Personalized Medicine Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Therapy Type (Targeted Therapies, Cell and Gene Therapies, Pharmacogenomics-based Treatments), by Technology (Molecular Diagnostics, Bioinformatics Platforms, Proteomics & Metabolomics Technologies), by Application (Oncology, Cardiovascular Diseases, Neurology & Rare Diseases, Other Applications), by End-User Industry (Hospitals & Specialty Clinics, Diagnostic Laboratories, Research Institutes & Academic Centers)

| Status : Published | Published On : Jan, 2026 | Report Code : VRHC1309 | Industry : Healthcare | Available Format :

|

Page : 200 |

Personalized Medicine Market Size & Share | Growth Forecast Report (2026-2035)

Industry Insight by Therapy Type (Targeted Therapies, Cell and Gene Therapies, Pharmacogenomics-based Treatments), by Technology (Molecular Diagnostics, Bioinformatics Platforms, Proteomics & Metabolomics Technologies), by Application (Oncology, Cardiovascular Diseases, Neurology & Rare Diseases, Other Applications), by End-User Industry (Hospitals & Specialty Clinics, Diagnostic Laboratories, Research Institutes & Academic Centers)

Personalized Medicine Market Overview

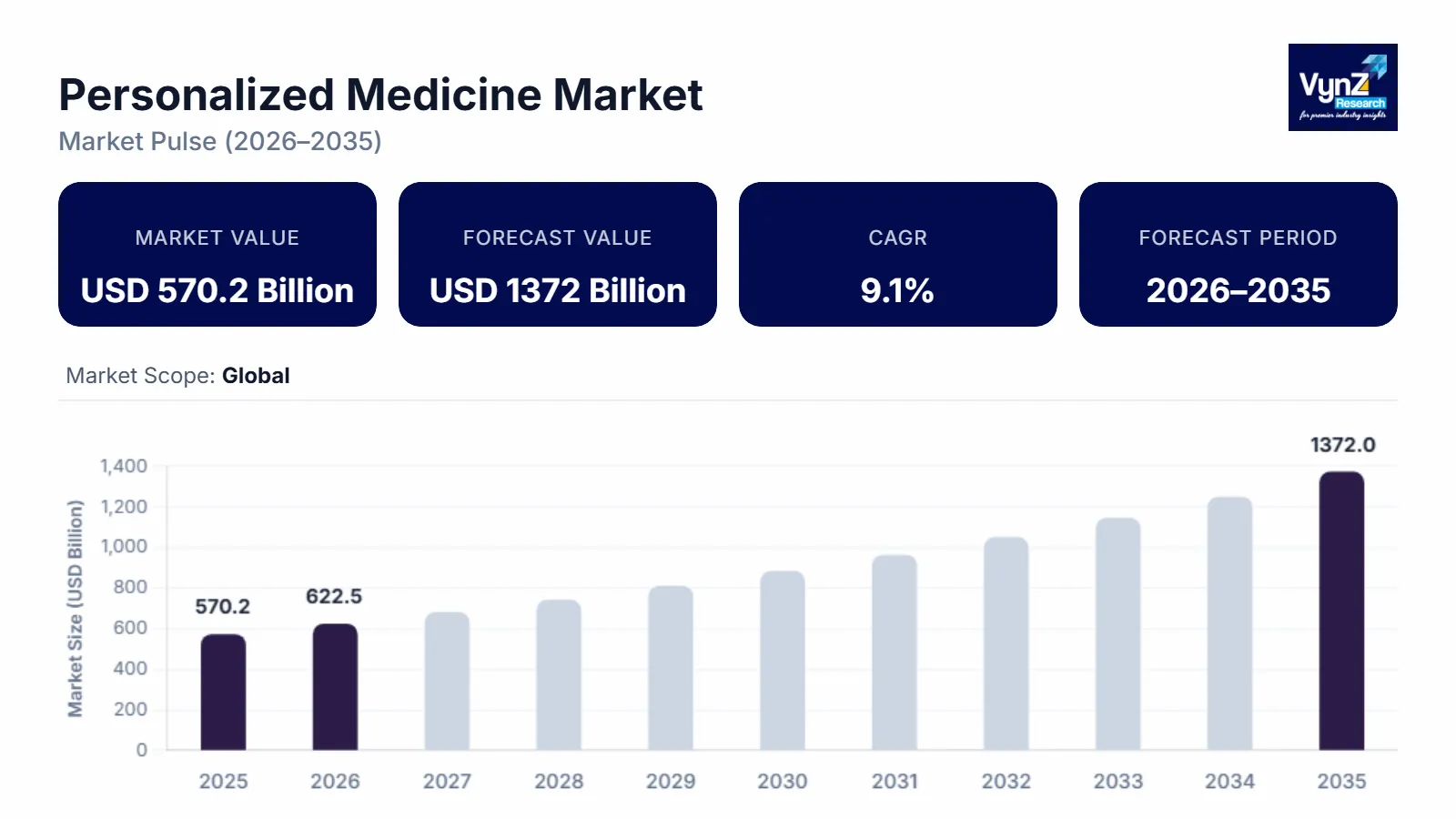

The global personalized medicine market which was valued at approximately USD 570.2 billion in 2025 and is estimated to reach around USD 622.5 billion in 2026, is projected to reach around USD 1372 billion by 2035, expanding at a CAGR of about 9.1% during the forecast period from 2026 to 2035. Market expansion is primarily supported by rapid advancements in genomic sequencing technologies and biomarker discovery, growing integration of artificial intelligence and machine learning in precision diagnostics, and increasing use of targeted therapies for oncology and chronic diseases across developed and emerging healthcare systems.

Adoption is supported by healthcare ecosystem emphasis on outcomebased care enhanced treatment efficacy, and reduced adverse drug reactions through patientspecific therapeutic strategies, aligned with formal precision medicine frameworks such as the U.S. National Institutes of Health All of US Research Program and Europe’s Innovative Medicines Initiative. These programs promote largescale genomic data generation, standardized clinical decision support tools, and collaborative