Non-residential), Construction Type (New Construction Projects, Renovation / Retrofit Projects), Certification and Compliance Focus (Certified Green Buildings, Non-certified Sustainable Buildings), Application (Energy Efficiency, Water Efficiency, Indoor Environmental Quality, Sustainable Material Usage), End Use (Commercial, Residential, Hospitality, Institutional, Industrial)

| Status : Published | Published On : Feb, 2026 | Report Code : VRCH2118 | Industry : Chemicals & Materials | Available Format :

|

Page : 110 |

GCC Green Buildings Market Size & Share | Growth Forecast Report 2036

Industry Insight by Building Type (Residential, Non-residential), Construction Type (New Construction Projects, Renovation / Retrofit Projects), Certification and Compliance Focus (Certified Green Buildings, Non-certified Sustainable Buildings), Application (Energy Efficiency, Water Efficiency, Indoor Environmental Quality, Sustainable Material Usage), End Use (Commercial, Residential, Hospitality, Institutional, Industrial)

GCC Green Buildings Market Overview

The GCC green buildings market which was valued at approximately USD 38.47 billion in 2025 and is estimated to rise further up to almost USD 42.12 billion by 2026 is projected to reach around USD 95.33 billion in 2035 expanding at a CAGR of about 9.5% during the forecast period from 2026 to 2035.

The industry is expanding in line with accelerated sustainable construction adoption across residential commercial and public infrastructure projects. Growth momentum is supported by rising energy efficiency compliance requirements water optimization mandates and lifecycle cost reduction priorities across the GCC construction sector.

Market expansion is reinforced by strong government backed sustainability frameworks including Saudi Vision 2030 UAE Net Zero 2050 and national green building codes enforced by municipal authorities across the GCC. Guidance and technical benchmarks issued by the United Nations Environment Program and World Green Building Council promote low emission materials renewable integration and resource efficient building design. Increasing public sector investments in sustainable housing transport infrastructure and smart cities combined with private developer alignment in Dubai, Riyadh, Abu Dhabi and Doha continue to strengthen the regional green construction landscape.

GCC Green Buildings Market Dynamics

Market Trends

The market is experiencing a structural shift toward energy efficient low emission and resource optimized construction practices aligned with national sustainability agendas across the GCC. One of the most prominent trends shaping the market is the increasing integration of energy performance-based building design supported by green building rating frameworks promoted by municipal authorities. Government programs under Saudi Vision 2030 and UAE Net Zero 2050 emphasize reduced operational energy intensity water efficiency and lifecycle sustainability which has accelerated adoption of high-performance building envelopes smart energy management systems and renewable energy integration across residential and commercial developments.

Another significant trend is the growing use of certified green construction materials and digitally enabled building management solutions driven by regulatory alignment and technology maturity. Guidelines issued by the United Nations Environment Program and technical recommendations supported by the World Green Building Council promote material transparency circular construction and carbon footprint reduction. These developments are encouraging developers and contractors to prioritize integrated green solutions combining materials technology and intelligent building systems thereby reshaping procurement strategies and competitive positioning within the GCC construction landscape.

Growth Drivers

The growth of the industry is primarily supported by strong government led sustainability mandates which continue to generate consistent demand across residential commercial and public infrastructure projects. Increasing investments in large scale urban development smart cities and public housing programs across Saudi Arabia the United Arab Emirates and Qatar are accelerating market expansion. Government backed building regulations and energy codes enforced by ministries of municipal affairs and climate change authorities mandate compliance with minimum energy and water efficiency benchmarks which is directly supporting sustained adoption of green building practices.

In addition. rising awareness among developers, investors and end users regarding long term operational cost savings and regulatory compliance is playing a critical role in driving market growth. As commercial enterprises and residential buyers prioritize energy efficiency performance and environmental compliance demand for certified green buildings and sustainable construction solutions is expected to remain strong throughout the forecast period. Public sector procurement policies favoring sustainable infrastructure further reinforce market expansion across the GCC.

