Qatar Greenhouse Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Greenhouse Type (Free standing Greenhouses, Gutter-connected Greenhouses), by Material Used (Plastic Greenhouse, Glass Greenhouse), by Technology (Heating System, Cooling System, Others), by Crop Type (Fruits & Vegetables, Flowers & Ornamentals, Nursery Crops, Others)

| Status : Published | Published On : Feb, 2026 | Report Code : VREP3064 | Industry : Energy & Power | Available Format :

|

Page : 125 |

Qatar Greenhouse Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Greenhouse Type (Free standing Greenhouses, Gutter-connected Greenhouses), by Material Used (Plastic Greenhouse, Glass Greenhouse), by Technology (Heating System, Cooling System, Others), by Crop Type (Fruits & Vegetables, Flowers & Ornamentals, Nursery Crops, Others)

Qatar Greenhouse Market Overview

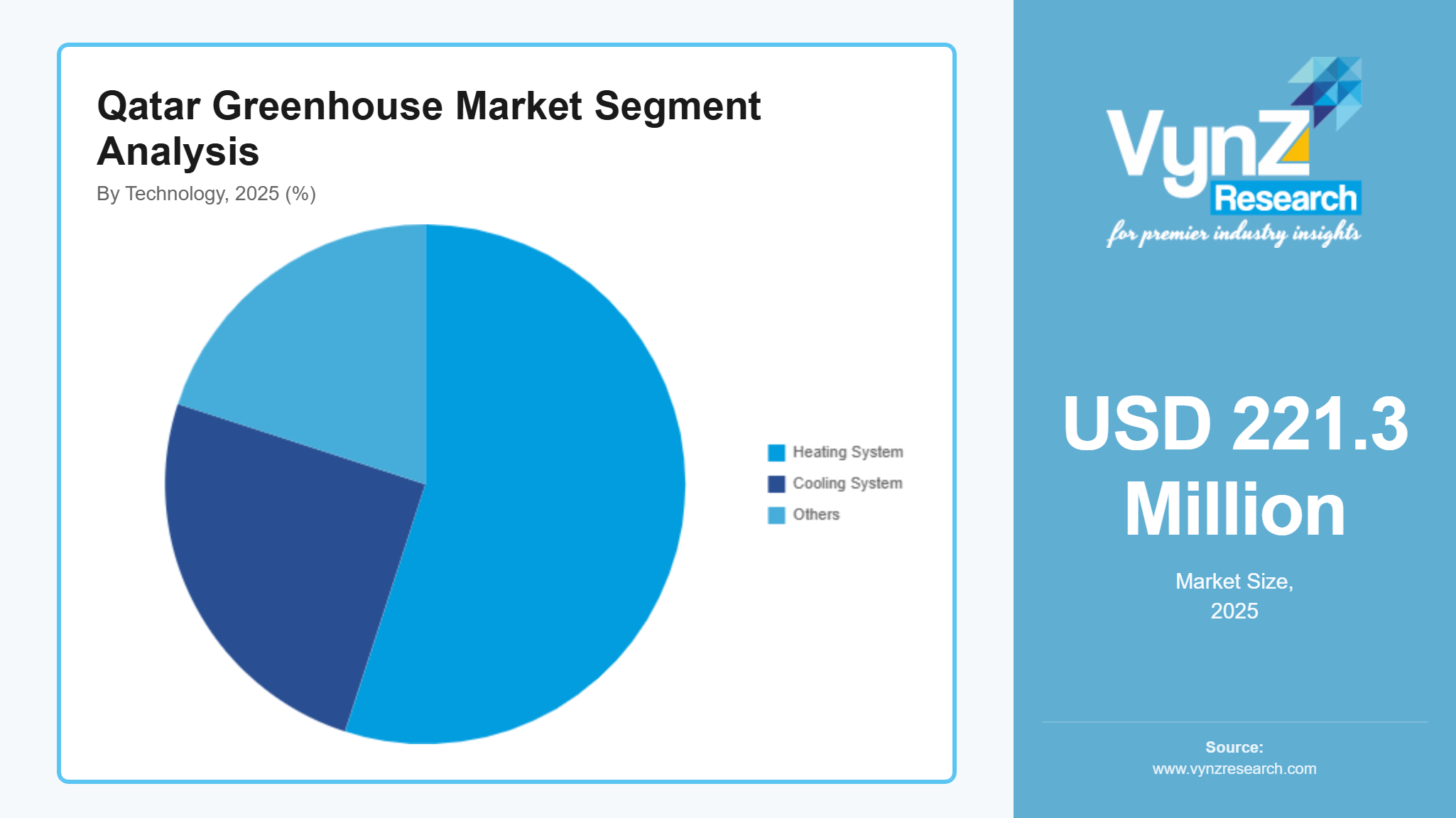

The Qatar greenhouse market which was valued at approximately USD 221.3 million in 2025 and is estimated to reach around USD 262.0 million in 2026, is projected to reach close to USD 814.3 million by 2035, expanding at a CAGR of about 13.4% during the forecast period from 2026 to 2035.

The market is witnessing sustained growth as the nation strategically reshapes its agricultural landscape to overcome structural limitations. Extreme climatic conditions, constrained arable land, and water scarcity have shifted farming priorities toward controlled-environment solutions that deliver consistency, efficiency, and scalability. Greenhouses are no longer viewed as supportive infrastructure; they are becoming a core production system enabling year-round cultivation and predictable output.

Rising consumer expectations for locally produced, high-quality fresh food is accelerating commercial adoption, while advancements in cooling, automation, and water-efficient technologies are significantly improving operational economics. Investors and agribusinesses are increasingly attracted by the ability of modern greenhouse systems to reduce supply volatility, optimize resource use, and enhance yield reliability. Simultaneously, the expansion of organized agricultural zones and private-sector participation is reinforcing long-term market confidence. Collectively, these factors are transforming greenhouse farming into a strategic, growth-driven segment within Qatar’s evolving agri-food ecosystem.

Market Dynamics

Market Trends

