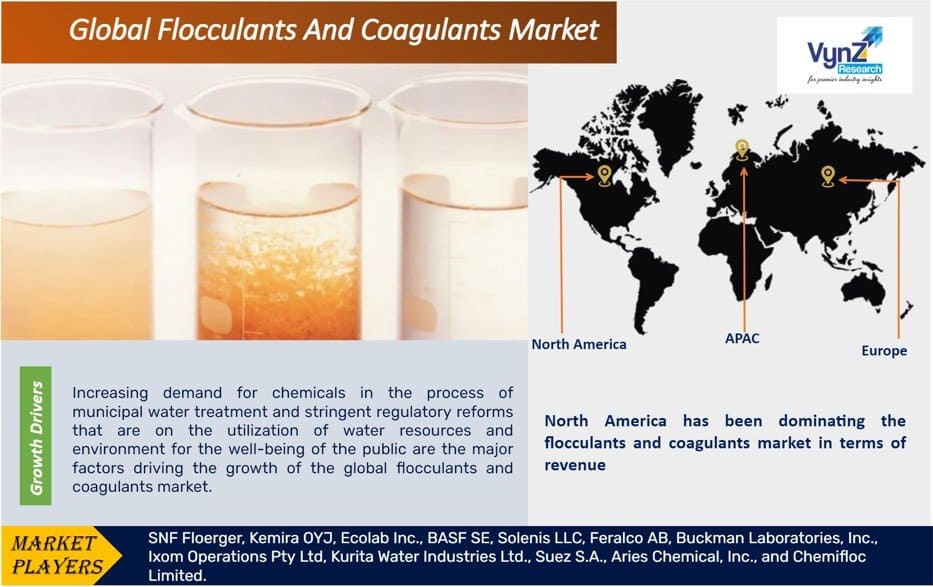

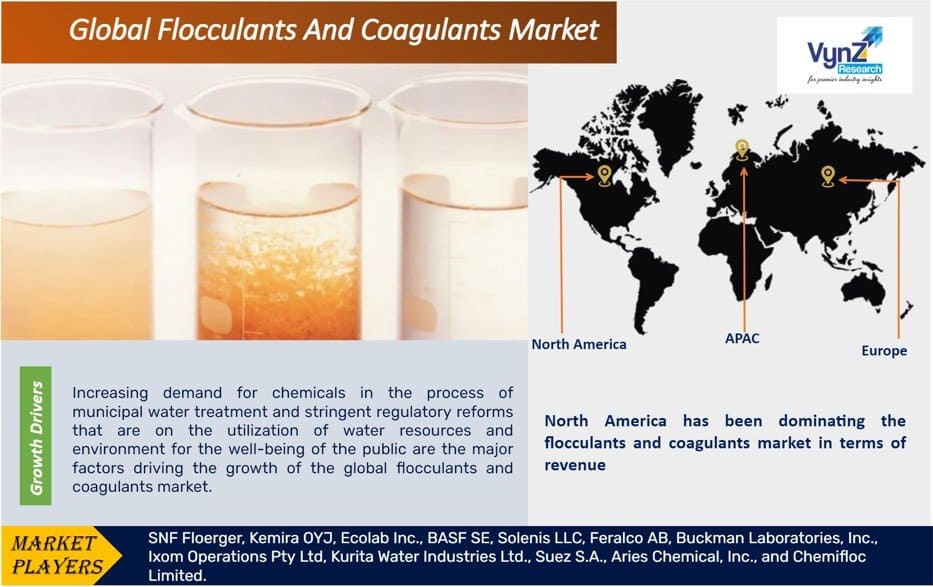

Flocculants and Coagulants Market Overview

The global Flocculants and Coagulants Market was valued at USD 11.27 billion in 2025 and is estimated to reach around USD 11.53 billion in 2026. .It is projected to reach around USD 14.13 billion by 2035, expanding at a CAGR of about 2.28 % during the forecast period from 2026 to 2035 .

. The growth of this market is attributed to its extensive utilization of every process of water treatment as it helps in diminishing the operating costs along with eradicating the particulate compositions present in contaminated water. Flocculation and coagulation aim at removing substances from the water with the help of a chemical cleaning action and are generally undertaken at the time of the sedimentation process.

Moreover, it has been observed that increasing preference towards organic coagulants as compared to that over traditional coagulant that includes polyacrylamides and alum is further driving the growth of the global flocculants and coagulants market. Moreover, increasing industrialization has further stimulated the need for treating water resources that are ultimately bolstering the growth of the global flocculants and coagulants market.

Flocculants and Coagulants Market Segmentation

Insight by Type

On the basis of type, the global flocculants and coagulants market is segmented into flocculants and coagulants. Flocculants are further subcategorized as anionic, cationic, non-ionic, and amphoteric. Coagulants are further sub-categorized into organic and inorganic. Organic are further sub-categorized as polyamine and polyDADMAC. Inorganic are further sub-categorized as aluminum sulfate, poly aluminum chloride, ferric chloride, and others. Among all these segments, flocculants are projected to hold larger revenue in the global flocculants and coagulants market. This segment is observing rampant growth owing to its widespread application in several industries.

