Global Aluminium Caps & Closures Market – Analysis and Forecast (2026-2035)

Industry Insights by Product Type (Roll-On-Pilfer-Proof, Easy open ends, Non-refillable closures, Others), By End-Use Sector (Beverage, Pharmaceutical, Food, Home & personal care, Others (automotive and chemical)) and By Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

| Status : Published | Published On : Mar, 2025 | Report Code : VRCH2027 | Industry : Chemicals & Materials | Available Format :

|

Page : 150 |

Global Aluminium Caps & Closures Market – Analysis and Forecast (2026-2035)

Industry Insights by Product Type (Roll-On-Pilfer-Proof, Easy open ends, Non-refillable closures, Others), By End-Use Sector (Beverage, Pharmaceutical, Food, Home & personal care, Others (automotive and chemical)) and By Geography (North America, Europe, Asia-Pacific, Middle East, and Rest of the World)

Aluminium Caps & Closures Market Overview

The Aluminium Caps and Closure Market is expected to grow from USD 5.8 billion in 2025 to USD 7.8 billion by 2035, registering a CAGR of 5.1% during the forecast period, of ranges from 2026 to 2035.

Aluminium caps and closures are typically made with flexible and corrosion-resistant aluminium and are used to seal containers to retain freshness and prevent contamination. These seals are typically made by rolling the metal into thin sheets and forming them into the desired shape. These caps also have a sealing material, usually made from plastic or rubber. This enhances the sealing capability. This results in durable, lightweight, and recyclable caps and closures.

The aluminium caps and closure market is growing at a significant rate due to its ability to provide leak-proof and contamination-resistant functionality. It also helps to ease the transport of different objects. These seals enhance the visual appeal and brand differentiation along with customer usability, and is therefore high in demand. It is used in various fields, such as food and drink, home and personal care, and pharmaceuticals for packaging. In addition, the growing demand for compact, user-friendly, and corrosion resistant seals are pushing the demand and market growth further.

A significant restraining factor to the growth of the global aluminium caps and closures market is the availability of cheaper plastic substitutes. The technical developments results in use of environmentally sustainable and health-friendly polymers which poses a negative impact on the growth of the market. The growth prospects of the aluminium caps and closures market lie in the growing demand for eco-friendly packaging solutions which is met by the higher recyclability of these closures.

Aluminium Caps & Closures Market Segmentation

Insight by Product Type

The aluminium caps and closure market is divided by product types into roll-on-pilfer-proof, easy open ends, non-refillable closures, and other segments. Out of all these segments, the roll-on pilfer-proof caps and closures segment is expected to dominate the market during the forecast period due to its tamper-evident property. It also supports a wide range of applications in the pharmaceutical and food & beverage fields.

Insight by End User

The aluminium caps and closure market is also divided by different end users into beverage, pharmaceutical, food, home & personal care, automotive, chemical, and other segments. Out of these, the beverage segment is expected to dominate and grow more during the forecast period due to its beneficial features, such as cost-effectiveness and lightweight. It also offers high applicability in packaging for alcoholic drinks and other food items. The pharmaceutical segment is also expected to grow at a significant rate due to higher demand, strict regulatory measures, and its support to anti-counterfeit and tamper-proof packaging.

Pharmaceutical Sector is Expected to Witness the Highest Growth Rate in Aluminium Caps and Closure Market

A persistently vigorous growth rate is expected for the pharmaceutical and healthcare industries, with growing demand in many regions, such as North America and Europe, owing to the tight regulatory climate in these regions. It is expected that anti-counterfeit and tamper-proof packaging technologies will boost the consumer demand for aluminium caps and closures. In the pharmaceutical industry, the use of aluminium closures is on the rise because their rubber counterparts appear to contaminate the products. Aluminium seals, in addition, create a highly efficient shield without compromising the taste and scent of the substance.

Global Aluminium Caps & Closures Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 5.8 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 7.8 Billion |

|

Growth Rate |

5.1% |

|

Segments Covered in the Report |

By Product Type, and By End-Use Sector |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Aluminium Caps & Closures Market Geographic Overview

