Drip Irrigation Market Size & Share - Growth Forecast Report, (2026-2035)

Industry Insight by Application Type (Surface Drip Irrigation, Subsurface Drip Irrigation), by Component (Emitters and Drippers, Drip Tubes and Lines, Filters, Pressure Pumps, Valves and Fittings, Controllers and Sensors, Accessories (Stake, Joiners, and Plugs)), by Crop Type (Field Crops, Vegetable Crops, Orchard Crops, Vineyards, Other Crops (Commercial and Ornamental)), by Sales Channel (Direct Sales, Dealer and Distributor, Online Retail), by End User (Commercial Farms, Greenhouses and Nurseries, Residential Gardens and Landscapes, Sports Fields and Golf Courses)

| Status : Published | Published On : Feb, 2026 | Report Code : VRFB11037 | Industry : Food & Beverage | Available Format :

|

Page : 190 |

Drip Irrigation Market Size & Share - Growth Forecast Report, (2026-2035)

Industry Insight by Application Type (Surface Drip Irrigation, Subsurface Drip Irrigation), by Component (Emitters and Drippers, Drip Tubes and Lines, Filters, Pressure Pumps, Valves and Fittings, Controllers and Sensors, Accessories (Stake, Joiners, and Plugs)), by Crop Type (Field Crops, Vegetable Crops, Orchard Crops, Vineyards, Other Crops (Commercial and Ornamental)), by Sales Channel (Direct Sales, Dealer and Distributor, Online Retail), by End User (Commercial Farms, Greenhouses and Nurseries, Residential Gardens and Landscapes, Sports Fields and Golf Courses)

