Geothermal Instrumentation and Monitoring Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Offering (Hardware, Software, Services), by Monitoring Technique (Wired Monitoring Systems, Wireless Monitoring Systems), by Structure Type (Well Monitoring, Surface Power Plant Monitoring, Pipeline & Infrastructure Monitoring), by End Use (Energy & Power Generation, Mining, Infrastructure/Heating Applications)

| Status : Published | Published On : Feb, 2026 | Report Code : VREP3063 | Industry : Energy & Power | Available Format :

|

Page : 184 |

Geothermal Instrumentation and Monitoring Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Offering (Hardware, Software, Services), by Monitoring Technique (Wired Monitoring Systems, Wireless Monitoring Systems), by Structure Type (Well Monitoring, Surface Power Plant Monitoring, Pipeline & Infrastructure Monitoring), by End Use (Energy & Power Generation, Mining, Infrastructure/Heating Applications)

Geothermal Instrumentation and Monitoring Market Overview

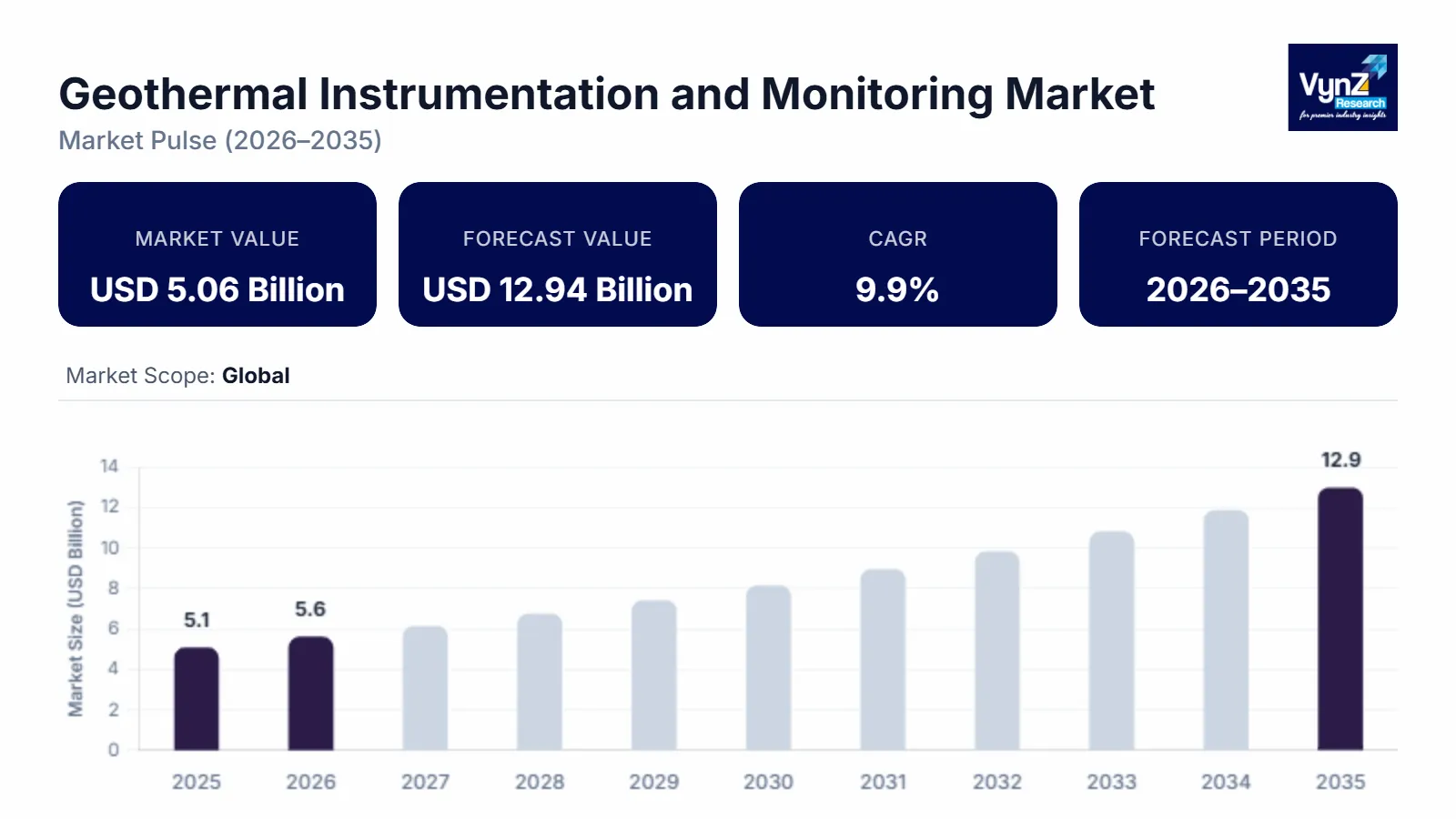

The global geothermal instrumentation and monitoring market which was valued at roughly USD 5.06 billion in 2025 and is estimated to rise further over to nearly USD 5.58 billion by 2026, is projected to reach around USD 12.94 billion in 2035, expanding at a CAGR of about 9.9% during the forecast period from 2026 to 2035.

Growth is supported by adding geothermal drilling depth, rising demand for force performance and subsurface stability monitoring, and strengthening nonsupervisory oversight concerning environmental and seismic threat operation, along with wider demand of automated digital data accession platforms. Expanding renewable baseload power generation capacity and sustained public investment in clean energy structure across the United States, Indonesia, and Iceland continue to support market expansion.

International energy data reflects harmonious additions in geothermal electricity capacity, particularly in tectonically active regions where nonstop monitoring enhances functional trustability and reduces drilling threat. Government backed renewable transition frameworks emphasize diversified power generation and long-term decarbonization targets, encouraging deployment of borehole detectors, pressure instruments, and micro-seismic monitoring systems. Environmental regulations addressing groundwater protection and convinced seismicity further necessitate structured instrumentation integration, supporting demand across both mature and developing geothermal markets.

Geothermal Instrumentation and Monitoring Market Dynamics

Market Trends

