Mining Remanufacturing Components Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Component / Product (Engines, Hydraulic Systems, Powertrain Components, Drivetrains, Undercarriage Components), by Equipment Type (Haul Trucks, Hydraulic Excavators, Wheel Loaders, Dozers, Drills / Auxiliary Equipment), by Mining Type (Surface Mining, Underground Mining), by End User (Large-Scale Mining Companies, Mid-Sized Mining Operators, Contract Mining Companies)

| Status : Published | Published On : Feb, 2026 | Report Code : VRCH2120 | Industry : Chemicals & Materials | Available Format :

|

Page : 182 |

Mining Remanufacturing Components Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Component / Product (Engines, Hydraulic Systems, Powertrain Components, Drivetrains, Undercarriage Components), by Equipment Type (Haul Trucks, Hydraulic Excavators, Wheel Loaders, Dozers, Drills / Auxiliary Equipment), by Mining Type (Surface Mining, Underground Mining), by End User (Large-Scale Mining Companies, Mid-Sized Mining Operators, Contract Mining Companies)

Mining Remanufacturing Components Market Overview

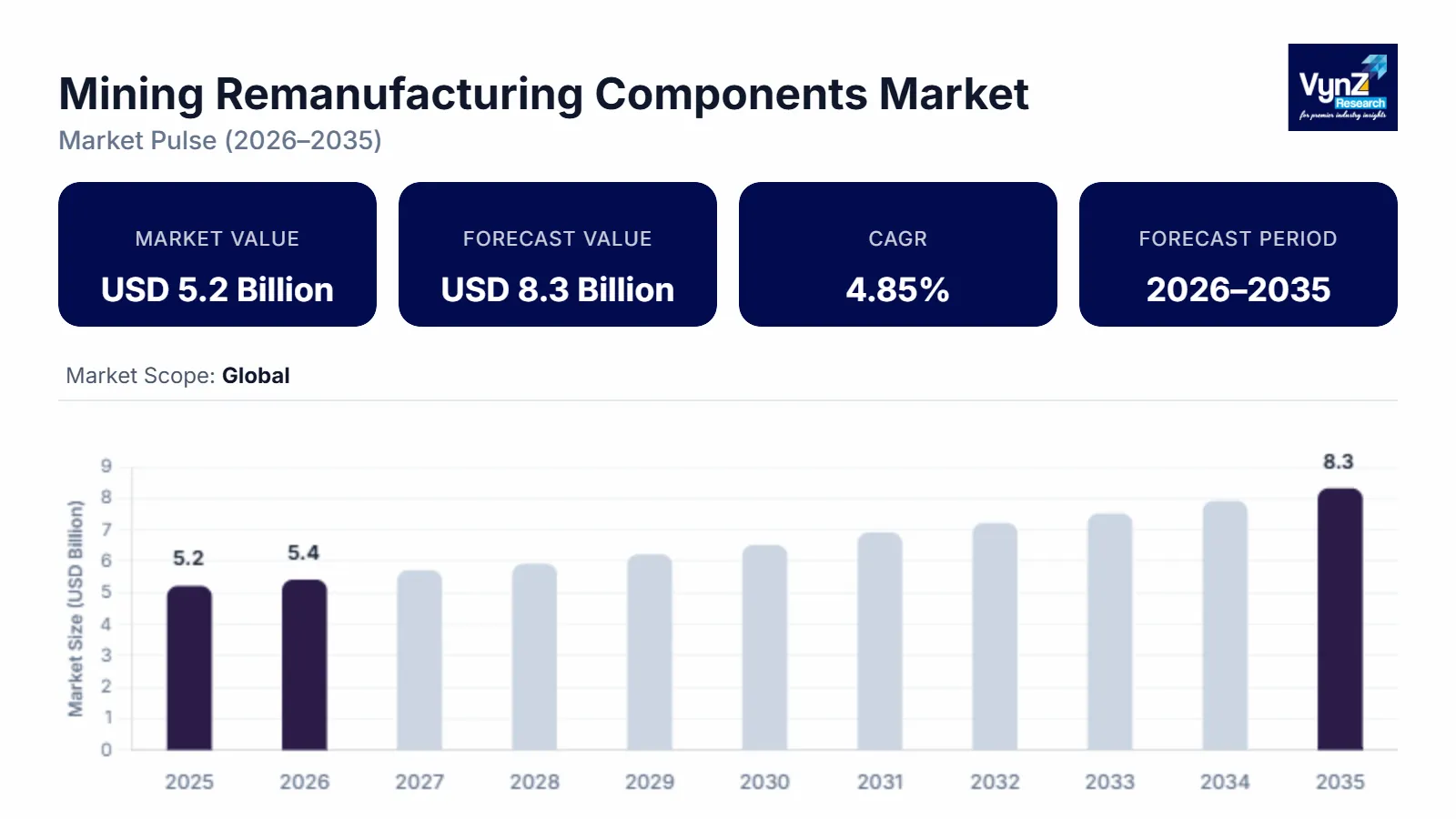

The mining remanufacturing components market which was valued at approximately USD 5.2 billion in 2025 and is estimated to rise further up to almost USD 5.4 billion by 2026, is projected to reach around USD 8.35 billion in 2035, expanding at a CAGR of about 4.85% during the forecast period from 2026 to 2035.

Market growth is driven by rising mining equipment utilization rates, increasing focus on reducing total cost of ownership, and stronger emphasis on extending machinery life cycles. Growing adoption of remanufactured components aligns with sustainability and resource efficiency objectives outlined by organizations such as the United Nations Environment Program and the Organization for Economic Co-operation and Development, which promote circular economy practices across heavy industries.

Market expansion is further supported by government-backed initiatives aimed at reducing industrial waste, lowering energy intensity, and improving operational efficiency within extractive sectors. Policy frameworks issued by international labor and environmental authorities emphasize responsible resource extraction and lifecycle optimization of capital equipment. In parallel, national mining and industrial development programs across Asia Pacific, North America, and Europe are encouraging infrastructure modernization and productivity enhancement. These publicly supported measures, combined with regulatory focus on emissions reduction and sustainable mining practices, continue to reinforce long-term demand for remanufactured mining components across major operating regions.

Mining Remanufacturing Components Market Dynamics

Market Trends

The mining remanufacturing components industry is witnessing structural shifts toward lifecycle optimization, sustainability-driven procurement, and increased adoption of circular economy practices across heavy industrial sectors. One of the key trends shaping the market is the growing preference for remanufactured engines, hydraulic systems, and powertrain components, reflecting a transition toward cost efficiency, resource conservation, and reduced environmental impact. Policy frameworks promoted by the United Nations Environment Program and the International Energy Agency emphasize material reuse, emissions reduction, and energy efficiency within extractive industries, encouraging mining operators to extend equipment service life through remanufacturing.

