Pet Snacks and Treats Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Product Type (Eatable, Chewable), by Distribution Channel (Supermarkets & Hypermarket, Specialty Pet Store, Online, Others), by Pet Type (Dogs, Cats, Others)

| Status : Published | Published On : Feb, 2026 | Report Code : VRFB11039 | Industry : Food & Beverage | Available Format :

|

Page : 186 |

Pet Snacks and Treats Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Product Type (Eatable, Chewable), by Distribution Channel (Supermarkets & Hypermarket, Specialty Pet Store, Online, Others), by Pet Type (Dogs, Cats, Others)

Pet Snacks and Treats Market Overview

The pet snacks and treats market which was valued at approximately USD 33.62 billion in 2025 and is estimated to rise further up to almost USD 36.00 billion by 2026 is projected to reach around USD 66.75 billion by 2035 expanding at a CAGR of about 7.1 % during the forecast period from 2026 to 2035.

Growth across the pet snacks and treats market is supported by increasing pet humanization rising expenditure on premium nutrition and stronger preference for functional formulations that support digestive dental and immunity related benefits driven by evolving consumer awareness and lifestyle changes.

Market expansion is further reinforced by sustained growth in companion animal populations and increasing focus on preventive pet health management. Government food safety and animal welfare authorities such as the United States Food and Drug Administration and the European Food Safety Authority continue to regulate pet food safety ingredient approval and labeling compliance which strengthens consumer trust and product standardization. In Asia Pacific, national food safety regulators and animal husbandry departments are strengthening import monitoring and quality norms for pet nutrition products. These regulatory frameworks combined with public initiatives supporting animal health surveillance are contributing to steady demand across major regions including North America, Europe, and Asia Pacific, while the remaining demand is covered by other regions not addressed in this section.

Pet Snacks and Treats Market Dynamics

Market Trends

The market is witnessing notable shifts in consumer behavior, product formulation, and procurement patterns, largely driven by increasing humanization of pets and stronger emphasis on animal health and nutrition. One of the key trends shaping the market is the growing preference for natural, functional, and ingredient-transparent pet treats. Government-backed food safety and animal health frameworks, including guidance from the U.S. Food and Drug Administration (FDA) Center for Veterinary Medicine and the European Commission’s animal feed regulations, are encouraging manufacturers to reduce artificial additives, improve traceability, and comply with stricter labeling standards. These policies are reinforcing demand for grain-free, high-protein, and functional treats that support dental health, digestion, and immunity.

Another emerging trend is the rapid expansion of digitally enabled retail and direct-to-consumer channels, driven by higher internet penetration and lifestyle changes among pet owners. Reports from government agencies such as the U.S. Department of Agriculture (USDA) and national statistics offices in Europe and Asia highlight sustained growth in household pet ownership and online grocery penetration. These developments are influencing product portfolios, encouraging companies to focus on premiumization, portion-controlled packaging, and differentiated formulations, thereby reshaping competitive dynamics in the market.

Growth Drivers

The growth of the market is strongly supported by rising global pet ownership and increasing expenditure on companion animal care. Government demographic and consumption data from agencies such as the U.S. Bureau of Economic Analysis and Eurostat indicate consistent growth in household spending on pet food and related products, reflecting pets’ elevated status as family members. This trend is generating steady demand across urban and semi-urban regions, particularly for snacks and treats used for training, bonding, and supplemental nutrition.

Additionally, growing awareness of pet health and preventive care is playing a crucial role in boosting adoption. Public animal health initiatives and veterinary nutrition guidelines promoted by authorities such as the World Organization for Animal Health (WOAH) and national veterinary councils emphasize balanced diets and controlled treat consumption. As pet owners increasingly prioritize quality, safety, and functional benefits, demand for fortified, vet-recommended, and compliance-certified pet treats is expected to remain strong throughout the forecast period.

Market Restraints / Challenges

Despite favorable growth prospects, the market faces challenges related to raw material price volatility and regulatory compliance. Fluctuations in meat, grain, and dairy prices, highlighted in commodity outlooks published by the Food and Agriculture Organization (FAO) and the USDA, continue to affect production costs and margins. These pressures are particularly significant for manufacturers targeting price-sensitive consumers and private-label segments in emerging markets.

