Cold Compression Therapy Market Size & Share - Growth Forecast Report, (2026-2035)

Industry Insight by Product Type (Intermittent cold compression systems, Static cold compression systems, Accessories), by Application (Sports injury management, Postoperative recovery, Chronic pain management), by Distribution Channel (Hospital procurement, Online direct-to-consumer, Retail pharmacies), by Price Tier (Premium products, Mid-range products, Economy products), by End Use / User (Hospitals, Rehabilitation centers, Sports medicine clinics, Home healthcare)

| Status : Published | Published On : Feb, 2026 | Report Code : VRHC1317 | Industry : Healthcare | Available Format :

|

Page : 180 |

Cold Compression Therapy Market Size & Share - Growth Forecast Report, (2026-2035)

Industry Insight by Product Type (Intermittent cold compression systems, Static cold compression systems, Accessories), by Application (Sports injury management, Postoperative recovery, Chronic pain management), by Distribution Channel (Hospital procurement, Online direct-to-consumer, Retail pharmacies), by Price Tier (Premium products, Mid-range products, Economy products), by End Use / User (Hospitals, Rehabilitation centers, Sports medicine clinics, Home healthcare)

Cold Compression Therapy Market Overview

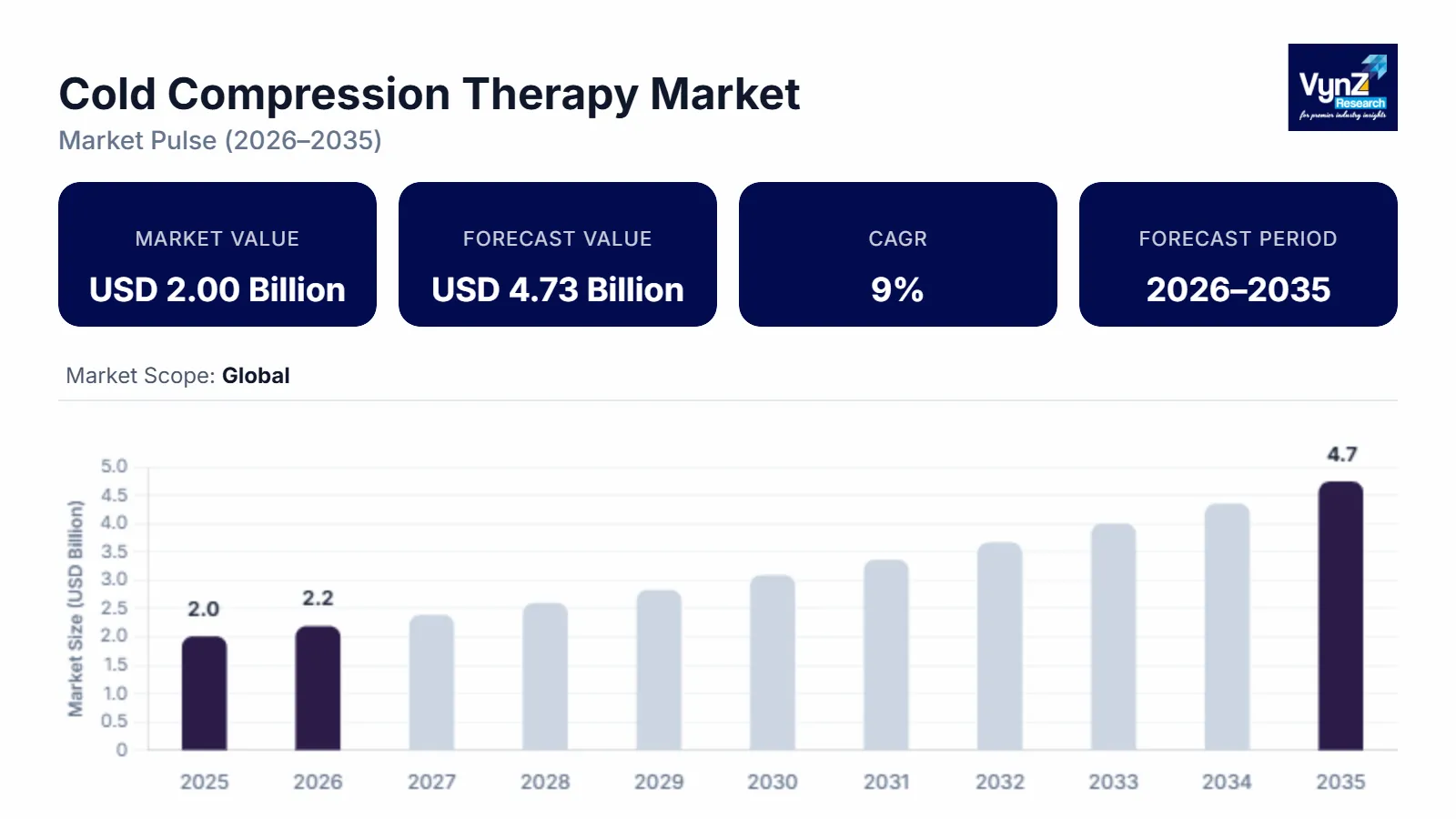

The cold compression therapy market which was valued at approximately USD 2.00 billion in 2025 and is estimated to rise further up to almost USD 2.10 billion by 2026, is projected to reach around USD 4.73 billion in 2035, expanding at a CAGR of about 9% during the forecast period from 2026 to 2035.

Market expansion is primarily supported by increasing prevalence of musculoskeletal disorders, rising volume of orthopedic surgical procedures, and growing adoption of non-invasive recovery solutions for postoperative care, along with increasing use of advanced cold compression devices in hospitals, clinics, and home rehabilitation settings. Rising demand for rapid pain management and ongoing investments in government-backed healthcare programs supported by institutions such as the U.S. Centers for Disease Control and Prevention and World Health Organization are further supporting market growth across major regions including North America, Europe, and Asia Pacific.

Adoption is reinforced by healthcare providers’ focus on enhancing patient recovery, reducing postoperative complications, and improving rehabilitation efficiency, aligned with formal clinical and rehabilitation frameworks. Public health agencies continue to emphasize conservative musculoskeletal care and early intervention strategies, supporting deployment of cold compression therapy in physiotherapy and sports medicine clinics. Regional initiatives promoting non-pharmacological pain management, rehabilitation accessibility, and injury prevention further strengthen market presence in developed and emerging healthcare systems.