In recent years, Qatar has accelerated the adoption of modern greenhouse and protected agriculture systems as part of its broader food security agenda. Government data shows that vegetable self-sufficiency has improved substantially, with local output reaching about 75,000 tonnes in 2025 and greenhouse units expanding markedly to support this growth, reflecting public commitment to controlled environment agriculture. This shift is supported by more than 950 productive farms nationwide incorporating advanced cultivation practices that extend the growing season beyond traditional agricultural limitations, enabling a reliable year-round supply. Increased marketing platforms and direct farm-to-market initiatives are also catalysing the trend, reinforcing the role of greenhouses in Qatar’s evolving agri-ecosystem. As domestic supply strengthens, this trend is transforming the agricultural sector toward sustainable, tech-driven production capable of meeting both national demand and strategic self-sufficiency goals.

Growth Drivers

A primary driver of greenhouse market expansion in Qatar is its National Food Security Strategy 2030, which sets ambitious targets to reduce dependence on food imports by scaling local production capabilities. Under the strategy, Qatar aims to achieve 55 % vegetable self-sufficiency by 2030, backed by comprehensive support measures for greenhouse infrastructure, irrigation modernisation, and agricultural services. In 2024, more than 26 million kg of local vegetables were marketed, signalling strong progress toward this goal. Government programmes now support organic farming expansion and the distribution of modern greenhouse units to enhance yield and resource efficiency. This strategic focus is reinforcing private investment as well as agribusiness confidence, transforming greenhouse projects from niche operations into core components of the country’s food resilience framework. The alignment of policy, technology adoption, and infrastructure development is creating a conducive environment for sustained sector growth.

Market Restraints / Challenges

Qatar’s greenhouse market contends with inherent resource limitations that pose significant operational challenges. Water scarcity remains a critical constraint, compelling reliance on treated and modern irrigation solutions to sustain year-round production under arid conditions. Energy demands for cooling systems further contribute to cost pressures, particularly in environments with extreme heat, increasing both capital and operational expenses for greenhouse operators. While government interventions provide essential support, balancing resource sustainability with rising input costs requires ongoing innovation and investment. The transition to efficient irrigation and controlled environment systems is capital-intensive, and smaller producers often face barriers to accessing the technologies necessary to optimise yields and reduce costs over time.