research networks that enable personalized intervention planning. Public investment programs focused on rare disease research, reimbursement policy enhancements, and national precision health strategies across North America, Europe, and Asia Pacific continue to sustain demand from hospitals, research institutions, and biotechnology and pharmaceutical end users.

Personalized Medicine Market Dynamics

Market Trends

The personalized medicine industry is undergoing a structural shift toward genomics-driven and patient-centric healthcare, supported by public health authorities and national precision medicine programs. One of the most significant trends shaping the market is the increasing adoption of next-generation sequencing and multi-omics platforms. This trend reflects growing preferences for treatment customization, predictive diagnostics, and improved therapeutic outcomes across oncology, rare diseases, and chronic conditions. Government-backed initiatives such as the U.S. All of US Research Program and the European Commission’s Innovative Medicines Initiative are promoting large-scale genomic data generation and standardized diagnostic protocols, accelerating adoption.

Another emerging trend is the integration of artificial intelligence and machine learning into clinical decision-making, driven by technological innovation and regulatory frameworks supporting digital health solutions. These developments are encouraging healthcare providers and biotech companies to focus on predictive analytics, advanced diagnostics, and integrated patient care platforms. Programs such as China’s Precision Medicine Initiative and national AI health strategies in Europe and North America are further reinforcing the development of AI-enabled personalized therapeutic solutions.

Growth Drivers

The growth of the market is strongly supported by rising demand for targeted therapies and precision diagnostics. This driver continues to generate consistent adoption across oncology, rare diseases, and chronic condition management. Increasing investments in genomic infrastructure, molecular diagnostics laboratories, and precision treatment platforms are further accelerating market expansion. Government programs promoting patient-specific care and clinical research funding are reinforcing adoption in both developed and emerging markets.