Drip Irrigation Market Overview

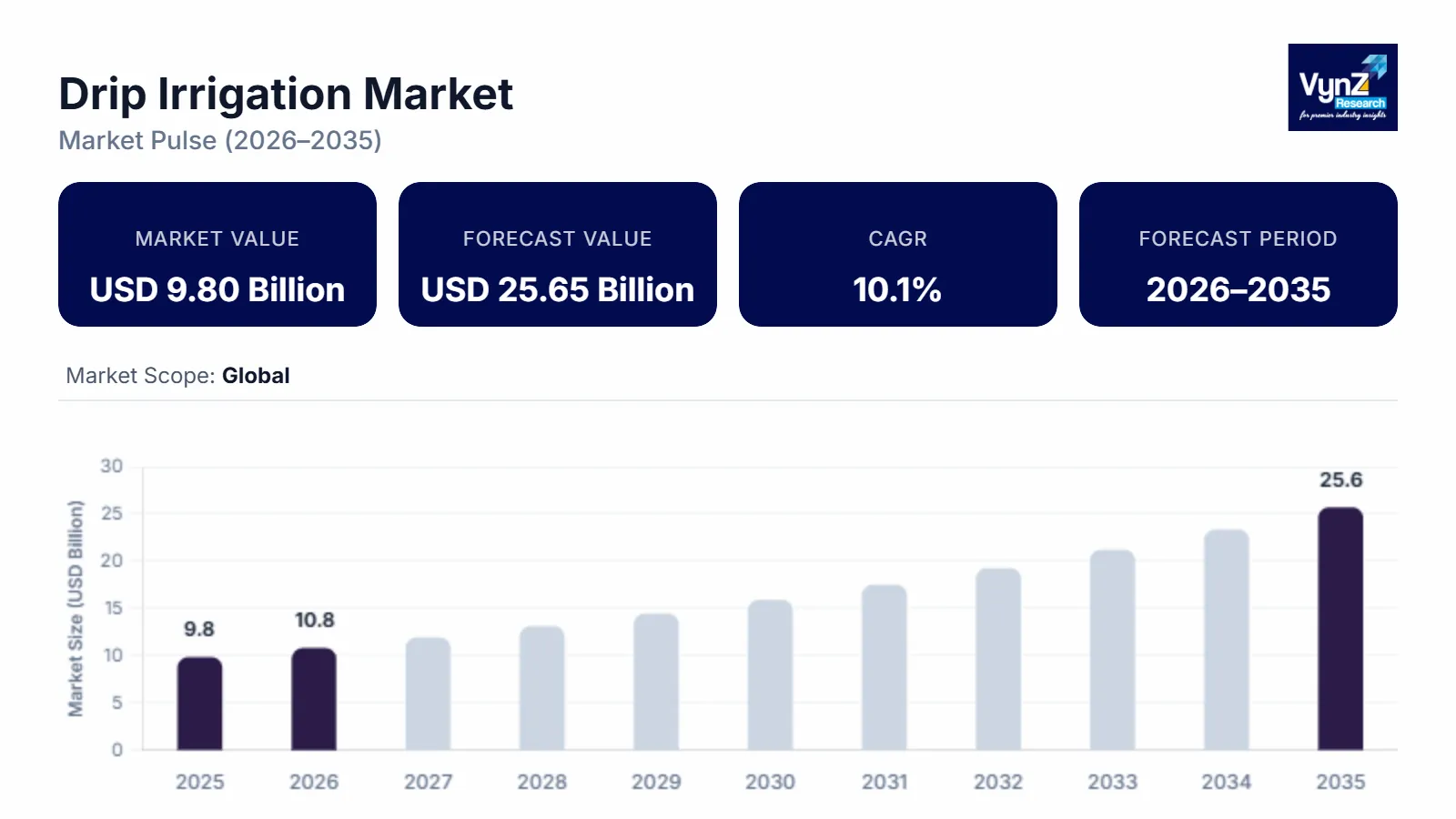

The drip irrigation market, which was valued at approximately USD 9.80 billion in 2025 and is estimated to rise further up to almost USD 10.79 billion by 2026 is projected to reach around USD 25.65 billion by 2035, expanding at a CAGR of about 10.1% during the forecast period from 2026 to 2035.

Expansion of the drip irrigation market is supported by escalating water stress, rising adoption of precision irrigation systems and increasing emphasis on improving crop yield per unit of water consumed.

Government backed initiatives promoting micro irrigation, water efficiency, and climate resilient agriculture, led by internationally recognized food and agriculture institutions and national agricultural ministries, continue to accelerate adoption through subsidy frameworks, technical extension programs, and structured rural development schemes. Multilateral policy frameworks focused on sustainable water management, modernization of irrigation infrastructure, and long-term agricultural productivity enhancement are reinforcing market demand across Asia Pacific, North America, and parts of Europe, where irrigated agriculture remains structurally critical to food security, rural livelihoods, and resource optimization.

Drip Irrigation Market Dynamics

Market Trends

The market is experiencing a structural shift toward precision driven and resource efficient irrigation systems, aligned with national water conservation and sustainable agriculture frameworks promoted by government backed agricultural authorities. A key trend shaping the market is the growing integration of micro irrigation with precision farming practices, reflecting increased preference for water efficiency, yield optimization, and input cost control. Policy programs supported by institutions such as the Food and Agriculture Organization and national ministries of agriculture emphasize adoption of drip systems to reduce conveyance losses and improve on farm water productivity, particularly in water stressed regions.

Another emerging trend is the adoption of pressure compensated and automated drip irrigation systems, driven by technological advancements in flow regulation and sensor-based monitoring. Public sector initiatives supporting climate resilient agriculture and smart irrigation practices are encouraging manufacturers to focus on value added features, system durability, and integrated solutions, thereby reshaping competitive dynamics within the market.

Growth Drivers

Growth of the market is strongly supported by increasing freshwater scarcity and rising demand for efficient irrigation solutions across agricultural regions with high dependency on irrigated farming. Government backed investments in micro irrigation infrastructure, subsidy driven adoption programs, and farmer awareness campaigns led by agricultural development agencies continue to generate consistent demand across commercial farms and smallholder segments. These initiatives are aligned with national water use efficiency targets and food security strategies implemented across Asia Pacific, North America, and parts of Europe.

Additionally, rising emphasis on crop yield stability and climate resilience is playing a critical role in accelerating adoption. As farmers prioritize cost efficiency, water optimization, and compliance with sustainable farming practices, demand for drip irrigation systems is expected to remain strong throughout the forecast period. Supportive regulatory frameworks and long-term rural development policies further reinforce market expansion.

Market Restraints / Challenges

Despite favorable growth prospects, the industry faces challenges related to high initial system installation costs and uneven access to financing mechanisms. Government assessments on agricultural mechanization highlight that affordability constraints continue to limit penetration among small and marginal farmers, particularly in developing economies where capital availability remains restricted. These cost related barriers can slow adoption despite long term operational benefits.

