Mental Health Apps Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Platform Type (Smartphone-based applications, Web-based platforms), by Application Focus (Anxiety and depression management, Stress management and wellness, Sleep and behavioral health support, Substance use and other mental health support), by Monetization Model (Subscription-based, Freemium, One-time purchase, Enterprise and institutional licensing), by End Use User (Individual users, Healthcare providers and institutions, Corporate and educational users)

| Status : Published | Published On : Jan, 2026 | Report Code : VRHC1311 | Industry : Healthcare | Available Format :

|

Page : 185 |

Mental Health Apps Market Size & Share - Growth Forecast Report (2026-2035)

Industry Insight by Platform Type (Smartphone-based applications, Web-based platforms), by Application Focus (Anxiety and depression management, Stress management and wellness, Sleep and behavioral health support, Substance use and other mental health support), by Monetization Model (Subscription-based, Freemium, One-time purchase, Enterprise and institutional licensing), by End Use User (Individual users, Healthcare providers and institutions, Corporate and educational users)

Mental Health Apps Market Overview

The mental health apps market which was valued at approximately USD 7.94 billion in 2025 and is estimated to reach nearly USD 9.02 billion in 2026 is projected to reach around USD 28.22 billion by 2035 expanding at a CAGR of about 13.5% during the forecast period from 2026 to 2035. Growth across the mental health applications landscape is supported by rising prevalence of anxiety depression and stress related disorders alongside expanding smartphone penetration and digital health acceptance.

According to the World Health Organization mental health conditions account for a significant share of global disease burden encouraging governments to promote digital interventions. National public health bodies including the U.S. Centers for Disease Control and Prevention and NHS England continue to endorse app based self-care monitoring and early intervention programs supporting adoption across North America Europe and Asia Pacific.

Mental Health Apps Market Dynamics

Market Trends

The mental health apps marketplace is experiencing a structural shift toward clinically informed digital interventions and evidence based self-management tools supported by public health frameworks. Government health agencies such as the World Health Organization and national bodies including the National Institute of Mental Health emphasize the role of digital platforms in early screening stress management and ongoing mental health support. This alignment has accelerated adoption of apps offering cognitive behavioral therapy modules mood tracking and guided interventions designed to complement traditional care systems and expand access at population level.

Another significant trend is the integration of data analytics artificial intelligence and remote monitoring capabilities driven by rising digital health penetration and policy support for telehealth services. Public health systems in regions such as North America Europe and Asia Pacific increasingly recognize app based solutions as scalable tools for addressing workforce shortages and improving continuity of care. This has encouraged developers to focus on secure data handling personalization and interoperability with broader digital health ecosystems.

Growth Drivers

Market growth is primarily supported by increasing prevalence of mental health conditions and the corresponding policy focus on accessible and cost-effective care delivery. According to the World Health Organization mental health disorders contribute substantially to global disease burden prompting governments to promote digital tools for prevention monitoring and self-care. National mental health strategies and public awareness programs in countries such as the United States United Kingdom and India are reinforcing demand for app-based solutions across diverse demographic segments.

Additionally expanding adoption of telemedicine and digital health platforms is strengthening long term market momentum. Public reimbursement frameworks and regulatory guidance issued by authorities such as the U.S. Department of Health and Human Services and NHS England support integration of digital mental health tools within formal care pathways. As healthcare systems prioritize early intervention continuity of care and reduced service delivery costs demand for mental health applications is expected to remain resilient throughout the forecast period.

Market Restraints / Challenges

Despite strong policy support the market faces challenges related to regulatory compliance data privacy and clinical validation requirements. Government backed frameworks such as guidance issued by the World Health Organization and national digital health authorities emphasize patient safety evidence-based outcomes and secure handling of sensitive health data. Compliance with regulations including data protection laws and medical device classifications increases development complexity and operational costs particularly for smaller developers and emerging market participants which can slow market penetration.

Another constraint relates to digital access inequality and workforce readiness. Reports from public health agencies highlight that uneven smartphone access limited digital literacy and shortage of trained mental health professionals to validate and integrate app-based tools can restrict adoption. Dependence on external clinical expertise and evolving regulatory approvals may lead to longer product development cycles scalability challenges and delayed commercialization during periods of policy transition.

Market Opportunities

The market presents substantial opportunities in expanding access to mental health support among underserved populations driven by demographic shifts and unmet care demand. Government mental health strategies promoted by the World Health Organization and national health ministries increasingly recognize digital applications as scalable tools for early screening self-management and continuity of care. Developers offering affordable clinically aligned and multilingual solutions are well positioned to capture incremental demand from youth working age populations and rural communities.