Another primary growth driver is the emphasis on patient-specific treatment planning and outcome-based healthcare. As hospitals, research institutions, and biotechnology enterprises prioritize treatment efficacy, regulatory compliance, and cost optimization, demand for personalized medicine solutions is expected to remain strong throughout the forecast period. Public investments in digital health, precision medicine research, and healthcare workforce development across North America, Europe, and Asia Pacific are supporting a robust ecosystem for long-term market expansion.

Market Restraints / Challenges

Despite strong growth potential, the personalized medicine market faces regulatory complexity that may moderate adoption, particularly among emerging healthcare providers and small biotechnology enterprises. Compliance with stringent frameworks such as the European Union General Data Protection Regulation (GDPR), the U.S. Health Insurance Portability and Accountability Act (HIPAA), and emerging AI and genomic governance guidelines increases operational costs and implementation timelines. Government-backed reports from the OECD and national health ministries highlight that navigating these compliance requirements can pose barriers for institutions with limited technical or legal resources.

Another significant challenge is the high dependency on advanced laboratory infrastructure, skilled personnel, and external technology ecosystems. Reports from the U.S. Government Accountability Office and national precision medicine programs in Asia Pacific emphasize persistent shortages of genomic experts, bioinformaticians, and clinical data analysts. This dependence can result in cost pressures, delayed project deployment, and scalability constraints, especially in regions where digital health and genomic infrastructure maturity remains uneven, thereby affecting overall market penetration during periods of economic or policy uncertainty.

Market Opportunities

The personalized medicine market presents substantial opportunities through expanding adoption among small and medium healthcare providers and research institutions seeking cost-efficient access to genomics and precision therapies. Government-backed initiatives, such as the U.S. All of US Research Program, China’s Precision Medicine Initiative, and the European Commission’s Innovative Medicines Initiative, are accelerating demand for modular, high-performance diagnostic and therapeutic solutions. These platforms enable deployment of targeted therapies, predictive analytics, and clinical decision support tools without heavy upfront investment, generating incremental demand across oncology, rare diseases, and chronic care management.

Another key opportunity lies in the growing integration of personalized medicine platforms with AI-enabled analytics, digital therapeutics, and compliance-aligned solutions. Rising public and private investments in digital health, smart hospitals, and biopharma innovation programs are creating avenues for higher-margin, long-term engagements. Advancements in cloud-enabled analytics, workflow automation, and secure genomic data management are expected to enhance patient engagement, improve clinical outcomes, and strengthen adoption confidence across enterprise and public sector healthcare institutions.

Global Personalized Medicine Market Report Coverage

|

Report Metric |

Details |

|

Historical Period |

2020 - 2024 |

|

Base Year Considered |

2025 |

|

Forecast Period |

2026 - 2035 |

|

Market Size in 2025 |

USD 570.2 Billion |

|

Revenue Forecast in 2035 |

USD 1372 Billion |

|

Growth Rate |

9.1% |

|

Segments Covered in the Report |

Therapy Type, Technology, Application, End-User Industry |

|

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

|

Regions Covered in the Report |

North America, Europe, Asia Pacific, GCC & Middle East, Other Regions |

|

Key Companies |

Illumina, Inc., GE Healthcare, QIAGEN NV, Abbott Laboratories, Danaher Corporation (Cepheid, Inc.), Exact Sciences Corporation, Thermo Fisher Scientific Inc., Roche Diagnostics (Roche Holding AG), Biogen Inc., Foundation Medicine, Inc. |

|

Customization |

Available upon request |

Personalized Medicine Market Segmentation

By Therapy Type

Targeted therapies are projected to account for approximately 45% of total market revenue in 2025. This reflects the growing adoption of treatments designed for specific genetic or molecular patient profiles, improving therapeutic outcomes and reducing adverse effects.

Cell and gene therapies contribute around 30% of the market share, driven by advances in regenerative medicine, oncology applications, and increasing regulatory approvals in North America and Europe.

Pharmacogenomics-based treatments represent roughly 25%, supported by growing integration of genetic testing in clinical decision-making and rising investment in precision diagnostics.