Cold Compression Therapy Market Dynamics

Market Trends

The industry is undergoing notable structural shifts driven by increasing demand for non-invasive pain management and postoperative rehabilitation solutions, reflecting evolving clinical preferences toward therapeutic efficiency and patient comfort. The rising incidence of sports-related injuries and musculoskeletal disorders has led healthcare providers to integrate advanced cold compression devices into standard care protocols, particularly in orthopedic and sports medicine clinics, as supported by national health authority reports. Technological innovation has also emerged as a prominent trend, with the integration of portable and user-friendly designs that support rehabilitation outside clinical settings and enhance patient engagement. These developments encourage companies to focus on improved device functionality and differentiated solutions that align with broader healthcare delivery models.

Growth Drivers

The growth of the market is strongly supported by the increasing global prevalence of musculoskeletal conditions and rising surgical volumes, which continue to generate consistent demand across clinical and home care applications. Reports from the World Health Organization highlight that musculoskeletal disorders affect over 1.7 billion people worldwide, contributing to sustained demand for effective pain and inflammation management technologies. Innovations in portable and wearable devices that enable convenient home rehabilitation, combined with increased healthcare investments and supportive public health initiatives advocating non-pharmacological treatments, further accelerate market expansion. Healthcare systems’ focus on reducing postoperative complications, minimizing reliance on opioid medications, and improving overall patient outcomes is also driving adoption across hospitals and outpatient facilities.

Market Restraints / Challenges

Despite favorable growth prospects, the market landscape faces challenges that may constrain broader adoption. High initial costs associated with advanced cold compression systems can limit penetration among cost-sensitive healthcare facilities and individual consumers, particularly in developing regions where healthcare expenditure per capita remains comparatively low. Inconsistent reimbursement policies and limited coverage for non-pharmacological therapies further affect market accessibility, as many insurance providers classify such devices as supplementary rather than essential treatments. Additionally, regulatory complexity and varying approval requirements across jurisdictions can delay product launch timelines and impose additional compliance costs, particularly for smaller manufacturers seeking to expand into multiple markets.

