Global Irrigation Automation Market – Analysis and Forecast (2025-2030)

Industry Insights by Irrigation Type (Sprinkler Irrigation, Drip Irrigation, Surface Irrigation), by System (Semi-Automatic, Automatic), by Automation Type (Time-Based, Volume-Based, Real-Time Feedback, Computer-Based), by Components (Controllers, Sensors, Weather-Based, Soil-Based, Fertigation Sensors, Valves, Sprinklers, Other Components, Flow meter, Pressure Gauge, Monitoring devices), by End-Use (Agricultural, Open fields, Greenhouses, Non-agricultural, Golf courses, Lawns, Sports Grounds) and by Geography (North America, Europe, Asia-Pacific, Middle East and Rest of the World)

| Status : Upcoming | Report Code : VRFB11013 | Industry : Food & Beverage | Available Format :

|

Global Irrigation Automation Market – Analysis and Forecast (2025-2030)

Industry Insights by Irrigation Type (Sprinkler Irrigation, Drip Irrigation, Surface Irrigation), by System (Semi-Automatic, Automatic), by Automation Type (Time-Based, Volume-Based, Real-Time Feedback, Computer-Based), by Components (Controllers, Sensors, Weather-Based, Soil-Based, Fertigation Sensors, Valves, Sprinklers, Other Components, Flow meter, Pressure Gauge, Monitoring devices), by End-Use (Agricultural, Open fields, Greenhouses, Non-agricultural, Golf courses, Lawns, Sports Grounds) and by Geography (North America, Europe, Asia-Pacific, Middle East and Rest of the World)

Irrigation Automation Market Overview

The Global Irrigation Automation Market is expected to reach around USD 7.6 billion in the year 2030 and is expected to account for a value of USD 3.1 billion by 2023, with a 16.5% CAGR from 2030. Some of the key driver factoring to this growth in the irrigation automation market is increased adoption and mechanization of smart agricultural technologies, the rising awareness among farmers regarding the benefits of using irrigation automation, and the government taking initiatives to promote water conservation. New services, products, technology launches, and collaboration were the common strategies adopted by irrigation automation market players to capture and capitalize on the strong market potential.

The demand for irrigation automation is drastically increasing because of the shifting trend from manual towards agricultural processes mechanization, and increased cases of water scarcity across the globe. One of the key factors that disrupt its adoption in small land-holding farmers of the Asia-Pacific region is the cost factor. The high expense of the Irrigation Automation Market is expected to act as a concern for the growth of the global Irrigation Automation Market for the forecast period.

The recent outbreak of COVID-19 has sellers and manufacturers of the irrigation automation market face many production issues, like shortage of resources, non-availability of raw materials, and factory shutdowns. In the same way, the pandemic has also led to disruptions in the many small and large supply chains in the agriculture ecosystems. The decrease in the supply of hardware equipment is affecting the market players across the irrigation automation market. Owing to low human intervention, remote irrigation procedures are affected less by the current pandemic and are likely to result in highly vigorous demand over the forecasted years.

Irrigation Automation Market Segmentation

Irrigation Automation is a process of irrigating with the added capabilities of automatic systems. Over the years, the manual irrigation process has shifted to automatic systems. An automated irrigation system is the operation of the system with zero or minimal manual intervention apart from surveillance. Almost every irrigation system, be it surface, sprinkler or drip, can be automated with the help of computers, sensors, timers, or other mechanical appliances. Agricultural activities globally are adopting the mechanization and latest smart technologies for varied purposes to reduce labor costs and complete the work in the lowest possible time with much better results. This requirement is fulfilled with the Irrigation Automation Market.

Based on Irrigation Type

Among all segments of the Irrigation Automation Market, the Drip Irrigation Segment is estimated to be the fastest-growing for the forecasted period.

As per the Irrigation type, the market for irrigation automation is segmented into the following irrigation control systems:

• Sprinkler Irrigation

• Drip Irrigation

• Surface Irrigation

Automated drip irrigation systems have a higher rate of efficiency and a life span of more than ten years making it the most adopted type of irrigation system in countries like the U.S.A, Brazil, Canada, & Spain, for row crops and vegetables.

Based on System

The automatic systems segment is expected to be the fastest-growing segment of the irrigation automation market for the forecast period.

The demand for irrigation automation market as per system is segmented into

• Semi-automatic

• Automatic

Due to the high adoption of automated irrigation systems in countries, like China, the US, Spain, Canada, and Italy, where these systems are highly used for non-agricultural applications, the market for them is expected to grow with a higher CAGR during the said period.