Furthermore, stringent food safety and animal feed regulations pose operational challenges for producers. Compliance with standards set by bodies such as the FDA, the European Food Safety Authority (EFSA), and national feed control agencies requires continuous investment in quality assurance, testing, and documentation. Dependence on imported ingredients and specialized processing facilities can also lead to cost escalation and supply chain disruptions, impacting scalability during periods of economic uncertainty.

Market Opportunities

The market presents significant opportunities in the development of functional and condition-specific pet snacks, driven by rising awareness of preventive pet healthcare and aging pet populations. Government-supported veterinary health programs and livestock-to-companion animal transition studies published by agricultural ministries highlight growing demand for products addressing dental health, weight management, and joint support. Companies offering scientifically formulated, affordable, and health-oriented treats are well positioned to capture incremental demand from both mass and premium consumer groups.

Another key opportunity lies in premium and digitally marketed pet treats, where rising investments in branding, e-commerce, and subscription models are creating avenues for higher margins and long-term customer engagement. Advancements in data-driven marketing and online retail infrastructure, supported by national digital commerce initiatives in regions such as North America, Europe, and Asia Pacific are expected to enhance customer reach and conversion rates. Manufacturers aligning innovation with regulatory compliance and government-endorsed safety standards are likely to benefit most from sustained market expansion.

Global Pet Snacks and Treats Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 33.62 Billion |

|

Revenue Forecast in 2035 |

USD 66.75 Billion |

|

Growth Rate |

7.1% |

|

Segments Covered in the Report |

Product Type, Distribution Channel, Pet Type |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Other Regions |

|

Key Companies |

Blue Buffalo Company, Colgate-Palmolive Company, Diamond Pet Foods, General Mills Inc., Mars Incorporated, Nestlé Purina PetCare, Spectrum Brands Holdings Inc., The Hartz Mountain Corporation, The J.M. Smucker Company, Wellness Pet Company |

|

Customization |

Available upon request |

Pet Snacks and Treats Market Segmentation

By Product Type

Eatable products accounted for the largest share of the market in 2025 representing approximately 62% of total revenue. Their dominance is supported by high consumption frequency routine inclusion in daily feeding practices and broad suitability across pet age groups. Strong demand is reinforced by consistent product availability across retail formats and regulatory oversight related to ingredient safety and nutritional labeling enforced by public animal health authorities. Increasing emphasis on balanced nutrition and portion-controlled feeding continues to sustain stable demand across both developed and emerging markets.

Chewable products are expected to register the fastest growth during the forecast period with an estimated CAGR of about 11.4% from 2026 to 2035. Growth is driven by rising awareness of dental health benefits longer engagement duration and perceived preventive care value among pet owners. Product innovation focused on texture durability digestibility and functional enrichment is further supporting accelerated adoption within this segment.