Another emerging trend is the integration of digital monitoring and predictive maintenance technologies, supported by industrial modernization programs issued by national mining and manufacturing authorities, which are influencing component design requirements and reinforcing demand for standardized, performance-validated remanufactured solutions.

Growth Drivers

The growth of the market is largely supported by rising global mining equipment utilization and sustained demand for cost-effective maintenance strategies across large-scale mining operations. Increasing investments in mining infrastructure development, fleet modernization, and productivity enhancement programs are accelerating market expansion, particularly in regions with active government-supported mining policies. International labor and industrial development agencies have highlighted remanufacturing as a key mechanism for reducing operational downtime, improving equipment reliability, and lowering capital expenditure in resource-intensive sectors.

Additionally, stricter environmental regulations and emissions control frameworks issued by environmental protection authorities are encouraging mining enterprises to adopt remanufactured components as part of compliance-oriented asset management strategies, sustaining long-term demand across surface and underground mining applications.

Market Restraints / Challenges

Despite favorable growth prospects, the market faces challenges related to regulatory complexity, supply chain dependency, and quality standardization. Compliance with technical certification requirements and environmental regulations issued by national mining safety administrations and environmental authorities can increase operational costs for remanufacturers, particularly smaller and regional players.

Furthermore, dependence on skilled labor, advanced machining capabilities, and imported core components poses operational challenges, as highlighted in industrial workforce and manufacturing capacity assessments published by international labor organizations. Supply chain disruptions, variability in core availability, and fluctuating raw material prices can lead to cost pressures and delivery delays, affecting scalability and profitability during periods of economic uncertainty.

Market Opportunities

The market presents significant opportunities in the expansion of remanufacturing adoption within emerging mining economies, driven by infrastructure development initiatives and government-backed industrial sustainability programs. Public investment frameworks promoted by national mining ministries and economic development agencies increasingly prioritize resource efficiency, equipment reuse, and domestic manufacturing capabilities, creating favorable conditions for remanufactured component deployment.