Based on Automation Type

The time-based system is estimated to capture the largest share of the irrigation automation market for the forecast period.

As per the automation type, the market for irrigation automation is segmented into the following irrigation control systems:

• Time-Based

• Volume-Based

• Real-Time Feedback

• Computer-Based

The volume-based and time-based are of the semi-automatic type and they provide the customer with the option to control the all-irrigation process concerning volume or time. The time-based systems provide this flexibility, which is highly common among farmers.

Based on Components

The controller component segment is estimated to be the fastest-growing in the market for irrigation automation market among all the segments during the forecast period.

As per the Components, the market for irrigation automation is segmented into the following irrigation control systems:

• Controllers

• Sensors

• Weather-Based

• Soil-Based

• Fertigation Sensors

• Valves

• Sprinklers

• Other Components

• Flow meter

• Pressure Gauge

• Monitoring devices

Controllers play an integral role in the irrigation system. The controller component was the highly adopted component of all automation systems in 2019. It helps in supplying the exact amount of water at the right time and with high efficiency in chemical, energy, and water usage.

Based on End Use

The fastest-growing segment in the irrigation automation market for the forecast period is estimated to be the non-agricultural segment.

As per the End Use, the market for irrigation automation is segmented into the following irrigation control systems:

• Agricultural

• Open fields

• Greenhouses

• Non-agricultural

• Golf courses

• Lawns

• Sports grounds

The rising number of Golf courses and other sports complexes around the globe has led to the adoption of the irrigation automation system for watering. These irrigation automated systems ensure on-time watering with the exact amount of water and reduce water bills for the growers and owners.

Irrigation Automation Market Trends in Market

Globally, there are large ranges of an irrigation automation system that are available in the markets, which are selected based on their uses in different sectors of agricultural operations. All the products in this section are smart sensors, weather tracking, , machine learning, farming & robotics, smart irrigation systems, RFID sensors & tracking, analytics, and much more which are trending in the market due to their specialty and features.

Global Irrigation Automation Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

U.S.D. 3.1 Billion |

|

Revenue Forecast in 2035 |

U.S.D. 7.6 Billion |

|

Growth Rate |

16.5% |

|

Segments Covered in the Report |

By Irrigation Type, By System, By Automation Type, By Components and By End Use |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia-Pacific, Middle East and Rest of the World |

Irrigation Automation Market Growth Drivers

Standardized and Low Cost

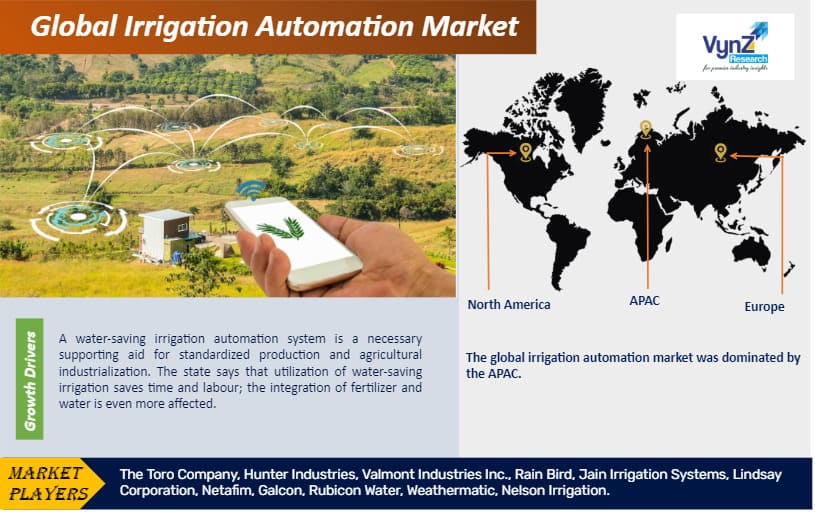

A water-saving irrigation automation system is a necessary supporting aid for standardized production and agricultural industrialization. The state says that the utilization of water-saving irrigation saves time and labor; the integration of fertilizer and water is even more affected. Hence, this technology is preferred by large farmers and agricultural parks.

Increased mechanization and adoption of smart technologies for agricultural work.

The government provided initiatives for promoting water conservation. Many governments aid in the installation of irrigation automation systems and take many initiatives to promote water conservation across the globe because of the rising issues of water scarcity. For example, just recently, the government of Australia announced the On-farm Irrigation Efficiency Program (OFIEP) to support individual irrigators and improve their productivity and efficiency in on-farm irrigation water management and use.