The market is passing a structural transition toward digital, automated, and remote monitoring frameworks aligned with public renewable energy deployment strategies. Energy transition roadmaps issued by the International Energy Agency and public energy ministries emphasize dependable baseload renewable generation, encouraging integration of real-time force analytics and nonstop subsurface performance monitoring. Regulatory guidance related to convinced seismicity and groundwater protection issued by geological authorities is accelerating the deployment of micro-seismic arrays, fiber optic seeing systems, and cloud-based data platforms. Drivers are decreasingly prioritizing predictive maintenance and remote diagnostics to enhance functional stability, upgrade drilling precision, and align with environmental compliance norms in geothermal producing regions like the United States, Indonesia, and Iceland.

Growth Drivers

Growth in the geothermal instrumentation and monitoring market is primarily supported by expanding geothermal electricity capacity and sustained public investment in clean energy structure. International energy statistics indicate steady additions in installed geothermal power capacity, particularly in tectonically active regions with favorable subsurface conditions. Government backed decarbonization commitments and public renewable energy targets are strengthening design channels and encouraging integration of advanced monitoring systems. Added focus on drilling effectiveness, asset life, and regulatory compliance is strengthening demand for pressure detectors, distortion monitoring instruments, and micro-seismic systems across production and exploration stages. Public sponsorship programs and multinational climate finances further support market expansion with adequate capital availability.

Market Restraints / Challenges

Despite favorable policy alignment, the market faces challenges related to high capital expenditure, lack of technical knowledge, and specialized complexity. Deployment of advanced subterranean monitoring systems requires significant investment in perfection detectors, data accession structure, and professional geological expertise. Government energy reports indicate that geothermal systems involve high examination threat and extended payback time, which may delay instrumentation demand in cost sensitive markets. Regulatory sanctions, environmental impact assessments, and seismic threat evaluations also extend design timelines, adding compliance costs. Dependence on imported high perfection equipment and specialized tech service providers can pressurize and disrupt supply chain, particularly during economic volatility across the world.

