Saudi Arabia Paints and Coating Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Product Type (Architectural Paints, Industrial Coatings, Protective Coatings, Powder Coatings, Marine Coatings, Specialty Coatings), by Resin Type (Acrylic, Epoxy, Polyurethane, Polyester, Alkyd), by Application (Residential, Commercial, Industrial, Automotive OEM, Automotive Refinish, General Industries, Packaging), by Technology (Water-Based Coatings, Solvent-Based Coatings, Powder-Based Coatings), by End-Use Industry (Construction & Infrastructure, Automotive & Transportation, Marine & Offshore, Furniture & Wood Products, Manufacturing & Equipment)

| Status : Published | Published On : Feb, 2026 | Report Code : VRCH2122 | Industry : Chemicals & Materials | Available Format : | Page : 147 |

Saudi Arabia Paints and Coating Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Product Type (Architectural Paints, Industrial Coatings, Protective Coatings, Powder Coatings, Marine Coatings, Specialty Coatings), by Resin Type (Acrylic, Epoxy, Polyurethane, Polyester, Alkyd), by Application (Residential, Commercial, Industrial, Automotive OEM, Automotive Refinish, General Industries, Packaging), by Technology (Water-Based Coatings, Solvent-Based Coatings, Powder-Based Coatings), by End-Use Industry (Construction & Infrastructure, Automotive & Transportation, Marine & Offshore, Furniture & Wood Products, Manufacturing & Equipment)