In addition, operational challenges linked to system maintenance and technical complexity pose constraints for wider deployment. Dependence on skilled installation, regular maintenance, and reliable water filtration infrastructure can lead to performance inefficiencies and increased lifecycle costs. Government agricultural extension reports note that limited technical awareness and inconsistent after sales support can affect system efficiency, impacting overall market performance in price sensitive regions.

Market Opportunities

The market presents significant opportunities in expanding adoption across water scarce and climate vulnerable agricultural regions, supported by growing alignment between irrigation modernization and national sustainability objectives. Government backed programs promoting efficient water use, crop diversification, and rural income enhancement are creating demand for affordable and modular drip irrigation solutions tailored to diverse farm sizes. Companies offering scalable and cost-effective systems are well positioned to capture incremental demand from emerging agricultural economies.

Another key opportunity lies in the integration of drip irrigation with automation and digital monitoring technologies. Rising public investment in smart agriculture initiatives and data driven farm management frameworks is opening avenues for premium and technology enabled offerings. Advancements in sensor-based irrigation control and remote monitoring solutions are expected to enhance system efficiency, strengthen farmer engagement, and support long term adoption.

Global Drip Irrigation Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 9.80 Billion |

|

Revenue Forecast in 2035 |

USD 25.65 Billion |

|

Growth Rate |

10.1% |

|

Segments Covered in the Report |

By Application Type, By Component, By Crop Type, By Sales Channel, By End User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Netafim Limited, Agrodrip S.A., Alkhorayef Group, Amiad Water Systems Ltd., Antelco Pty Ltd., ARKA, Chinadrip Irrigation Equipment Co. Ltd., Dayu Irrigation Group Co. Ltd., Dripworks Inc., Elgo Irrigation Ltd.,Golden Key Middle East, Grupo Valmont Industries Inc., Jain Irrigation Systems Ltd., KSNM Drip, Lindsay Corporation, Mahindra EPC Irrigation Ltd., Shanghai Huawei Water Saving Irrigation Corp |

