Global Gas Separation Membrane Market – Analysis and Forecast (2026-2035)

Industry Insight by Material Type (Polyimide & Polyaramide, Polysulfone, Cellulose Acetate, and Others), by Application (Nitrogen Generation & Oxygen Enrichment, Carbon Dioxide Removal, Vapor/Gas Separation, Vapor/Vapor Separation, Air Dehydration, Hydrogen Recovery, and Others), by Module Type (Spiral Wound, Hollow Fiber, Plate & Frame, and Others), by End-User (Food & Beverage, Waste & Wastewater Treatment, Pharmaceuticals, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

| Status : Published | Published On : Apr, 2025 | Report Code : VRCH2086 | Industry : Chemicals & Materials | Available Format :

|

Page : 250 |

Global Gas Separation Membrane Market – Analysis and Forecast (2026-2035)

Industry Insight by Material Type (Polyimide & Polyaramide, Polysulfone, Cellulose Acetate, and Others), by Application (Nitrogen Generation & Oxygen Enrichment, Carbon Dioxide Removal, Vapor/Gas Separation, Vapor/Vapor Separation, Air Dehydration, Hydrogen Recovery, and Others), by Module Type (Spiral Wound, Hollow Fiber, Plate & Frame, and Others), by End-User (Food & Beverage, Waste & Wastewater Treatment, Pharmaceuticals, and Others), and Geography (U.S., Canada, Germany, U.K., France, China, Japan, India, and Rest of the World)

Gas Separation Membrane Market Overview

The global gas separation membrane market is anticipated to grow from USD 1 billion in 2025 to USD 1.5 billion by 2035, registering a CAGR of 6.8% during the forecast period 2026-2035.

Gas separation membranes are used to separate gases from a mixture of gases with varying dimensions. The notion of selective permeation via the membrane surface is used in gas separation membranes. The penetration rate of each gas is determined by the solubility of each gas molecule in the membrane material and the diffusion rate of each gas molecule. Small molecules and gas molecules with a high solubility pass through the membrane easily. Membrane-based gas separation has reduced operating and maintenance costs since it uses less energy, is chemical-free, and has fewer moving components. The rising population, urbanization, and increased demand for gas separation membranes in industry verticals like oil & gas, food processing, biogas processing, electronics, and manufacturing industries will proliferate the growth in the gas separation membranes market. In many industrial applications and plants, gas separation techniques are essential for instance, in the pharmaceutical sector, gas separation membranes are used to separate oxygen gas for medical applications. Membrane-based gas separation could be a viable alternative to traditional gas separation methods like absorption, adsorption, and distillation.

The COVID-19 outbreak has severely impacted the global gas membrane separation market owing to a decline in economic growth in all countries which has affected consumer spending patterns, national and international transport have been hampered which has disrupted the supply chain in various industries. Furthermore, an insufficient supply of raw materials will hinder the production process of gas separation membranes, thus hampering the growth of the market.

Gas Separation Membrane Market Segmentation

Insight by Material Type

Based on material type, the global gas separation membrane market is segregated into polyimide & polyamide, polysulfone, cellulose acetate, and others. The polyimide & polyamide segment contributes to the largest share in the market owing to its excellent selectivity, high chemical, and thermal stability, permeability, enhanced film-forming properties, and improves mechanical strength of the material. They are increasingly adopted for carbon dioxide removal. Polysulfone is anticipated to grow at a constant pace owing to the increased thermal stability and availability.

Insight by Application

Based on application, the global gas separation membrane market is segmented into nitrogen generation & oxygen enrichment, carbon dioxide removal, vapor/gas separation, vapor/vapor separation, air dehydration, hydrogen recovery, and others. The carbon dioxide removal segment contributes to the largest share in the gas separation membrane market owing to the increased demand for shale gas in North America, rising concern related to global warming, strict regulations related to the emission of carbon dioxide from industries, increased demand for membrane separation process in natural gas treatment to capture CO2 will further drive the development of the market. Also, a gas separation membrane is an effective solution for CO2 removal due to its properties like compact, energy-efficient, and more economical than conventional technologies.

Nitrogen generation & oxygen enrichment are anticipated to have a high CAGR during the forecast period as it is widely adopted in various industries like oil &gas, electronics, mining, etc. Furthermore, membrane systems require less supervision, are easy to install, occupy less space, have less maintenance, and are eco-friendly as do not emit gases or work with solvents, thereby highly preferred for nitrogen generation & oxygen enrichment.

Insight by Module Type

Based on the module type, the global gas separation membranes are segmented into the spiral wound, hollow fiber, plate & frame, and others. The hollow fiber is anticipated to contribute to the largest share during the forecast period. Porous polymer fibers are commonly found in hollow diaphragm fiber gas membranes, which perform well under high-pressure situations and hence expand their applicability. Furthermore, the diameter of hollow gas fiber construction membranes is smaller, which is an important physical attribute that aids in the reduction of the total size of a membrane-based gas separation system.

Insight by End-User

Based on end-user, the global gas separation membrane is categorized into food & beverage, waste & wastewater treatment, pharmaceuticals, and others. The food & beverage industry is anticipated to grow at a faster pace during the forecast period owing to increased disposable income, a shift in consumer habits, and rising exports from major countries like the US, resulting in the adoption of techniques like adsorption, absorption, and cryogenic distillation.

Global Gas Separation Membrane Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 1 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 1.5 Billion |

|

Growth Rate |

6.8% |

|

Segments Covered in the Report |

Material Type, Application, Module Type, End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Industry Dynamics

Industry Trends

The trend toward organic and environmentally friendly fuels has resulted in a major increase in demand for gas separation membranes. The increased adoption to remove CO2 from natural gas and for better transmission and processing of natural gas resulted in the growth of the gas separation membrane market.