Another significant opportunity lies in integration with public telehealth and primary care systems. Government investments in digital health infrastructure and interoperable health records encourage adoption of advanced analytics remote monitoring and personalized intervention features. Apps aligned with public reimbursement frameworks and national digital health programs can establish long term partnerships improve engagement and support sustainable revenue growth through value-based care models.

Global Mental Health Apps Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 7.94 Billion |

|

Revenue Forecast in 2035 |

USD 28.22 Billion |

|

Growth Rate |

13.5% |

|

Segments Covered in the Report |

Platform Type, Application Focus, Monetization Model, End Use User |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Asia Pacific, Europe, Other Regions |

|

Key Companies |

BetterHelp (Teladoc Health), Big Health (Sleepio), CVS Health (Aetna Inc.), MoodMission Pty Ltd., Sanvello Health Inc., Happify Health, Inner Explorer Inc., MindDoc Health GmbH, Wysa Ltd., Lyra Health Inc. |

|

Customization |

Available upon request |

Mental Health Apps Market Segmentation

By Platform Type

Based on platform type the mental health apps market demonstrates clear differentiation between smartphone-based applications and web-based platforms with mobile applications accounting for an estimated 68% share in 2025. This dominance is supported by high smartphone penetration continuous daily usage patterns and ease of integration with sensors notifications and offline access features. Growth within this segment is supported by rising adoption of self-guided therapy stress management and mindfulness tools with an estimated growth rate of about 10.8% driven by younger demographics and working age users prioritizing on demand support.

Web based platforms represent approximately 32% of the market reflecting institutional usage and structured therapy environments. This segment is expected to grow at around 9.1% supported by government backed telehealth platforms and workplace mental health programs promoted by public health authorities. Policy emphasis on digital care continuity and data interoperability supports steady adoption particularly in regulated healthcare environments.

By Application Focus

By application focus anxiety and depression management represents the largest share at approximately 44% of total market revenue in 2025 supported by high global prevalence rates highlighted by who mental health burden assessments. Consistent public awareness campaigns and government supported screening initiatives continue to drive usage with estimated growth of about 11.5% as early intervention programs expand.

Stress management and wellness focused applications account for nearly 31% supported by rising workplace mental health initiatives and occupational health guidelines issued by public health agencies. This segment is growing at around 12.2% as employers integrate digital wellness tools into benefit structures. Remaining application areas including sleep behavioral support and substance use management contribute roughly 25% collectively with steady growth supported by expanding preventive care policies and digital health literacy programs.

By Monetization Model

Based on monetization model subscription-based solutions account for approximately 52% of market value in 2025 reflecting predictable revenue streams and continuous engagement models. This segment benefits from public payer pilot programs and institutional licenses encouraged by government digital health frameworks and is projected to grow at about 11.9% supported by long term care adoption.

Freemium models represent around 28% driven by accessibility and public awareness initiatives promoted by national mental health programs. Growth is estimated at 10.4% as conversion rates improve through clinical feature integration. One time purchase and enterprise licensing models together contribute nearly 20% supported by workplace and academic adoption with growth near 9.3% reflecting budget constrained institutional procurement cycles.