Saudi Arabia Paints and Coating Market Overview

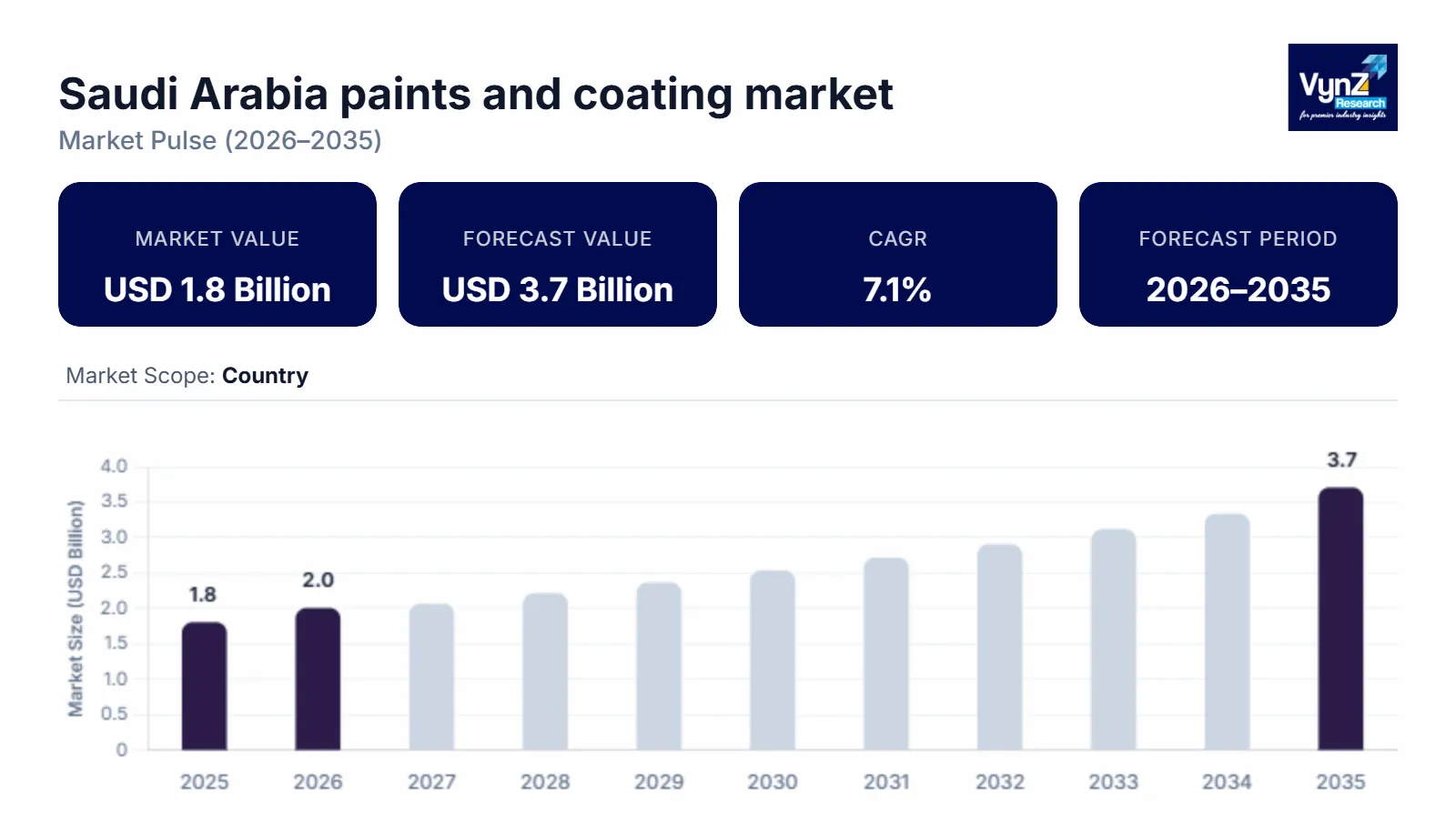

The Saudi Arabia paints and coating market, which was valued at approximately USD 1.8 billion in 2025 and is estimated to reach around USD 2.0 billion in 2026, is projected to reach close to USD 3.7 billion by 2035, expanding at a CAGR of about 7.1% during the forecast period from 2026 to 2035.

The market has grown due to construction in residential, commercial and industrial sectors, continuing to use durable materials with an emphasis on appearance and asset value in accordance with national urban development programs. The increased need for high-quality building finishes, refurbishing of older property and higher performance expectations will continue to drive the demand for long-lasting and improved surface coatings that provide a protective layer and extend the life of the coating. The increase in sustainable construction is also promoting the use of lower emission, lower odor and speciality coatings as part of the protective formulation process. Furthermore, large infrastructure projects, hospitality projects and industrial facilities are increasingly specifying products which meet the demands of their specific environment and have a greater expectation of compliance from suppliers who can provide ready-to-apply solutions in the most extreme climates and working environments, as According to the World Green Building Council certified sustainable building space exceeded 5 billion square meters in 2024 reflecting global preference for high-performance construction materials.

Saudi Arabia Paints and Coating Market Dynamics

Market Trends

The paint and coating industries have moved dramatically in recent years from an emphasis on traditional VOC-based (volatile organic compound) coatings toward a growing interest in sustainable and low-VOC coatings as well as specialized coatings with enhanced performance properties for both commercial and residential applications. The increasing use of new, green chemistries and advanced resin systems is enabling manufacturers to better address the regulatory requirements for reduced emissions as well as the growing consumer demand for lower VOC content to achieve healthier indoor air quality. In addition, the construction and industrial markets are moving toward greater utilization of digital color-matching technology, automatic painting equipment, and specification-coatings; all of which are being driven by increased customer demands for specific performance characteristics. As such, the increased focus on protective coatings against corrosion, uv light degradation and abrasive wear is creating a need for longer lasting finishes in the most extreme weather conditions. This emerging trend is leading to changes in the product line portfolios of many manufacturers as well as their supply chains to offer products that meet both performance and regulatory compliance requirements, as According to the International Federation of Robotics 542,000 industrial robots were installed in manufacturing in 2024 supporting automated coating and application technologies.

Growth Drivers

The most important growth driver of the Saudi Arabia paints and coatings market is the unprecedented expansion of the construction and infrastructure sector driven by national development initiatives. Saudi Arabia is undergoing a structural transformation under Saudi Vision 2030, which prioritizes large-scale investments in housing, transportation networks, tourism destinations, and industrial zones. Landmark developments such as NEOM, The Red Sea Project, and Qiddiya are significantly increasing demand for architectural, decorative, and protective coatings across residential, commercial, and public infrastructure segments. Paints and coatings are essential at every stage of construction, from initial surface protection to aesthetic finishes and long-term durability, particularly in Saudi Arabia’s harsh climatic conditions. In addition, the surge in affordable housing programs and urban expansion is accelerating recurring demand for repainting and maintenance. As construction activity remains central to economic diversification efforts, it continues to generate sustained, high-volume consumption of paints and coatings, making it the dominant driver of market growth in the Kingdom.

Market Restraints / Challenges

The market is subject to a number of constraints including volatility in raw material prices, and disruptions in the supply chain that lead to increased variability in input cost to manufacturers (i.e., increases in input uncertainty) and therefore increase pressure on the manufacturer's profit margin. In addition to the input uncertainty, many manufacturers are dependent upon specialty resin, pigment and additive imports from foreign countries which exposes them to currency risks as well as potential delays in procurement, which can complicate production planning for these companies.