Market Opportunities

The market presents significant opportunities in the expansion of home healthcare and at-home rehabilitation segments, driven by a growing preference for recovery solutions that enable patient autonomy and minimize clinical visits. Advancements in design and connectivity, including integration with digital monitoring and telehealth platforms, offer avenues for enhanced patient engagement and differentiated value propositions that extend beyond traditional clinical settings. Emerging markets, particularly in Asia Pacific and Latin America, also offer untapped growth potential as healthcare infrastructure improves, disposable incomes rise, and awareness of non-invasive therapeutic options increases. Companies focusing on cost-effective, modular, and customizable cold compression solutions are well positioned to capture incremental demand from a broader range of end users.

Global Cold Compression Therapy Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 2.00 Billion |

|

Revenue Forecast in 2035 |

USD 4.73 Billion |

|

Growth Rate |

9% |

|

Segments Covered in the Report |

By Product Type, By Application, By Distribution Channel, By Price Tier, By End Use / User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, Other Regions |

|

Key Companies |

3M, ACI Medical, LLC, Arjo, BIOCOMPRESSION SYSTEMS, BSN Medical, Cardinal Health, Devon Medical Products, DJO LLC, Spectrum Healthcare, Tactile Medical, THUASNE SAS, Medtronic |

|

Customization |

Available upon request |

Cold Compression Therapy Market Segmentation

By Product Type

Intermittent cold compression systems accounted for the largest market share in 2025, approximately 50%, supported by superior clinical outcomes and broad applicability in postoperative care and sports injury management.

Static systems held around 30% market share, reflecting adoption in budget-sensitive clinical settings, with projected growth at 6.8% CAGR during 2026 to 2035.

Accessories contributed roughly 20% of the market in 2025 and are expected to grow at 7.5% CAGR, driven by replacement purchases and bundling strategies.

By Application

Sports injury management represented the largest share in 2025 at approximately 52%, driven by widespread adoption in sports medicine clinics and rehabilitation centers.

Postoperative recovery accounted for roughly 27% of the market and is projected to grow at 8.1% CAGR, supported by integration into enhanced recovery after surgery protocols.

Chronic pain management held around 21% share in 2025, with growth estimated at 7.3% CAGR, reflecting long-term usage among aging populations and musculoskeletal disorder prevalence.

