Pharma-Grade Probiotics Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Dosage Form (Powder, Capsules & Tablets, Liquid Suspensions, Others), by Strain Type (Lactobacillus Strains, Bifidobacterium Strains, Yeast-based Probiotics, Other Specialty Strains), by Application (Gastrointestinal Disorders, Immune Support, Women’s Health, Metabolic Disorders, Pediatric Health, Others), by End-User (OTC Dietary Supplements, Prescription Probiotics (Rx), Medical Nutrition Products, Hospital/Clinical Use)

| Status : Published | Published On : Feb, 2026 | Report Code : VRHC1313 | Industry : Healthcare | Available Format :

|

Page : 180 |

Pharma-Grade Probiotics Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Dosage Form (Powder, Capsules & Tablets, Liquid Suspensions, Others), by Strain Type (Lactobacillus Strains, Bifidobacterium Strains, Yeast-based Probiotics, Other Specialty Strains), by Application (Gastrointestinal Disorders, Immune Support, Women’s Health, Metabolic Disorders, Pediatric Health, Others), by End-User (OTC Dietary Supplements, Prescription Probiotics (Rx), Medical Nutrition Products, Hospital/Clinical Use)

Pharma-Grade Probiotics Market Overview

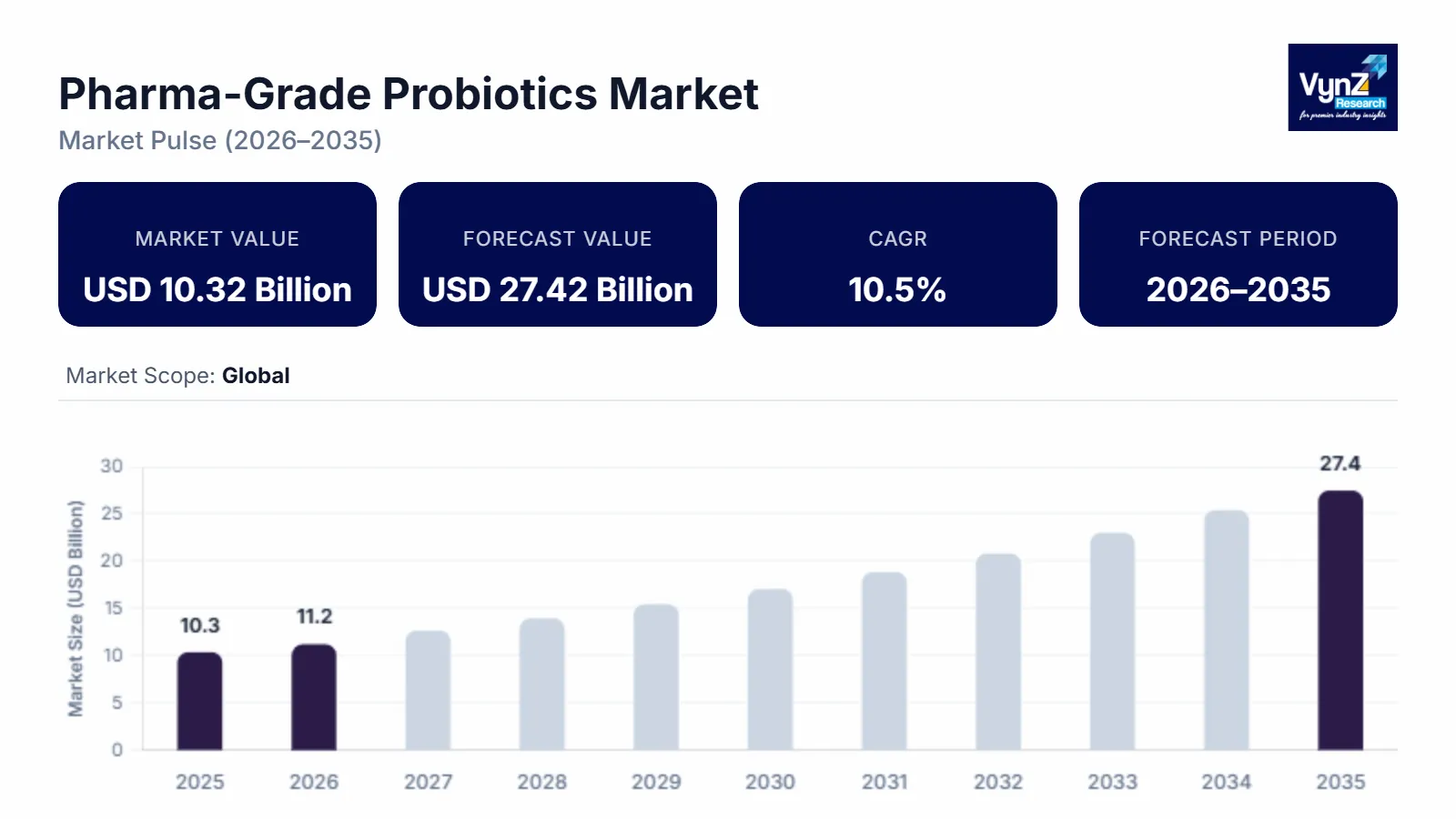

The pharma-grade probiotics market which was valued at approximately USD 10.32 billion in 2025 and is estimated to rise further up to around USD 11.16 billion by 2026, is projected to reach nearly USD 27.42 billion by 2035, expanding at a CAGR of about 10.5% during the forecast period from 2026 to 2035.