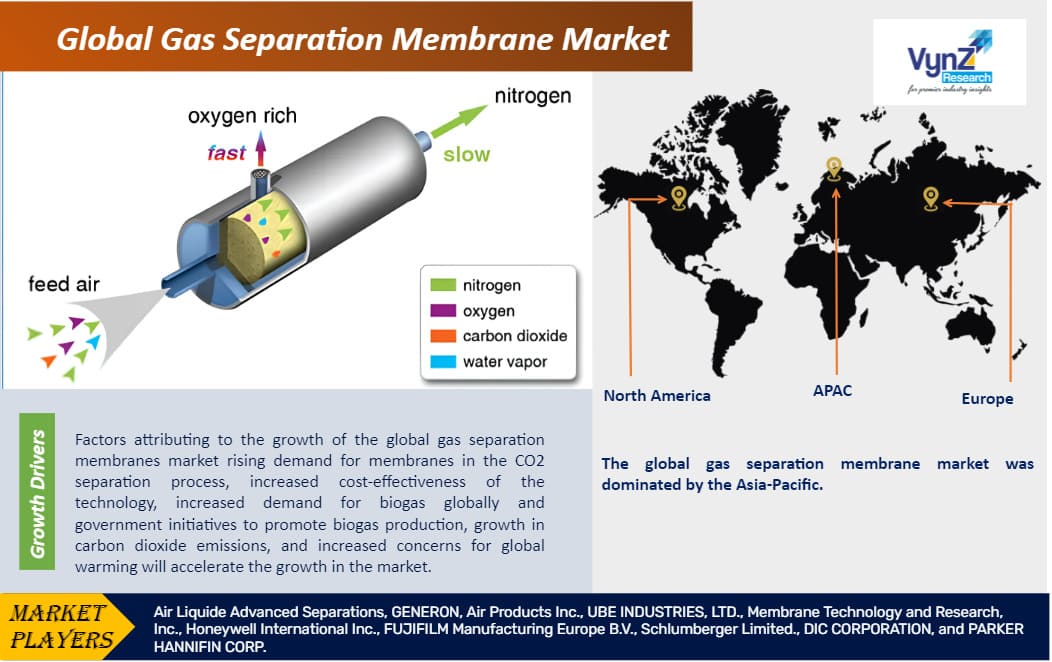

Gas Separation Membrane Market Growth Drivers

Factors attributing to the growth of the global gas separation membranes market rising demand for membranes in the CO2 separation process, increased cost-effectiveness of the technology, increased demand for biogas globally and government initiatives to promote biogas production, growth in carbon dioxide emissions, and increased concerns for global warming will accelerate the growth in the market. Moreover, the low cost of membrane separation, stringent regulations to control carbon emissions, and high energy efficiency protect the environment by offering increased awareness and legislation to support environmental sustainability, thereby propelling the growth of the gas separation membrane market. For example, China's 2030 Paris Agreement Nationally Determined Contribution (NDC), which intends to reduce greenhouse gas emissions while also encouraging the use of bio-methane in the transportation sector, is expected to boost market growth.

Gas Separation Membrane Market Challenges

The plasticization of polymeric membranes at high temperatures will result in breakdown owing to reduced mechanical strength and the costly production process of metallic membranes will hamper the growth of the gas separation membranes market. Also, the adoption of pressure swing adsorption technology owing to its long lifespan, less sensitivity, and efficiency in harsh environments than the membrane separation technology, will pose challenges for the growth of the market.

Gas Separation Membrane Market Opportunities

The increased demand for durable membrane materials that have high selectivity and permeability and can withstand harsh conditions. This is leading to the development of improved mixed matrix membranes that use materials like zeolites or other molecular sieving media, thereby providing promising opportunities for growth in the gas separation membranes market during the forecast period 2025-2030.

Gas Separation Membrane Market Geographic Overview

Asia-Pacific is anticipated to have the largest share during the forecast period owing to the rapidly growing urbanization and industrialization, enhanced standard of living, increased demand for sanitation and fresh water, and augmented demand for carbon dioxide removal from reservoirs will further expand the growth of the gas separation membrane market. Furthermore, the increased consumption from countries like China, India, and Japan, and growing government initiatives to promote biogas production will proliferate the growth in the region.

North America is anticipated to be the fastest-growing region in the gas separation membrane market owing to the increased consumption of natural gas as gas separation membranes are needed to purify natural gas.

Europe is anticipated to have significant growth during the forecast period owing to stringent government laws about carbon dioxide emissions and the increased adoption of biogas in the region.

Gas Separation Membrane Market Competitive Insight

There is massive competition owing to the presence of local and international players, resulting in increased investment in R&D activities. Moreover, manufacturers in the gas separation membrane market are emphasizing developing multifunctional gas membranes for safety and waterproofing. Furthermore, the strategies adopted by industry players include mergers & acquisitions, and technology launches, in order to provide a competitive edge in the market.

Recent Developments By the Key Players

Through an investment of more than 140 million euros, Air Liquide has announced that it will establish in Bécancour, Québec (Canada), a breakthrough platform supplying low-carbon industrial gases including hydrogen, oxygen, nitrogen and argon.

- Air Liquide Advanced Separations

- GENERON

- Air Products Inc.

- UBE INDUSTRIES, LTD.

- Membrane Technology and Research, Inc.

- Honeywell International Inc.

- FUJIFILM Manufacturing Europe B.V.

- Schlumberger Limited.

- DIC CORPORATION

- PARKER HANNIFIN CORP.

.png)

Region Covered in the Report

• North America

- U.S.

- Canada

- Mexico

• Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

• Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

• Rest of the World (RoW)

- Brazil

- Saudi Arabia

- South Africa

- U.A.E.

- Other Countries

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Gas Separation Membrane Market