Market Restraints / Challenges

Despite favorable growth prospects the market faces challenges related to high initial capital requirements and regulatory complexity. The cost premium associated with certified green materials advanced insulation systems and smart building technologies continues to impact adoption among cost sensitive developers particularly in mid-scale residential projects. Government and intergovernmental reports including assessments supported by the United Nations Environment Program highlight that upfront investment requirements remain a barrier despite long term operational savings.

Additionally, dependence on imported green construction materials specialized technologies and skilled technical expertise poses operational challenges for contractors and suppliers. Reliance on external supply chains can result in cost pressures project delays and scalability constraints during periods of economic volatility or logistical disruption. Limited availability of locally manufactured certified materials in certain GCC countries further intensifies these challenges impacting project timelines and profitability.

Market Opportunities

The market presents significant opportunities in large scale public infrastructure and affordable sustainable housing segments driven by demographic growth and urban expansion. Government led investments in social housing transport infrastructure and mixed-use developments under national development plans are creating demand for cost optimized green construction solutions. Companies offering modular energy efficient and compliance ready building systems are well positioned to capture incremental demand from government and semi government projects.

Another key opportunity lies in premium commercial and smart city developments where rising investment in advanced building automation and sustainability analytics is supporting higher value project execution. Advancements in digital building management platforms energy monitoring and smart grid integration supported by government smart city initiatives are expected to enhance asset performance and long-term returns. These developments create avenues for differentiated offerings and long-term partnerships across the GCC green construction ecosystem.

GCC Green Buildings Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 38.47 Billion |

|

Revenue Forecast in 2035 |

USD 95.33 Billion |

|

Growth Rate |

9.5% |

|

Segments Covered in the Report |

By Building Type, By Construction Type, By Certification and Compliance Focus, By Application, By End Use |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Saudi Arabia, United Arab Emirates, Rest of GCC |

|

Key Companies |

Alumasc Group plc, Kingspan Group plc, Bauder Limited, Forbo International SA, Interface Inc, BASF SE, Abdullah Al Othaim Investment Co., DuPont, Owens Corning, Turner Construction Company, Saint-Gobain, Rockwool International A/S, USG Boral Middle East, Knauf Insulation, Lafarge Holcim (Holcim Group), Sika AG, Armstrong World Industries, GAF Materials Corporation, Masdar (Abu Dhabi Future Energy Company), Emaar Properties PJSC, Aldar Properties PJSC, Qatari Diar Real Estate Investment Company |

|

Customization |

Available upon request |

GCC Green Buildings Market Segmentation

By Building Type

Non-residential green buildings are estimated to account for approximately 58% of total market revenue in 2025. This dominance is supported by sustained government expenditure on commercial offices public infrastructure healthcare facilities and mixed-use developments across the GCC. National diversification programs and public procurement frameworks increasingly mandate compliance with energy efficiency water conservation and emissions standards which reinforces adoption across this segment.

Residential green buildings represent the remaining share and are projected to record faster growth during the forecast period. Growth for residential applications is estimated at around 11.9% supported by population growth urban housing demand and rising awareness of long-term energy and water cost savings. Government backed housing initiatives and sustainable community programs across Saudi Arabia and the United Arab Emirates continue to support expansion in this segment.

By Construction Type

New green construction projects accounted for approximately 61% of market value in 2025 reflecting strong greenfield development activity across smart cities economic zones and infrastructure corridors in the GCC. Sustainability compliance is increasingly embedded at the planning and design stage which enables higher adoption of green building standards in new developments. This segment is projected to grow at about 11.2% supported by long term urban master plans.

Renovation and retrofit projects contributed roughly 39% of total revenue driven by the need to upgrade existing building stock to meet revised energy and environmental regulations. Growth for retrofit applications is estimated at nearly 10.4% supported by energy efficiency incentive programs rising utility costs and regulatory requirements focused on extending asset lifecycles while improving environmental performance.

By Certification and Compliance Focus

Certified green buildings accounted for approximately 54% of the market in 2025 supported by mandatory national green building regulations and adoption of internationally recognized certification frameworks across public sector projects. Government enforcement of building energy codes and sustainability reporting requirements continues to strengthen this segment with an estimated growth rate of around 11.5%.