Market Opportunities

Rapid technological advancement in greenhouse cultivation presents a compelling opportunity for investors and agribusiness stakeholders in Qatar. With policies favouring precision irrigation, automation, and climate-smart cultivation, greenhouse operations are poised to deliver higher yields with lower resource consumption. Public-private partnerships and expanded infrastructure create favourable conditions for scaling greenhouse technologies such as hydroponics and controlled climate systems. The expansion of local agricultural markets, featuring over 100 farms nationwide in the 2025/2026 season, highlights increasing consumer demand for locally grown produce and the potential for direct market access. This growth trajectory not only enhances domestic food security but also opens avenues for export-focused agricultural products. Stakeholders who align with sustainable innovation and operational excellence stand to benefit from long-term returns as Qatar’s greenhouses become integral to resilient, high-value agri-production.

Qatar Greenhouse Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 221.3 Million |

|

Revenue Forecast in 2035 |

USD 814.3 Million |

|

Growth Rate |

13.4% |

|

Segments Covered in the Report |

Greenhouse Type, Material Used, Technology, Crop Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

Northern, Southern |

|

Key Companies |

Arab Qatari Agricultural Production Company (QATFA), Hassad Food Company Q.P.S.C., Baladna Food Industries Q.P.S.C. ,Qatari Agricultural Development Company (AGRICO), Widam Food Company Q.P.S.C., Elite Agro Company W.L.L. (Elite Agro Qatar), Pergola Contracting & Green Houses |

|

Customization |

Available upon request |

Market Segmentation

By Greenhouse Type

In Qatar’s agricultural transformation, gutterconnected greenhouses held the largest market share of approx. 65% in 2025, as well as growing rapidly at a CAGR of 13.8% during the forecast period. Designed with continuous roof connections across multiple bays, these systems enable integrated climate control, centralised irrigation, and efficient resource usage — critical in Qatar’s extreme heat and water-limited environment. Government-led distribution programmes have prioritised greenhouse infrastructure to stabilise food supply and extend cultivation seasons, with installations planned across major farm clusters nationwide. In 2023–2024, the Ministry of Municipality reported the productive farm network reached over 1,068 active farms, many of which use advanced protected cultivation systems that include gutter-connected designs, reflecting their dominant role in large-scale vegetable and highvalue crop production. This trend underscores governmental emphasis on resilient and scalable greenhouse systems as a foundation of Qatar’s longterm food security strategy.

By Material Used

Plastic greenhouses represented the largest category with an estimated 70% share in 2025 and experienced the fastest growth rate with a CAGR of 14.1% in the coming years. Driven by governmentled distribution programmes that have provided greenhouses across more than 666 hectares of arable land and aim to install about 3,478 units on productive farms, plastic structures are widely adopted for their costefficiency and adaptability in harsh climatic conditions. Plastic materials, especially polyethylene and polycarbonate, allow farmers to implement controlled cultivation quickly and with lower upfront cost compared to heavier materials, aligning with national priorities to expand year-round vegetable production and reduce import dependency. As greenhouse rollout accelerates, plastic greenhouses continue to dominate installations in both small and large farm operations, strengthening domestic food production capacity under the National Food Security strategy.

There Material further classified into followings

- Plastic Greenhouse

- Polyethylene (PE)

- Polycarbonate

- Polymethyl Methacrylate (PMMA)

- Glass Greenhouse

- Horticulture Glass

- Other Greenhouse Glass

By Technology

In Qatar’s greenhouse sector, cooling systems are the largest and fastest-growing technology category due to the country’s extreme heat and arid conditions. Cooling systems held the market share of around 55% in 2025. Maintaining optimal temperatures is critical for year-round production of vegetables and high-value crops, making cooling systems the backbone of controlled-environment agriculture. These systems range from evaporative cooling and climate-controlled airflow to integrated fan-and-pad solutions, all designed to maximize yield, conserve water, and ensure crop consistency. Government agricultural initiatives emphasize modern, climate-smart greenhouses, with cooling systems at the heart of sustainable cultivation strategies. By enabling reliable production even during peak summer months, cooling technologies allow farms to meet national food security goals while improving efficiency and reducing operational risks. Their rapid adoption across both large commercial farms and smaller pilot projects underscores their central role in transforming Qatar’s agriculture into a technologically advanced, resilient, and high-performing sector.