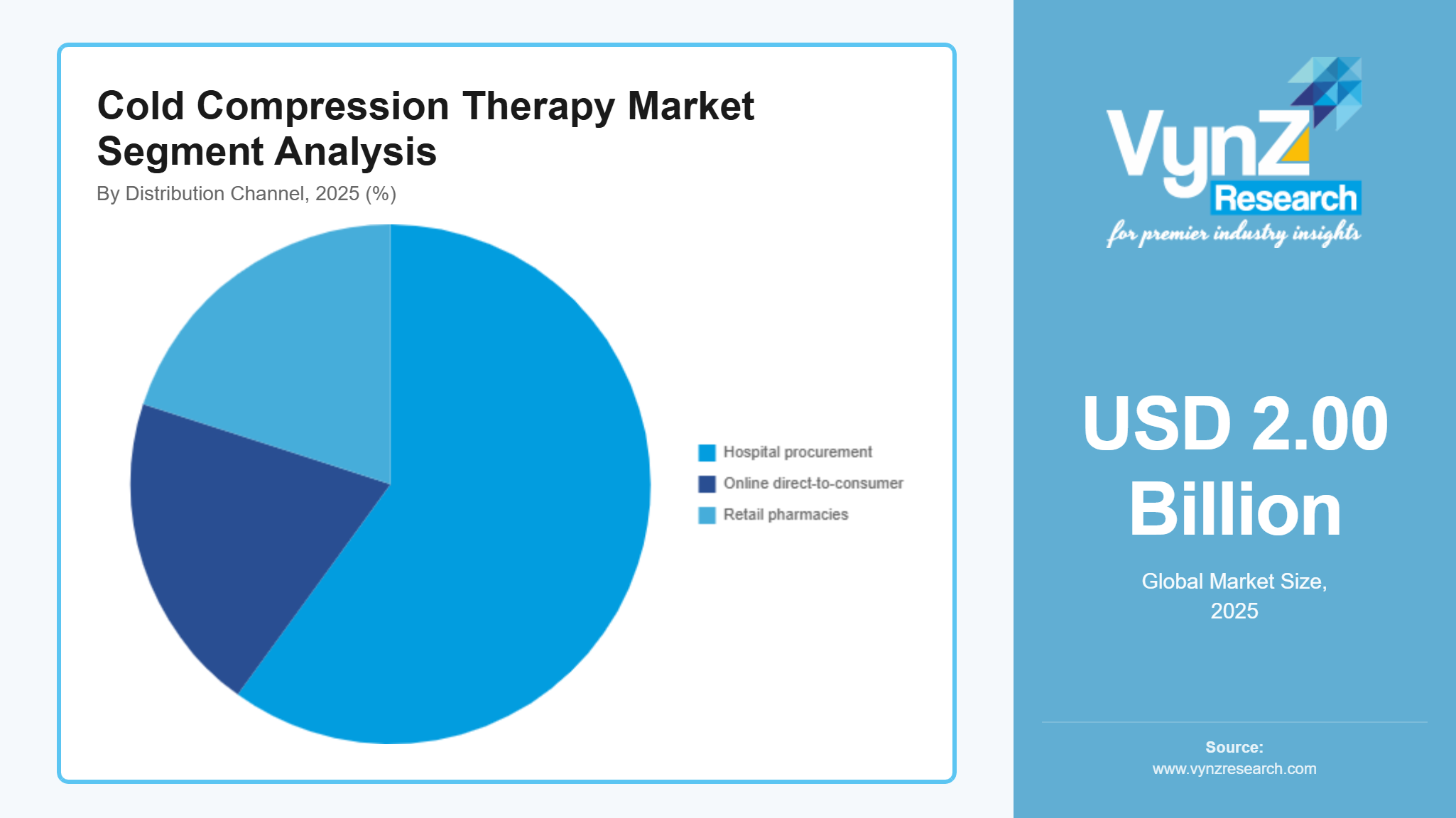

By Distribution Channel

Hospital procurement dominated the market in 2025, holding approximately 60% share, due to bulk purchases and integration into clinical protocols.

Online direct-to-consumer platforms contributed around 20% and are expected to grow at 9.3% CAGR, driven by digital penetration, e-commerce accessibility, and subscription models.

Retail pharmacies represented approximately 20% of the market and are projected to expand at 6.5% CAGR, supported by product availability, pharmacist guidance, and integration with local clinical networks.

By Price Tier

Mid-range products accounted for the largest share in 2025 at approximately 45%, supported by balanced cost-performance offerings appealing to hospitals and home care users.

The premium segment contributed roughly 25% of the market and is projected to grow at 8.7% CAGR, driven by institutional adoption, advanced technology integration, and automated pressure control systems.

Economy products held around 30% of the market in 2025 and are expected to expand at a CAGR of 6.2%, appealing to cost-sensitive buyers and secondary clinical facilities.

By End Use / User

Hospitals accounted for the largest share in 2025, approximately 55%, reflecting high surgical volumes and standardized procurement practices.

Rehabilitation centers and sports medicine clinics together represented around 30% of the market and are projected to grow at 7.9% CAGR, driven by demand for specialized recovery services and performance optimization.

The home healthcare segment held about 15% of the market in 2025 and is expected to grow at 9.3% CAGR, supported by at-home recovery trends, patient autonomy, and portable device adoption.

Regional Insights

North America

North America accounted for approximately 32% of the cold compression therapy market in 2025. Growth is driven by rising demand for postoperative recovery and sports injury management, coupled with high adoption in hospitals and rehabilitation centers across major cities such as Boston, New York, and Los Angeles. Government-backed healthcare programs, including federal funding for rehabilitation infrastructure and patient-centric care initiatives, are encouraging investments in advanced cold compression devices. The expansion of hospital procurement channels, clinical partnerships, and home healthcare solutions is further strengthening regional market performance. Rising awareness among athletes and increasing insurance coverage for postoperative therapies continue to support market expansion.