Furthermore, there are environmental/health regulations that require significant investment by both large and small producers to reformulate their products and comply with government regulations; however, due to the financial burden of such an investment, the smaller producers may be limited in their ability to invest in this manner. Lastly, technical skills are lacking in many areas related to advanced applications and quality control, which can limit the adoption of high-performance coating systems by these smaller producers. Due to the lack of a single unified demand source across all end-use application markets, forecasting demand is particularly difficult, and therefore, many stakeholders have postponed making strategic decisions regarding capital expenditures and/or expanding their current production capacity until the demand for premium coating products has stabilized.

Market Opportunities

The market offers great potential as a result of growing interest in using environmentally friendly products and higher performing coatings consistent with green building regulations and sustainable building practices. There is growing investment in upgrading existing infrastructure, creating "smart" cities and expanding industry, which will drive demand for specialized protective coatings to increase the durability and long-term performance of products exposed to harsh climate conditions. There is also increasing demand for high-end coating products to support the continued emphasis on renovation and retrofits of older residential and commercial structures. Finally, emerging technologies related to nanotechnology, anti-corrosive formulation development and digital color matching will provide companies with new opportunities to differentiate their products and position them at a premium level, which will encourage companies to invest in innovation and create collaborative relationships throughout the supply chain.

Saudi Arabia Paints and Coating Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 1.8 Billion |

|

Revenue Forecast in 2035 |

USD 3.7 Billion |

|

Growth Rate |

7.1% |

|

Segments Covered in the Report |

Product Type, Resin Type, Application, Technology, End-Use Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Eastern and Central |

|

Key Companies |

Jotun Saudi Arabia, Al-Jazeera Paints Company, National Paints Factories Co. Ltd., AkzoNobel Saudi Arabia, PPG Industries Saudi Arabia, Kansai Paint Arabia, Saudi Paints and Coatings Company, Protech Powder Coatings Inc., Sigma Paints (PPG), Sak Coat, Hempel Saudi Arabia Co. Ltd., Nippon Paint Saudi Arabia, Berger Paints Saudi Arabia, Rust-Oleum Saudi Arabia, United Coatings Industries |

|

Customization |

Available upon request |

Saudi Arabia Paints and Coating Market Segmentation

By Product Type

Architectural paints are the largest market with a market share of around 70% in 2025, because they are continually in demand by new residential development and mixed-use properties along with normal repainting schedules of urban and suburban construction projects. Housing communities, hotels and hospitality-related establishments, as well as commercial fit-out's focus on decorative finishes to provide aesthetic appeal, surface protection, and to comply with local building codes. Due to widespread use by contractors, strong brand awareness, and a well-established distribution through both retail and professional trade channels.

Protective coatings are currently the fastest growing category with a CAGR of 7.5% in the coming years due to a large number of new industrial facilities, energy assets, logistics hubs and transport infrastructure being constructed that will be exposed to severe weather and corrosion. More asset owners are specifying high-durability coatings in their specifications to increase the service life, reduce maintenance downtime and comply with performance standards on steel structures, pipelines and marine adjacent assets, with corrosion creating economic losses exceeding USD 2.5 trillion globally in 2025, highlighting demand for high-durability protection systems.

By Resin Type

Acrylics constitute the largest single category with a share of approx. 45% in 2025 because they are highly versatile in terms of their applications in both interior and exterior architectural settings; as a result, acrylics are also relatively easy to formulate and have consistently demonstrated satisfactory durability against both high-heat conditions and ultraviolet (UV) light exposure. Contractor’s favor using acrylic systems primarily based upon the consistency and predictability of their curing characteristics, along with their resistance to color degradation and compatibility with an assortment of substrates, which has facilitated widespread adoption of these products in large scale mainstream construction and renovation projects.

Polyurethane is the fastest-growing category, as the demand for these products increases in both industrial and automotive applications and protective coatings. The demand for coating products that offer excellent abrasion resistance, chemical stability, and long-term surface protection is increasing as consumers require coatings to protect their products from extreme environmental conditions. In addition, coatings are required on equipment that requires extended service intervals and has premium finishes.

By Application

Residential is the largest category with an estimated share of 60% in 2025, a result of continued construction of residential units and renovations that require repaints of both interior and exterior surfaces in all types of residential units (villas, apartments, etc.) as well as common area spaces in condominium or townhome-style residential projects. The decorative finish, durability, and water resistance in very hot weather conditions provide constant volume sales to homeowners, builders, and maintenance companies.