This program will help irrigators to enhance irrigation infrastructure to save water and change irrigation practices. Some of these practices include installing automatic outlets or gates, telemetry systems, and water metering, among others. Also, in September 2019, the Western Australian government offered a rebate for an automated irrigation controller and weather smart to Perth’s residential customers. This rebate was for the purchase and programming of smart irrigation and weather-automated products to aid them in saving water.

Growing awareness about the benefits of irrigation automation among farmers.

Real-time Control Station Function:

Real-time control handles the task of opening or closing the water delivery valve as per the soil moisture, growth of crops, etc. Real-time data collection through the collection of pipeline flow, pressure, soil moisture, operating conditions, valve status, and other parameters; and as per the actual situation of alarm and data pre-processing. The system does not need human interference through the pre-programmed control program, and it can actually open and close the pump automatically for a long time and also automatically irrigate as per exact parameters reflecting the required crop water demand.

Irrigation Automation Market Opportunities

The lack of consistent electricity supply to operate irrigation automation systems in rural areas of emerging and developing countries has generated the need for alternate and independent energy systems. Non-Governments and government bodies around the globe are highly promoting sustainable agricultural practices, to create a need for an improved irrigation system. Financial support to farmers has also been offered to purchase the irrigation automation equipment or to upgrade to automatic systems, by the non-government bodies. Irrigation automation systems, like drip irrigation and micro-irrigation, are proven to be effective in increasing food production, which augments revenue generation for farmers. Thus, creating a demand for Irrigation automation systems. The need for vendors, to develop solar-powered automatic irrigation systems, is provided by the lack of proper electric supply. Hence, increasing the need for an Irrigation automation market. Solar-powered micro or drip irrigation systems eliminate fuel costs and require minimum maintenance.

Irrigation Automation Market Challenges

High installation and maintenance costs associated with the irrigation automation tools. Although advancements in the technological sector have enabled easy access to automatic irrigation systems, they are still quite expensive. The farmers lack proper technical knowledge regarding using, maintaining, and developing irrigation automation tools, especially the farmers from emerging or developing nations. Data aggregation and management in irrigation automation systems is a very tedious task to accomplish.

Irrigation Automation Market Geographical Analysis

Based on Geography, the Irrigation Automation market is segmented into:

• North America – U.S.A, Canada

• Germany, U.K, France, Italy, Spain, Rest of Europe

• Asia Pacific (APAC) – India, Japan, China, Rest of APAC

• Rest of the World – Middle East & Africa

Significant growth is to be witnessed by the Asia Pacific segment from the year 2021 to 2027.

The key driver for APAC to grow over the next 5 years, at the estimated highest CAGR, is the decrease in annual precipitation and water scarcity. Increasing awareness among the farmers regarding the benefits of adoption automated and semi-automated systems along with the decreasing water levels of the river basins in the Asia Pacific region too are a few of the drivers factoring in the growth of the Irrigation automation market.

Irrigation Automation Market Competitive Analysis

The market players are focusing mainly on new product development; and mergers and acquisitions, which helps them in creating a firm hold in their market presence.

Key players in the global market include:

• The Toro Company (U.S.A)

• Hunter Industries (U.S.A)

• Valmont Industries Inc. (U.S.A)

• Rain Bird (U.S.A)

• Jain Irrigation Systems (India)

• Lindsay Corporation (U.S.A)

• Netafim (Israel)

• Galcon (Israel)

• Rubicon Water (Australia)

• Weathermatic (U.S.A)

• Nelson Irrigation (U.S.A)

Some of the other large players in the global irrigation automation market are:

• Mottech Water Solution Ltd

• Avanijal Agri Automation Pvt Ltd

• Hortau

• Calsense Water Bit

• Hydro point Data Systems

• Blurain

• Irritec S.P.A.

• Novagric

• Tevatronic, Dorset Group B.V

Recent Developmet by Key Players

Lindsay Corporation (a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology) collaborated with Pessl Instruments, a global manufacturer and leading provider of advanced agricultural technology solutions under the METOS® brand. Through this partnership, growers will be able to access certain Pessl field monitoring systems, such as weather stations and soil moisture probes, within the FieldNET platform, providing real-time insights into crop water needs and enhancing growers' ability to remotely monitor, control, analyze and apply irrigation recommendations.

Rubicon Water, Uzbekistan implement joint water management projects

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: 1 888 253 3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Irrigation Automation Market