|

Customization |

Available upon request |

Drip Irrigation Market Segmentation

By Application Type

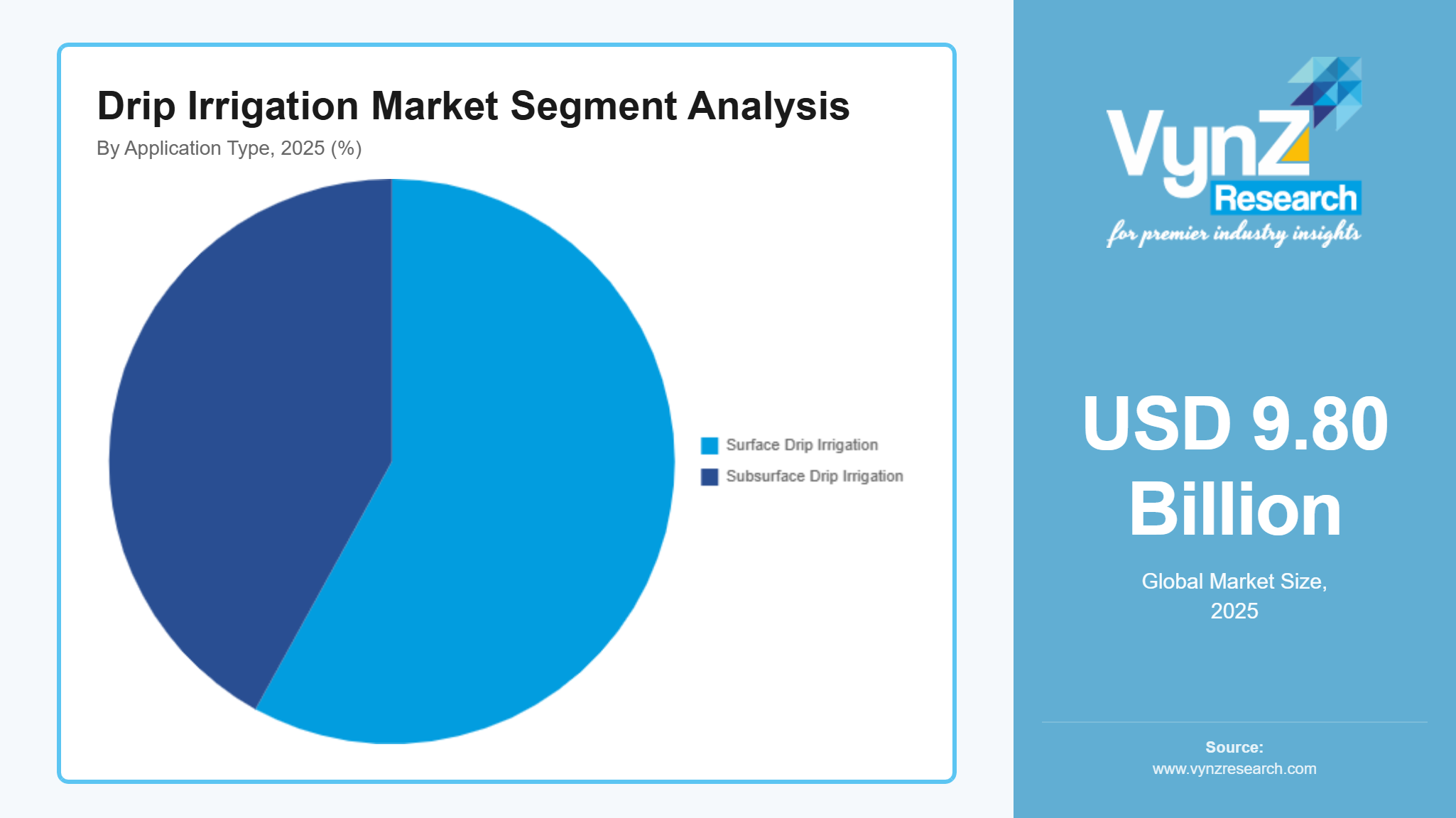

Surface drip irrigation accounted for approximately 58% of total market revenue in 2025, making it the largest application segment. This dominance is supported by its widespread adoption across open field agriculture, ease of installation, and lower initial system complexity compared to subsurface solutions. Surface systems remain the preferred choice for row crops, vegetables, and orchard farming where visual monitoring and maintenance accessibility are critical. Government backed agricultural extension programs promoting water efficient irrigation practices have further reinforced adoption, particularly in regions with established irrigated farmland.

Subsurface drip irrigation is estimated to represent around 42% of the market and is expected to register faster growth at approximately 10.8% during the forecast period. Growth is driven by increasing focus on minimizing evaporation losses, improving root zone water delivery, and enhancing long term soil moisture retention. Adoption is rising across water stressed regions and high value crop cultivation where yield stability and water optimization are strategic priorities.

By Component

Drip tubes and lines contributed nearly 34% of market revenue in 2025, reflecting their essential role in water conveyance and system coverage across agricultural plots. High replacement frequency, exposure to environmental wear, and expanding cultivated area under drip irrigation continue to support strong demand.

Emitters and drippers accounted for approximately 27%, supported by their critical function in regulating flow uniformity and application precision. Technological improvements focused on clog resistance and pressure compensation are enhancing adoption across diverse soil conditions.

Filters, valves, fittings, and pressure pumps collectively represented close to 29% of the market, driven by increasing emphasis on system efficiency and longevity.

Controllers, sensors, and accessories accounted for the remaining 10%, with this segment expected to grow at over 11% due to rising integration of automation and smart irrigation practices supported by public sector precision agriculture initiatives.

By Crop Type

Field crops held the largest share at approximately 41% in 2025, supported by extensive acreage coverage and increasing adoption of water efficient irrigation in staple crop production. Government programs aimed at improving water productivity and reducing irrigation losses in cereal and oilseed cultivation continue to support this segment.

Vegetable crops accounted for around 26%, driven by higher irrigation intensity, shorter crop cycles, and rising demand for consistent yield quality.

Orchard crops and vineyards collectively represented nearly 24%, supported by drip irrigation suitability for perennial crops requiring controlled water delivery. These segments are projected to grow at approximately 10.5%, reflecting increasing investment in high value horticulture.

Other crops, including ornamental and commercial landscaping applications, contributed the remaining 9%, supported by urban landscaping and nonfood agricultural uses.

By Sales Channel

Dealer and distributor networks dominated the market with approximately 46% share in 2025, reflecting strong reliance on localized sales, technical support, and after sales service. Farmers continue to prefer established distribution channels for system customization, installation guidance, and maintenance assurance.