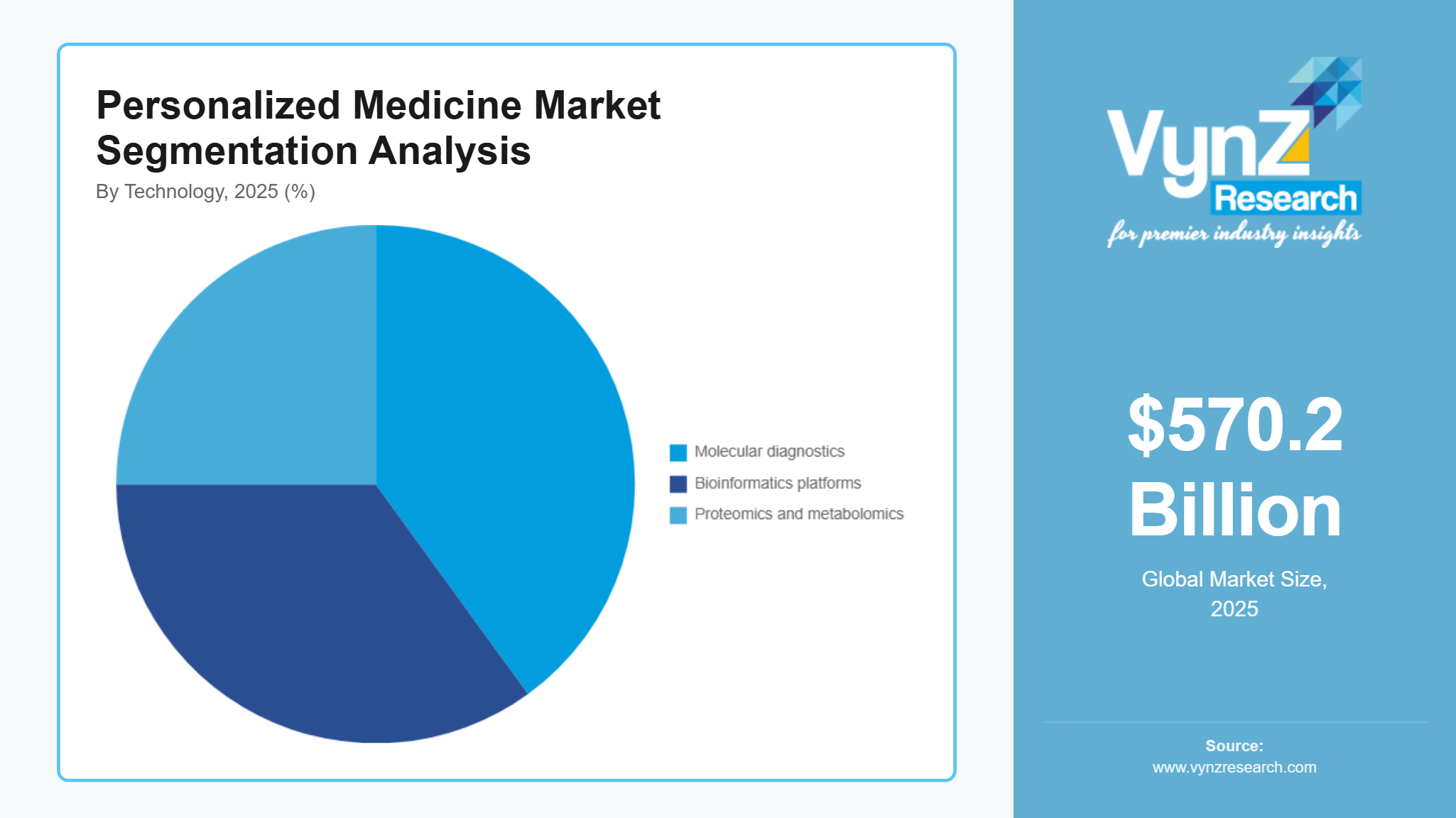

By Technology

Molecular diagnostics are estimated to hold approximately 40% of total revenue in 2025. This is underpinned by widespread use for biomarker detection, companion diagnostics, and patient stratification across oncology, cardiology, and rare diseases.