The market for pharmaceutical-grade probiotics has emerged as one of the most dynamic sectors within the global healthcare landscape, showcasing significant momentum as both consumer and clinical interest continues to rise.

The therapeutic applications of probiotics are rapidly broadening, although gastrointestinal health remains the most established area of application. Probiotics are frequently prescribed and utilized to address conditions such as irritable bowel syndrome, inflammatory bowel disease, constipation, and complications arising from antibiotic use. The endorsement of healthcare professionals and a substantial body of clinical research have reinforced their standing in this field. However, the more rapid expansion is being driven by their growing applications in other therapeutic domains. Women's health is emerging as one of the fastest-growing segments, with studies highlighting their significance in maintaining vaginal and urinary tract health, as well as supporting hormonal balance and pregnancy outcomes. Simultaneously, the rising prevalence of obesity, diabetes, and cholesterol-related issues is accelerating the use of probiotics as complementary treatments for metabolic disorders. Furthermore, pediatric and immune health applications are witnessing significant growth, particularly with the launch of formulations specifically designed for infants and children, along with products aimed at enhancing immunity during both preventive and recovery phases.

The dynamics of end-use further illustrate the market's transition from general consumer products to medically integrated therapies. The over-the-counter supplement segment continues to dominate, supported by the extensive availability of probiotics in pharmacies, supermarkets, and online platforms. Nevertheless, probiotics prescribed by physicians are swiftly gaining traction, as enhanced clinical evidence and growing physician confidence facilitate their integration into treatment protocols. Additionally, hospitals and clinical nutrition are emerging as key areas for growth, particularly for patients recovering from antibiotic treatments, undergoing cancer therapies, or requiring support in critical care. This transformation underscores the evolving perception of probiotics, shifting from general wellness aids to targeted therapeutic agents with measurable outcomes.

Pharma-Grade Probiotics Market Dynamics

Market Trends

The integration of artificial intelligence (AI) and machine learning (ML) is emerging as a crucial trend in the research and development of probiotics. Historically, the identification and validation of probiotic strains relied on labor-intensive laboratory experiments and clinical trials, which were frequently constrained by limited datasets. However, AI/ML technologies are now accelerating this process by analyzing extensive metagenomic, proteomic, and metabolomic datasets to identify new probiotic candidates with therapeutic potential.

By utilizing advanced algorithms, researchers can predict strain functionality, survivability in gastrointestinal environments, and interactions with the host microbiome. For example, ML-driven models are currently employed to identify strains that demonstrate anti-inflammatory properties, immunomodulatory effects, or metabolic benefits. Furthermore, these tools facilitate in silico simulations that reduce the dependence on costly preclinical trials, enabling faster prioritization of candidates for clinical research.

In the area of clinical validation, AI is being utilized to develop adaptive trials, improve patient recruitment based on microbiome profiles, and anticipate diverse responses to probiotic treatments. These precision-focused strategies not only shorten development timelines but also enhance the likelihood of regulatory approval by providing robust, data-driven evidence of efficacy.

Pharmaceutical and biotechnology companies are increasingly forming partnerships with AI-focused startups and bioinformatics firms to integrate these capabilities into their research and development efforts. This convergence is expected to lead to next-generation, patient-specific probiotic formulations and significantly improve the efficiency of drug development in this domain.

Growth Drivers

The market for pharmaceutical-grade probiotics is increasingly shaped by the growing body of clinical evidence that supports the efficacy of probiotics across various therapeutic areas. Over the past decade, randomized controlled trials, systematic reviews, and meta-analyses have provided substantial proof that probiotics are not only beneficial for overall gut health but also hold clinical importance in the treatment or management of specific health conditions.

One of the most thoroughly researched domains is irritable bowel syndrome (IBS), where comprehensive clinical studies have shown that probiotics can significantly reduce abdominal pain, bloating, and the overall severity of symptoms. Recent meta-analyses indicate that multi-strain formulations or high-dose regimens offer the most consistent symptom relief, highlighting the essential role of strain selection and dosage. Similarly, in the realm of inflammatory bowel disease (IBD), trials suggest that probiotics can modify gut microbiota composition, lower inflammatory markers such as C-reactive protein, and promote mucosal healing, although clinical outcomes may still be modest in certain studies.