Direct sales accounted for nearly 34%, supported by large scale commercial farms and institutional buyers procuring integrated irrigation solutions.

Online retail channels represented around 20% and are the fastest growing, expanding at approximately 12.1% during the forecast period. Growth is driven by improved digital access, pricing transparency, and availability of standardized components. Integration of digital platforms with physical service networks is further enhancing reach and customer engagement.

By End User

Commercial farms accounted for approximately 49% of total market revenue in 2025, making them the largest end user segment. This dominance is supported by large acreage operations, higher capital availability, and strong alignment with government backed irrigation modernization and food security programs.

Greenhouses and nurseries represented around 22%, driven by demand for controlled irrigation environments and high value crop production.

Residential gardens, sports fields, and golf courses collectively accounted for approximately 29%. This segment is expected to grow steadily at around 9.4%, supported by urban landscaping development, water conservation regulations, and increasing awareness of efficient irrigation solutions across nonagricultural applications.

Regional Insights

North America

North America accounted for approximately 20% of the market in 2025, driven by increasing emphasis on water-efficient agriculture and sustainable farming practices. The United States is leading adoption through federal programs promoting precision irrigation, crop yield optimization, and water conservation, including initiatives by the U.S. Department of Agriculture (USDA) and Natural Resources Conservation Service (NRCS). Strong demand from states such as California, Texas, and Florida, characterized by intensive agriculture and recurring water scarcity, continues to support market growth. Government subsidies, technical assistance programs, and rural development schemes are encouraging investments in drip irrigation technologies, while expansion of agricultural co-operatives and distribution networks further strengthens regional market performance.

Europe

Europe is estimated to contribute approximately 15% to the market in 2025, supported by regulatory focus on sustainable water management and modernization of irrigation infrastructure. Countries such as Spain, Italy, and France are witnessing growing adoption of drip irrigation systems in vineyards, orchards, and horticulture, where water efficiency is a critical requirement. European Union initiatives, including the Common Agricultural Policy (CAP) and Horizon Europe funding for precision agriculture and climate-smart irrigation, are reinforcing market growth. Investments in digital monitoring, automated irrigation controls, and energy-efficient pumps are driving consistent adoption across commercial and institutional farms.

Asia Pacific

Asia Pacific is projected to account for roughly 28% of the market in 2025. Growth is fueled by rising agricultural productivity demands, population growth, and government-led micro-irrigation programs in India, China, and Southeast Asian countries. In India, schemes such as the Pradhan Mantri Krishi Sinchai Yojana (PMKSY) promote efficient water use and subsidized drip irrigation installation for smallholder farmers. China is investing in smart irrigation technologies through initiatives by the Ministry of Agriculture and Rural Affairs, targeting high-value crops and reducing water loss. Expansion of modern agricultural practices, farmer training programs, and rural credit support continues to drive market adoption.

Latin America

The Latin America drip irrigation market accounted for approximately 8% of total revenue in 2025. Growth is driven by modernization of sugarcane, coffee, and vegetable farms in Brazil, Mexico, and Chile. National agricultural development programs and credit support for irrigation infrastructure, along with private sector partnerships for sustainable water use, are accelerating adoption. Investment in precision irrigation systems and drip technology for high-value crops is increasing, supported by government-led initiatives emphasizing climate-resilient agriculture and enhanced crop yields.

Middle East & Africa (MEA)

MEA contributed around 7% to the global market in 2025. Adoption is supported by arid climates, scarce freshwater resources, and growing government focus on agricultural water efficiency. Countries such as Saudi Arabia, UAE, and South Africa are deploying modern irrigation projects under national agricultural strategies, including subsidies for water-efficient farming and technical support programs. Expansion of commercial farms and high-value crop cultivation is driving sustained demand. The remaining 22% of the market is represented by other regions not explicitly covered, including emerging African and Oceanic markets, which offer long-term strategic growth opportunities.

Competitive Landscape / Company Insights

The drip irrigation market is moderately competitive, with global and regional players focusing on technology innovation, water-use efficiency, and geographic expansion. Key vendors offer advanced drip emitters, digital controllers, and precision irrigation solutions. Adoption is supported by government initiatives such as India’s Pradhan Mantri Krishi Sinchai Yojana (PMKSY), China’s smart irrigation programs under the Ministry of Agriculture and Rural Affairs, and U.S. Department of Agriculture (USDA) water conservation schemes, which drive deployment of micro-irrigation systems for sustainable agriculture. These regulatory and policy frameworks encourage vendors to strengthen their market position and secure long-term contracts across North America, Europe, and Asia Pacific.