Non-certified sustainable buildings represent about 46% of market value primarily driven by private developers implementing selective efficiency measures to manage upfront costs. This segment is projected to grow at nearly 10.1% supported by gradual regulatory tightening and increasing awareness of operational savings which is expected to encourage future transition toward full certification.

By Application

Energy efficiency applications accounted for approximately 36% of total market revenue in 2025 making it the largest application segment. This dominance is driven by stringent building energy codes electricity tariff reforms and national targets to reduce building energy intensity across the GCC. Growth for energy efficiency focused applications is estimated at around 11.7% supported by adoption of high-performance building envelopes smart energy systems and renewable integration.

Water efficiency applications represented nearly 27% of the market supported by regional water scarcity concerns and regulatory emphasis on conservation. Growth for this application is estimated at about 10.9% driven by adoption of low flow fixtures greywater reuse systems and efficient irrigation technologies. Indoor environmental quality and sustainable material usage together accounted for the remaining share supported by occupant wellbeing standards lifecycle emissions reduction and public sector procurement guidelines.

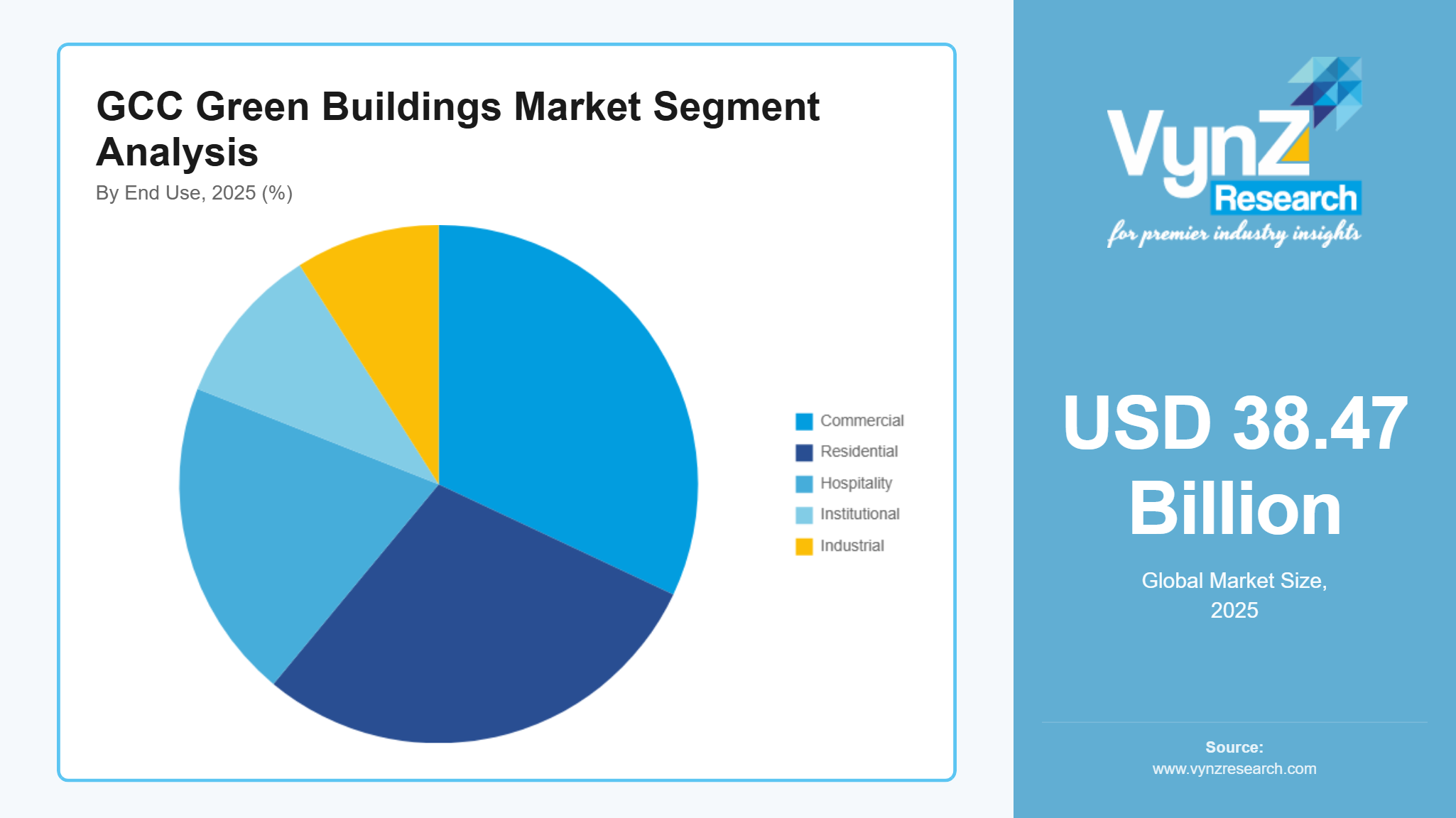

By End Use

Commercial end use accounted for the highest revenue share in 2025 estimated at approximately 32% supported by office developments retail complexes and mixed-use projects concentrated in major GCC cities. Growth for commercial green buildings is projected at around 10.8% driven by corporate sustainability commitments regulatory compliance and operating cost optimization priorities.

Residential end use followed with an estimated share of about 29% supported by housing demand affordability driven green construction policies and government backed residential programs growing at nearly 11.4%. Hospitality institutional and industrial end uses collectively accounted for the remaining share supported by tourism healthcare education logistics and manufacturing investments expanding at approximately 11.6% across the GCC.

Regional Insights

Saudi Arabia

Saudi Arabia accounted for approximately 32% of the market in 2025 driven by large scale urban development infrastructure expansion and regulatory enforcement under national sustainability agendas. Strong demand from major cities including Riyadh Jeddah and Neom continues to support market growth supported by public sector construction pipelines. Government initiatives under Saudi Vision 2030 led by the Ministry of Municipal and Rural Affairs and the Saudi Energy Efficiency Center mandate compliance with building energy codes water efficiency standards and emissions reduction targets. These policies combined with rising demand for sustainable residential and commercial developments are encouraging investments in energy efficient building materials smart building systems and certified green construction practices across the Kingdom.