Market Opportunities

The market presents significant openings through expansion of geothermal survey in developing countries and integration of digital analytics within renewable energy structure. Carbon impartiality roadmaps and energy diversification strategies are opening new geothermal development zones in Asia Pacific and a few major European regions. Public sector subsidies supporting risk mitigation in exploration are encouraging demand of advanced monitoring technologies during early-stage drilling. Advancements in fiber optic seeing, artificial intelligence grounded force modeling, and cloud-based administrative control systems are enhancing functional effectiveness and perfecting long term asset operation. Companies delivering scalable, digitally enabled monitoring platforms are well deposited to capture incremental demand as geothermal capacity continues to expand under structured clean energy investment frameworks.

Global Geothermal Instrumentation and Monitoring Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 5.06 Billion |

|

Revenue Forecast in 2035 |

USD 12.94 Billion |

|

Growth Rate |

9.9% |

|

Segments Covered in the Report |

By Offering, By Monitoring Technique, By Structure Type, By End Use |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia Pacific, Europe, Rest of the World |

|

Key Companies |

COWI A/S, Deep Excavation LLC, Fugro N.V., Geocomp Corporation, Geokon Inc., James Fisher and Sons plc, Keller Group plc, Nova Metrix LLC, RST Instruments Ltd., Sisgeo S.r.l. |

|

Customization |

Available upon market |

Geothermal Instrumentation and Monitoring Market Segmentation

By Offering

Hardware contributed to the largest share of the market in 2025, representing roughly 64% of total profit. Its dominance reflects expansive deployment of subterranean detectors, pressure monitoring instruments, and seismic discovery systems across geothermal exploration and product wells. High capital allocation toward drilling and force integrity assessment continues to support demand across established geothermal producing regions. It is expected to expand at an estimated CAGR of 9.6% during 2026 to 2035, supported by continued well development and modernization of monitoring systems.

Software is anticipated to register the fastest growth, with a projected CAGR of 10.4% over the forecast period. Growth is driven by rising integration of real-time analytics platforms, automated data interpretation systems, and predictive modeling tools. Rising digitalization of geothermal operations and expansion of remote administrative control frameworks are strengthening market expansion.

Services are projected to grow at 9.2%, supported by installation, estimation, standardization and long-term maintenance agreements to ensure functional optimization and regulatory compliance.

By Monitoring Technique

Wired systems held the largest market share in 2025, counting for roughly 58% of total profit. Their dominance reflects trustability in high temperature and high-pressure geothermal well surroundings, along with compatibility with non-stop data transmission conditions in large scale installations. It is anticipated to grow at a CAGR of 9.3% through 2026 to 2035, supported by stable structure investment and long-term functional safety authorizations.

Wireless systems are projected to witness the highest growth rate, expanding at an estimated CAGR of 10.8% during the forecast period. Demand is adding due to sensing abilities, lower installation complexity, and enhanced scalability in distributed geothermal systems. Developments in low power communication technologies and real-time field data availability continue to drive further expansion.

By Structure Type

Well monitoring provided for the largest profit share in 2025, contributing roughly 47% of it. It benefits from strict instrumentation conditions during drilling, force testing, and long-term operation management. Increasing drilling depth and improved environmental oversight are likely to support a CAGR of 10.1% during 2026 to 2035.

Surface power factory monitoring is anticipated to grow at roughly 9.4%, driven by modernization activities and integration of automated administrative systems.

Monitoring of channels and associated structure is projected to expand at 8.9%, supported by asset integrity operation conditions and functional effectiveness improvement programs.