Bioinformatics platforms account for around 35%, driven by increasing adoption of AI-enabled data analysis, genomic sequencing, and predictive modeling for personalized treatment planning.

Proteomics and metabolomics technologies contribute roughly 25%, supported by advances in high-throughput screening, biomarker discovery, and tailored drug development initiatives.

By Application

Oncology is projected to dominate with approximately 38% of the market in 2025, reflecting extensive use of targeted therapies, immunotherapies, and companion diagnostics to improve treatment efficacy and patient outcomes.

Cardiovascular diseases represent around 22%, driven by growing prevalence, genetic risk profiling, and integration of personalized treatment strategies in clinical practice.

Neurology and rare disease applications account for roughly 20%, supported by rising investment in gene therapy, biomarker research, and specialized patient care programs.

Other applications, including metabolic and infectious diseases, make up the remaining 20%, benefiting from ongoing research, early diagnostics, and emerging treatment options.

By End User

Hospitals and specialty clinics are estimated to contribute approximately 50% of total market revenue in 2025. Adoption is supported by increasing availability of advanced diagnostic tools, access to specialized treatment protocols, and collaboration with pharmaceutical partners.

Diagnostic laboratories account for around 30%, driven by rising demand for molecular and genomic testing services, outsourcing of personalized medicine testing, and integration of high-throughput platforms.

Research institutes and academic centers contribute roughly 20%, reflecting investments in translational research, clinical trials, and development of novel personalized therapies.

Regional Insights

North America

North America is estimated to hold approximately 32% of the global personalized medicine market in 2025. Growth is driven by high healthcare expenditure, advanced infrastructure, and extensive adoption of precision therapeutics in major hubs such as Boston, San Francisco, and New York. Government initiatives, including the U.S. National Institutes of Health (NIH) Precision Medicine Initiative and FDA’s regulatory frameworks for genomics-based therapies, support clinical trials, regulatory approvals, and patient access programs. Increasing adoption of genetic testing, companion diagnostics, and AI-enabled treatment planning is further accelerating market penetration across hospitals, specialty clinics, and research centers.

Europe

Europe accounted for roughly 25% of the market in 2025. Expansion is supported by strong regulatory frameworks such as the European Medicines Agency (EMA) guidelines for advanced therapies and EU Health Program funding for precision medicine initiatives. Countries including Germany, France, and the UK are witnessing significant integration of genomics, targeted therapies, and molecular diagnostics in oncology, rare diseases, and cardiovascular care. Government-backed research grants and public-private collaborations are encouraging adoption in academic centers, diagnostic laboratories, and healthcare institutions. Rising awareness among clinicians and patients is also driving regional demand.

Asia Pacific

Asia Pacific is projected to represent approximately 20% of the market in 2025. Rapid urbanization, rising healthcare expenditure, and government-backed AI and genomics initiatives in China, India, Japan, and South Korea are key growth drivers. National strategies such as China’s Next Generation AI Development Plan and India’s National AI Strategy promote personalized treatment adoption, digital health infrastructure, and genomics research. Expanding hospital networks, investment in diagnostic laboratories, and rising awareness of precision therapeutics in oncology and rare diseases are further supporting market growth.

GCC and Middle East

The GCC region is expected to account for approximately 13% of total market revenue in 2025. Adoption is fueled by government healthcare modernization programs, including Saudi Arabia’s Vision 2030 National Transformation Program and UAE AI Strategy 2031. Investment in advanced diagnostic platforms, precision therapeutics, and digital healthcare solutions across major cities such as Riyadh, Dubai, and Abu Dhabi is driving steady market expansion. Strategic partnerships with global pharmaceutical and genomics companies are further enhancing regional capabilities.

Other Regions

The remaining regions collectively contribute about 10% of the global market in 2025. Growth is supported by emerging digital health initiatives, infrastructure development, and increasing awareness of precision medicine. Although adoption is slower compared with North America, Europe, Asia Pacific, and GCC, these regions offer long-term potential driven by government programs, expanding hospital networks, and growing demand for advanced therapies.