Mini Profiles

Agrodrip S.A. focuses on advanced drip emitters and irrigation systems, supported by strong regional distribution networks and brand recognition, enabling efficient water management and sustainable agricultural practices.

Antelco Pty Ltd. operates in premium and niche irrigation segments, emphasizing precision design, customization, and high-performance water distribution solutions for horticulture and specialty crops.

Chinadrip Irrigation Equipment Co. Ltd. leverages local manufacturing and strategic partnerships to expand market presence across China and Southeast Asia, delivering cost-efficient micro-irrigation systems for commercial and industrial farms.

Jain Irrigation Systems Ltd. specializes in integrated drip irrigation solutions, digital controllers, and precision agriculture technologies, supported by a robust global network and strong service infrastructure.

Rzin Bird Corporation offers mass-market irrigation products, including drip and sprinkler systems, focusing on cost efficiency, operational reliability, and advanced water conservation solutions across commercial and residential sectors.

Key Players

- Netafim Limited

- Agrodrip S.A.

- Alkhorayef Group

- Amiad Water Systems Ltd.

- Antelco Pty Ltd.

- ARKA

- Chinadrip Irrigation Equipment Co. Ltd.

- Dayu Irrigation Group Co. Ltd.

- Dripworks Inc.

- Elgo Irrigation Ltd.

- Golden Key Middle East

- Grupo Chamartin Chamsa

- Jain Irrigation Systems Ltd.

- KSNM Drip

- Lindsay Corporation

- Mahindra EPC Irrigation Ltd.

- Shanghai Huawei Water Saving Irrigation Corp

Recent Developments

In January 2026 - Sistema Azud S.A. has entered India with a new irrigation system factory, backed by €0.5 million in financing from COFIDES (Centre for the Promotion of Industrial Development and Economic and Social Cooperation). The project, involving a total investment of €1.845 million, will establish a plant in the Bawal Industrial Park near New Delhi, Haryana, aimed at producing irrigation systems for the rapidly growing Indian agricultural market. date

In January 2025, Rain Bird has launched its new All-in-One Zone Control (AIOZC), a breakthrough commercial irrigation solution designed to help landscape contractors overcome labor shortages, simplify installation, and minimize the size and number of valve boxes.

Global Drip Irrigation Market Coverage

Application Type Insight and Forecast 2026 - 2035

- Surface Drip Irrigation

- Subsurface Drip Irrigation

Component Insight and Forecast 2026 - 2035

- Emitters and Drippers

- Drip Tubes and Lines

- Filters

- Pressure Pumps

- Valves and Fittings

- Controllers and Sensors

- Accessories (Stake

- Joiners

- and Plugs)

Crop Type Insight and Forecast 2026 - 2035

- Field Crops

- Vegetable Crops

- Orchard Crops

- Vineyards

- Other Crops (Commercial and Ornamental)

Sales Channel Insight and Forecast 2026 - 2035

- Direct Sales

- Dealer and Distributor

- Online Retail

End User Insight and Forecast 2026 - 2035

- Commercial Farms

- Greenhouses and Nurseries

- Residential Gardens and Landscapes

- Sports Fields and Golf Courses

Global Drip Irrigation Market by Region

- North America

- By Application Type

- By Component

- By Crop Type

- By Sales Channel

- By End User

- By Country - U.S., Canada, Mexico

- Europe

- By Application Type

- By Component

- By Crop Type

- By Sales Channel

- By End User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Application Type

- By Component

- By Crop Type

- By Sales Channel

- By End User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Application Type

- By Component

- By Crop Type

- By Sales Channel

- By End User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Drip Irrigation Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Application Type