United Arab Emirates

The United Arab Emirates represented approximately 26% of the market in 2025 supported by advanced regulatory frameworks and early adoption of sustainability standards. Steady growth is driven by urban development activity in Dubai Abu Dhabi and Sharjah alongside strong demand from commercial real estate hospitality and mixed-use developments. Government backed initiatives such as UAE Net Zero 2050 and the Esti Dama and Dubai Green Building Regulations issued by municipal authorities are accelerating adoption of green building practices. Increasing focus on operational efficiency occupant wellbeing and lifecycle emissions reduction continues to drive consistent demand across residential and non-residential sectors.

Rest of GCC

GCC countries including Qatar, Oman, Kuwait, and Bahrain collectively accounted for approximately 18% of the market in 2025 supported by infrastructure development modernization programs and rising sustainability awareness. Growth across these markets is driven by public investments in transport infrastructure tourism related developments and institutional facilities aligned with national development plans. Government guidance from ministries of housing and environment supported by frameworks referenced by the United Nations Environment Program is encouraging gradual adoption of energy efficient and water optimized construction practices. The remaining share of the market is covered by other GCC regions not individually detailed which continue to represent long-term growth opportunities as regulatory frameworks mature and sustainable construction adoption increases.

Competitive Landscape / Company Insights

The GCC Green Buildings Market is moderately competitive with the presence of regional developers, construction firms and material suppliers focusing on sustainability compliance cost optimization and project execution capabilities. Key participants include ACC, ALEC Engineering and ASGC which actively deliver certified green projects across the GCC. Adoption is supported by government frameworks such as Saudi Vision 2030 UAE Net Zero 2050 and municipal green building regulations aligned with guidance from the United Nations Environment Program. These policies encourage firms to strengthen technical expertise and secure long-term public and private sector contracts.