The growing demand for personalized and precision medicine is revolutionizing the development, prescription, and use of probiotics. For an extended period, conventional healthcare has relied on standardized treatments; however, it is now widely recognized that individuals respond differently based on their genetic composition, lifestyle, and, most importantly, their gut microbiome makeup. Considering that the microbiome is exceptionally unique and plays a crucial role in digestion, immunity, metabolic regulation, and even neurological health, probiotics have naturally aligned with this shift towards customized healthcare solutions. Recent progress in microbiome sequencing and diagnostic technologies is driving this trend forward. These advancements facilitate the mapping of an individual's distinct microbial ecosystem and the detection of imbalances that may be linked to specific health issues, such as irritable bowel syndrome, obesity, or metabolic disorders. As a result, probiotic formulations can be chosen or even customized to effectively address these imbalances, exceeding the effectiveness of generic solutions. The incorporation of artificial intelligence and bioinformatics further improves this process, enabling researchers and clinicians to predict how specific strains will perform in different individuals and to recommend targeted interventions.

Market Restraints / Challenges

The creation of pharmaceutical-grade probiotics, classified as live biotherapeutic products (LBPs), under most major regulatory frameworks requires substantial financial resources and extended timeframes. Unlike dietary supplements, which can be launched with limited safety documentation, LBPs necessitate a drug-level development process. This process encompasses discovery, strain isolation, genomic characterization, toxicology evaluations, preclinical animal research, and multi-phase human clinical trials. This methodology is similar to the development of biologics, demanding advanced infrastructure, GMP-compliant manufacturing facilities, and intricate quality-control methods for live organisms.

Securing robust intellectual property (IP) protection for pharmaceutical-grade probiotics presents a considerable challenge due to the inherent biological traits of probiotics and the diverse strains that are publicly available. Unlike synthetic drugs, which are typically novel chemical entities eligible for strong composition-of-matter patents, probiotics are made up of naturally occurring microorganisms. This situation complicates the assertion of exclusive ownership over strains that may already exist in nature or are widely used in food and dietary supplements. As a result, patents usually focus on unique formulations, genetic modifications, manufacturing processes, or specific therapeutic applications; however, these provide limited protection and can be more readily bypassed. Furthermore, the standards for patentability vary significantly across different jurisdictions. In the United States, the USPTO has gradually allowed patents on genetically modified or specifically characterized microbial strains. In contrast, the European Patent Office (EPO) takes a more rigorous stance, particularly regarding claims related to naturally occurring strains that do not involve genetic modification. In emerging markets, the enforcement of microbial patents is weaker, which places innovators at risk of imitation and parallel commercialization.

Market Opportunities

One of the most promising opportunities in the field of pharmaceutical-grade probiotics is the advancement of genetically engineered probiotics (GEPs), which are microorganisms that have been altered to enhance their functionality, therapeutic efficacy, and precision in targeting specific diseases. Traditional probiotics provide general advantages for gut health; however, their mechanisms often show variability across different patient demographics. Genetic engineering enables researchers to develop strains with optimized traits, such as improved survival rates in the gastrointestinal tract, better adhesion to mucosal surfaces, and controlled release of therapeutic molecules.

Recent progress in synthetic biology and CRISPR-Cas gene editing has accelerated advancements in this area. Researchers are currently modifying bacterial strains to act as "living drug factories," capable of generating bioactive compounds such as anti-inflammatory peptides, enzymes, and metabolic regulators directly within the host. For instance, engineered Escherichia coli Nissle 1917 has been assessed for its capacity to deliver anti-tumor agents in colorectal cancer, while modified Lactococcus lactis has shown promise in secreting interleukin-10 for inflammatory bowel disease (IBD). Similarly, engineered strains are being created to metabolize toxic substances in rare metabolic disorders, thus opening new avenues in the treatment of orphan diseases.

Global Pharma-Grade Probiotics Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 10.32 Billion |

|

Revenue Forecast in 2035 |

USD 27.42 Billion |

|

Growth Rate |

10.5% |

|

Segments Covered in the Report |

Dosage Form, Strain Type, Application and End Use |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America (U.S., Canada, Mexico), Europe (Germany, U.K., France), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Argentina, Rest of Latin America), MEA (Saudi Arabia, UAE, South Africa) |

|

Key Companies |

BIOGAIA AB, DANONE NUTRICIA RESEARCH, DUPONT DE NEMOURS, INC. (INTERNATIONAL FLAVORS & FRAGRANCES), LALLEMAND HEALTH SOLUTIONS, LONZA GROUP AG, NESTLÉ HEALTH SCIENCE, NOVONESIS GROUP, PROBI AB, WINCLOVE PROBIOTICS, YAKULT HONSHA CO., LTD. |

|

Customization |

Available upon request |

Pharma-Grade Probiotics Market Segmentation

By Dosage Form

Powder formulations rank among the most frequently used dosage forms in the pharmaceutical-grade probiotics industry, offering versatility in both administration and product development. These powders are particularly advantageous due to their straightforward incorporation into food, beverages, and infant nutrition products, making them suitable for a diverse array of patient demographics, including children, the elderly, and individuals with swallowing difficulties. This flexibility encourages their application in both prescription probiotics and over-the-counter therapeutic supplements.