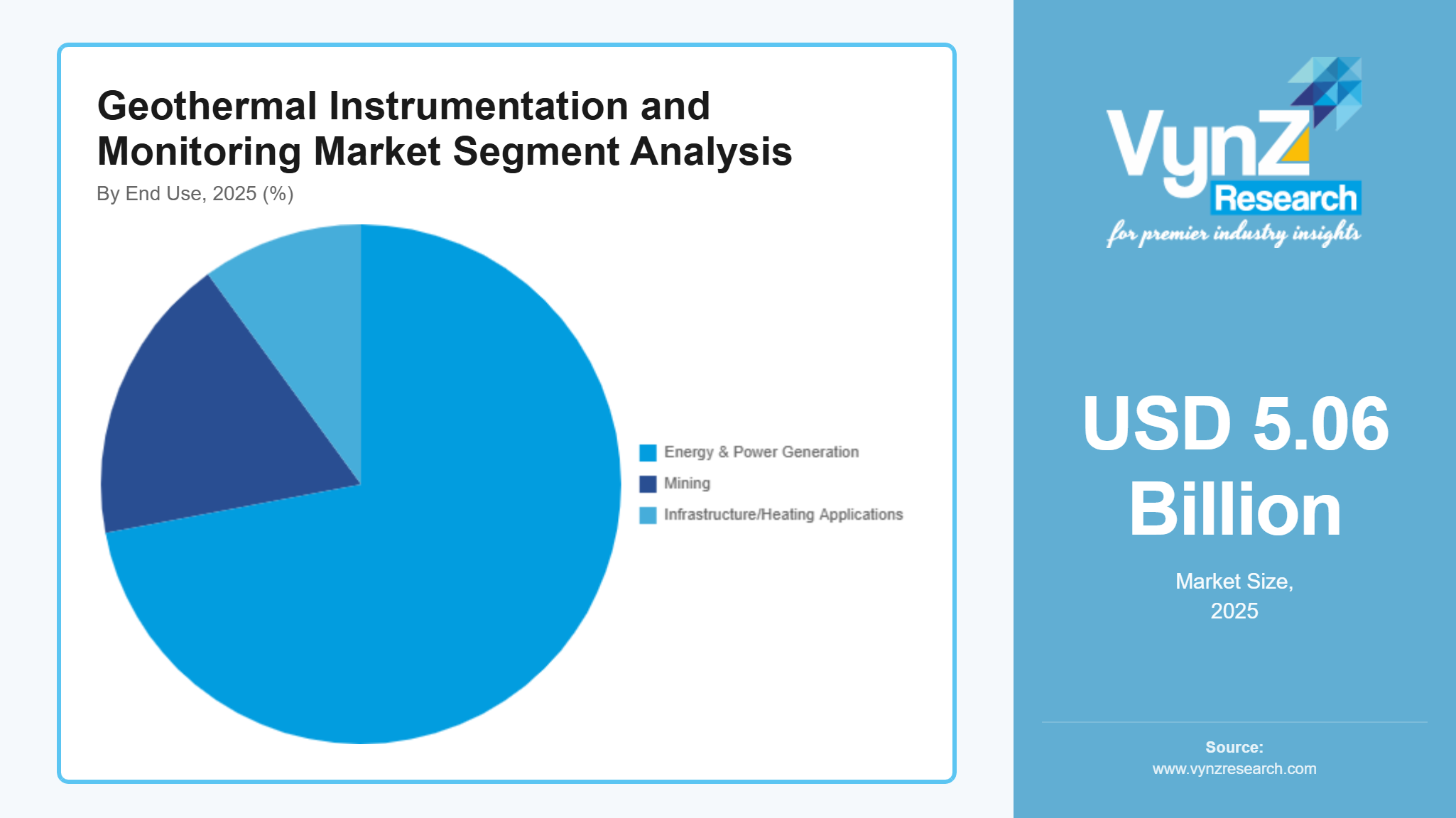

By End Use

Energy and power generation held the largest share in 2025, representing roughly 72% of total market revenue. Expansion of geothermal electricity capacity and sustained public investment in renewable baseload power generation continue to support dominance. It is projected to grow at a CAGR of 9.8% during the forecast period, reflecting steady increase in installed geothermal power capacity.

Mining integrated geothermal operations are anticipated to grow at 8.7%, supported by combined resource application activities and energy diversification strategies. Structure related geothermal heating operations are projected to expand at 9.1%, driven by quarter heating systems and policy aligned decarbonization commitments in geothermal active regions.

Regional Insights

North America

North America contributed roughly 29% of the market in 2025. Growth in the region is driven by established geothermal capacity in the United States and sustained clean energy support programs. Data from the U.S. Energy Information Administration and the U.S. Department of Energy indicate continued investment in geothermal resource exploration and improved geothermal systems study. Major geothermal capitals like California and Nevada support strong demand for advanced monitoring and seismic threat assessment systems.