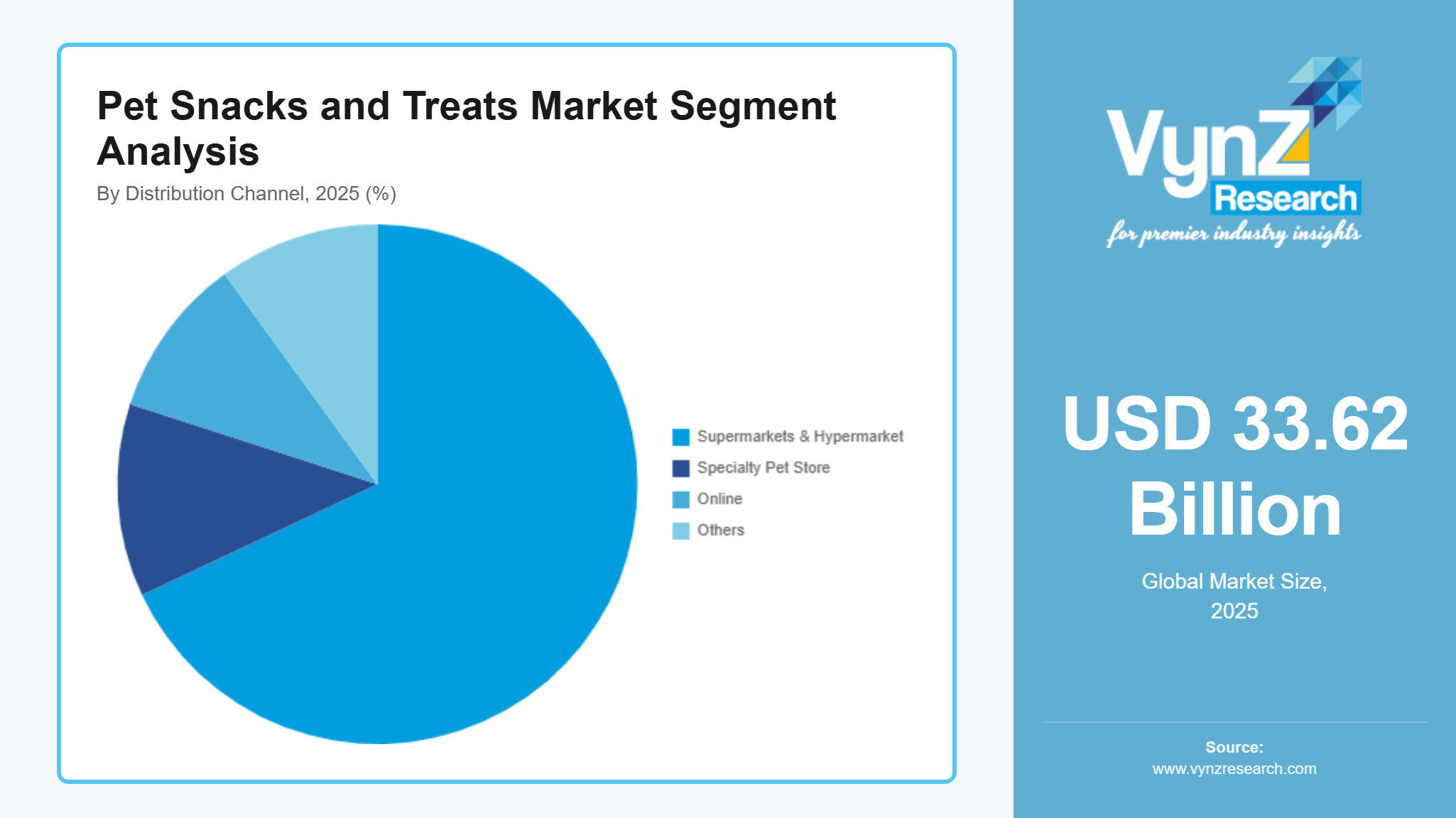

By Distribution Channel

Supermarkets and hypermarkets along with specialty pet stores accounted for the largest share of market revenue in 2025 contributing approximately 68% of total sales. Their dominance reflects strong consumer preference for physical product validation brand familiarity and immediate availability. These channels benefit from established supply chains and compliance with government regulations governing storage hygiene shelf life and labeling standards which reinforces consumer confidence and repeat purchasing behavior.

Online distribution channels are projected to witness the highest growth rate with an estimated CAGR of about 12.1% during the forecast period from 2026 to 2035. Growth is supported by increasing digital adoption subscription-based purchasing models enhanced logistics infrastructure and wider product assortment visibility. Integration of online platforms with promotional strategies and doorstep delivery services continues to expand reach particularly among urban and digitally engaged consumers while other channels maintain steady baseline contribution.

By Pet Type

Dogs accounted for the largest share of the pet snacks and treats market in 2025 representing approximately 64% of total revenue. This dominance is driven by higher consumption frequency larger average pet size and broader availability of tailored product offerings. Demand is further reinforced by rising dog ownership structured feeding routines and government supported animal welfare vaccination and registration programs that promote responsible pet care practices across regions.

The cats segment is expected to grow at a faster pace registering an estimated CAGR of about 10.5% from 2026 to 2035. Growth is supported by increasing urban adoption smaller household preferences and expanding availability of specialized formulations aligned with feline nutritional requirements. Other pet categories continue to contribute a smaller yet stable share supporting overall market balance.