From a manufacturing standpoint, probiotic powders are typically produced using freeze-drying (lyophilization) or spray-drying techniques, which help preserve bacterial viability during storage and transit through the gastrointestinal tract. The ability to control excipient composition further enhances stability, allowing powders to deliver a higher number of colony-forming units (CFUs) compared to certain capsule or tablet forms. This feature makes powders the preferred choice in clinical situations that require precise dosing and high strain viability.

Pharmaceutical companies are also investing in microencapsulation and protective coating technologies to improve the survivability of probiotic strains in powder form, particularly against degradation caused by heat, moisture, and stomach acid. This ensures more dependable clinical outcomes and expands their use in areas such as gastrointestinal disorders, immune modulation, and the management of metabolic diseases. On the commercial front, the powder segment is witnessing a surge in demand from pediatric care (due to the ease of mixing with milk or formula) and hospital settings (where powders can be reconstituted for enteral feeding). Although challenges such as sensitivity to humidity and the risk of contamination persist, advancements in packaging and controlled-release technologies are tackling these concerns, thereby solidifying the position of powders in the market.

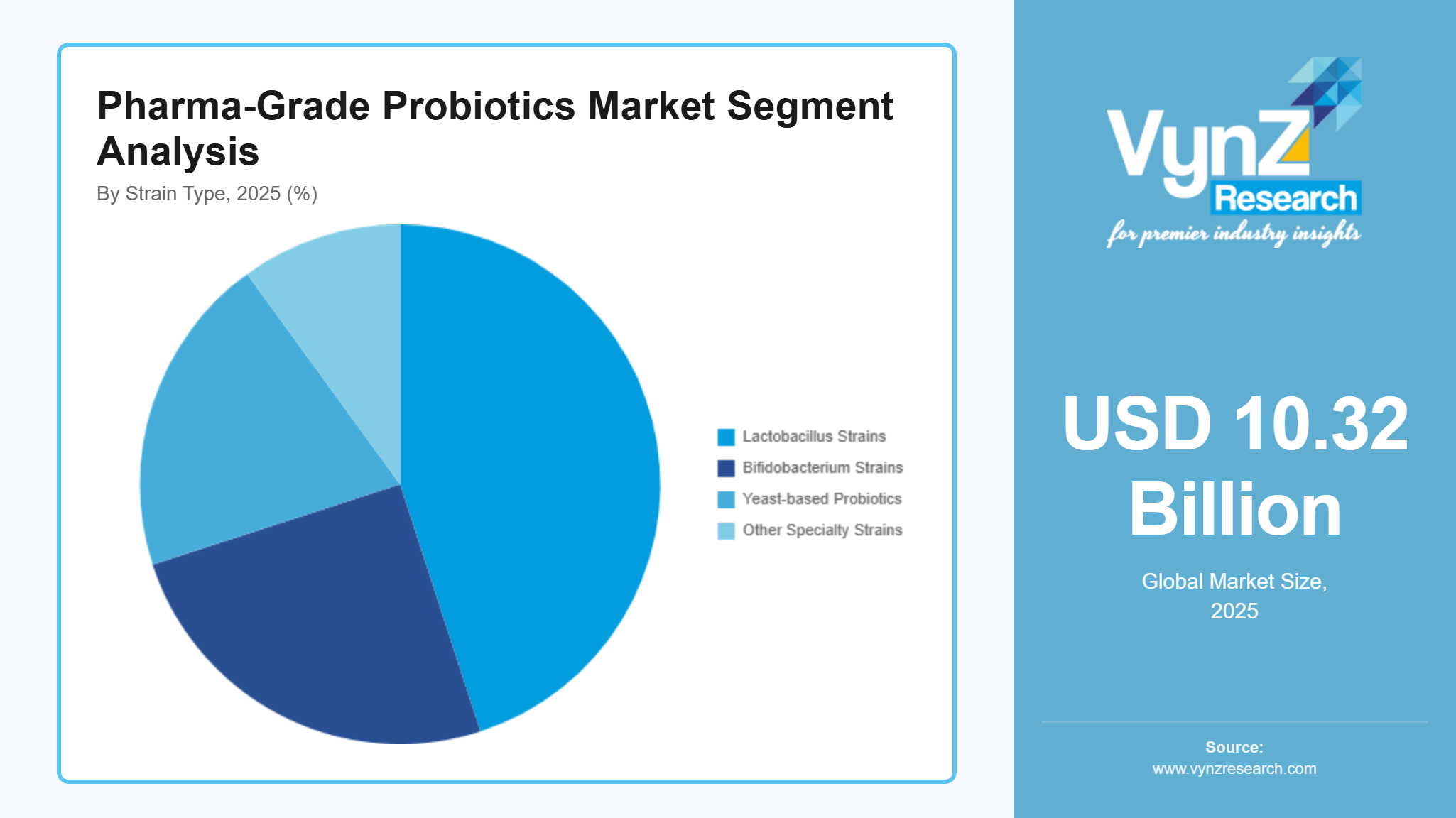

By Strain Type

Lactobacillus strains are the most thoroughly researched and utilized category of pharmaceutical-grade probiotics, primarily due to their natural presence in the human gastrointestinal and urogenital systems, along with their well-documented role in maintaining microbial balance, gut barrier integrity, and modulating the immune system. Their adaptability across a range of pharmaceutical delivery methods, from conventional capsules and powders to advanced controlled-release drug delivery systems, has reinforced their prominent status in the probiotic therapeutic field.

Clinically, Lactobacillus strains have demonstrated efficacy in addressing antibiotic-associated diarrhea, irritable bowel syndrome (IBS), lactose intolerance, and Clostridium difficile infections, in addition to enhancing respiratory health and supporting women's health. For instance, Lactobacillus rhamnosus GG (LGG) and Lactobacillus acidophilus are among the most well-established strains, found in both prescription and over-the-counter products. Concurrently, Lactobacillus plantarum is gaining attention for its involvement in metabolic disorders, while Lactobacillus casei is recognized for its capacity to diminish systemic inflammation, underscoring the growing emphasis on strain-specific benefits.

Recent research is expanding their potential applications to oncology, where specific strains are being explored for their capability to alleviate chemotherapy-induced gastrointestinal toxicity, and to urogenital health, where they help prevent recurrent bacterial vaginosis and urinary tract infections. The accumulating evidence supporting these therapeutic uses continues to expand, establishing them as crucial components in precision medicine approaches.

By Application

Gastrointestinal (GI) disorders represent the primary therapeutic area for pharmaceutical-grade probiotics, driven by their well-established role in modulating gut microbiota, improving barrier integrity, and regulating immune responses. Conditions such as irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), ulcerative colitis, Crohn’s disease, gastroenteritis, constipation, and antibiotic-associated diarrhea are critical focal points where clinical research has demonstrated significant benefits from probiotic interventions.