Government backed renewable portfolio norms and decarbonization frameworks are encouraging modernization of geothermal installations and integration of real time subsurface monitoring technologies. Federal subsidies supporting drilling invention and geothermal demonstration systems further support regional demand for instrumentation accuracy and improved digital administrative systems.

Asia Pacific

Asia Pacific held 27% of the market in 2025 with further growth supported by huge geothermal reserves and growing electricity generation capacity in Indonesia, the Philippines, and Japan. National energy agencies in these countries highlight geothermal as a stable baseload renewable source, aligned with long-term decarbonization obligations. Public investment plans targeting renewable variation are fast-tracking geothermal field progress, thereby adding demand for well-conditioned integrity monitoring and micro-seismic systems.

Government-backed exploration threat mitigation schemes and infrastructure funding efforts are encouraging distribution of digital monitoring platforms across developing geothermal regions. Speedy capacity add-ons and modernization of aging plants continue to increase demand of cutting-edge instrumentation solutions in the region.

Europe

Europe accounts for roughly 18% of the market in 2025. Growth is supported by structured renewable energy transition programs and geothermal heating activities in countries like Iceland, Italy, Germany, and France. The European Commission energy transition agenda and public geological checks emphasize sustainable geothermal application and environmental compliance. Rising heating integration and modernization of geothermal installations are pushing the need for subterranean distortion and groundwater monitoring systems.

Public support programs for decarbonization and sustainable heating infrastructure are accelerating demand of automated data accession and remote detection technologies. Environmental regulations governing seismic monitoring and groundwater protection further strengthen indigenous demand for advanced instrumentation deployment.

Rest of the World

The Rest of the World accounts for roughly 26% of the market in 2025, including Latin America, Africa, and major Middle Eastern economies with growing potential in geothermal activities.

Countries similar as Kenya, Mexico, and Türkiye are expanding geothermal capacity under public renewable energy programs supported by development finance institutions and multinational climate finances. Government energy strategies promoting energy security and low-emission power generation are creating demand for well monitoring and drilling optimization systems.

Competitive Landscape / Company Insights

The market is relatively to largely competitive, with global and local players emphasizing product invention, pricing strategies, and geographic expansion. Major players invest in advanced detector technologies, digital monitoring platforms, and real-time data analytics. Demand is supported by government enterprise similar as the U.S. Department of Energy geothermal programs, European Union Horizon exploration subsidies, and Asia Pacific renewable energy modernization systems, encouraging companies to strengthen market position and expand functional reach.

Mini Profiles

COWI A/S focuses on advanced geothermal and geotechnical monitoring solutions, results, supported by strong international experience, digital data analytics capabilities, and effective deployment across multiple sectors.

Deep Excavation LLC operates in niche geothermal and subterranean monitoring parts, emphasizing customizable instrumentation, dependable field performance, and integration with civil engineering systems.

Fugro N.V. leverages global digital reach and strategic connections to expand market presence, offering perfection detectors, remote monitoring services, and robust analytics for geothermal operations.

Geocomp Corporation focuses on real-time monitoring systems and detector results, supported by cost-effective manufacturing, local distribution networks, and engineering consultancy moxie.

Geokon Inc. operates in advanced monitoring results, emphasizing design performance, durable instrumentation, and integration with advanced geotechnical data platforms for sustainable energy systems.

Key Players

- COWI A/S

- Deep Excavation LLC

- Fugro N.V.

- Geocomp Corporation

- Geokon Inc.

- James Fisher and Sons plc

- Keller Group plc

- Nova Metrix LLC

- RST Instruments Ltd.

Recent Developments

In February 2026, The French energy company TotalEnergies has awarded a contract to Dutch geo-data specialist Fugro NV to do geotechnical studies for their 2-GW NordSee Energies 1 wind project in the North Sea. Investigations at over 140 sites, down to a depth of 50 meters below the seabed, will be part of the program. Data regarding the seabed conditions at the intended placements of wind turbines and inter-array cable routes will be obtained from the surveys. Laboratory testing will be conducted at Fugro's facilities in Wallingford, UK, and Louvain, Belgium, following the completion of the offshore activities.