Regional Insights

North America

North America accounted for approximately 34% of the pet snacks and treats market in 2025 supported by high pet ownership rates strong spending on premium pet nutrition and well-established retail infrastructure. Demand is concentrated in major urban centers such as New York, Los Angeles and Toronto where pet humanization trends are highly pronounced. Regulatory oversight by the United States Food and Drug Administration and the United States Department of Agriculture ensures compliance with pet food safety ingredient approval and labeling standards which strengthens consumer confidence. Government supported animal welfare programs veterinary public health initiatives and enforcement of feed safety regulations continue to encourage adoption of formulated and functional pet treat products across the region.

Europe

Europe represented approximately 26% of the global market in 2025 driven by mature pet care practices high awareness of animal nutrition and strong regulatory frameworks. Countries including Germany the United Kingdom, France and Italy demonstrate steady demand supported by structured retail networks and specialty pet stores. Oversight by the European Food Safety Authority and national veterinary authorities ensures strict compliance with ingredient safety nutritional adequacy and traceability requirements. Government backed animal welfare policies public awareness campaigns on responsible pet feeding and enforcement of food safety regulations are supporting consistent market expansion across both Western and Central European economies.

Asia Pacific

Asia Pacific accounted for approximately 18% of the pet snacks and treats market in 2025 with growth supported by rising urbanization increasing disposable income and expanding companion animal populations in countries such as China, India and Japan. Major cities including Beijing Shanghai Mumbai and Tokyo are emerging as key consumption hubs driven by organized retail expansion and growing digital adoption. Government agencies overseeing animal husbandry and food safety are strengthening import monitoring quality standards and labeling compliance for pet food products. Public initiatives focused on animal health surveillance and vaccination programs are indirectly supporting structured growth in pet nutrition consumption across the region.

Other Regions

The remaining approximately 22% of market demand is distributed across other regions not covered in this section including Latin America, the Middle East and Africa which collectively contribute to overall global market balance and long-term growth potential.

Competitive Landscape / Company Insights

The pet snacks and treats market is moderately to highly competitive with the presence of global and regional players emphasizing product differentiation pricing strategies and geographic expansion. Companies are increasingly investing in research and development clean label formulations and digital distribution capabilities to strengthen market positioning. Regulatory oversight and guidance from authorities such as the United States Food and Drug Administration, the European Food Safety Authority and national food safety agencies in Asia Pacific support standardization quality compliance and consumer trust which encourages sustained innovation and competitive expansion across key markets.

Mini Profiles

Blue Buffalo Company focuses on natural and premium pet snacks and treats, supported by strong brand recognition, clean-label positioning, and wide retail and e-commerce distribution across mature pet care markets.

Colgate-Palmolive Company operates in mass and premium pet treat segments through science-backed nutrition brands, emphasizing product safety, global manufacturing scale, and strong penetration across supermarkets and specialty pet channels.

Diamond Pet Foods leverages large-scale manufacturing and private-label capabilities to expand market presence, offering cost-efficient pet snacks and treats supported by extensive distribution partnerships and supply chain integration.

General Mills Inc. focuses on branded pet snacks and treats within premium and natural categories, supported by strong marketing capabilities, omnichannel distribution, and continued portfolio expansion in value-added pet nutrition.

Mars Incorporated operates across mass and premium pet treat segments, emphasizing product innovation, nutritional research, and global distribution strength supported by long-term investments in pet health and sustainability initiatives.

Key Players

- Blue Buffalo Company

- Colgate-Palmolive Company

- Diamond Pet Foods

- General Mills Inc.

- Mars Incorporated

- Nestlé Purina PetCare

- Spectrum Brands Holdings Inc.

- The Hartz Mountain Corporation

- The J.M. Smucker Company

- Wellness Pet Company

Recent Developments

In January 2026, Colgate-Palmolive and the WHO Foundation has collaborated to assist the WHO's oral health initiatives for supporting the integration of oral health into national health systems that shall increase awareness of oral health as a public health priority. This project strengthens Colgate's dedication to offer oral health education and tools to communities. Since 1991, the Colgate Bright Smiles, Bright Futures® program has provided oral health education to nearly two billion children and their families worldwide, according to a recent announcement from the company.