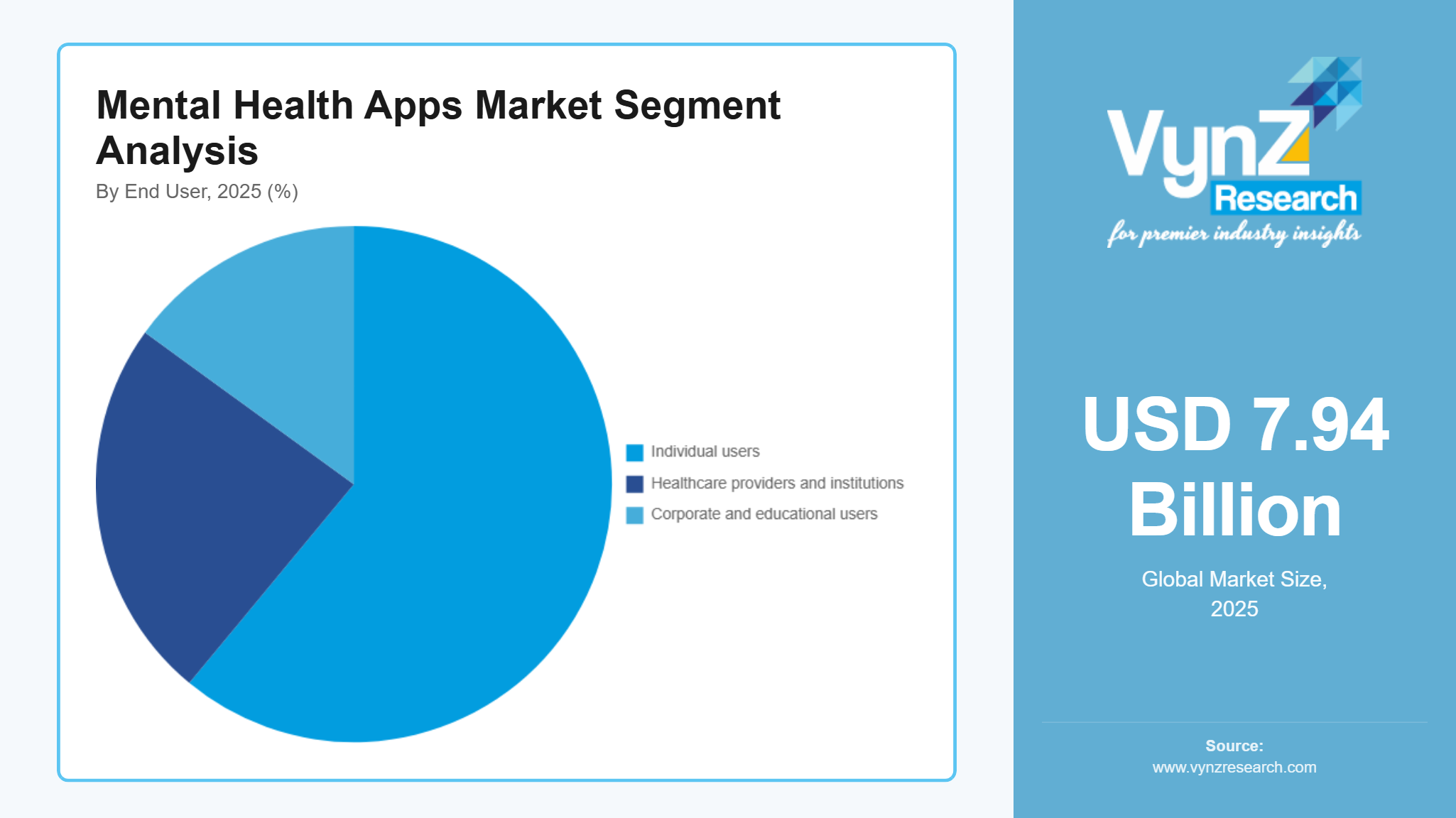

By End Use User

By end use user individuals constitute the largest segment with approximately 61% share in 2025 supported by direct-to-consumer adoption and government awareness campaigns promoting self-care and early intervention. Growth in this segment is estimated at 12.1% driven by mobile accessibility and expanding public endorsement of digital mental health tools.

Healthcare providers and institutional users account for around 27% reflecting integration into clinical workflows and public health systems with growth near 10.6% supported by telehealth reimbursement frameworks. Corporate and educational users contribute roughly 12% supported by occupational health policies and student wellness initiatives with growth estimated at 9.4%. Remaining usage is covered by other smaller organized user groups within public and nonprofit sectors maintaining overall market balance at 100%.

Regional Insights

North America

North America accounted for approximately 29% of the global mental health apps market in 2025 supported by advanced digital health infrastructure strong smartphone penetration and high awareness of mental health conditions. Government backed initiatives from agencies such as the U.S. Department of Health and Human Services and the Centers for Disease Control and Prevention promote digital mental health tools as part of preventive care and telehealth expansion. Public funding for behavioral health programs and reimbursement support under federal telemedicine frameworks continue to encourage adoption across major urban centers including New York, California and Texas strengthening regional market performance.

Asia Pacific

Asia Pacific represented an estimated 34% share of the market in 2025 driven by large population base rising mental health awareness and rapid digitalization of healthcare systems. Governments in countries such as India China Japan and Australia are promoting digital health platforms under national mental health and e health missions supported by ministries of health and public health agencies. Reports aligned with who regional mental health action plans highlight increasing use of mobile applications to address care access gaps workforce shortages and rural outreach which is sustaining long term growth across the region.