Competitive Landscape / Company Insights

The market is moderately to highly competitive, with global and regional players focusing on technology innovation, strategic partnerships, and geographic expansion. Key vendors including Microsoft, IBM, Google, Amazon Web Services, Alibaba Cloud, Salesforce, Oracle, SAP, NVIDIA, and ServiceNow are investing heavily in R&D, AI-driven analytics, and genomics-based solutions. Adoption is reinforced by government-backed programs such as the U.S. NIH Precision Medicine Initiative, FDA genomic therapy guidelines, and Europe’s Horizon Europe funding for advanced therapeutics. These regulatory frameworks and public research initiatives enable vendors to strengthen market presence and secure long-term collaborations with healthcare institutions, diagnostic labs, and research centers worldwide.

Mini Profiles

Illumina, Inc. makes gene sequencing machines that many labs rely on these days. For instance, a hospital in New York uses their tools to check patients’ tumors before deciding on treatment. Doctors say it saves time and helps pick medicines that actually work for that individual.

GE Healthcare has machines and software that let doctors combine scans with lab results. Many clinics find it easier to see the full picture this way. It also reduces mistakes and makes personalized care feel realistic rather than theoretical.

QIAGEN NV offers test kits that labs can use to find genetic markers. A small clinic in Europe recently started using these kits, and doctors report that it helps them choose drugs that suit the patient rather than trying several options blindly.

Abbott Laboratories provides tests for everyday conditions and serious diseases like cancer. Nurses and doctors say it’s easier to explain results to patients when they can show that the treatment plan is tailored just for them.

Danaher Corporation (Cepheid, Inc.) makes fast molecular tests. In busy hospitals, these tests let doctors detect diseases quickly and start the right treatment, which patients really appreciate because it feels personal and not generic.

Key Players

- Illumina, Inc.

- GE Healthcare

- QIAGEN NV

- Abbott Laboratories

- Danaher Corporation (Cepheid, Inc.)

- Exact Sciences Corporation

- Thermo Fisher Scientific Inc.

- Roche Diagnostics (Roche Holding AG)

- Biogen Inc.

- Foundation Medicine, Inc.

Recent Developments

January 2026 - Together with its original pharmaceutical partners, AstraZeneca, Merck, and Eli Lilly and Company, Illumina is constructing the Atlas. The partnership focuses on leveraging large-scale biology to improve AI model training and drug target validation. Additionally, the partnership will facilitate research into illness pathways that have proven challenging to investigate. Merck intends to use the Atlas to improve precision medicine in all of its drug development initiatives. The business also plans to use the data to train internal AI and machine-learning base models.

July 2025 - The Definium Pace Select ET1, GE HealthCare's cutting-edge floor-mounted digital X-ray system, is now available for purchase. It is intended to provide excellent image quality, maximize efficiency in extremely demanding settings, and improve accessibility and affordability. Since X-ray scans make up 60% of all imaging investigations, they frequently serve as the starting point for diagnostic imaging. As a result, radiologists and technicians have an ever-growing burden.2-3 In addition to the severe staffing issues—80% of healthcare institutions are understaffed, with radiology technologists having the most open positions—this increased demand3. Patients who require X-ray imaging face significant obstacles to timely and efficient diagnostic imaging due to high levels of burnout and work-related injuries.