1.2.2. By

Component

1.2.3. By

Crop Type

1.2.4. By

Sales Channel

1.2.5. By

End User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Application Type

5.1.1. Surface Drip Irrigation

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Subsurface Drip Irrigation

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Component

5.2.1. Emitters and Drippers

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Drip Tubes and Lines

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Filters

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Pressure Pumps

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.2.5. Valves and Fittings

5.2.5.1. Market Definition

5.2.5.2. Market Estimation and Forecast to 2035

5.2.6. Controllers and Sensors

5.2.6.1. Market Definition

5.2.6.2. Market Estimation and Forecast to 2035

5.2.7. Accessories (Stake

5.2.7.1. Market Definition

5.2.7.2. Market Estimation and Forecast to 2035

5.2.8. Joiners

5.2.8.1. Market Definition

5.2.8.2. Market Estimation and Forecast to 2035

5.2.9. and Plugs)

5.2.9.1. Market Definition

5.2.9.2. Market Estimation and Forecast to 2035

5.3. By Crop Type

5.3.1. Field Crops

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Vegetable Crops

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Orchard Crops

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Vineyards

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.3.5. Other Crops (Commercial and Ornamental)

5.3.5.1. Market Definition

5.3.5.2. Market Estimation and Forecast to 2035

5.4. By Sales Channel

5.4.1. Direct Sales

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Dealer and Distributor

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Online Retail

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.5. By End User

5.5.1. Commercial Farms

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Greenhouses and Nurseries

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Residential Gardens and Landscapes

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.5.4. Sports Fields and Golf Courses

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Application Type

6.2. By

Component

6.3. By

Crop Type

6.4. By

Sales Channel

6.5. By

End User

6.5.1.

U.S. Market Estimate and Forecast

6.5.2.

Canada Market Estimate and Forecast

6.5.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Application Type

7.2. By

Component

7.3. By

Crop Type

7.4. By

Sales Channel

7.5. By

End User

7.5.1.

Germany Market Estimate and Forecast

7.5.2.

U.K. Market Estimate and Forecast

7.5.3.

France Market Estimate and Forecast

7.5.4.

Italy Market Estimate and Forecast

7.5.5.

Spain Market Estimate and Forecast

7.5.6.

Russia Market Estimate and Forecast

7.5.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Application Type

8.2. By

Component

8.3. By

Crop Type

8.4. By

Sales Channel

8.5. By

End User

8.5.1.

China Market Estimate and Forecast

8.5.2.

Japan Market Estimate and Forecast

8.5.3.

India Market Estimate and Forecast

8.5.4.

South Korea Market Estimate and Forecast

8.5.5.

Vietnam Market Estimate and Forecast

8.5.6.

Thailand Market Estimate and Forecast

8.5.7.

Malaysia Market Estimate and Forecast

8.5.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Application Type

9.2. By

Component

9.3. By

Crop Type

9.4. By

Sales Channel

9.5. By

End User

9.5.1.

Brazil Market Estimate and Forecast

9.5.2.

Saudi Arabia Market Estimate and Forecast

9.5.3.

South Africa Market Estimate and Forecast

9.5.4.

U.A.E. Market Estimate and Forecast

9.5.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1.

Netafim Limited

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5.

Recent

Developments

10.2.

Agrodrip S.A.

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5.

Recent

Developments

10.3.

Alkhorayef Group

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5.

Recent

Developments

10.4.

Amiad Water Systems Ltd.

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5.

Recent

Developments

10.5.

Antelco Pty Ltd.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5.

Recent

Developments

10.6.

ARKA

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5.

Recent

Developments

10.7.

Chinadrip Irrigation Equipment Co. Ltd.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5.

Recent

Developments

10.8.

Dayu Irrigation Group Co. Ltd.

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5.

Recent

Developments

10.9.

Dripworks Inc.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5.

Recent

Developments

10.10.

Elgo Irrigation Ltd.

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5.

Recent

Developments

10.11.

Golden Key Middle East

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5.

Recent

Developments

10.12.

Grupo Chamartin Chamsa

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5.

Recent

Developments

10.13.

Jain Irrigation Systems Ltd.

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5.

Recent

Developments

10.14.

KSNM Drip

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5.

Recent

Developments

10.15.

Lindsay Corporation

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5.

Recent

Developments

10.16.

Mahindra EPC Irrigation Ltd.

10.16.1.

Snapshot

10.16.2.

Overview

10.16.3.

Offerings

10.16.4.

Financial

Insight

10.16.5.

Recent

Developments

10.17.

Shanghai Huawei Water Saving Irrigation Corp

10.17.1.

Snapshot

10.17.2.

Overview

10.17.3.

Offerings

10.17.4.

Financial

Insight

10.17.5.

Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Drip Irrigation Market