Among the most extensively studied applications, antibiotic-associated diarrhea (AAD) and Clostridioides difficile infections have shown significant reductions in recurrence rates when probiotic formulations are used alongside standard treatments. Similarly, in the treatment of IBS, strains of Lactobacillus and Bifidobacterium have been linked to improvements in bloating, stool consistency, and abdominal discomfort. For IBD, ongoing clinical trials are assessing the effectiveness of multi-strain formulations in maintaining remission and reducing flare-ups.

Quantitatively, gastrointestinal disorders affect a considerable global population: approximately 40% of adults’ worldwide experience functional GI disorders, with IBS alone impacting 5–10% of the global population. This large patient demographic underscores the need for effective adjunct therapies, positioning probiotics as a vital alternative to long-term pharmacological treatments, which often come with side effects.

By End-User

Over-the-counter (OTC) dietary supplements constitute a significant segment of the pharma-grade probiotics market, catering to consumers who prioritize preventive health, gut support, and overall wellness. Unlike prescription products, OTC probiotics are easily accessible, do not require physician oversight, and are often marketed for digestive health, immune support, and women’s wellness. Their widespread availability and consumer awareness establish them as a crucial element in the global uptake of probiotics.

The OTC category includes various forms of delivery, such as capsules, powders, liquids, sachets, and gummies, offering flexibility in dosing and administration for different age demographics, including children and the elderly. Common strains present in OTC products include Lactobacillus rhamnosus, Bifidobacterium lactis, and Saccharomyces boulardii, typically found in either single-strain or multi-strain formulations. Multi-strain products are increasingly preferred for their wider benefits to gut and immune health, while functional combinations may incorporate prebiotics, vitamins, or minerals to enhance efficacy.

Regulatory standards vary by region, influencing label claims, CFU counts, and quality criteria. Leading companies are investing heavily in quality assurance, strain validation, and marketing strategies to build consumer trust. As knowledge of gut-immune interactions grows and clinical evidence mounts, the OTC dietary supplement industry is expected to continue its rapid expansion, particularly in North America, Europe, and Asia-Pacific regions, reinforcing its position as a vital part of the pharma-grade probiotic market.

Regional Insights

North America

North America is recognized as a key region in the adoption of pharmaceutical-grade probiotics, driven by increased consumer health awareness, advanced healthcare systems, and rigorous regulatory frameworks. In the United States, probiotics are widely used for digestive health, immune support, and overall wellness. Data from the Centers for Disease Control and Prevention (CDC) indicates that over 57% of adults reported using dietary supplements in the past month, with a higher prevalence among women and older age groups. This trend highlights a notable consumer interest in preventive healthcare and microbiome wellness. The FDA regulates probiotics as dietary supplements, focusing on product safety, accurate labeling, and monitoring adverse events, especially for vulnerable populations such as preterm infants, where clinical evidence has shown cases of invasive infections associated with probiotic use.