Market Coverage

By Therapy Type

Targeted Therapies

Cell and Gene Therapies

Pharmacogenomics-based Treatments

By Technology

Molecular Diagnostics

Bioinformatics Platforms

Proteomics & Metabolomics Technologies

By Application

Oncology

Cardiovascular Diseases

Neurology & Rare Diseases

Other Applications

By End-User Industry

Hospitals & Specialty Clinics

Diagnostic Laboratories

Research Institutes & Academic Centers

Global Personalized Medicine Market Coverage

Therapy Type Insight and Forecast 2026 - 2035

- Targeted Therapies

- Cell and Gene Therapies

- Pharmacogenomics-based Treatments

Technology Insight and Forecast 2026 - 2035

- Molecular Diagnostics

- Bioinformatics Platforms

- Proteomics & Metabolomics Technologies

Application Insight and Forecast 2026 - 2035

- Oncology

- Cardiovascular Diseases

- Neurology & Rare Diseases

- Other Applications

End-User Industry Insight and Forecast 2026 - 2035

- Hospitals & Specialty Clinics

- Diagnostic Laboratories

- Research Institutes & Academic Centers

Global Personalized Medicine Market by Region

- North America

- By Therapy Type

- By Technology

- By Application

- By End-User Industry

- By Country - U.S., Canada, Mexico

- Europe

- By Therapy Type

- By Technology

- By Application

- By End-User Industry

- By Country - Germany, U.K., France, Italy, Spain, Russia, Rest of Europe

- Asia-Pacific (APAC)

- By Therapy Type

- By Technology

- By Application

- By End-User Industry

- By Country - China, Japan, India, South Korea, Vietnam, Thailand, Malaysia, Rest of Asia-Pacific

- Rest of the World (RoW)

- By Therapy Type

- By Technology

- By Application

- By End-User Industry

- By Country - Brazil, Saudi Arabia, South Africa, U.A.E., Other Countries

Table of Contents for Personalized Medicine Market Report

1. Research Overview

1.1. The Report Offers

1.2. Market Coverage

1.2.1. By

Therapy Type

1.2.2. By

Technology

1.2.3. By

Application

1.2.4. By

End-User Industry

1.3. Research Phases

1.4. Limitations

1.5. Market Methodology

1.5.1. Data Sources

1.5.1.1.

Primary Research

1.5.1.2.

Secondary Research

1.5.2. Methodology

1.5.2.1.

Data Exploration

1.5.2.2.

Forecast Parameters

1.5.2.3.

Data Validation

1.5.2.4.