Europe

Europe represented approximately 22% of the market in 2025. Market growth is supported by modernization of rehabilitation facilities, integration of advanced physiotherapy protocols, and government programs promoting outpatient recovery services. Countries including Germany, the United Kingdom, France, and Italy are witnessing steady adoption due to healthcare infrastructure upgrades, high hospital density, and growing consumer awareness of non-invasive therapy options. Investment in digital healthcare platforms and medical device distribution networks is enhancing product accessibility and operational efficiency. Rising prevalence of musculoskeletal disorders and sports injuries across Europe reinforces demand for cold compression therapy solutions, while reimbursement policies in several nations encourage wider adoption.

Asia Pacific

Asia Pacific is projected to account for roughly 20% of the market in 2025. Rapid urbanization, expanding hospital networks, and government health initiatives in countries such as China, Japan, South Korea, and India are driving adoption. Rising awareness of rehabilitation care and sports medicine practices, along with increased disposable income, supports growth. Public health programs aimed at reducing post-surgical recovery time and improving patient outcomes are encouraging investments in cold compression therapy devices. Expansion of e-commerce platforms and home care solutions is further enabling regional penetration. Rising focus on preventive healthcare and physiotherapy adoption is contributing to long-term market growth.

Other Regions

Other regions, including Latin America, Africa, and the GCC, collectively accounted for approximately 26% of the global market in 2025. Growth is supported by gradual development of healthcare infrastructure, rising rehabilitation and physiotherapy services, and increased awareness of non-invasive therapy solutions. Countries such as Saudi Arabia, the United Arab Emirates, Brazil, and South Africa are witnessing growing adoption in hospitals, rehabilitation centers, and sports clinics. Government-backed initiatives promoting medical technology, outpatient care, and patient-centric recovery programs are encouraging investments. Although adoption remains slower compared with North America, Europe, and Asia Pacific, these regions present long-term opportunities for market expansion.

Competitive Landscape / Company Insights

The cold compression therapy market is moderately to highly competitive, with global and regional players offer advanced compression systems, portable devices, and integrated recovery solutions. Adoption is supported by government healthcare programs, rehabilitation funding initiatives, and public health awareness campaigns, which drive demand for non-invasive therapy solutions. These frameworks encourage companies to strengthen R&D, expand distribution networks, and enhance digital capabilities to secure long-term contracts across North America, Europe, and Asia Pacific.

Mini Profiles

3M provides advanced medical tapes, compression products, and wound care solutions, supported by global brand recognition, innovation in materials, and strong distribution channels across healthcare markets.

Biocompression Systems delivers specialized compression therapy devices and garments, operating in premium segments, emphasizing performance, patient comfort, and clinical efficacy in vascular and lymphedema care.

Cardinal Health leverages extensive distribution networks and supply chain expertise to offer medical products, surgical supplies, and compression devices, expanding its presence in hospitals and outpatient facilities.

DJO, LLC specializes in orthopedic bracing, rehabilitation, and compression solutions, focusing on design innovation, patient-specific customization, and integrated therapy systems for musculoskeletal care.

Paul Hartmann AG offers hygiene, wound care, and compression products, supported by local manufacturing and strategic partnerships, enhancing European and global healthcare service delivery.

Key Players

- 3M

- ACI Medical, LLC

- DJO, LLC

- Sigvaris Group

- Spectrum Healthcare

- Tactile Medical

- Thuasne SAS

- Medtronic

Recent Developments

In September 2025, Medi expanded its product range with the mediven comfort print, a new medical compression stocking featuring full digital print designs. This iteration pairs therapeutic compression performance with customizable aesthetics which is the first of its kind in the brand’s compression portfolio available in multiple motifs and color variants starting October 2025.

In April 2025, Arjo launched the Maxi Move 5, an advanced mobile patient floor lift designed to reduce caregiver injuries and improve transfer efficiency. This product launch reinforces Arjo’s market position in patient handling solutions and includes features like Arjo Motion Assist and powered dynamic positioning.

In April 2025, Juzo, a leading global manufacturer of compression and orthopedic solutions has collaborated with a major European e‑commerce platform designed to expand the online availability of its therapeutic compression garments, supports and orthoses across key European markets. The collaboration focus on improving accessibility for patients and customers by leveraging the platform’s wide‑reaching digital marketplace and logistics network.