Mini Profiles

Alumasc Group plc provides sustainable roofing, insulation, and building envelope solutions, supported by strong GCC distribution, brand recognition, and compliance with green building standards for residential, commercial, and industrial projects.

Kingspan Group plc operates in premium insulation and facade solutions, emphasizing energy efficiency, regulatory compliance, and high-performance design, supported by strategic partnerships and regional project execution across GCC markets.

Bauder Limited specializes in flat and green roofing systems, delivering certified sustainable solutions for commercial and residential projects, supported by robust regional supply chains and brand reputation in the GCC.

Forbo International SA offers sustainable flooring and wall coverings, focusing on durability, design, and environmental compliance, with extensive GCC distribution and adoption in residential, commercial, and institutional green building projects.

Interface Inc delivers modular carpet tiles and sustainable flooring solutions, emphasizing environmental compliance, design flexibility, and lifecycle performance, supported by regional partnerships and commercial project adoption across GCC countries.

Key Players

- Alumasc Group plc

- Kingspan Group plc

- Bauder Limited

- Forbo International SA

- Interface Inc

- BASF SE

- Abdullah Al

- Othaim

- Investment Co.

- DuPont

- Owens Corning

- Turner Construction Company

- Saint-Gobain

- Rockwool International A/S

- USG Boral Middle East

- Knauf Insulation

- Lafarge Holcim (Holcim Group)

- Sika AG

- Armstrong World Industries

- GAF Materials Corporation

- Masdar (Abu Dhabi Future Energy Company)

- Emaar Properties PJSC

- Aldar Properties PJSC

- Qatari Diar Real Estate Investment Company

Recent Developments

January 2026 - Datasea Jingwei Information Technology Co., Ltd. and Nanjing Linghang Intelligent Aviation Technology Co., Ltd., a prominent Chinese company that focuses on brain–computer interface ("BCI") research and commercial applications, have signed a strategic collaboration agreement. In order to lay the technical groundwork for the eventual productization and commercialization of acoustic technologies in rehabilitation training and healthcare service scenarios, the collaboration will involve system integration validation, engineering testing, and application-oriented exploration.

January 2026 - Sika has received the renowned German Sustainability Award for its SikaBaffle® AutoStack system. The jury recognized the design for improvements in logistics, material efficiency, and energy use across the automotive supply chain.

October 2025 - Leading flat roofing system maker Bauder Ltd. has commemorated the formal launch of its new UK distribution center in Stowmarket, close to Ipswich. The building is situated in Gateway 14, the biggest commercial, innovation, and logistics park in East Anglia. In addition to bolstering the company's notable expansion throughout the UK, it expands Bauder's footprint in Suffolk. This new location becomes Bauder's biggest distribution center in the nation, in addition to its UK operations headquarters in Ipswich.

GCC Green Buildings Market Coverage

Building Type Insight and Forecast 2026 - 2035

- Residential

- Non-residential

Construction Type Insight and Forecast 2026 - 2035

- New Construction Projects

- Renovation / Retrofit Projects

Certification and Compliance Focus Insight and Forecast 2026 - 2035

- Certified Green Buildings

- Non-certified Sustainable Buildings

Application Insight and Forecast 2026 - 2035

- Energy Efficiency

- Water Efficiency

- Indoor Environmental Quality

- Sustainable Material Usage

End Use Insight and Forecast 2026 - 2035

- Commercial

- Residential

- Hospitality

- Institutional

- Industrial

GCC Green Buildings Market by Region

- Saudi Arabia

- By Building Type

- By Construction Type

- By Certification and Compliance Focus

- By Application

- By End Use

- United Arab Emirates

- By Building Type

- By Construction Type

- By Certification and Compliance Focus

- By Application

- By End Use

- Rest of GCC

- By Building Type

- By Construction Type

- By Certification and Compliance Focus

- By Application

- By End Use

Table of Contents for GCC Green Buildings Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Building Type