In Canada, probiotics are categorized as Natural Health Products (NHPs) by Health Canada, necessitating product licensing, clinical evidence, and compliance with strict quality standards. Reports indicate that around 20% of children aged 1 to 5 years are given probiotics, primarily for gastrointestinal issues, reflecting adoption trends in both pediatric and adult demographics. Canadian regulatory authorities also provide detailed monographs, guidance documents, and safety protocols, ensuring the reliability of marketed probiotic products.

In Mexico, an increasing awareness of health concerns has resulted in a greater acceptance of probiotic-rich foods and supplements. The Federal Commission for the Protection against Sanitary Risk (COFEPRIS) oversees regulatory compliance, ensuring the safety and efficacy of products available in the market. Urban populations show higher consumption rates, indicating a lifestyle-driven demand for gut health and preventive nutrition.

Asia Pacific

Asia Pacific is projected to hold roughly 34% of the market in 2025. China, Taiwan, South Korea, and Japan are leading the adoption of Pharma-Grade Probiotics technologies due to large-scale semiconductor manufacturing, increasing AI and HPC deployments, and government-backed initiatives for advanced packaging and R&D. Policies promoting domestic semiconductor capabilities, along with incentives for foundries and integrated device manufacturers, encourage investments in Pharma-Grade Probiotics-enabled processors. Rapid industrial digitization and growing cloud infrastructure in metropolitan centers such as Shanghai, Seoul, and Tokyo further boost regional demand.

Europe

Europe represents a well-established and highly regulated market for pharmaceutical-grade probiotics, characterized by significant consumer awareness, scientific validation, and strict regulatory oversight. Probiotics are widely used across the region for digestive health, immune support, metabolic health, and overall wellness. The demand is especially strong in countries such as Germany, France, the United Kingdom, Italy, and Spain, collectively known as the EU-5, which account for a substantial portion of regional consumption. Recent surveys conducted in Europe reveal that a majority of adults regularly incorporate dietary supplements, including probiotics, into their daily routines, reflecting a proactive approach to preventive healthcare. Regulatory oversight in Europe is primarily managed by the European Food Safety Authority (EFSA) and the EU Food Information to Consumers Regulation (EU FIC), which ensures product safety, efficacy, and quality. EFSA evaluates and approves health claims, requiring manufacturers to provide scientific evidence to substantiate the functional benefits of probiotic strains. This stringent regulatory framework guarantees that products marketed as probiotics meet consistent quality standards, thereby enhancing consumer trust and encouraging adoption among diverse demographics.

APAC

The Asia-Pacific region is marked by a swiftly growing and varied market for pharmaceutical-grade probiotics, driven by increased consumer awareness, rising healthcare expenditures, and a focus on preventive and integrative health.

Probiotics are widely used for digestive health, immune support, women's health, pediatric care, and metabolic wellness. Adoption rates are increasing among both urban and semi-urban populations, with adults, seniors, and children progressively incorporating probiotic supplements and functional foods into their daily lives. Regulatory frameworks in the Asia-Pacific region vary by country but are generally becoming more stringent to ensure product safety and efficacy.

Consumer behavior indicates a notable tendency towards preventive healthcare, as surveys show a broad use of dietary supplements, including probiotics, to tackle gastrointestinal issues, enhance immunity, and promote overall wellness. Healthcare practitioners are progressively integrating probiotics into their treatment plans, especially within hospital and clinical settings, employing them for ailments like irritable bowel syndrome, antibiotic-related diarrhea, and support for pediatric digestion.

Latin America

Consumer behavior indicates a notable tendency towards preventive healthcare, as surveys show a broad use of dietary supplements, including probiotics, to tackle gastrointestinal issues, enhance immunity, and promote overall wellness. Healthcare practitioners are progressively integrating probiotics into their treatment plans, especially within hospital and clinical settings, employing them for ailments like irritable bowel syndrome, antibiotic-related diarrhea, and support for pediatric digestion.

Middle East & Africa

The Middle East & Africa (MEA) region is evolving into a promising yet distinctly diverse market for pharmaceutical-grade probiotics. The rising occurrence of gastrointestinal and metabolic disorders, coupled with an increased focus on preventive healthcare, is driving interest in microbiome-based therapies. According to the World Health Organization (WHO), non-communicable diseases (NCDs) account for nearly 74% of deaths in the Middle East and 46% in Africa, with digestive health and metabolic imbalances recognized as major public health concerns. This scenario highlights the need for clinically validated probiotic interventions.