Assumptions

1.5.3. Study Period & Data Reporting Unit

2. Executive Summary

3. Industry Overview

3.1. Industry Dynamics

3.1.1. Market Growth Drivers

3.1.2. Market Restraints

3.1.3. Key Market Trends

3.1.4. Major Opportunities

3.2. Industry Ecosystem

3.2.1. Porter’s Five Forces Analysis

3.2.2. Recent Development Analysis

3.2.3. Value Chain Analysis

3.3. Competitive Insight

3.3.1. Competitive Position of Industry

Players

3.3.2. Market Attractive Analysis

3.3.3. Market Share Analysis

4. Global Market Estimate and Forecast

4.1. Global Market Overview

4.2. Global Market Estimate and Forecast to 2035

5. Market Segmentation Estimate and Forecast

5.1. By Therapy Type

5.1.1. Targeted Therapies

5.1.1.1. Market Definition

5.1.1.2. Market Estimation and Forecast to 2035

5.1.2. Cell and Gene Therapies

5.1.2.1. Market Definition

5.1.2.2. Market Estimation and Forecast to 2035

5.1.3. Pharmacogenomics-based Treatments

5.1.3.1. Market Definition

5.1.3.2. Market Estimation and Forecast to 2035

5.2. By Technology

5.2.1. Molecular Diagnostics

5.2.1.1. Market Definition

5.2.1.2. Market Estimation and Forecast to 2035

5.2.2. Bioinformatics Platforms

5.2.2.1. Market Definition

5.2.2.2. Market Estimation and Forecast to 2035

5.2.3. Proteomics & Metabolomics Technologies

5.2.3.1. Market Definition

5.2.3.2. Market Estimation and Forecast to 2035

5.3. By Application

5.3.1. Oncology

5.3.1.1. Market Definition

5.3.1.2. Market Estimation and Forecast to 2035

5.3.2. Cardiovascular Diseases

5.3.2.1. Market Definition

5.3.2.2. Market Estimation and Forecast to 2035

5.3.3. Neurology & Rare Diseases

5.3.3.1. Market Definition

5.3.3.2. Market Estimation and Forecast to 2035

5.3.4. Other Applications

5.3.4.1. Market Definition

5.3.4.2. Market Estimation and Forecast to 2035

5.4. By End-User Industry

5.4.1. Hospitals & Specialty Clinics

5.4.1.1. Market Definition

5.4.1.2. Market Estimation and Forecast to 2035

5.4.2. Diagnostic Laboratories

5.4.2.1. Market Definition

5.4.2.2. Market Estimation and Forecast to 2035

5.4.3. Research Institutes & Academic Centers

5.4.3.1. Market Definition

5.4.3.2. Market Estimation and Forecast to 2035

6. North America Market Estimate and Forecast

6.1. By

Therapy Type

6.2. By

Technology

6.3. By

Application

6.4. By

End-User Industry

7. Europe Market Estimate and Forecast

7.1. By

Therapy Type

7.2. By

Technology

7.3. By

Application

7.4. By

End-User Industry

8. Asia-Pacific (APAC) Market Estimate and Forecast

8.1. By

Therapy Type

8.2. By

Technology

8.3. By

Application

8.4. By

End-User Industry

9. Rest of the World (RoW) Market Estimate and Forecast

9.1. By

Therapy Type

9.2. By

Technology

9.3. By

Application

9.4. By

End-User Industry

10. Company Profiles

10.1. Illumina, Inc.

10.1.1.

Snapshot

10.1.2.

Overview

10.1.3.

Offerings

10.1.4.

Financial

Insight

10.1.5. Recent

Developments

10.2. GE Healthcare

10.2.1.

Snapshot

10.2.2.

Overview

10.2.3.

Offerings

10.2.4.

Financial

Insight

10.2.5. Recent

Developments

10.3. QIAGEN NV

10.3.1.

Snapshot

10.3.2.

Overview

10.3.3.

Offerings

10.3.4.

Financial

Insight

10.3.5. Recent

Developments

10.4. Abbott Laboratories

10.4.1.

Snapshot

10.4.2.

Overview

10.4.3.

Offerings

10.4.4.

Financial

Insight

10.4.5. Recent

Developments

10.5. Danaher Corporation (Cepheid, Inc.)

10.5.1.

Snapshot

10.5.2.

Overview

10.5.3.

Offerings

10.5.4.

Financial

Insight

10.5.5. Recent

Developments

10.6. Exact Sciences Corporation

10.6.1.

Snapshot

10.6.2.

Overview

10.6.3.

Offerings

10.6.4.

Financial

Insight

10.6.5. Recent

Developments

10.7. Thermo Fisher Scientific Inc.

10.7.1.

Snapshot

10.7.2.

Overview

10.7.3.

Offerings

10.7.4.

Financial

Insight

10.7.5. Recent

Developments

10.8. Roche Diagnostics (Roche Holding AG)

10.8.1.

Snapshot

10.8.2.

Overview

10.8.3.

Offerings

10.8.4.

Financial

Insight

10.8.5. Recent

Developments

10.9. Biogen Inc.

10.9.1.

Snapshot

10.9.2.

Overview

10.9.3.

Offerings

10.9.4.

Financial

Insight

10.9.5. Recent

Developments

10.10. Foundation Medicine, Inc.

10.10.1.

Snapshot

10.10.2.

Overview

10.10.3.

Offerings

10.10.4.

Financial

Insight

10.10.5. Recent

Developments

11. Appendix

11.1. Exchange Rates

11.2. Abbreviations

Note: Financial insight and recent developments of different companies are subject to the availability of information in the secondary domain.

Frequently Asked Questions

Purchase Options

Latest Report

Research Methodology

- Desk Research / Pilot Interviews

- Build Market Size Model

- Research and Analysis

- Final Deliverable

Connect With Our Sales Team

- Toll-Free: +1-888-253-3960

- Phone: +91 9960 288 381

- Email: enquiry@vynzresearch.com

Personalized Medicine Market