1.2.2. By

Construction Type

1.2.3. By

Certification and Compliance Focus

1.2.4. By

Application

1.2.5. By

End Use

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. GCC Market Estimate and Forecast

4.1. GCC Market Overview

4.2. GCC Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Building Type

5.1.1. Residential

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Non-residential

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Construction Type

5.2.1. New Construction Projects

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Renovation / Retrofit Projects

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Certification and Compliance Focus

5.3.1. Certified Green Buildings

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Non-certified Sustainable Buildings

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By Application

5.4.1. Energy Efficiency

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Water Efficiency

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Indoor Environmental Quality

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Sustainable Material Usage

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

5.5. By End Use

5.5.1. Commercial

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Residential

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Hospitality

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.5.4. Institutional

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2035

5.5.5. Industrial

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2035

6. Saudi Arabia Market Estimate and Forecast

6.1. By

Building Type

6.2. By

Construction Type

6.3. By

Certification and Compliance Focus

6.4. By

Application

6.5. By

End Use

6.5.1.

Saudi Arabia Market Estimate and Forecast

6.5.2.

United Arab Emirates Market Estimate and Forecast

6.5.3.

Rest of GCC Market Estimate and Forecast

7. United Arab Emirates Market Estimate and Forecast

7.1. By

Building Type

7.2. By

Construction Type

7.3. By

Certification and Compliance Focus

7.4. By

Application

7.5. By

End Use

7.5.1.

Saudi Arabia Market Estimate and Forecast

7.5.2.

United Arab Emirates Market Estimate and Forecast

7.5.3.

Rest of GCC Market Estimate and Forecast

8. Rest of GCC Market Estimate and Forecast

8.1. By

Building Type

8.2. By

Construction Type

8.3. By

Certification and Compliance Focus

8.4. By

Application

8.5. By

End Use

8.5.1.

Saudi Arabia Market Estimate and Forecast

8.5.2.

United Arab Emirates Market Estimate and Forecast

8.5.3.

Rest of GCC Market Estimate and Forecast

10. Company Profiles

10.1. Alumasc Group plc

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Kingspan Group plc

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Bauder Limited

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Forbo International SA

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Interface Inc

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. BASF SE

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Abdullah Al Othaim Investment Co.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. DuPont

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Owens Corning

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Turner Construction Company

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. Saint-Gobain

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Rockwool International A/S

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. USG Boral Middle East

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

10.14. Knauf Insulation

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5. Recent

Developments

10.15. Lafarge Holcim (Holcim Group)

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5. Recent

Developments

10.16. Sika AG

10.16.1.

Snapshot

10.16.2.

Overview

10.16.3.

Offerings

10.16.4.

Financial

Insight

10.16.5. Recent

Developments

10.17. Armstrong World Industries

10.17.1.

Snapshot

10.17.2.

Overview

10.17.3.

Offerings

10.17.4.

Financial

Insight

10.17.5. Recent

Developments

10.18. GAF Materials Corporation

10.18.1.

Snapshot

10.18.2.

Overview

10.18.3.

Offerings

10.18.4.

Financial

Insight

10.18.5. Recent

Developments

10.19. Masdar (Abu Dhabi Future Energy Company)

10.19.1.

Snapshot

10.19.2.

Overview

10.19.3.

Offerings

10.19.4.

Financial

Insight

10.19.5. Recent

Developments

10.20. Emaar Properties PJSC

10.20.1.

Snapshot

10.20.2.

Overview

10.20.3.

Offerings

10.20.4.

Financial

Insight

10.20.5. Recent

Developments

10.21. Aldar Properties PJSC

10.21.1.

Snapshot

10.21.2.

Overview

10.21.3.

Offerings

10.21.4.

Financial

Insight

10.21.5. Recent

Developments

10.22. Qatari Diar Real Estate Investment Company

10.22.1.

Snapshot

10.22.2.

Overview

10.22.3.

Offerings

10.22.4.

Financial

Insight

10.22.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

GCC Green Buildings Market