By Crop Type

In Qatar’s greenhouse sector, fruits and vegetables stand out as the largest and fastest-growing crop category, forming the backbone of the country’s efforts to enhance domestic food security. Fruits and vegetables held the market share of about 60% in 2025. Protected cultivation systems, particularly modern greenhouses with climate control, enable year-round production, overcoming the challenges posed by extreme heat, limited arable land, and scarce water resources. These systems support high-volume vegetable production, allowing farmers to reliably supply both local markets and strategic national reserves. Government initiatives under the National Food Security Strategy 2030 have prioritized the expansion of vegetable cultivation within controlled environments, promoting innovation, irrigation efficiency, and the adoption of sustainable agricultural practices. The Ministry of Municipality reports that by 2025, local vegetable output reached 75,000 tonnes, highlighting the critical role of this crop category. With consistent technological support and strong policy backing, fruits and vegetables remain the fastest-growing and most commercially significant segment in Qatar’s greenhouse ecosystem.

Regional Insights

Northern

Northern Qatar stands out as the largest region in Qatar’s greenhouse market, encompassing major agricultural hubs such as Al Khor, Al Shamal, Umm Salal, and Al Shahaniya. This region hosts the highest concentration of productive farms, extensive greenhouse installations, and large-scale vegetable production projects due to favorable land availability and established agricultural infrastructure. Northern Qatar also benefits from its proximity to key distribution networks and government support programmes focused on expanding protected cultivation, making it the primary source of locally grown fresh produce. Large producers and agribusinesses have concentrated their greenhouse operations here, reinforcing the region’s dominance in acreage, output volume, and investment activity within Qatar’s controlled-environment agriculture landscape.

Southern

Southern Qatar is emerging as the fastest-growing region in the country’s greenhouse market. Areas such as Al Wakra and its surroundings are witnessing rising adoption of modern greenhouse technologies and expanded cultivation capacity due to increasing private-sector interest and proximity to Doha’s logistic hubs. Southern municipalities are strategically positioned to absorb new investments and pilot projects, especially those focused on climate-adaptive greenhouse systems and smart farming solutions. As growers look to diversify production sites beyond traditional northern clusters, Southern Qatar is experiencing accelerated development in greenhouse infrastructure, crop portfolios, and supportive services, making it the fastest-expanding region in Qatar’s protected agriculture sector.

Competitive Landscape / Company Insights

Qatar’s greenhouse market is moderately fragmented, with a combination of a few large, vertically integrated agricultural producers and a wide base of small- to mid-scale greenhouse operators. Large players benefit from economies of scale, advanced greenhouse technologies, and strong distribution networks, allowing them to supply consistent volumes year-round. At the same time, smaller farms remain competitive by focusing on niche crops, seasonal production, and gradual adoption of modern protected cultivation systems. The competitive environment is strongly influenced by government support for local food production, which has lowered entry barriers and encouraged technology upgrades across farm sizes. As a result, competition is shifting from purely volume-based production toward efficiency, crop quality, and sustainability. Companies that invest in automation, climate control, and water-efficient solutions are gaining a clear advantage, while partnerships with suppliers and logistics providers are becoming essential for long-term competitiveness in Qatar’s evolving greenhouse sector.

Mini Profiles

Arab Qatari Agricultural Production Company (QATFA) operates Qatar’s largest vegetable farm in Al Shahaniya, producing fresh vegetables using cooled and non-cooled greenhouses, soilless systems, and open-field cultivation. The company also supplies agricultural inputs and technical services to local farms.

Hassad Food Company Q.P.S.C. is Qatar’s strategic food investment company, established to support national foodsecurity through domestic and international investments in agriculture, livestock, and food supply chains.

Baladna Food Industries Q.P.S.C. is a Qatari public shareholding company and a leading integrated food producer, operating large-scale dairy farms and production facilities to supply fresh and locally produced food to the domestic market.

Key Players

- Arab Qatari Agricultural Production Company (QATFA)

- Hassad Food Company Q.P.S.C.

- Baladna Food Industries Q.P.S.C.

- Qatari Agricultural Development Company (AGRICO)

- Widam Food Company Q.P.S.C.

