Pre-Insulated Pipes Market - Analysis and Forecast (2026-2035)

Industry Insights by Installation (Above Ground, Below Ground), by End-use Industry (Oil and Gas, District Heating and Cooling, Infrastructure and Utility, Chemicals, Water Treatment, Food Processing, Pharmaceutical)

| Status : Published | Published On : Sep, 2025 | Report Code : VRCH2025 | Industry : Chemicals & Materials | Available Format :

|

Page : 159 |

Pre-Insulated Pipes Market - Analysis and Forecast (2026-2035)

Industry Insights by Installation (Above Ground, Below Ground), by End-use Industry (Oil and Gas, District Heating and Cooling, Infrastructure and Utility, Chemicals, Water Treatment, Food Processing, Pharmaceutical)

Pre-Insulated Pipes Market Overview

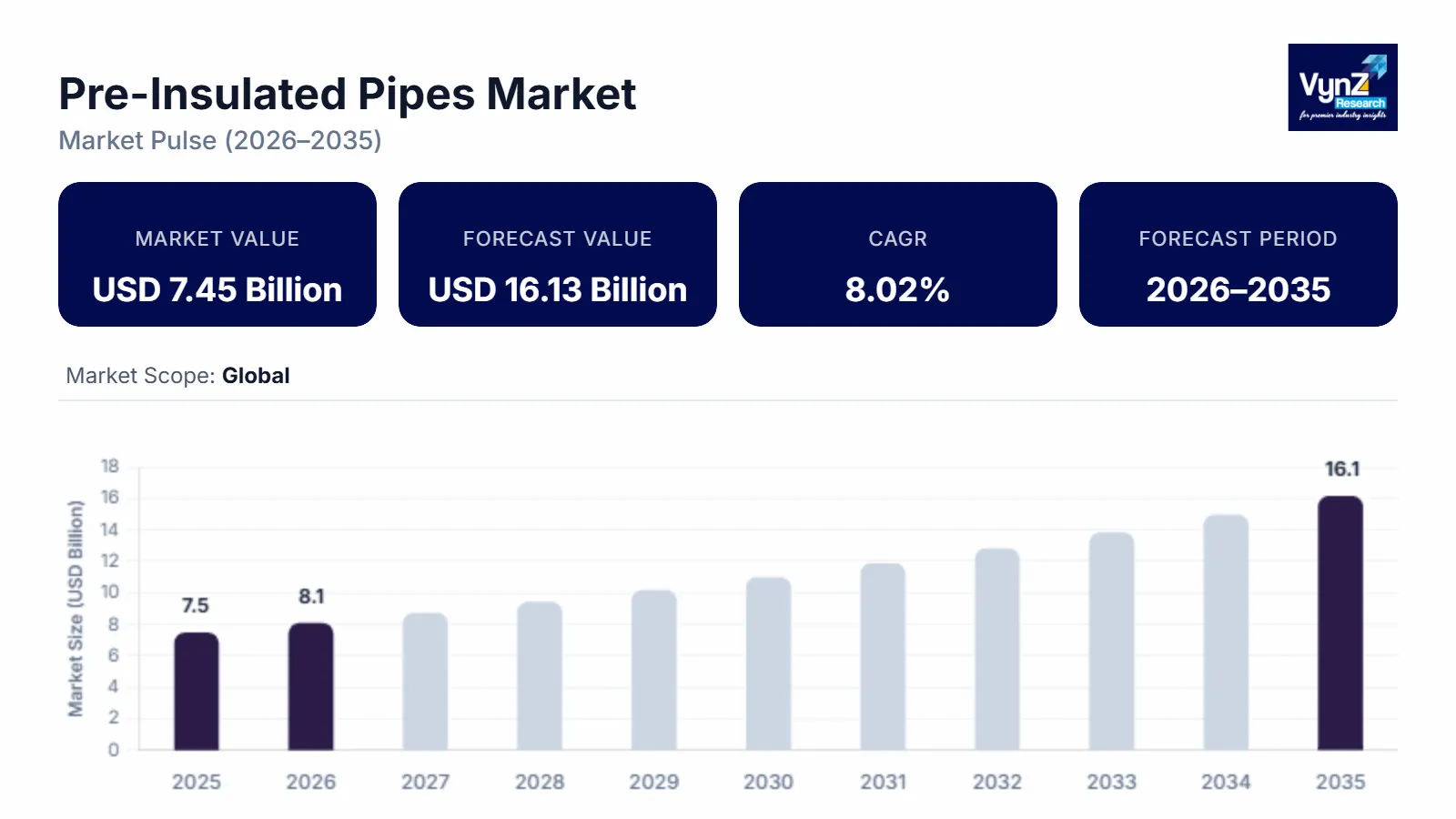

The global Pre-Insulated Pipes Market was valued at USD 7.45 billion in 2025 and is estimated to reach around USD 8.05 billion in 2026. It is projected to reach around USD 16,13 billion by 2035, expanding at a CAGR of about 8.02 % during the forecast period from 2026 to 2035.

Pre-insulated pipes are also used for maintaining liquid temperature of those pipes, called isolated pipes or bonding pipes. For both heating and cooling networks Smithline offers insulated pipe systems. The SYSTEM PRE-INSULATED PIPING is ideally suited for use in areas that need to reduce heat loss. This product range was designed specifically for the supply of hot fluids to networks. Installers can overcome numerous problems in installing heat distribution and packaging systems due to their reliability, easy to install and relevant physico-mechanic properties of the materials used.

Pre-Insulated Pipes Market Analysis

Pre-insulated pipe systems are commonly used for the transport of gas and liquids to the heating and temperature control district. It is used mainly for the supply of warm water and local heating in North America and Europe. The main goal and aim of the pipes are to conserve the fluid and gas temperature in the pipes. The primary isolation substance of pre-isolated pipes is polyurethane foam.

The growth of the global pre-insulated piping market is expected to be driven primarily by growing adoption of pre-insulated pipes in niche applications and increased knowledge about energy efficient products. Furthermore, the expanding positive demand for pre-insulate pipes in end-use applications is also expected to generate growth opportunities for the industry over the forecast period due to increased investments in emerging countries.