• APAC

• Europe

• North America

• Middle East & Africa

• South America

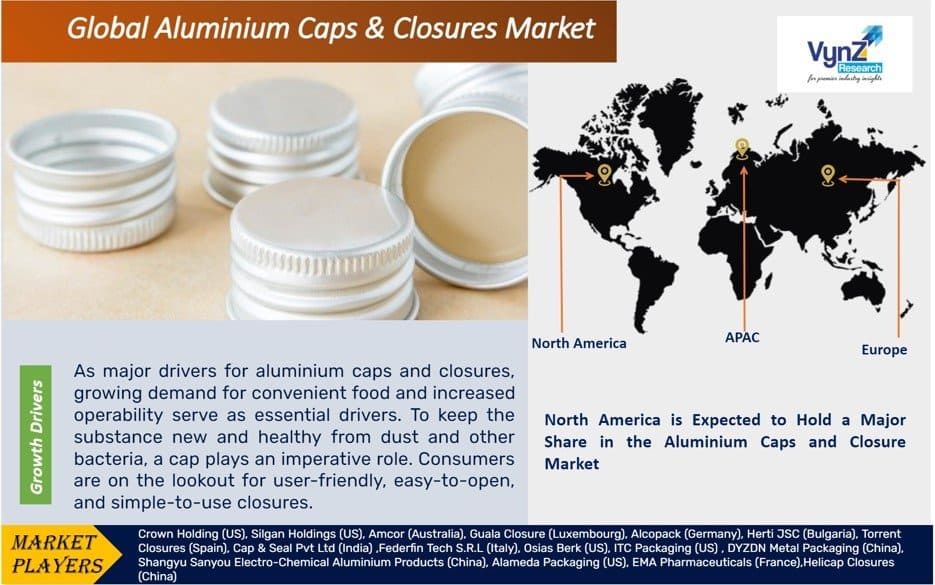

North America is Expected to Hold a Major Share in the Aluminium Caps and Closure Market

• A substantial market share is anticipated in the North American area, which is home to several firms, including Reynold Group Holding Limited, Silgan Holding, Cary Company, O.Berk Company, and Crown Holding, among others.

• In addition, the food and beverage industry is one of the region's largest users in the demand for aluminium caps and closures. For the preservation of food items, such as seeds, usually contained in glass containers, aluminium caps or seals are often used.

• The intake of alcoholic drinks in the United States in 2019 was 30,53 billion litres, according to Banco do Nordeste. In 2018, the selling of spirits in Canada was CND 5.49 billion, according to StatsCan. Many alcoholic drinks use aluminium packaging enclosures, which are expected to fuel the region's market for aluminium caps and closures.

Industry Trends

One significant trend of the industry is the growing demand for uncontaminated food and beverages to meet the need of the growing population. It is also witnessed that new brands are joining all the end-use verticals which is pushing the demand for these caps and seals for single packaged units. The growing demand for such caps in the healthcare sector for sealing bottles of syrups and powdered drugs are also a notable trend.

Aluminium Caps & Closures Market Growth Drivers

The major growth drivers for the global aluminium caps and closures market include the growing demand for convenient food storage and increased operability. The useful features of these caps such as easy to use and open drive its demand thereby pushing the market growth. The growing popularity of dispensing and pump closures, rising beverage consumption, growing pharmaceutical industry and its adoption for contamination-resistant packaging, rise in sustainability concerns, developments in packaging technology, and rapid urbanization and on-the-go lifestyles is pushing the demand for convenient packaging solutions, fueling the demand and sales of aluminium closures and thereby the growth of the market.

Aluminium Caps & Closures Market Challenges

The growth of the aluminium caps and closures market is hindered by the fluctuating prices of the raw material required to make them which affects the profitability of the manufacturers. In addition, the intense competition from alternative packaging materials, strict environmental regulations, and the high initial investment needed for implementing advanced technologies in manufacturing are hindering the market growth.

Aluminium Caps & Closures Market Opportunities

The market growth opportunities are presented by the growing markets in developing economies and their higher consumer bases. In addition, innovations in lightweight and tamper-evident designs, growing health consciousness among consumers pushing demand for bottled water and safe pharmaceutical packaging, strategic collaborations with beverage and pharmaceutical companies, and developments in manufacturing technologies are providing new growth opportunities to the global aluminium caps and closures market.

Key players

• Leading players in the aluminium caps & closures market:-

• Crown Holding (US)

• Silgan Holdings (US)

• Amcor (Australia)

• Guala Closure (Luxembourg)

• Alcopack (Germany)

• Herti JSC (Bulgaria)

• Torrent Closures (Spain)

• Cap & Seal Pvt Ltd (India)

• Federfin Tech S.R.L (Italy)

• Osias Berk (US)

• ITC Packaging (US)

• DYZDN Metal Packaging (China)

• Shangyu Sanyou Electro-Chemical Aluminium Products (China)

• Alameda Packaging (US)

• EMA Pharmaceuticals (France)

• Helicap Closures (China)

Recent Developments

Silgan Holdings Inc.(a leading supplier of sustainable rigid packaging solutions) has aquired Weener Plastics Holdings B.V., which is a leading producer of differentiated dispensing solutions for personal care, food and healthcare products for an enterprise value of Euro 838 million.

Guala Closures has aquired Astir Vitogiannis to strengthen its position in the beer sector.

The Aluminium Caps & Closures Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

Segments Covered in the Report

- Product Type

- Roll-On-Pilfer-Proof

- Easy open ends

- Non-refillable closures

- Others

- End-Use Sector Type

- Beverage

- Pharmaceutical

- Food

- Home & personal care

- Others (automotive and chemical)

Region Covered in the Report

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Rest of the World

- Middle East and Africa (MEA)

- South America

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

What is the expected CAGR of the global Aluminium Caps & Closures Market during the forecast period?

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Aluminium Caps & Closures Market