- Elite Agro Company W.L.L. (Elite Agro Qatar)

- Pergola Contracting & Green Houses

Recent Developments

October 2025 - Hassad Food Company launched an innovative project testing advanced Korean greenhouse covering technology designed to lower internal greenhouse temperatures and extend the growing season for leafy vegetables. This pilot combines modern greenhouse systems, humidity-based irrigation, and renewable energy, aiming to increase efficiency and sustainability of local food production. The initiative reflects Qatar’s broader agricultural innovation strategy and efforts to enhance greenhouse productivity.

July 2025 - Baladna Food Industries Q.P.S.C. signed initial contracts worth over $500 million (about QAR 1.8 billion) for its integrated agri-industrial project in Algeria, marking a key milestone in the first phase of a large-scale initiative that also includes irrigation networks and production infrastructure.

Qatar Greenhouse Market Coverage

Greenhouse Type Insight and Forecast 2026 - 2035

- Free standing Greenhouses

- Gutter-connected Greenhouses

Material Used Insight and Forecast 2026 - 2035

- Plastic Greenhouse

- Glass Greenhouse

Technology Insight and Forecast 2026 - 2035

- Heating System

- Cooling System

- Others

Crop Type Insight and Forecast 2026 - 2035

- Fruits & Vegetables

- Flowers & Ornamentals

- Nursery Crops

- Others

Qatar Greenhouse Market by Region

- Northern

- By Greenhouse Type

- By Material Used

- By Technology

- By Crop Type

- Southern

- By Greenhouse Type

- By Material Used

- By Technology

- By Crop Type

Table of Contents for Qatar Greenhouse Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Greenhouse Type

1.2.2. By

Material Used

1.2.3. By

Technology

1.2.4. By

Crop Type

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Qatar Market Estimate and Forecast

4.1. Qatar Market Overview

4.2. Qatar Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Greenhouse Type

5.1.1. Free standing Greenhouses

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Gutter-connected Greenhouses

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Material Used

5.2.1. Plastic Greenhouse

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Glass Greenhouse

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.3. By Technology

5.3.1. Heating System

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Cooling System

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Others

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By Crop Type

5.4.1. Fruits & Vegetables

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Flowers & Ornamentals

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Nursery Crops

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.4.4. Others

5.4.4.1. Market Definition

5.4.4.2. Market Estimation and Forecast to 2035

6. Northern Market Estimate and Forecast

6.1. By

Greenhouse Type

6.2. By

Material Used

6.3. By

Technology

6.4. By

Crop Type

7. Southern Market Estimate and Forecast

7.1. By

Greenhouse Type

7.2. By

Material Used

7.3. By

Technology

7.4. By

Crop Type

8. Company Profiles

8.1.

Arab Qatari Agricultural Production Company (QATFA)

8.1.1.

Snapshot

8.1.2.

Overview

8.1.3.

Offerings

8.1.4.

Financial

Insight

8.1.5.

Recent

Developments

8.2.

Hassad Food Company Q.P.S.C.

8.2.1.

Snapshot

8.2.2.

Overview

8.2.3.

Offerings

8.2.4.

Financial

Insight

8.2.5.

Recent

Developments

8.3.

Baladna Food Industries Q.P.S.C.

8.3.1.

Snapshot

8.3.2.

Overview

8.3.3.

Offerings

8.3.4.

Financial

Insight

8.3.5.

Recent

Developments

8.4.

Qatari Agricultural Development Company (AGRICO)

8.4.1.

Snapshot

8.4.2.

Overview

8.4.3.

Offerings

8.4.4.

Financial

Insight

8.4.5.

Recent

Developments

8.5.

Widam Food Company Q.P.S.C.

8.5.1.

Snapshot

8.5.2.

Overview

8.5.3.

Offerings

8.5.4.

Financial

Insight

8.5.5.

Recent

Developments

8.6.

Elite Agro Company W.L.L. (Elite Agro Qatar)

8.6.1.

Snapshot

8.6.2.

Overview

8.6.3.

Offerings

8.6.4.

Financial

Insight

8.6.5.

Recent

Developments

8.7.

Pergola Contracting & Green Houses

8.7.1.

Snapshot

8.7.2.

Overview

8.7.3.

Offerings

8.7.4.

Financial

Insight

8.7.5.

Recent

Developments

9. Appendix

9.1. Exchange Rates

9.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Qatar Greenhouse Market