Commercial is rapidly growing at a CAGR of 7.2% during the forecast period, due to continued developments of office buildings, hotels, shopping centres, and other multi-purpose commercial projects. Many of these projects are now specifying high-quality decorative finishes, high-traffic areas with performance-based coatings, and specific branded aesthetic requirements, which have contributed to the accelerated adoption of higher-cost coating systems on both new-build and rehabilitation projects.

By Technology

Solvent-based coatings are the largest category, due to a long history of use within industrial and protective coatings, as well as their ability to meet the requirements of high-performance under extreme conditions and their capacity for adherence to surfaces. Legacy specifications, contractor familiarity with solvent-based coatings, and their ability to be applied over heavy-duty surfaces continue to drive its extensive usage throughout industrial and infrastructure assets.

Water-based coatings are the fastest-growing category, due to the increasing demands of regulatory compliance (indoor air quality), sustainability mandates, and decreasing VOC emission levels. As a result of the growing demand for low VOC-emitting products, developers and asset owners have increasingly chosen to use water-based systems in both residential and commercial interior applications, leading to fast penetration rates on new construction and renovation projects. According to the International Energy Agency, investment in energy efficiency reached USD 660 billion in 2024, supporting low-emission material adoption.

By End-Use Industry

Construction & infrastructure is the largest category with a market share of 70% in 2025, driven by a continuous build-out of housing, commercial real estate, transportation corridors, and public buildings. The large number of projects in the pipeline, along with the need for ongoing maintenance, will continue to provide a constant source of demand for both decorative and protective coatings.

The automotive & transportation is the fastest growing category with a CAGR of 7.9% in the coming years because of the growth in the size of logistics fleets, public transportation assets and vehicle maintenance ecosystems; therefore, increasing demand for specialized coatings. The performance requirements for corrosion protection, surface durability and aesthetically pleasing finishes are also creating an environment where there is a greater adoption rate of more advanced coating technologies for use in this end-use segment, as according to the International Organization of Motor Vehicle Manufacturers, vehicle sales reached about 95 million units in 2024, increasing automotive coating consumption.

Regional Insights

Saudi Arabia Paints and Coating Market

The paint and coating markets in Saudi Arabia are characterized as being structurally strong because of the ongoing urban growth, large-scale residential and commercial developments, and the continued upgrading of public and private buildings. Saudi Arabia's paint and coating markets have been impacted by national building programs, hotel and tourism developments, and the continuing renovation and replacement of home and community environments. The need to coat surfaces that can withstand the climatic conditions (i.e., extreme heat, intense sunlight, sand, and moisture) has created a consistent demand for coatings with high heat tolerance, UV stability, and moisture and sand resistance. In addition to a local production base and distribution networks, the preference for products that meet or exceed environmental regulations and emissions standards is beginning to influence the purchasing habits of customers. Specification-driven construction projects now prefer coated systems that have received certification of performance to protect the long term condition of an asset.

Eastern Region Market

The eastern region remains the largest market, due to it being home to most of the country's major industrial complexes, the majority of the nation's energy-generating facilities, numerous port locations and large-scale infrastructure that requires ongoing protective coating applications. Continued high exposure to corrosive environments has ensured a consistent demand for industrial coatings and coatings for asset protection, throughout all phases of the equipment maintenance cycle (i.e., maintenance, shut-down and refurbishment). According to the Ministry of Industry and Mineral Resources, 179 industrial licenses were issued in 2025, representing investments exceeding SAR 6.6 billion, expanding manufacturing activity.

Central Region Market

The central region is the fastest-growing market, due to an increasing rate of urbanization in the region, and associated with that increased rate of urbanization are multiple mixed-use real estate projects, and an increasing number of commercial construction activities centered in the nation's capital. The demand for architectural finishes, premium interior coatings, and compliance-based formulations continues to grow within both residential and commercial developments, with Riyadh accounting for 38% of national contract awards totalling USD 54 billion in 2023, indicating strong construction expansion.

Competitive Landscape / Company Insights

The market is fragmented, characterized by the presence of multiple international coating manufacturers alongside strong regional producers and a wide base of local formulators and distributors. International companies are competing against domestic companies for sales in all three markets (residential, commercial and infrastructure). Companies also use a model called "project-based" which means that they will bid on a specific project and may be selected as one of the many potential bidders to provide coatings for that project. This model provides local companies with several advantages. For example, local companies can provide their products closer to the customer and can customise their product to meet performance requirements unique to the local climate. Additionally, local companies have established long-term business relationships with contractors who purchase coatings for various construction projects. On the other hand, international companies continue to capture market share by being specified in larger development projects, having a recognized brand name and having long term partnership agreements with major developers and engineers.