Another key opportunity lies in the adoption of advanced diagnostics, automation, and digital tracking systems within remanufacturing processes, aligned with smart manufacturing strategies promoted by international industrial development organizations. Companies offering standardized, performance-certified, and digitally enabled remanufactured solutions are well-positioned to capture incremental demand, strengthen long-term partnerships with mining operators, and improve asset lifecycle management across global mining regions.

Global Mining Remanufacturing Components Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 5.2 Billion |

|

Revenue Forecast in 2035 |

USD 8.35 Billion |

|

Growth Rate |

4.85% |

|

Segments Covered in the Report |

By Component, By Equipment Type, By Mining Type, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Rest of the World |

|

Key Companies |

Atlas Copco, Bosch Rexroth AG, Caterpillar Inc., Cummins Inc., Dana Incorporated, Danfoss A/S, Epiroc AB, Sandvik AB, SRC Holdings Corporation, Swanson Industries Inc., The Weir Group PLC, Volvo Construction Equipment AB |

|

Customization |

Available upon request |

Mining Remanufacturing Components Market Segmentation

By Component

Based on component type, the market is segmented into multiple categories, with engine-related components accounting for the largest share of the market in 2025, contributing approximately 38% of total segment revenue. This dominance is supported by high replacement frequency, intensive wear under continuous mining operations, and the critical role of engines in determining equipment uptime and productivity. Government-backed industrial efficiency frameworks and emissions compliance standards issued by environmental and energy authorities encourage refurbishment and reuse of engine systems to reduce material consumption and carbon intensity, reinforcing sustained demand across both surface and underground mining fleets.

Hydraulic and powertrain-related components are expected to register the fastest growth during the forecast period, with an estimated CAGR of around 6.2% from 2026 to 2035. Growth is driven by increasing mechanization of mining operations, rising adoption of high-capacity equipment, and government-supported mining modernization initiatives that emphasize productivity enhancement and operational efficiency. Public infrastructure and mining development programs across Asia Pacific and Latin America further support adoption by encouraging lifecycle extension of heavy machinery through remanufacturing practices.

By Equipment Type

Based on equipment type, the market is primarily driven by large mobile mining machinery, with haul trucks and hydraulic excavators collectively accounting for the largest revenue share in 2025, estimated at approximately 45%. Their dominance reflects extensive deployment in open-pit and large-scale mining operations, high operating hours, and significant component wear rates. Government-supported mining expansion projects and infrastructure investments continue to increase demand for remanufactured components in these equipment categories, particularly in regions prioritizing domestic mineral production and energy security.

Wheel loaders and dozers are expected to witness the fastest growth, registering an estimated CAGR of about 5.9% during the forecast period. Growth is supported by rising adoption in mid-scale mining operations, quarrying activities, and government-funded infrastructure and construction-linked mining projects. Public sector emphasis on cost-effective equipment utilization and reduced capital expenditure further encourages operators to adopt remanufactured solutions for auxiliary and support equipment fleets.