Europe

Europe accounted for approximately 17% of global revenue in 2025 supported by strong regulatory frameworks and public healthcare integration. National Health Services and public agencies including NHS England and European commission backed digital health programs encourage use of clinically validated mental health applications for early intervention and self-management. Rising adoption across countries such as Germany France and the United Kingdom is supported by public reimbursement pilots and cross border digital health strategies under EU mental health policy frameworks contributing to steady market expansion.

Other Regions

The remaining regions including Latin America, Middle East and Africa collectively contribute approximately 20% of the global mental health apps market. Growth in these regions is supported by expanding mobile connectivity and increasing government focus on mental health inclusion aligned with world health organization action plans. Although adoption levels remain lower compared with North America, Asia Pacific and Europe these regions represent emerging opportunities as public digital health infrastructure and awareness programs continue to develop.

Competitive Landscape / Company Insights

The mental health apps market is moderately to highly competitive with global and regional players emphasizing clinical validation data security and continuous feature enhancement. Leading companies focus on digital capabilities analytics and content personalization to align with public health guidelines. Adoption is reinforced by policy frameworks and recommendations from government backed bodies such as the World Health Organization and national health agencies including HHS and NHS England which promote evidence based digital mental health tools. These initiatives encourage vendors to expand geographically and strengthen partnerships with healthcare systems and employers.

Mini Profiles

Headspace provides guided meditation, mindfulness and online therapy through a widely used app. It blends audio meditations, stress management programs and mental wellness coaching to support users seeking emotional balance. The company serves a global audience and aims to make mental health support accessible and scalable.

Calm focuses on emotional wellness using meditation routines, sleep stories, mindfulness exercises and relaxation content. Its app targets people looking for stress relief, better sleep, or daily calm — combining convenience with a broad content library that appeals to wellness oriented users worldwide.

BetterHelp offers online therapy and counselling services through web or mobile platforms. Users can connect with licensed therapists via chat, video or voice sessions, making professional mental health support accessible without needing to visit a clinic — ideal for people seeking flexible and private therapy options.

Talkspace provides digital therapy and psychiatry services, allowing users to access licensed therapists remotely via text, audio, or video. This approach offers flexible mental health support for individuals who prefer remote sessions over traditional in person therapy, expanding reach especially where local services are limited.

Wysa is an AI powered mental health app combining chatbot based emotional support with self help tools including CBT exercises, mood tracking, and mindfulness routines. It aims to provide affordable, around the clock support online, serving both individual and corporate wellness users globally.

Key Players

- BetterHelp (Teladoc Health)

- Big Health (Sleepio)

- CVS Health (Aetna Inc.)

- MoodMission Pty Ltd.

- Sanvello Health Inc.

- Happify Health

- Inner Explorer Inc.

- MindDoc Health GmbH

- Wysa Ltd.

- Lyra Health Inc.

Global Mental Health Apps Market Coverage

Global Mental Health Apps Market by Region

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Table of Contents for Mental Health Apps Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

6. North America Market Estimate and Forecast

6.0..

U.S. Market Estimate and Forecast

6.0.1.

Canada Market Estimate and Forecast

6.0.2.

Mexico Market Estimate and Forecast

7. Europe Market Estimate and Forecast

7.0.3.

Germany Market Estimate and Forecast

7.0.4.

France Market Estimate and Forecast

7.0.5.

U.K. Market Estimate and Forecast

7.0.6.

Italy Market Estimate and Forecast

7.0.7.

Spain Market Estimate and Forecast

7.0.8.

Russia Market Estimate and Forecast

7.0.9.

Rest of Europe Market Estimate and Forecast

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.0.10.

China Market Estimate and Forecast

8.0.11.

Japan Market Estimate and Forecast

8.0.12.

India Market Estimate and Forecast

8.0.13.

South Korea Market Estimate and Forecast

8.0.14.

Rest of Asia-Pacific Market Estimate and Forecast

9. Rest of the World (RoW) Market Estimate and Forecast

9.0.15.

Brazil Market Estimate and Forecast

9.0.16.

Saudi Arabia Market Estimate and Forecast

9.0.17.

South Africa Market Estimate and Forecast

9.0.18.

U.A.E. Market Estimate and Forecast

9.0.19.

Other Countries Market Estimate and Forecast

10. Company Profiles

10.1. BetterHelp (Teladoc Health)

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. Big Health (Sleepio)

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. CVS Health (Aetna Inc.)

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. MoodMission Pty Ltd.

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Sanvello Health Inc.

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Happify Health

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Inner Explorer Inc.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. MindDoc Health GmbH

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Wysa Ltd.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Lyra Health Inc.

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Mental Health Apps Market