In October 2025, Blue Buffalo has launched their Love Made Fresh line nationwide, that marks its first foray into the fresh pet food industry. The goods are sold by retailers like Walmart, Target, Kroger, and Meijer. Love Made Fresh is available in two formats that is scoop-and-serve resealable tubs in variations of chunky beef stew and chunky chicken stew, and slice-and-serve rolls in recipes for beef and chicken with carrots and peas. Vitamins, minerals, and nutrients are present in the items. According to the firm, the introduction places Blue Buffalo as the biggest pet food brand in the United States with options for dry, wet, and fresh feeding. The market value of fresh pet food is $3 billion.

In September 2025, by partnering with Diamond Pet Foods, Pet Food Experts (PFX) has expanded its distribution portfolio to include the company's pet food products. PFX will supply Diamond's products to pet retailers in states in the Pacific Northwest and mountain regions as a result of the partnership.

Global Pet Snacks and Treats Market Coverage

Product Type Insight and Forecast 2026 - 2035

- Eatable

- Chewable

Distribution Channel Insight and Forecast 2026 - 2035

- Supermarkets & Hypermarket

- Specialty Pet Store

- Online

- Others

Pet Type Insight and Forecast 2026 - 2035

- Dogs

- Cats

- Others

Global Pet Snacks and Treats Market by Region

- North America

- By Product Type

- By Distribution Channel

- By Pet Type

- By Country - U.S., Canada, Mexico

- Europe

- By Product Type

- By Distribution Channel

- By Pet Type

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Product Type

- By Distribution Channel

- By Pet Type

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Product Type

- By Distribution Channel

- By Pet Type

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Pet Snacks and Treats Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Product Type

1.2.2. By

Distribution Channel

1.2.3. By

Pet Type

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Product Type

5.1.1. Eatable

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Chewable

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.2. By Distribution Channel

5.2.1. Supermarkets & Hypermarket

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Specialty Pet Store

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Online

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.2.4. Others

5.2.4.1. Market Definition

5.2.4.2. Market Estimation and Forecast to 2035

5.3. By Pet Type

5.3.1. Dogs

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Cats

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Others

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Product Type

6.2. By

Distribution Channel

6.3. By

Pet Type

6.3.1.

U.S. Market Estimate and Forecast

6.3.2.

Canada Market Estimate and Forecast

6.3.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Product Type

7.2. By

Distribution Channel

7.3. By

Pet Type

7.3.1.

Germany Market Estimate and Forecast

7.3.2.

U.K. Market Estimate and Forecast

7.3.3.

France Market Estimate and Forecast

7.3.4.

Italy Market Estimate and Forecast

7.3.5.

Spain Market Estimate and Forecast

7.3.6.

Russia Market Estimate and Forecast

7.3.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Product Type

8.2. By

Distribution Channel

8.3. By

Pet Type

8.3.1.

China Market Estimate and Forecast

8.3.2.

Japan Market Estimate and Forecast

8.3.3.

India Market Estimate and Forecast

8.3.4.

South Korea Market Estimate and Forecast

8.3.5.

Vietnam Market Estimate and Forecast

8.3.6.

Thailand Market Estimate and Forecast

8.3.7.

Malaysia Market Estimate and Forecast

8.3.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Product Type

9.2. By

Distribution Channel

9.3. By

Pet Type

9.3.1.

Brazil Market Estimate and Forecast

9.3.2.

Saudi Arabia Market Estimate and Forecast

9.3.3.

South Africa Market Estimate and Forecast

9.3.4.

U.A.E. Market Estimate and Forecast

9.3.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. Blue Buffalo Company

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Colgate-Palmolive Company

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. Diamond Pet Foods

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. General Mills Inc.

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Mars Incorporated

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Nestlé Purina PetCare

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Spectrum Brands Holdings Inc.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. The Hartz Mountain Corporation

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. The J.M. Smucker Company

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Wellness Pet Company

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Pet Snacks and Treats Market