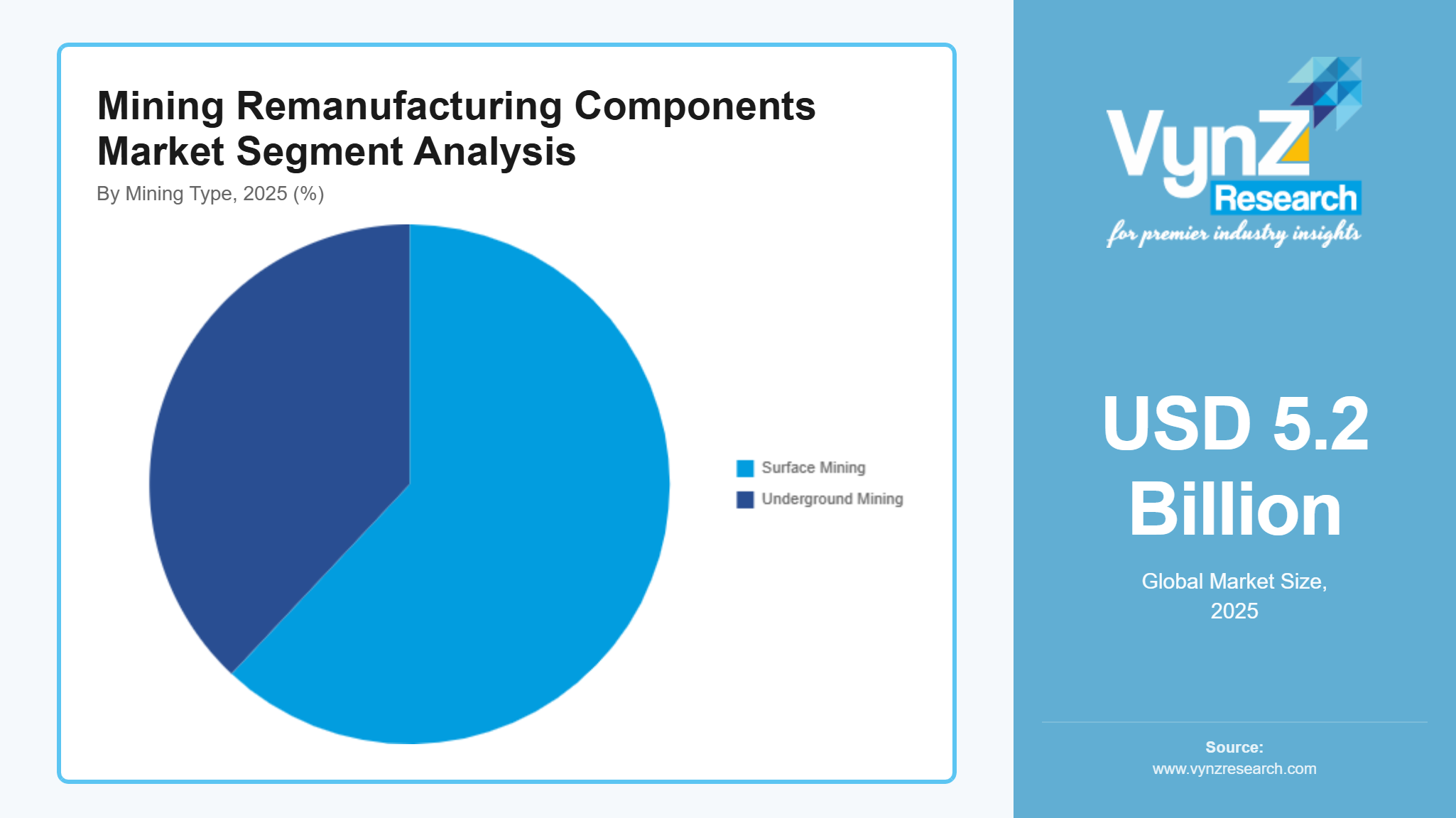

By Mining Type

Based on mining type, surface mining operations accounted for the largest share of the market in 2025, contributing approximately 62% of total revenue. This dominance is attributed to higher equipment density, larger fleet sizes, and greater exposure to abrasive operating conditions that accelerate component wear. Government mining policies promoting large-scale mineral extraction, particularly for metals and industrial minerals critical to energy transition and infrastructure development, continue to support strong demand for remanufactured components in surface mining environments.

Underground mining is projected to grow at a faster pace, with an estimated CAGR of around 6.0% from 2026 to 2035. Growth is driven by increasing depth of mineral extraction, stricter safety and efficiency standards, and public investment in technologically advanced underground mining operations. Regulatory oversight from mining safety authorities and labor agencies further encourages the adoption of reliable, remanufactured components to ensure operational continuity and equipment safety in confined environments.

By End User

Based on end user, large-scale mining companies represented the largest segment in 2025, accounting for approximately 58% of total market revenue. Their dominance is supported by extensive equipment fleets, structured maintenance programs, and long-term supply contracts that favor remanufactured components to optimize lifecycle costs. Government-backed mining productivity initiatives and sustainability mandates encourage major operators to integrate remanufacturing into asset management strategies, reinforcing consistent demand across global mining regions.

Mid-sized and contract mining operators are expected to register the fastest growth, with an estimated CAGR of about 5.7% during the forecast period. Growth is driven by increasing outsourcing of mining activities, rising cost sensitivity, and limited capital budgets among emerging operators. Public mining development programs, access to financing support, and regulatory encouragement for efficient resource utilization are enabling these end users to adopt remanufactured components as a viable alternative to new equipment parts, supporting broader market penetration.

Regional Insights

North America

North America accounted for approximately 32% of the market in 2025, driven by high mining output, advanced equipment fleets, and strong adoption of circular economy practices. The presence of large-scale mining operations across the United States and Canada, particularly in regions such as Nevada, Arizona, Ontario, and British Columbia, continues to support demand for remanufactured engines, drivetrains, and hydraulic components.