Mini Profiles

Al-Jazeera Paints Company

Leading Saudi paints manufacturer producing decorative, architectural, and protective coatings for residential, commercial, and infrastructure projects across the Kingdom and wider Middle East markets.

Jotun Saudi Arabia

Global coatings company supplying decorative paints, marine, and protective coatings for construction, industrial assets, and infrastructure projects serving contractors, asset owners, and developers nationwide.

AkzoNobel Saudi Arabia

International coatings producer delivering architectural paints and industrial coatings for commercial buildings, manufacturing facilities, and infrastructure operators across Saudi Arabia’s construction and maintenance markets.

Hempel Saudi Arabia Co. Ltd.

Specialist coatings provider serving the marine, energy, and infrastructure sectors with protective coatings for industrial assets, pipelines, and critical facilities operating across harsh regional environments.

National Paints Factories Co. Ltd.

Regional coatings manufacturer supplying decorative and industrial paint solutions for residential housing, commercial developments, and maintenance contractors across Saudi Arabia and neighbouring markets.

Key Players

- Jotun Saudi Arabia

- Al-Jazeera Paints Company

- National Paints Factories Co. Ltd.

- AkzoNobel Saudi Arabia

- PPG Industries Saudi Arabia

- Kansai Paint Arabia

- Saudi Paints and Coatings Company

- Protech Powder Coatings Inc.

- Sigma Paints (PPG)

- Sak Coat

- Hempel Saudi Arabia Co. Ltd.

- Nippon Paint Saudi Arabia

- Berger Paints Saudi Arabia

- Rust-Oleum Saudi Arabia

- United Coatings Industries

Recent Developments

September 2025 - Jazeera Paints launched its coatings range in select SACO showrooms, extending its distribution footprint into home improvement and construction retail channels.

April 2025 - ONYX COATING opened its Saudi Arabia franchise, introducing automotive surface protection and advanced coating systems to support vehicle maintenance and industrial finishing.

March 2025 - Saudi Industrial Paint Company completed the acquisition of Premium Paints Company, expanding its local manufacturing footprint and broadening its decorative and protective coatings portfolio across the Kingdom.

January 2025 - Jazeera Paints inaugurated multiple new showrooms in Jazan, Al‑Madinah, Saihat, and Suwayr, enhancing retail presence and local access to decorative and architectural paint products.

Saudi Arabia Paints and Coating Market Coverage

Product Type Insight and Forecast 2026 - 2035

- Architectural Paints

- Industrial Coatings

- Protective Coatings

- Powder Coatings

- Marine Coatings

- Specialty Coatings

Resin Type Insight and Forecast 2026 - 2035

- Acrylic

- Epoxy

- Polyurethane

- Polyester

- Alkyd

Application Insight and Forecast 2026 - 2035

- Residential

- Commercial

- Industrial

- Automotive OEM

- Automotive Refinish

- General Industries

- Packaging

Technology Insight and Forecast 2026 - 2035

- Water-Based Coatings

- Solvent-Based Coatings

- Powder-Based Coatings

End-Use Industry Insight and Forecast 2026 - 2035

- Construction & Infrastructure

- Automotive & Transportation

- Marine & Offshore

- Furniture & Wood Products

- Manufacturing & Equipment

Saudi Arabia Paints and Coating Market by Region

- Eastern and Central

- By Product Type

- By Resin Type

- By Application

- By Technology

- By End-Use Industry

Table of Contents for Saudi Arabia Paints and Coating Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Product Type

1.2.2. By

Resin Type

1.2.3. By

Application

1.2.4. By

Technology

1.2.5. By

End-Use Industry

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Saudi Market Estimate and Forecast