Insight by Application

On the basis of application, the global flocculants and coagulants market is segmented into pulp & paper, oil & gas, water and wastewater treatment, mining, textile, and others. Among all these segments, the water and wastewater treatment application are anticipated to witness the fastest growth of 5.7% during the forecast period in terms of value.

Global Flocculants and Coagulants Market Report Coverage

|

Report Metric

|

Details

|

|

Historical Period

|

2020 - 2024

|

|

Base Year Considered

|

2025

|

|

Forecast Period

|

2026 - 2035

|

|

Market Size in 2025

|

U.S.D. 11.27 Billion

|

|

Revenue Forecast in 2035

|

U.S.D. 14.13 Billion

|

|

Growth Rate

|

2.28%

|

|

Segments Covered in the Report

|

By Type, and Type Application

|

|

Report Scope

|

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling

|

|

Regions Covered in the Report

|

North America, Europe, Asia-Pacific, Middle East, and Rest of the World

|

Industry Dynamics

Flocculants and Coagulants Market Growth Drivers

Increasing demand for chemicals in the process of municipal water treatment and stringent regulatory reforms that are on the utilization of water resources and environment for the well-being of the public are the major factors driving the growth of the global flocculants and coagulants market. The growth of the flocculants and coagulants market is highest in Asia-Pacific due to the increasing population and increasing rate of industrialization that has forced the governmental authorities of this region to execute stringent government reforms on the water treatment processes that are further exaggerating the growth of global flocculants and coagulants market.

Flocculants and Coagulants Market Challenges

Accelerating demand for alternative water treatment practices such as UV disinfection and RO filtration are expected to hamper the growth of global flocculants and coagulants market.

Flocculants and Coagulants Market Industry Ecosystem

Globally industry players in global flocculants and coagulants market are leveraging market growth through technological advancements, product extensions, and the development of a competitive edge that develops competitive strength among the industry players on factors that include operational cost, innovation, product quality, and price.

Flocculants and Coagulants Market Geographic Overview

Geographically, North America has been dominating the flocculants and coagulants market in terms of revenue. Infrastructural development along with the implementation of stringent government reforms are the major factors driving the growth of the flocculants and coagulants market in this region. Furthermore, it has been observed that the encounter of shale gas in North America has bolstered the demand for flocculants and coagulants in the oil & gas industry of this region.

Moreover, Asia-Pacific is expected to witness the fastest growth of 7.7% during the forecast period in terms of value due to rapid industrialization, demand for flocculants and coagulants from municipal sectors increasing demand for renewed water reservoirs. Additionally, the pulp & paper industry in this region occupies a dominant position specifically in Indonesia and China which is ultimately impacting the growth of the flocculants and coagulants market in this region.

Flocculants and Coagulants Market Competitive Insight

Kemira Oyj is a chemical industry group headquartered in Helsinki, Finland. The company was has developed into a global leader in its two main segments, Industry&Water and Pulp&Paper. It has safe, sustainable chemistries which ensure hygiene, safe water, food safety and more. They are the chosen partners for water-intensive industries worldwide, helping their customers design for reuse resources, efficiency and revitalize natural systems.

SNF (a global leader in manufacturing water-soluble polymers) has developed a range of more than 1,000 products that help to preserve natural resources, encourage recycling, and improve industrial process efficiencies. SNF polymers have several complementary functionalities such as rheology modification, flocculation, coagulation and friction reduction.

Some of the key players in the global flocculants and coagulants market include SNF Floerger, Kemira OYJ, Ecolab Inc., BASF SE, Solenis LLC, Feralco AB, Buckman Laboratories, Inc., Ixom Operations Pty Ltd, Kurita Water Industries Ltd., Suez S.A., Aries Chemical, Inc., and Chemifloc Limited.

Recent Developments by Key Players

Qatar University's Gas Processing Centre developed a new method for treating wastewater using green materials. To treat colloidal suspension-contaminated wastewater with fine suspended particles, multiple green materials were examined . A new coagulant for colloidal suspensions has been discovered using natural deep eutectic solvents which are based on choline chloride.

Evoqua Water Technologies has purchased EPICOR, Inc., a leading manufacturer of ion exchange resin and resin mixtures for the energy sector. Evoqua's Integrated solutions and services segment has a stronger ability to serve power market customers with this acquisition.

The Flocculants and Coagulants Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

Segments Covered in the Report

- Type

- Flocculants

- Anionic

- Cationic

- Non-Ionic

- Amphoteric

- Coagulants

- Organic

- PolyDADMAC

- Polyamine

- Inorganic

- Others

- Ferric Chloride

- Polyaluminum Chloride

- Aluminum Sulphate

- Application

- Pulp & Paper

- Oil & Gas

- Water and Waste Water Treatment

- Mining

- Textile

- Others

Region Covered in the Report

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Middle East and Africa (MEA)

- South America

Source: VynZ Research