Government-backed sustainability initiatives and resource efficiency programs led by agencies such as the U.S. Department of Energy (DOE), U.S. Environmental Protection Agency (EPA), and Natural Resources Canada (NRCan) encourage the reuse and lifecycle extension of heavy mining equipment. Policy emphasis on emissions reduction, waste minimization, and cost-efficient mining operations is strengthening regional market performance.

Europe

Europe contributed approximately 23% of the market in 2025, supported by strict environmental regulations, established mining equipment standards, and strong adoption of remanufacturing practices. Mining activities across Germany, Sweden, Finland, and Poland are increasingly aligned with sustainability and resource efficiency objectives.

Regulatory oversight and policy frameworks promoted by the European Commission, European Environment Agency (EEA), and national mining authorities encourage remanufacturing as a means to reduce industrial waste and carbon emissions. Public funding for sustainable industrial processes and modernization of mining infrastructure continues to drive steady demand for remanufactured components across the region.

Asia Pacific

Asia Pacific is estimated to represent approximately 20% of the market in 2025, driven by expanding mining operations, rising demand for cost-effective equipment solutions, and increasing focus on asset optimization. Countries such as China, India, and Australia remain key contributors, with major mining hubs including Western Australia, Odisha, and Inner Mongolia supporting regional growth.

Government-supported mining modernization programs, industrial efficiency policies, and sustainability initiatives led by bodies such as China’s Ministry of Industry and Information Technology (MIIT), India’s Ministry of Mines, and Geoscience Australia promote the adoption of remanufactured mining components. Growing awareness of lifecycle cost reduction and equipment uptime further supports market expansion.

Rest of the World

The Rest of the World, including Latin America, Africa, and the Middle East, accounted for approximately 25% of the market in 2025. Growth in these regions is supported by increasing mining investments, gradual modernization of equipment fleets, and rising awareness of cost-saving maintenance practices. Countries such as Brazil, Chile, South Africa, and Peru are emerging as key markets for remanufactured mining components.

Government-backed mining development programs and resource management policies implemented by institutions such as Brazil’s Ministry of Mines and Energy, Chile’s National Geology and Mining Service (SERNAGEOMIN), and South Africa’s Department of Mineral Resources and Energy (DMRE) are improving access to sustainable mining solutions.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on technological innovation, quality certification, pricing strategies, and geographic expansion. Key vendors invest in digital diagnostics, predictive maintenance, and remanufacturing efficiency tools to gain advantage. Market growth aligns with government and regulatory emphasis on circular economy and sustainable mining practices, with environmental policies and resource‑efficiency frameworks encouraging remanufacturing adoption and stronger market positioning.

Mini Profiles

Atlas Copco focuses on industrial air compressors, mining and construction equipment, supported by global distribution strength, strong brand recognition, and cost‑efficient service solutions that reinforce leadership in diversified industrial markets.

Bosch Rexroth AG operates in premium and mass automation and motion control segments, emphasizing precision design, performance, and integrated drive solutions that enhance machine productivity and support broad industrial modernization.

Caterpillar Inc. leverages local manufacturing and strategic partnerships to expand market presence, offering heavy‑duty mining and construction equipment with robust aftermarket support and extensive dealer networks that drive global adoption.

Dana Incorporated focuses on advanced drivetrain, sealing, and thermal technologies, supported by design performance, customized engineering solutions, and strong OEM relationships that enhance vehicle efficiency across industrial and off‑highway applications.

Epiroc AB operates in niche mining and infrastructure equipment segments, emphasizing innovative rock drilling and automation technologies, supported by strategic alliances, digital solutions, and focused service offerings that strengthen customer value.

Key Players

- Atlas Copco

- Bosch Rexroth AG

- Caterpillar Inc.

- Cummins Inc.

- Dana Incorporated

- Danfoss A/S

- Epiroc AB

- Sandvik AB

- SRC Holdings Corporation

- Swanson Industries Inc.

- The Weir Group PLC

- Volvo Construction Equipment AB (AB Volvo)

Recent Developments

In December 2025, The newest high-performance portable air compressor from Atlas Copco, the X-Air⁺ 750-20, is designed to revolutionize mining and water well drilling operations. By establishing a benchmark for quiet operations, enhanced mobility, fuel efficiency, and sophisticated monitoring, the new model responds to the growing need for reliable, efficient, and adaptable drilling solutions across India.