4.1. Saudi Market Overview

4.2. Saudi Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Product Type

5.1.1. Architectural Paints

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Industrial Coatings

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Protective Coatings

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.1.4. Powder Coatings

5.1.4.1. Market Definition

5.1.4.2. Market Estimation and Forecast to 2035

5.1.5. Marine Coatings

5.1.5.1. Market Definition

5.1.5.2. Market Estimation and Forecast to 2035

5.1.6. Specialty Coatings

5.1.6.1. Market Definition

5.1.6.2. Market Estimation and Forecast to 2035

5.2. By Resin Type

5.2.1. Acrylic

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Epoxy

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Polyurethane

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Polyester

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.2.5. Alkyd

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2035

5.3. By Application

5.3.1. Residential

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Commercial

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Industrial

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Automotive OEM

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.3.5. Automotive Refinish

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2035

5.3.6. General Industries

5.3.6.1. Market Definition

5.3.6.2. Market Estimation and Forecast to 2035

5.3.7. Packaging

5.3.7.1. Market Definition

5.3.7.2. Market Estimation and Forecast to 2035

5.4. By Technology

5.4.1. Water-Based Coatings

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Solvent-Based Coatings

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Powder-Based Coatings

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.5. By End-Use Industry

5.5.1. Construction & Infrastructure

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Automotive & Transportation

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Marine & Offshore

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.5.4. Furniture & Wood Products

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2035

5.5.5. Manufacturing & Equipment

5.5.5.1. Market Definition

5.5.5.2. Market Estimation and Forecast to 2035

6. Eastern and Central Market Estimate and Forecast

6.1. By

Product Type

6.2. By

Resin Type

6.3. By

Application

6.4. By

Technology

6.5. By

End-Use Industry

7. Company Profiles

7.1.

Jotun Saudi Arabia

7.1.1.

Snapshot

7.1.2.

Overview

7.1.3.

Offerings

7.1.4.

Financial

Insight

7.1.5.

Recent

Developments

7.2.

Al-Jazeera Paints Company

7.2.1.

Snapshot

7.2.2.

Overview

7.2.3.

Offerings

7.2.4.

Financial

Insight

7.2.5.

Recent

Developments

7.3.

National Paints Factories Co. Ltd.

7.3.1.

Snapshot

7.3.2.

Overview

7.3.3.

Offerings

7.3.4.

Financial

Insight

7.3.5.

Recent

Developments

7.4.

AkzoNobel Saudi Arabia

7.4.1.

Snapshot

7.4.2.

Overview

7.4.3.

Offerings

7.4.4.

Financial

Insight

7.4.5.

Recent

Developments

7.5.

PPG Industries Saudi Arabia

7.5.1.

Snapshot

7.5.2.

Overview

7.5.3.

Offerings

7.5.4.

Financial

Insight

7.5.5.

Recent

Developments

7.6.

Kansai Paint Arabia

7.6.1.

Snapshot

7.6.2.

Overview

7.6.3.

Offerings

7.6.4.

Financial

Insight

7.6.5.

Recent

Developments

7.7.

Saudi Paints and Coatings Company

7.7.1.

Snapshot

7.7.2.

Overview

7.7.3.

Offerings

7.7.4.

Financial

Insight

7.7.5.

Recent

Developments

7.8.

Protech Powder Coatings Inc.

7.8.1.

Snapshot

7.8.2.

Overview

7.8.3.

Offerings

7.8.4.

Financial

Insight

7.8.5.

Recent

Developments

7.9.

Sigma Paints (PPG)

7.9.1.

Snapshot

7.9.2.

Overview

7.9.3.

Offerings

7.9.4.

Financial

Insight

7.9.5.

Recent

Developments

7.10.

Sak Coat

7.10.1.

Snapshot

7.10.2.

Overview

7.10.3.

Offerings

7.10.4.

Financial

Insight

7.10.5.

Recent

Developments

7.11.

Hempel Saudi Arabia Co. Ltd.

7.11.1.

Snapshot

7.11.2.

Overview

7.11.3.

Offerings

7.11.4.

Financial

Insight

7.11.5.

Recent

Developments

7.12.

Nippon Paint Saudi Arabia

7.12.1.

Snapshot

7.12.2.

Overview

7.12.3.

Offerings

7.12.4.

Financial

Insight

7.12.5.

Recent

Developments

7.13.

Berger Paints Saudi Arabia

7.13.1.

Snapshot

7.13.2.

Overview

7.13.3.

Offerings

7.13.4.

Financial

Insight

7.13.5.

Recent

Developments

7.14.

Rust-Oleum Saudi Arabia

7.14.1.

Snapshot

7.14.2.

Overview

7.14.3.

Offerings

7.14.4.

Financial

Insight

7.14.5.

Recent

Developments

7.15.

United Coatings Industries

7.15.1.

Snapshot

7.15.2.

Overview

7.15.3.

Offerings

7.15.4.

Financial

Insight

7.15.5.

Recent

Developments

8. Appendix

8.1. Exchange Rates

8.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Saudi Arabia Paints and Coating Market