In the Gulf Cooperation Council (GCC) countries, significant disposable incomes, advanced healthcare infrastructure, and government-backed health initiatives such as Saudi Arabia’s Vision 2030, which prioritizes biotechnology and innovative healthcare, promote the adoption of pharmaceutical-grade probiotics. The obesity rate in the Gulf region exceeds 30% among adults, creating a favorable environment for probiotics designed to tackle metabolic and gastrointestinal disorders. Simultaneously, in nations like South Africa and Egypt, challenges related to digestive health and the increasing prevalence of antibiotic resistance are leading physicians to more frequently prescribe probiotics as complementary therapies.

Competitive Landscape / Company Insights

The market for pharma-grade probiotics is somewhat consolidated, with the leading five companies—Danone, Nestlé Health Science, Yakult Honsha, Kerry Group, and ADM—together representing around 40–45% of the global market share according to analyses conducted for 2025. The competition is fierce, driven by thorough clinical research on the effectiveness of strains, established brand loyalty due to long-term safety records, and focused strategies that align with regulated health claims as mandated by organizations such as the FDA and EFSA.

Research and Development and Strain Innovation: Companies emphasize patented strains (for instance, Yakult's Lactobacillus casei Shirota) for pharmaceutical applications related to immunity and digestive issues, supported by comprehensive trials.

Mergers and Acquisitions and Partnerships: Nestlé's collaborations with biotech companies and Danone's ventures into therapeutics strengthen their portfolios in response to the growing demand for medical-grade products.

Regulatory Advantage: Industry leaders excel in Good Manufacturing Practice (GMP) production and the substantiation of claims, establishing barriers for new entrants in pharmaceutical markets.

Mini Profiles

Novonesis Group is one a significant global biosolutions company that was formed in 2024 by merging Novonesis Group A/S and Chr. Hansen. It is based in Copenhagen, Denmark. Novonesis employs around 10,000 people around the world and serves over 30 industries. The company's innovative biological solutions focus on making global production systems more sustainable and efficient. It specializes in producing and selling industrial enzymes, microorganisms, and ingredients for biopharmaceuticals. Novonesis Group mainly operates in two business segments such as Food & Health Biosolutions and Planetary Health Biosolutions. The Food & Health Biosolutions includes areas such as Food & Beverages and Human Health. It aims to create biologically based solutions that improve food production and nutrition. The Human Health area features probiotics and human milk oligosaccharides (HMOs), which are vital for infant formula and gut health.

Danone Nutricia Research is the global research and innovation arm of Danone Group, specializing in advancing nutrition science to bring health through food for people at every stage of life. Headquartered in Utrecht, Netherlands, with other strategic centers in France, Singapore, China, and Spain, Danone Nutricia Research drives innovation in specialized nutrition through a deep understanding of human biology, microbiome science, and digital health technologies.

BioGaia AB is a Swedish healthcare company and a global leader in the research, development, manufacturing, and marketing of probiotic products. BioGaia has established itself at the forefront of microbiome research with a strong commitment to science-backed innovation. The company’s probiotics primarily revolve around various patented strains of Lactobacillus reuteri, which stand among the most clinically documented probiotics globally.

Yakult Honsha Co., Ltd., founded in 1935 and headquartered in Tokyo, Japan, is a pioneering global enterprise in the field of probiotics and functional health beverages. The company operates through two primary business segments such as Food and Beverages, and Others, which include Pharmaceuticals and Beauty Care Products.

Probi AB, headquartered in Lund, Sweden, is a globally recognized biotechnology company specializing in the development, production, and commercialization of clinically proven probiotic solutions. Founded in 1991 and now a wholly owned subsidiary of Symrise AG, Probi has evolved into a science-driven enterprise that operates across the full value chain from proprietary strain development to finished consumer products.

Key Players

- BIOGAIA AB

- DANONE NUTRICIA RESEARCH

- DUPONT DE NEMOURS, INC. (INTERNATIONAL FLAVORS & FRAGRANCES)

- LALLEMAND HEALTH SOLUTIONS

- LONZA GROUP AG

- NESTLÉ HEALTH SCIENCE

- NOVONESIS GROUP

- PROBI AB

- WINCLOVE PROBIOTICS

- YAKULT HONSHA CO., LTD.

Recent Developments

January 2026 - Juneyao Werdery introduced the "Probiotic Nutrition Bottle," which features pharmaceutical-grade strains including Lactobacillus rhamnosus JL-1, Bifidobacterium animalis subsp. lactis BL-G101, and Lactobacillus acidophilus LA-G80. Aimed at promoting gut health and enhancing immunity, this product aligns with precision nutrition trends in functional pharmaceutical offerings for daily therapeutic use.

December 2025 - Yuansheng Biotechnology Co., Ltd. revealed that its BeeAngel Probiotic Powder, marketed under the Jianxiaoda brand, successfully achieved China's inaugural Level-One Probiotic Strain Certification for domestically manufactured powder. This significant milestone in pharmaceutical-grade validation confirms the efficacy of high-potency strains for therapeutic purposes, thereby increasing confidence in clinical and FSMP applications amidst national quality standards.