Due to their superior nature, pre-insulated pipes allow cost savings. The rapid implementation of such CO2-reducing systems has resulted in strict environmental regulations. Higher incentives for sustainable heating and refrigeration systems are offered in Europe. In Europe there are financial advantages such as direct subsidies, tax cuts (direct and indirect taxes), preferential rates and incentives to subsidize housing.

Size economies, per-use wage and decreased energy losses are additional advantages. Almost 90% of heating and nearly 100% of cooling in the EU is made and used for single buildings, while the rest is provided through district heating and cooling networks, an attractive market in the areas of renewable heating and cooling systems.

Restraint: Unpredictability in price of Raw Materials

The most common raw materials used in the production of pre-insulated pipes are polyethylene, polybutene, chlorinated polyvinyl chloride (CPVC), fiber enhanced plastics (FRP) and stainless steel. Changes to raw materials' demand and supply can have a huge effect on the industry of pre-insulated pipes. Since some of these products come from petroleum, a rise in crude oil prices leads to rises in raw material prices, thus affecting the pre-isolated piping industry. Price fluctuations of the raw materials often affect manufacturers' operating margins, which make it hard for them to sustain themselves.

Pre-Insulated Pipes Market Challenge: Rigorous regulatory compliances

Highly regulated output of pre-insulated tubing. For the manufacturing processes a range of regulations and compliances, including EN, ASTM, and API, were introduced. This is a significant entry obstacle for small and medium-sized manufacturers who are unable to make the large initial investments on the market and do not earn the cost to benefit ratio in the long term. The lack of incentives, for example debt provision, bond funding, city grants and unfair competition, makes new entrants even more difficult

Pre-Insulated Pipes Market Segmentation

Based on Installation

- Above Ground

- Below Ground

By installation, the market will lead in the forecast period in below ground segment. Pre-insulated pipe systems are commonly used to move mediums while preserving temperature in energy-related applications. The production of pre insulated pipes is highly regulated by several regulatory requirements for conveyor pipes, insulation, and jacketing. These pipes are made in regulated conditions in the factory in order to ensure high standards of quality and great longevity. The lower segment is powered by the growing use of district heating and cooling systems. Pre-insulated tubing systems below the floor are favored for long straight installations as these minimize the necessary amount of attachment, joints, and welding costs.