In February 2026, An important stage in the company James Fisher and Sons plc’s global expansion was the official initiation of operations in Guyana's maritime and energy sectors. Local energy officials, representatives from Go-Invest (Guyana's investment promotion agency), and members of the business sector attended the launch ceremony, which was held at the Pegasus Hotel in Georgetown, the country's capital.

Global Geothermal Instrumentation and Monitoring Market Coverage

Offering Insight and Forecast 2026 - 2035

- Hardware

- Software

- Services

Monitoring Technique Insight and Forecast 2026 - 2035

- Wired Monitoring Systems

- Wireless Monitoring Systems

Structure Type Insight and Forecast 2026 - 2035

- Well Monitoring

- Surface Power Plant Monitoring

- Pipeline & Infrastructure Monitoring

End Use Insight and Forecast 2026 - 2035

- Energy & Power Generation

- Mining

- Infrastructure/Heating Applications

Global Geothermal Instrumentation and Monitoring Market by Region

- North America

- By Offering

- By Monitoring Technique

- By Structure Type

- By End Use

- By Country - U.S., Canada, Mexico

- Europe

- By Offering

- By Monitoring Technique

- By Structure Type

- By End Use

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Offering

- By Monitoring Technique

- By Structure Type

- By End Use

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Offering

- By Monitoring Technique

- By Structure Type

- By End Use

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Geothermal Instrumentation and Monitoring Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Offering

1.2.2. By

Monitoring Technique

1.2.3. By

Structure Type

1.2.4. By

End Use

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Offering

5.1.1. Hardware

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Software

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Services

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Monitoring Technique

5.2.1. Wired Monitoring Systems

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Wireless Monitoring Systems

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Structure Type

5.3.1. Well Monitoring

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Surface Power Plant Monitoring

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Pipeline & Infrastructure Monitoring

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By End Use

5.4.1. Energy & Power Generation

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Mining

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Infrastructure/Heating Applications

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Offering

6.2. By

Monitoring Technique

6.3. By

Structure Type

6.4. By

End Use

6.4.1.

U.S. Market Estimate and Forecast

6.4.2.

Canada Market Estimate and Forecast

6.4.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Offering

7.2. By

Monitoring Technique

7.3. By

Structure Type

7.4. By

End Use

7.4.1.

Germany Market Estimate and Forecast

7.4.2.

U.K. Market Estimate and Forecast

7.4.3.

France Market Estimate and Forecast

7.4.4.

Italy Market Estimate and Forecast

7.4.5.

Spain Market Estimate and Forecast

7.4.6.

Russia Market Estimate and Forecast

7.4.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Offering

8.2. By

Monitoring Technique

8.3. By

Structure Type

8.4. By

End Use

8.4.1.

China Market Estimate and Forecast

8.4.2.

Japan Market Estimate and Forecast

8.4.3.

India Market Estimate and Forecast

8.4.4.

South Korea Market Estimate and Forecast

8.4.5.

Vietnam Market Estimate and Forecast

8.4.6.

Thailand Market Estimate and Forecast

8.4.7.

Malaysia Market Estimate and Forecast

8.4.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Offering

9.2. By

Monitoring Technique

9.3. By

Structure Type

9.4. By

End Use

9.4.1.

Brazil Market Estimate and Forecast

9.4.2.

Saudi Arabia Market Estimate and Forecast

9.4.3.

South Africa Market Estimate and Forecast

9.4.4.

U.A.E. Market Estimate and Forecast

9.4.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1.

COWI A/S

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5.

Recent

Developments

10.2.

Deep Excavation LLC

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5.

Recent

Developments

10.3.

Fugro N.V.

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5.

Recent

Developments

10.4.

Geocomp Corporation

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5.

Recent

Developments

10.5.

Geokon Inc.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5.

Recent

Developments

10.6.

James Fisher and Sons plc

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5.

Recent

Developments

10.7.

Keller Group plc

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5.

Recent

Developments

10.8.

Nova Metrix LLC

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5.

Recent

Developments

10.9.

RST Instruments Ltd.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5.

Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Geothermal Instrumentation and Monitoring Market