Global Cold Compression Therapy Market Coverage

Product Type Insight and Forecast 2026 - 2035

- Intermittent cold compression systems

- Static cold compression systems

- Accessories

Application Insight and Forecast 2026 - 2035

- Sports injury management

- Postoperative recovery

- Chronic pain management

Distribution Channel Insight and Forecast 2026 - 2035

- Hospital procurement

- Online direct-to-consumer

- Retail pharmacies

Price Tier Insight and Forecast 2026 - 2035

- Premium products

- Mid-range products

- Economy products

End Use / User Insight and Forecast 2026 - 2035

- Hospitals

- Rehabilitation centers

- Sports medicine clinics

- Home healthcare

Global Cold Compression Therapy Market by Region

- North America

- By Product Type

- By Application

- By Distribution Channel

- By Price Tier

- By End Use / User

- By Country - U.S., Canada, Mexico

- Europe

- By Product Type

- By Application

- By Distribution Channel

- By Price Tier

- By End Use / User

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Product Type

- By Application

- By Distribution Channel

- By Price Tier

- By End Use / User

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Product Type

- By Application

- By Distribution Channel

- By Price Tier

- By End Use / User

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Cold Compression Therapy Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Product Type

1.2.2. By

Application

1.2.3. By

Distribution Channel

1.2.4. By

Price Tier

1.2.5. By

End Use / User

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Product Type

5.1.1. Intermittent cold compression systems

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Static cold compression systems

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Accessories

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Application

5.2.1. Sports injury management

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Postoperative recovery

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Chronic pain management

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Distribution Channel

5.3.1. Hospital procurement

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Online direct-to-consumer

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Retail pharmacies

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.4. By Price Tier

5.4.1. Premium products

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Mid-range products

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Economy products

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

5.5. By End Use / User

5.5.1. Hospitals

5.5.1.1. Market Definition

5.5.1.2. Market Estimation and Forecast to 2035

5.5.2. Rehabilitation centers

5.5.2.1. Market Definition

5.5.2.2. Market Estimation and Forecast to 2035

5.5.3. Sports medicine clinics

5.5.3.1. Market Definition

5.5.3.2. Market Estimation and Forecast to 2035

5.5.4. Home healthcare

5.5.4.1. Market Definition

5.5.4.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Product Type

6.2. By

Application

6.3. By

Distribution Channel

6.4. By

Price Tier

6.5. By

End Use / User

6.5.1.

U.S. Market Estimate and Forecast

6.5.2.

Canada Market Estimate and Forecast

6.5.3.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.1. By

Product Type

7.2. By

Application

7.3. By

Distribution Channel

7.4. By

Price Tier

7.5. By

End Use / User

7.5.1.

Germany Market Estimate and Forecast

7.5.2.

U.K. Market Estimate and Forecast

7.5.3.

France Market Estimate and Forecast

7.5.4.

Italy Market Estimate and Forecast

7.5.5.

Spain Market Estimate and Forecast

7.5.6.

Russia Market Estimate and Forecast

7.5.7.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Product Type

8.2. By

Application

8.3. By

Distribution Channel

8.4. By

Price Tier

8.5. By

End Use / User

8.5.1.

China Market Estimate and Forecast

8.5.2.

Japan Market Estimate and Forecast

8.5.3.

India Market Estimate and Forecast

8.5.4.

South Korea Market Estimate and Forecast

8.5.5.

Vietnam Market Estimate and Forecast

8.5.6.

Thailand Market Estimate and Forecast

8.5.7.

Malaysia Market Estimate and Forecast

8.5.8.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Product Type

9.2. By

Application

9.3. By

Distribution Channel

9.4. By

Price Tier

9.5. By

End Use / User

9.5.1.

Brazil Market Estimate and Forecast

9.5.2.

Saudi Arabia Market Estimate and Forecast

9.5.3.

South Africa Market Estimate and Forecast

9.5.4.

U.A.E. Market Estimate and Forecast

9.5.5.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. 3M

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. ACI Medical, LLC

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. DJO, LLC

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Sigvaris Group

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Spectrum Healthcare

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Tactile Medical

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Thuasne SAS

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Medtronic

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Cold Compression Therapy Market