Based on End-use Industry

- Oil and Gas

- District Heating and Cooling

- Infrastructure and Utility

- Chemicals

- Water Treatment

- Food Processing

- Pharmaceutical

Heating and cooling by the dealer is the interconnection of different hot/steam/chilled water sources or chillers to provide customers with room heating or cooling. District heating and refrigeration systems are suitable for areas of high thermal load and annual load factor. The area heater and cooling segment is estimated by the end-use industry to be the largest segment of the demand for pre-isolated pipes. Some of the primary advantages of pre-insulated tubing are excellent thermal efficiencies, lower maintenance, reduced on-site labor and increased protection, as they are better protected against leaks.

Global Pre-Insulated Pipes Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 7.45 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 16.13 Billion |

|

Growth Rate |

8.02% |

|

Segments Covered in the Report |

By Installation, and By End-Use Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

Based on Region

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- South America

During the forecast era, Pre-insulated pipes will expand in Europe in the highest CGR. The pre-insulated pipes market in Europe is expected to account for the largest share of the projected era. As leading players in this region, Europe is the largest district heating sector. The growth of this market in Europe is driven by increased technological developments in communication, digitization and IoT integration, growing demand for energy-efficient solutions and increasing efforts to reduce emissions of greenhouse gases. District heating is used to provide space heating and hot water for commercial, industrial, and residential applications.

Competitive Landscape

Global market for pre-insulated pipes is highly fragmented and the key players have used different strategies for growing their footprints in this market, such as launches of new products, extensions, alliances, joint ventures, collaborations, acquisitions, and others.

Georg Fischer comprises four divisions GF Piping Systems, GF Uponor, GF Casting Solutions, and GF Machining Solutions. Founded in 1802, the corporation is headquartered in Switzerland and is present in 45 countries, with 187.

Uponor Oyj is a Finnish company that sells products for drinking water delivery, radiant heating and cooling. Its head office is located in Helsinki, Finland.

- Georg Fischer AG

- Perma-Pipe International Holdings, Inc. (NASDAQ: PPIH)

- Watts water technologies, Inc.

- Uponor Oyj

- Group Polypipe plc

- Kabelwerke Brugg AG Holding

- Interplast Limited

- Others

Recent Development of Key Players

GF has acquired an Italian machine tool service provider Vam Control S.r.l., a company based in Italy to expand its service offerings in Europe

Primary Research

VynZ Research conducts extensive primary research to understand the market dynamics, validate market data and have key opinions from the industry experts. The key profiles approached within the industry includes, CEO, CFO, CTO, President, Vice President, Product Managers, Regional Heads and Others. Also, end user surveys comprising of consumers are also conducted to understand consumer behavior.

The Pre-Insulated Pipes Market report offers a comprehensive market segmentation analysis along with an estimation for the forecast period 2026–2035.

Segments Covered in the Report

- Installation

- Above Ground

- Below Ground

- End-Use Industry

- Oil and Gas

- District Heating and Cooling

- Infrastructure and Utility

- Chemicals

- Water Treatment

- Food Processing

- Pharmaceutical

Region Covered in the Report

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Russia

- Rest of Europe

Asia-Pacific (APAC)

- China

- Japan

- Vietnam

- India

- South Korea

- Rest of Asia-Pacific

Middle East and Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Latin America

- Argentina

- Brazil

- Chile

- Rest of LATAM

.png)

Source: VynZ Research

.png)

Source: VynZ Research

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Pre-Insulated Pipes Market