In September 2025, The Indian Institute of Technology Madras (IIT Madras) and Caterpillar Inc., a multinational manufacturing company based in the United States has collaborated on research on advanced technologies. This partnership will result in a number of innovative goods that meet international requirements.

In August 2025, A Memorandum of Agreement (MOA) was signed by the firms, according to which Epiroc would supply their CAS solution to all five of Hindustan Zinc's underground mines spread throughout the northwest Indian state of Rajasthan. The Sindesar Khurd Mine, one of the top five silver-producing mines in the world, will be the first of several phases to implement the technology. The CAS will be used on 100 people and 30 low-profile dump trucks during the test phase.

Global Mining Remanufacturing Components Market Coverage

Component / Product Insight and Forecast 2026 - 2035

- Engines

- Hydraulic Systems

- Powertrain Components

- Drivetrains

- Undercarriage Components

Equipment Type Insight and Forecast 2026 - 2035

- Haul Trucks

- Hydraulic Excavators

- Wheel Loaders

- Dozers

- Drills / Auxiliary Equipment

Mining Type Insight and Forecast 2026 - 2035

- Surface Mining

- Underground Mining

End User Insight and Forecast 2026 - 2035

- Large-Scale Mining Companies

- Mid-Sized Mining Operators

- Contract Mining Companies

Global Mining Remanufacturing Components Market by Region

- North America

- By Component / Product

- By Equipment Type

- By Mining Type

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Component / Product

- By Equipment Type

- By Mining Type

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Component / Product

- By Equipment Type

- By Mining Type

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Component / Product

- By Equipment Type

- By Mining Type

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Mining Remanufacturing Components Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Component / Product

1.2.2. By

Equipment Type

1.2.3. By

Mining Type

1.2.4. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Component / Product

5.1.1. Engines

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Hydraulic Systems

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Powertrain Components

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.1.4. Drivetrains

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2035

5.1.5. Undercarriage Components

5.1.5.1. Market Definition

5.1.5.2. Market Estimation and Forecast to 2035

5.2. By Equipment Type

5.2.1. Haul Trucks

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Hydraulic Excavators

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Wheel Loaders

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Dozers

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.2.5. Drills / Auxiliary Equipment

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2035

5.3. By Mining Type

5.3.1. Surface Mining

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Underground Mining

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.4. By End User

5.4.1. Large-Scale Mining Companies

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Mid-Sized Mining Operators

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Contract Mining Companies

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Component / Product

6.2. By

Equipment Type

6.3. By

Mining Type

6.4. By

End User

6.4.1.

U.S. Market Estimate and Forecast

6.4.2.

Canada Market Estimate and Forecast

6.4.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Component / Product

7.2. By

Equipment Type

7.3. By

Mining Type

7.4. By

End User

7.4.1.

Germany Market Estimate and Forecast

7.4.2.

U.K. Market Estimate and Forecast

7.4.3.

France Market Estimate and Forecast

7.4.4.

Italy Market Estimate and Forecast

7.4.5.

Spain Market Estimate and Forecast

7.4.6.

Russia Market Estimate and Forecast

7.4.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Component / Product

8.2. By

Equipment Type

8.3. By

Mining Type

8.4. By

End User

8.4.1.

China Market Estimate and Forecast

8.4.2.

Japan Market Estimate and Forecast

8.4.3.

India Market Estimate and Forecast

8.4.4.

South Korea Market Estimate and Forecast

8.4.5.

Vietnam Market Estimate and Forecast

8.4.6.

Thailand Market Estimate and Forecast

8.4.7.

Malaysia Market Estimate and Forecast

8.4.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Component / Product

9.2. By

Equipment Type

9.3. By

Mining Type

9.4. By

End User

9.4.1.

Brazil Market Estimate and Forecast

9.4.2.

Saudi Arabia Market Estimate and Forecast

9.4.3.

South Africa Market Estimate and Forecast

9.4.4.

U.A.E. Market Estimate and Forecast

9.4.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Atlas Copco

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Bosch Rexroth AG

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Caterpillar Inc.

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Cummins Inc.

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Dana Incorporated

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Danfoss A/S

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Epiroc AB

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Sandvik AB

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. SRC Holdings Corporation

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Swanson Industries Inc.

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. The Weir Group PLC

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. Volvo Construction Equipment AB (AB Volvo)

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Mining Remanufacturing Components Market