November 2025 - PharmExtracta unveiled two new pharmaceutical-grade precision probiotics, Colipral® and Brevicillin® Drops, during CPHI Frankfurt 2025. These formulations, which are specific to certain strains, are designed to promote intestinal balance across various age demographics, with Brevicillin® Drops providing an oil-based suspension suitable for newborns, containing 5 billion live cells per dose and supported by clinical efficacy data.

November 2025 - Juneyao Health and Hema launched the "J26 10-Billion Live Probiotics Green Plum Drink," which includes Lactiplantibacillus plantarum J26 (≥200×10^8 CFU) along with additional strains and prebiotics. This pharmaceutical-grade beverage is designed to support daily gut health in both dining and athletic contexts, catering to consumer preferences for functional innovations.

October 2025 - Yili Group announced its strategic expansion into the probiotics and protein supplement markets during its Investor Day, with the goal of achieving a top-five position in key segments through technological advancements. This initiative enhances the company's pharmaceutical-grade offerings for special medical purposes (FSMPs) and functional nutrition in response to shifts in China's health policy.

Global Pharma-Grade Probiotics Market Coverage

Global Pharma-Grade Probiotics Market by Region

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Table of Contents for Pharma-Grade Probiotics Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

6. North America Market Estimate and Forecast

6.0..

U.S. Market Estimate and Forecast

6.0.1.

Canada Market Estimate and Forecast

6.0.2.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.0.3.

Germany Market Estimate and Forecast

7.0.4.

France Market Estimate and Forecast

7.0.5.

U.K. Market Estimate and Forecast

7.0.6.

Italy Market Estimate and Forecast

7.0.7.

Spain Market Estimate and Forecast

7.0.8.

Russia Market Estimate and Forecast

7.0.9.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.0.10.

China Market Estimate and Forecast

8.0.11.

Japan Market Estimate and Forecast

8.0.12.

India Market Estimate and Forecast

8.0.13.

South Korea Market Estimate and Forecast

8.0.14.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.0.15.

Brazil Market Estimate and Forecast

9.0.16.

Saudi Arabia Market Estimate and Forecast

9.0.17.

South Africa Market Estimate and Forecast

9.0.18.

U.A.E. Market Estimate and Forecast

9.0.19.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. BIOGAIA AB

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. DANONE NUTRICIA RESEARCH

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. DUPONT DE NEMOURS, INC. (INTERNATIONAL FLAVORS & FRAGRANCES)

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. LALLEMAND HEALTH SOLUTIONS

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. LONZA GROUP AG

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. NESTLÉ HEALTH SCIENCE

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. NOVONESIS GROUP

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. PROBI AB

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. WINCLOVE PROBIOTICS

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. YAKULT HONSHA CO., LTD.

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

10.11. BIOGAIA AB

10.11.1.

Snapshot

10.11.2.

Overview

10.11.3.

Offerings

10.11.4.

Financial

Insight

10.11.5. Recent

Developments

10.12. DANONE NUTRICIA RESEARCH

10.12.1.

Snapshot

10.12.2.

Overview

10.12.3.

Offerings

10.12.4.

Financial

Insight

10.12.5. Recent

Developments

10.13. DUPONT DE NEMOURS, INC. (INTERNATIONAL FLAVORS & FRAGRANCES)

10.13.1.

Snapshot

10.13.2.

Overview

10.13.3.

Offerings

10.13.4.

Financial

Insight

10.13.5. Recent

Developments

10.14. LALLEMAND HEALTH SOLUTIONS

10.14.1.

Snapshot

10.14.2.

Overview

10.14.3.

Offerings

10.14.4.

Financial

Insight

10.14.5. Recent

Developments

10.15. LONZA GROUP AG

10.15.1.

Snapshot

10.15.2.

Overview

10.15.3.

Offerings

10.15.4.

Financial

Insight

10.15.5. Recent

Developments

10.16. NESTLÉ HEALTH SCIENCE

10.16.1.

Snapshot

10.16.2.

Overview

10.16.3.

Offerings

10.16.4.

Financial

Insight

10.16.5. Recent

Developments

10.17. NOVONESIS GROUP

10.17.1.

Snapshot

10.17.2.

Overview

10.17.3.

Offerings

10.17.4.

Financial

Insight

10.17.5. Recent

Developments

10.18. PROBI AB

10.18.1.

Snapshot

10.18.2.

Overview

10.18.3.

Offerings

10.18.4.

Financial

Insight

10.18.5. Recent

Developments

10.19. WINCLOVE PROBIOTICS

10.19.1.

Snapshot

10.19.2.

Overview

10.19.3.

Offerings

10.19.4.

Financial

Insight

10.19.5. Recent

Developments

10.20. YAKULT HONSHA CO., LTD.

10.20.1.

Snapshot

10.20.2.

Overview

10.20.3.

Offerings

10.20.4.

Financial

Insight

10.20.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Pharma-Grade Probiotics Market